Did BYD overtake Tesla in China

The Straits Times

HONG KONG - Chinas BYD bills itself as the biggest car brand youve never heard of. It might need a different tagline soon.

The automaker is poised to surpass Tesla as the new worldwide leader in fully electric vehicle (EV) sales. When it does likely in the current quarter it will be both a symbolic turning point for the EV market and further confirmation of Chinas growing clout in the global automotive industry.

In a sector still dominated by more familiar names such as Toyota Motor, Volkswagen and General Motors, Chinese manufacturers including BYD and SAIC Motor are making serious inroads. After leapfrogging the United States, South Korea and Germany over the past few years, China now rivals Japan for the global lead in passenger car exports. Some 1.3 million of the 3.6 million vehicles shipped from the mainland as at October this year were electric.

The competitive landscape of the auto industry has changed, said Bridget McCarthy, head of China operations for Shenzhen-based hedge fund Snow Bull Capital, which has invested in both BYD and Tesla. Its no longer about the size and legacy of auto companies; its about the speed at which they can innovate and iterate. BYD began preparing long ago to be able to do this faster than anyone thought possible, and now the rest of the industry has to race to catch up.

The passing of the EV sales crown also reflects the shift in competitive dynamics between Teslas Elon Musk, the worlds richest executive, and BYDs billionaire founder Wang Chuanfu.

Whereas Mr Musk has been warning that not enough consumers can afford his EVs with such high interest rates, Mr Wang is firmly on the offensive. His company offers half a dozen higher-volume models that cost much less than what Tesla charges for its cheapest Model 3 sedan in China.

When a Tesla owners club shared a clip in May of Mr Musk snickering at BYDs cars during a 2011 appearance on Bloomberg Television, Musk wrote back that BYDs vehicles are highly competitive these days.

The likely change in the global EV pecking order marks the realisation of a goal that Mr Wang, 57, set back when China was just starting to foster its now world-beating electric car industry. While BYD continues to pull away from Tesla and all other auto brands at home, replicating its runaway success abroad is proving tricky.

Europe looks poised to join the US in slapping Chinese car imports with higher tariffs to shield thousands of manufacturing jobs. Other countries EV markets are still in their infancy and are not nearly as lucrative. Management views the US as virtually off-limits due to the escalating trade tensions between Washington and Beijing.

Mr Wang is no Musk he eschews social media and largely steers clear of the limelight. But in an uncharacteristically brash address delivered weeks before the European Union opened an investigation into how China has subsidised its EV industry, Mr Wang declared the time had come for Chinese brands to demolish the old legends of the auto world.

While many car buyers outside of China are still only dimly aware of BYD, Warren Buffett surely is not. In 2008, Berkshire Hathaway invested about US$230 million (S$304 million) for an almost 10 per cent stake in the Chinese automaker. When Berkshire started paring its holding last year BYD shares were trading near their all-time high the value of its stake had soared roughly 35-fold to around US$8 billion.

In 2016, the company hired Wolfgang Egger as design chief, a role he previously played for Audi and Alfa Romeo. It also lured away other international executives, including Ferraris head of exterior design and a top interior designer for Mercedes-Benz.

By the time China invited Tesla to build the countrys first car plant fully owned by a foreign entity, BYD was no longer resigned to making no-frills econoboxes. Now, its most expensive model the Yangwang U8 sport utility vehicle costs 1.09 million yuan (S$203,700).

Tesla overtaken by Chinas BYD as worlds biggest EV maker

Unlock the Editors Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Elon Musks Tesla has been knocked off the top spot as the worlds best-selling electric-vehicle maker for the first time by BYD after recording fewer deliveries than its Chinese rival in the past quarter.

The US group handed over 484,000 cars in the fourth quarter, more than the 473,000 anticipated by analysts but not enough to hold on to its title after BYD reported record sales of battery-only vehicles of 526,000 for the same period.

Teslas dethroning by BYD reflects the rise of what was a little-known Chinese group only a decade ago, which Musk himself has publicly dismissed. While growth at the Warren Buffett-backed Chinese company has been mostly achieved on its home turf, BYD is sharpening its focus on finding new foreign markets including in Europe.

