Are electric cars the best for the future width

The 41 Future Electric Cars Were Most Excited to Drive

The era of electric cars isnt coming; its already here. Though they still make up a small portion of the new car market, EVs are where the action is when it comes to the exciting realms of vehicular development. No longer are they battery-powered compliance cars or subcompact shuttles for the crunchy granola set; todays electric vehicles come in a broad range of sizes, shapes and prices.

Still, while Tesla may have carved out a solid niche as a purveyor of cutting-edge automobiles, Porsche has redefined sport sedans and Audi and Jaguar have whipped up stylish crossovers that feel imported from the future. The next few years will be the ones that truly open up the electric vehicle market. Pickup trucks and SUVs packing battery packs instead of gas engines will soon be rolling off production lines en masse, remaking the American automotive landscape with every day theyre on sale.

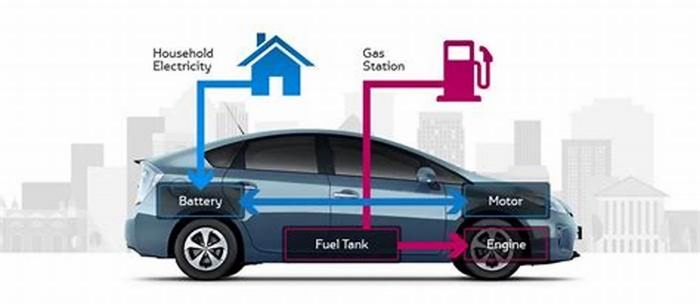

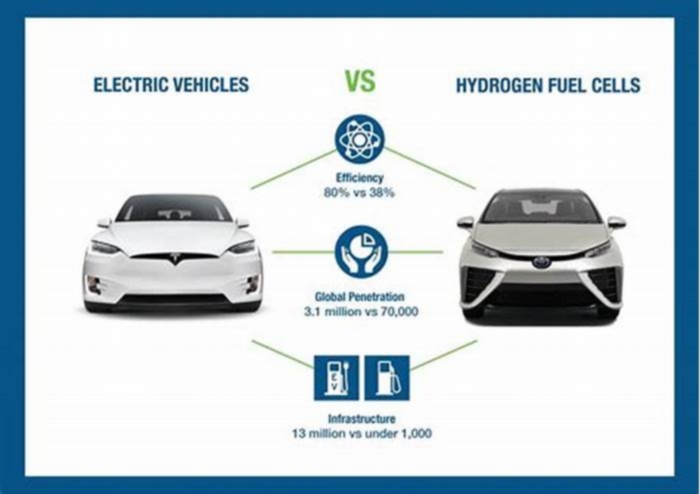

So to keep tabs on all the cool new EVs coming down the pike, weve put together this roundup of the ones we know about that have us most excited. You wont find plug-in hybrids or hydrogen-powered fuel cell cars or anything like that here; were just talking about pure electric vehicles, the kind that only gets power from a plug and wouldnt know what to do with liquid fuel if they had it dumped on their hoods.

Vehicles formerly on this list weve now driven:

(Note: the years in the story below refer to the year the vehicle is expected to debut, not the model year hence why they come at the end of the vehicle name and are in parenthesis.)

Why electric cars will take over sooner than you think

Why electric cars will take over sooner than you think

Getty Images

Getty ImagesI know, you probably haven't even driven one yet, let alone seriously contemplated buying one, so the prediction may sound a bit bold, but bear with me.

We are in the middle of the biggest revolution in motoring since Henry Ford's first production line started turning back in 1913.

And it is likely to happen much more quickly than you imagine.

Many industry observers believe we have already passed the tipping point where sales of electric vehicles (EVs) will very rapidly overwhelm petrol and diesel cars.

It is certainly what the world's big car makers think.

Jaguar plans to sell only electric cars from 2025, Volvo from 2030 and last week the British sportscar company Lotus said it would follow suit, selling only electric models from 2028.

Getty Images

Getty ImagesAnd it isn't just premium brands.

