How much income do you need to qualify for the 7500 EV tax credit

Credits for new clean vehicles purchased in 2023 or after

If you place in service a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV)in 2023 or after, you may qualify for a clean vehicle tax credit. For more information on how to qualify see Publication 5866, New Clean Vehicle Tax Credit ChecklistPDF.

At the time of sale, a seller must give you information about your vehicle's qualifications. Sellers must also register online and report the same information to the IRS. If they don't, your vehicle won't be eligible for the credit. For more information see Information for Consumers Purchasing a New or Used Clean Vehicle, Publication 5905PDF.

Find information on credits forused clean vehicles,qualified commercial clean vehiclesandnew plug-in EVs purchased before 2023.

Who qualifies

You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032.

The credit is available to individuals and their businesses.

To qualify, you must:

- Buy it for your own use, not for resale

- Use it primarily in the U.S.

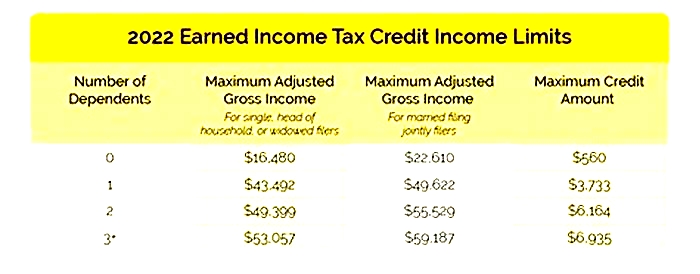

In addition, your modified adjusted gross income (AGI) may not exceed:

- $300,000 for married couples filing jointlyor a surviving spouse

- $225,000 for heads of households

- $150,000 for all other filers

You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the 2 years, you can claim the credit.

If you do not transfer the credit, it is nonrefundable when you file your taxes, so you can't get back more on the credit than you owe in taxes. You can't apply any excess credit to future tax years.

Credit amount

The amount of the credit depends on when you placed the vehicle in-service (took delivery), regardless of purchase date.

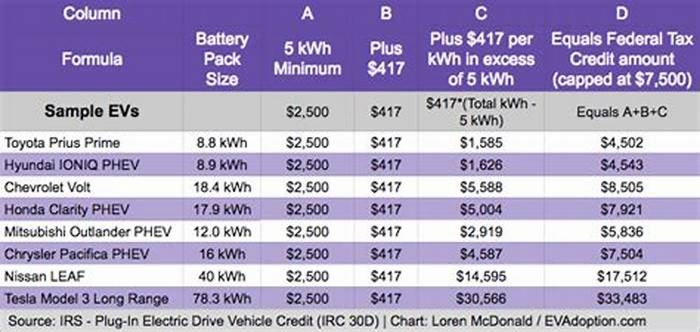

For vehicles placed in-service January 1 to April 17, 2023:

- $2,500 base amount

- Plus $417 for a vehicle with at least 7kilowatt hours of battery capacity

- Plus $417 for each kilowatt hour of battery capacity beyond 5kilowatt hours

- Up to $7,500 total

In general, the minimum credit will be $3,751 ($2,500 + 3 times $417), the credit amount for a vehicle with the minimum 7kilowatt hours of battery capacity.

For vehicles placed in-service April 18, 2023 and after:

Vehicles will have to meet all of the same criteria listed above, plus meet new critical mineral and battery component requirements for a credit up to:

- $3,750 if the vehicle meets the critical minerals requirement only

- $3,750 if the vehicle meets the battery components requirement only

- $7,500 if the vehicle meets both

A vehicle that doesn't meet either requirement will not be eligible for a credit.

Qualified vehicles

Click the button below to see if a vehicle is eligible for the new clean vehicle credit.Go to fueleconomy.gov

To qualify, a vehicle must:

- Have a battery capacity of at least 7kilowatt hours

- Have a gross vehicle weight rating ofless than 14,000 pounds

- Be made bya qualified manufacturer

- FCVs do not need to be made by a qualified manufacturer to be eligible. SeeRev. Proc. 2022-42for more detailed guidance.

- Undergo final assembly in North America

- Meet critical mineral and battery component requirements (as of April 18, 2023)

The sale qualifies only if:

- You buy the vehicle new.

- The seller reports required information to you at the time of sale and to the IRS.

In addition, the vehicle's manufacturer suggested retail price (MSRP) can't exceed:

- $80,000 for vans, sport utility vehicles and pickup trucks

- $55,000 for other vehicles

MSRP is the retail price of the automobile suggested by the manufacturer, including manufacturer installed options, accessories and trim but excluding destination fees. It isn't necessarily the price you pay.

