Do hybrids have good resale value

Is the resale value of hybrid vehicles higher?

You've probably heard that the value of a new car drops as soon as you drive it off the lot. That happens to be true. As soon as you finalize that transaction, the vehicle is worth its wholesale price, which can be 15 to 20 percent less than what you just paid for it [source: Lazarony]. It doesn't matter what brand or type of car it is. So what gives? And will a hybrid hold resale value better?

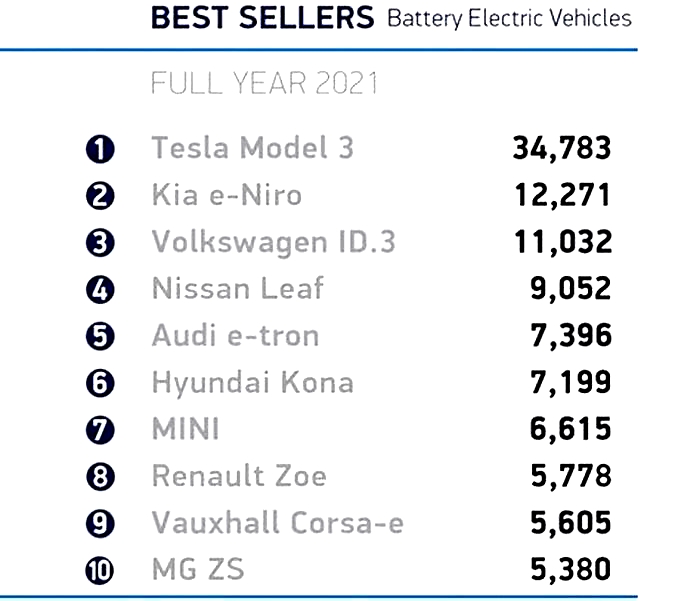

The key to vehicle resale prices is brand and demand. For example, of the 10 vehicles with the best resale value in 2009 according to the Kelley Blue Book, two were hybrids. Those were the Honda Civic Hybrid and Toyota Prius. But all 10 vehicles were four-cylinder, compact or mid-compact cars. The Prius made the list again in 2010, but of the 2011 Kelley Blue Book Best Resale Award winners, none were hybrids. Look no further than gas prices for an explanation. Perhaps you recall the gas crisis that hit the U.S. during the summer of 2008 that had throngs of drivers forming lines at the pumps. The average price for a gallon of gas soared over $4 during July 2008, while they never surpassed $3 in 2010 [source: USEIA].

The best way to determine whether a hybrid has a better resale value is to compare two similar makes, in this case a 2009 Honda Civic EX and a Civic Hybrid. Again we'll use the Kelley Blue Book as our tool. The manufacturer's suggested retail price (MSRP) for the hybrid in 2009 was $23,550, while the Civic EX four-door was $20,005. Twenty-three months and 26,500 miles (42,648 kilometers) later, the hybrid has a suggested retail value of $18,730 for a depreciation of $4,820. Here's where things get interesting. According to the KBB, the EX has a suggested retail value of $17,380. With $2,625 of depreciation in two years, the EX's resale value is 87 percent, compared to 79.5 percent for the hybrid.

Research shows the cost of owning a hybrid often outweighs the money saved. The initial cost of a hybrid and higher depreciation are two factors. Depreciation often depends on demand. When gas prices aren't through the roof as they were in 2008, the demand for hybrids isn't as high. Nor are the savings in fuel prices enough to offset the premium price of a hybrid. Some research also suggests hybrids cost more to operate [source: CarGurus]. It's best to keep all of this in mind when deciding whether purchasing a hybrid is worth it for you.

Visit the links on the next page to continue your hybrid education.

Do Electric and Hybrid Cars Hold their Value?

