How big is the Chinese EV market

The Chinese EV market is exploding. Here are the 5 major Chinese EV brands you should know about.

4. Geely's Zeekr is just 2 years old, but it already has international ambitions

Zeekr is an electric vehicle brand under the privately held Chinese auto giant Geely which boughtthe Swedish brand Volvo in 2010.

Founded only in 2021, Zeeker already has international ambitions.

In April this year, Zeekr said it plans to sell its newly launched SUV-style Zeekr X and Zeekr 001 EV sedan in Western Europe, Reuters reported. The EV maker did not indicate a timeline for its plans.

The $27,000 Zeekr X even has facial recognition software to unlock the car and owners can also opt to install a refrigerator in the car, Andy An, the CEO of Zeekr, said at an event, Reuters further reported.

The company aims to deliver 40,000 Zeekr X cars to the China market this year, with its first domestic deliveries starting in June, An said per Reuters.

And even though Zeekr is backed by a major auto player, it still trails its EV peers in the domestic Chinese markets.

Zeekr sold just 15,234 of its existing models in the first quarter of 2023 this is half of the 31,000 vehicles Nio sold and just 10% of what Tesla sold in the same period, per Reuters.

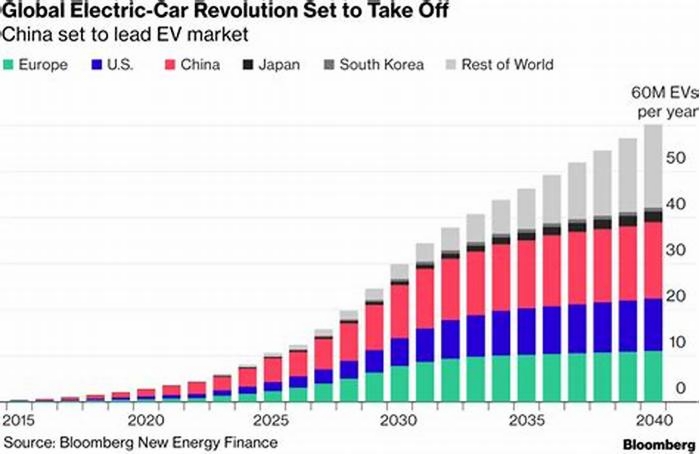

Global

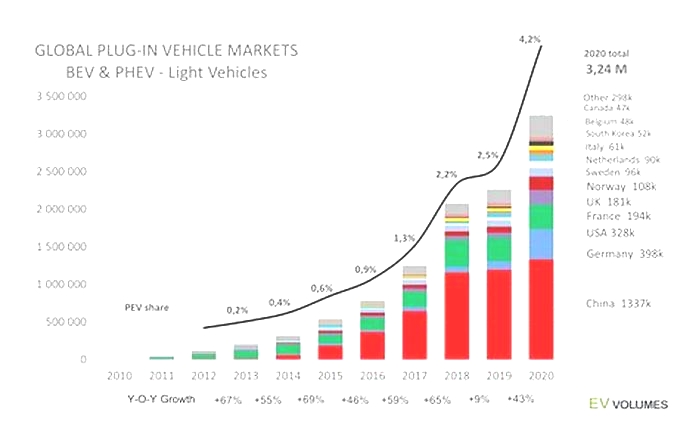

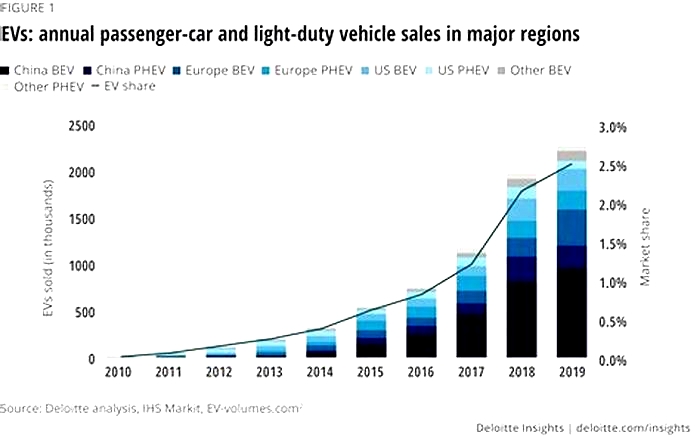

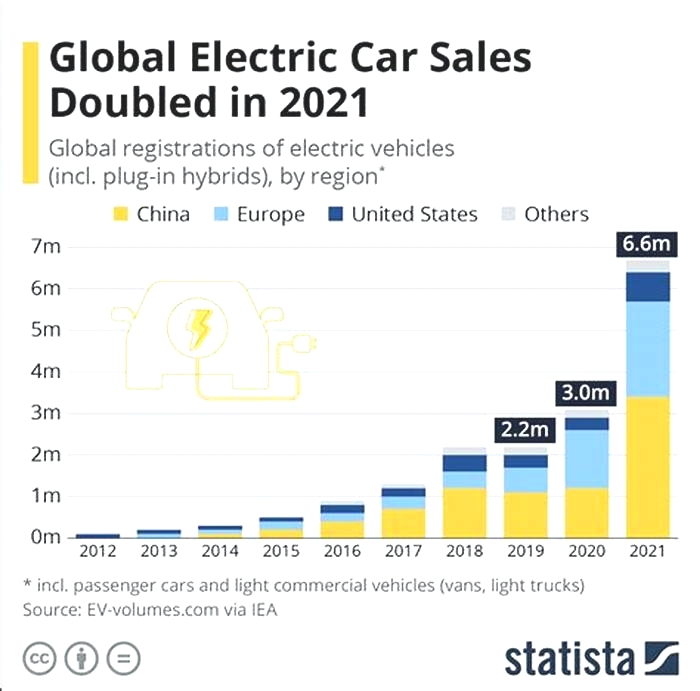

After a decade of rapid growth, in 2020 the global electric car stock hit the 10million mark, a 43% increase over 2019, and representing a 1% stock share. Battery electric vehicles (BEVs) accounted for two-thirds of new electric car registrations and two-thirds of the stock in 2020. China, with 4.5 million electric cars, has the largest fleet, though in 2020 Europe had the largest annual increase to reach 3.2million.

Overall the global market for all types of cars was significantly affected by the economic repercussions of the Covid-19 pandemic. The first part of 2020 saw new car registrations drop about one-third from the preceding year. This was partially offset by stronger activity in the second-half, resulting in a 16% drop overall year-on-year. Notably, with conventional and overall new car registrations falling, global electric car sales share rose 70% to a record 4.6% in 2020.

