Exploring EV Ownership Costs From Purchase to Long Term Maintenance

Exploring consumer sentiment on electric-vehicle charging

The transition to electric mobility is accelerating across the world. McKinsey analysis shows that annual sales of electrified passenger vehicles exceeded ten million units in 2022, marking an increase of more than 50 percent over sales in 2021. And McKinsey projects that they will reach roughly 40 million in 2030.

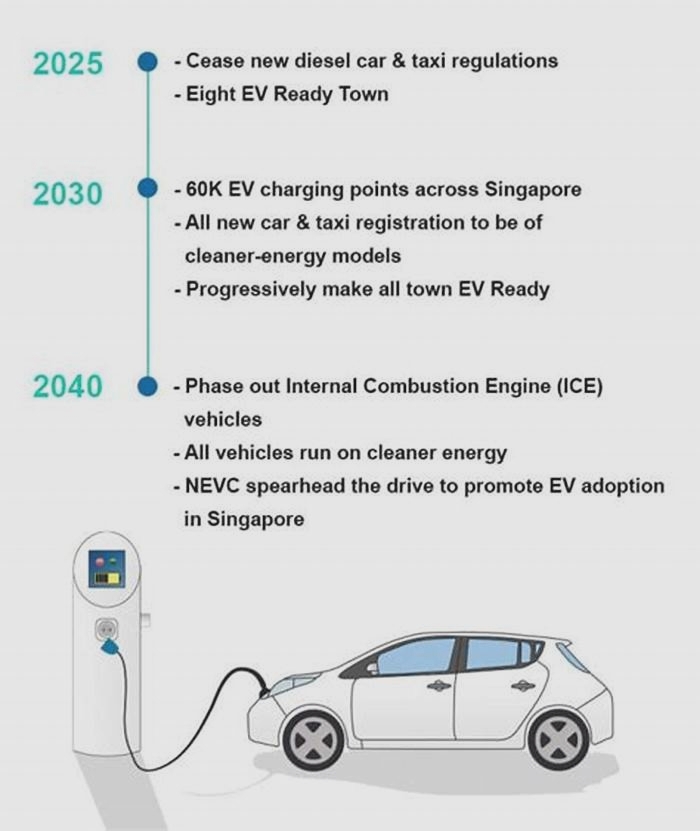

An increase of this scale has repercussions that go far beyond electric-vehicle (EV) sales. First and foremost, it will require an equally impressive rise in the availability of public and private chargers. In the United States, for instance, about 2.6 million ports were available in 2022; but with the number of EVs increasing every year, the country will need approximately 9.5 million ports by 2025 and 28.0 million by 2030. If the growth in EV-charging infrastructure fails to keep pace with demand, consumers may hesitate to make the shift from an internal combustion engine (ICE) vehicle. Other charging issues, including consumers lingering concerns about being able to charge as conveniently as they can fuel up today, could also slow the widespread adoption of EVs.

The most recent McKinsey Mobility Consumer Pulse Survey asked EV drivers and prospective buyers about their thoughts on charging, including their current satisfaction levels, major concerns, and what their ideal charging network would provide. (See sidebar, About the survey, for information on methodology.) The resulting insights can help EV industry stakeholders understand customer needs as they prioritize the technological and infrastructure investments required to keep the market strong and capture new opportunities.

Convenience matters, especially accessibility and range

When it comes to powering their vehicles, prospective EV buyers want the same convenience they now enjoy with ICE vehicles. In our survey, a subset of respondents state that they would rather buy at least one more traditional ICE car before switching to an EV. Forty-two percent of respondents in this group, who we refer to as skeptical EV buyers, state that they will only move forward with an EV purchase if public-charger availability is equivalent to that of current gas stations (Exhibit 1).

The current public-charging network falls short of consumer expectations for convenience. Over 80 percent of survey respondents who are considering an EV as their next car believe that the current availability is insufficient; another 15 percent are satisfied with it but worry that the future network will not be robust enough to meet surging demand. Current EV ownersthose with experience using the networkshare these concerns, with 70 percent stating that they are dissatisfied with the current infrastructure and only 10 percent agreeing that enough charging points are available.

A similar story unfolds with regard to battery capacity and vehicle range. As with charge point availability, 42 percent of hesitant EV buyers state that they will not purchase an EV until battery capacity and driving range improve. Whats more, consumers requirements for battery range continue to rise drastically. In our survey, prospective EV buyers say they want to get more than 310 miles per full charge, up from 270 in 2021, and 40 percent state they would prefer to see a driving range of 400 miles or more before they would consider switching to an EV. These findings suggest that an improved charging infrastructure could encourage greater EV adoption, since many people have concerns about running out of charge.

