How does the 7 500 tax credit work

How the EV Tax Credit Works

A federal EV tax credit is here, thanks to the Inflation Reduction Act (IRA) massive tax and climate legislation promoting clean energy. The credit of up to $7,500 for certain electric vehicles, called clean vehicles, is supposed to encourage more people to use EVs. However, there are many questions about how the EV tax credit works.

- Some buyers wonder if they can claim the credit because of income limits. (More on that later.)

- Due to ongoing changes to U.S. Treasury Department and IRS rules, there are questions about which electric vehicles qualify for the full tax credit for the 2023 tax year and in 2024.

Despite the confusion, electric vehicle tax credits can benefit some consumers. So, here is some information to help you navigate the latest EV credit rule changes and better understand which vehicles do (and dont) qualify and why.

And, of course, if youre eligible, you need to know to claim the EV credit when you file your federal income tax return with the IRS. Read on for some answers.

Subscribe to Kiplingers Personal Finance

Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplingers Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

EV Tax Credit Overview

How does the EV tax credit work?

Here are some of the key points to know about the federal electric vehicle tax credit.

Key Points

- Under the IRA, the EV tax credit is in place for 10 years, until December 2032, for electric vehicles placed into service this year.

- The tax credit is taken in the year you take delivery of a qualifying clean vehicle.

- The credit is up to $7,500 for new vehicles. The credit amount considers factors like the vehicles sourcing and assembly (which must primarily be in North America for the full credit) and when you placed your vehicle into service. (More on all of that below.)

- Certain used/previously owned EVs can qualify for a tax credit of up to $4,000 or 30% of the sales price (whichever is less).

- As of Jan. 1, 2024, you can take the EV tax credit as a discount when purchasing the vehicle.

However, one of the most important points is that there are income limits for the clean vehicle tax break. Heres what you need to know.

EV Income Limits

EV tax credit income limit

Your modified adjusted gross income (MAGI) is used for the following income limits, which apply to qualifying new clean vehicles. (MAGI, found on Line 11 of Form 1040, often determines your eligibility for various tax breaks and is generally your adjusted gross income (AGI) with certain deductions or income exclusion added.)

When claiming the EV credit, the IRS says that you can use the lesser of your MAGI in the year you take delivery of your EV or your MAGI from the year before you took delivery of the vehicle.

Income limits for new qualifying electric vehicles

Swipe to scroll horizontally

| SINGLE | Modified AGI over $150,000 | Don't qualify for the EV credit |

| MARRIED (Filing Jointly) | Modified AGI over $300,000 | Don't qualify for the EV credit |

| HEAD OF HOUSEHOLD | Modified AGI over $225,000 | Don't qualify for the EV credit |

| ALL OTHER FILERS | Modified AGI over $150,000 | Don't qualify for the EV credit |

You won't qualify for the EV tax credit if you are single and your modified adjusted gross income exceeds $150,000.

The EV tax credit income limit for married couples filing jointly is $300,000.

And, if you file as head of household and make more than $225,000, you also wont be able to claim the electric vehicle tax credit.

The EV credit income limit is $150,000 for all other filing statuses.

Qualifications and income limits for previously owned eligible EVs

You must meet the following criteria to qualify for the federal EV tax credit for eligible used/previously owned clean vehicles.

- Be an individual who bought the vehicle for use and not for resale

- Not be the original owner

- Not be claimed as a dependent on another persons tax return

- Not have claimed another used clean vehicle credit in the three years before the purchase date

Additionally, for the EV tax credit for used vehicles, the IRS says your MAGI cannot exceed the following income limits.

Swipe to scroll horizontally

| $150,000 | MARRIED FILING JOINTLY OR SURVIVING SPOUSE | Row 0 - Cell 2 |

| $112,500 | HEAD OF HOUSEHOLD | Row 1 - Cell 2 |

| $75,000 | ALL OTHER FILING STATUSES | Row 2 - Cell 2 |

- $150,000 for married filing jointly or a surviving spouse

- $112,500 for heads of households

- $75,000 for all other filers

*You can use your MAGI from the year you took delivery of the vehicle or the year before, whichever is less.

Qualifying Vehicles

What vehicles qualify for EV tax credit?

