Electric Vehicles Popular in Southeast Asia with Focus on Affordability

Capturing growth in Asias emerging EV ecosystem

The case for immediate electrification of consumer transport is undeniable. The transport sector accounts for about 17 percent of global greenhouse gas emissions, and stimulating supply and demand for electric-vehicle (EV) adoption in the mass market will be pivotal for Asian countries to meet national emissions goals and a global 1.5-degree climate change target.

For industry incumbents and attackers, accelerating EV ecosystem development across Asia is a major opportunity to seize significant growth through new green business-building opportunities. This articlepart of McKinseys series Green Business Building in Asia, which explores trends and opportunities for significant green growth in Asiaprovides an overview of the EV imperative. We then explore the key challenges facing EV ecosystem scale-up in Asia and what it takes to capture emerging business opportunities.

Asia at the forefront

Asian countries are in many ways on the front line of climate challenges. Asia is home to 93 of the 100 most polluted cities and six of the top ten countries most affected by climate risks. The region also faces relatively high energy demand, as many countries are still rapidly growing and urbanizing. China alone consumes more than three times the total energy used in Europe, a situation that complicates its effort to reach net zero.

The transport sector is one of the largest sources of greenhouse gas (GHG) emissions, so its progress will be pivotal for meeting the climate change challenge in Asia. We estimate that between 2018 and 2050, the sector could contribute around 14 percent of emission abatement potential (Exhibit 1).

To capture this decarbonization potential, regulators around the world have introduced ambitious goals for electric vehicles. These include the EUs Fit for 55 plan to achieve carbon neutrality by 2050 and the Biden administrations target for half of new autos sold in the United States in 2030 to be EVs.

In line with these goals, by 2030, we could expect EV adoption to reach 45 percent under currently expected regulatory targets. This estimate includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs).

In Asian countries, consumers are adopting EVs at different paces.Compared with mature markets, such as China and Japan, emerging Asiaparticularly India and ASEANis lagging. In 2021, EVs made up less than 1 percent of new-vehicle sales in the region (Exhibit 2).

Building an EV ecosystem in emerging Asia is imperative for ASEAN countries to accelerate consumer uptake and achieve their climate goals. Building tomorrows EV ecosystems means radically building out the EV value chain by stimulating both supply and demand sides of the equation. This requires greater investment in partnerships, infrastructure and technology development, accelerated low-cost EV model distribution (with total cost of ownership at or ahead of parity with internal combustion engines), integrated finance, government incentives to encourage EV adoption and discourage ICE, and a supporting green investment framework.

Four signs of growth in emerging Asias EV market

While challenges exist, we are seeing strong signs that significant growth lies ahead.

