How do I claim 7 500 EV tax credit

EV Tax Credit 2024: Rules and Qualifications for Electric Vehicle Purchases

People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

New this year, consumers can choose between claiming a nonrefundable credit on their tax returns or transferring the credit to the dealer to lower the price of the car at the point of sale, giving taxpayers more flexibility in how to apply the benefit.

However, there may be some hiccups for consumers as the changes roll out. Fewer cars are qualifying for the benefit in 2024 than previously, as battery manufacturing restrictions tighten.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Transparent pricing

Hassle-free tax filing* is $50 for all tax situations no hidden costs or fees.

Maximum refund guaranteed

Get every dollar you deserve* when you file with this tax product, powered by Column Tax.

Faster filing

File up to 2x faster than traditional options.* Get your refund, and get on with your life.

*guaranteed by Column Tax

What is the electric vehicle tax credit?

The electric vehicle tax credit, or the EV credit, is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug-in hybrid vehicles. Nonrefundable tax credits lower your tax liability by the corresponding credit amount but do not result in a refund of any excess credit amount.

In 2024, taxpayers can choose to either claim the tax credit on their federal returns or transfer the credit to an eligible dealership. For those who choose to transfer the credit, participating dealerships would then be able to either lower the cost of the vehicle by the corresponding credit amount or provide the consumer with a cash equivalent.

To qualify for either option, your income must fall beneath certain thresholds, and the vehicle you plan to purchase must also meet several IRS specifications, including price caps and manufacturing guidelines.

Which cars qualify for a federal EV tax credit?

As of April 2024, the following fully electric and plug-in hybrid vehicles may be eligible for either a full or partial tax credit if delivered on or after Jan. 1, 2024.

The IRS urges taxpayers to use the tool on the FuelEconomy.gov website for the most up-to-date information on eligible models. You can filter by purchase scenario, model year, and vehicle type and determine which car is eligible based on its date of delivery. Be sure to check with the dealer as well, the IRS warns, because some versions of the cars below may not qualify.

Q5 PHEV 55 TFSI e quattro (2023-2024)Q5 S Line 55 TFSI e quattro (2023-2024) |

Bolt (2022-2023)Bolt EUV (2022-2023) |

Pacifica PHEV (2022-2024) |

F-150 Lightning: Standard, Extended Range Battery (2022-2024) |

Grand Cherokee PHEV 4xe (2022-2024) |

Wrangler PHEV 4xe (2022-2024) |

Corsair Grand Touring (2022-2024) |

Leaf S (2024)Leaf SV Plus (2024) |

R1S Dual Large (2023-2024)R1S Quad Large (2022-2024)R1T Dual Large (2023-2024)R1T Dual Max (2023-2024)R1T Quad Large (2022-2024) |

Model 3 Performance (2023-2024) |

Model X Long Range (2023-2024) |

Model Y AWD (2023-2024)Model Y Performance (2023-2024)Model Y RWD (2024) |

ID.4 AWD ProID.4 AWD Pro SID.4 AWD Pro S Plus ID.4 ProID.4 Pro SID.4 Pro S Plus |

How to qualify for the 2024 EV tax credit

Price cap

Vans, SUVs and pickup trucks must have an MSRP, or manufacturer's suggested retail price, of $80,000 or less to qualify. Other vehicles, such as sedans and passenger cars, are capped at $55,000. For used vehicles, the price cap drops to $25,000.

For new vehicles, the MSRP, as defined by the IRS, is the base retail price provided by the manufacturer, plus the retail price of each accessory or optional piece of equipment that is physically present on the car at the time of delivery to the dealer. For purposes of claiming the credit, MSRP does not include taxes and other fees added on by the dealer.

EV tax credit income limits

New EVs

Single and married filing separately: $150,000.

Head of household: $225,000.

Married filing jointly: $300,000.

Used EVs

Single and married filing separately: $75,000.

Head of household: $112,500.

Married filing jointly: $150,000.

A nice bonus here is that, per the IRS, you can use your MAGI from either the year the car is delivered, or the year before delivery. This means if your income exceeded the threshold one year, but was below the cap during the other year, you may still be able to snag a credit.

If your income precludes you from qualifying, there are also several tax strategies you can consider to lower your income throughout the year, such as maxing out your 401(k) or contributing to an HSA or FSA.

Final assembly requirements

To be eligible for the credit, vehicles must have had final assembly in North America. You can reference the National Highway Traffic Safety Administrations VIN, or vehicle identification number, database to check out a cars final assembly details.

