Electric Vehicles in the Sharing Economy Benefits and Challenges

Global

After a decade of rapid growth, in 2020 the global electric car stock hit the 10million mark, a 43% increase over 2019, and representing a 1% stock share. Battery electric vehicles (BEVs) accounted for two-thirds of new electric car registrations and two-thirds of the stock in 2020. China, with 4.5 million electric cars, has the largest fleet, though in 2020 Europe had the largest annual increase to reach 3.2million.

Overall the global market for all types of cars was significantly affected by the economic repercussions of the Covid-19 pandemic. The first part of 2020 saw new car registrations drop about one-third from the preceding year. This was partially offset by stronger activity in the second-half, resulting in a 16% drop overall year-on-year. Notably, with conventional and overall new car registrations falling, global electric car sales share rose 70% to a record 4.6% in 2020.

About 3million new electric cars were registered in 2020. For the first time, Europe led with 1.4 million new registrations. China followed with 1.2 million registrations and the United States registered295000 new electric cars.

Numerous factors contributed to increased electric car registrations in 2020. Notably, electric cars are gradually becoming more competitive in some countries on a total cost of ownership basis. Several governments provided or extended fiscal incentives that buffered electric car purchases from the downturn in car markets.

Europe

Overall Europes car market contracted 22% in 2020. Yet, new electric car registrations more than doubled to 1.4million representing a sales share of 10%. In the large markets, Germany registered 395000new electric cars and France registered 185000. The United Kingdom more than doubled registrations to reach 176000. Electric cars in Norway reached a record high sales share of 75%, up about one-third from 2019. Sales shares of electric cars exceeded 50% in Iceland, 30% in Sweden and reached 25% in the Netherlands.

This surge in electric car registrations in Europe despite the economic slump reflect two policy measures. First, 2020 was the target year for the European Unions CO2 emissions standards that limit the average carbon dioxide (CO2) emissions per kilometre driven for new cars. Second, many European governments increased subsidy schemes for EVs as part of stimulus packages to counter the effects of the pandemic.

In European countries, BEV registrations accounted for 54% of electric car registrations in 2020, continuing to exceed those of plug-in hybrid electric vehicles (PHEVs). However, the BEV registration level doubled from the previous year while the PHEV level thripled. The share of BEVs was particularly high in the Netherlands (82% of all electric car registrations), Norway (73%), United Kingdom (62%) and France (60%).

China

The overall car market in China was impacted by the panademic less than other regions. Total new car registrations were down about 9%.

Registration of new electric cars was lower than the overall car market in the first-half of 2020. This trend reversed in the second-halfas China constrained the panademic. The result was a sales share of 5.7%, up from 4.8% in 2019. BEVs were about 80% of new electric cars registered.

Key policy actions muted the incentives for the electric car market in China. Purchase subsidies were initially due to expire at the end of 2020, but following signals that they would be phased out more gradually prior to the pandemic, by April 2020 and in the midst of the pandemic, they were instead cut by 10% and exended through 2022. Reflecting economic concerns related to the pandemic, several cities relaxed car licence policies, allowing for more internal combustion engines vehicles to be registered to support local car industries.

United States

The US car market declined 23% in 2020, though electric car registrations fell less than the overall market. In 2020, 295000new electric cars were registered, of which about 78% were BEVs, down from 327000 in 2019. Their sales share nudged up to 2%. Federal incentives decreased in 2020 due to the federal tax credits for Tesla and General Motors, which account for the majority of electric car registrations, reaching their limit.

Other countries

Electric car markets in other countries were resilent in 2020. For example, in Canada the new car market shrunk 21% while new electric car registrations were broadly unchanged from the previous year at 51000.

New Zealand is a notable exception. In spite of its strong pandemic response, it saw a decline of 22% in new electric car registrations in 2020, in line with a car market decline of 21%. The decline seems to be largely related to exceptionally low EV registrations in April 2020 when New Zealand was in lockdown.

