Do electric vehicles hold their value

Do Electric and Hybrid Cars Hold their Value?

When consumers buy hybrid or electric cars, they typically do so with a greater purpose. Either they wish to help the planet by limiting the burning of fossil fuels and reducing emissions, or they are early adopters of new technologies and want to try that which is new and shiny, or they simply want to save money by limiting their trips to the gas pump. These consumers tend to be more affluent, more highly educated, and lean towards being green or progressive - most also drive their cars like wearing a badge of honor, suggesting I am doing my part to save the planet.

Are they Worth it?

What virtually everyone wants to know, however, is whether or not they receive a good return on their hybrid/electric investment, and if the higher purchase price is justified by lower fuel costs over their ownership period. This question has been asked by, and answered by, millions, and we will not attempt to do so yet again. Instead, we will focus on what the car is worth when you sell it - what do you get for a trade-in allowance. Is it worth saving $500 per year on fuel, if your car loses half of its value in three years? Or, do hybrid/electric drivers save on fuel, and also get more for their vehicles when theyre traded in or sold privately?

The Method and Key Takeaway

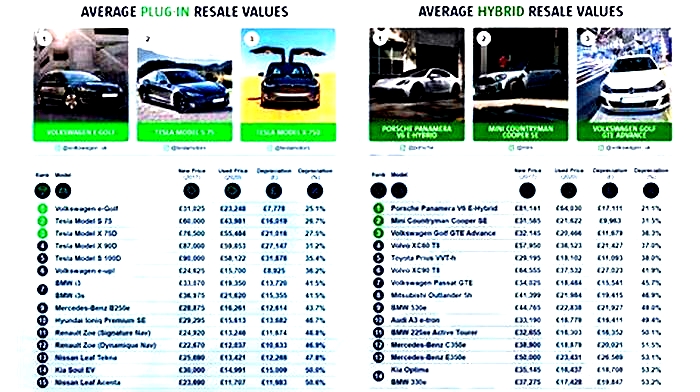

CarEdge.com has calculated the annual depreciation of 193 car models through at least five years of ownership, and can tell you with little question, which cars have historically been relatively good investments, and which ones have been underperformers. For this article, we will focus on 2015 model-year hybrids and electrics - comparing what they sold for new, versus what theyre worth today. Of the 193 models tracked by caredge.com, we looked at 12 of the more popular hybrids and electrics, to see how they fared with respect to holding their value, relative to their fossil fuel cousins. The bottom line is that results are all over the map, and hybrids/electrics ranked as high as 12th within all (193 models) of the 2015 models tracked, but also as low as 191st, with the remaining ten scattered all throughout the rankings.

Lets Start with the Worst

Lets start with the bad news (for hybrid/electric owners) first, and tell you about the worst performing hybrid/electrics out there for maintaining their value. The Ford Fusion Energi (ranked 191st), which originally sold on average for $36,000, is now worth 1/3 that amount, or a little over $12,000. Over the five-year period, this vehicles value has fallen by almost $5,000 per year, significantly exceeding any monies that would have been saved by purchasing less gas, even when compared to the depreciation of other fossil fuel-burning cars. Even if the Energi ran on water, and fuel cost you nothing, youd still come out on the losing end of this purchase. When it comes to resale, unlike the Energizer Bunny, the Energi has lost its mojo. Coming in at a close second (2nd worst) for value retention of hybrids/electrics, is the Nissan Leaf electric. The Leaf originally sold on average for $30,000, and is now worth less than $11,000, a 65% decrease in value over 5 years - clearly the Leaf has fallen far from the value tree, and foliage has turned into spoilage. Clearly, for these two, unless youre driving 50,000 miles per year, theres no way that fuel savings are turning this investment into a good one. You may have been an early-mover buying a Leaf or Energi, but it turned out to be a big mistake - at least financially. Rounding out the remaining sub-par performers, are the Ford Fusion Hybrid (131st), Toyota Avalon Hybrid (110th), and Lexus RX450h (89th). None have done a very good job with respect to holding their value, but perhaps if you put on enough miles, the fuel savings may offset the big bucks you lost through depreciation.

