Comparing Electric Vehicle Infrastructure Development in Different Regions

Building the electric-vehicle charging infrastructure America needs

Cars and trucks produce nearly one-fifth of Americas greenhouse-gas emissions (GHGs), all of which must be eliminated to achieve the federal target of net-zero emissions by 2050. Although electric-vehicle (EV) sales in the United States have climbed by more than 40 percent each year, on average, since 2016, nearly half of US consumers say that battery or charging issues are their top concerns about buying EVs. Its no stretch to say that the nations limited network of charging stations probably discourages many prospective buyers.

In response, the Bipartisan Infrastructure Law (BIL) provides $7.5 billion to develop the countrys EV-charging infrastructure. The goal is to install 500,000 public chargerspublicly accessible charging stations compatible with all vehicles and technologiesnationwide by 2030. However, even the addition of half a million public chargers could be far from enough. In a scenario in which half of all vehicles sold are zero-emission vehicles (ZEVs) by 2030in line with federal targetswe estimate that America would require 1.2 million public EV chargers and 28 million private EV chargers by that year. All told, the country would need almost 20 times more chargers than it has now.

Merely setting up more charging stations isnt all that matters. The BIL highlights equity, to name one specific priority. Electricity purchased at a public charger can cost five to ten times more than electricity at a private one. To keep EVs powered up, public charging stations will probably need to be economical, equitably distributed, appealing to use, and wired to a robust power grid. They will also probably have to present a viable business opportunity for the companies expected to install and operate them. States and businesses could better fulfill Americas need for public charging by taking such considerations into account in their planning efforts.

Going electric: The outlook for EV-charging infrastructure in America

A mass shift from cars and trucks with internal combustion engines (ICEs) to ZEVs will be critical to achieving the countrys overall net-zero goals. The federal government has set a target: half of new passenger cars and light trucks sold in 2030 should be ZEVsa category that includes both battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), which can be recharged with electricity, and fuel-cell electric vehicles (FCEVs), which run on hydrogen. (In this article, the terms electric vehicles and EVs refer to battery-electric vehicles and plug-in hybrids.) The extent of the GHG emissions reductions resulting from a shift to EVs will depend largely on how much GHG emissions come from generating electricity. Decarbonizing the power sector is thus integral to lessening emissions from cars and trucksand the focus of a federal goal to make the US power sector carbon free by 2035.

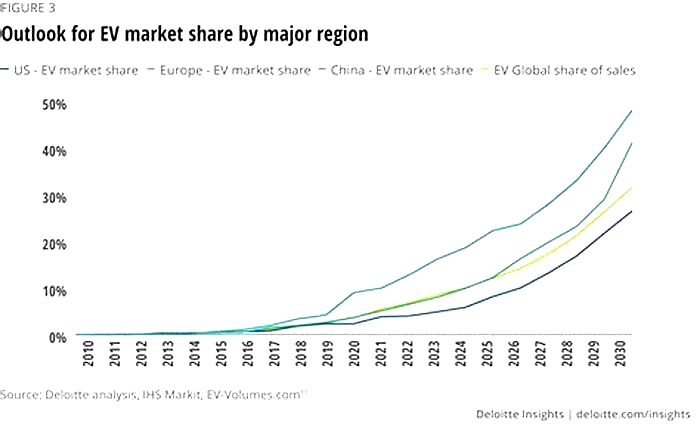

In a scenario in which the nation reaches the federal ZEV sales target, we estimate that the countrys fleet of EVs would grow from less than three million today to more than 48 million in 2030about 15 percent of all vehicles on the road in the United States. Passenger cars could number more than 44 million; the rest of the EV fleet would consist of buses, light commercial vehicles, and trucks (Exhibit 1).

As the number of EVs on the road increases, annual demand for electricity to charge them would surge from 11 billion kilowatt-hours (kWh) now to 230 billion kWh in 2030, according to our scenario-based modeling. The demand estimate for 2030 represents approximately 5 percent of current total electricity demand in the United States. Our modeling indicates that nearly 30 million chargers would be needed to deliver so much electricity in that year. While most of these chargers would be installed at residences, 1.2 million would be public chargers, installed at on-the-go locations and at destinations where vehicles are parked for long periods (Exhibit 2). We estimate that the cost of hardware, planning, and installation for this amount of public charging infrastructure would come to more than $35 billion over the period to 2030 (Exhibit 3).

