Best Selling Electric Vehicles in China vs the Rest of the World

MIT Technology Review

What does Chinas EV market look like now?

As a result of all this, China now has an outsize domestic demand for EVs: according to a survey from the US consulting company AlixPartners, over 50% of Chinese respondents were considering battery-electric vehicles as their next car in 2021, the highest proportion in the world and two times the global average.

There are a slew of Chinese-built options for these customersincluding BYD, SAIC-GM-Wuling, Geely, Nio, Xpeng, and LiAuto. While the first three are examples of gas-car companies that successfully made the switch to EVs early on, the last three are pure-EV startups that grew from nothing to household names in less than a decade.

And the rise of these companies (and other Chinese tech behemoths) coincided with the rise of a new generation of car buyers who dont see Chinese brands as less prestigious or worse in quality than foreign brands. Because theyve grown up with Alibaba, because theyve grown up with Tencent, they effectively were born into a digital environment, and theyre much more comfortable with Chinese brands versus their parents, who would still rather likely buy a German brand or a Japanese brand, says Tu. The fact that these Chinese brands have sprinkled a little bit of nationalism into their marketing strategy also helps, Tu says.

Can other countries replicate Chinas success?

Many countries are almost certainly now looking at Chinas EV experience and feeling jealous. But it may not be that easy for them to achieve the same success, even if they copy Chinas playbook.

While the US and some countries in Europe meet the objective requirements to supercharge their own EV industries, like technological capability and established supply chains, ICCTs He notes that they also have different political systems. Is this country willing to invest in this sector? Is it willing to give special protection to this industry and let it enjoy an extremely high level of policy priority for a long time? she asks. Thats hard to say.

I think the interesting question is, would a country like India or Brazil be able to replicate this? Mazzocco asks. These countries dont have a traditional auto industry as strong as Chinas, and they also dont have the Chinese governments sophisticated background in handling massive industrial policies through a diverse set of policy tools, including credits, subsidies, land use agreements, tax breaks, and public procurements. But Chinas experience suggests that EVs can be an opportunity for developing countries to leapfrog developed countries.

Its not that you can't replicate it, but China has had decades of experience in leveraging these [systems], says Mazzocco.

Chinese brands are now looking to other markets. What challenges are they facing?

For the first time ever, Chinese EV companies feel they have a chance to expand outside of China and become global brands. Some of them are already entering the European market and even considering coming to the US, despite its saturated market and the sensitive political situation. Chinese gas cars could never have dreamed of that.

Tesla overtaken by Chinas BYD as worlds biggest EV maker

Unlock the Editors Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

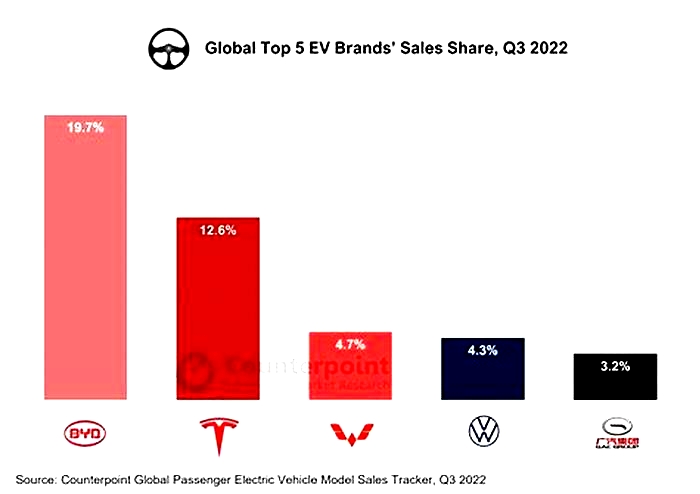

Elon Musks Tesla has been knocked off the top spot as the worlds best-selling electric-vehicle maker for the first time by BYD after recording fewer deliveries than its Chinese rival in the past quarter.

The US group handed over 484,000 cars in the fourth quarter, more than the 473,000 anticipated by analysts but not enough to hold on to its title after BYD reported record sales of battery-only vehicles of 526,000 for the same period.

