Is China the leader in EV

Chinas BYD moves closer to unseating Tesla as EV leader

Unlock the Editors Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Chinese group BYD has moved a step closer to unseating Tesla as the worlds top-selling electric-vehicle manufacturer after reporting bumper fourth-quarter sales.

The Shenzhen-based company, which has become emblematic of Chinas rise as a powerhouse in clean technology, said on Monday that it sold a record 526,000 of its battery-only vehicles in the quarter, helped by a more than 70 per cent surge in December sales.

The figures leave Elon Musks Tesla needing to beat analyst expectations and deliver a blockbuster fourth quarter to maintain its position as the biggest seller of purely electric vehicles.

According to estimates compiled by Bloomberg, Tesla is expected to have sold about 483,000 vehicles in the quarter. The company is scheduled to release production figures on Tuesday.

At the end of the third quarter, BYD and Tesla each boasted about a 17 per cent share of the global market for fully electric cars. In the third quarter, BYD sold about 432,000 versus Teslas 435,000.

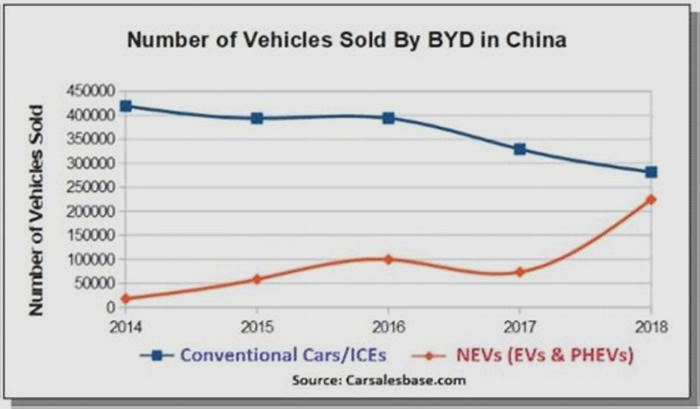

When including plug-in hybrid vehicles which China counts as new energy vehicles, or NEVs, alongside pure battery and hydrogen-powered models BYD overtook Tesla in the first half of 2022.

While BYD is now making inroads into international markets, the group is strongest on home turf where it has built a 35 per cent market share across the NEV segment.

BYD was founded by Wang Chuanfu, a former university professor, in the mid-1990s. Wang initially focused on making rechargeable batteries, including for early cell phones, but expanded into the car industry in the early 2000s. The company counts Warren Buffetts Berkshire Hathaway as a shareholder.

After initially relying on existing industry technology, BYD is now considered a leader, with a focus on stripping out costs from the production process. It also boasts a high level of vertical integration, including owning one of the worlds biggest EV battery-making companies.

The groups total sales for 2023 were up 62 per cent to more than 3mn vehicles, according to the figures released on Monday.

While much attention has focused on the rivalry between Tesla and BYD, analysts have also pointed out that the biggest losers from the rapid transition to cleaner vehicles has been many of the oldest carmakers who have been slow to adapt.

Daniel Roeska, an auto analyst with Bernstein, said that consumers had perceived a chasm between the industry leaders Tesla and BYD and the traditional [original equipment manufacturers] such as Volkswagen, Mercedes or Renault.

Many incumbent OEMs rushed into electric vehicles without appreciating the far-reaching technological and design difference between combustion and electric vehicles, he said.

