Are electric cars the future

Global

After a decade of rapid growth, in 2020 the global electric car stock hit the 10million mark, a 43% increase over 2019, and representing a 1% stock share. Battery electric vehicles (BEVs) accounted for two-thirds of new electric car registrations and two-thirds of the stock in 2020. China, with 4.5 million electric cars, has the largest fleet, though in 2020 Europe had the largest annual increase to reach 3.2million.

Overall the global market for all types of cars was significantly affected by the economic repercussions of the Covid-19 pandemic. The first part of 2020 saw new car registrations drop about one-third from the preceding year. This was partially offset by stronger activity in the second-half, resulting in a 16% drop overall year-on-year. Notably, with conventional and overall new car registrations falling, global electric car sales share rose 70% to a record 4.6% in 2020.

About 3million new electric cars were registered in 2020. For the first time, Europe led with 1.4 million new registrations. China followed with 1.2 million registrations and the United States registered295000 new electric cars.

Numerous factors contributed to increased electric car registrations in 2020. Notably, electric cars are gradually becoming more competitive in some countries on a total cost of ownership basis. Several governments provided or extended fiscal incentives that buffered electric car purchases from the downturn in car markets.

Europe

Overall Europes car market contracted 22% in 2020. Yet, new electric car registrations more than doubled to 1.4million representing a sales share of 10%. In the large markets, Germany registered 395000new electric cars and France registered 185000. The United Kingdom more than doubled registrations to reach 176000. Electric cars in Norway reached a record high sales share of 75%, up about one-third from 2019. Sales shares of electric cars exceeded 50% in Iceland, 30% in Sweden and reached 25% in the Netherlands.

This surge in electric car registrations in Europe despite the economic slump reflect two policy measures. First, 2020 was the target year for the European Unions CO2 emissions standards that limit the average carbon dioxide (CO2) emissions per kilometre driven for new cars. Second, many European governments increased subsidy schemes for EVs as part of stimulus packages to counter the effects of the pandemic.

In European countries, BEV registrations accounted for 54% of electric car registrations in 2020, continuing to exceed those of plug-in hybrid electric vehicles (PHEVs). However, the BEV registration level doubled from the previous year while the PHEV level thripled. The share of BEVs was particularly high in the Netherlands (82% of all electric car registrations), Norway (73%), United Kingdom (62%) and France (60%).

China

The overall car market in China was impacted by the panademic less than other regions. Total new car registrations were down about 9%.

Registration of new electric cars was lower than the overall car market in the first-half of 2020. This trend reversed in the second-halfas China constrained the panademic. The result was a sales share of 5.7%, up from 4.8% in 2019. BEVs were about 80% of new electric cars registered.

Key policy actions muted the incentives for the electric car market in China. Purchase subsidies were initially due to expire at the end of 2020, but following signals that they would be phased out more gradually prior to the pandemic, by April 2020 and in the midst of the pandemic, they were instead cut by 10% and exended through 2022. Reflecting economic concerns related to the pandemic, several cities relaxed car licence policies, allowing for more internal combustion engines vehicles to be registered to support local car industries.

United States

The US car market declined 23% in 2020, though electric car registrations fell less than the overall market. In 2020, 295000new electric cars were registered, of which about 78% were BEVs, down from 327000 in 2019. Their sales share nudged up to 2%. Federal incentives decreased in 2020 due to the federal tax credits for Tesla and General Motors, which account for the majority of electric car registrations, reaching their limit.

Other countries

Electric car markets in other countries were resilent in 2020. For example, in Canada the new car market shrunk 21% while new electric car registrations were broadly unchanged from the previous year at 51000.

New Zealand is a notable exception. In spite of its strong pandemic response, it saw a decline of 22% in new electric car registrations in 2020, in line with a car market decline of 21%. The decline seems to be largely related to exceptionally low EV registrations in April 2020 when New Zealand was in lockdown.

Another exception is Japan, where the overall new car market contracted 11% from the 2019 level while electric car registrations declined 25% in 2020.Theelectric car market in Japan has fallen in absolute and relative terms every year since 2017, when it peaked at 54000registrations and a 1% sales share. In 2020, there were 29000registrations and a 0.6% sales share.

Global EV Outlook 2021

There were 10 million electric cars on the worlds roads at the end of 2020, following a decade of rapid growth. Electric car registrations increased by 41% in 2020, despite the pandemic-related worldwide downturn in car sales in which global car sales dropped 16%. Around 3million electric cars were sold globally (a 4.6% sales share), and Europe overtook the Peoples Republic of China (China) as the worlds largest electric vehicle (EV) market for the first time. Electric bus and truck registrations also expanded in major markets, reaching global stocks of 600000 and 31000 respectively.