Danni Hewson, head of financial analysis at AJ Bell, said BYDs electric cars were becoming increasingly visible on European roads thanks to keen pricing.

BYDs success in chasing down Tesla also underlines the struggle of legacy automakers from the US, Europe, Japan and Korea to adapt to fast-changing consumer preferences for cheaper, smarter electric vehicles.

In a statement published in China, the Shenzhen-based group called itself the world champion for new energy vehicles after notching total annual sales of more than 3mn for 2023 across its vehicles which also include plug-in hybrid cars.

Teslas annual sales were 1.81mn vehicles in 2023, while BYD delivered 1.58mn fully electric cars.

Through much of the past 12 months, BYD benefited from price cuts sparked by Teslas attempt to chase market share, pushing consumers to consider Chinas lower-cost models, according to analysts.

For any doubters left in the west, I hope this is the final data point that points to BYDs strength and, as importantly, how China EV Inc has bullied its way on to the global stage, said Tu Le, founder of Beijing-based advisory company Sino Auto Insights.

He added that while both companies cut prices on some cars over the past year, Tesla did so much more dramatically, signalling that BYD could distance itself further from the US group over the coming year.

Still, WedbushSecurities analyst Dan Ives said it was an important quarter for Tesla to show strong deliveries and momentum heading into 2024.

Teslas annual sales of 1.8mn last year was a major achievement in a choppy macro [economic environment] for the electric vehicles sector, he added.

BYD was founded by Wang Chuanfu, a former university professor, in the mid-1990s. After focusing on manufacturing rechargeable batteries, including for mobile phones, the company expanded into the car industry in the early 2000s.

The Chinese groups early success prompted Buffetts Berkshire Hathaway to invest in the company in 2008. Despite relying on existing industry technology for many years, BYD has focused on stripping out costs from the production process.

Following years of state support and careful industrial planning by Beijing, Chinas automakers now leverage their countrys control over the production of almost every resource, material and component used to make electric vehicles.

BYDs vertically integrated structure it controls mines and produces batteries and chips has made it the envy of foreign rivals as the global car industry transitions away from the combustion engine.

At the end of last year six out of the top-selling EV models in China, the worlds largest car market, were BYD cars, according to Automobility, a Shanghai-based consultancy. While BYDs share of sales has expanded to more than 35 per cent, Tesla has struggled to keep up with the cadence of product launches by Chinese rivals, the consultancy added.

Did BYD Overtake Tesla as World's Biggest EV Seller? That Depends on How You Count

Photo: Tesla/BYD/edited by autoevolution

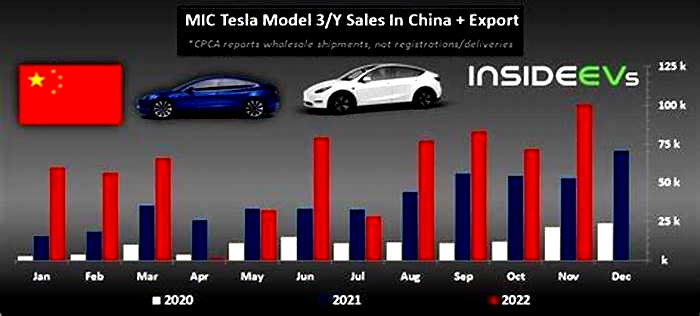

BYD celebrated selling 134,036 new energy vehicles (NEVs) in June. For the Financial Times and Nikkei Asia, that has settled the controversy around who is the worlds largest EV seller: they have written that the Chinese titan has beaten Tesla and is now number one. According to Nikkei Asia, BYD has sold 641,000 new vehicles so far this year. The problem is how you decide to count.