General Motors says it will make only electric vehicles by 2035, Ford says all vehicles sold in Europe will be electric by 2030 and VW says 70% of its sales will be electric by 2030.

This isn't a fad, this isn't greenwashing.

Yes, the fact many governments around the world are setting targets to ban the sale of petrol and diesel vehicles gives impetus to the process.

But what makes the end of the internal combustion engine inevitable is a technological revolution. And technological revolutions tend to happen very quickly.

This revolution will be electric

By my reckoning, the EV market is about where the internet was around the late 1990s or early 2000s.

Back then, there was a big buzz about this new thing with computers talking to each other.

Jeff Bezos had set up Amazon, and Google was beginning to take over from the likes of Altavista, Ask Jeeves and Yahoo. Some of the companies involved had racked up eye-popping valuations.

Getty Images

Getty ImagesFor those who hadn't yet logged on it all seemed exciting and interesting but irrelevant - how useful could communicating by computer be? After all, we've got phones!

But the internet, like all successful new technologies, did not follow a linear path to world domination. It didn't gradually evolve, giving us all time to plan ahead.

Its growth was explosive and disruptive, crushing existing businesses and changing the way we do almost everything. And it followed a familiar pattern, known to technologists as an S-curve.

Riding the internet S-curve

It's actually an elongated S.

The idea is that innovations start slowly, of interest only to the very nerdiest of nerds. EVs are on the shallow sloping bottom end of the S here.

For the internet, the graph begins at 22:30 on 29 October 1969. That's when a computer at the University of California in LA made contact with another in Stanford University a few hundred miles away.

The researchers typed an L, then an O, then a G. The system crashed before they could complete the word "login".

A decade later there were still only a few hundred computers on the network but the pace of change was accelerating.

In the 1990s the more tech-savvy started buying personal computers.

As the market grew, prices fell rapidly and performance improved in leaps and bounds - encouraging more and more people to log on to the internet.

The S is beginning to sweep upwards here, growth is becoming exponential. By 1995 there were some 16 million people online. By 2001, there were 513 million people.

Now there are more than three billion. What happens next is our S begins to slope back towards the horizontal.

The rate of growth slows as virtually everybody who wants to be is now online.

Jeremy Clarkson's disdain

We saw the same pattern of a slow start, exponential growth and then a slowdown to a mature market with smartphones, photography, even antibiotics.

The internal combustion engine at the turn of the last century followed the same trajectory.

So did steam engines and printing presses. And electric vehicles will do the same.

In fact they have a more venerable lineage than the internet.

The first crude electric car was developed by the Scottish inventor Robert Anderson in the 1830s.

But it is only in the last few years that the technology has been available at the kind of prices that make it competitive.

The former Top Gear presenter and used car dealer Quentin Willson should know. He's been driving electric vehicles for well over a decade.

Getty Images

Getty ImagesHe test-drove General Motors' now infamous EV1 20 years ago. It cost a billion dollars to develop but was considered a dud by GM, which crushed all but a handful of the 1,000 or so vehicles it produced.

The EV1's range was dreadful - about 50 miles for a normal driver - but Mr Willson was won over. "I remember thinking this is the future," he told me.

He says he will never forget the disdain that radiated from fellow Top Gear presenter Jeremy Clarkson when he showed him his first electric car, a Citroen C-Zero, a decade later.

"It was just completely: 'You have done the most unspeakable thing and you have disgraced us all. Leave!'," he says. Though he now concedes that you couldn't have the heater on in the car because it decimated the range.

How things have changed. Mr Willson says he has no range anxiety with his latest electric car, a Tesla Model 3.

He says it will do almost 300 miles on a single charge and accelerates from 0-60 in 3.1 seconds.

"It is supremely comfortable, it's airy, it's bright. It's just a complete joy. And I would unequivocally say to you now that I would never ever go back."

We've seen massive improvements in the motors that drive electric vehicles, the computers that control them, charging systems and car design.

But the sea-change in performance Mr Willson has experienced is largely possible because of the improvements in the non-beating heart of the vehicles, the battery.

Tesla

TeslaThe most striking change is in prices.