Sign 1: Strong E4W adoption in China as emerging Asia accelerates production

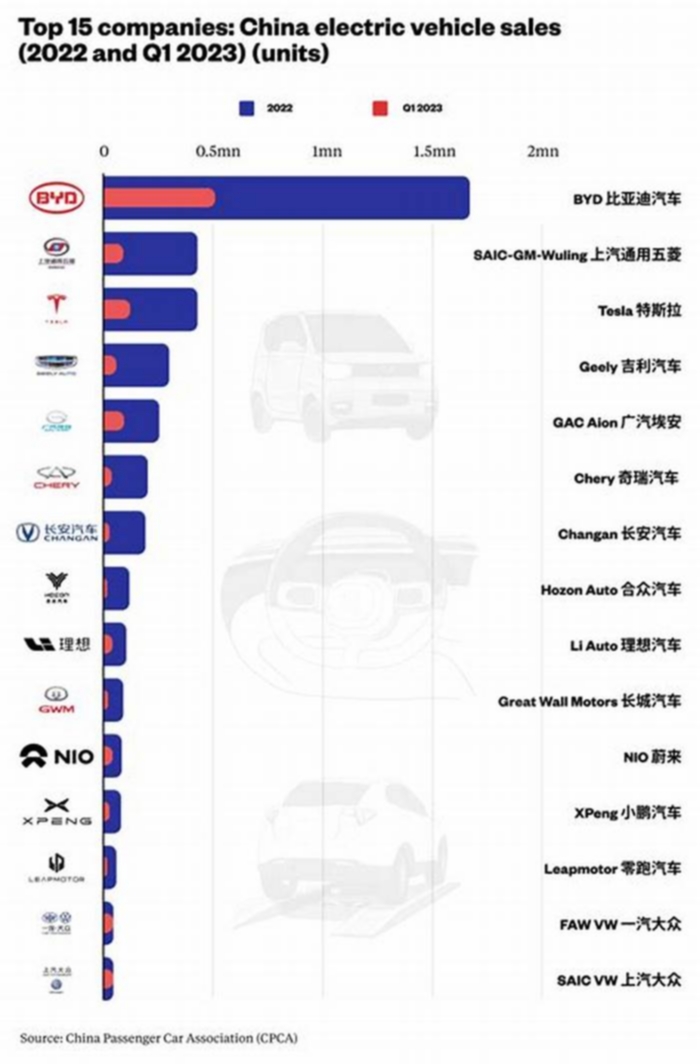

According to our adoption model, mature Asian markets will continue to see strong momentum in adoption of electric four-wheelers (E4W). China will become the largest EV market in absolute terms. On its current trajectory, the adoption rate in China will reach 60 percent, and China will represent more than 40 percent of total new EVs sold by 2030.

In emerging Asia, production of E4Ws will pick up rapidly. Thailand and Indonesia are already major regional automotive production hubs. E4W production will scale rapidly from low levels to a significant share in these markets, growing at a combined 45 percent (Exhibit 3). Together, countries within emerging Asia could produce more than two million E4W units annually by 2030.

Sign 2: Consumers in emerging Asia snapping up electric two-wheelers

Emerging Asia markets today represent the largest micromobility markets. India, for example, overtook China to become the largest market for electric two-wheelers (E2Ws) in 2017. With the increasing cost-competitiveness of electric models and regulators incentivizing consumer adoption, E2Ws will become a predominant mode of transport in the region.

Our modeling shows that by 2030, India and Indonesia will become the second- and third-largest E2W markets in the world after China, growing at more than 60 percent annually (Exhibit 4). Such development will translate into an electrification rate of two-wheelers at around 36 percent in India and ASEAN by 2030, compared with less than 1 percent today.

Sign 3: Asian regulators ramping up EV regulations

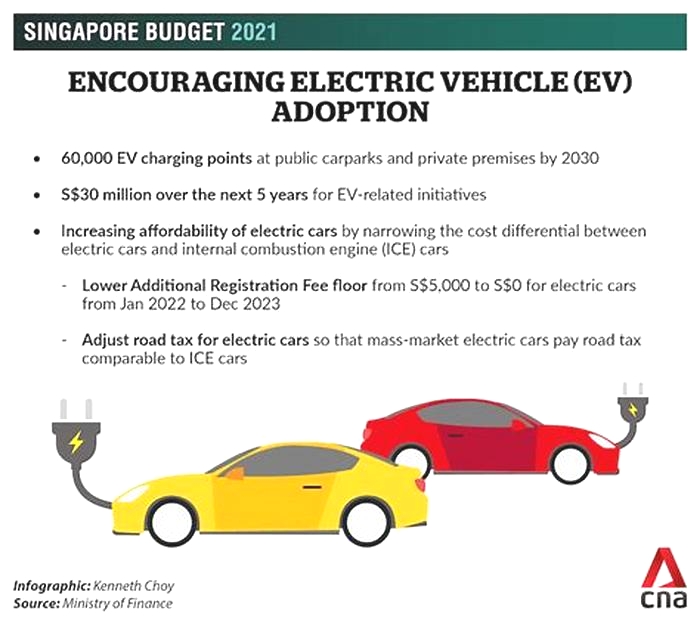

The rapid development of mature EV markets is supported by strong policy actions on four fronts: official EV targets, restrictions on ICE production and sales, consumer incentives, and support for EV charging infrastructure (EVCI).

In Asia, governments show different levels of commitment towards electrification (Exhibit 5). China, Japan, and South Korea have established comprehensive policy frameworks to support adoption. In emerging Asia, Thailand has set out its 3030 EV Production Policy, which aims to reach 30 percent of domestic vehicle production by 2030. Indonesia is banning all sales of fossil fuel motorcycles by 2040 and fossil fuel cars by 2050.

In Malaysia, EV adoption has been lagging other countries in developing Asia. This is potentially because buyers and sellers await a clearer policy framework, including an official ICE ban. However, Malaysia is reexamining its EV policy and has made fresh announcements on tax exemptions for locally made and imported EVs, as well as significant expansion of the countrys EV network charging footprint by 2025. In markets like Malaysia, it will be important to invest in EV distribution and EV charging simultaneously in order to achieve EV adoption levels similar to those forecast for other ASEAN markets.

A combination of early and bold investment and supporting regulation is the key for generating significant momentum. Once momentum is established and emerging Asias markets mature, we will likely see governments cutting back on incentives, as consumer demand drives sufficient growth independently. This has already happened in China, where the government cut subsidies on battery and plug-in hybrid vehicles by 30 percent in 2022 and aimed to withdraw them altogether by the end of the year.

