Comparing Popular Electric Vehicles in North America vs Europe

A small but significant share of car owners in the United States have traded filling up for plugging in, and many more are thinking of joining them. In a recent Pew Research Center survey, 7% of U.S. adults said they currently have an electric or hybrid vehicle, and 39% said they were very or somewhat likely to seriously consider buying an electric vehicle the next time theyre in the market for new wheels.

Outside of a few major metropolitan areas, electric vehicles (EVs) arent all that common in the U.S. While their numbers have grown rapidly in absolute terms in recent years, thats from a relatively small base.

As of 2020, nearly 1.8 million EVs were registered in the U.S., more than three times as many as in 2016, according to the International Energy Agency (IEA). They come in three broad categories. All-electric vehicles (also called battery-electric vehicles) have been the fastest-growing category: The total number of such vehicles registered in the U.S. has soared from fewer than 300,000 in 2016 to more than 1.1 million last year. Consumers have purchased the other two types of EVs, plug-in hybrid vehicles and fuel cell vehicles, at lower rates.

With electric vehicles (EVs) slowly but steadily gaining in popularity in the U.S., we wanted to find out just how widespread they are, and how their growth here compares with that in other parts of the world.

Our main data source was the International Energy Agency, an affiliate of the Organization for Economic Cooperation and Development. We also used data on EVs and charging stations from the U.S. Energy Department, specifically the Office of Energy Efficiency & Renewable Energy and its Alternative Fuels Data Center. This dataset is updated frequently; we accessed it on May 25, 2021.

Other sources included the Census Bureau, for data on vehicle registrations and information on electric cars a century ago, and the Idaho National Laboratory for information on the past, present and possible future of electric cars.

Although the details can be a bit confusing, these days electric vehicles (EVs) come in three basic types. All-electric vehicles, sometimes called battery electric vehicles, run entirely on the electricity stored in their onboard battery packs. Plug-in hybrid electric vehicles have a small internal-combustion engine along with the battery pack; should the batteries run down, the gasoline engine can take over. With both those types, users recharge the batteries by plugging their cars into special charging stations. The third type, fuel cell electric vehicles, has onboard fuel cells that generate electricity from compressed hydrogen to power the motor. But there are far fewer fuel cell vehicles than the other two varieties.

All of these are distinct from hybrid electric vehicles, in which a relatively small electric motor supplements an internal combustion engine. This was a common setup in the first generation of mass-market electric cars, but because these cars dont have rechargeable batteries and their electric motors are too small to propel the car on their own, theyre not generally counted as EVs today.

But the U.S. represents only about 17% of the worlds total stock of 10.2 million EVs, according to IEA data. China has 44% of all the EVs in the world (more than 4.5 million), and the nearly 3.2 million in Europe account for about 31%.

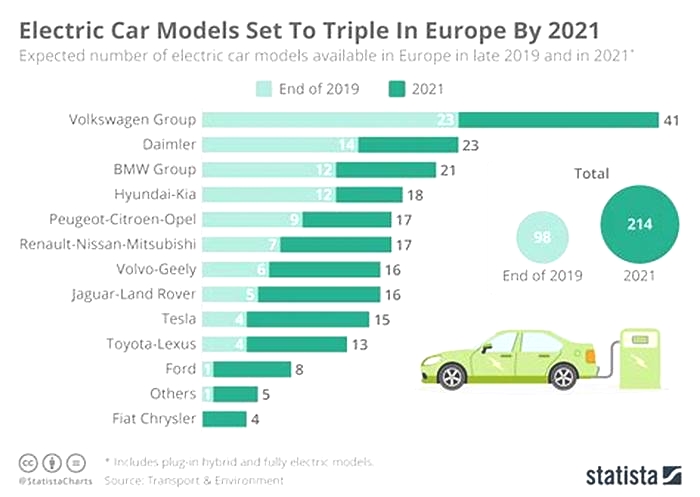

The fastest growth in EV sales has been in Europe: a compound annual growth rate of 60% from 2016 to 2020, compared with increases of 36% in China and 17% in the U.S.