When consumers buy hybrid or electric cars, they typically do so with a greater purpose. Either they wish to help the planet by limiting the burning of fossil fuels and reducing emissions, or they are early adopters of new technologies and want to try that which is new and shiny, or they simply want to save money by limiting their trips to the gas pump. These consumers tend to be more affluent, more highly educated, and lean towards being green or progressive - most also drive their cars like wearing a badge of honor, suggesting I am doing my part to save the planet.

Are they Worth it?

What virtually everyone wants to know, however, is whether or not they receive a good return on their hybrid/electric investment, and if the higher purchase price is justified by lower fuel costs over their ownership period. This question has been asked by, and answered by, millions, and we will not attempt to do so yet again. Instead, we will focus on what the car is worth when you sell it - what do you get for a trade-in allowance. Is it worth saving $500 per year on fuel, if your car loses half of its value in three years? Or, do hybrid/electric drivers save on fuel, and also get more for their vehicles when theyre traded in or sold privately?

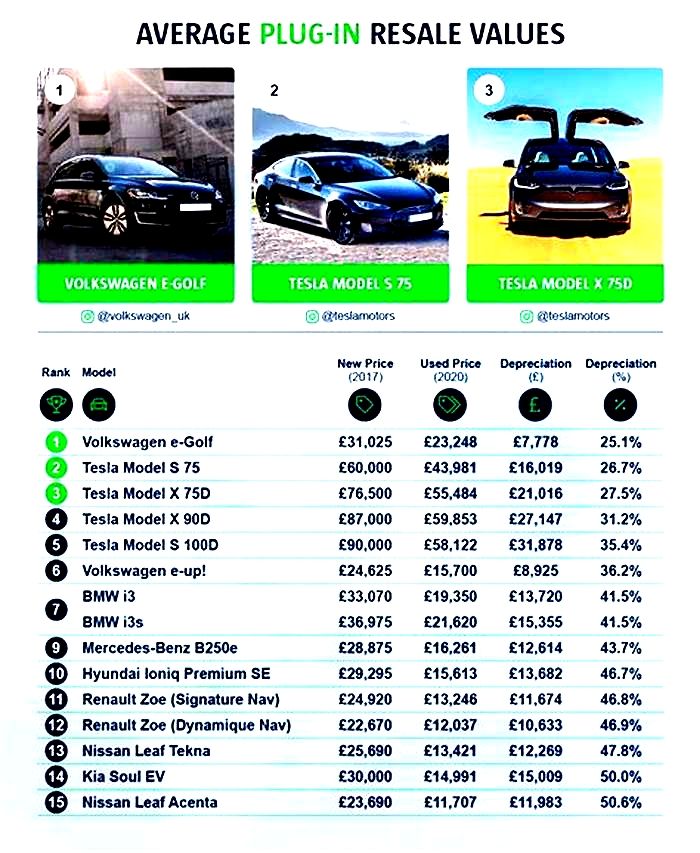

The Method and Key Takeaway

CarEdge.com has calculated the annual depreciation of 193 car models through at least five years of ownership, and can tell you with little question, which cars have historically been relatively good investments, and which ones have been underperformers. For this article, we will focus on 2015 model-year hybrids and electrics - comparing what they sold for new, versus what theyre worth today. Of the 193 models tracked by caredge.com, we looked at 12 of the more popular hybrids and electrics, to see how they fared with respect to holding their value, relative to their fossil fuel cousins. The bottom line is that results are all over the map, and hybrids/electrics ranked as high as 12th within all (193 models) of the 2015 models tracked, but also as low as 191st, with the remaining ten scattered all throughout the rankings.