The resilience of EV sales in the face ofthe pandemic rests on three main pillars:

- Supportive regulatory frameworks: even before the pandemic many countries were strengthening key policies such as CO2 emissions standards and zero-emission vehicle (ZEV) mandates. By the end of 2020, more than 20countries had announced bans on the sales of conventional cars or mandated all new sales to be ZEVs.

- Additional incentives to safeguard EV sales from the economic downturn: some European countries increased their purchase incentives and China delayed the phase-out of its subsidy scheme.

- The number of EV models expanded and battery cost continued to fall.

Vehicle manufacturers announced increasingly ambitious electrification plans. Out of the worlds top 20 vehicle manufacturers, which represented around 90% of new car registrations in 2020, 18 have stated plans to widen their portfolio of models and to rapidly scale up the production of light-duty electric vehicles. The model availability of electric heavy-duty vehicles is also broadening, with four major truck manufacturers indicating an all-electric future.

Consumer spending on electric car purchases increased to USD120billion in 2020. In parallel, governments across the world spent USD14billion to support electric car sales, up 25% from 2019, mostly from stronger incentives in Europe. Nonetheless, the share of government incentives in total spending on electric cars has decreased over the past five years, suggesting that EVs are becoming increasingly attractive to consumers.

The near-term outlook for EV sales is bright. In the first-quarter of 2021, global electric car sales rose by around 140% compared to the same period in 2020, driven by sales in China of around 500000vehicles and in Europe of around 450000. US sales more than doubled relative to the first-quarter of 2020, albeit from a much lower base.

Global EV Outlook 2022

About this report

The Global EV Outlook is an annual publication that identifies and discusses recent developments in electric mobility across the globe. It is developed with the support of the members of the Electric Vehicles Initiative (EVI).

Combining historical analysis with projections to 2030, the report examines key areas of interest such as electric vehicle and charging infrastructure deployment, energy use, CO2 emissions, battery demand and related policy developments. The report includes policy recommendations that incorporate lessons learned from leading markets to inform policy makers and stakeholders with regard to policy frameworks and market systems for electric vehicle adoption.

This edition features an in-depth assessment of the EV battery supply chain and reviews government targets and strategies in this area. It assesses charging infrastructure development targets in key regions. A section on the integration of EVs into the distribution grid is also included. Finally, the report makes available two online tools: the Global EV Data Explorer and Global EV Policy Explorer, which allow users to interactively explore EV statistics and projections, and policy measures worldwide.

The increase in demand for electric vehicles is driving demand for batteries and related critical minerals. Automotive lithium-ion (Li-ion) battery demand increased by about 65% to 550GWh in 2022, from about 330GWh in 2021, primarily as a result of growth in electric passenger car sales. In 2022, about 60% of lithium, 30% of cobalt and 10% of nickel demand was for EV batteries. Only five years prior, these shares were around 15%, 10% and 2%, respectively. Reducing the need for critical materials will be important for supply chain sustainability, resilience and security, especially given recent price developments for battery material.

New alternatives to conventional lithium-ion are on the rise. The share of lithium-iron-phosphate (LFP) chemistries reached its highest point ever, driven primarily by China: around 95% of the LFP batteries for electric LDVs went into vehicles produced in China. Supply chains for (lithium-free) sodium-ion batteries are also being established, with over 100GWh of manufacturing capacity either currently operating or announced, almost all in China.

The EV supply chain is expanding, but manufacturing remains highly concentrated in certain regions, with China being the main player in battery and EV component trade. In 2022, 35% of exported electric cars came from China, compared with 25% in 2021. Europe is Chinas largest trade partner for both electric cars and their batteries. In 2022, the share of electric cars manufactured in China and sold in the European market increased to 16%, up from about 11% in 2021.

EV supply chains are increasingly at the forefront of EV-related policy-making to build resilience through diversification. The Net Zero Industry Act, proposed by the European Union in March 2023, aims for nearly 90% of the European Unions annual battery demand to be met by EU battery manufacturers, with a manufacturing capacity of at least 550GWh in 2030. Similarly, India aims to boost domestic manufacturing of electric vehicles and batteries through Production Linked Incentive (PLI) schemes. In the UnitedStates, the Inflation Reduction Act emphasises the strengthening of domestic supply chains for EVs, EV batteries and battery minerals, laid out in the criteria to qualify for clean vehicle tax credits. As a result, between August 2022 and March 2023, major EV and battery makers announced cumulative post-IRA investments of at least USD52billion in North American EV supply chains of which 50% is for battery manufacturing, and about 20% each for battery components and EV manufacturing.