3 Drivers of Chinas Booming Electric Vehicle Market

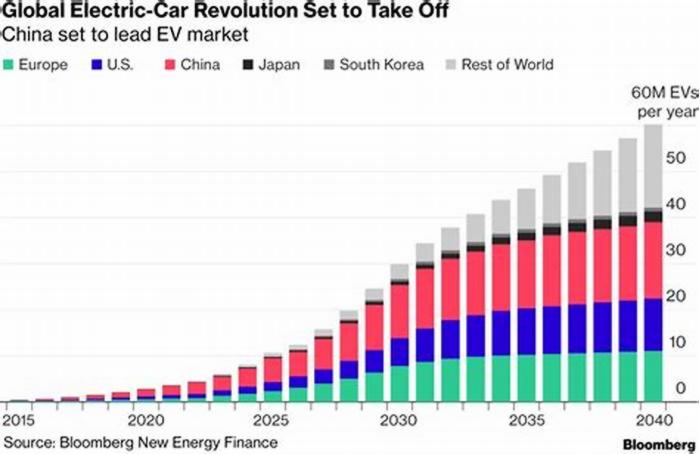

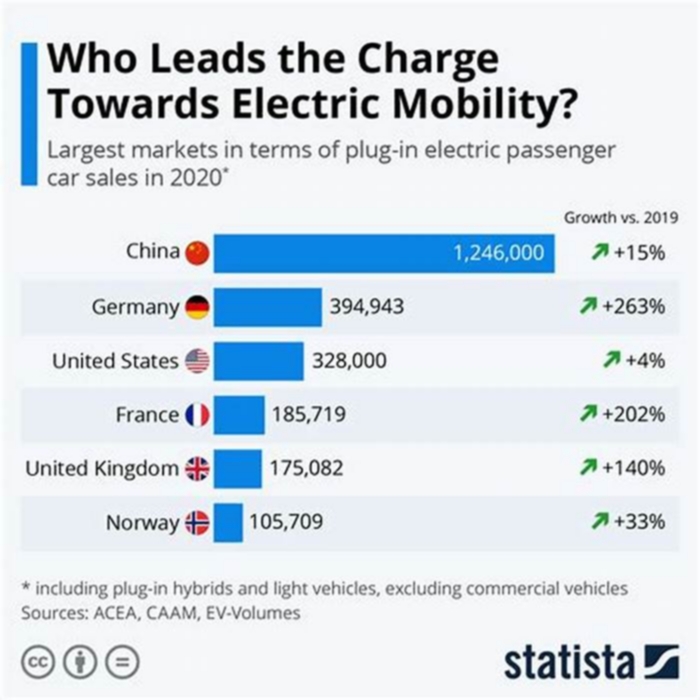

More than half of the electric vehicles (EVs) on roads worldwide are found in China. In 2022, new EV sales in China grew by 82%, and the country provided 35% of global EV exports. While the U.S., Norway, and other Scandinavian nations were early adopters of EVs, and Germany and Japan have long been automotive powerhouses, their EV markets have lagged in mass market adoption compared to China. How did China get to this point? What can companies looking to scale up their innovations learn from their approach? This article outlines three key reasons for the growth of Chinas EV sector: experimenting in adjacent industries, encouraging operational solutions, and doubling down on core technology.

Electric vehicle market in China - statistics & facts

Widely promoting battery electric vehicles (BEVs)

In China, sometimes the word "electric vehicles" is used interchangeably with "new energy vehicles" or "alternative energy vehicles", with the only exception being the exclusion of fuel cell electric vehicles (FCEVs). Battery electric vehicles (BEVs) have been more popular than plug-in hybrid electric vehicles (PHEVs), with their respective

sales volumesof 2.9 million and 600,000 units in the year 2021. During the year,

BEVs market sharein China soared to 10.9 percent, and such a figure is expected to further increase in the coming years. The reason for the widespread promotion of BEVs in China is that driving BEVs allows independence from oil consumption, emits zero CO

2, and produces very little noise. In addition, China's expanding EV charging infrastructure adds to the allure of BEVs. By 2021, the number of

publicand

private EV charging pilesin China reached nearly 1.2 million and 1.5 million, respectively.

Yet, BEVs have a relatively short driving range compared to PHEVs due to the limited energy storage capacity of the batteries. But this does not largely constrain Chinese consumers from buying them. During an

online customer surveyconducted in October 2021, Chinese consumers considered purchasing a BEV with a driving range of 258 miles, while participants from the United States expected at least 518 miles.

Which one is the best seller?

