Is insurance on an electric car cheaper

Car insurance for electric cars

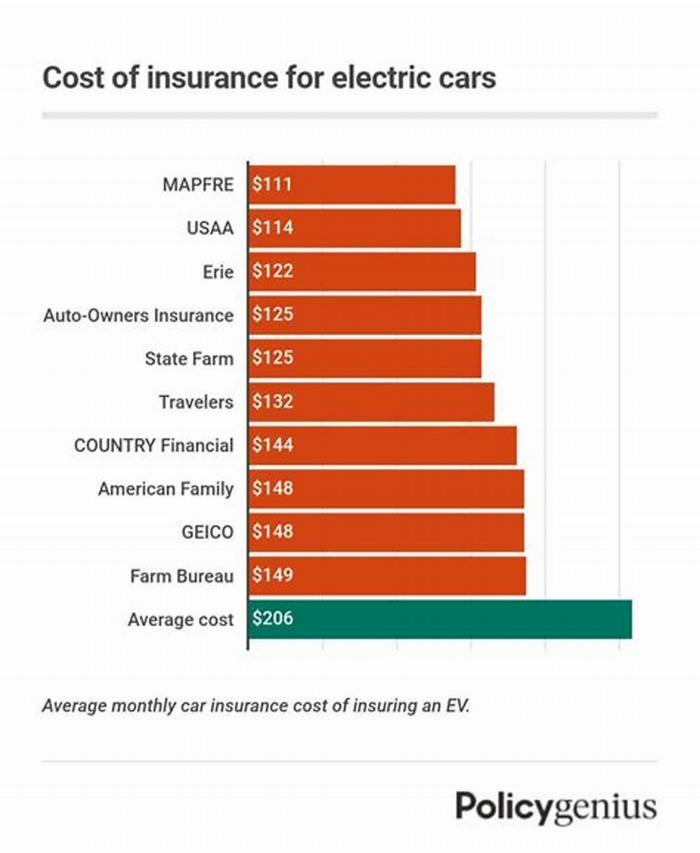

Electric car insurance costs are higher than for non-electric vehicles. On average, the cost of electric car insurance is $206 per month (or $2,468 per year). Thats $44 more per month than the cost to insure a gas-powered car.

We don't sell your information to third parties.

Besides cost, insurance coverage for electric cars is no different than for a gas-powered vehicle. You can get EV insurance from the same companies as the owner of a gas-powered car. We found that MAPFRE is the cheapest company for electric car insurance. Larger companies like USAA and State Farm also have cheap quotes for electric vehicles.

What is the cost of electric car insurance?

The cost of car insurance for electric cars is $206 per month, though the average premium depends on the model. Our quote comparison for the cost of electric car insurance for some of the most popular EVs found that the Nissan Leaf is the cheapest model to insure at $170 per month.

We don't sell your information to third parties.

The cost of insurance for electric cars also depends on your company. For example, electric car insurance costs $111 per month with MAPFRE 46% cheaper than average. On the other hand, with Hanover the cost to insure an EV is 129% more expensive than average.

Since the cost of electric car insurance can depend so heavily on the company, its important to compare quotes from multiple companies to be sure youre getting the best rates for your EV.

Collapse table

Monthly cost of full-coverage car insurance for electric vehicles.

Electric car insurance cost vs. other vehicles

We compared the cost of car insurance for 24 popular car models to find out how the cost of insuring an electric car compares with the cost of coverage for gas-powered vehicles. On average, insurance for an electric car is $44 per month more expensive than the cost of insuring a gas-powered car.

Out of 24 vehicles, the top two most expensive to insure Tesla's Model Y and Model 3 are electric. The Chevy Bolt and Nissan Leaf also placed in the top 10 most expensive cars to insure.

Rank | Vehicle | Average annual premium |

|---|---|---|

1 | Tesla Model Y | $248 |

2 | Tesla Model 3 | $231 |

3 | Honda Accord | $177 |

4 | Ram 1500 | $176 |

5 | Toyota Corolla | $174 |

6 | Toyota Camry | $174 |

7 | Chevrolet Bolt | $174 |

8 | Honda Civic | $174 |

9 | Nissan Leaf | $170 |

10 | Toyota RAV4 | $167 |

11 | Chevrolet Silverado | $164 |

12 | Nissan Rogue | $162 |

13 | Subaru Forester | $161 |

14 | Ford Explorer | $160 |

15 | Jeep Grand Cherokee | $160 |

16 | Toyota Highlander | $157 |

17 | Jeep Wrangler | $156 |

18 | Ford Escape | $155 |

19 | Chevrolet Equinox | $153 |

20 | Subaru Outback | $152 |

21 | Toyota Tacoma | $152 |

22 | GMC Sierra | $151 |

23 | Honda CR-V | $148 |

24 | Ford F-150 | $146 |

Collapse table

Monthly cost of full-coverage car insurance, sorted from most expensive to cheapest to insure.

Why is insurance higher for electric cars?