Onto the Better Performers

On the other end of the extreme, are some hybrids/electrics that have proven to be relatively good purchases, irrespective of whether they save the planet, or fuel costs. At the top of the hybrid/electric list, placing 12th of all 193 models, is the Toyota Highlander Hybrid. This mainstay SUV from Toyota originally sold for roughly $47,000, and is still worth almost $29,000 today, holding over 60% of its value since new. The Highlander Hybrid ranks well - both for hybrids, but also for all vehicle models. Given the attractive value retention, and your ability to pass by gas stations without hesitation, the Highlander is one solid investment. Of special note, the gas-powered Highlander ranks four notches lower on value retention, so it would appear that the hybrid saved you fuel costs, and is worth a touch more, even five years after purchase.

Running a distant second/third to the Highlander, are the Honda Fit (29th) and Toyota Camry Hybrid (30th), who both retain close to 55% of their value, versus an average of 47% of all 193 models tracked through 5 years. In both cases, the Fit and the Camry Hybrid offer exceptional value retention, and youre able to feel good about saving on fuel costs, and saving the planet.

What about Tesla?

No article about hybrids or electric cars would be complete without a commentary on Tesla. With such, we will tell you that the Tesla Model S - the only Tesla qualifying for 5-year results - ranks 75th overall, and 6th of the 12 hybrid/electrics that we researched. The Model S, which cost roughly $92,000 when purchased in 2015, is today worth exactly half, at $46,000. Again, this 50% year-5 value retention still beats our overall average of 47%, but not by much. Losing $46,000 of value is never fun, regardless of what you drive (unless you drive a Ferrari, and then its a bargain), but that was the cost of being an early-adopter five years ago. Our take is that Tesla deserves credit for producing a fully-electric car, and still having it be worth something meaningful with its technology 5 years old, and after youve put some significant miles on it.

Our Not-So-Dirty Dozen Rankings

Bottom Line

Our bottom line on whether hybrids and electric cars provide good resale value, is an earth-shattering, it depends. Some models, such as the Highlander, Fit and Camry Hybrid have done extremely well in limiting depreciation, and have saved you fuel costs through the years. On the other hand, The Nissan Leaf and Ford Fusion Energi have few rivals when it comes to losing a majority of their value so quickly. Tesla, given their quest to lower the price of their new models, is likely to fare well in the coming years with their latest models, even if gas falls to $.99 per gallon. They seem to have cracked the code, and they are the EV company for others to emulate. The smart shopper, however, will do their homework, see what has worked in the past, and learn more about what causes some models to perform well in the aftermarket, and why failures occur. You wont have a crystal ball, but this internet thing sure is handy.

Find Out More

Research depreciation rates for almost 200 models over their entire lives, by visiting www.caredge.com/ranks to see how your car or truck does versus all the rest. Good luck, and happy motoring.

Do Electric Cars Hold Their Value: Battery Impact?

The landscape of transportation is being redefined by the electric vehicle market, making strides in technology and consumer adoption. The electric car value over time is a topic of growing interest as individuals look to invest wisely in a rapidly transitioning automotive industry. With approximately 2.2 million electric vehicles (EVs) navigating U.S. roads per Experians data, and a more than doubling in EV sales from below 450,000 in 2021 to over 800,000 in 2022, according to Kelley Blue Book, the future shines bright for electric car enthusiasts. However, alongside the enthusiasm for sustainable transportation, potential owners and investors are closely evaluating the electric vehicle resale value, which is becoming an essential part of the ownership experience.

The surge in electric models has inevitably led to burgeoning curiosity regarding how these vehicles maintain their value over time, especially in the used car market. Challenges like limited public charging infrastructure signal a critical area for growth to enhance EV convenience and appeal. Despite these hurdles, the EV market forges ahead, with sales expected to top one million this year, hinting at a maturing market ready to embrace a more sustainable driving future.

Key Takeaways

- Expanding EV sales signify the increasing popularity of electric cars in the United States.

- Electric vehicle resale value is a crucial factor for consumers considering the switch to electric.

- The used EV market is small but growing, with more diverse options anticipated over time.

- Charging infrastructure remains a vital component of the EV markets development.