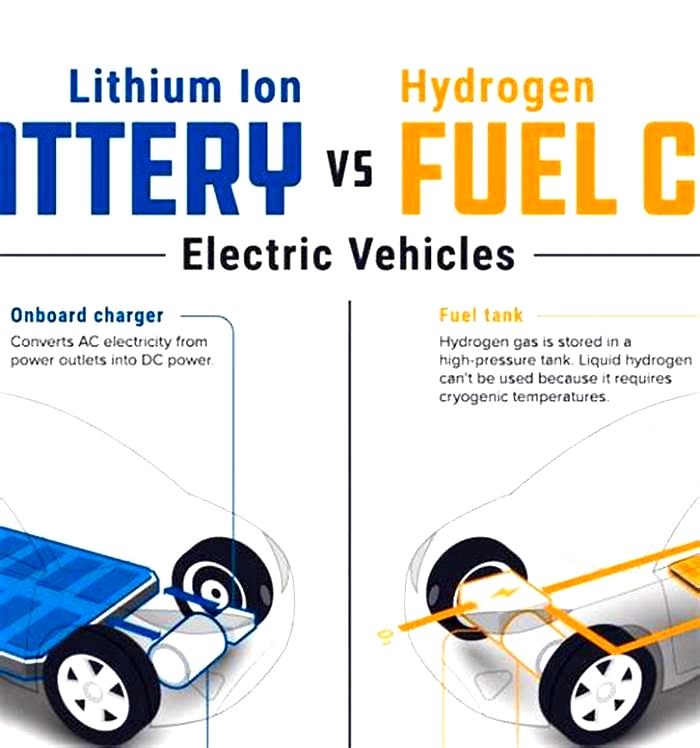

China includes plug-in hybrids (

PHEV) in its NEV classification. Although some business intelligence companies count the two types of vehicles without distinction, such as BNEF, other analysts prefer to count them separately, as Matthias Schmidt does at Schmidt Automotive Research.

Some PHEVs offer higher pure electric ranges than some battery electric vehicles (BEVs). Despite that, they may end up being used as regular

ICEvehicles if they are not adequately charged. China restricted incentives to plug-in hybrids to the owners that could prove they plugged them in a minimum number of times every month, among other demands.

According to

Nikkei Asia, Tesla sold 564,000 cars in the first half of 2022. Considering the company only makes BEVs, there are no PHEVs among them. The Twitter account Moneyball (@DKurac) helped us clarify how many BEVs

BYDsold in the first half of 2022: 323,519. In other words, fewer BEVs than Tesla. If you only consider them as true electric cars, BYD is still halfway to threatening Teslas lead, but there is a catch.

Recently, Plain Site accused Tesla of including used EVs among its delivery numbers. If that is correct, the

EVmaker could be artificially inflating its sales results. Wed ask the company about that if it had a working PR department or anyone willing to answer difficult questions, but that is not the case.

Unfortunately for Tesla, the company has a record of inconsistencies with its numbers. On June 17, 2019, Francine McKenna wrote on

MarketWatchabout how the companys delivery numbers changed between filings. She gave multiple examples of that happening and said the discrepancies revealed

potential weaknesses in accounting and disclosure controls.Considering what Plain Site brought up, things have not changed that much at Tesla since McKenna published her text.

BYD does not seem to have the same issues. Moneyballs data even corrects the number Nikkei Asia presented: BYD sold 638,157 NEVs in H1, not 641,000. For those who suspect that BYD inflates its NEV numbers with PHEV sales, it sold fewer PHEVs (314,638 units) than BEVs. Regarding production, BYD manufactured a total of 644,721 units, with 327,037

BEVsand 317,684 PHEVs.

The bottom line is that BYDs win depends on how people make their calculations. If we are to consider

PHEVsand BEVs as electric cars, BYD is the clear winner. In fact, it already was the winner after May sales numbers were disclosed, as Taylor Ogan pointed out in a tweet on June 8.

If you consider that the right choice is to separate BEVs from PHEVs,

Teslais still ahead (if you trust its numbers). BYD seems determined to change that until the end of the year by presenting new products and opening new factories at an impressive speed. Well check again in January 2023 to see if it wins, regardless of the method to count EVs.