Another exception is Japan, where the overall new car market contracted 11% from the 2019 level while electric car registrations declined 25% in 2020.Theelectric car market in Japan has fallen in absolute and relative terms every year since 2017, when it peaked at 54000registrations and a 1% sales share. In 2020, there were 29000registrations and a 0.6% sales share.

Electric Vehicles

Electric car sales saw another record year in 2022, achieving a 14% sales share, despite supply chain disruptions, macro-economic and geopolitical uncertainty, and high commodity and energy prices. The growth in electric car sales took place in the context of globally contracting car markets: total car sales in 2022 dipped by 3% relative to 2021. Electric car sales including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) exceeded 10million last year, up 55% relative to 2021.

In the course of just 5 years, from 2017 to 2022, EV sales jumped from around 1million to more than 10million. It previously took 5 years from 2012 to 2017 for EV sales to grow from around 100000 to 1million, underscoring the exponential nature of EV sales growth.

In the Net Zero Scenario, electric car sales reach around 65% of total car sales in 2030. To get track with this scenario, electric car sales must increase by an average of around 25% per year from 2023 to 2030. For comparison, electric car sales increased by 55% in 2022 compared to 2021.

Electrification is happening in other vehicle segments, though in 2022 the electric sales share of buses and trucks was only around 4% and 1%, respectively.

For further data on historical and projected EV sales and stock, see the IEA Global EV Data Explorer.