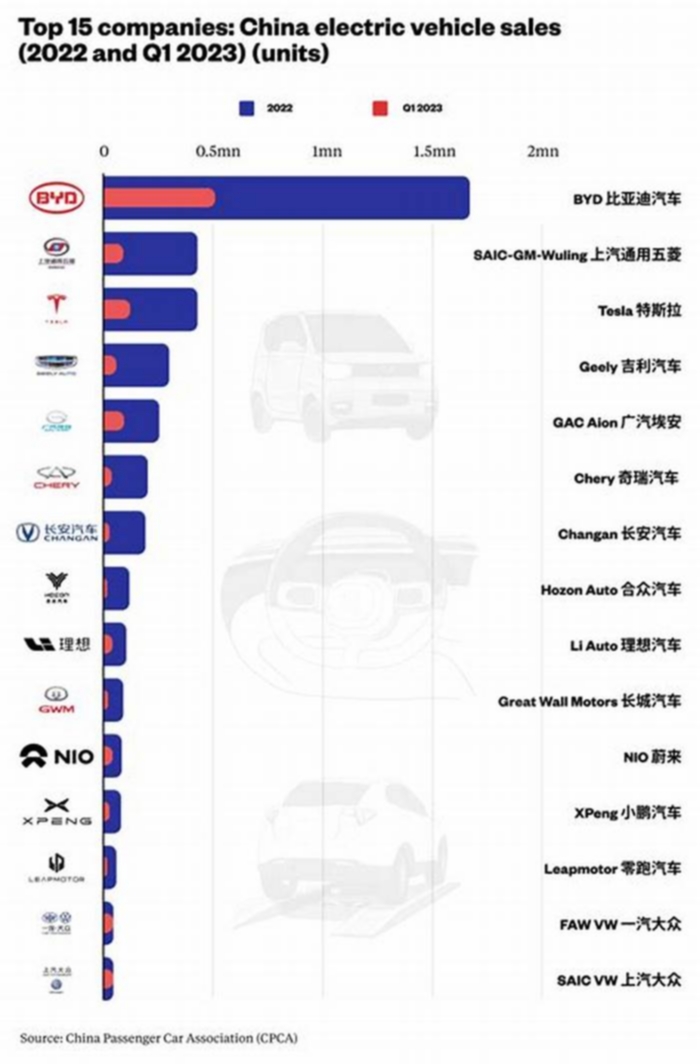

With the growing global rollout of EVs, Chinese EV manufacturers are becoming well-known. As Chinas top EV producer, BYD realized a

global EV market shareof 8.8 percent in 2021, behind only Tesla and Volkswagen Group. In the ranking of the

worlds best-selling EVsthat year, six Chinese models were among the top 10. For

passenger BEVs, the joint venture SAIC-GM-Wuling is the front-runner in China, with sales of over 424,350 units in 2021, surpassing Tesla and BYD. Its Hongguang Mini EV model was ranked as the second best-selling model in the world, right behind the Tesla Model 3.

This text provides general information. Statista assumes no liability for the information given being complete or correct. Due to varying update cycles, statistics can display more up-to-date data than referenced in the text.

The Chinese EV market is exploding. Here are the 5 major Chinese EV brands you should know about.

4. Geely's Zeekr is just 2 years old, but it already has international ambitions

Zeekr is an electric vehicle brand under the privately held Chinese auto giant Geely which boughtthe Swedish brand Volvo in 2010.

Founded only in 2021, Zeeker already has international ambitions.

In April this year, Zeekr said it plans to sell its newly launched SUV-style Zeekr X and Zeekr 001 EV sedan in Western Europe, Reuters reported. The EV maker did not indicate a timeline for its plans.

The $27,000 Zeekr X even has facial recognition software to unlock the car and owners can also opt to install a refrigerator in the car, Andy An, the CEO of Zeekr, said at an event, Reuters further reported.

The company aims to deliver 40,000 Zeekr X cars to the China market this year, with its first domestic deliveries starting in June, An said per Reuters.

And even though Zeekr is backed by a major auto player, it still trails its EV peers in the domestic Chinese markets.

Zeekr sold just 15,234 of its existing models in the first quarter of 2023 this is half of the 31,000 vehicles Nio sold and just 10% of what Tesla sold in the same period, per Reuters.

Chinas BYD overtakes Tesla as top-selling electric car seller

Elon Musks Tesla has been overtaken by its Chinese rival, BYD, as the worlds top selling electric carmaker.

BYD, which has been backed by the US investment billionaire Warren Buffett since 2008, has beaten Teslas production for a second consecutive year.

BYD, which stands for Build Your Dreams, said it produced 3.02m new energy vehicles in 2023. The American multinational Tesla announced on Tuesday that it made 1.84m cars. However, BYDs sales figures include 1.6m battery-only cars, and 1.4m hybrids, which means Tesla is still the leader in the production of electric battery-only cars.

Nevertheless, in the final quarter of last year BYD outsold Tesla in battery-only cars 526,000 to 484,000 for the first time.

Most of BYDs vehicles sell at a lower price point than Tesla, which derives about 20% of its sales from the Chinese market.

Chinese electric carmakers such as BYD and Nio have set their sights on becoming major players in international markets, with a particular focus on Europe. In December, BYD, which sells five models in Europe and has plans to launch three more this year, announced plans to build a new factory in Hungary. Last year, the company said it did not consider building its first European factory in the UK because of the impact of Brexit. BYD said the UK had not even made a top 10 list of possible locations to build its first European car plant.

Chinas top-selling electric carmaker is targeting sales of about 800,000 cars annually in Europe by 2030. However, these goals could be under threat after the European Commission launched an anti-subsidy investigation last September into Chinese electric vehicle imports.

Commenting on the decision at the time, the European Commission president, Ursula von der Leyen, said that Chinese electric vehicles were now flooding global markets and were being kept artificially low by state subsidies.

The investigation, which is expected to last a year, could result in the EU imposing punitive tariffs on Chinese vehicles.

The Hong Kong-listed BYD, which was founded by a former university professor, Wang Chuanfu, and began developing batteries in 1995, intends to become a global powerhouse in the electric vehicle market.

Tesla, which is led by Musk, said last month it was recalling just over 2m vehicles in the US fitted with its Autopilot advanced driver-assistance system to install new safeguards

One of the advantages BYD has over its US and European counterparts is its ability to manufacture electric vehicle batteries in-house.