Just a decade ago, it cost $1,000 per kilowatt hour of battery power, says Madeline Tyson, of the US-based clean energy research group, RMI. Now it is nudging $100 (71).

That is reckoned to be the point at which they start to become cheaper to buy than equivalent internal combustion vehicles.

But, says Ms Tyson, when you factor in the cost of fuel and servicing - EVs need much less of that - many EVs are already cheaper than the petrol or diesel alternative.

At the same time energy density - how much power you can pack into each battery - continues to rise.

They are lasting longer too.

Companies that run big fleets of cars like Uber and Lyft are leading the switchover, because the savings are greatest for cars with high mileage.

But, says Ms Tyson, as prices continue to tumble, retail customers will follow soon.

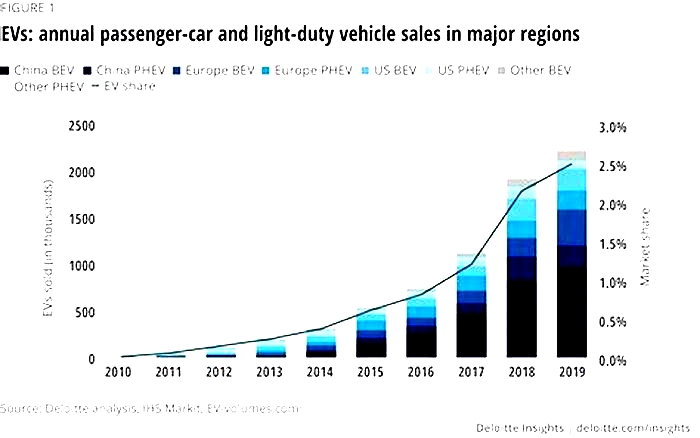

Like the internet in the 90s, the electric car market is already growing exponentially.

Global sales of electric cars raced forward in 2020, rising by 43% to a total of 3.2m, despite overall car sales slumping by a fifth during the coronavirus pandemic.

That is just 5% of total car sales, but it shows we're already entering the steep part of the S.

By 2025 20% of all new cars sold globally will be electric, according to the latest forecast by the investment bank UBS.

That will leap to 40% by 2030, and by 2040 virtually every new car sold globally will be electric, says UBS.

The reason is thanks to another curve - what manufacturers call the "learning curve".

The more we make something, the better we get at making it and the cheaper it gets to make. That's why PCs, kitchen appliances and - yes - petrol and diesel cars, became so affordable.

Getty Images

Getty ImagesThe same thing is what has been driving down the price of batteries, and hence electric cars.

We're on the verge of a tipping point, says Ramez Naam, the co-chair for energy and environment at the Singularity University in California.

He believes as soon as electric vehicles become cost-competitive with fossil fuel vehicles, the game will be up.

That's certainly what Tesla's self-styled techno-king, Elon Musk, believes.

Last month he was telling investors that the Model 3 has become the best-selling premium sedan in the world, and predicting that the newer, cheaper Model Y would become the best-selling car of any kind.

"We've seen a real shift in customer perception of electric vehicles, and our demand is the best we've ever seen," Mr Musk told the meeting.

There is work to be done before electric vehicles drive their petrol and diesel rivals off the road.

Most importantly, everyone needs to be able charge their cars easily and cheaply whether or not they have a driveway at their home.

That will take work and investment, but will happen, just as a vast network of petrol stations rapidly sprang up to fuel cars a century ago.

And, if you are still sceptical, I suggest you try an electric car out for yourself.

Most of the big car manufacturers now have a range of models on offer. So take one for a test drive and see if, like Quentin Willson, you find you want to be part of motoring's future.

China

In China, where the sales share of electric cars has been high for several years, the sales-weighted average price of electric cars (before purchase subsidy) is already lower than that of ICE cars. This is true not only when looking at total sales, but also at the small cars segment, and is close for SUVs. After accounting for the EV exemption from the 10% vehicle purchase tax, electric SUVs were already on par with conventional ones in 2022, on average.