On the Move: Unpacking the Challenges and Opportunities of Electric Vehicles

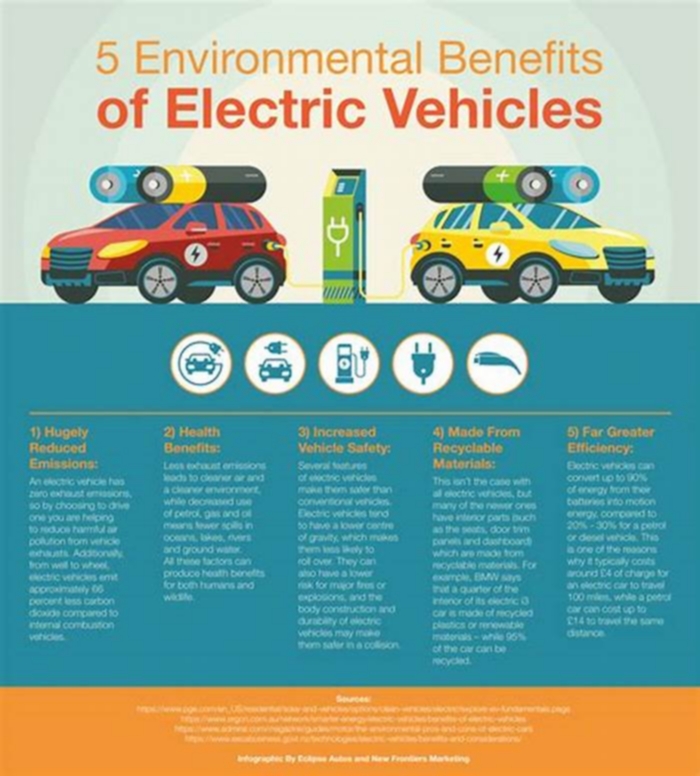

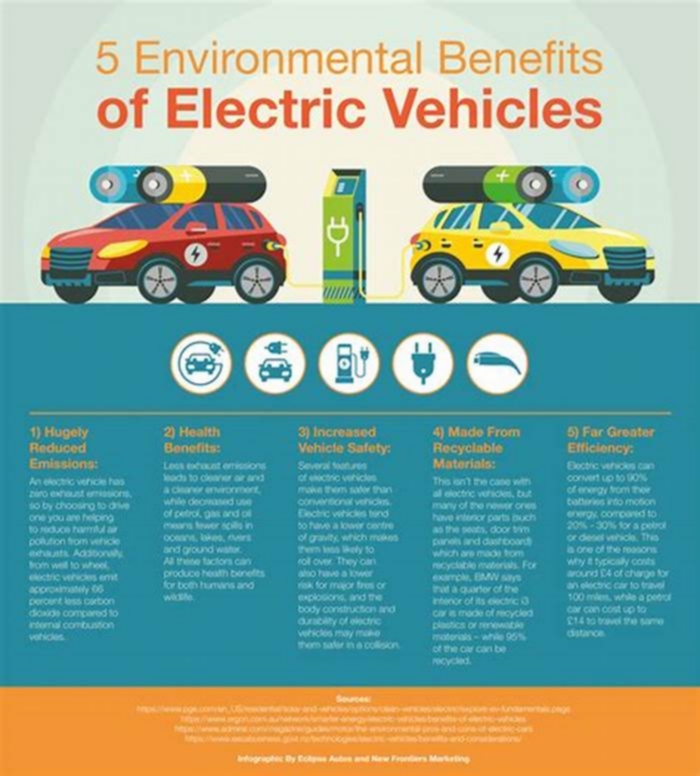

Electric vehicles have the potential to reshape the transportation sector in the United States, drastically cutting carbon emissions and clearing the way for significant climate progress. Transportation is the highest-emitting sector in the country, producing 28 percent of all carbon (CO2) emissions in 2018. Electric cars could transform this high-emissions sector. A study released by the Union of Concerned Scientists in 2015 shows that, in the United States, electric cars generate half or less than half of the emissions of comparable gasoline-powered cars from manufacturing to disposal.

California Governor Gavin Newsom recently underscored the importance of electric vehicles when he announced on September 23 that California would require all new cars and passenger trucks sold in the state to be zero-emission vehicles by 2035. Though electric vehicles (EVs) still emit carbon emissions through the manufacturing process and from the fossil fuels used to generate the electricity they need to recharge, their enhanced energy efficiency secures significant emission reductions. On average, EVs convert over 77 percent of the electrical energy from the grid to power at the wheels, while gasoline vehicles only convert between 12 to 30 percent of the energy stored in gasoline to power at the wheels. Nevertheless, there remain significant hurdles to widespread adoption of electric vehicles, which are explored below in part 1. Congress is considering legislation that would address these hurdles, including the Electric Vehicle Freedom Act, and has already passed the Charging Helps Agencies Realize General Efficiencies (CHARGE) Act (see part 2 of this article).

Part 1: Electric Vehicle Challenges and Opportunities

Charging times. There are three major levels of chargers available for EVs. The standard 120-volt plug, often used for home appliances, charges slowly but can fill a battery to near full capacity with several nights charge, or about 20 to 40 hours. The 240-volt "level two chargers generally provide 20 to 25 miles of charge in an hour, which shortens charging time to eight hours or less. In homes, level two chargers can use the same outlet type required for clothes dryers or electric ovens. In the EV industry, the connectors used for level two charging are known as SAE J1772. Finally, "level 3" direct current (DC) fast chargers can charge a battery up to 80 percent in 30 minutes. Currently, level two chargers are the most widely availablethe Department of Energy lists 22,816 public stations in the United States. There are important cost differences between charger types. According to a study by the Rocky Mountain Institute, costs for a level two chargers components range from $2,500 to $7,210 and from $20,000 to $35,800 for a DC fast charger. The decision of which stations to install requires balancing the cost of installation with the needs and convenience of drivers.

Charger compatibility.Level two charger development has been a relatively coordinated process, with all automakers besides Tesla using the same charge port model (with Tesla drivers using an adapter to connect). Three different varieties of DC fast chargers are used by different auto manufacturers: the SAE Combined Charging System (CCS), used by most manufacturers; CHAdeMO, used by Nissan and Mitsubishi; and the Tesla Supercharger (only available to Tesla drivers). This lack of vehicle compatibility differs from universal vehicle access to gas stations and could be an obstacle to widespread electric car adoption.

