Is Tesla losing the EV market

Tesla's losing ground in the EV market and its future all hinges on the Cybertruck

- The Cybertruck arrives as Tesla is losing ground to competitors.

- Tesla needs the Cybertruck to claw back market share from other brands.

- After years of little-to-no competition, Tesla's EV dominance is being tested.

Thanks for signing up!

Access your favorite topics in a personalized feed while you're on the go.

Tesla is losing ground in the electric-vehicle market as competition heats up, raising the stakes for the launch of the long-awaited Cybertruck.

Investors and customers have been clamoring for Tesla's Cybertruck since it was first revealed in 2019, pointing to the futuristic-looking truck as a turning point for Elon Musk's electric car company. Four years later, the Cybertruck finally arrives in an increasingly crowded EV market and, for the first time, as a late-arriver to its electric truck segment.

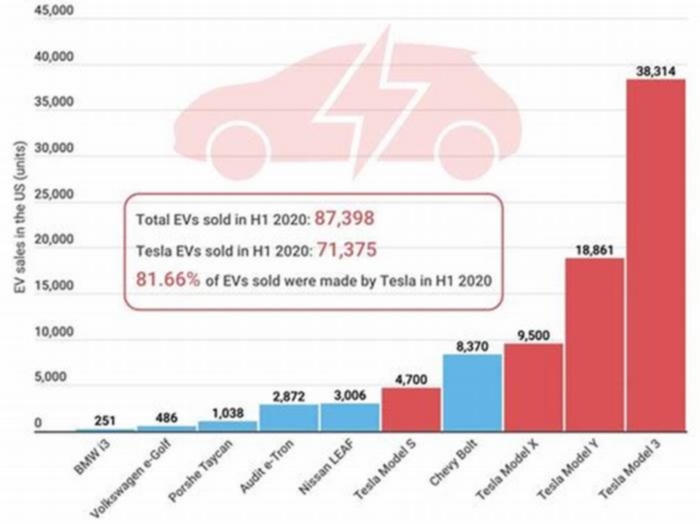

Even as total EV sales in the US hit a record high in the third quarter, Tesla's share fell to a record low of 50%, according to Cox Automotive.

Though Tesla still held 56.5% of the market from January through October of this year, that's significantly down from its 65.4% last year, 68.2% in 2021, and a whopping 79.4% in 2020, per Experian data.

While Tesla enjoyed years of dominance with little-to-no competition from legacy automakers, it's clear the firm is starting to lose ground in the face of a more crowded EV market.

Big names like Ford, GM, and Volkswagen have raced to introduce more plug-in models and shore up their EV production lines in the last few years, gobbling up market share from the EV pioneer and driving overall sales of electrics to record levels. Still, all of these brands are fighting over a smaller share of the pie while Tesla remains far and away the top seller of electric cars at half of the market.

It's not even close. The brands following Tesla in US EV segment share year-to-date are Chevrolet at 5.7%, Ford at 5.3%, Hyundai at 4.7%, and Rivian at 4.2%, according to Cox.

The Cybertruck is more important than ever

The Cybertruck is coming at a time when Musk's company is making a variety of previously unprecedented moves to boost sales volumes, including slashing prices, spending more on marketing, and offering dealer-like incentives for timely purchases.

Tesla's first foray into the lucrative truck market is supposed to hit consumer driveways Thursday, and it couldn't be coming at a better time.

Tesla started the year with bloated inventory and a list of problems that looked a lot like issues the Silicon Valley EV company's legacy startups have faced for years. Musk has managed to turn these problems into advantages at nearly every turn, but long-standing issues like stale designs and spotty quality will begin to catch up as more competition hits the market.

"The long-promised Cybertruck may reverse the downward trend," Cox analysts said, "although competition from Ford, Rivian and Chevrolet will likely impact Tesla's electric pickup volume potential."

Tesla's aging lineup is in desperate need of a shot to the arm, and the unique-looking Cybertruck certainly does that, industry analysts have said. The risk is that the Cybertruck is so atypical that it ends up being a smaller, more niche status symbol than a driver of sales volume.

"If the Cybertruck becomes just another Tesla model that sells in the 50,000-unit range," Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions, told Insider, "there may be cracks in the foundation at Tesla."

Yahoo Finance

Tesla (TSLA) should be looking over its shoulder at the fully charged EVs barreling right toward its castle.

While Elon Musk's non-Twitter creation still has a stronghold on the EV market based on name recognition, market share, and production capabilities, the clear takeaway from this years New York International Auto Show (which Tesla was not a part of) is that traditional automakers such as Ford (F), General Motors (GM), and Nissan (NSANY) are all gunning for Tesla's dominance and lucrative profit margins.