Teslas dethroning by BYD reflects the rise of what was a little-known Chinese group only a decade ago, which Musk himself has publicly dismissed. While growth at the Warren Buffett-backed Chinese company has been mostly achieved on its home turf, BYD is sharpening its focus on finding new foreign markets including in Europe.

Danni Hewson, head of financial analysis at AJ Bell, said BYDs electric cars were becoming increasingly visible on European roads thanks to keen pricing.

BYDs success in chasing down Tesla also underlines the struggle of legacy automakers from the US, Europe, Japan and Korea to adapt to fast-changing consumer preferences for cheaper, smarter electric vehicles.

In a statement published in China, the Shenzhen-based group called itself the world champion for new energy vehicles after notching total annual sales of more than 3mn for 2023 across its vehicles which also include plug-in hybrid cars.

Teslas annual sales were 1.81mn vehicles in 2023, while BYD delivered 1.58mn fully electric cars.

Through much of the past 12 months, BYD benefited from price cuts sparked by Teslas attempt to chase market share, pushing consumers to consider Chinas lower-cost models, according to analysts.

For any doubters left in the west, I hope this is the final data point that points to BYDs strength and, as importantly, how China EV Inc has bullied its way on to the global stage, said Tu Le, founder of Beijing-based advisory company Sino Auto Insights.

He added that while both companies cut prices on some cars over the past year, Tesla did so much more dramatically, signalling that BYD could distance itself further from the US group over the coming year.

Still, WedbushSecurities analyst Dan Ives said it was an important quarter for Tesla to show strong deliveries and momentum heading into 2024.

Teslas annual sales of 1.8mn last year was a major achievement in a choppy macro [economic environment] for the electric vehicles sector, he added.

BYD was founded by Wang Chuanfu, a former university professor, in the mid-1990s. After focusing on manufacturing rechargeable batteries, including for mobile phones, the company expanded into the car industry in the early 2000s.

The Chinese groups early success prompted Buffetts Berkshire Hathaway to invest in the company in 2008. Despite relying on existing industry technology for many years, BYD has focused on stripping out costs from the production process.

Following years of state support and careful industrial planning by Beijing, Chinas automakers now leverage their countrys control over the production of almost every resource, material and component used to make electric vehicles.

BYDs vertically integrated structure it controls mines and produces batteries and chips has made it the envy of foreign rivals as the global car industry transitions away from the combustion engine.

At the end of last year six out of the top-selling EV models in China, the worlds largest car market, were BYD cars, according to Automobility, a Shanghai-based consultancy. While BYDs share of sales has expanded to more than 35 per cent, Tesla has struggled to keep up with the cadence of product launches by Chinese rivals, the consultancy added.

Chinese electric vehicle makers lead the world, rivaling U.S. pioneers

Only a few years ago, China had an estimated 300 EV makers, a number that analysts say will be winnowed down to a dozen or so in the coming years. Though local brands dominate Chinas EV market, they also face competition from foreign automakers that are trying to muscle in, such as General Motors and Volkswagen.

As with their counterparts in the U.S. and elsewhere, Chinese EV makers profitability is threatened by excess capacity and a price war set off in January by Tesla, which has a factory in Shanghai. A pledge this month by Tesla and 15 other automakers to avoid abnormal pricing was retracted by the China Association of Automobile Manufacturers, which cited antitrust law.

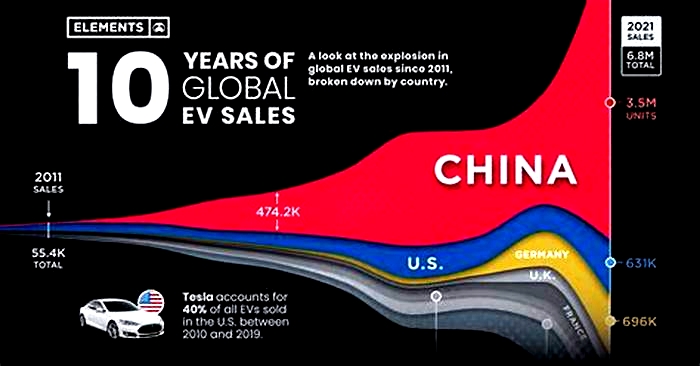

Faced with pressure at home, Chinas EV makers are pursuing expansion abroad, especially in emerging markets. Last year, Chinas exports of EVs increased 131.8% year on year to around 680,000 units, official data showed. Thanks in part to the surge in EV sales, China overtook Japan as the worlds top auto exporter in the first quarter of this year.