- Prospective buyers are encouraged to consider range and charging options in alignment with lifestyle needs.

Understanding Electric Vehicle (EV) Depreciation Trends

EV depreciation is a critical consideration for potential buyers and existing owners alike. As electric technology begins to permeate the market, electric car depreciation rates have become an essential metric for evaluating the long-term value of this vehicle class. Notably, electric vehicles tend to depreciate more rapidly than their internal combustion engine (ICE) counterparts. Investigating the factors driving this trend helps us to understand the overall electric vehicle resale value sentiment.

Data from respected industry sources such as Kelley Blue Book presents a revealing picture of value retention in electric cars. For instance, after three years, an average electric vehicle will retain about 63% of its initial cost, a marginal decline when compared to ICE vehicles, which maintain around 66%. As the timeline extends to five years, this gap in preservation of value becomes more pronounced, with electric vehicles holding about 37% of their starting price, distinct from the nearly 46% retained by ICE models.

Although at first glance, the depreciation statistics may appear unfavorable for EV owners, the scenario changes when considering total cost of ownership. Its here that electric vehicles shine. Despite higher depreciation ratios, electric cars often necessitate less frequent maintenance and have fewer mechanical components that could fail translating to significant savings over time.

Consumer Reports has provided pivotal insight by revealing that EVs cost approximately half as much to maintain and repair than gas-powered vehicles. Therefore, while the sticker price of a used EV may seem steep, such as the average March selling price of $42,895, these figures dont capture the full financial picture without factoring in the ongoing operational savings.

The economic dynamics of the EV market suggest that while buyers might face greater upfront costs when purchasing an electric vehicle, these can be offset over time with maintenance expenditures in mind. Now, lets delve into some specifics that define the landscape of electric vehicle depreciation:

| Vehicle Type | 3-Year Retained Value (%) | 5-Year Retained Value (%) | Average Used Price ($) | Maintenance Cost Efficiency |

|---|---|---|---|---|

| Electric Vehicle (EV) | 63 | 37 | 42,895 | High |

| Internal Combustion Engine (ICE) | 66 | 46 | 27,000 (Market Average) | Lower |

Its clear that the future presents myriad opportunities and challenges for the electric car market. Consumers poised to ride the wave of EV adoption thus have much to contemplate, especially concerning depreciation, which is but one facet of the complex decision-making process surrounding electric vehicles.

Do Electric Cars Hold their Value

When considering an investment in an electric vehicle (EV), one may ponder about electric car price retention and the long-term financial implications. In essence, does an electric car maintain its value comparably to its gasoline-powered ancestors? As the market witness burgeoning EV adoption, understanding factors like the resale value of electric cars, battery health, and overall EV value is crucial for savvy consumers and stakeholders.

The Impact of Battery Health on Electric Car Resale Value

The crux of an EVs longevity and its resale value is undeniably linked to its battery health. Interestingly, various studies indicate that a typical EV batter has a substantial capacity lossbetween 5% to 10%within its first half-decade on the road. This attrition can be exacerbated by factors such as extreme temperature exposure and the frequent use of rapid charging. Knowing this, potential EV buyers might be wary; however, federal warranties cushion this impact by covering batteries for at least

Understanding the severity of the batterys condition and the impending maintenance or replacement costswhich may exceed $10,000plays a pivotal role in evaluating a used EVs worth. Its a variable that can either fortify or fracture the confidence of used EV buyers, thereby sculpting the landscape of electric car resale values.

Comparing Electric Car Depreciation Rates to Internal Combustion Vehicles

In a direct comparison, data lay bare the rapid depreciation rate of electric vehicles relative to internal combustion engine vehicles. Electric cars, according to observations, may forfeit about 52% of their original value after three years, while their gasoline-fueled rivals typically lose around 39.1%. Yet, its imperative to remember that depreciation is an inescapable fate for all vehicleselectric or not.

However, with the burgeoning acceptance of EVs and advancements in technology, one may anticipate an evolution in the market dynamic and potentially enhanced electric car price retention figures in the future. As innovation perseveres and as manufacturers produce more electric models, the gap in depreciation rates between EVs and ICE vehicles might narrow, hinting at a promising horizon for the resale value of electric cars.