About 3million new electric cars were registered in 2020. For the first time, Europe led with 1.4 million new registrations. China followed with 1.2 million registrations and the United States registered295000 new electric cars.

Numerous factors contributed to increased electric car registrations in 2020. Notably, electric cars are gradually becoming more competitive in some countries on a total cost of ownership basis. Several governments provided or extended fiscal incentives that buffered electric car purchases from the downturn in car markets.

Europe

Overall Europes car market contracted 22% in 2020. Yet, new electric car registrations more than doubled to 1.4million representing a sales share of 10%. In the large markets, Germany registered 395000new electric cars and France registered 185000. The United Kingdom more than doubled registrations to reach 176000. Electric cars in Norway reached a record high sales share of 75%, up about one-third from 2019. Sales shares of electric cars exceeded 50% in Iceland, 30% in Sweden and reached 25% in the Netherlands.

This surge in electric car registrations in Europe despite the economic slump reflect two policy measures. First, 2020 was the target year for the European Unions CO2 emissions standards that limit the average carbon dioxide (CO2) emissions per kilometre driven for new cars. Second, many European governments increased subsidy schemes for EVs as part of stimulus packages to counter the effects of the pandemic.

In European countries, BEV registrations accounted for 54% of electric car registrations in 2020, continuing to exceed those of plug-in hybrid electric vehicles (PHEVs). However, the BEV registration level doubled from the previous year while the PHEV level thripled. The share of BEVs was particularly high in the Netherlands (82% of all electric car registrations), Norway (73%), United Kingdom (62%) and France (60%).

