Are electric cars failing

EV Sales Are in a Slump Why Arent More Car Buyers Going Electric?

The EV revolution is losing momentum: After electric car sales soared in 2022, interest among buyers has underwhelmed and plans for a rapid transition away from gas-powered cars could be in jeopardy.

While the EV market has grown in 2023, sales aren't rising as fast as expected, even with new model launches and price cuts and generous tax credits lowering costs for buyers. Automakers are taking notice and acting accordingly.

In just the last few weeks, EV leader Tesla slashed its prices once again; Ford reduced production of its F-150 Lightning electric pickup truck and postponed $12 billion of EV spending; Mercedes-Benz CFO Harald Wilhelm described the EV market as a brutal space as the company continues to discount vehicles; General Motors delayed three model launches and backed off a public goal of producing 400,000 EVs by the middle of next year; and Honda announced it was ending plans with GM to jointly develop affordable EVs.

Over at Toyota, which has prioritized hybrids over EVs, Chairman Akio Toyoda told reporters that people are finally seeing reality. Despite EV tax credits of up to $7,500, fewer Americans are ready to switch to EVs than automakers or government officials thought.

Ads by Money. We may be compensated if you click this ad.AdAutomakers losing money on EVs

In the U.S., the days' supply for new EVs has doubled since last year to 88 days, meaning thats how long it would take for the current inventory of vehicles to sell at the current sales rate, Pat Ryan, CEO of AI car shopping app CoPilot, told Money. For reference, the average days' supply for gas-powered cars is 59 days, which is basically normal by historic standards.

Traditional automakers overestimated the current demand levels for EVs and are building more vehicles than they currently need, Ryan said. At the same time, the traditional automakers are losing money as they venture into EVs.

Automakers are being forced to lower their EV prices to attract customers and compete with Tesla. But this approach is especially painful because they're already losing money on their EV investments. Ford, for example, lost about $36,000 for every EV it sold last quarter.

According to Cox Automotive, automakers have plans for 150 new electric models between 2023 and 2026, but those goals are complicated by lower-than-expected demand and the tough price environment.

As EV technology improves, Jessica Stafford, senior vice president consumer solutions at Cox, expects the fuel savings and environmental benefits to motivate Americans to buy them.

"It may appear that the EV revolution is slowing down, but our data doesnt corroborate that," she says, noting that EV sales have increased 12 quarters in a row. "Automakers are not stalling on EVs, but instead, adjusting to a pace that is more sustainable for efficient growth without over-saturating the market."

Why Americans arent buying electric cars

Electric vehicles used to be in hot demand because supply was limited and early adopters were eager to try the new tech or shift to more environmentally-friendly transportation. These enthusiasts were often willing to pay luxury prices for their EVs.

But for automakers to capture the mass market, EVs have to outcompete gas-powered on cost and quality. When gas prices are high, it makes more sense for buyers to consider switching to an electric car. Gas prices have been fairly low in 2023 they're currently down around 30 cents per gallon compared to a year ago, on average nationally so there's less incentive to go electric.

According to experts, here are some of the big reasons the demand for EVs isn't as high as some want it to be:

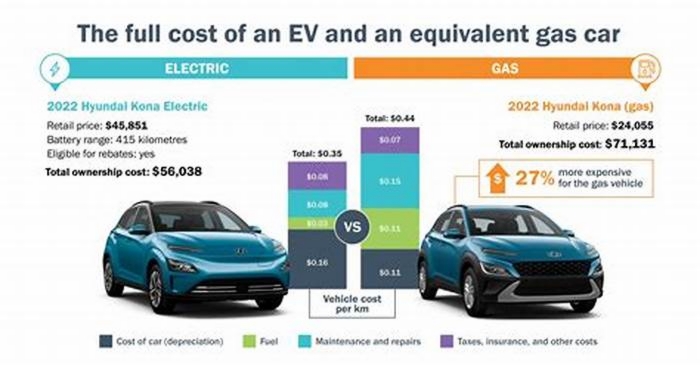

- EVs are too expensive: Joseph McCabe, president of AutoForecast Solutions, says vehicle cost is the No. 1 barrier to EV adoption. EVs usually cost at least $10,000 more than their comparable gas counterparts, he says.