And they may just have success at that target practice.

Hyundai aims to lead the EV pack

Tesla who, Hyundai Motor Americas CEO Randy Parker quipped when Yahoo Finance Live asked about Hyundai's IONIQ 6, an EV that was named 'Car of the Year' for 2023.

The impressive specs and pricing of Hyundai's IONIQ 6 places it in direct competition with Tesla's Model 3, the second-most-popular EV in the U.S. Hyundai's IONIQ 6 starts at $41,600 with a range of up to 240 miles. By comparison, the $41,990 Model 3 reaches 272 miles on one charge.

Gap closed.

The IONIQ 6 from a technology standpoint, you cant do better, Parker crowed.

And its that type of Teslamentality thats likely to test the EV leadership of Musk's EV outfit.

Older automakers known for their gas-powered rides are ramping up their push into the EV market with edgy new styles and attractive specs like those showcased at this year's New York Auto Show, including the Kia EV9, Nissan Ariya, Chevrolet Equinox EV, and Ram 1500 REV electric truck.

These will be added to a class of solid EVs already in the market like Ford's F-150 Lightning and Mach-E and the coming Chevy Silverado.

What's next for Tesla

Tesla's Cybertruck isn't even on the market yet. The company is reportedly working on a compact EV dubbed the Model 2, but it's unclear when that will arrive.

And more EV models, not from Tesla, are coming and fast.

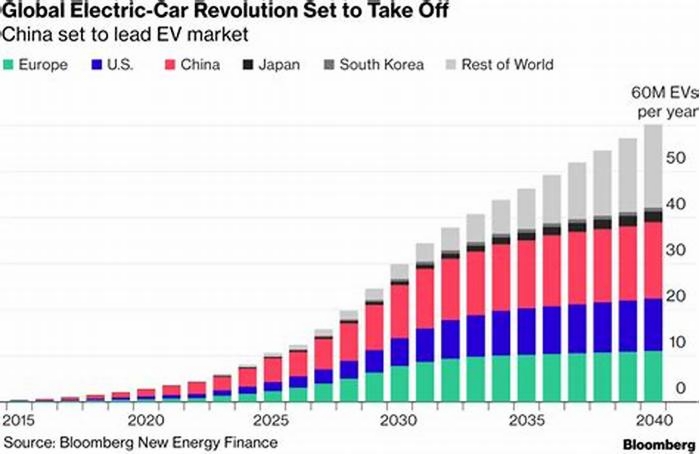

S&P Global estimates the EV market will grow from just over 50 models today to 78 by year-end before more than doubling to 160 by the end of 2025.

S&P Global Mobilitys Tom Libby told Yahoo Finance in a chat that "competitive pressure is pushing OEMs to move quickly,' and that Tesla's market share will keep declining' as a result.

The inroads into Tesla's dominance are already being felt without question.

General Motors sold more than 20,000 EVs for the first time in a quarter, fueled by demand for its cheaper Chevy Bolt EV, which accounted for 95% of the auto giants EV sales. And according to GM, Bolt sales are expected to soar to reach 70,000 by the end of this year.

That may not sound too impressive when you compare it to Teslas record first-quarter delivery numbers, which totaled 422,875 globally. But data compiled by S&P Global Mobility shows Tesla's competitors are gaining ground.

Teslas U.S. EV share subsequently fell from nearly three-quarters of the market in January 2022 to just over half in January 2023. Within that same time frame, General Motors' EV market share grew from 0.1% to 9.9%, and Fords foothold grew to 8.4%.

The pressure on Tesla is one of the factors forcing the carmaker to slash prices again. Tesla marked down its vehicles for the fifth time this year, its latest effort to boost demand and regain lost market share.

"In this EV arms race Tesla needs to defend their turf and customer base with price cuts," Wedbush analyst Dan Ives wrote in an email to Yahoo Finance. "Everyone is trying to catch up. Tesla cutting prices were the near-term pain for long-term gain strategic poker move."

RBC analyst Tom Narayan also thinks lower prices could help Tesla's demand issue, telling Yahoo Finance Live that lower prices are a "great way to really steal market share."

Despite some upbeat outlooks from Wall Street on price cuts and the fact Tesla's stock has been a favorite among investors since the start of the year, shares are still off more than 40% in the past 12 months. That's a much starker decline than competitors Ford and General Motors, with respective one-year drops of 14% and 10%.

The relative underperformance of Tesla's stock proves some investors are looking at its recent price cuts and quarterly delivery miss as a sign of trouble ahead for the electric vehicle maker. And perhaps a sign that mighty Tesla is losing its grip on an industry it has dominated for the last five years.