Factors Influencing Electric Car Value Over Time

Analyzing the electric car resale market reveals that multiple factors intricately determine the EV resale value determinants. Given that the adoption of EVs is in a rapid growth phase, evaluating the elements that affect EV value is essential for consumers and industry stakeholders. Prominent among these factors are a vehicles mileage, its maintenance history, brand reputation, and the effects of government incentives. These components, individually and collectively, play a significant role in the depreciation and eventual resale value of electric vehicles.

The impact of mileage on an electric cars value is similar to that of traditional vehicles; higher mileage typically translates to a lower resale value. However, for electric vehicles, the way mileage affects the batterys condition is also of paramount importance. Frequent use and high reliance on rapid charging options may speed up battery wear, leading to a depreciation in value more significant than in combustion engine cars.

Maintenance history is another critical factor. Electric vehicles, by design, have fewer moving parts and thus require less maintenance. However, the maintenance that is performed, particularly on the battery and electric motor, can significantly influence resale prices. Proactive maintenance and comprehensive records can help retain the vehicles value.

Brand reputation is an often under-considered but critical factor in the EV market. Brands like Tesla have established a strong market presence and consumer trust, which in many cases, help their vehicles hold value better over time. Conversely, electric vehicles from less established manufacturers or brands with a weaker reputation in the EV space might not fare as well on the resale market.

Government incentives also have a two-fold effect on the EV market. Initially, they can reduce the purchase price of new electric cars, making them more accessible to consumers. This, in turn, can influence the depreciation curve and EV value at resale, as the effective cost basis is lower.

Demand is an inherent driver of value in any market, and as the general public becomes more comfortable with EV technology and infrastructure continues to develop, demand is expected to increase. Currently, the demand for EVs lags behind that for gas-powered vehicles, which contributes to faster depreciation rates. However, the shift toward electric mobility is gaining momentum, possibly heralding a change in this trend.

It is essential to consider these factors within the broader context of a rapidly evolving electric vehicle industry. As market dynamics shift, so too will the factors impacting EV resale value. Heres a closer examination of the factors involved:

| Mileage | Car Age | Maintenance | Brand Reputation | Government Incentives | Demand | Rapid Charging Impact |

|---|---|---|---|---|---|---|

| Negative Effect on Value | Likely Depreciates Value Over Time | History Can Enhance Value Retention | Strong Reputation Boosts Resale Value | Reduces Initial Cost, Affecting Depreciation Curve | Increasing EV Popularity May Bolster Values | May Accelerate Battery Wear and Impact Value |

The landscape of the electric car resale market is concurrently shaped and challenged by these factors. By understanding this markets nature, prospective EV buyers and sellers can make informed decisions, reflecting the vehicles true value across its lifespan.

Is the Electric Car Resale Market Maturing?

The trajectory of the electric car resale market is ascending, exhibiting clear signs of growth and maturity. New and seasoned buyers alike are increasingly valuing the benefits that EVs provide, propelling the electric car resale market. A significant contribution to this maturation is the notably increased scope of EV sales growth, which is now beginning to reflect in the pre-owned segments.

Amidst an eco-conscious consumer base, the resale values are adjusting as the market witnesses a noticeable expansion in used electric vehicle availability. With greater acceptance of electric transportation as a norm rather than an exception, the horizons for resale market dynamics are broadening.

Growth Trajectory of EV Sales and Their Resale Channels

Considering the number of EVs on the road, the electric car resale market is ripening. Exponential sales growth is now finding its echo in the secondary market, with a variety of makes and models becoming more commonplace. This diversity brings along a more nuanced and structured resale marketplace, capable of catering to a range of consumer needs and budgets.

Challenges and Opportunities in the Used EV Market

While the prospects are promising, challenges in the used electric vehicle market persist, primarily concerning supportive infrastructure like charging stations. This shortfall could hinder the markets potential for certain geographical areas where potential EV adopters are concerned about the practicality of owning an electric vehicle. However, as the network of charging stations grows, these concerns are gradually being assuaged. Moreover, the advancements in EV technology and an increase in awareness amongst buyers indicate positive trends for the markets future.