You can find your vehicle's weight, battery capacity, final assembly location (listed as "final assembly point") and VIN on the vehicle's window sticker.

How to claim the credit

To claim the credit, fileForm 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit (Including Qualified Two-Wheeled Plug-in Electric Vehicles)with your tax return. You will need to provide your vehicle's VIN.

Get a time-of-sale report

The dealer should give you a paper copy of a time-of-sale report when you complete your purchase.

- Keep this copy for your records because it affirms that the dealer sent a report to the IRS on the purchase date.

- If you didnt receive a copy of the report, follow ourstep-by-step guide.

File Form 8936 with your tax return

You must fileForm 8936when you file your tax return for the year in which you take delivery of the vehicle. This is true whether you transferred the credit at the time of sale or youre waiting to claim the credit when you file.

If you have questions or concerns, follow ourstep-by-step guide.

Related

Everything you need to know about the new EV tax credit and how to get it

Thanks to the Inflation Reduction Act, the federal EV tax credit has changed. Its still possible to claim $7,500 off the cost of new plug-in vehicles, but the eligibility criteria has had a complete overhaul. There are a lot of changes, some good and some bad, but the key thing buyers need to know is that the list of eligible cars is now a lot smaller than it used to be.

We heard that the EV tax credit would be changing back in August 2022, as part of the Inflation Reduction Act. The first changes to the tax credit came into effect immediately on August 16, but that was only the beginning. New changes to the EV tax credit will be happening over the next few years, and the most recent came into effect on January 1 2023.

Heres what you need to know about the new EV tax credit now known as the Clean Vehicle Credit.

What were the previous eligibility criteria?

The previous EV tax credit rules were pretty lax. The main qualifier was that the car weighed under 14,000 pounds, had a battery with a capacity of at least 5 kWh and could only be recharged by plugging it in. This applied to electric cars and hybrids, with credits ranging from $2,500 to $7,500.

To qualify for the full $7,500 credit, the car needed to have at least 70 miles of battery range and combined CO2 emissions under 50g/km. Since every electric car on the market meets those criteria, it only really impacted plug-in hybrids.

Cars also stopped being eligible once they reached a sales cap of 200,000 eligible vehicles. However only three companies actually reached that cap: Tesla, General Motors and Toyota.

What are the current EV tax credit eligibility criteria?

The Inflation Reduction Act outlines various changes to the EV tax credit, some of which went into effect immediately, and others that won't be happening until further down the line. The general goal of encouraging EV adoption and bringing more EV and battery production to the United States.

As of August 16 2022, a car has to have undergone final assembly in North America (the U.S., Canada and Mexico). All cars that have not has final assembly in North America do not qualify for the credit under the new rules.

January 1 2023 also saw a wave of new changes to eligibility criteria, notably the lifting of the previous 200,000 unit sales cap. That means any new car made by Tesla, General Motors or Toyota, that meets all the other eligibility requirements, will be entitled for some sort of tax credit. However the changes also mean eligibility criteria is a lot stricter than before.

The biggest change is capping the credits based on the price of a vehicle and the income of the person who purchased it. Cars with an MSRP over $55K wont be eligible, while trucks, SUVs and vans have an $80K MSRP cap. Single tax filers earning over $150K wont qualify either, though that number increases to $225K for heads of households and $300K for joint filings.

One thing to note is that compact SUVs may be officially listed as cars, with the appropriate price cap. The Tesla Model Y is weirdly affected by this, since the seven-seater models are listed as SUVs by the IRS, while the 5-seater models are cars. The Ford Mustang Mach-E is similarly listed as a car with a $55K price cap.

The IRS also notes that cars need at least 7 kWh of battery capacity, which every battery-electric car does, and has to weigh less than 14,000 lbs. It also needs to be purchased for personal use (not resale) in the U.S., to be primarily used in the U.S.

The expanded credits renaming to Clean Vehicle Credit is not just a linguistic flourish either, since it will apply to any clean vehicle.Primarily thats electric cars and plug-in hybrids, but also includes hydrogen fuel cell cars that meet all the other criteria. However hydrogen cars are rare, and the models actually on sale in the U.S. are all assembled in Asia, meaning none are eligible.

2023 will also see the first used cars become eligible for the EV tax credit.

How do used electric cars claim a tax credit?

Up until now electric car incentives have focussed on new models, and limits the savings to people who can afford to buy a brand new car. That limits adoption, more so when you remember that EVs are generally more expensive than gas-powered counterparts.