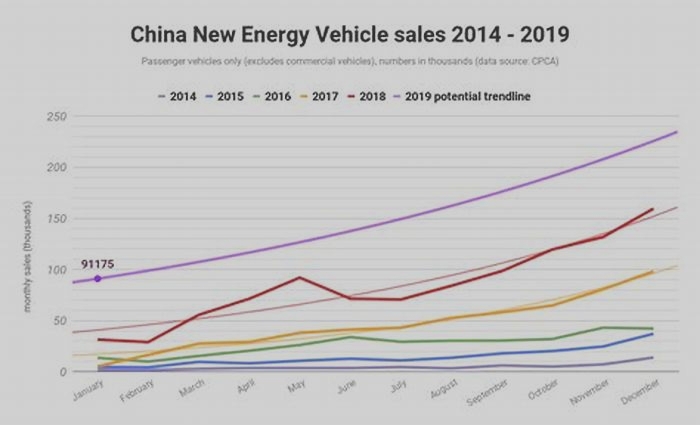

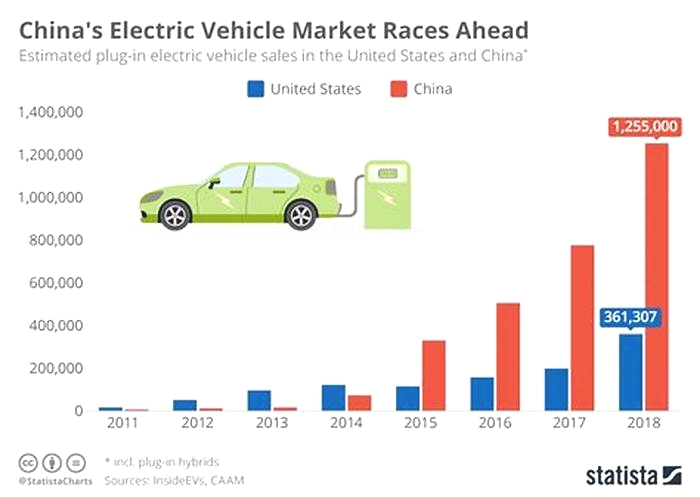

China

The overall car market in China was impacted by the panademic less than other regions. Total new car registrations were down about 9%.

Registration of new electric cars was lower than the overall car market in the first-half of 2020. This trend reversed in the second-halfas China constrained the panademic. The result was a sales share of 5.7%, up from 4.8% in 2019. BEVs were about 80% of new electric cars registered.

Key policy actions muted the incentives for the electric car market in China. Purchase subsidies were initially due to expire at the end of 2020, but following signals that they would be phased out more gradually prior to the pandemic, by April 2020 and in the midst of the pandemic, they were instead cut by 10% and exended through 2022. Reflecting economic concerns related to the pandemic, several cities relaxed car licence policies, allowing for more internal combustion engines vehicles to be registered to support local car industries.

United States

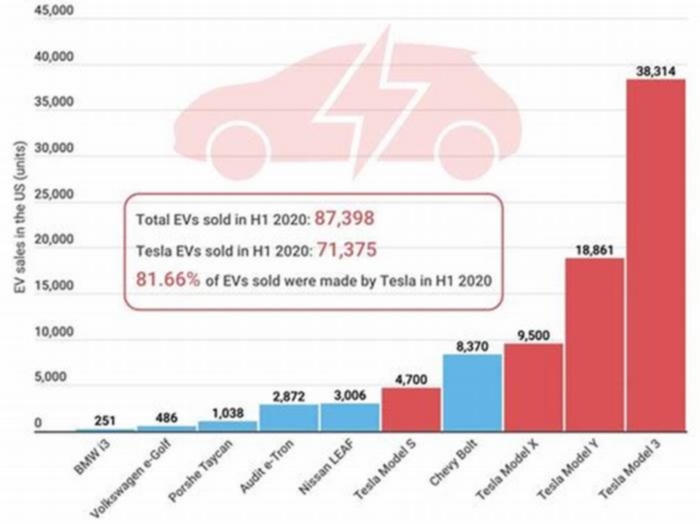

The US car market declined 23% in 2020, though electric car registrations fell less than the overall market. In 2020, 295000new electric cars were registered, of which about 78% were BEVs, down from 327000 in 2019. Their sales share nudged up to 2%. Federal incentives decreased in 2020 due to the federal tax credits for Tesla and General Motors, which account for the majority of electric car registrations, reaching their limit.