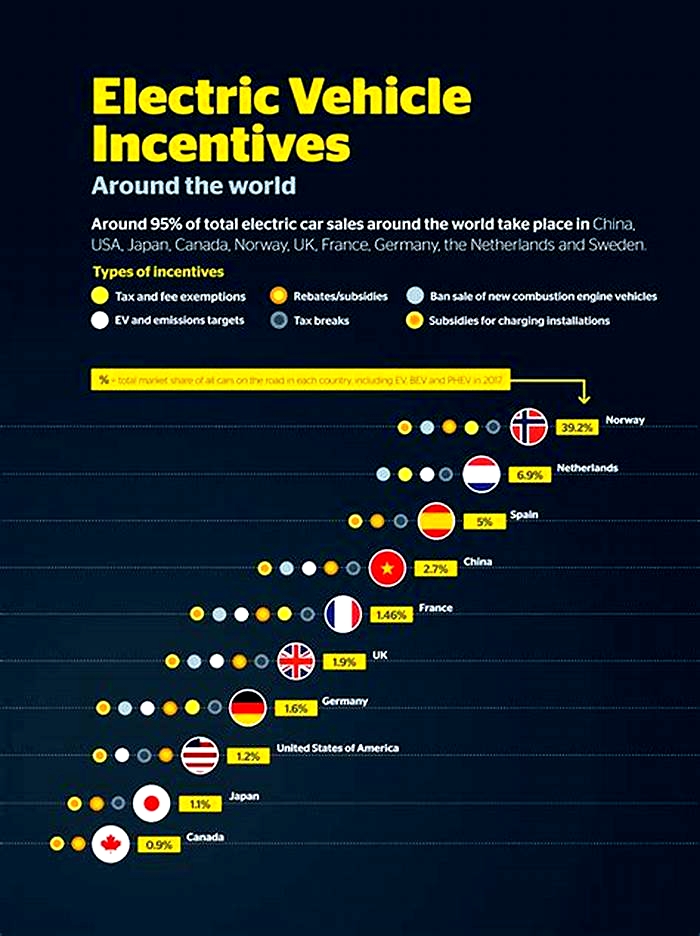

Last year, nearly three-quarters of all cars sold in Norway and more than half of those sold in Iceland were electric by far the highest market shares for EVs in any of the 31 countries for which IEA has collected data. In 10 other European countries, between a tenth and a third of all new-car sales last year were electric.

By contrast, sales have slowed in the U.S. in the past few years, largely due to the declining popularity of plug-in hybrids and the phaseout of federal tax credits on some of the most popular models. Last year, about 64,300 plug-in hybrids were sold, about half as many as in 2018, according to the IEA. Meanwhile, about 231,000 all-electric vehicles were sold in 2020, down 3.2% from 2018. In each of the past three years, EVs accounted for about 2% of the U.S. new-car market. The COVID-19 pandemic may have affected vehicle sales of all types in 2020, making comparisons difficult.

California has by far the highest share of EVs of any U.S. state which is to be expected, given that for decades the state has required carmakers to build EVs and has used an array of rebates and other incentives to encourage Californians to buy them. As of 2018, the most recent year for which federal data is available, California had about 12 EV registrations per 1,000 people; the next-highest state, Hawaii, had roughly six registrations per 1,000 people.

To support all those EVs, California also has led in building out networks of charging stations. Of the more than 42,000 publicly accessible charging stations in the U.S. as of May 25, 2021 (containing more than 102,000 individual outlets) across the U.S., nearly a third (30.8%) are in California, according to Pew Research Centers analysis of Energy Department data. For comparison, there are an estimated 145,000 to 150,000 gasoline retailers in the U.S.