Electric car prices have dropped significantly since 2018. We estimate that around 55% of the electric cars sold in China in 2022 were cheaper than their average ICE equivalent, up from under 10% in 2018. Given the further price declines between 2022 and 2023, we estimate that this share increased to around 65% in 2023. These encouraging trends suggest that price parity between electric and ICE cars could also be reached in other countries in certain segments by 2030, if the sales share of electric cars continues to grow, and if supporting infrastructure such as for charging is sustained.

As reported in detail in GEVO-2023, China remains a global exception in terms of available inexpensive electric models. Local carmakers already market nearly 50 small, affordable electric car models, many of which are priced under CNY100000 (USD15000). This is in the same range as best-selling small ICE cars in 2023, which cost from CNY70000 to CNY100000. In 2022, the best-selling electric car was SAICs small Wuling Hongguang Mini EV, which accounted for 10% of all BEV sales. It was priced around CNY40000, weighing under 700kg for a 170-km range. In 2023, however, it was overtaken by Tesla models, among other larger models, as new consumers seek longer ranges and higher-end options and digital equipment.

United States

In the United States, the sales-weighted average price of electric cars decreased over the 2018-2022 period, primarily driven by a considerable drop in the price of Tesla cars, which account for a significant share of sales. The sales-weighted average retail price of electric SUVs fell slightly more quickly than the average SUV battery costs over the same period. The average price of small and medium models also decreased, albeit to a smaller extent.

Across all segments, electric models remained more expensive than conventional equivalents in 2022. However, the gap has since begun to close, as market size increases and competition leads carmakers to cut prices. For example, in 2023-2024, Teslas Model 3 could be found in the USD39000 to USD42000 range, which is comparable to the average price for new ICE cars, and a new Model Y priced under USD50000 was launched. Rivian is expecting to launch its R2 SUV in 2026 at USD45000, which is much less than previous vehicles. Average price parity between electric and conventional SUVs could be reached by 2030, but it may only be reached later for small and medium cars, given their lower availability and popularity.

Smaller, cheaper electric models have further to go to reach price parity in the United States. We estimate that in 2022, only about 5% of the electric cars sold in the United States were cheaper than their average ICE equivalent. In 2023, the cheapest electric cars were priced around USD30000 (e.g.Chevrolet Bolt, Nissan Leaf, Mini Cooper SE). To compare, best-selling small ICE options cost under USD20000 (e.g.Kia Rio, Mitsubishi Mirage), and many best-selling medium ICE options between USD20000 and USD25000 (e.g.Honda Civic, Toyota Corolla, Kia Forte, Hyundai Avante, Nissan Sentra).

Around 25 new all-electric car models are expected in 2024, but only 5 of them are expected below USD50000, and none under the USD30000 mark. Considering all the electric models expected to be available in 2024, about 75% are priced above USD50000, and fewer than 10 under USD40000, even after taking into account the USD7500 tax credit under the IRA for eligible cars as of February 2024. This means that despite the tax credit, few electric car models directly compete with small mass-market ICE models.

In December 2023, GM stopped production of its best-selling electric car, the Bolt, announcing it would introduce a new version in 2025. The Nissan Leaf (40kWh) therefore remains the cheapest available electric car in 2024, at just under USD30000, but is not yet eligible for IRA tax credits. Ford announced in 2024 that it would move away from large and expensive electric cars as a way to convince more consumers to switch to electric, at the same time as increasing output of ICE models to help finance a transition to electric mobility. In 2024, Tesla announced it would start producing a next-generation, compact and affordable electric car in June 2025, but the company had already announced in 2020 that it would deliver a USD25000 model within 3 years. Some micro urban electric cars are already available between USD5000 and USD20000 (e.g.Arcimoto FUV, Nimbus One), but they are rare. In theory, such models could cover many use cases, since 80% of car journeys in the UnitedStates are under 10 miles.

Europe

Pricing trends differ across European countries, and typically vary by segment.