Other countries

Electric car markets in other countries were resilent in 2020. For example, in Canada the new car market shrunk 21% while new electric car registrations were broadly unchanged from the previous year at 51000.

New Zealand is a notable exception. In spite of its strong pandemic response, it saw a decline of 22% in new electric car registrations in 2020, in line with a car market decline of 21%. The decline seems to be largely related to exceptionally low EV registrations in April 2020 when New Zealand was in lockdown.

Another exception is Japan, where the overall new car market contracted 11% from the 2019 level while electric car registrations declined 25% in 2020.Theelectric car market in Japan has fallen in absolute and relative terms every year since 2017, when it peaked at 54000registrations and a 1% sales share. In 2020, there were 29000registrations and a 0.6% sales share.

China EV Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

China Electric Vehicles Market Size

View Global ReportShare

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 305.57 Billion |

| Market Size (2029) | USD 674.27 Billion |

| CAGR (2024 - 2029) | 17.15 % |

| Market Concentration | High |

Major Players *Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

China Electric Vehicles Market Analysis

The China Electric Vehicles Market size is estimated at USD 305.57 billion in 2024, and is expected to reach USD 674.27 billion by 2029, growing at a CAGR of 17.15% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in the first half of 2020. Market growth was disrupted owing to lockdowns and the reduced income of the population in China. Manufacturing and sales activities slowed and the supply chain was disrupted in the first half of 2020. The automotive industry in China witnessed significant growth in terms of the production of electric vehicles last year, and it is expected to continue during the forecast period.

Over the medium term, with the rise in exhaust emissions and rising environmental concerns, the country has been focusing on and working toward the development of sustainable transportation. This, in turn, has resulted in the electrification of its transport sector.

During the forecast period, the country may witness growth in the adoption of electric buses, as more than 30 Chinese cities have made plans to achieve 100% electrified public transit shortly, including Guangzhou, Zhuhai, Dongguan, Foshan, Zhongshan in the Pearl River Delta, along with Nanjing, Hangzhou, Shaanxi, and Shandong. EV sales account for about 60% of cities without a limit on vehicle increments. This indicates that there is still room for increased electric vehicle sales in China in the coming years.

China Electric Vehicles Market Trends

Tremendous Adoption Rate of Hybrid and Electric Vehicles due to Government Norms

With an increase in vehicle sales and rapid urbanization, China is determined to reduce exhaust emissions from vehicles. Meanwhile, the country plans to lessen its dependence on oil imports, boosting the demand for and sales of electric vehicles in the country. Furthermore, many key cities and provinces are imposing more strict restrictions. For instance, Beijing only issues 10,000 permits for the registration of combustion-engine vehicles per month to boost its inhabitants to switch to electric vehicles.

Growing government regulations improving electric vehicle adoption and robust expansion adopted by OEMs and suppliers in the region to accommodate rising demand from the automotive industry in China are expected to create a positive outlook for market growth during the forecast period. For instance, the Government of China is encouraging people to adopt electric vehicles. The country has already made plans to phase out diesel fuel, which runs the current generation of tractors and construction equipment. The country plans to ban all diesel and petrol vehicles by 2040. Also, in January 2021, BYD announced that it bagged a cumulative order to supply 1,002-unit pure-electric buses to Bogota, Colombia. These buses are scheduled to be delivered during 2021 and continue into the first half of 2022. They will be put into operation on 34 bus routes across five regions of the city.

The Chinese government invested in building charging stations across the country to promote electric vehicle sales. For instance, in January 2022, the Chinese government announced plans to build enough charging stations for 20 million electric vehicles by 2025.