Relative to the size of its vehicle fleet, though, Washington, D.C., may be the most convenient place in the U.S. to drive an EV. The 237 charging stations in the federal district have a total of 630 outlets, or one for every 487 privately owned cars and trucks on D.C. roads. (Vermont and, yes, California place second and third; the national average is one outlet for every 2,570 private and commercially owned cars and trucks.)

Nationwide, the number of publicly available charging stations has more than tripled since 2015, when there were fewer than 32,000 throughout the country, according to IEA data. The agency projects that number to grow dramatically by the end of the decade, to between 800,000 and 1.7 million, depending on which public policies are adopted. (President Joe Bidens infrastructure proposal includes a national network of 500,000 charging stations; in the Pew Research Center poll, 62% of Americans said they favored such a plan.)

Electric cars werent always such a small percentage of the U.S. market. Over a century ago, while the auto business was still in the learners-permit stage, electricity competed fiercely with steam and gasoline to be the new industrys dominant power source. In 1900, in fact, more than a third of all cars built in the U.S. were electric, according to a Census Bureau report from that time. (True, that was 1,575 cars out of a total of 4,192, but still.)

Within a couple of decades, however, several developments would lead to the dominance of the gas-powered internal-combustion engine. Among them were public desire for longer-range vehicles; electric starters replacing cumbersome and hazardous hand-cranks; lower gasoline prices; and assembly line mass production. By 1935, electric vehicles had all but disappeared.

Global

After a decade of rapid growth, in 2020 the global electric car stock hit the 10million mark, a 43% increase over 2019, and representing a 1% stock share. Battery electric vehicles (BEVs) accounted for two-thirds of new electric car registrations and two-thirds of the stock in 2020. China, with 4.5 million electric cars, has the largest fleet, though in 2020 Europe had the largest annual increase to reach 3.2million.

Overall the global market for all types of cars was significantly affected by the economic repercussions of the Covid-19 pandemic. The first part of 2020 saw new car registrations drop about one-third from the preceding year. This was partially offset by stronger activity in the second-half, resulting in a 16% drop overall year-on-year. Notably, with conventional and overall new car registrations falling, global electric car sales share rose 70% to a record 4.6% in 2020.

About 3million new electric cars were registered in 2020. For the first time, Europe led with 1.4 million new registrations. China followed with 1.2 million registrations and the United States registered295000 new electric cars.

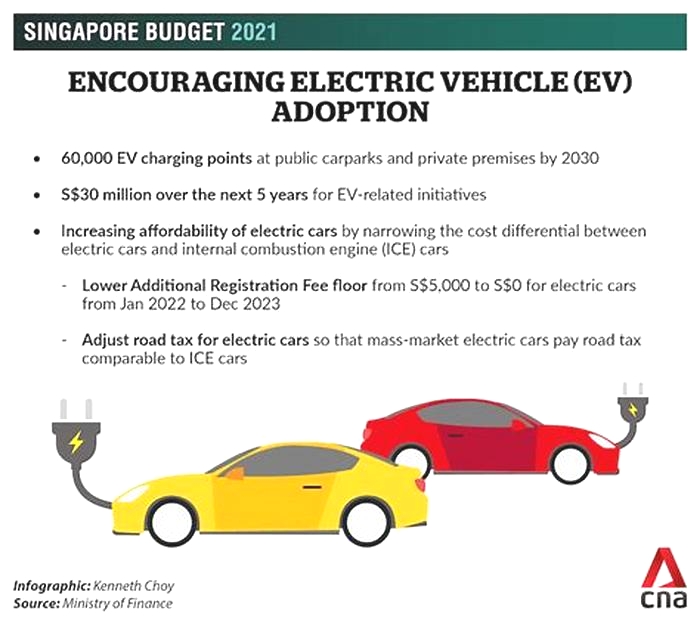

Numerous factors contributed to increased electric car registrations in 2020. Notably, electric cars are gradually becoming more competitive in some countries on a total cost of ownership basis. Several governments provided or extended fiscal incentives that buffered electric car purchases from the downturn in car markets.