In Norway, after taking into account the EV sales tax exemption, electric cars are already cheaper than ICE equivalents across all segments. In 2022, we estimate that the electric premium stood around -15%, and even -30% for medium-sized cars. Five years earlier, in 2018, the overall electric premium was less advantageous, at around -5%. The progressive reintroduction of sales taxes on electric cars may change these estimates for 2023 onwards.

Germanys electric premium ranks among the lowest in the EuropeanUnion. Although the sales-weighted average electric premium increased slightly between 2018 and 2022, it stood at 15% in 2022. It is particularly low for medium-sized cars (10-15%) and SUVs (20%), but remains higher than 50% for small models. In the case of medium cars, the sales-weighted average electric premium was as low as EUR5000 in 2022. We estimate that in 2022, over 40% of the medium electric cars sold in Germany were cheaper than their average ICE equivalent. Looking at total sales, over 25% of the electric cars sold in 2022 were cheaper than their average ICE equivalent. In 2023, the cheapest models among the best-selling medium electric cars were priced between EUR22000 and EUR35000 (e.g.MG MG4, Dacia Spring, Renault Megane), far cheaper than the three front-runners priced above EUR45000 (VW ID.3, Cupra Born, and Tesla Model 3). To compare, best-selling ICE cars in the medium segment were also priced between EUR30000 and EUR45000 (e.g.VW Golf, VW Passat Santana, Skoda Octavia Laura, Audi A3, Audi A4). At the end of 2023, Germany phased out its subsidy for electric car purchases, but competition and falling model prices could compensate for this.

In France, the sales-weighted average electric premium stagnated between 2018 and 2022. The average price of ICE cars also increased over the same period, though more moderately than that of electric models. Despite a drop in the price of electric SUVs, which stood at a 30% premium over ICE equivalents in 2022, the former do not account for a high enough share of total electric car sales to drive down the overall average. The electric premium for small and medium cars remains around 40-50%.

These trends mirror those of some of the best-selling models. For example, when adjusting prices for inflation, the small Renault Zoe was sold at the same price on average in 2022-2023 as in 2018-2019, or EUR30000 (USD32000). It could be found for sale at as low as EUR25000 in 2015-2016. The earlier models, in 2015, had a battery size of around 20kWh, which increased to around 40kWh in 20182019 and 50kWh in newer models in 2022-2023. Yet European battery prices fell more quickly than the battery size increased over the same period, indicating that battery size alone does not explain car price dynamics.

In 2023, the cheapest electric cars in France were priced between EUR22000 and EUR30000 (e.g.Dacia Spring, Renault Twingo E-Tech, Smart EQ Fortwo), while best-selling small ICE models were available between EUR10000 and EUR20000 (e.g.Renault Clio, Peugeot 208, Citron C3, Dacia Sandero, Opel Corsa, Skoda Fabia). Since mid-2024, subsidies of up to EUR4000 can be granted for electric cars priced under EUR47000, with an additional subsidy of up to EUR3000 for lower-income households.

In the United Kingdom, the sales-weighted average electric premium shrank between 2018 and 2022, thanks to a drop in prices for electric SUVs, as in the United States. Nonetheless, electric SUVs still stood at a 45% premium over ICE equivalents in 2022, which is similar to the premium for small models but far higher than for medium cars (20%).

In 2023, the cheapest electric cars in the United Kingdom were priced from GBP27000 to GBP30000 (USD33000 to 37000) (e.g.MG MG4, Fiat 500, Nissan Leaf, Renault Zoe), with the exception of the Smart EQ Fortwo, priced at GBP21000. To compare, best-selling small ICE options could be found from GBP10000 to 17000 (e.g.Peugeot 208, Fiat 500, Dacia Sandero) and medium options below GBP25000 (e.g.Ford Puma). Since July 2022, there has been no subsidy for the purchase of electric passenger cars.

Elsewhere in Europe, electric cars remain typically much more expensive than ICE equivalents. In Poland, for example, just a few electric car models could be found at prices competitive with ICE cars in 2023, under the PLN150000 (Polish zloty) (EUR35000) mark. Over 70% of electric car sales in 2023 were for SUVs, or large or more luxurious models, compared to less than 60% for ICE cars.