Availability of charging infrastructure. Rather than being refueled at a typical gas station, electric vehicles must be charged at electrical outlets in order to run. Many EV owners charge their cars at home in their garage using a special wall-mounted charger. This arrangement works for most people, because the average person drives 29 miles per day. This distance is well within the range of todays electric vehicles, most of which can travel between 150 and 250 miles on a charge, depending on the model. However, two major difficulties arise. First, for drivers who live in apartments, parking garages are rarely equipped with charging infrastructure, and installing such infrastructure may be cost prohibitive for building managers. There is also the additional problem of the electric costs incurred at common outlets. Because regular EV charging consumes more energy than most other residential uses, building managers need a mechanism to monitor EV charging to ensure the driver of each vehicle pays for their own electricity usage.

Second, expanded charging infrastructure is needed for EVs to make long-distance trips that require multiple stops for charging. A recent study by the International Council on Clean Transportation indicated that 10,000 more charging stations will be required to support EVs traveling on inter-city corridors by 2025, based on trends of increasing EV ownership. When it comes to longer trips, EV owners can experience range anxiety, the fear that the car will run out of power before reaching a suitable charging station. Surveys show that concerns about range and charging availability are an important limit on consumer uptake of EVs. A 2018 report by the Harris polling firm found that 58 percent of respondents named running out of power as their top reason for not purchasing an EV, and 49 percent named low availability of charging stations.

Renewable energy and climate mitigation. While not a hurdle to widespread EV adoption in and of itself, the electrical grids continued reliance on fossil fuels can reduce the cost-effectiveness of EV adoption as an emissions abatement strategy. Despite reducing emissions even when connected to a fossil-powered grid, electric vehicles are a much more cost-effective emission reduction tool when renewable energy sources make up a greater proportion of the energy mix. According to the Intergovernmental Panel on Climate Change (IPCC), on a relatively high-carbon grid (which produces 500600 grams of CO2 equivalent emissions per kilowatt-hour of power generation), light-duty electric vehicles can cost many hundreds of dollars per ton of CO2 abated. However, in a relatively low-carbon grid (which emits below 200 grams of CO2 equivalent per kilowatt-hour), EVs cost below $200 per ton of abatement. Maximizing the use of renewable energy to power electric vehicles is therefore crucial.

Grid capacity. Trading out a national fleet of gasoline-powered cars and trucks for a fleet of EVs means that millions of people will depend on the electric grid in new ways. Therefore, power generation capacity will need to increase to accommodate these vehicles without straining the grid. Expert assessments vary on how much electricity demand will increase with widespread EV use. The Department of Energy predicts a 38 percent increase in electricity consumption by 2050, mostly due to a high penetration of electric vehicles. Researchers at the Energy Institute at the University of Texas Austin conducted a state-by-state assessment of a scenario in which all personal cars, trucks, and SUVs are converted to plug-in electric models. The study finds that state energy consumption would range from an increase of 17 percent in Wyoming to 55 percent in Maine. Most states consumption increases clustered between 20 to 30 percent. While some state grids have the available excess capacity to generate increased amounts of power with existing infrastructure under favorable assumptions for charging times, others do not. The ability of grids to handle EV charging also depends on what time of day the vehicles are plugged in. EVs have a much lower chance of overloading grids if charged at off-peak hours, when fewer consumers are using electricity.

Vehicle costs. Electric cars generally have higher sticker prices than their gasoline-fueled counterparts, mostly because of expensive materials and processes used in battery production. Although these costs have fallen steeply over the last decade, the average sticker price on a new electric vehicle is around $30-40,000. However, electric vehicles are likely to accrue significant savings on fuel over a 15-year lifespan. According to a study by the U.S. Department of Energy's National Renewable Energy Laboratory (NREL) and the Idaho National Laboratory, under baseline scenario assumptions about gas prices, electricity costs, and charging behavior, electric vehicles could save consumers anywhere between $4,500 to $12,000. The savings depend on the drivers state of residence, with Hawaii offering the lowest savings and California the highest. Even with the savings over time, it remains important for electric vehicles to be affordable at point of purchase to compete with gasoline-powered cars.