Weighing in these dynamics, clarity emerges regarding the maturation of the electric car resale market and the pattern it is likely to follow as it integrates deeper into the fabric of the automotive industry.

| Market Indicator | Description | Impact on Resale Market |

|---|---|---|

| EV Sales Volume | Growth in new EV registrations. | Positive, as higher new sales volume eventually feeds into used market. |

| Consumer Confidence | Buyer trust in EV performance and longevity. | Enhances market stability and sustains resale values. |

| Availability & Variety | Range of EV models in the used market. | Drives competition and provides more options for buyers. |

| Infrastructure Development | Expansion of charging networks. | Reduces practicality concerns, potentially boosting resale values. |

| Technological Advancements | Improvements in EV features and capabilities. | Increases perceived long-term value, reinforcing resale prices. |

The Role of Charging Infrastructure in EV Resale Value

As the electric vehicle (EV) market continues to evolve, the availability and sophistication of EV charging infrastructure are becoming pivotal factors determining the electric car resale value. A robust network of charging stations not only makes owning an electric car more convenient but also bolsters confidence in EVs as a viable long-term investment. This increased confidence can directly impact their appeal on the resale market.

For EV owners, the decision to sell or trade-in their vehicle often revolves around the accessibility of charging options. In regions where the density of charging stations is high, electric vehicles tend to maintain their value better. The reasoning is straightforward: the easier it is for the next owner to charge the vehicle, the more desirable and thus valuable the vehicle is. As of the moment, with around 53,000 public charging options for electric vehicles, theres still room for growth compared to the 145,000 gas stations across the U.S.

While the public charging network continues to expand, the option for home charging presents a significant value proposition for EV owners. The ability to charge an EV overnight in the convenience of ones own garage can be a compelling reason for a buyer to consider a used electric vehicle over a new one. This too positively influences the cars resale value.

| Charging Infrastructure Attribute | Effect on EV Resale Value |

|---|---|

| Number of Public Charging Stations | More stations may lead to higher resale values |

| Availability of Fast Charging Options | Increased number of fast chargers correlates with enhanced convenience and potentially higher values |

| Home Charging Feasibility | Can significantly boost an EVs appeal in the resale market |

| Regional Charging Station Density | Areas with more stations typically see better retention of electric car resale value |

Therefore, when evaluating the long-term value of an electric vehicle, both current and prospective owners must factor in the state of the charging infrastructure: is it vast, reliable, and conveniently accessible? These considerations will ultimately shape the vehicles worth when its time to pass it on to the next driver.

Key Considerations When Shopping for a Used Electric Vehicle

Embarking on the journey to buy a pre-owned electric vehicle (EV) is an exciting endeavor. However, it requires a level of diligence unique to the nature of electric cars, which includes scrutinizing used electric vehicle considerations, especially important aspects like electric car range and battery health inspections. These checkpoints are critical to ensure that the EV aligns with personal transportation needs and lifestyle while providing longevity and value.

Evaluating Range and Charging Options

One primary concern when evaluating a used EV is its range. How far the vehicle can travel on a single charge can greatly influence its practicality and suitability for your daily needs. As such, digging into the details of the EVs range and the availability of charging options in your area is a cornerstone of the decision-making process. This approach not only speaks to the core of used electric vehicle considerations but also pinpoints whether the vehicle is a sound match for your lifestyle.

Consider the following when exploring range and charging:

- The official electric car range provided by the manufacturer versus real-world range experiences shared by current or past owners.

- The proximity and availability of public charging stations along your usual routes and whether they meet the EVs charging requirements.

- Home charging capabilities and whether you have access to either a Level 1 or Level 2 charger, which affects charging time and convenience.

Professional Inspections and Battery Health Assessments

To mitigate the chances of unforeseen expenses, professional inspections and battery health assessments are key components when assessing a used EV. Given the absence of universal criteria to gauge battery health in the auto industry, acquiring a comprehensive understanding of the batterys condition is essential. Professional services can lead to discoveries beyond superficial appearance and help project the anticipated longevity and performance of the EV.

A thorough inspection should highlight:

- The current state of the EVs battery health through diagnostic tests, which can uncover potential issues that may not be immediately apparent.