One place those exports are not going is the U.S., amid geopolitical tensions with China and efforts to strengthen U.S. domestic manufacturing.

U.S. automakers are present in China, but there are no Chinese automakers present in the U.S., Mandal said.

Chinese industry leader BYD a Shenzhen-based company whose name stands for Build Your Dreams, which is backed by U.S. investor Warren Buffett now rivals Tesla as the worlds biggest seller of electric vehicles, including hybrids.

The Seagull, a subcompact hatchback BYD unveiled at the Shanghai auto show, is the cheapest EV in the world, at about $11,000, compared with $25,000 for a Toyota bZ4X and$40,000 for Teslas top-selling Model Y.

Tesla CEO Elon Musk, who laughed when he was asked about competition from BYD in a 2011 interview with Bloomberg, now says his views on the company have changed.

That was many years ago, he wrote on Twitter in May. Their cars are highly competitive these days.

Mini electric cars are big in China will the rest of the world catch on?

I dont think its a question of moving from big SUVs to electric SUVs because that all takes bigger batteries, more materials. I think we could learn a lot from China. One of the best-selling EVs is this tiny Wuling Mini.

Mini EVs make a lot of sense for short urban commutes. They are cheap, and they do less damage to the environment than full-sized cars throughout their production process and lifespan. They are maneuverable on busy urban streets, and easy to park, but they still have many of the features of conventional cars they are protected from the elements and are lockable, unlike electric scooters

And many of the most popular mini EVs in China can seat up to four people, making them a viable alternative for taking kids to school and other family activities.

These practical advantages of mini EVs have made them very popular in China, and fundamental to Chinas shift to electric mobility.

China news, weekly.

Sign up for The China Projects weekly newsletter, our free roundup of the most important China stories.

Chinas most popular mini EV packs a punch

The highest selling electric sedan in China in both 2021 and 2022 was the car mentioned by Sanderson, the Hongguang () mini EV, manufactured by Wuling , part of the SAIC-GM-Wuling joint venture. The little juggernaut sold 404,823 units last year, and 395,451 units in 2021. The closest competitor was the full-size BYD Qin sedan which sold 341,943 units and 272,418 units those years (the highest selling EV overall in 2022 was BYDs Song SUV, which sold 478,811 units).

The Hongguangs top speed is 60 mph, and it has a maximum range of about 100 miles. The car is about the size of a golf cart and is certified to seat four people, although some Chinese online reviews suggest five passengers can fit if one of them is small.

The sweetest part for consumers is the price: The Hongguang starts at 44,800 yuan ($6,563), with three other models ranging up to 99,900 yuan ($14,635). In September 2023, SAIC-GM-Wuling is planning to launch three more premium mini EVs under the Baojun () brand, with prices ranging from 87,800 yuan ($12,862) to 102,800 yuan ($15,060).

For comparison, the Nissan Leaf which is about three feet longer and a little wider than the Hongguan is currently the cheapest EV in the U.S., and its entry level model has a price tag of $20,875 (after the $7,500 federal tax credit).

Lots of mini EVs, not much profit

The Hongguang launched in July 2020. It shook up Chinas rapidly expanding EV market and inspired a whole range of competitors and imitators, including the Dongfeng Fengguang (), the Chery QQ Ice Cream (QQ), and the Changan Lumin. Most recently, on February 7 2023, Geely launched the Panda ().