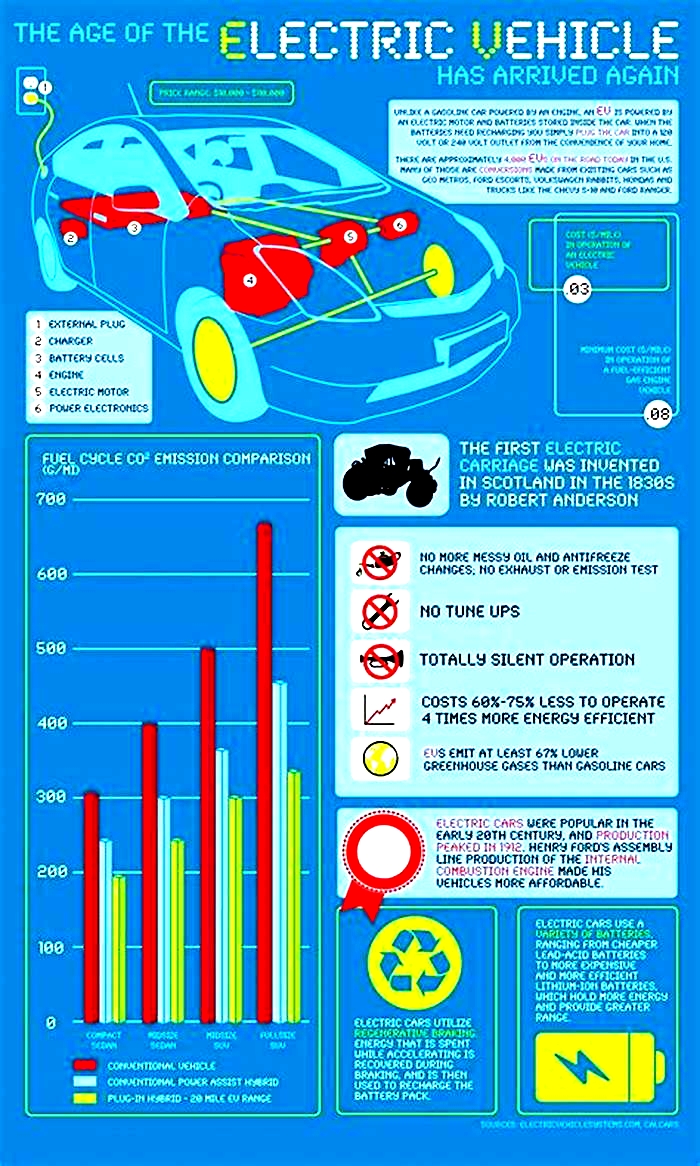

- Charging is expensive: If you can charge your EV at home, there are considerable fuel savings that come with going electric: Youd spend about 3x more on gas than the cost of home charging. However, the costs are about the same if youre using a public charger, and getting fuel at a gas station is much more reliable and less time-consuming.

- Charging is inconvenient: Fast chargers are still hard to find in many more remote parts of the country. According to AAA, 56% of people say the lack of convenient charging is a top reason for not going electric.

- Depreciation: The average used EV price dropped nearly 20% in the past year, according to iSeeCars.com. Potential EV buyers have good reason to worry their cars wont hold their value well as the technology improves. The used market is not as strong for electric vehicles, and as a result the depreciation is higher, says Greg Brannon, director of automotive engineering research at AAA. That's your single biggest operating expense.

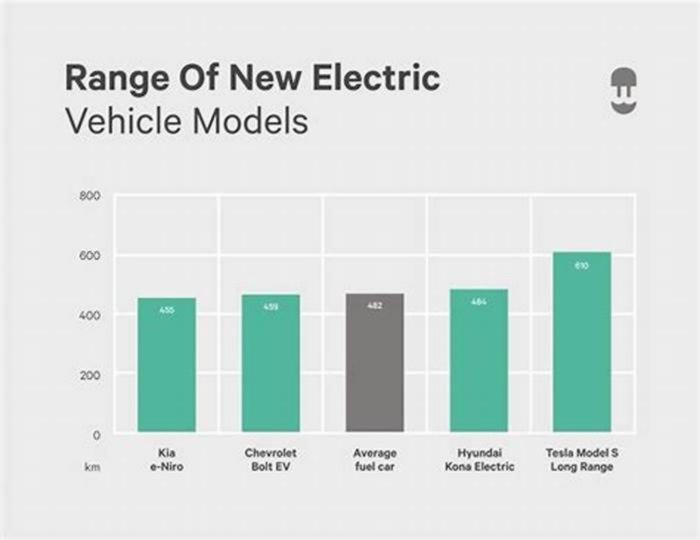

- Range anxiety: Some high-end EVs promise 300+ miles of range on a single charge, but even that is not enough to cover a common drive like San Francisco to Los Angeles. Youd have to take a charging break, potentially adding 30 minutes or an hour to an already long drive.

- Hybrids are more popular: According to Adam Ragozzino, principal analyst, batteries and electric powertrains at Wards Intelligence, Tesla isnt the best-selling electrified vehicle brand in the U.S. Its Toyota, which has over 20 hybrid models and is focused on these cars in the near term, given that they offer good fuel efficiency and are capable of making long trips without requiring charging breaks. Hybrids are not only more practical and familiar to drivers than EVs, they also tend to be cheaper.

Whats next for EVs

Auto experts are increasingly skeptical that the U.S. will be able meet a 2032 target essentially requiring 67% of new cars to be EVs. Right now, the current EV market share in the U.S. is just 7.9%, according to Cox. Automakers are already adjusting their own goals, and it's possible that more EV model launches will be delayed in the coming months.

Ragozzino says the government's goals won't be possible unless automakers make major progress on charging infrastructure and bringing down production costs to the point where they can price their EVs on par with gas and hybrid cars.

Ryan agrees that automakers can't justify scaling up their production with the levels of demand among buyers today.