Either way, it will be electric for investors to bet on.

Seana Smith is an anchor and journalist at Yahoo Finance. Follow Smith on Twitter @SeanaNSmith. Tips on deals, mergers, activist situations, or anything else? Email [email protected].

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Tesla fans will stay loyal no matter what Elon Musk does

- Tesla trumped all other automakers in terms of overall brand loyalty in a recent study.

- It shows that despite the EV-maker's many controversies, current fans remain loyal.

- Still, as other automakers go electric, Tesla might not keep its lead forever.

Thanks for signing up!

Access your favorite topics in a personalized feed while you're on the go.

Tesla has been able to keep a loyal fanbase, but some say Elon Musk might not keep his lead forever.

Tesla trumped all other automakers in terms of overall brand loyalty (beating out Ford) and most improved loyalty (unseating Genesis) last year, according to a loyalty study out of S&P Global Mobility in February. Tesla also won segment model loyalty awards, including luxury small utility for the Model Y, and luxury small car, for the Model 3.

Tesla also, for another year, won awards for the top "conquest" percentage or when a brand pulls a customer away from another brand and highest loyalty among owners of electric vehicles.

S&P Global Mobility analyzed 11.7 million new vehicle registrations in the US throughout 2022 and weighed when a customer acquired a new vehicle of the same make, model, or manufacturer as a vehicle they had already owned.

Tesla's success in 2022 was largely driven by inventory challenges among the traditional automakers, Tesla customers returning to market faster than the average buyer of other brands, and its many advantages as the EV market front-runner. S&P Global Mobility said the brand's resonance with ethnic consumers also drove loyalty improvement, and the company beginning to qualify for crucial EV tax credits in the US again spurred interest.

The results show that despite Musk's controversial way of doing things, volatility impacting the electric-vehicle maker, federal investigations, Twitter distractions, self-driving tech problems, and more, owners and fans are largely committed no matter what.

Still, that might only go so far as Tesla loses EV market share. Tesla held 65.4% of the EV market in 2022, according to Experian. That is down from 68.2% in 2021 and 79.4% in 2020.

Tesla lost ground with some of its customers due to sweeping price cuts that meant the value of brand-new Teslas dropped by as much as 20% overnight.

The cuts were an effort to boost waning demand, per a recent J.D. Power EV Index. But those cuts worked to snag attention from other buyers; consideration of the brand, which saw just 39% of EV shoppers indicating interest in December, shot back up to 44% in January.

Tesla and Musk could be playing a role in alienating prospective buyers, but that's not all. More legacy automakers and startups are racing to get new EV products to the market.

"Down the road, this hold that Tesla has may not be as strong, but in the short term, they have built that up, because they have the infrastructure, they have the brand recognition," Vince Palomarez, product management principal at S&P Global Mobility, said. "While Tesla will still have that hold on their buyers, I don't think it will be as dominating going forward.

"Based off what we're seeing for future production plans," he added, "I do expect there to be some kind of erosion to Tesla's share."

Electric cars are more popular than ever, but Tesla is losing market share to new competitors

- Tesla's share of the US electric-vehicle market is shrinking as rivals gain momentum.

- Around 66% of new EVs registered in the US from January to June were Teslas, a big drop from 2020.

- Ford, Audi, and General Motors are gaining share as the electric-car market grows.

Thanks for signing up!

Access your favorite topics in a personalized feed while you're on the go.

Tesla is the biggest electric-vehicle powerhouse in the US by far, but rivals are starting to eat away at its share of the market as appetite for electric cars explodes.