- Validation of charging and discharging patterns, which play a critical role in the overall lifespan of the EVs battery.

- An assessment from platforms like Recurrent, which offer educated predictions on battery lifespan and future performance benchmarks.

Accompanied by a rigorous test drive, these insights into battery health inspections can paint a real-time picture of the EVs capabilities. A test drive not only offers a tangible feel for the cars performance but also shows how quickly the battery depletes under various driving conditions.

By prudently addressing these factors, you position yourself to make an informed decision, ensuring that your investment into a used electric vehicle is sound and secure.

How Government Incentives and Tax Credits Affect EV Resale Value

The allure of electric vehicles (EVs) extends beyond their environmentally friendly appeal or cutting-edge technology. EV tax credits and government incentives for electric cars play a transformative role in shaping the EV market, particularly concerning the used EV resale value. With substantial financial incentives available, prospective and current EV owners are keenly assessing how these benefits might influence the long-term value of their electric cars.

At the heart of these incentives is the federal tax credit system, designed to make electric vehicles more affordable and appealing to a broader range of consumers. This system not only lowers the initial purchase price but can also have a ripple effect on the secondary market, presenting an attractive proposition for potential EV buyers.

For example, a used electric vehicle purchased for up to $25,000 from a licensed dealer can garner up to $4,000 in federal tax credits. This incentive directly lowers the consumers cost burden and, in turn, can affect the vehicles resale value by essentially lowering the starting point of its depreciation curve.

While federal incentives form a foundational component of the savings, many states also offer separate tax breaks or rebates for electric vehicles. These state-level incentives vary widely and are crafted to meet the ecological and economic goals specific to each region. Adopting state incentives can further deepen the discount on the initial EV purchase, thus improving the potential resale value relative to the reduced purchase price.

Bridging the Gap Between New and Used EVs:

- Federal EV Tax Credits: Reduce upfront costs for new EVs, thereby affecting the markets perception of used EV values.

- State Incentives: Additional savings that can vary by location, influencing regional used EV market prices.

- Used EV Resale Value: Impacted by combined federal and state incentives that decrease the initial effective cost.

The interplay between government incentives and electric vehicle retention value is an intricate one. On one side, these incentives help in lowering the entry barrier, making EVs more accessible. On the other, by altering the initial cost basis for new EVs, the expected resale value also shifts. As a result, the second-hand EV market becomes more dynamic, with the potential for previously owned EVs to hold more value over time due to reduced depreciation stemming from these subsidies.

| Incentive Type | Impact on New EV Purchase Price | Effect on Used EV Resale Value |

|---|---|---|

| Federal Tax Credit | Lowers initial purchase cost | May elevate resale price point |

| State Incentives | Additional reduction in cost | Potentially increases resale value in respective state markets |

In conclusion, as the EV market matures and government policies continue to evolve, the significance of government incentives for electric cars will likely remain a key factor in determining both the appeal and the financial viability of electric vehicle ownership. Consequently, the used EV resale value is an essential indicator of the market response to these initiatives, with tax credits serving not just as incentives for purchase but as pivotal elements for understanding the total cost of EV ownership over time.

Cost of Ownership: Electric Cars vs. Traditional Combustion Vehicles

When examining the overall affordability of vehicles, it becomes increasingly clear that electric cars (EVs) offer a compelling financial narrative over their lifecycle compared to traditional internal combustion engine (ICE) vehicles. This narrative pivots on the EV ownership cost, where EVs typically boast lower ongoing expenses, reflecting in the total EV cost of ownership.

The Long-Term Financial Benefits of Owning an Electric Car

Initial price tags notwithstanding, the long-term ownership of an EV paints a picture of electric car savings due to their inherent design and operation benefits. EVs, known for their reduced maintenance requirements and lack of engine fluids, provide a tangible reduction in upkeep costs. Additionally, the environmental leverage of driving an EV can translate to tax incentives, further sweetening the deal for eco-conscious consumers.