Sign 4: Asian brands on the rise

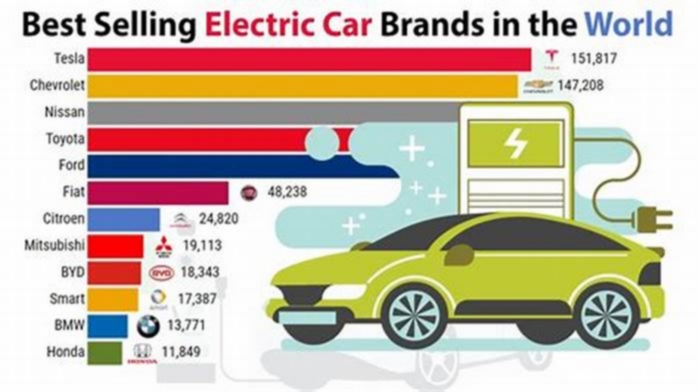

Asian brands already account for a large share of the regions consumer automotive spending, with similar trends emerging in EVs. For E4Ws, Chinese brands have established solid positions. In 2021, Chinas BYD rose 5 percent in market share, and Wulings popular and accessible Hongguang Mini EV sold more than 400,000 units within a year of its debut. Between 2017 and 2021, 13 out of 20 top-selling EV brands came from Asia.

In the E2W space, we see increased innovation in ASEAN markets and India. These E2W markets, which had been traditionally dominated by Japanese incumbents, are becoming a hotbed for local entrepreneurship. Between 2011 and 2021, more than 50 E2W start-ups were founded in the region, most notably Ola and Ather Energy from India and Beam from Singapore.

With the influx of new players, competition is bound to intensify and disrupt incumbents. This has prompted non-traditional players to enter the EV market across the value chain. In 2021, a major Thai oil and gas player announced multiple partnerships to expand into the EV space, including including joint ventures with an electronics manufacturer and an EV start-up whilst launching its own EV mobility e-commerce business. In addition, the company launched its own EV mobility e-commerce business. Not isolated to Thailand, we are seeing across key global markets increasingly bold plays by large energy incumbents and technology giants to build innovative EV businesses. While the full potential of EV will not be fully realized for several years to come, it is worth observing that the foundations of future EV value chains are already being built and that there is real urgency for future players to act fast in order to gain outsized benefits from first-mover advantages.

Challenges of building up emerging Asias EV market

For emerging EV markets, we see three typical challenges: (1) parity in total cost of ownership (TCO), which is closely tied to regulatory environment; (2) OEM model availability and supply chain readiness; and (3) critical mass in charging infrastructure. When looking at mature and greatly accelerating markets, we observe strong policy frameworks driving TCO parity; OEMs from incumbents to start-ups delivering a wide array of attractive models, including low-cost EV models with close feature parity to ICE equivalents at similar price points; and large-scale government and corporate investment ahead of the curve on EV charging infrastructure to support the targeted volume of EVs on the road. Again, evidence points to the need to stimulate supply and demand simultaneously.

These challenges are more pronounced in emerging Asia, where TCO parity and supply chain readiness are key to unlocking consumer uptake. For auto consumers from the region, McKinsey research across ASEAN suggests TCO remains the top concern for adoption of EVs, whereas environmental friendliness is a weaker demand driver of mass market adoption behind cost, prestige, and technology. In ASEAN, EVs are typically priced at a premium above ICE equivalentsparticularly European and Japanese imports, which are unaffordable for most households. Without continued investment in low-cost EV models and distribution, we estimate that under the current business as usual distribution trajectory, TCO parity will not be reached by 2030 in many countries of Southeast Asia (Exhibit 6); this is especially likely for four-wheelers.

Regulation remains an important element to driving TCO parity and consumer adoption. By way of illustration, let us consider Indonesia for example. Our model predicts that a 25 percent reduction in import tax can take EV penetration to as much as 24 percent by 2035. Furthermore, if local manufacturing is enabled, this rate could go as high as 63 percent.