Charging behavior. Electric vehicle charging behavior differs significantly from the refueling behaviors of cars owners with conventional internal combustion engines. According to the Department of Energy, 80 percent of EV charging is done at home. However, many consumers are uneasy about the prospect of long charging times at public stations on longer trips that exceed the range of their vehicles.

Sales outlook. According to the Department of Energy, as of 2019, electric cars made up 2.1 percent of all new light-duty vehicle sales in the United States, up from 0.7 percent in 2015. Currently, Tesla sells the largest share of new electric vehicles in the United States, but the Nissan Leaf makes up the largest share of used EV sales. The Edison Electric Institute predicts that electric vehicles will make up 7 percent of all vehicles on the road by 2030, or about 18.7 million vehicles. While this growth rate is impressive, it will need to be dramatically increased if uptake is to progress fast enough to meet international climate targets.

Charging station financing and ownership. Electric vehicle charging stations are expensive to installas mentioned above, public station component costs can range from as little as $2,500 for a level two charger up to $35,800 for a DC fast charger. These price ranges do not include installation costs and soft costs, such as navigating the permitting process, regulations, and interconnection with utilities. These costs raise the question of who pays for the construction of these stations. Currently, charging station construction is paid for primarily by car and energy companies and business owners, including the managers of parking lots and garages, shopping centers, and retailers seeking to attract EV users. Some of the largest charging station projects in the country are Volkswagens Electrify America program and Teslas station deployment. Each company is spending around $2 billion on its respective project. EVgo, a company that installs DC fast chargers, is currently working on a project funded by venture capital and grants from state governments and environmental programs. Historically, such large projects have tended to be unprofitable due to high upfront costs; electric car use will need to become more widespread before they can turn a profit. Several states, including California and Texas, have also allowed utilities to invest in EV charging stations. Some state officials have expressed concern that utility participation could reduce private competition, but officials in states that have allowed it argue that it has expanded charging station infrastructure at a much faster rate.

Pricing. Unlike gas stations, where the price of fuel is set per gallon, EV charging can currently follow a number of different pricing schemes, which can lead to inconsistent pricing and sometimes high charging costs. Home charging prices are consistent rates per kilowatt-hour (kWh) set by utility regulators. Public charging station pricing has used schemes including per-session fees, per-minute fees, and tiered pricing based on a vehicles max charging speed. Charging fees are often not displayed at charging stations. This inconsistency and lack of transparency are barriers to EV adoption because they can lead to frustration and negative customer experiences. Per-kWh pricing models most clearly resemble gas prices in that the price is determined per unit of energy delivered to the vehicle. EV drivers typically favor this pricing model. Available pricing structures are constrained by state laws. States are increasingly moving to allow per-kWh pricing, sometimes with a tiered pricing structure, which charges higher rates for faster charging speeds. In states like Maryland where charging stations are operated by regulated utilities, drivers pay per-kWh rates set by the utility regulator.

Part 2: Federal EV Legislation

Congress is actively working to break down barriers for EVs. A recent piece of legislation, the Charging Helps Agencies Realize General Efficiencies (CHARGE) Act (Public Law No: 116-160) became law on October 1, 2020. The bipartisan bill, originally sponsored by Rep. Ro Khanna (D-Calif.) with Rep. Anthony Gonzalez (R-Ohio) in the House and Sen. Gary Peters (D-Mich.) with Sen. Rob Portman (R-Ohio) in the Senate, allows federal employees to use Fleet Service Cards provided by the General Services Administration (GSA) to pay for charging at public electric vehicle charging stations. Fleet Service Cards provide for the refueling of government vehicles, but currently only cover gas station refueling. This means that federal employees who own EVs are unable to take advantage of the card and must shoulder higher costs. The Act aims to facilitate more widespread use of EVs by federal employees by removing this obstacle to charging availability. It also lowers fuel costs for federal agencies by taking advantage of the energy efficiency of EVs.