Used EV tax credit qualifications

Qualifying used EV purchases can fetch taxpayers a credit of up to $4,000, limited to 30% of the cars purchase price. Some other qualifications:

Used car must be plug-in electric or fuel cell with at least 7 kilowatt hours of battery capacity.

Only qualifies for the first transfer of a vehicle.

Purchase price of car must be $25,000 or less.

Car model must be at least two years old.

Vehicle must weigh less than 14,000 pounds.

Credit can only be claimed once every three years.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

How the electric vehicle tax credit is calculated

The new tax credit, worth up to $7,500, consists of battery and sourcing requirements, each adding up to half of the credit. If the car meets both requirements, it is eligible for the full credit. If it meets only one requirement, it may be eligible for a partial credit of $3,750.

Per the IRS, the requirements below apply to vehicles that are delivered (i.e., placed in service) to the taxpayer on and after April 18, 2023.

To be eligible for the battery portion of the credit (up to $3,750), a certain percentage of the vehicles battery must be assembled or manufactured within North America. The percentage thresholds will be as follows:

Critical minerals requirement

Cars must meet a "critical minerals requirement" to receive the remaining $3,750 portion of the credit. This requirement stipulates that a certain percentage of critical minerals in the car's battery must be extracted or processed within the U.S. or within a country with which the U.S. has a free-trade agreement. The percentage thresholds will be as follows:

Beginning in 2024, vehicles may also not source battery parts from a foreign country of concern (e.g., China). And starting in 2025, EVs cannot contain any critical minerals sourced from a foreign country of concern.

How to claim the federal EV tax credit

Claiming the clean vehicle tax credit on your taxes

To claim the credit, taxpayers can file Form 8936 when they file their federal income taxes. The credit is nonrefundable, which means it can lower or eliminate your tax liability, but you won't get any overage of the credit refunded once your liability hits zero. You also won't be able to carry over any excess amount to offset future taxes.

Some fine print: According to the agency, you generally can only claim the clean vehicle tax credit for the tax year the vehicle was delivered to you, not necessarily the year it was purchased. This means, for example, that if you bought a qualifying EV in 2023 but won't receive it until 2024, you must claim the credit on your 2024 tax return (filed in 2025).

Transferring the EV tax credit to a dealer

Taxpayers who transfer the credit to the dealership for a direct discount still need to follow a few tax rules. Transferring can result in an immediate discount on your purchase rather than a reduction in your tax liability when you file the following year. However, it does not do away with having to report your purchase on your taxes.

If you transfer the EV credit to the dealer, youll also need to fill out Form 8936 when you file your return for that year to report on your election and to provide the agency with your VIN. And buyer beware if you take a rebate but are not eligible for it, youll be required to pay the IRS back when you file your tax return.

What information do you need to claim the EV tax credit?

Before you leave a dealership with a new EV, make sure you have certain documents that youll need to claim the credit or report the purchase on your taxes.

If youre claiming the credit on your tax return

Sellers must provide taxpayers with a report containing certain information about the vehicle and this report should be furnished to the taxpayer by the date of the vehicles purchase. Make sure it includes the following:

If youre transferring the credit to the dealer

If youre electing to transfer the credit to the dealer for a direct discount, you must disclose your taxpayer identification number typically your Social Security number and a photo ID at the time of purchase:

You must also officially attest to, or confirm, the following information:

EV rebates and incentives

With all the focus on credits, its important to know about additional incentives on the state and local levels. Californias Clean Air Vehicle program, for example, grants carpool lane access to select electric vehicles. And New Yorkers might be eligible for a state-level rebate of up to $2,000 on top of the federal tax credit.

Make sure youre aware of any restrictions that come with applying for multiple incentives, though. Some states may not allow you to double-dip or claim a state-level rebate on top of a federal one.

Leasing and the EV tax credit

Although individual consumers cant claim the clean vehicle tax credit when leasing an EV, they might still see some trickle-down savings passed down from the dealer if they choose to lease.

Some businesses (i.e., dealerships and leasing agencies) may qualify for another type of tax credit called the commercial vehicle tax credit. The commercial credit is far less restrictive than the clean vehicle credit currently available to individual taxpayers. It allows businesses to claim tax breaks for a wider range of eligible electric vehicles, including ones that were not manufactured in the U.S.

Even though the dealership gets the tax credit for purchasing the car, the potential benefit to individual consumers here is that the dealer can, in theory, then pass down the savings by lowering the leasing cost by the credit amount.