The Straits Times

Remember the last time you used a kerosene lamp? Maybe not, but you could ask your grandparents about them. They might fondly remember the warm glow of the flickering light, but leave out the part about needed constant top ups. There's no going back from the bright, clean electric lighting of today.

Likewise, if the car was only invented today, it would almost certainly run on electricity. Think about it for a second. Electricity itself is clean, silent, responsive, reliable and cost-effective, so it makes sense that electric vehicles (EVs) are, too.

Cars like the Hyundai Kona Electric not only exemplify this superior tech, but also demonstrate how responsible carmakers are helping to make EVs a reality for any motorist today. In fact, Hyundai's decision to produce the Kona Electric shows that EVs are now for mainstream drivers, and not luxury car buyers.

State-of-the-art

The Kona Electric's futuristic styling reflects the state-of-the-art engineering that went into it. A smooth panel in place of a traditional front grille hints at the compact motor behind it, letting bystanders know that there's no combustion engine under the bonnet.

Motors need batteries, and the Kona Electric's are neatly packaged under the car's floor so it takes up little room. An added plus is that they lower the car's centre of gravity, which makes it highly stable through corners.

In fact, driving the Kona Electric reveals just how engaging and exciting the EV era is. Step on the accelerator and it responds instantly - there's no engine to rev up and no transmission to change gears, so there's no waiting. EVs are all about power on-demand!

Despite the engaging performance, the Kona Electric is quieter than most combustion-engine luxury cars. That's because electrons are silent and exploding fuel is not.

In fact, experiencing the Kona Electric's performance must be what it was like for our ancestors, when they went from noisy, dirty steam or diesel locomotives to electric trains for the first time.

Yet, efficiency comes in many forms, and the Kona Electric's superior packaging means it is surprisingly spacious for a compact sport utility vehicle (SUV). There is plenty of room for the needs of a family living in the city, with a generous boot size of 332 litres - expandable to 1,143 litres by folding the rear seats, more than enough for an active lifestyle.

Outside, the Kona Electric's dimensions make it ultra-manoeuvrable and supremely easy to park - so much the better for exploiting its zippy performance and agile handling.

Clean, cost-effective and convenient

Given how fun it is to drive, it's almost easy to forget how environmentally friendly the Kona Electric is.

It is also as clean as any car can get: There is no tailpipe, so there are no tailpipe emissions to choke the immediate surroundings. City life would be so much more pleasant if every car around you is as clean and quiet as this EV.

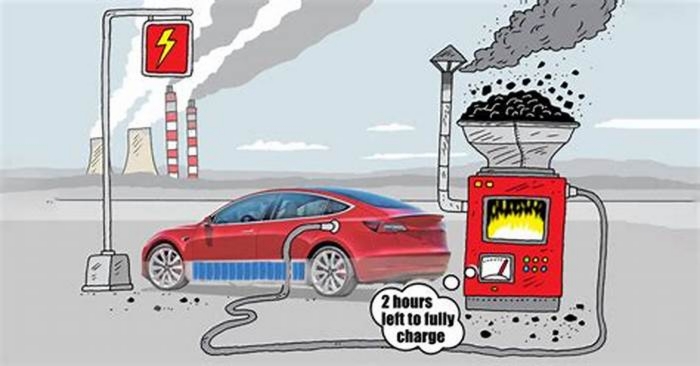

Even if you factor in the energy needed to generate the power for a Kona Electric, it emits less than 56g of carbon dioxide per km. A comparable car that runs on petrol would belch out two to three times as much in its emission.

The Kona Electric also shows that efficiency and cost-effectiveness usually go hand-in-hand. A full charge for its battery costs as little as under S$10, while refuelling a comparable 1.6-litre car would easily cost around S$80.

That's not all; an electric powertrain has far fewer moving parts and is much cheaper to service and maintain - no filters to change, no spark plugs to renew, no gaskets to replace, and no belts to worry about. In fact, the overall maintenance cost is less than S$200 a year for the Kona Electric.

Keeping an EV topped-up is set to become just as hassle-free as maintaining it, even in Singapore.