Lets Start with the Worst

Lets start with the bad news (for hybrid/electric owners) first, and tell you about the worst performing hybrid/electrics out there for maintaining their value. The Ford Fusion Energi (ranked 191st), which originally sold on average for $36,000, is now worth 1/3 that amount, or a little over $12,000. Over the five-year period, this vehicles value has fallen by almost $5,000 per year, significantly exceeding any monies that would have been saved by purchasing less gas, even when compared to the depreciation of other fossil fuel-burning cars. Even if the Energi ran on water, and fuel cost you nothing, youd still come out on the losing end of this purchase. When it comes to resale, unlike the Energizer Bunny, the Energi has lost its mojo. Coming in at a close second (2nd worst) for value retention of hybrids/electrics, is the Nissan Leaf electric. The Leaf originally sold on average for $30,000, and is now worth less than $11,000, a 65% decrease in value over 5 years - clearly the Leaf has fallen far from the value tree, and foliage has turned into spoilage. Clearly, for these two, unless youre driving 50,000 miles per year, theres no way that fuel savings are turning this investment into a good one. You may have been an early-mover buying a Leaf or Energi, but it turned out to be a big mistake - at least financially. Rounding out the remaining sub-par performers, are the Ford Fusion Hybrid (131st), Toyota Avalon Hybrid (110th), and Lexus RX450h (89th). None have done a very good job with respect to holding their value, but perhaps if you put on enough miles, the fuel savings may offset the big bucks you lost through depreciation.

Onto the Better Performers

On the other end of the extreme, are some hybrids/electrics that have proven to be relatively good purchases, irrespective of whether they save the planet, or fuel costs. At the top of the hybrid/electric list, placing 12th of all 193 models, is the Toyota Highlander Hybrid. This mainstay SUV from Toyota originally sold for roughly $47,000, and is still worth almost $29,000 today, holding over 60% of its value since new. The Highlander Hybrid ranks well - both for hybrids, but also for all vehicle models. Given the attractive value retention, and your ability to pass by gas stations without hesitation, the Highlander is one solid investment. Of special note, the gas-powered Highlander ranks four notches lower on value retention, so it would appear that the hybrid saved you fuel costs, and is worth a touch more, even five years after purchase.

Running a distant second/third to the Highlander, are the Honda Fit (29th) and Toyota Camry Hybrid (30th), who both retain close to 55% of their value, versus an average of 47% of all 193 models tracked through 5 years. In both cases, the Fit and the Camry Hybrid offer exceptional value retention, and youre able to feel good about saving on fuel costs, and saving the planet.

What about Tesla?

No article about hybrids or electric cars would be complete without a commentary on Tesla. With such, we will tell you that the Tesla Model S - the only Tesla qualifying for 5-year results - ranks 75th overall, and 6th of the 12 hybrid/electrics that we researched. The Model S, which cost roughly $92,000 when purchased in 2015, is today worth exactly half, at $46,000. Again, this 50% year-5 value retention still beats our overall average of 47%, but not by much. Losing $46,000 of value is never fun, regardless of what you drive (unless you drive a Ferrari, and then its a bargain), but that was the cost of being an early-adopter five years ago. Our take is that Tesla deserves credit for producing a fully-electric car, and still having it be worth something meaningful with its technology 5 years old, and after youve put some significant miles on it.

Our Not-So-Dirty Dozen Rankings

Bottom Line

Our bottom line on whether hybrids and electric cars provide good resale value, is an earth-shattering, it depends. Some models, such as the Highlander, Fit and Camry Hybrid have done extremely well in limiting depreciation, and have saved you fuel costs through the years. On the other hand, The Nissan Leaf and Ford Fusion Energi have few rivals when it comes to losing a majority of their value so quickly. Tesla, given their quest to lower the price of their new models, is likely to fare well in the coming years with their latest models, even if gas falls to $.99 per gallon. They seem to have cracked the code, and they are the EV company for others to emulate. The smart shopper, however, will do their homework, see what has worked in the past, and learn more about what causes some models to perform well in the aftermarket, and why failures occur. You wont have a crystal ball, but this internet thing sure is handy.

Find Out More

Research depreciation rates for almost 200 models over their entire lives, by visiting www.caredge.com/ranks to see how your car or truck does versus all the rest. Good luck, and happy motoring.