A word of caution for potential lessees, though: Just because the dealership could pass those savings onto you, doesnt mean it will. Dealers arent required to give customers a discount on their leases, so it may require some negotiating on your end.

Assessing the transparency of any deal that claims the savings are being passed down may also require research and shopping around to ensure youre getting the best deal. Plus, there are other factors about leasing that you may want to take into account.

The clean vehicle credit expansion is exciting news for taxpayers looking to go green, but it still remains fairly complicated and nuanced especially given the murk surrounding the new sourcing requirements that are set to adjust each year. If youre confused about your eligibility or want guidance for your personal situation, consider consulting a qualified tax professional, such as a CPA or a tax preparer, before you sign on the dotted line.

Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit

Key Takeaways

- Use Form 8936 to claim either the Qualified Plug-In Electric Drive Motor Vehicle Credit or the new Clean Vehicle Credit.

- The Qualified Plug-In Electric Drive Motor Vehicle Credit and the new Clean Vehicle Credit are each worth up to $7,500.

- The Qualified Plug-In Electric Drive Motor Vehicle Credit has been replaced with the Clean Vehicle Credit for qualifying vehicles purchased after December 31, 2022.

- The credit for personal vehicles is non-refundable and any excess value cant be claimed on future tax returns. However, if youre claiming the credit as a depreciable business asset, you can carry forward any unused portion as a general business credit.

What are the Qualified Plug-In Electric Drive Motor Vehicle Credit and the Clean Vehicle Credit?

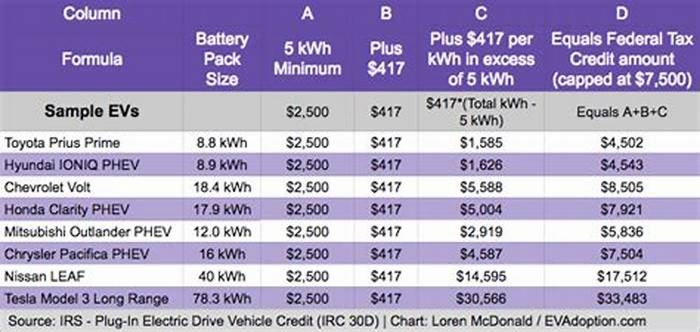

The Qualified Plug-In Electric Drive Motor Vehicle Credit is a tax credit available for certain new, plug-in electric vehicles (EVs) placed in service before 2023. Namely, the credit is worth up to $7,500 under Internal Revenue Code Section 30D.

The credit equals:

- $2,917 for an electric vehicle with a battery capacity of at least 5 kilowatt hours (kWh), plus

- $417 for each kWh of capacity over 5 kWh, up to $7,500 in combined value.

The credit isnt refundable if youre claiming it as an individual, so you wont be able to get back any credit value in excess of the taxes you owe. Further, you cant apply any excess credit value to future tax years, meaning you can only claim the full $7,500 value in one year or forfeit the unused balance. If youre claiming the credit as a business, any excess credit value not used in the year of acquisition can be carried forward to future years.

The credit, available to both individuals and businesses, is only eligible for vehicles you buy for your own use (not for resale) and are used primarily in the United States.

The credit only applies to qualifying vehicles, meaning they have to:

- Have an external charging source

- Have a gross vehicle weight rating of less than 14,000 pounds (found on the vehicles window sticker at the time of sale)

- Be made by a manufacturer that hasnt sold more than 200,000 EVs in the US

Because of the Inflation Reduction Act of 2022, the credit is replaced by the Clean Vehicle Credit for vehicles purchased after 2022. Further, certain final assembly requirements were added for vehicles purchased after August 16, 2022. That means if you bought and took delivery of a qualified electric vehicle beginning August 17, 2022 through December 31, 2022, the same rules applied but the vehicle needed to undergo final assembly in North America. The Department of Energy maintains a database for you to assess whether your model meets these assembly requirements.

You can confirm the assembly location for your specific vehicle using the VIN Decoder tool and check a list of qualifying Model Year 2022 and early Model Year 2023 EVs.

TurboTax Tip:

Some electric vehicles are assembled in multiple locations. Check both sets of details on the Department of Energy site for your specific vehicle.

Lastly, if you entered into a written binding contract to buy a qualifying vehicle beginning January 1, 2021, and before August 16, 2022, but took delivery on or after August 16, 2022, you may elect to claim the credit based on the rules prior to changes made by the Inflation Reduction Act. If you choose to use these prior rules on your 2022 tax return, you will need to claim it on that tax return after you take delivery of the vehicle. Depending on when you took delivery of the vehicle, you can claim the credit on your original, superseding, or amended 2022 tax return.