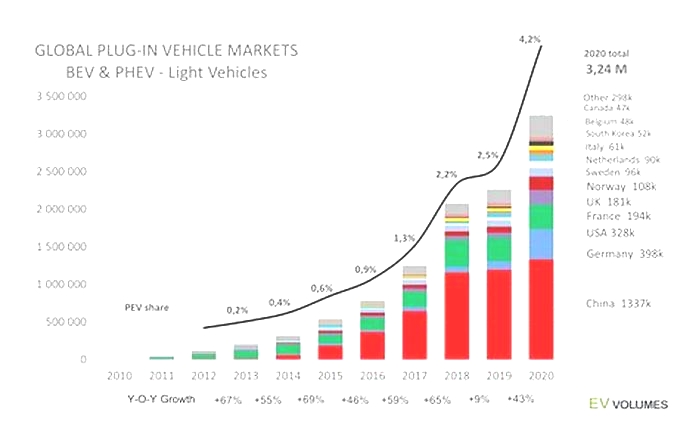

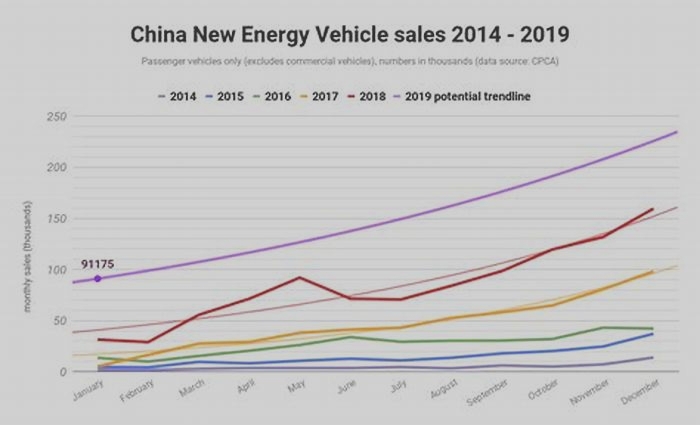

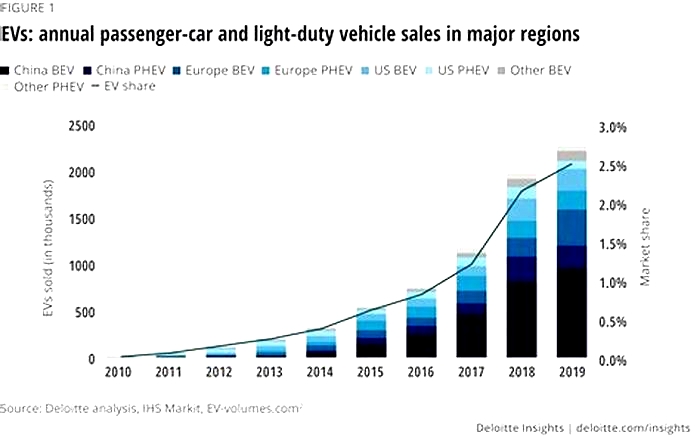

From January through June 2020, Tesla accounted for a staggering 79.5% of all new EVs registered in the US. During the same six months in 2021, 66.3% of new-EV registrations went to Tesla, according to Experian data published Monday.

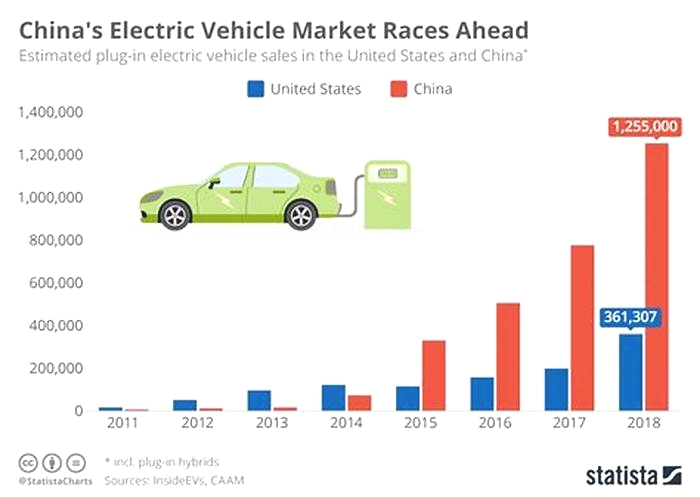

Auto industry titans like Volkswagen, Ford, and General Motors are betting big on a future dominated by battery-powered cars, and they're plunging billions into efforts to electrify. In 2021, Audi's share of EV registrations grew to 3.3%, Ford's grew to 5.2%, and Chevrolet's increased 1.3% to hit 9.6%, according to Experian. Nissan's share rose to 3.9%.

Ford launched its first modern EV, the Mach-E SUV, in late 2020. Audi's first mass-market EV, the E-Tron SUV, went on sale in 2019, and the Volkswagen subsidiary has announced multiple new electric models since.

Tesla may be losing market share, but its sales and the EV space more broadly are growing dramatically. Tesla sold some 386,000 vehicles during the first half of 2021, more than double the number it sold during that period in 2020.

From January to June of 2021, EVs made up 2.4% of new vehicle registrations, according to Experian. That's not much, but it's more than double the same six months in 2020.

Wall Street analysts expect that Tesla will remain dominant for years, but rivals will overtake it in EV sales within the decade. Analysts at UBS said in March that Volkswagen will sell more electric models than Tesla in 2025, but Tesla will turn a bigger profit on the cars it sells.