Wary consumers may forgo EV purchases if their concerns about charging availability, battery capacity, and range persist. That provides industry stakeholders with an incentive to accelerate infrastructure expansion and prioritize improvements in battery performance. Without these moves, EV sales might not reach their full potential, delaying the transition to a more sustainable mobility ecosystem.

Its home sweet home for chargingbut not for long

Survey respondents are homebodies, at least when it comes to charging. About half of all charging sessions occur at their residences, with those in Europe reporting the highest rates (Exhibit 2). Public charging is still critical, however, with the percentage of sessions occurring at these locations ranging from 23 percent (Europe) to 33 percent (United States). In all locations, about 10 percent of sessions occur at a drivers workplace.

The high rate of home charging is only possible because current EV owners share certain characteristics. Worldwide, about 48 percent have their own parking spot and a power outlet suitable for home charging (Exhibit 3). Another 35 percent state that they could charge at home if they had an extension cable or requested a grid upgrade, and only 17 percent say that home charging is not an option.

As the EV ownership base expands, public-charging infrastructure will become more important because a greater proportion will lack the needed space or power requirement at their residences for charging. In our survey, 42 percent of respondents who do not yet own EVs state that they will be unable to charge at home.

How fast and how muchthe importance of charging speed and cost

When selecting a public charge point, 42 percent of survey respondents indicate that charging speed is their most important consideration (Exhibit 4). Whats more, they have high performance expectations, with over 60 percent wanting charging times of 30 minutes or less.

Respondents rank cost as the second most important decision factor, but the amount people are willing to pay varies by use case. EV drivers, for example, are willing to pay about 10 percent more for on-highway charging than for inner-city or destination (last stop) charging. That pattern holds true regardless of whether the price for charging is relatively high or low, suggesting that EV customers appreciate the time savings and convenience of fast charging.

Home bundles that go beyond charging

Drivers often switch to EVs primarily because they want a more environmentally friendly means of transportand that may be just one of many areas where they want to go green. In our survey, over half of current EV owners also express high interest in bundling their home-charging solutions with photovoltaicsalso called solar cellsor battery storage and energy management solutions for their homes (Exhibit 5). Companies might appeal to consumers and potentially gain more market share by creating attractive packages that extend beyond vehicle charging.

Going green at the charging station

Climate change is now impossible to ignore, and consumers are responding. In our survey, about 55 percent of respondents state that green charging from renewables is important, with another 25 percent agreeing that it is nice to have (Exhibit 6). Their commitment is so strong that 70 percent indicate that they would pay a surcharge for electricity generated with renewables. As with any purchase, however, consumers are price conscious, and the average acceptable premium for green charging is only 7 percent. Thats down from 14 percent in 2021, and the downward trend may suggest that more consumers expect green charging to be a standard option.

OEMs and start-ups are investing heavily in EVs, but even the most sophisticated, environmentally friendly vehicles may not appeal to consumers if concerns about charging persist. A drop in global EV sales could harm the automotive industry, and the implications for climate change are even more severe. Our recent survey provides some insight about what consumers want, from convenient, fast charging to in-home chargers bundled with other green solutions. The only question that remains is how quickly industry stakeholders will act to meet consumer expectations. To keep the transition to sustainable mobility on track, the time to act is now.

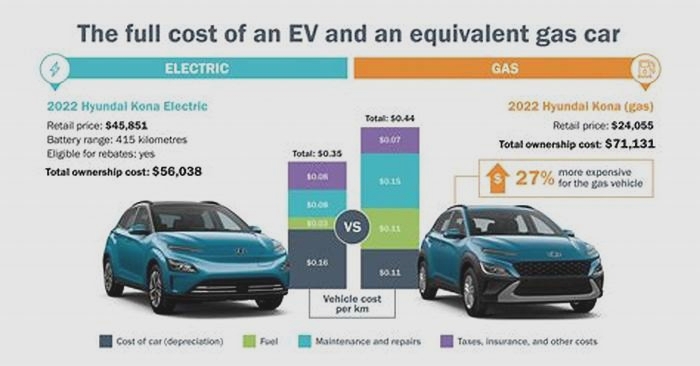

Is it cheaper to own an electric car? Do EVs save you money?

Are EVs cheaper to own, in the long run, than a petrol or diesel car?