So, now January 1 2023 has passed us by, used electric cars are eligible for their own tax credit. This credit is worth up to $4,000, or 30% of the car's sale price whichever is lower. However the car does have to match certain eligibility criteria first.

The main one is that the car needs to be at least two calendar years old at the time of sale. It also can't have been bought specifically to resell, and has to have been used by at least one previous driver. The sale price can't exceed $25,000, and most importantly you have to have purchased the car from a licensed used car dealer.

So that used Tesla selling for more than the MSRP likely wont be eligible, nor will you be able to write off most of the cost of that ancient Nissan Leaf you spotted on Craigslist.

There are income caps here as well, lower than those of a new car. This means the credit will not be available to single filers earning over $75,000, heads of households earning over $125,000 and joint filings over $150,000.

The IRS has a full list of cars eligible for the used EV tax credit, which isn't nearly as strict as the criteria for new electric cars. The IRS has a full list, though some manufacturers haven't submitted a list of eligible models just yet. So refer to this before you lock yourself into a deal.

Eligibility changes from 2024 and beyond

January 1 2023 was originally when eligibility becomes dependent on where materials and component are sourced. However this particular clause has now been delayed by the Treasury Department until March 2023.

Before January 1 2024 the bill states that 40% of critical minerals have to be sourced within the United States or a country that has a free trade agreement with the U.S. 50% of battery components will need to be manufactured or assembled in North America.

Each of the two criteria is worth $3,750 each. So if a car meets the mineral criteria but not the battery, drivers can claim up to $3,750 on their taxes. And vice versa.

The list of critical minerals is lengthy, and covers almost everything you'd need to extract from the ground for car production from Aluminum to Yttrium. The full list is available on page 161 of the IRA.

The critical mineral and battery component criteria will be getting stricter over time, with annual increases to the percentages required to ensure cars are eligible for the tax credit. Those increases are scheduled to happen on January 1 each year.

The level of critical minerals sourced from the U.S., or a free trade ally, will increase to 50% in 2024, 60% in 2025, 70% in 2026 and 80% in 2027. The amount of battery components manufactured or assembled in North America will similarly increase to 60% in 2024 or 2025, 70% in 2026, 80% in 2027, 90% in 2028 and 100% in 2029.

Any batteries with minerals extracted, processed, or recycled by a foreign entity of concern will be ineligible. That category currently includes China, which reportedly controls around 79% of the worlds existing lithium-ion battery manufacturing capacity.

However there is some good news. From January 1 2024 it will be possible to transfer your tax credit to an approved dealer in order to get a point of sale discount. That discount will be a payout of the full credit amount

Which cars have final assembly in North America?

The IRS has released a list of cars that have final assembly in the North America, and may meet the current tax credit criteria. Its not as extensive as the previous list, but it does include a number of electric and plug-in hybrid (PHEV) vehicles.

This list is not final, and has changed since the IRA was signed into law. That means cars will come and go as automakers bring or remove final assembly from North America.

It's worth noting that these cars might meet the final assembly requirements. Since automakers can build their cars in multiple locations, that may not be the case for every single car produced.

For that reason the government advises you to check a cars VIN number with the NHTSAs VIN Decoder tool. That will confirm the manufacture location of that individual car.

Finally having final assembly in North America doesn't mean the car also meets the mineral and battery assembly requirements. So this isn't a comprehensive list of which cars are eligible for tax credits. We'll just have to wait for the IRS and Department of Energy's alternative fuels center to enlighten us in the coming months.

What if you ordered an electric car before August 16 2022?

The waiting list for new cars is pretty long at the moment, electric or not. Supply chain issues have had a big impact on the auto industry, so there may be quite the gap between ordering a car and it being delivered. If youre one of those people, the news that the tax credit has now changed may be a little worrying or irritating, depending on your disposition.

But there is good news for those people, because according to the IRS you can still claim the tax credit under the old pre-August 16 rules. This applies to anyone that entered into a written binding contract to purchase a new qualifying electric vehicle before August 16, 2022, but do not take possession of the vehicle until on or after August 16, 2022.

The written binding contract part means this doesnt apply to people who have reserved a car or put down a refundable deposit. According to the IRS you need to have parted with a significant non-refundable deposit or down payment before August 16. The agency defines that as at least 5% of the final price.

Next: Hybrid and electric cars can regain some lost power through regenerative braking. But what is regenerative braking and how does it work? We'll tell you everything you need to know about it. And I took a 500-mile trip in an EV but range anxiety was the least of my problems. You can also read about what happened when my car's infotainment system broke. Also check out why now is the worst time to buy a Tesla.