BYD Overtakes Tesla, With Other Chinese EV Makers Close Behind

BYD Seal eIectric car on display during the Japan Mobility Show 2023 on October 25, 2023 in Tokyo, ... [+] Japan. (Photo by Jun Sato/WireImage)

BYD has overtaken Tesla as the worlds biggest selling electric vehicle maker, and other Chinese manufacturers will soon join it as they lead the electric revolution at the expense of their Western competitors.

We believe BYD and other leading Chinese [manufacturers] are set to conquer the world market with high-tech, low-cost EVs for the masses, hereby accelerating global EV adoption, investment bank UBS said in a report.

UBS and other experts said only Tesla can keep pace with the Chinese.

Europe will be the main target and exclude the U.S., at least for now, according to the Wall Street Journal.

Western countries are getting anxious about cheaper Chinese EVs flooding their markets. Europe has launched an anti-subsidy probe into EVs from China, while the Biden administration is considering raising tariffs on Chinese EVs, said the WSJs Heard on the Street columnist Jacky Wong.

No Chinese EVs are sold in the U.S. because of rules excluding batteries and other components produced by Chinese manufacturers from its supply chain under the Inflation Reduction Act.

BYD accelerated past Tesla to claim the title of the worlds biggest seller of EVs in 2023s fourth quarter, selling about 530,000, beating Teslas 485,000.

Late last year, BYD announced it would build a new factory in Szeged, southern Hungary, which would help it avoid any increased tariffs the European Union might levy if it finds excess subsidies. Other Chinese companies will likely follow BYDs example and assemble cars in Europe.

Europe is likely to become a battleground for Chinese EVs with only one likely winner, given the at least 30% price advantage the likes of China's BYD, Geely, SAIC, NIO and Great Wall Motors have, according to UBS. The BYD Dolphin costs around $33,000 in Britain, almost a third less than its claimed equivalent, the VW ID.3.

BYD ATTO-3 EV (Photo By Sonu Mehta/Hindustan Times via Getty Images)

Reuters Breakingviews column reckons Tesla will still be mixing it with the Chinese at the top of the EV tree while so-called legacy players like Ford Motor, General Motors and Volkswagen struggle. In Europe and the U.S., demand for EVs has taken a hit recently, with these legacy firms finding their output of electric cars piling up on dealer lots.

Even allowing for recent wobbles, worldwide EV sales are rising faster than those powered by gasoline yet account for only slightly more than a tenth of new car deliveries. Both companies are still expanding manufacturing capacity too, Tesla in Germany and Mexico, while BYD is setting up in Hungary, Brazil and Thailand (and reportedly in Mexico also, according to Dunne Insights), Breakingviews Antony Currie said.

Michael Dunne, CEO of Dunne Insights, said no other manufacturer can match BYDs EVs for price. The company is comfortable making thin margins to win market share, and this frightens the competition in the U.S., Europe, Korea and Japan, except Tesla.

BYD Dolphin EV (Photo by John Keeble/Getty Images)

BYD now produces arguably the worlds most advanced battery, called the Blade. The battery delivers maximum energy density, safety and efficiency. Most of the gains are from the super-efficient blade battery pack design and inventive manufacturing processes. Think of the Blade as the equivalent of a high-quality Toyota gasoline engine: reliable, affordable and efficient. Mercedes, Ford and Kia have already decided to source some of their batteries from BYD, Dunne said.

Dunn said Tesla doesnt fear BYD yet.

Tesla enjoys extraordinary global brand power. The BYD image is rather bland, evoking little emotion. As a battery company that moved up into cars, BYD is still searching for an identity that clicks with customers, Dunne said.

Tesla is still a premium manufacturer while BYD serves mostly mass markets.

Things could change. But today few people looking at a Tesla opt for a BYD, Dunne said. Teslas charging network and software is still way ahead of BYDs.

Ford Mustang Mach-E (Photo by FREDERIC J. BROWN/AFP via Getty Images)

UBS said EV demand in Europe will remain lackluster in 2024, with the Chinese adding up to 200,000 vehicles to the total market reaching about 1,950,000. But after that, watch out Europe.

We expect Chinese [manufacturers] to own one-third of the global [EV] car market by 2030. Europeans most at risk, UBS said.