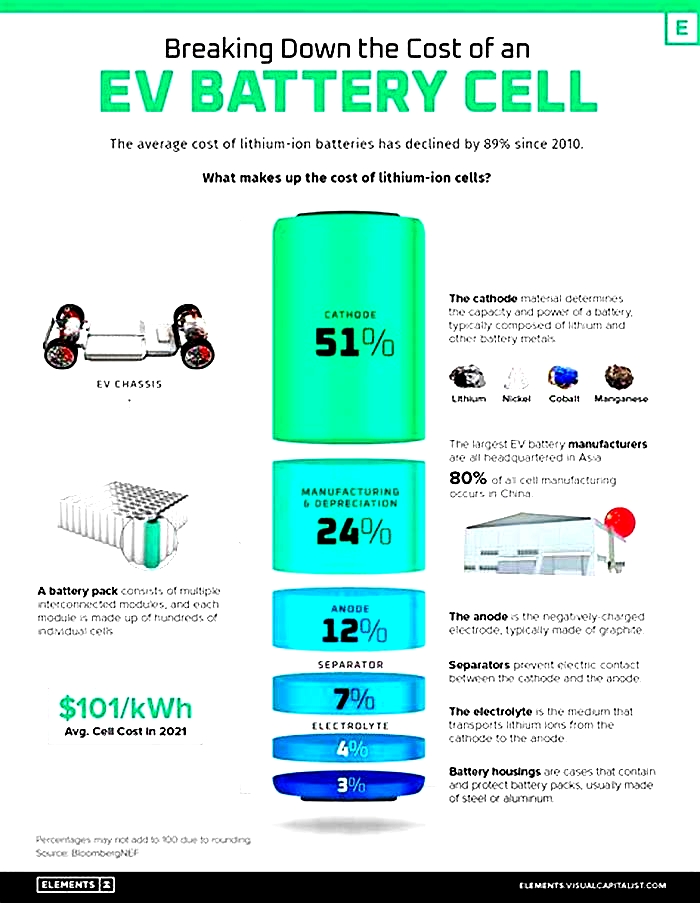

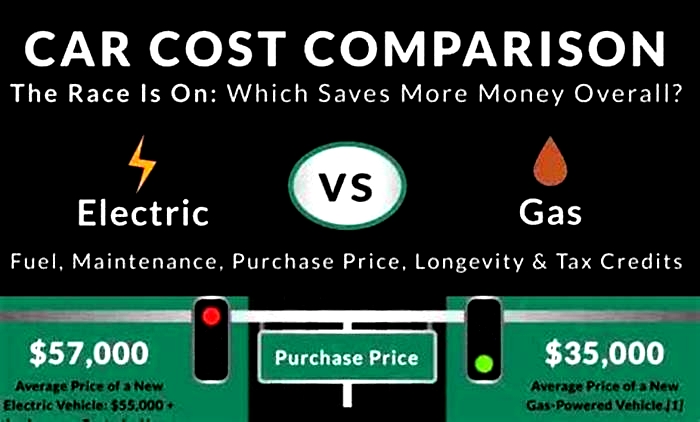

There are a couple of reasons why its more expensive to get insurance for an electric car. Insurance for EVs costs more because electric cars tend to be more expensive to replace than gas-powered models. This is especially true of high-end electric cars, such as Teslas.

Electric cars also cost more to insure because they have more specialized features than a regular car does. These features cost more to manufacture and more to repair. When insurance companies determine their rates, they take into account the cost it would take to repair a car after a crash.

Are hybrids more expensive to insure?

Hybrid electric vehicles are more expensive to insure than cars that run only on gas. The reason is because hybrids cost more than most standard gas-powered vehicles. After a crash or a total loss, a hybrid would cost more to repair or replace completely than an all-gas counterpart.

Best car insurance for electric vehicles: Travelers

Travelers

4.3

Policygenius rating

How we score: Policygenius ratings are determined by our editorial team. Our methodology takes multiple factors into account, including pricing, financial ratings, quality of customer service, and other product-specific features.

Best company for insuring electric cars

Travelers is affordable and has a discount that hybrid and electric vehicle owners can use to lower their rates.

Travelers is the best insurance company for electric cars. On average, coverage from Travelers costs $132 per month (or $1,579 per year). While its slightly more expensive than a few of its competitors, Travelers has electric vehicle insurance thats still 36% cheaper than average.

Electric car owners can lower their premiums even more with the hybrid/electric car discount that Travelers offers. On top of that discount, Travelers also allows drivers to save by:

Signing up for electronic payments

Avoiding accidents and tickets for at least three years

Completing a training course

Requesting a quote before their existing policy expires

Owning a home

We also recommend Travelers as the best car insurance for electric vehicles because of its options for additional insurance. Drivers can add new car replacement, roadside assistance, gap coverage for a vehicle paid for with a loan, and accident forgiveness to a regular policy.

Cheapest electric car insurance in every state

MAPFRE is the most affordable company for electric car insurance overall, but its not the cheapest company in any one state. Instead USAA is the cheapest electric car insurance company in 20 states, which makes it most often the company with the lowest rates.

For drivers who arent in the military, State Farm, Auto-Owners, American National, and GEICO are all cheap companies for electric car insurance. In 31 states, coverage from the company with the cheapest electric car insurance rates costs less than $100 per month.

Collapse table

Monthly cost of full-coverage car insurance for electric vehicles.