Executive orders and federal legislation signed over the past 18 months aim to accelerate the shift to EVs by expanding the nations charging infrastructure. An executive order issued in August 2021 set the ZEV sales target noted above. Another goal, announced in December 2021, calls for the federal government to buy only EVs for light-duty vehicles by 2027 and nothing but EVs for all vehicle classes by 2035. Whats more, 12 states are formally members of the Zero-Emission Vehicle program, which requires an increase in ZEV production and in-state sales from the largest vehicle manufacturers through 2025.

Of the $7.5 billion the BIL provides to pay for the installation of public EV chargers, $5 billion is available through the National Electric Vehicle Infrastructure Formula program, which focuses on adding public charging stations in underserved communities and on highways. States are expected mostly to contract with private companies to install, maintain, and operate public chargers. To tap into these funds, states must present plans demonstrating how they will meet the federal governments requirements. These include promoting equity, serving rural and urban areas, and creating opportunities for small businesses to participate. As we explain in the next section, those requirements could be addressed by a balanced consideration of factors.

Plugging in: Principles for building EV-charging infrastructure

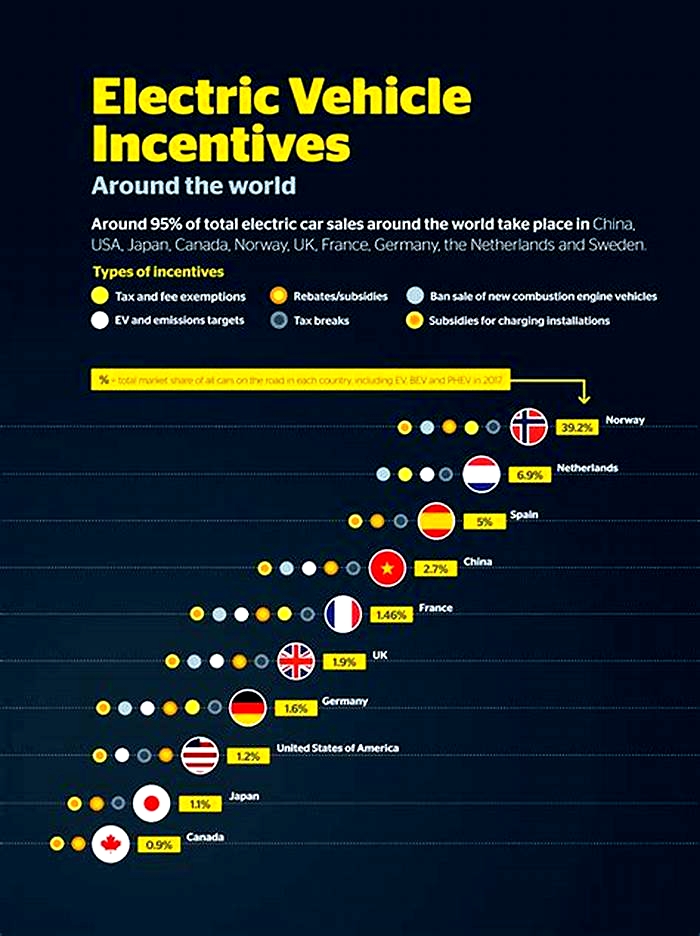

We have experience designing charging-system plans for private-sector players in the United States and several players in Europe, where EVs account for one in five new-car sales (as opposed to one in 20 in the United States). In this way, we have identified principles that could help determine whether a charging infrastructure can both meet drivers needs well enough to enable a broad shift to EVs and be built and operated in a financially sustainable way, involving a combination of viable business opportunities and public support. Of course, Europes market conditions differ from those of the United States. Here we examine these principles in the light of current conditions and future requirements in the latter.

Promoting equity in the public EV-charging system

One factor, highlighted in the funding guidance that the federal government issued for the BIL, merits consideration: equity. For EVs to catch on with all drivers, Americas charging infrastructure must serve a diverse population. This includes sizable groups of drivers who will make extensive, if not exclusive, use of public chargers because they may lack home charging equipment. It also includes the many drivers who need public chargers to keep commercial or ride-sharing vehicles powered throughout long days (and nights) on the road. Finally, it includes rural drivers, who see plenty of filling stations but few fast EV chargers in their areas and dont want to risk running out of power.