Another recent piece of legislation looks towards a more comprehensive expansion of EVs. The Electric Vehicle Freedom Act, or EV Freedom Act (H.R. 5770), proposed in February by Rep. Andy Levin (D-Mich.), intends to construct electric vehicle supply equipment along all public roads in the National Highway System within five years so that EV drivers can travel anywhere on these roads in the continental United States, Alaska, Hawaii, and Puerto Rico without running out of charge. Specifically, the electric vehicle supply equipment would be level three DC fast chargers. The charging stations must be compatible with multiple brands of electric vehicle so as not to favor any individual manufacturer.

The EV Freedom Acts primary aim is to eliminate range anxiety on long-distance trips, and therefore address one of the major concerns of would-be EV drivers. By mandating the use of DC fast chargers, the bill also intends to eliminate inconvenience to drivers as much as possible, allowing drivers to fill 80 percent of the car battery in about half an hour. As of mid-2020, according to the Department of Energy, only 3,653 publicly available fast-charging stations were operating in the United States, so this bill would constitute a dramatic expansion.

Given the high costs of producing and installing DC fast charging stations, the cost of the project would likely be steep. In the trade-off between cost and driver convenience, the bill leans heavily toward convenience. However, the bill cannot fully eliminate the inconveniences associated with EV charging, since even a half-hour charging time takes longer than a visit to a gas station. Driver adaptation will still be necessary. Further, there may be long waiting times at charging stations if EVs reach high market penetration. The bill attempts to address this concern by explicitly mandating consideration of dense corridors where multiple stations or a greater number of charging ports at the location are necessary to meet demand.

The bills concern for standardization of DC fast-charging stations would also remedy the current problems of interoperability between car manufacturers. Setting this DC standard would require coordination between manufacturers, but the bill provides for extensive consultations with them and other stakeholders.

The bill would direct the Secretary of Energy and Secretary of Transportation to convene and create a national electric vehicle supply equipment plan within three years of its passage, in consultation with government entities, Native American nations, nonprofit organizations, and businesses. The plan would then be presented to Congressional committees with jurisdiction over transportation, energy, and environment. The plan would consider ways to optimize EV connectivity with renewable energy infrastructure, thus lowering the CO2 abatement costs of EV use. It also calls for electric distribution upgrades, so that grids are able to handle energy demand at peak charging times.

To conduct a study of suitable financial instruments and public-private partnership arrangements, the bill would commission a study by the Transportation Research Board of the National Academy of Sciences. According to Rep. Levin during a recent webinar hosted by the Environmental Law and Policy Center, the study would aim to find ways to maximize direct investment from the private sector. Private businesses, such as retailers, would operate the charging stations instead of regulated utilities. However, public-private collaborations of this kind risk distributing costs disproportionately to the public by requiring the government put up a higher initial investment than the private sector, so the details of the financing plan are crucial.

The legislation calls for a plan to impose pricing guidelines that enable operators of publicly available electric vehicle supply equipment (EVSE), namely charging stations, to allow free charging or impose a fee for charging, promoting a consistent, reliable consumer charging and payment experience. This addresses concerns over inconsistent or unreasonably high charging prices, but leaves the response to those concerns an open question without favoring specific tools to keep prices low, such as regulated utility rates or per-kWh pricing.

Electric vehicles have great potential to draw down carbon emissions if widely adopted. Vehicle costs are falling as battery prices have decreased 87 percent in the last decade, and EV sales are increasing at a rapid rate. But, meaningful emissions mitigation through mainstream EV adoption is inhibited by many complex technological, economic, and behavioral problems and trade-offs, and policy responses are needed to address these challenges. The CHARGE Act is a promising first step and the EV Freedom Act provides possible next steps. But many different approaches are possible, and all deserve consideration as political momentum builds on this critical issue.

By: Joseph Glandorf