Learn the best way to find EV charging stations near you

Electric car insurance costs by state

The average cost of insuring an electric vehicle is $206 per month, but cost also depends on the state you live in among other factors that affect rates. We found that the cost of car insurance for an electric vehicle can vary by as much as $2,502 per year depending on where you live.

On average, the most expensive state for electric car insurance is Florida. In Florida, coverage costs drivers $313 per month, but can get as high as $782 per month. The cheapest state for insurance on an electric car is North Carolina, where rates are $105 per month.

We also found that the difference in electric car insurance costs and premiums for gas-powered vehicles varies by the state. In North Carolina, the difference is the smallest (just $11 per month). The difference is largest in Mississippi, where it costs $79 more per month to insure an electric car.

State | Monthly cost | Difference from non-EVs |

|---|---|---|

Alabama | $195 | $33 |

Alaska | $162 | $39 |

Arizona | $182 | $34 |

Arkansas | $223 | $55 |

California | $217 | $46 |

Colorado | $210 | $46 |

Connecticut | $224 | $62 |

Delaware | $219 | $39 |

District of Columbia | $224 | $62 |

Florida | $313 | $78 |

Georgia | $181 | $24 |

Hawaii | $121 | $21 |

Idaho | $122 | $19 |

Illinois | $158 | $32 |

Indiana | $147 | $28 |

Iowa | $145 | $32 |

Kansas | $203 | $45 |

Kentucky | $247 | $47 |

Louisiana | $295 | $62 |

Maine | $130 | $23 |

Maryland | $209 | $41 |

Massachusetts | $174 | $31 |

Michigan | $264 | $51 |

Minnesota | $160 | $28 |

Mississippi | $240 | $79 |

Missouri | $202 | $47 |

Montana | $194 | $43 |

Nebraska | $218 | $45 |

Nevada | $235 | $42 |

New Hampshire | $150 | $37 |

New Jersey | $226 | $33 |

New Mexico | $172 | $31 |

New York | $223 | $27 |

North Carolina | $105 | $11 |

North Dakota | $167 | $31 |

Ohio | $119 | $22 |

Oklahoma | $208 | $36 |

Oregon | $151 | $25 |

Pennsylvania | $193 | $37 |

Rhode Island | $224 | $51 |

South Carolina | $210 | $36 |

South Dakota | $184 | $34 |

Tennessee | $162 | $38 |

Texas | $196 | $30 |

Utah | $172 | $33 |

Vermont | $141 | $32 |

Virginia | $193 | $68 |

Washington | $180 | $34 |

West Virginia | $199 | $44 |

Wisconsin | $132 | $24 |

Wyoming | $170 | $29 |

Collapse table

We don't sell your information to third parties.

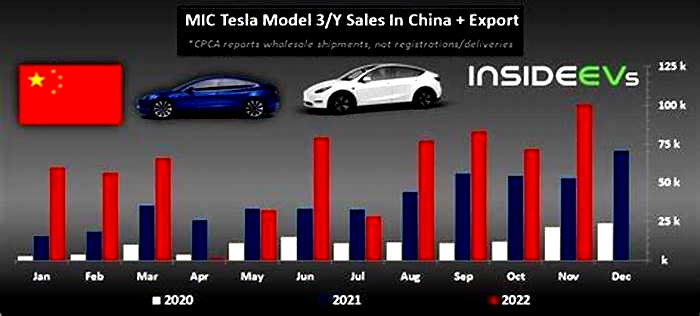

Car insurance for Teslas

While you can get auto coverage for a Tesla from any of the major insurance companies, the brand also offers its own insurance that claims can offer drivers lower rates than competitors. Tesla partners with insurance companies to offer its own coverage in the following states:

Arizona

California

Colorado

Illinois

Ohio

Oregon

Texas

Virginia

If you sign up for Tesla car insurance, your driving behavior is recorded by your vehicle. The system updates your monthly premium based on the distance you keep from other cars, your braking, speed, turning, and use of the cars autopilot.

Read more about how car insurance for a Tesla works

How to save money on car insurance for electric vehicles

Although the cost of electric car insurance can be expensive, its still possible to get affordable coverage. In addition to comparing quotes to get the lowest rate, take the following steps to reduce car insurance costs for EVs:

Search for discounts: Almost every company offers drivers a few discounts that lead to cheaper car insurance. When youre comparing companies, pay attention to which ones offer discounts that youre most likely to qualify for.

Bundle two forms of coverage: You could lower your cost of insurance for an electric car by insuring the vehicle with the company you already use for your home or renters insurance.

Sign up for usage-based discounts: One of the best ways to save money on car insurance is by enrolling in your insurers usage-based discount program. As long as youre a careful driver, you could see much lower rates after you complete the monitoring period.

Consider a per-mile insurance plan: If your EV isnt your primary vehicle or you dont often have to drive it, you could benefit from per-mile insurance. Under these plans, which are offered by Liberty Mutual, Allstate, and Nationwide, youre charged by the mile instead of a set amount each month.

Increase your deductible: Because electric cars are costly to repair, you may be able to afford to raise your deductible the amount you pay out of pocket on a comprehensive or collision claim.