In 2023, there were several announcements by European OEMs for smaller models priced under EUR25000 in the near-term (e.g.Renault R5, Citron e-C3, Fiat e-Panda, VW ID.2all). There is also some appetite for urban microcars (i.e.L6-L7 category), learning from the success of Chinas Wuling. Miniature models bring important benefits if they displace conventional models, helping reduce battery and critical mineral demand. Their prices are often below USD5000 (e.g.Microlino, Fiat Topolino, Citron Ami, Silence S04, Bir B2211).

In Europe and the United States, electric car prices are expected to come down as a result of falling battery prices, more efficient manufacturing, and competition. Independent analyses suggest that price parity between some electric and ICE car models in certain segments could be reached over the 2025-2028 period, for example for small electric cars in Europe in 2025 or soon after. However, many market variables could delay price parity, such as volatile commodity prices, supply chain bottlenecks, and the ability of carmakers to yield sufficient margins from cheaper electric models. The typical rule in which economies of scale bring down costs is being complicated by numerous other market forces. These include a dynamic regulatory context, geopolitical competition, domestic content incentives, and a continually evolving technology landscape, with competing battery chemistries that each have their own economies of scale and regional specificities.

Japan

Japan is a rare example of an advanced economy where small models both for electric and ICE vehicles appeal to a large consumer base, motivated by densely populated cities with limited parking space, and policy support. In 2023, about 60% of total ICE sales were for small models, and over half of total electric sales. Two electric cars from the smallest Kei category, the Nissan Sakura and Mitsubishi eK-X, accounted for nearly 50% of national electric car sales alone, and both are priced between JPY2.3million (Japanese yen) and JPY3million (USD18000 to USD23000). However, this is still more expensive than best-selling small ICE cars (e.g.Honda N Box, Daihatsu Hijet, Daihatsu Tanto, Suzuki Spacia, Daihatsu Move), priced between USD13000 and USD18000. In 2024, Nissan announced that it would aim to reach cost parity (of production, not retail price) between electric and ICE cars by 2030.

Emerging market and developing economies

In EMDEs, the absence of small and cheaper electric car models is a significant hindrance to wider market uptake. Many of the available car models are SUVs or large models, targeting consumers of high-end goods, and far too expensive for mass-market consumers, who often do not own a personal car in the first place (see later sections on second-hand car markets and 2/3Ws).

In India, while Tatas small Tiago/Tigor models, which are priced between USD10000 and USD15000, accounted for about 20% of total electric car sales in 2023, the average best-selling small ICE car is priced around USD7000. Large models and SUVs accounted for over 65% of total electric car sales. While BYD announced in 2023 the goal of accounting for 40% of Indias EV market by 2030, all of its models available in India cost more than INR3million (Indian rupees) (USD37000), including the Seal, launched in 2024 for INR4.1million (USD50000).

Similarly, SUVs and large models accounted for the majority share of electric car sales in Thailand (60%), Indonesia (55%), Malaysia (over 85%) and Viet Nam (over 95%). In Indonesia, for example, Hyundais Ionic 5 was the most popular electric car in 2023, priced at around USD50000. Looking at launch announcements, most new models expected over the 2024-2028 period in EMDEs are SUVs or large models. However, more than 50 small and medium models could also be introduced, and the recent or forthcoming entry of Chinese carmakers suggests that cheaper models could hit the market in the coming years.

In 2022-2023, Chinese carmakers accounted for 40-75% of the electric car sales in Indonesia, Thailand and Brazil, with sales jumping as cheaper Chinese models were introduced. In Thailand, for example, Hozon launched its Neta V model in 2022 priced at THB550000 (Thai baht) (USD15600), which became a best-seller in 2023 given its relative affordability compared with the cheapest ICE equivalents at around USD9000. Similarly, in Indonesia, the market entry of Wulings Air EV in 2022-2023 was met with great success. In Colombia, the best-selling electric car in 2023 was the Chinese mini-car, Zhidou 2DS, which could be found at around USD15000, a competitive option relative to the countrys cheapest ICE car, the Kia Picanto, at USD13000.