What is Form 8936?

Form 8936 is the official IRS form used to claim the Qualified Plug-In Electric Drive Motor Vehicle Credit or the new Clean Vehicle Credit. If you purchased a qualifying plug-in EV or clean vehicle during the required timeframes (either after December 31, 2009, through December 31, 2022, or January 1, 2023, through December 31, 2032), you can claim the respective credit by filling out Form 8936 and attaching it to your Form 1040 when you file your tax return.

Who can file Form 8936?

Depending on the vehicle you purchased, you can only claim the credit applicable to your vehicle. You cant claim both credits on the same vehicle. If you meet the requirements laid out above for claiming the Qualified Plug-in Electric Drive Motor Vehicle Credit, you may file Form 8936 with your tax return to claim the credit. If you purchased a qualifying vehicle after December 31, 2022, you have to meet the requirements before filing Form 8936 to claim the Clean Vehicle Credit:

Income requirements for the Clean Vehicle Credit

The Clean Vehicle Credit comes with income limitations for who can claim it. Eligibility is based on the lesser of your modified adjusted gross income (MAGI) for the year that the new clean vehicle was placed in service or for the preceding year. The limits are:

- If your filing status is Married Filing Jointly: Your MAGI cant exceed $300,000

- If your filing status is Head of Household: Your MAGI cant exceed $225,000

- If your filing status is Single or Married Filing Separately: Your MAGI cant exceed $150,000

Clean Vehicle Credit price caps

The Clean Vehicle Credit also has price limitations on the vehicle you purchase based on the Manufacturers Suggested Retail Price (MSRP) on new EVs as follows: vans, SUVs, and pickup trucks cant exceed $80,000, while sedans and other vehicle types cant exceed $55,000.

Requirements for clean vehicles placed in service January 1 to April 17, 2023

For the first part of 2023, the Clean Vehicle Credit has a base amount for qualifying EVs and Fuel Cell Vehicles (FCVs), and an additional amount based on the vehicle's battery capacity. Specifically:

- $2,500 base amount

- Plus $417 for a vehicle with at least 7 kilowatt hours of battery capacity

- Plus $417 for each kilowatt hour of battery capacity beyond 5 kilowatt hours

- Up to $7,500 total

In general, the minimum credit will be $3,751 ($2,500 + 3 times $417), the credit amount for a vehicle with the minimum 7 kilowatt hours of battery capacity.

Requirements for clean vehicles placed in service after April 17, 2023

For clean vehicles placed in service beginning April 18, 2023, the new Clean Vehicle Credit is made up of two requirements that total to $7,500 ($3,750 each) - battery components and critical minerals. Youll need to meet each requirement to claim each portion of the Clean Vehicle Credit on Form 8936.

Used cars now eligible

Used cars have become eligible for the new Clean Vehicle Credit claimed on Form 8936, under the used Clean Vehicle Credit. The amount is lesser than the Clean Vehicle Credit for new clean vehicles (equal to the lesser of $4,000 or 30% of the sales price), but it still is a new credit that can make purchasing previously-owned clean vehicles more affordable for consumers. The new tax credit for pre-owned clean vehicles lasts for tax years 2023 through 2032.

How to file Form 8936

To file Form 8936 and claim either the Qualified Plug-In Electric Drive Motor Vehicle Credit for cars purchased prior to January 1, 2023, or the Clean Vehicle Credit for qualifying vehicles purchased afterward, youll need to complete the form with the VIN for your electric vehicle. Form 8936 is also used to determine your tax credit value for certain qualified two or three-wheeled plug-in EVs.

In addition to the buyer filing Form 8936, the seller or dealer is required to report to both the buyer and the IRS certain information about the vehicle including:

- Seller/Dealer name and taxpayer ID number

- Buyer's name and taxpayer ID number

- Maximum credit allowable under IRC 30D for new vehicles or IRC 25E for previously owned vehicles

- Vehicle identification number (VIN), unless the vehicle is not assigned one

- Battery capacity

- Date of sale

- Sale price

- For new vehicles, verification that the buyer is the original user

Let a local tax expert matched to your unique situation get your taxes done 100% right with TurboTax Live Full Service. Your expert can work with you in real time and maximize your deductions, finding every dollar you deserve, guaranteed. You can also file taxes on your own with TurboTax Deluxe. Well search over 350 deductions and credits so you dont miss a thing.