How to get car insurance for electric vehicles

Theres no special insurance requirement for electric cars. Instead, the process of getting car insurance for an electric vehicle is the same as it is for a conventional, gas-powered car. To get electric car insurance, you should:

Decide how much coverage you need

Shop for coverage

Compare quotes to find the best rates

Pick a company and select a start date

Cancel your old policy

Read more about how to shop for insurance and get covered

Frequently Asked Questions

Are electric cars more expensive to insure?

Yes, electric cars are more expensive to insure. This is because EVs cost more to repair and replace than a traditional, gas-powered car.

Are electric cars more expensive to maintain?

It depends. Electric car repairs are more expensive, but there are fewer parts than a gas-powered car to repair. For example, an EV doesnt need new spark plugs, timing belts, or oil changes. Over time, the cost of increased electricity use also stays cheaper than the cost of getting gas.

What is the best insurance company for electric cars?

Travelers has the best insurance for electric cars. On average, the companys cost of electric car insurance is 36% less than average. It also has a range of coverage options and discounts that drivers can use to lower their rates even more including one for hybrid and electric cars.

Methodology

Policygenius found the cost of insurance for an electric car by analyzing rates provided by Quadrant Information Services. We calculated the average premium for drivers living in every ZIP code in all 50 states plus Washington, D.C. The rates we used were for full-coverage insurance, and had the following limits:

Bodily injury liability: 50/100

Property damage liability: $50,000

Uninsured/underinsured motorist: 50/100

Comprehensive: $500 deductible

Collision: $500 deductible

In some cases, additional coverages were added where required by state or insurer. Rates for overall average rate, rates by ZIP code, and cheapest companies determined using averages for single drivers ages 30, 35, and 45. Our sample vehicle was a 2017 Toyota Camry LE driven 10,000 miles/year.

Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of costs. Your actual quotes may differ.

Everything you need to know about insuring an electric vehicle

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a stricteditorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

The Best Electric Car Insurance UK 2024

Welcome to our review of the best electric car insurance providers in the UK. As EVs are becoming increasingly common on the UKs roads, understanding electric car insurance and how it compares to traditional car insurance, is important for EV owners.

Compare EV Insurance Quotes

- Cheap insurance from over 110 providers

- Save up to 504 on your electric car insurance

- Enjoy cashback and rewards

- 97% of customers recommend Quotezone

- Get a quote online in 5 minutes

Thats where our guide to EV insurance comes in. Well explain the distinctive features of EV insurance, offer insights on the elements of EV insurance that are important to EV owners and we will showcase the best EV insurance coverage on offer in the UK.

What is Electric Car Insurance?

Electric car insurance, while serving the same purpose as normal car insurance (to protect the vehicle and its owner) is tailored to address the specific challenges and characteristics of EVs.Heres how electric car insurance is different from standard car insurance:

Battery CoverThe most important part of an electric car is the battery, a vital and usually very expensive component. Unlike traditional vehicles where the engine is the primary concern, EVs revolve around their batteries. So a comprehensive electric car insurance policy should provide cover for potential damages or other issues with the battery.

Charging Cable CoverEVs rely on charging cables. These cables, due to their frequent use and exposure, are susceptible to wear, damage, or even theft. Electric car insurance policies typically provide cover for charging cables.

Cover for Injury and Damage Caused by Charging CablesAn added concern with EVs is the potential hazards their charging cables might pose, especially if they are positioned in public areas. Theres a risk of someone tripping over them or the cables causing an accident. Electric car insurance can include cover for this. Should a third party sustain injuries or damages due to your charging cable, policies might cover the liabilities.

Cover for running out of chargeWhile traditional breakdown cover might help you out with common issues like flat tires or misfuelling at a petrol station, EVs present their own unique challenges. One such challenge is running out of charge at an inconvenient location! Some electric car insurance policies offer specialised EV breakdown cover tailored for EVs. In the event your vehicle runs out of charge, this cover assists in getting your car to the nearest charging point or can recharge you at the roadside.Cover that provides an Electric Courtesy CarSome insurance companies offer EV owners ICE cars as replacements! This is not what EV owners want they want dedicated EVs or hybrid replacements should they need to put the EV in for repairs.

The Best Electric Car Insurance Providers 2024

We have reviewed the best electric car insurance companies in the UK, drawing insights from trusted sources such as the Electric Car Guides EV focus group, alongside consumer reviews and our own expert assessment. We identified that the 5 most important components for EV insurance according to EV owners are battery cover, charging equipment cover, provisions for running out of charge, EV courtesy car options and liability cover for potential injuries caused by charging equipment.

With these criteria in mind, the insurance companies that made it onto our shortlist of the best electric car insurance providers are The AA, AXA, Admiral, Aviva, LV, Esure, and Direct Line. They have best met the specific insurance needs of EV owners identified in our research.

The AA are our best-rated EV car insurance provider in the UK. The AA cover all the essential EV insurance components outlined above, and they also bring the added advantage of their own highly-rated EV breakdown recovery service.Heres an in-depth look at the best electric car insurance providers for EVs and why we like them:

AA EV Insurance

- Best For: Best Overall EV cover

- Battery Cover: AA EV insurance covers the most important part of your electric car, the battery. AA safeguards your EV batttery against accidental damage, fire, and theft.