As with so many things we buy as a utility for our daily tasks, our buying decisions when it comes to cars are often driven by the cost of ownership.

After all, it's one thing to find the money for a purchase, but ongoing costs like servicing and maintenance, registration and insurance can be hard to bear particularly when it comes to the fluctuating and regularly climbing cost of fuel.

It's no surprise then that many people are starting to wonder if an electric car could be the answer. They're generally more expensive to buy, but they can be much more affordable to run. Does the one cancel out the other? You'll find a number of links here to our guides on this question and many others.

The decision could get easier soon, too, thanks to an increasing number of options in the market. Over 30 new or updated EVs are due in Australia over the next two years and more are being announced almost weekly.

Likewise, one of the key barriers to EV supply and competitive pricing has been the absence of strict emissions regulations in Australia. Why?

Supply, demand ...and penalties.

Australia has the demand, but it can't yet have supply because it doesn't penalise brands for selling so many combustion-engined cars.

Most other governments now enforce significant penalties for brands that don't offset the emissions of their combustion-engined cars with a proportionate number of sales for low- and zero-emissions vehicles.

In short, every EV sent to Australia is a car not being sold in another market, where demand is high and production capacity is limited.

Why don't car brands just stop selling combustion-engined cars?

Because EV tech has cost brands tens of billions to develop, and EVs are still far more expensive to build than conventional cars so, for now, the profits from combustion-engined car sales is needed to recoup some of those costs.

4

Regulations are coming, though, and car brands are planning for it.

In particular, the next 12 months will bring a huge number of launches.

This is thanks both to the semiconductor chip shortage that delayed several models planned for 2022, and the growing demand for EVs in Australia.

The prominence of electric cars has grown worldwide thanks to rising fuel prices, with many seeking to reduce the ownership costs and environmental impact typically associated with internal-combustion vehicles.

So, to help you understand the costs of owning an EV and whether it can be cheaper than owning a conventional car, we've built a number of detailed guides and you'll find them at the links below.

4

GUIDE: Crunching the numbers on EV ownership

Is the tide of opinion and financial benefit finally turning on electric cars? We crunch the numbers on how much you could save by making the change.

GUIDE: How much more expensive are electric cars in 2023?

Amid inevitably increasing new car prices, how big is the electric vehicle price premium today?

GUIDE: What do EVs cost to maintain?

Do electric cars need routine servicing? What does it include? Is it cheaper to maintain an EV than a petrol or diesel car? Find out in this handy guide.

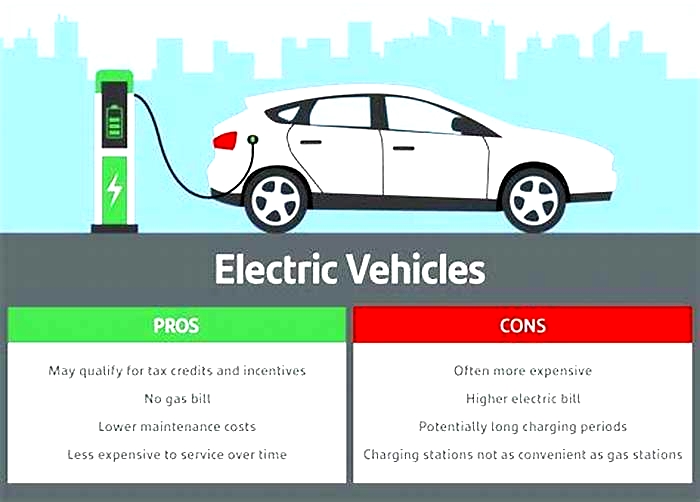

THE GOOD

- It's true that EV owners don't need to contend with the oil changes, spark plugs, timing belts, complicated transmission internals and exhaust systems associated with ICE vehicles (and hybrids), but...

THE NOT SO GOOD

- There are no miracles here. Battery-electric cars do still require regular maintenance, because they still share many 'consumables' with their ICE counterparts, with the addition of more advanced battery and electronic systems.

GUIDE: Are electric cars more expensive to insure?

Electric cars are cheaper to own over time, yet comprehensive insurance premiums are typically higher. We explain why, and break down the differences.

GUIDE: Government incentives for buying an EV

With more EVs being introduced into the market, what are governments offering to increase uptake among private buyers?