(Image credit: Getty Images)

Once you know if youre income-eligible to claim the electric vehicle tax credit, a big question on EV buyers minds is which vehicles qualify. The short answer is that very few models currently qualify for the full $7,500 electric vehicle tax credit. Others qualify for half that amount, and some dont qualify at all.

Stricter rules adopted last spring limited the credit depending on whether a vehicle meets battery and sourcing requirements.Additionally, more stringent EV tax credit requirements kicked in on Jan. 1, 2024, which has further impacted which vehicles qualify.

But first, price limits determine whether a vehicle is eligible for a tax credit.

EV credit vehicle price limits for new vehicles

- Vans, pickup trucks, and SUVs with a manufacturers suggested retail price (MSRP) of more than $80,000 wont qualify for the credit.

- For clean cars to qualify for the EV tax credit, the MSRP cant be more than $55,000.

- Also, a previously owned clean vehicle will qualify for the tax credit only if it costs $25,000 or less.

Note: Used or previously owned for the EV tax credit purposes means that the car is at least two years old.

Which vehicles are considered SUVs?More clarity was needed over which vehicles were classified as SUVs for the $80,000 price limit. Treasury and IRS released guidance saying they will use criteria based on the Environmental Protection Agencys (EPA) Fuel Economy Labeling Standard to determine whether a vehicle is a car or an SUV. Some SUVs are eligible for EV tax credits for automakers and consumers where they weren't previously.

(Image credit: Getty Images)

The guidance on SUV classification is retroactive to Jan. 1, 2023. So, if you took possession of your EV on or after January of 2023, you can use the new classification to determine whether your purchased vehicle is eligible for the tax credit.

Price limits for used EVs

A used/previously owned electric vehicle must meet the following requirements to qualify for the up to $4,000 federal EV tax credit.

- Have a sale price of $25,000 or less

- Have a model year at least two years earlier than the calendar year when you buy it. For example, a vehicle purchased in 2023 would need a model year of 2021 or older

- Not have already been transferred to a qualified buyer after Aug. 16, 2022

- Have a gross vehicle weight rating of less than 14,000 pounds

- Be an eligible FCV or plug-in EV with a battery capacity of at least 7 kilowatt hours

- Be for use primarily in the United States

To see if a vehicle is eligible for the used clean vehicle credit, visit the federal fueleconomy.gov website.

Battery and sourcing requirements

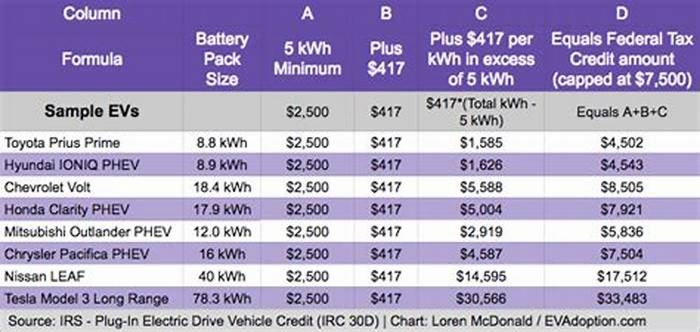

Another piece of the puzzle with vehicle eligibility deals with battery and sourcing requirements.

IRS guidance limits the number of EVs that qualify for the full $7,500 EV tax credit. Those EV tax credit rules address requirements for critical mineral and battery component requirements for electric vehicles. They are effective for EVs placed into service after April 17, 2023.

As a result, an electric vehicle that qualified for the up to $7,500 tax credit on April 17 of last year might, as of April 18, qualify for only half the tax credit amount for the 2023 tax year, or perhaps, no EV tax credit at all. Battery and sourcing requirements will also become more strict in the coming years, meaning some cars will fail to qualify that qualified previously.

Treasury is taking an important step that will help consumers save up to $7,500 on a new clean vehicle and hundreds of dollars per year on gas, Treasury Secretary Janet Yellen said in a statement about the stricter EV credit rules.

(Image credit: Getty Images)

Tesla tax credit

Tesla models, like the Model Y and all Model 3 versions, were eligible for the full $7,500 EV credit through the 2023 tax year. However, not all Tesla models are eligible for the EV credit in 2024.