Europe

Overall Europes car market contracted 22% in 2020. Yet, new electric car registrations more than doubled to 1.4million representing a sales share of 10%. In the large markets, Germany registered 395000new electric cars and France registered 185000. The United Kingdom more than doubled registrations to reach 176000. Electric cars in Norway reached a record high sales share of 75%, up about one-third from 2019. Sales shares of electric cars exceeded 50% in Iceland, 30% in Sweden and reached 25% in the Netherlands.

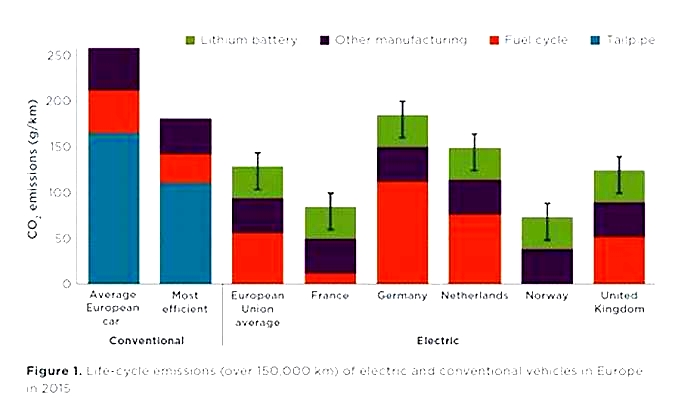

This surge in electric car registrations in Europe despite the economic slump reflect two policy measures. First, 2020 was the target year for the European Unions CO2 emissions standards that limit the average carbon dioxide (CO2) emissions per kilometre driven for new cars. Second, many European governments increased subsidy schemes for EVs as part of stimulus packages to counter the effects of the pandemic.

In European countries, BEV registrations accounted for 54% of electric car registrations in 2020, continuing to exceed those of plug-in hybrid electric vehicles (PHEVs). However, the BEV registration level doubled from the previous year while the PHEV level thripled. The share of BEVs was particularly high in the Netherlands (82% of all electric car registrations), Norway (73%), United Kingdom (62%) and France (60%).

China

The overall car market in China was impacted by the panademic less than other regions. Total new car registrations were down about 9%.

Registration of new electric cars was lower than the overall car market in the first-half of 2020. This trend reversed in the second-halfas China constrained the panademic. The result was a sales share of 5.7%, up from 4.8% in 2019. BEVs were about 80% of new electric cars registered.

Key policy actions muted the incentives for the electric car market in China. Purchase subsidies were initially due to expire at the end of 2020, but following signals that they would be phased out more gradually prior to the pandemic, by April 2020 and in the midst of the pandemic, they were instead cut by 10% and exended through 2022. Reflecting economic concerns related to the pandemic, several cities relaxed car licence policies, allowing for more internal combustion engines vehicles to be registered to support local car industries.

United States

The US car market declined 23% in 2020, though electric car registrations fell less than the overall market. In 2020, 295000new electric cars were registered, of which about 78% were BEVs, down from 327000 in 2019. Their sales share nudged up to 2%. Federal incentives decreased in 2020 due to the federal tax credits for Tesla and General Motors, which account for the majority of electric car registrations, reaching their limit.

Other countries

Electric car markets in other countries were resilent in 2020. For example, in Canada the new car market shrunk 21% while new electric car registrations were broadly unchanged from the previous year at 51000.

New Zealand is a notable exception. In spite of its strong pandemic response, it saw a decline of 22% in new electric car registrations in 2020, in line with a car market decline of 21%. The decline seems to be largely related to exceptionally low EV registrations in April 2020 when New Zealand was in lockdown.

Another exception is Japan, where the overall new car market contracted 11% from the 2019 level while electric car registrations declined 25% in 2020.Theelectric car market in Japan has fallen in absolute and relative terms every year since 2017, when it peaked at 54000registrations and a 1% sales share. In 2020, there were 29000registrations and a 0.6% sales share.