Calculating Total Cost of Ownership for Electric Vehicles

To grasp the true cost implications of EV ownership, one must delve into a holistic analysis that goes beyond the showroom sticker. Numerous factors contribute to the total EV cost of ownership, including depreciation, fuel (or electricity) costs, insurance, maintenance, and repairs.

| Ownership Cost Factor | Electric Vehicle (EV) | Internal Combustion Engine (ICE) |

|---|---|---|

| Initial Purchase Price | Generally Higher | Lower |

| Fuel/Electricity Cost | Lower | Higher |

| Depreciation | Accelerated | More Gradual |

| Maintenance & Repairs | Substantially Lower | Higher |

| Insurance | Varies | Varies |

| Tax Incentives | Available for New and Used EVs | Limited or Non-existent |

Moreover, the upfront cost differentials that had once deterred some buyers are now mitigated by the second-hand EV market. Here, depreciation plays an advantageous role, eroding the initial premium while preserving the inherent cost efficiencies of electric operations. Such economic dynamics signal a shift where electric vehicles, despite their rapid depreciation, can still end up being more cost-effective in the longer run.

Ultimately, its the fusion of lower operating costs, government incentives, and growing market acceptance that solidly positions electric vehicles as a wise economic choice for the discerning consumer, seeking a blend of sustainability and value over the lifespan of their automobile investment.

The Future of EV Battery Technology and Resale Value

The longevity and efficiency of EV battery technology are pivotal in shaping the resale value of electric vehicles. As the automotive industry shifts towards a more sustainable future, the focus on improving electric car battery longevity presents an opportunity to elevate the appeal and practicality of EVs in the market. With this goal in sight, two pivotal industry players, Toyota and Panasonic, are joining forces to pave the way towards a new era of next-generation batteries.

Toyota and Panasonics Approach to Enhance EV Battery Longevity

Toyota has long been synonymous with reliability and is now extending this reputation to the realm of electric vehicles. In collaboration with Panasonic, Toyota is steering its resources to develop advanced EV battery technology designed to meet stringent quality and endurance criteria. It is anticipated that such efforts will help solidify electric cars as a wise purchase for the long term, ensuring they hold value much like their gasoline-powered predecessors.

Toyota and Panasonic are implementing rigorous quality control methodologies. One example is subjecting each battery to an extensive 20-day aging process, where the battery undergoes extensive testing, simulating various charge and discharge cycles to ensure it meets high standards of performance and reliability. Such meticulous attention to detail distinguishes their EV battery technology as a benchmark for the industry and is a crucial step in positioning electric cars favorably in the used car market.

Next-Generation Batteries and Their Projected Impact on EV Value

As the horizon brightens with the prospects of next-generation batteries, stakeholders and consumers alike are intrigued by how this technological leap will factor into the resale equations of electric vehicles. With advancements not only in quality but safety and performance, the industry witnesses a promising shift towards batteries that not only last longer but also offer greater driving ranges.

Toyota is on course to unveil new electric vehicles by 2026 that harness these next-generation batteries. Through this initiative, they aim to provide models that are not only more environmentally friendly but also hold their value better over time. This focus on extending battery life and enhancing driving range is directly tied to the crux of resale valuemaintaining vehicle functionality and reliability throughout its lifecycle.

| Battery Feature | Toyota and Panasonic Enhancements | Expected Impact on EV Resale Value |

|---|---|---|

| Performance | Greater range per charge | Increased desirability, potentially higher resale prices |

| Reliability | Extensive aging and testing process | Confidence in longevity, sustaining value over time |

| Safety | State-of-the-art technology | Instills buyer trust, supports solid resale value |

| Quality | Stringent standards | Reduces battery-related issues, enhances resale prospects |

| Longevity | Advanced manufacturing techniques | Lengthier battery life cycle, beneficial for second-hand market |

As this fortuitous blend of collaborative innovation and strategic foresight unfolds, the resulting boost in electric car battery longevity is set to have profound implications on the resale value of electric vehicles. The burgeoning landscape of EV battery technology presents an exciting mix of challenges and opportunities, with the potential to redefine the parameters of automotive value retention in the years to come.