- Charging Equipment: AA provides comprehensive coverage for your charging cables, charger, and charging adaptors. These are protected from accidental damage, fire, and theft whether theyre in the car, at a garage, or at your home.

- Out of Charge Recovery: If youre an AA breakdown cover member and your vehicles battery runs out, theyll ensure a patrol takes your vehicle to the nearest charging point.

- Liability for Charging Cable: In case someone trips over your charging cable outside your property, AA liability cover ensures youre protected from potential claims.

- 24/7 Support: Claims can be made at any time, thanks to the AAs 24/7 UK contact centre.

- Cover for Personal Items: Personal belongings in the car, up to 250 (or 500 for members), are also protected, covering items such as handbags, phones, or wallets.

- Trust Pilot: 4.3

What we like about The AA electric car insurance

The AAs electric car insurance provides comprehensive coverage for both owned and leased batteries against accidental damage, fire, and theft this offers peace of mind for what is arguably the most critical component of an EV. They have a 24/7 claims line operated from the UK, ensuring support is always available when needed.

The AA also offer protection for charging equipment. From cables and chargers to adaptors, they ensure these essentials are covered not just when theyre inside the vehicle, but also when in use at a garage or at home. The AA also provide liability coverage for charging cables. The risk of someone tripping over a charging cable outside a property is real, especially if a granny charger is trailed across the pavement with an EV charger extension lead. The AA provides cover for this potential liability.

The AAs out-of-charge recovery service gives reassurance in the event of your battery running out. With its national breakdown recovery network, the AA will promptly transport your vehicle to the nearest charging point is incredibly reassuring. The AA claims to have the most trained mechanics in the UK. The Uninsured Driver Promise is a key benefit, safeguarding your no claim discount and sparing you from excess fees in the unfortunate event an uninsured driver causes damage to your car, and the fault isnt yours.

Additionally, AA extends protection to personal belongings, offering up to 250 coverage for items like handbags, mobile phones, or wallets, with an enhanced coverage of up to 500 for AA Members.

AA provides a courtesy car while your vehicle undergoes repairs. In cases where the accident is not your fault, AA Accident Assist will do its best to supply a courtesy car of the same electric model as your own, depending on whats available.

The AAs 5 Star Rating from Defaqto demonstrates a high-rated, quality product. They have a round-the-clock claims line and seem to do their best to keep drivers on the move after accidents with courtesy car provisions.

AXA EV Insurance

- Best For: Comprehensive Battery Protection

- Battery Cover: AXA provides a specialised battery cover to protect your EV battery.

- Charging Equipment: AXA offers protection against theft and accidental damage to charging cables.

- Out of Charge Recovery: With AXA, youre never stranded. If your electric vehicle runs out of charge, AXAs optional breakdown cover promises to transport your car to the nearest convenient charging station.

- Reassuring claims data: A whopping 99.8% of car insurance claims are paid out.

- Liability for Charging Cable: AXA provide cover for third-party incidents. AXA protects you against injuries and damages caused by someone tripping over your charging cable.

- Trust Pilot: 4.3

What we like about AXA electric car insurance

AXA Electric Car Insurance has an impressive track record of a 99.8% claim payout rate, which offers an assurance that when the unexpected occurs, AXA is there to support its EV policyholders.

AXA offers a comprehensive battery cover and inclusive coverage for charging cables against potential threats like theft or accidental damages.AXA also provides third-party coverage for charging cables. This means that if someone accidentally trips over your charging cable in a public setting or if a malfunctioning cable inflicts unexpected damage, AXAs coverage will come to the rescue. This coverage for third-party incidents ensures that youre protected from the unique risks associated with charging an electric vehicle in public spaces or at home.AXAs electric car insurance has the option for breakdown cover which includes out-of-charge cover. With AXAs optional addition, EV owners arent left stranded but are instead taken to the nearest public charging station.

Admiral EV Insurance

- Best For: Personal Item Protection

- Battery Cover: Admirals policy covers EV batteries against accidental damage, fire, and theft.

- Charging Equipment: Admirals EV policy protects charging cables, theyre covered against accidental damage, fire, and theft.

- Out of Charge recovery: If your electric car runs out of battery while youre out and about, Admiral provides an EV recovery service (hybrid vehicles arent included).

- Personal Injury Protection: With Admirals EV insurance, both you and your partner receive a comprehensive 5,000 personal injury cover

- Protection for Personal Belongings: If your personal effects in your electric car get damaged or stolen, Admiral steps in. They offer compensation up to 200 to assist in replacing these items.

- Round-the-Clock Assistance: Admiral provides a 24-hour emergency helpline for unexpected incidents on the road. This service is available to comprehensive and third-party, fire & theft policyholders.

- Trust Pilot: 4.5

What we like about Admiral electric car insurance

Admiral has plenty of EV-specific provisions, like covering batteries and standard charging cables against potential risks, and they also offer a handy out-of-charge EV recovery service.