Current charger installations tend to be located in higher-income areas, following the location of early EV sales (Exhibit 4). Future charger installations could be planned for areas on all income levels to make ownership of EVs as practical as ownership of ICE vehicles. Broader geographic accessibility to chargers will likely be pivotal to improving visibility and viability; in a McKinsey survey, seven out of ten respondents who dont own EVs said the areas near their homes lack a significant number of chargers.

Building public chargers where people need them

Another important principle to consider is placing public chargers where EV owners will charge their vehicles. This point may seem obvious, but it can be challenging to accomplish in practice. To distribute public chargers in the right numbers and places, states and companies can analyze the driving and parking behavior of motorists in detail at the local level.

Our modeling suggests a few guidelines states could bear in mind as they determine where to place public chargers. In the United States, most EV charging (in terms of electricity consumption) now takes place at home. By 2030, in the scenario we analyzed, we estimate that considerably less charging would be done at home, and the amount of charging in fleet depots would nearly double. Overall, private use cases would still account for a large majority of all charging. One reason is that newer EVs, with ranges of more than 200 miles per charge, can meet the needs of most drivers if charged while parked overnight: on average, each person in the United States travels about 30 miles a day by private vehicle.

EV drivers who cannot charge at home or must recharge on the road will want chargers to be placed where they need them. In the scenario we analyzed, our estimates suggest that public charging would deliver more than 20 percent of the electricity EVs would use in 2030 (Exhibit 5). Determining how much public-charging demand a states infrastructure must serve, and how much demand there will be in particular locations, is a consideration not only in building an equitable infrastructure but also in helping businesses that operate public charging stations to be profitable. States could think creatively about providing chargers that work well in public settings such as curbsides, parking lots, and highway rest stops.

Matching charging speed to customers needs

States and businesses may also want to consider choosing charging technologies that best meet customers needs. Fast direct-current (DC) charging technology is pivotal to relieve range anxiety, but our estimates suggest that it isnt necessary in every charging application. Drivers of private passenger cars with access to home or overnight charging will mostly charge at home, given the significantly lower cost of energy, and seven in ten drivers are likely to install a home-charging system, according to the McKinsey survey cited above. These drivers will need fast chargers only when they are on long-distance trips and cant take the extra time to refuel at a slower public alternating-current Level 2 (AC L2) charger or when they forgot to charge at home and cant make the round trip in the time available.

Drivers of private passenger cars who dont have access to home or overnight charging, by contrast, will choose either fast or slow public charging, depending on their daily trip plans. Drivers of electric commercial-fleet vehicles will charge publicly only as required by the length and location of their trips. Overall, six in ten charging sessions globally will take place at home or work, according to the McKinsey survey, and US drivers say they expect to rely more on home charging than drivers elsewhere do.

So the use cases for fast charging are limited, to say nothing of the steep extra cost of fast chargers and the significant burden they put on the grid. States and businesses may therefore want to be careful not to install fast public chargers where slow chargers would do. At parking lots and other public destinations, for example, DC charging can be available as a premium service, but when a driver is parked for an hour or more, slower AC L2 charging usually works well enough. For EV owners who cant install their own chargers where they live, AC L2 chargers can be exceedingly usefuland less expensive for municipalities to installfor public overnight charging. Exhibit 6 sets out our estimates for the proportions of fast and slow chargers needed for various use cases.

Making public charging affordable

Utilities largely determine the prices consumers pay for electricity at EV-charging stations by establishing electricity rates (varying with the time of day) and demand charges (covering a utilitys infrastructure maintenance expenses). EV drivers who rely on public charging stations have less flexibility to choose when and where they can charge than those who charge at home. (The time of day matters because most public charging takes place during the day, when the cost per kilowatt-hour is typically higher.) These drivers might therefore end up paying between five and ten times more per kilowatt-hour than those who charge their EVs at home.

In laying out plans to build an EV-charging infrastructure, states may want to prioritize efforts to ensure that public-charging costs are equitable. They could do so by helping defray demand charges, by subsidizing the installation and operation of chargers in less profitable locations, or by other means to help defray demand charges.