"Moving forward, it will remain very challenging for the traditional automakers to make meaningful inroads on their EV commitments," he says.

Newsletter Every day we publish the latest news, stories, and content on the financial topics that matter. This is your daily guide to all things personal finance.

More from Money:

8 Best Car Loan Rates of 2023

Auto Loan Delinquencies Reach a Record High Heres What to Do if You Cant Make a Car Payment

10 Best Auto Refinance Companies of 2023

EVs are the least reliable vehicle type: Consumer Reports points to some problem areas

In a reliability survey published last November, Consumer Reports named electric SUVs the least-reliable vehicle type. Now CR has followed that up with a report shedding light on specific problem areas.

On average, EVs have significantly higher problem rates than internal-combustion vehicles across model years 2019 and 2020, according to CR's data. That improved somewhat for 2021, but certain models still showed high rates of problems, according to the report.

The most common EV problem areas were "in-car electronics, noises and leaks, power equipment, climate system, body hardware, drive system, and paint and trim," the report said.

2019 Audi E-tron

A specific example of an "in-car electronics" failure was a display screen going blank in 2019 Audi E-Tron models, while problems with exterior door lights in the same model constituted a "power equipment" issue.

The report also pointed out "drive system" problems with the 2019 Chevrolet Bolt EV that included "electrical failure, drive unit replacement, and other faulty components."

Other examples involved Tesla vehicles, from failing temperature sensors in the 2020 Model S, to loose trim and mismatched paint on the 2020 Model Y. CR singled out the latter for "much worse than average" reliability last year.

2020 Tesla Model X

Survey respondents also reported problems with seals and weatherstripping in the 2020 Model X, which can cause water leaks and wind noise. The Model X's doors have presented issues from the start. In 2016, CEO Elon Musk said he was "not sure anyone should have built or designed this car, because it's so difficult to make."

In all cases, the important point is not just that these problems occur, but that they occur at a higher rate than in comparable internal-combustion vehicles. Despite that, CR found high rates of owner satisfaction, indicating that many EV owners aren't too worried about reliability issues.

The same 2021 reliability survey also found that hybrids and plug-in hybrids cost less to maintain and repair. CRalso noted that "most of these vehicles are built on proven systems," which could be an advantage when it comes to reliability.

Electric cars will fail, but we'll build them anyway, say global auto execs: KPMG

Juxtaposed against a growing electric-vehicle market in China and increasingly stringent global carbon-emission limits, a survey by KPMG has revealed a majority of global auto executives believe electric vehicles are a fool's errand.

Those executives believe electric cars will eventually be leapfrogged by fuel-cell vehicles, due to the infrastructure challenges of both lower-rate public charging and DC fast-charging for long-distance travel.

The report, based on data collected from 953 senior executives, paints an interesting picture of future automotive trends as predicted by the world's automaking C-suites.

DON'T MISS:Half of all Porsches will plug in by 2025, showing importance of electric cars

The main takeaway remains that 62 percent of decision-makers at automakers and their suppliers have a dim view of electric cars.

But the KPMG report is filled with contradictory data points.

As well as the prevailing negative view on EVs, 50 percent of executives believe nonetheless that battery-electric vehicles will be the key automotive trend as we drive forth into 2025but mostly because a regulatory environment will dictate it.

Global automotive light vehicle production (< 6t) by drive technology, KPMG

Muddying the waters further, 76 percent of automotive executives believe internal-combustion engines will continue as the dominant global drivetrain for many years to come.

But as we move toward a lower- and zero-emission future, 78 percent of respondents think the breakthrough technology of the future for road vehicles will be hydrogen fuel cells.

"The faith in FCEVs can be explained," the report explains, "by the hope that FCEVs will solve the recharging and infrastructure issue BEVs face today."

READ MORE:2017's most important green car story: internal-combustion engine ban in China

The report also used survey data collected from consumers to summarize their thoughts on future trends.

Actual car shoppers were asked which drivetrain technology they'd consider for their next car.

The option that received the most respondents was conventional hybrid-electric vehicles, coming in at 36 percent, followed by internal-combustion vehicles at 21 percent.

Hyundai ix35 (Tucson) Fuel Cell for H2 Aberdeen car-sharing service, Scotland [Intl Man of Mystery]

Plug-in hybrids are likely not on too many shoppers' radar, even seven years after the debut of the Chevrolet Volt.

That's largely because automakers have not been able to explain concisely and intuitively why both an engine and a short-range battery make sense.

On the part of companies that make cars, however, "Over the next 5 years, 53 percent of executives are planning to highly invest in plug-in hybrids and 52 percent in ICEs and full hybrids," the report says.

Those companies that do business in China, of course, will have to comply with that country's zero-emission vehicle sales rules, which come into effect next year.

China is also planning to ban the sale of new vehicles with engines entirely in some future year yet to be determined.

BYD e6 electric taxi in service in Shenzhen, China

KPMG has made available a PDF version of the report for those of you who like to print things off to read them.

However, it also has an interactive version of the report you can view online that lets you drill down into the data.

_______________________________________

Follow GreenCarReports onFacebookandTwitter.