Admiral provides up to 1,000 towards the replacement of your wallbox (the charging station installed at home) if its damaged due to an accident, vandalism, fire, or theft, further ensuring that your EV charging infrastructure is protected (this cover does not extend to hybrid vehicles).Going beyond EV-specific cover, they offer 5,000 personal injury cover for the policyholder and their partner. Admiral also provides a generous 200 compensation for personal effects damaged or stolen from the car.

Emergencies are unpredictable, and Admirals 24-hour emergency helpline, accessible to comprehensive and third-party, fire & theft policyholders, provides round-the-clock support.

Admiral provides a Bonus Match feature, which typically matches the No Claims Bonus when a second vehicle is insured with them.

Additionally, for households with more than one vehicle, Admirals MultiCar discount can be a cost-saving advantage. Admiral offers up to 90 days of European coverage which eliminates the hassle of seeking additional insurance for cross-border travel.

Aviva EV Insurance

- Best For: Out of Charge recovery

- Battery Cover: Aviva provides coverage against damage or theft of the EV battery.

- Charging Equipment: Avivas policy extends to the charging cables, whether theyre stored in your EV or in use, as well as home EV chargers installed in your garage.

- Out of Charge Recovery: Aviva offers an Out of Charge service. If your electric car runs out of power, a RAC mechanic will either provide a direct charge to help you reach a nearby station or transport you, your electric car, and any passengers to the closest charging point or even back home.

- Uninsured driver cover: Uninsured driver cover comes into play if you find yourself in an accident with a driver who does not have insurance, provided the fault doesnt lie with you.

- Vehicle recovery: In situations where your electric car needs recovery, Aviva ensures roadside repairs to make your vehicle roadworthy again. They also provide coverage up to 150 for alternate accommodation or public transport if necessary.

- Driving other cars: For those occasions when you might need to drive another persons car, Aviva offers cover provided youre 25 or older. Young EV drivers will have to secure separate insurance cover if they wish to drive another persons car.

- Trust Pilot: 4.0

What we like about Aviva electric car insurance

Aviva has a range of features tailored specifically to EV insurance. A highlight is their Out of charge recovery service. In the event your electric car runs out of charge, an RAC mechanic is dispatched to either provide an immediate charge to reach a nearby charging point or transport you, your passengers and your vehicle to the closest charging station or your home.

Aviva understands the uncertainties associated with new technologies and offers robust accidental damage protection. This means if your car suffers damage, including from an electrical surge while charging, theyve got you covered. Furthermore, Avivas policy extends beyond just the car. They cover essential electric vehicle accessories, like charging cables (either stored in your vehicle or in use) and chargers installed in your garage.Aviva has a strong multiple-car insurance offering. By adding more cars to your insurance, irrespective of them being electric or a traditional ice car, Aviva offers savings. You could receive a 10% discount for every additional vehicle insured under their Multicar cover.

Aviva also offers bicycle insurance for electric bikes or scooters through their partner, Cycleplan.

LV= EV Insurance

- Best For: Lifetime guarantee on repairs

- Battery Cover: LV electric car insurance policy offers dedicated protection for the battery against potential risks like accidental damage, fire, and theft.

- Charging Equipment: Electric cars are as reliant on their charging cables as they are on their batteries. LV provides comprehensive coverage for essential charging components such as cables, home charging stations, and charging adaptors. Whether its accidental damage or unfortunate events like fire and theft, LV= ensures your charging equipment is protected.

- Out of Charge Recovery: If you find yourself stranded due to an exhausted battery, LVs partnership with AFF guarantees recovery to the nearest charge point in the UK. The service is designed to get drivers back on the road swiftly, with no excess charges and without affecting the No Claims Discount.

- Accidental Damage Cover: Any dents or scratches on your EV will be taken care of, restoring your electric vehicle.

- Vandalism Promise: Vandalism can be distressing, but with LV=, any resultant claims will not impact your NCD, although an excess payment will be necessary.

- Uninsured Driver Promise: In the event of an accident with an uninsured driver where youre not at fault, LV ensures your NCD remains intact and you wont have to pay any excess.

- Trust Pilot: 4.5

What we like about LV electric car insurance

LV has designed its EV insurance product with features tailored to service the needs of the electric car owner.

A standout feature is the recovery service to the nearest charge point in the UK if your car runs out of charge. In collaboration with AFF, LV= ensures that drivers are quickly back on the road without any additional excess and with no impact on their No Claims Discount (NCD).

Protection extends to essential equipment, with coverage for charging cables, wall boxes, and adaptors against accidental damage, fire, and theft. Additionally, the policy recognises the importance of the electric car battery, offering protection for this rather expensive component of the electric car.

Another nice feature for EV owners is LV electric charger liability cover, LV= provides cover if an accident occurs due to the charging cable. In the event that your electric charging cable causes an accident while its attached to your car and in use, LV= provides liability cover, assuming you have taken reasonable steps to prevent such an accident. This coverage is essential for protecting EV owners against the potential risks associated with charging their vehicles in public spaces or at home

For long-term peace of mind, LV= offers a lifetime guarantee on repairs, as long as you use their recommended repairer service. And if your EV is undrivable, those who opt for hire car cover can get an electric or hybrid hire car during the downtime.

esure EV Insurance

- Best For: In-car entertainment cover

- Battery Cover: esure provides a comprehensive battery cover, ensuring that if your battery gets accidentally damaged, they have you covered.