Susannah Streeter, head of money and markets at the investment platform Hargreaves Lansdown, said: While its the worlds leading supplier of rechargeable batteries, Tesla relies on several suppliers and has flagged shortages of lithium as demand ratchets up as a supply chain obstacle in the years to come.

BYD is already making moves to secure the precious metal by buying a stake in a Chinese lithium producer. Its had its eye on purchasing mines in Africa and is scouting assets in South America, where the metal is mined.

The emergence of China as the top-selling electric vehicle producer comes at a significant time: the start of a presidential election year in the US.

China-US relations, particularly around trade, are likely to be a key part of the campaign for the presidency, which looks likely to be fought between Joe Biden and Donald Trump.

Last month, the Biden administration brought in new protectionist measures for its EV market by blocking full subsidies through his Inflation Reduction Act to EV companies with significant Chinese links. US-manufactured electric vehicles that include Chinese-made battery components would also be blocked from accessing full subsidies.

The Wall Street Journal also reported just before Christmas that the US government was looking at raising tariffs on some Chinese goods, including electric vehicles, to bolster the US clean energy sector. This would be on top of the 25% tariffs on vehicles imported from China, which were brought in under Trumps presidency, and extended under the Biden administration.

The US is looking to take action in other areas where it has security concerns about Chinas manufacturing capabilities.

On Monday it was reported that the Biden administration had put pressure on the Dutch government to block the shipments of hi-tech chip-making machinery to China by one of its key technology companies.

ASML, a leading supplier to the semiconductor industry, confirmed that the government had partially revoked its licence to export three chip-making lithography machines to China.

Bloomberg reported that the decision came after US officials had requested the move in an attempt to restrict the growth in Chinas semiconductor manufacturing capabilities.

Tesla overtaken by Chinas BYD as worlds biggest EV maker

Unlock the Editors Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Elon Musks Tesla has been knocked off the top spot as the worlds best-selling electric-vehicle maker for the first time by BYD after recording fewer deliveries than its Chinese rival in the past quarter.

The US group handed over 484,000 cars in the fourth quarter, more than the 473,000 anticipated by analysts but not enough to hold on to its title after BYD reported record sales of battery-only vehicles of 526,000 for the same period.

Teslas dethroning by BYD reflects the rise of what was a little-known Chinese group only a decade ago, which Musk himself has publicly dismissed. While growth at the Warren Buffett-backed Chinese company has been mostly achieved on its home turf, BYD is sharpening its focus on finding new foreign markets including in Europe.

Danni Hewson, head of financial analysis at AJ Bell, said BYDs electric cars were becoming increasingly visible on European roads thanks to keen pricing.

BYDs success in chasing down Tesla also underlines the struggle of legacy automakers from the US, Europe, Japan and Korea to adapt to fast-changing consumer preferences for cheaper, smarter electric vehicles.

In a statement published in China, the Shenzhen-based group called itself the world champion for new energy vehicles after notching total annual sales of more than 3mn for 2023 across its vehicles which also include plug-in hybrid cars.

Teslas annual sales were 1.81mn vehicles in 2023, while BYD delivered 1.58mn fully electric cars.

Through much of the past 12 months, BYD benefited from price cuts sparked by Teslas attempt to chase market share, pushing consumers to consider Chinas lower-cost models, according to analysts.

For any doubters left in the west, I hope this is the final data point that points to BYDs strength and, as importantly, how China EV Inc has bullied its way on to the global stage, said Tu Le, founder of Beijing-based advisory company Sino Auto Insights.

He added that while both companies cut prices on some cars over the past year, Tesla did so much more dramatically, signalling that BYD could distance itself further from the US group over the coming year.

Still, WedbushSecurities analyst Dan Ives said it was an important quarter for Tesla to show strong deliveries and momentum heading into 2024.

Teslas annual sales of 1.8mn last year was a major achievement in a choppy macro [economic environment] for the electric vehicles sector, he added.

BYD was founded by Wang Chuanfu, a former university professor, in the mid-1990s. After focusing on manufacturing rechargeable batteries, including for mobile phones, the company expanded into the car industry in the early 2000s.

The Chinese groups early success prompted Buffetts Berkshire Hathaway to invest in the company in 2008. Despite relying on existing industry technology for many years, BYD has focused on stripping out costs from the production process.

Following years of state support and careful industrial planning by Beijing, Chinas automakers now leverage their countrys control over the production of almost every resource, material and component used to make electric vehicles.

BYDs vertically integrated structure it controls mines and produces batteries and chips has made it the envy of foreign rivals as the global car industry transitions away from the combustion engine.

At the end of last year six out of the top-selling EV models in China, the worlds largest car market, were BYD cars, according to Automobility, a Shanghai-based consultancy. While BYDs share of sales has expanded to more than 35 per cent, Tesla has struggled to keep up with the cadence of product launches by Chinese rivals, the consultancy added.