Conclusion: Evaluating the Electric Car as a Sustainable Investment

As we look towards a future defined by sustainable solutions, the electric vehicle market outlook remains both promising and complex. With the burgeoning growth in EV sales, it is apparent that consumer confidence is on the rise, but it is the long-term EV resale value sustainability that is generating intense discourse. The durability of an EVs battery, the accessibility of charging stations, the strength of brand reputations, and consistently unfolding government incentives are all critical elements fueling the viability and appeal of the electric car investment.

Whether considering the upfront costs or the overall long-term ownership expenses, potential investors are becoming increasingly savvy. They scrutinize not just the environmental benefits, but also the economic practicality of their choices. Intrinsic to maintaining the momentum of the electric vehicles value proposition is technological advancementparticularly in battery healthand regulatory support that together enhance the electric cars desirability in both the new and pre-owned markets.

In sum, as the automotive industry continues to pivot away from ICE vehicles and towards electrification, the indicators are optimistic. The strengthening infrastructure, along with innovative policies and consumer education, are sculpting a market ripe for growth. Hence, an electric vehicle stands not just as a badge of environmental consciousness but also as a robust, eco-friendly economic choice for contemporary and future drivers alike.

FAQ

How do electric vehicle resale values compare over time?

Electric car value over time tends to depreciate faster than internal combustion engine vehicles. Data shows that three-year-old EVs retain 63% of their value, while ICE vehicles retain 66%, and at five years, EVs retain 37% versus 46% for ICE vehicles. However, as the EV market grows and technology improves, resale values are anticipated to become more competitive.

What are the trends in EV depreciation?

EV depreciation rates suggest that electric vehicles depreciate faster than traditional cars, although this gap may narrow over time as the electric vehicle resale value benefits from increasing consumer confidence, technology advancements, and a maturing resale market.

Do electric cars hold their value?

While electric cars tend to depreciate faster than conventional cars, certain factors such as brand reputation, advancing technology, and market conditions can help electric cars maintain a substantial portion of their value over time.

How does battery health impact electric car resale value?

The health of an electric cars battery is crucial to its resale value. Batteries that have been well-maintained and show minimal degradation can help an EV retain its value. On the contrary, a battery that exhibits significant capacity loss could potentially decrease the resale value of an EV.

How do electric car depreciation rates compare to internal combustion vehicles?

Electric cars experience faster depreciation rates than internal combustion vehicles, with electric cars losing about 52% of their value after three years, compared to 39.1% for ICE cars. However, both types of vehicles inevitably lose value over time.

What factors influence electric car value over time?

Several determinants affect EV resale value, including mileage, car age, maintenance history, brand reputation, government incentives, and the current demand in the market. Charging infrastructure and battery health are also critical factors that influence the value of EVs over time.

Is the electric car resale market maturing?

Yes, the electric car resale market is gradually maturing, as indicated by the rise in EV sales and an increase in buyer confidence. With more makes and models available, resale channels are expanding, thus simplifying the consumer shopping experience for pre-owned EVs.

How does charging infrastructure affect EV resale value?

The availability and convenience of charging infrastructure can significantly influence electric vehicle resale values. Areas with abundant charging options may contribute to higher EV resale values, whereas limited infrastructure could be seen as a disadvantage to potential buyers.

What should be considered when shopping for a used electric vehicle?

When shopping for a used electric vehicle, considerations include evaluating the vehicles range, available charging options, battery health, and the availability of a professional inspection that can accurately assess the state of the EVs battery life and overall condition.

How do government incentives and tax credits affect EV resale value?

Government incentives and tax credits, like the potential federal tax credits of up to $4,000 for used EV purchases, can positively affect the resale value of electric cars by reducing the effective purchase price for consumers, making EVs more financially attractive.

Are there financial benefits to owning an electric car compared to a traditional combustion vehicle?

Owning an electric car can offer long-term financial benefits due to lower maintenance and repair costs. Over time, these savings, alongside the potential for state and federal incentives, can contribute to a lower total cost of ownership, mitigating the initial higher purchase price of EVs.

What is the future of EV battery technology and its impact on resale value?

Advancements in EV battery technology, such as those undertaken by collaborations like Toyota and Panasonic, aim to improve battery longevity, quality, and performance. As new-generation batteries become more prevalent, their enhanced capabilities are expected to positively influence electric vehicle resale values by offering longer life spans and possibly extended driving ranges.