- Charging Equipment: esure provides cable cover, so EV drivers can charge their cars with peace of mind, knowing that their charging accessories are insured.

- Out of Charge Recovery: esure partners with the RAC to provide an optional breakdown cover. If drivers opt for this cover and find themselves out of charge, the RAC will be ready to transport them and their vehicle to the nearest charging point (or charge roadside using the RAC Charging Boost feature).

- In-car Entertainment Cover: A neat option from Esure,helps protect the high-tech EV gadgets we love and use daily.

- Hire Car Cover: Offering a similar-sized courtesy car, electric and hybrid options, ensuring you are still on the road while your claim is processed.

- Key Cover: With the RAC stepping in again, this time assisting with lost, stolen, or damaged keys.

- Trust Pilot: 3.3

What we like about esure electric car insurance

esures electric car insurance is a well-rounded product, created with attention to the actual real-life needs of electric and hybrid vehicle drivers.They offer a variety of add-ons: Whether its the Hire Car Cover that ensures drivers have a replacement vehicle post-theft or an accident, or the Motor Legal Protection that provides legal support after mishaps. They offer a 5-Year Repair Guarantee that speaks to their confidence in service quality, and round-the-clock online claims which is a convenience for customers.

esure has a trusted partnership with the RAC, a renowned name in the recovery industry. This partnership guarantees that in the event an electric car runs out of charge, drivers will be helped quickly, reducing the stress of the dreaded range anxiety!

esure provides thorough coverage for crucial electric vehicle components. The Battery Cover means that users are protected against accidental damage to the EVs most expensive part! Additionally, the Power Cable Cover safeguards against damages or theft to charging cables.

Direct Line EV Insurance

- Best for: Exclusive partnerships and discounts

- Battery Cover: Direct Line provides protection for one of the most critical components of an electric vehicle: the battery.

- Charging Equipment: Direct Line offers comprehensive coverage for charging equipment. This includes protection for charging cables and home chargers against accidental damage, fire, and theft.

- Direct Line and Zoom EV: Direct Line customers are treated to an exclusive Zoom EV bundle. From discounts on home charging solutions, to cheaper public charging. The bundle also provides discounted parking rates.

- Innovative Community Charging: Direct Line supports Charger Sharing to help EV owners without a home charger. This community-led initiative matches them with nearby neighbours who have chargers, all done via an app.

- Added Value with GreenFlag: Direct Line partners with GreenFlag to offer customers a discount in the Green Flag store.

- Trust Pilot: 3.8

What we like about Direct Line electric car insurance

It seems like Direct Lines approach to electric car insurance offers plenty of add-ons to provide their customers with a variety of perks and discounts.First and foremost they get the basics right: Direct Line provides comprehensive battery and charging cover. The inclusion of cover for potential accidents caused by someone tripping over the charging cable, whether at home or elsewhere, shows they care about the small everyday risks as much as the big-ticket car issues that might happen.Their collaboration with Zoom EV adds more value for EV owners. With discounts on home and public charging, as well as parking. We also like Direct Lines emphasis on renewable energy with their partnerships offering rapid charging using 100% renewable energy. This shows Direct Lines commitment to the environment and green causes.

Its important to note that this list is not exhaustive of all the electric car insurance providers available in the market. There are many other companies that offer EV insurance, and we encourage EV owners to thoroughly research all options. Always consider factors such as cost, level of coverage and customer reviews.

What are the benefits of getting a specific EV insurance policy?

A dedicated EV insurance policy is a must for EV drivers because it covers the essential parts that are integral to the safety of your vehicle.

The Battery is the heart of the vehicle and while traditional car insurance policies might offer blanket cover, an EV-specific policy ensures the battery is properly covered.EV charger insurance coverage is another benefit of EV-specific insurance. As owners invest in home chargers they open up the risk of financial loss through potential damage or theft of an EV charger installed at home. EV insurance policies can offer protection for chargers. They also can cover the risk posed by charging cables, like someone tripping over them in public spaces.On the road, the possibility of an EV running out of charge can also be covered if your EV insurance features EV-specific breakdown cover. Its not just the hardware that benefits from EV-specific cover; the advanced technology integrated into EVs also needs special attention. The state-of-the-art driver assistance systems require comprehensive coverage to safeguard against malfunctions or damages.

How much does it cost to insure an electric car?

Historically, electric cars and vans often cost more to insure compared to their petrol or diesel counterparts. This higher cost is down to the more expensive and less available spare parts, coupled with a frequent need for specialist repairs. However, the landscape of electric car insurance has seen a bit of a shift recently, with several factors contributing to costs coming down for EV drivers.

The rising number of electric and hybrid vehicles on the roads has meant that theres a broader understanding of their maintenance needs, increased availability of parts, and a wider network of specialists capable of handling servicing and EV MOTs.

The UK governments impending 2035 ban on new petrol and diesel cars has spurred rapid growth in the EV market, which has also impacted insurance rates. As EVs become mainstream, insurance premiums have started to reduce.