The Economics of Buying a Hybrid Car

While anything is possible, it looks like the long-term price of gasoline is going to stay below the $3.00 per gallon mark. Given this new price point, the economics of buying a hybrid vehicle are changing, which is good news for "green" consumers. In this article, we're going to discuss how gasoline prices at the pump are changing the economics of driving in America. We're going to evaluate the premiums paid for hybrid cars, and determine if it makes good business sense to buy these vehicles. We're also going to talk about a very important variable that's often overlooked when evaluating the purchase of a hybrid. Finally, we'll provide a link to an online tool, which can help figure out if owning a hybrid makes good economic sense.

Vehicle Demand and Gasoline Prices

According to statistics published by the Department of Energy, during the week ending June 16, 2008, the national average price of regular gasoline hit the $4.00 mark for the first time. In October 2020, the price of regular gasoline averaged $2.19 per gallon across the United States. Car owners that once paid $40.00 to fill up their vehicles are paying $20.00, while SUV owners are paying closer to $30.00. For many consumers, the sharp rise in gasoline prices brought back memories of the energy crisis of 1979. Customers once willing to drive SUVs and small trucks were now looking for more energy efficient vehicles. Automobile manufacturers were stuck with huge inventories of what were once high-margin vehicles back in 2008. They found themselves scrambling to retool plants, so they could manufacture more energy efficient vehicles. The marketplace demand for gas-guzzlers was dropping, while consumer interest in hybrid vehicles was on the rise.

Economics of Buying Hybrid Cars

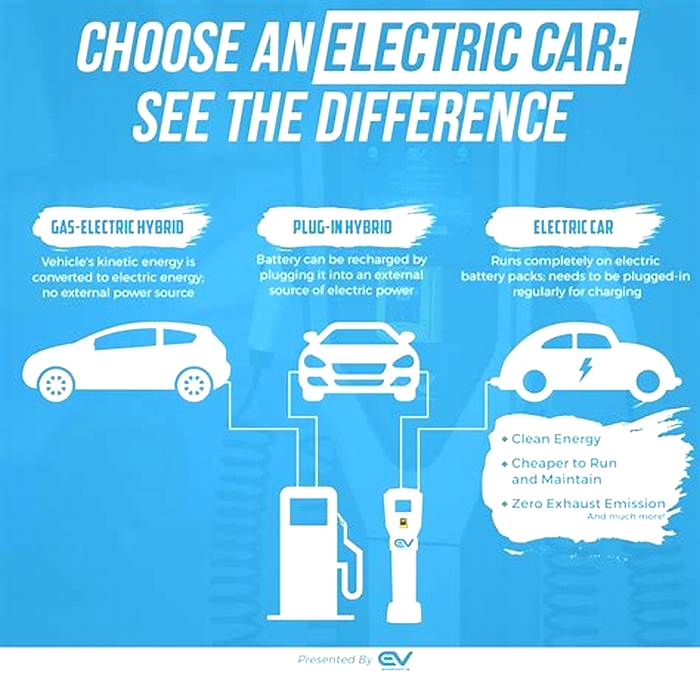

Hybrid vehicles owe their energy efficiency to their mechanical sophistication. Traditional combustion engines are paired with electric motors. This combination allows manufactures to deliver the performance drivers are looking for in a car from smaller engines.

Surplus energy is routed to batteries and stored there until needed. Regenerative brakes return the energy used to slow cars back to battery storage, while in conventional cars this energy is normally dissipated as heat. Unfortunately, the same technologies that are used to increase the vehicle's miles per gallon come at a cost: hybrids are expensive to manufacture.

To boost consumer interest in hybrid vehicles, the federal government introduced a series of tax deductions and credits. Under the clean fuel tax deduction for new hybrids, vehicles purchased before 2006 were eligible for a "clean fuel" deduction of up to $2,000. Hybrids purchased after December 31, 2005 were eligible for a federal income tax credit of up to $3,400. These credits were phased-out for each vehicle type once the manufacturer sold over 60,000 units. In January 2011, the last tax credits were provided on these cars.