For electric vehicles, the Chinese government has provided tax exemptions or lowered taxes. These initiatives by the government have attracted a lot of buyers to purchase EVs in this country. For instance, in September 2022, China's Ministry of Finance (MOF), the State Taxation Administration (STA), and the Ministry of Industry and Information Technology (MIIT) announced purchases of new energy vehicles (NEVs) that occur between January 1, 2023, and December 31, 2023, will continuously be exempted from vehicle purchase tax. Furthermore, China's Ministry of Transport offers subsidies and other benefits for the development of low-emission bus fleets, thereby further positively influencing the market. For instance, 61,000 more new energy buses were sold by Chinese bus makers in 2020, despite the pandemic. Such events are assisting China to formulate a resolute and optimistic prospect for the development of electric vehicles in the country, which is anticipated to propel the market.

Understand The Key Trends Shaping This Market

Download PDF

The Passenger Cars Segment is Anticipated to Dominate the Market

Currently, the passenger cars segment is witnessing more demand than commercial vehicles, and it is expected to continue its dominance during the forecast period. The growth is due to the growing population, which provides for the growth of EVs. Stringent government emission norms are expected to drive sales of EVs. For instance, the Chinese government implemented China 6 norms for pollution control in the region, based on EUR 6 norms, in July 2020, which resulted in promoting the demand for hybrid vehicles in this region.

Several competitors have been driving the battery-electric vehicle market in China, along with generous government support. China extended the incentives related to the purchase of new energy vehicles (NEVs) until 2022.

Some non-automotive companies, like Alibaba, are entering the rapidly growing EV market in the country. For instance,

- In January 2021, Alibaba Group announced two electric models in the country under the IM (Intelligence in Motion) brand in partnership with SAIC Motor. Battery cells for these vehicles are provided by CATL. Of the two models launched, one is an electric sedan, and the other is an electric SUV. The sedan is anticipated to be launched first, with presale starting at Auto China 2021 in April, and the SUV may hit the market in 2022. The company informed that the vehicles may offer a 93-kWh battery, while a 115-kWh battery will be available as an option. Henceforth, the sedan may provide a range of up to 874 km in the NEDC cycle.

- In December 2020, Hyundai Motor Group announced its plans to present an electric-only platform in 2021, utilizing its battery technology to cut production costs and time.

- In September 2020, Tesla Inc. announced that it worked on reducing the cost of its EV batteries and increasing production. The cheapest Tesla was priced at USD 36,500 in 2021.

Due to the high number of local electric components and vehicles and the government's key national strategies and plans, it is expected that the country's market will achieve extraordinary growth in the coming years.

China Electric Vehicles Industry Overview

The Chinese electric vehicles market is dominated by a few players such as BAIC Motors, SAIC Motors, Honda Motor Company, Geely Motors, and BYD Co. BYD is the leading player in the Chinese electric vehicles market, owing to the increasing orders for its passenger cars and electric buses from the domestic and international markets. SAIC is expected to be the second-largest company, followed by Geely Motors and BAIC Motors. In order to develop advanced products and technologies, companies invest heavily in research and development.

- In June 2022, BMW AG opened its new factory in Shenyang, China. The company invested CNY 15 billion (USD 2.2 billion) to focus on electric vehicles.

- In February 2022, Danfoss announced that its Editron division successfully began mass production of its EM-PMI240-T180 motor, which is specifically designed for electric and hybrid drivetrains in buses at its Nanjing factory, located in eastern Jiangsu province.

- In June 2021, China Yuchai International Limited announced that it partnered with Guangxi Shenlong Automobile Manufacturing (Sun long) to develop four new energy powertrain systems, including an e-CVT power-split hybrid powertrain ("YC e-CVT"), integrated electric drive axle powertrain ("YC e-Axel") for new energy bus production in southern China.

- In February 2020, Honda Motor Company Ltd announced the beginning of its sales of all-new Honda Fit Hybrid vehicles. It is fortified with Honda's 2-motor hybrid system, which drives the vehicle with an electric motor, which results in a smooth drive and better fuel efficiency.

China Electric Vehicles Market Leaders

BYD Company Ltd

SAIC Motor Corporation Limited

BAIC Motor Corporation

Geely Auto Group

Tesla Inc.