To put this into numbers: MoneySupermarket data suggested that in 2021, the average annual insurance premium for electric cars stood at 1,238. By 2022, this figure witnessed a reduction, with premiums averaging 1,097 a year, marking a decrease of 141 in just a year.

Are electric cars expensive to insure? Well, even though electric car insurance rates have seen a decrease, theyre still more expensive than those of petrol and diesel vehicles. However, this gap is closing, and as EVs continue to dominate the automotive market, its expected that insurance premiums will further align or even potentially become more favourable for electric vehicle owners as time goes on.

What factors affect EV Insurance premiums?

Just as with traditional petrol cars, the insurance premiums for electric cars are influenced by a variety of factors. Some of these factors are common to all vehicles, while others are specific to EVs:

- Value of the VehicleTypically, EVs have had higher upfront costs compared to conventional vehicles, though this is changing. The higher the vehicles value, the higher the potential insurance premium, as insurers might have to pay out more in the event of a total loss.

- Cost of RepairsIn the past, the specialised nature of EVs meant that repairs could be more expensive, particularly if they involved high-tech components or the electric battery. However, as more mechanics become trained in EV repairs and parts become more available, this cost should go down.

- Battery CoverageThe battery is one of the most expensive components of an EV. Insuring it can influence premiums.

- Driving RangeEVs with a longer driving range might be seen as less risky, especially when it comes to potential accidents or issues related to running out of charge on the road.

- Safety Features and TechnologyMany EVs come equipped with advanced safety technologies, which can influence insurance premiums. Vehicles with features that reduce the likelihood of an accident or protect occupants if one occurs might benefit from lower premiums.

- LocationJust like with other cars, where you live and where the car is parked can influence premiums. Urban areas with higher traffic and crime rates might see higher premiums than rural areas.

- Driver ProfileThe age, driving history, and experience of the driver play a role. An EV driver with a history of accidents or traffic violations will likely face higher premiums than a driver with a clean record.

- Annual MileageThe more you drive, the higher the risk of an accident. If you drive your EV more than the average person, you might see higher premiums.

How can I get cheap EV insurance?

The best way to get cheap electric car insurance is with careful planning and awareness of the factors that affect the cost of a policy.

Research and Multiple QuotesYou have to cast a wide net when looking for electric car insurance. Prices can vary considerably between providers. By getting quotes from several insurance companies, youre better positioned to find a cheaper rate.

Bundling and Excess ChoicesYou might be able to bundle your car insurance with other policies you might hold, such as home insurance. On the excess insurance front (the amount you agree to pay out of pocket before the insurance covers the rest), a higher excess can lead to lower premiums. But remember to set an excess amount thats affordable in the event of a claim.

Safety Measures Modern EVs often come with advanced safety features, and some even have specific anti-theft mechanisms. Such enhancements can reduce the perceived risk for insurers and thus may qualify you for discounts.

Mileage and Driving HabitsFor those who dont clock up many miles on their EV, a low-mileage discount could be beneficial. Some insurers in the UK also provide telematics or black box policies. With these, your driving habits are monitored, usually via a device in the car or an app. Demonstrating good driving habits can lead to further reductions in premiums.

Look out for EVs in lower insurance groups EVs are categorised into 50 insurance groups, these insurance groups have a direct impact on the price you pay for your electric car insurance. If you want to get cheaper insurance then you need to buy an electric car that falls into one of the lower insurance groups. Many of the high-end EVs, such as the Tesla models or the Porche Tayacan, fall into the highest insurance group 50 category meaning that Porche Tayacan insurance and Tesla insurance are some of the most expensive out there.

The final word on the best EV insurance

Choosing the best insurance for your electric car is crucial. Its not just about finding a policy that covers the basics but ensuring it is tailored to the unique needs of EVs.

To determine the best EV insurance providers, we collaborated with the Electric Car Guides EV Focus Group, to garner insights from EV insurance customers. Their firsthand experiences identified the most important components of EV insurance:

- Battery Cover: The battery is one of the most vital parts of an EV.

- Charging Equipment Cover: As EVs require specific charging equipment, this needs to be covered.

- Running Out of Charge Recovery: The best EV insurance policy should provide support if you run out of charge.

- Liability for Charging Equipment: To cover the risk of someone tripping or other incidents.

- Replacement Courtesy Cars must be electric: Too many providers offer ICE car replacements.

We reviewed the dedicated EV insurance providers in the UK, the best providers are The AA, AXA, Admiral, Aviva, LV, Esure, and Direct Line. The AA emerged as a standout, not only covering all the basic EV requirements but also offering its own breakdown recovery service as an extra safeguard for EV owners.

However, the best insurance for one person might not be the best for another. EV owners should compare these aspects and consider factors like cost, customer service, and additional perks when making their decisions.

This article is intended solely for informational purposes and should not be considered as advice. It is important to consult the specific terms and conditions of an insurer before making any commitments to financial products.

Ready to dive even deeper...

John Ellmore

John is the Editor and Spokesperson for Electric Car Guide.

With over 20 years of writing experience, he has written for titles such as City AM, FE News and NerdWallet.com, covering various automotive and personal finance topics.

Johns market commentary has been covered by the likes of The Express, The Independent, Yahoo Finance and The Evening Standard.