4

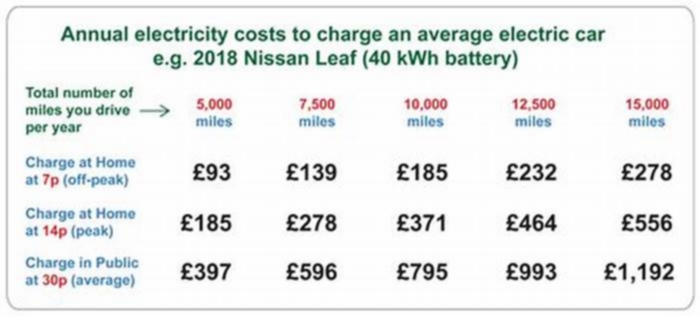

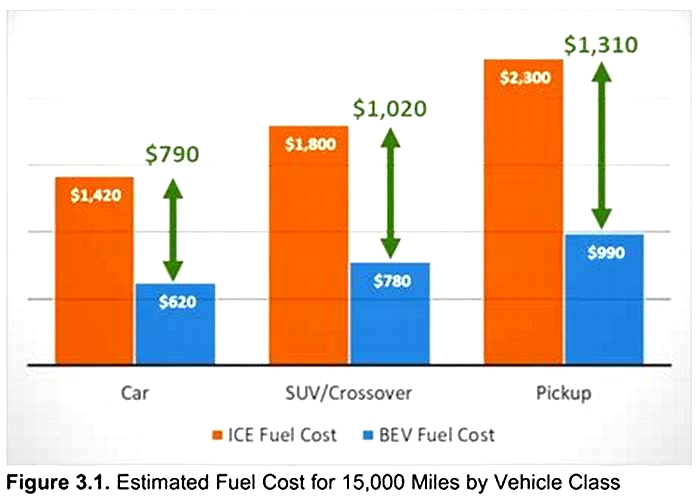

GUIDE: Is it cheaper to charge an EV than to fuel a regular car?

What are the running costs of an electric vehicle when compared to the combustion-engined cars we've known for so long?

Still hungry for info?

More EV stories to help you choose the best car for your needs

MORE advice stories to help you with buying and owning a car

Comparison of 3-year ownership costs of EV, gas pickup trucks

Comparison of 3-year ownership costs of EV, gas pickup trucks

We look at the three-year running costs of gasoline, hybrid, and all-electric versions of Canadas workhorses

Published Dec 02, 2023 Last updated Apr 02, 2024 5 minute read

You can save this article by registering for free here. Or sign-in if you have an account.

Article content

In our last couple of instalments in this series, we aimed our TI-84 calculators at two distinctly different types of vehicles: the crushingly popular mainstream small crossover segment and the fancy-pants luxury SUV arena. Those types of vehicles comprise the vast majority of sales in this country, so we felt it important to examine three-year running costs on those rigs to help our readers make good buying decisions.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

Article content

But an outsized number of comments, at least in reference to gasoline-vs-electric debates, are hurled at pickup trucks. To say truck buyers are a loyal (and often traditional) lot would be an understatement to the point of saying crispy bacon is merely delicious. Injecting a skiff of electrification be it via a hybrid or pure electric powertrain reliably sets opinions aflame.

As with our other efforts, we are projecting a three-year cost of ownership across vehicles of equivalent trim levels and body styles to try and make sure the options are roughly the same in terms of comfort features no matter the powertrain choice. Since it is the dominant purchase, weve pinned our flag to crew cab trucks with a short box and four-wheel drive. No extra options are included beyond whatever is included in a particular trim but padding a hybrid model with a towing package proved be roughly the same value proposition as adding one to a gas-powered truck. This helps level the comparison and keep our conclusions relevant.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

The numbers shown here are accurate as of this writing and, for consistency, rebates are correct for the province in which your author resides. Readers are encouraged to examine their own areas willingness to shovel money at these programs. Energy costs are noted in the charts, and we assume an average driving distance of 20,000 km per year. Estimated maintenance costs are three-year packages paid at the time of vehicle purchase.

Comparison of 3-year ownership costs of Fords EV and gas pickup trucks

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Well start with the Blue Oval, mainly because its trucks have outsold every other brand in Canada for eleventy billion years and counting. Numbers shown here are for a workaday XLT trim across all powertrains, so there are no six-figure Platinums in this group.

Surprised? Join the club. A gulf of just $8 per month between the EcoBoost gasser and PowerBoost hybrid drives home the estimated efficiency of the latter, erasing its $3,500 price premium at sticker. Maintenance costs will be equal thanks to the presence of a blown 3.5L V6 under the hood of both trucks. Given the hybrid also has an ability to power multitudes of equipment through its Pro Power Onboard feature, the choice is clear.