Commercial EVs

Last fall, Mullen Automotive (NASDAQ: MULN) became an IRS qualified manufacturer of commercial EVs. The designation means that some of the automakers electric vehicles can qualify for the up to $7,500 EV tax credit.

Regarding the new designation, John Schwegman, Mullens chief commercial officer, acknowledged in a statement that the total cost of ownership is important to commercial customers. Schwegman added, Tax credits such as these, along with lower fuel and maintenance costs, show a clear advantage for Mullens commercial offerings compared to traditional internal combustion vehicles.

EV News

2024 EV tax credit

You can find the complete list of vehicles qualifying for the credit on the federal fueleconomy.gov website.

The Department of Transportation also has a tool on its website to enter the vehicle identification number (VIN) of the electric vehicle you're interested in to determine its eligibility for the EV tax credit. This guidance might help you decide when its best (tax-wise) to buy an EV.

What else can you do? Double-check the list of qualifying clean vehicles if youre in the market for a new or used EV. You can also look at the IRS FAQ Fact Sheet for the clean vehicle tax credit.

(Image credit: Getty Images)

Also, remember that EV tax credit rules have changed again for 2024. Part of the reason is political controversy in Congress surrounding the EV tax credit and concerns from overseas manufacturers about vehicles not qualifying for the tax break.

Additionally, changes to the ev tax credit for 2024 will be due to stricter battery and mineral component sourcing rules.

- Critical mineral component percentages that need to be domestically produced or extracted will increase from 40% in 2023 to 50% in 2024.

- The qualifying percentage of North American battery components for a vehicle to receive a tax credit will increase from 50% in 2023 to 60% in 2024.

- Another significant change for the new year is that vehicles with components made in China or by firms under Chinese government control wont qualify for the tax credit.

2024 EV Credit Point of Sale

What is the EV tax credit 2024 point of sale rebate?

Another new EV tax credit benefit in 2024. If youre buying a clean vehicle, you may have the option as of Jan. 1, 2024, to take the EV tax credit as a discount at the point of sale when you purchase the vehicle.

Essentially, you would be transferring the credit to the dealer, who could lower the vehicle price by the amount of the credit. That means you wont have to wait until its time to file your tax return to benefit from the electric vehicle tax credit. The rebate is available beginning Jan. 1, 2024, but dealers need to register to be qualified to pass EV credit savings to consumers.

Qualified dealers can transfer the value of the federal EV tax credit on eligible vehicles for eligible consumers (income limits apply). That value can either be a cash refund or, as previously mentioned, a discount on the total price of the electric vehicle.

Related: The EV Tax Credit Changed Again on New Year's Day: What to Know

Claiming the EV Tax Credit

How to claim the $7,500 EV tax credit on your return

To claim the EV tax credit, you file IRS Form 8936 with your federal income tax return. Youll need the VIN (vehicle identification number) for your electric vehicle to complete the form. Form 8936 is used to determine your tax credit for qualified two- or three-wheeled plugin electric vehicles.

EV Leases

What if you're leasing an EV?

There is a tax credit available for leased electric vehicles. But theres also a catch. The tax credit belongs to the lessor, not to you, the lessee.

Under the IRA, leased electric vehicles are classified as "commercial vehicles," making them eligible for the entire federal clean vehicle credit without meeting strict battery and sourcing requirements. That means you could have a more comprehensive selection of electric vehicles to save money if the dealer agrees to pass any tax credit savings on to you.

However, remember that the lessor receives the tax credit (not you). So, savings you receive, if any, would be a rebate or reduced lease price.

More from Kiplinger Leasing an EV? There's a Tax Credit 'Loophole' for That

Home EV Chargers

Is there a federal EV charger tax credit?

(Image credit: Getty Images)

If you're in the market for an EV home charger, the IRA revives a credit for electric vehicle chargers that previously expired two years ago. The "Alternative Fuel Refueling Property tax credit" is extended for 10 years through Dec. 31, 2032.

For more information on the federal tax credit for electric vehicle chargers, see Kiplinger's guide to the federal EV charger tax credit.

Other IRA Tax Credits

Solar and other federal energy tax credits for 2023

The IRA contains billions of dollars in tax credits and incentives, not just for eligible electric vehicles. Theres a tax break for numerous green home improvements, like installing home solar panels.

More from Kiplinger on Federal Engery Tax Credits