Enhancing the public-charging experience

The McKinsey survey suggests that customers experiences with public charging are often unsatisfying. Respondents mentioned the speed, cost, availability (including both free and working chargers), and safety of charging locations as the main shortcomings of public charging. Drivers struggle to find chargers because information is limited; mobile apps for locating them tend to exclude competitors chargers, and that reduces both availability and pricing options. Pricing systems can vary considerablyfrom pricing by the minute or kilowatt-hour to different rates for memberships or pay per use. It isnt always easy to tell which option offers better value, and payment is often a hassle. Finally, the design and operation of chargers differ greatly, and customer service isnt always prompt or helpful.

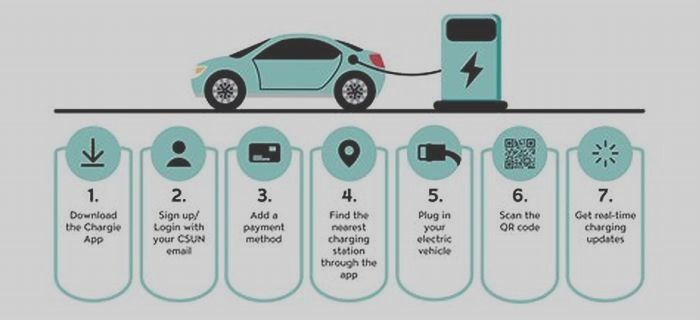

State regulators cant address all these problems, but they could consider addressing several of them with standards and mandates aimed at simplifying and enhancing the charging experience. For example, they could require all stations to accept credit cards and use standard plugs and connectors. They might also call for the use of plug and charge adapters. These collect the drivers billing information automatically from the vehicle once the charging cable is plugged into the electricity port, so drivers can charge their vehicles without having to provide a form of payment.

Building up Americas network of charging stations could make EVs more appealing to more people and thereby accelerate their uptake.

Integrating chargers with the power grid

While most power grids in the United States can supply enough electricity to meet demand from EV charging, few can deliver large amounts of electricity to many EVs at high rates at the same time. A particular concern is that grid constraints will occur locally, in neighborhoods and business districts (and near fleet depots) where EV charging will be concentrated. Upgrading grids will be costly: for a single public direct-current fast-charging (DCFC) station consisting of four DC 150-kW chargers, the cost of upgrading the grid and the site could be more than $150,000. In addition, to maximize emissions reductions from the transition to EVs, grid power would have to be as low carbon as possible. Grids themselves play an integral role in reducing the carbon intensity of electricity.

Our experience suggests that state-led EV-charging programs could accelerate the reinforcement of power grids and the buildout of renewable-generation capacity in several ways. They could, for example, set up initiatives to help utilities add storage capacity to bank renewable electricity during the day and then feed that electricity to commercial-fleet vehicles (or home-charged EVs) at night. Or they might allow charging providers to purchase renewable energy or renewable-energy credits at a discount. Utilities, too, could help accelerate the adoption of EVsfor example, by reducing the costs of energy and grid upgrades, and by supporting improvements in the planning and design of networks (which would enable the higher utilization of chargers).

Creating viable opportunities for charging businesses

Today, most charging companies in the United States use one of two business models. Under the first, companies sell electricity from public charging stations they own and operate. Few of these stations get used enough to generate a profit. Under the second, companies collect service fees for installing, operating, and maintaining charging stations at third-party locations, such as shopping malls or parking garages. These companies, too, are seldom profitable.

Making it profitable to sell public-charging services will probably be a prerequisite for building out a nationwide infrastructure, since government agencies are unlikely to build, own, or operate all the public-charging stations drivers will need. States could help support charging businesses in various ways, such as defraying the up-front capital cost of installing chargers and establishing offtake agreements to purchase a set amount of charging service each month, regardless of how much EV users pay for. They also could consider incentives to deploy charging infrastructure, as well as premiums for providing renewable energy (these would improve the economics of charging businesses by providing ancillary revenue streams). States could also streamline permitting processes so that providers can install and start operating new chargers more quickly; as it is, it can take nine to 24 months to get a charging station up and running.

Building up Americas network of charging stations could make EVs more appealing to more people and thereby accelerate their uptake. That will help abate GHG emissions, in line with the nations goals. States and companies that want to develop EV-charging infrastructure could do so more effectively by adhering to the principles described here.