But the real surprise showed itself whilst examining numbers for the all-electric Lightning. Before we start, be it known that, as of this writing, Ford is offering an approximate 3.5 per cent interest rate cut on the EV truck compared to gassers over the same terms. This makes a large difference in payment, as does the iZEV rebate which is available only on the XLT Standard Range model. Even without government contribution and the addition of an extended range battery pack, the interest rate slash combined with less maintenance costs and smaller energy bills can place an XLT Lightning within a shout of an XLT EcoBoost or XLT Hybrid. As an experiment, we adjusted the interest rates to equivalency which placed the extended range EV about $130 more per month than the petrol-fuelled trucks.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Comparison of 3-year ownership costs of General Motors EV and gas pickup trucks

Running cost scenarios for the Chevrolet Silverado and Silverado EV proved to be a mite more nebulous since that pickup truck has yet to go on sale in this country. Nevertheless, turning over a quarrys load of rocks unearthed enough numbers (or solid approximations thereof) with which to form a completed Excel spreadsheet.

Theres absolutely no surprise with the two gasoline powered models, given the traditional price spread (and fuel consumption difference) between the 5.3L and 6.2L engines. Expect to pay an extra $130ish per month for the privilege of piloting that hand-of-god L87 mill though the newly-standard active valve exhaust produces a sound that just might be worth the cash. We selected the RST trim since that is the first one out of the gate for the Silverado EV.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

Well, an RST First Edition, at least. Its six-figure price tag towers over the gassers like King Kong over Manhattan, pushing its three-year proposition so high that no amount of energy or maintenance savings can redeem it. Perhaps the standard RST will be different, but that pricing is not yet available. What was available was a sticker for the base EV Work Truck, a rig which has more power than the 6.2L V8 but an estimated range roughly equal to a tank of fuel. Ceteris paribus in terms of interest rates, and even without iZEV largesse, a 3WT EV may undercut gassers by hundreds per month.

Comparison of 3-year ownership costs of Toyotas EV and gas pickup trucks

Whilst the Big T doesnt have an all-electric Tundra in its mix, it does have a choice between its iForce V6 powered solely by gasoline and iForce Max V6 hybrid fuelled partially by electrons. Gearheads will immediately point to the latters extra horsepower, even though most drivers will appreciate the extra 100+ lb-ft of torque more in their daily duties.

As the chart shows, its largely par for the course with this comparison, though the hybrids smaller estimated fuel economy numbers do offset the initial purchase price to a decently significant degree. That delta will only further shrink as ones annual driven mileage increases. However, it is worth noting that, in this writers personal experience, putting a load on the hybrid (towing, payload, and the like) erases any fuel economy gains over the non-hybrid.

More in Shopping Advice

See moreShare this article in your social network

Matthew Guy

Matthew Guy is a lifelong gearhead who writes automotive content for Canadian and American outlets. He is alternately described as a freelance author, podcast host, road test magnate, and legend in his own mind. As a member of AJAC, he enjoys sharing his excitement about cars and is very pleased to contribute at Driving.

EXPERIENCE

Matthews goal is to put readers in the drivers seat for a unique and entertaining look at the automotive industry whether penning vehicle reviews with a creative bent, travelling to manufacturer events for first drives of new models, or speaking with industry stakeholders to gain extra insight for an article During the past decade, he has enjoyed creating unique and creative long-distance adventure drives, sating his (and the readers) appetite for driving accomplishments like traversing the spartan wilds of Labrador. Timed challenges in speedy machines also spin his crank. For a spell, he was also behind the microphone for this sites Truck Guy podcast, interviewing guests ranging from knowledgeable local technicians to world-famous television stars. Find out what its like to jump behind the wheel of a pickup truck and successfully tackle gnarly off-road courses. Ride along whilst tackling twisty roads along the Pacific Coast in a droptop convertible. Bundle up as he explores the frigid expanses of Canada from his home on the East Coast to venturing north of the Arctic Circle.

EDUCATION

Memorial University of Newfoundland, School of Business B.Comm (Hons.)

AWARDS

2021 Castrol-Wakefield Automotive Writing Award, runner-up

Runner Up - 2023 AJAC Adventure and Travel Journalism Award presented by Genesis Canada

Winner - 2023 AJAC Road Safety Journalism Award presented by Volvo Canada

CONTACT

Email: [email protected]

LinkedIn: linkedin.com/in/matthewkguy

Instagram: @DudeDrivesCars