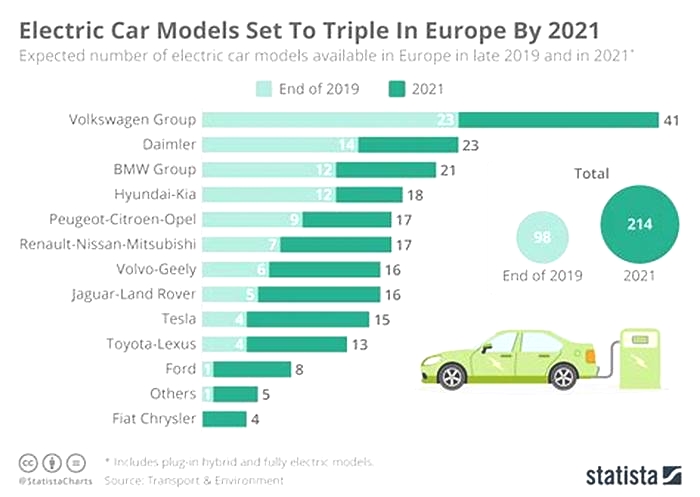

European EV imports still dominate EV distribution in emerging Asia, with less than 20 new low-cost EV models planned for local distribution. This is in stark contrast to more mature Asian markets where more than 200 low-cost EV models are in production or commercially available today. Despite increased awareness for building EV ecosystems across Asia, many startups across the value chain struggling to scale up and achieve long-term commercial viability. Moving into EV is not a short-term bet; it requires high upfront investment, and IRR is low in the first few years. In response, successful start-ups and attackers are leveraging strategic partnerships to challenge incumbents who already possess critical distribution networks and service capabilities.

Infrastructure is critical, yet many ASEAN markets lack sufficient charging stations to support the projected growth of EVs on the road or, as importantly, to increase consumer confidence and overcome range anxiety. According to our modelling, ASEAN markets collectively will require an estimated 95,000 public AC and 40,000 DC charging points to support forecast numbers of registered EVs by 2030 (assuming a mixed modelling of laggard/medium/advanced adoption trends)30 times greater than the number today. This number could be significantly higher should national ambitions reflect more aggressive mature-market targets of 45 percent or more EV parc penetration. Without government intervention, demand for EVs and EVCI becomes a chicken-and-egg problem: private companies have diminished incentives to expand EVCI networks with high upfront cost and initial low utilization, while consumers are reluctant to purchase EVs with limited charge point availability. While Thailand and the Philippines have started to incentivize expansion of EV infrastructure, considerable change is still required across Asian markets.

Finally, beyond these core challenges, the global EV market is facing severe supply chain constraints in many core segments, due to geopolitical conflicts, shortage of e-parts and components, and the impact of the COVID-19 pandemic. In battery production, key raw materials face significant headwinds such as trade wars, causing major production delays. While Asian companies represents nearly 90 percent of the worlds semiconductor market, reduced production significantly affected global EV supply chains. With e-parts and components representing the fastest-growing areas of EV production value pools, large-scale electronics manufacturers have material opportunities to expand into EV adjacencies.

Capturing the value from EV ecosystems

Asias EV market is on track for enormous growth, and material opportunities for significant value creation exist across the value chain. However, capturing these opportunities and tackling challenges in emerging Asia requires thinking and working in ecosystems. Thinking in ecosystems, centered around shifting consumer preferences and behaviors, goes beyond a traditional auto industry frame of reference to involve a broader network of technology, energy, and financial players that come together to deliver compelling value propositions and seamless integrated experiences (Exhibit 7).

Technology giants will play an increasingly large role in this ecosystem. These players leverage the ecosystem to deepen customer relationships through connected experiences, provide omnichannel e-commerce (predominantly direct to consumer), and build sophisticated data models to predict customer needs, behaviors, and preferences by capturing, harvesting, and ultimately monetizing consumer data. For example, charge point operators are increasingly using data to drive loyalty programs and subsidized charging through digital marketing.

Traditional players can accelerate through innovative partnerships, specifically by leveraging competitors-turned-collaborators for new technologies. They can enable joint R&D investments to accelerate development and share capital expenditures for infrastructure projects. Ecosystem partnerships also improve supply chain resiliency. For example, the case for battery and component players includes long-term partnerships with materials producers to hedge against supply chain fluctuations.

As the interveners, governments can anchor on the big problem and tie EV adoption to climate change targets. While most countries in Asia have signed up to COP26 and committed to net zero, many need to bridge the gap between commitment and action. EV is a front-runner for government action, as mass consumer transport electrification is not only a necessary path to net zero but also can significantly boost national economies that specialize in key segments. For example, Indonesia has the potential to become a major regional battery supplier, given its access to raw materials such as nickel and captive demand, and Australia has clear opportunities in minerals and energy exports (among others) that would add over A$75 billion to the Australian economy each year through 2035.

EV ecosystems may take several years to build, but conditions are shifting quickly, and there is a real and urgent need for Asia to participate in green business building. The opportunities for building green businesses, particularly in EV, are more attractive than ever. Asian playersboth established firms and start-upsshould seize the moment and apply the lessons learned globally to build tomorrows EV ecosystem.