*Disclaimer: Major Players sorted in no particular order

Need More Details on Market Players and Competitors?

Download PDF

China Electric Vehicles Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Porter's Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size by Value - USD Billion)

5.1 Drivetrain Type

5.1.1 Battery Electric Vehicles

5.1.2 Plug-in Hybrid Electric Vehicles

5.2 Vehicle Type

5.2.1 Passenger Cars

5.2.2 Commercial Vehicles

6. COMPETITIVE LANDSCAPE

6.1 Vendor Market Share

6.2 Company Profiles*

6.2.1 BAIC Motors Corporation

6.2.2 Honda Motor Company

6.2.3 Geely Auto Group

6.2.4 SAIC Motor Corporation Limited

6.2.5 BYD Company Ltd

6.2.6 Chery Motors

6.2.7 Jiangling Motors Corporation

6.2.8 JAC Motors

6.2.9 Changan Automobile

6.2.10 Great Wall Motors

6.2.11 Tesla Inc.

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

You Can Purchase Parts Of This Report. Check Out Prices For Specific Sections

Get Price Break-up Now

China Electric Vehicles Industry Segmentation

An electric vehicle (EV) operates on an electric motor instead of an internal combustion engine that generates power by burning a mix of fuel and gases. Rising pollution, global warming, and depleting natural resources are likely to see such a vehicle as a possible replacement for current-generation automobiles across the country.

The Chinese electric vehicle market is segmented by vehicle type and drivetrain type. Based on vehicle type, the market is segmented into passenger cars and commercial vehicles. Based on the drivetrain type, the market is segmented into battery-electric and plug-in hybrid electric vehicles. For each segment, market sizing and forecasting have been done based on value (USD billion).

| Drivetrain Type |

| Battery Electric Vehicles |

| Plug-in Hybrid Electric Vehicles |

| Vehicle Type |

| Passenger Cars |

| Commercial Vehicles |

Need A Different Region Or Segment?

Customize Now

China Electric Vehicles Market Research FAQs

How big is the China Electric Vehicles Market?

The China Electric Vehicles Market size is expected to reach USD 305.57 billion in 2024 and grow at a CAGR of 17.15% to reach USD 674.27 billion by 2029.

What is the current China Electric Vehicles Market size?

In 2024, the China Electric Vehicles Market size is expected to reach USD 305.57 billion.

Who are the key players in China Electric Vehicles Market?

BYD Company Ltd, SAIC Motor Corporation Limited, BAIC Motor Corporation, Geely Auto Group and Tesla Inc. are the major companies operating in the China Electric Vehicles Market.

What years does this China Electric Vehicles Market cover, and what was the market size in 2023?

In 2023, the China Electric Vehicles Market size was estimated at USD 253.16 billion. The report covers the China Electric Vehicles Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the China Electric Vehicles Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What are the key factors driving the China Electric Vehicle Market?

The key factors driving China Electric Vehicle Markets are: a) Stringent government emission norms b) Growing population, and c) Government incentives, including tax exemptions or lowered taxes for electric vehicles

China EV Industry Report

The electric vehicle market in China is witnessing significant growth, fueled by an increase in EV production and sales, the presence of key manufacturers, and escalating environmental concerns that are shifting focus towards sustainable transportation. This growth also extends to the light electric commercial vehicle market, which is seeing a surge due to the introduction of new electric commercial vehicles by OEMs. Despite potential hindrances such as high manufacturing costs and low battery range, the country is experiencing a rising demand for EVs for commercial applications. Various initiatives are being launched to boost electric car sales and curb vehicle emissions, with a particular emphasis on the development of battery electric vehicles and increasing efficiency across vehicle systems. However, the high cost of EVs compared to ICE vehicles and the limited range of EVs due to lower battery density may pose challenges to market growth. In addition, Mordor Intelligence Industry Reports provide statistics for the China Electric Vehicle Market Food Truck market share, size, and revenue growth rate, including a market forecast and historical overview. A sample of this industry analysis is available as a PDF download.

80% of our clients seek made-to-order reports. How do you want us to tailor yours?