Tellingly, from 2019 to 2021, the proportion of mini EV sales of total EV sales increased from 17.7% to 29.8%, according to China Passenger Car Association (CPCA) data. In 2022, total EV sales in China jumped to 6.49 million units, however, and the proportion of mini EVs fell back slightly to 19.3%. But that is still 1.09 million mini EVs sold in China, a year-on-year increase of 21.5%.

Despite the sales volume, the mini EV industry suffers from the same problem as Chinas entire EV sector: no profits. The Hongguang accounts for around 90% of SAIC-GM-Wulings total sales, and the companys gross profit margin is as low as 3% per vehicle sold. In the first half of 2022, the company reported a mere 350 million yuan ($51.27 million) in profit.

Still, thats a profit, and it looks very healthy compared to Chinas leading manufacturers of conventionally-sized EVs, most of which are losing hundreds of millions or billions of dollars every year, and often selling the cars at a loss, an approach to the business that resembles consumer internet companies.

Are mini EVs safe?

There is one question buyers may ask that could slow the global growth of the mini EV: Are they safe?

The Hongguang and its competitors do not have all the safety features of a conventional size EV. The most notable difference is that they have no airbags which is one reason they are more affordable. They are fitted with some smart seatbelt technology like conventional cars.

A crash test carried out in 2021 actually turned out quite well for the Hongguang. In a collision with another, much cheaper mini EV at a speed of 40 mph, the other car was completely destroyed, while the Hongguang offered some protection to its passengers thanks to a crumple zone built into its chassis. But the test was done as part of a reality show type TV program, and no doubt funded by a PR budget.

There does not, however, seem to be any good research available in the public domain about the cars safety. Internet searches in Chinese about the safety record of the Hongguan return results like:I want to buy a mini EV, but my mom and dad say theyre not safe, and Aside from being cheap, everything else is bad, and there have been fatal accidents.

On the other hand, motorcycles remain popular all over the world, and mini EVs are certainly safer.

Mini electric car vs. electric motorbike: Who would win?

In fact, if consumers are not put off by the poor safety record of motorcycles, perhaps mini EVs will not find much demand in developing countries, particularly where the weather does not get too cold. And electric bikes, scooters and motorbikes are even cheaper, greener, and more maneuverable in tight urban spaces than mini EVs.

Deborah Seligsohn is a scholar whose research includes a focus on energy and environmental politics in China and India, and who spent more than 20 years at the U.S. Department of State working on energy and environment issues in China, India, Nepal, and New Zealand, among other subjects. In an opinion piece she recently wrote for The China Project, she says, when we talk about transportation in the U.S., we tend to mean simply automobiles, or we jump immediately to the technically more difficult question of how to electrify heavier vehicles (trucks) or to replace jet fuel.

But that misses many other parts of the transport systems that can be electrified. One example she cites are electric two-wheelers: This is the core of the Chinese solution to urban transportation and the part most often missed by both Chinese and foreign commentators.

Can Chinese mini EVs go global?

If the electric bike does not win out, mini EVs seem to be a future growth market. They are environmentally friendly, and they are selling well enough in China to know that they offer a somewhat practical solution to urban transport and commuting. And they are cheap.

So, its easy to imagine seeing lots of Hongguang cars parked on European streets next to tiny cars from BMW, Citron, Fiat, Mini, and other companies that have been popular for decades. In fact the Hongguang is already on sale in Europe under the brand FreZe Nikrob for 13,000 to 15,000 ($13,800 to $16,000). The company behind FreZe Nikrob is Dartz Motorz, a privately-held company that emerged from Russo-Baltic Wagon Factory, a company that was founded in Riga in 1874, and went on to make cars and planes.

The Hongguang and other mini EVs will probably also sell well across the developing world, where urbanization continues apace. The biggest cities in Nigeria, for example, will eclipse the size of their Chinese counterparts in the coming years. The Hongguang is perfect for an enormous, densely-populated city.

There is one country, however, where the Hongguang will not find any market demand, except perhaps as an amusement park entertainment: the U.S.A., where size matters: there are more than 95,000 results for a Google search for Why do Americans hate small cars.

Companies

Sources and additional data