Gasoline Prices and Hybrid Paybacks

One of the ways to measure the performance of an investment is by using a financial metric called the payback period or break-even point. Essentially, the break-even point is the time it takes to recover an investment. We're going to use this measure in the examples below to figure out if the premium paid for a hybrid is worth the investment.

Comparing the Cost of Hybrids

In the example shown in the table that follows, we're going to compare a hybrid vehicle to its standard combustion engine look-alike. The vehicle we've chosen for this analysis is the Toyota Camry.

2019 Toyota Camry

Model | SE 4 Dr. Sedan | Hybrid 4 Dr. Sedan |

MPG City | 28.0 | 51.0 |

MPG Highway | 39.0 | 53.0 |

Combined MPG | 32.0 | 52.0 |

MSRP | $24,600 | $28,400 |

Tax Credit | $0 | $0 |

Net Cost | $24,600 | $28,400 |

Premium Paid | $3,800 | |

Annual Fuel Cost at $4.00 | $1,406 | $865 |

Breakeven at $4.00 (Years) | 7.0 | |

Annual Fuel Cost at $3.50 | $1,172 | $721 |

Breakeven at $3.50 (Years) | 8.4 |

Note: Annual Fuel Cost is based on 45% highway, 55% city driving, and 15,000 annual miles per year. As the above example demonstrates, with fuel prices in the $2.50 to $3.00 range, the break-even period for this vehicle is around seven years or 105,000 miles. Therefore, the premiums paid for these vehicles do not appear to be justified by fuel savings alone. That being said, the above analysis ignores one important variable: the resale value of the vehicle.

Car Depreciation and Hybrid Vehicles

If everything else were the same, two cars would be expected to experience the same level of depreciation. That is to say, their resale value would be the same. But a hybrid car is not the same as its standard engine counterpart. It achieves greater gas mileage. Therefore, the seller of a hybrid should expect to be paid a premium when the car is sold. It's worth more to the car's buyer. With a higher starting cost for a hybrid, and a nearly identical rate of depreciation, the resale value of a hybrid should be higher than a car with a standard engine. This is a very important point that's often overlooked when analyzing whether or not it makes sense to buy a hybrid. For example, according to Kelley Blue Book, a used 2016 Toyota Camry LE Hybrid would sell for $13,900, while its standard engine look-alike sells for $12,800 (as of June 2018). That's a $1,100 premium. Fortunately, we offer an online hybrid car calculator that takes into consideration the car's depreciation. In fact, it's possible to use the information above, along with our calculator, to determine if owning a hybrid vehicle is a sound investment.

Additional Resources

Increasing the efficiency of a car is a lesson in physics. Automobile manufacturers can attempt to extract more miles per gallon of gas in several ways:

When gasoline prices first jumped in the summer of 2005, consumer interest in fuel efficient cars increased dramatically. Individuals that were used to paying around $20 to fill up their cars were suddenly paying over $50. That summer was a wake up call for everyone that thought paying $3.00 or more for a gallon of gasoline would never happen.

Anyone thinking about buying a new car over the next couple of years may be introduced to an entirely new breed of vehicles: fuel cell cars. They're not exactly ready for sale today, but in the coming years everyone will be hearing from several car manufacturers that have these vehicles in the evaluation stage right now.

With the cost of gasoline hovering around the $4.00 per gallon mark at one point, it cost $50 or more to fill up at a gasoline station. Just as fuel economy became more worrisome for many consumers, the automotive industry introduced a new technology with a promise to lower those monthly gasoline bills: hybrid cars.

In the never-ending drive to squeeze more miles per gallon of fuel, automobile manufacturers are once again turning to lean burn technologies. The government showed its support for this equipment when it passed the Energy Policy Act of 2005. Cars, trucks, and SUVs certified as advanced lean-burn vehicles qualify for tax credits as high as $1,800 under the provisions of that law.