Is there a lithium shortage in 2025

The Lithium Supply Crunch Doesnt Have to Stall Electric Cars

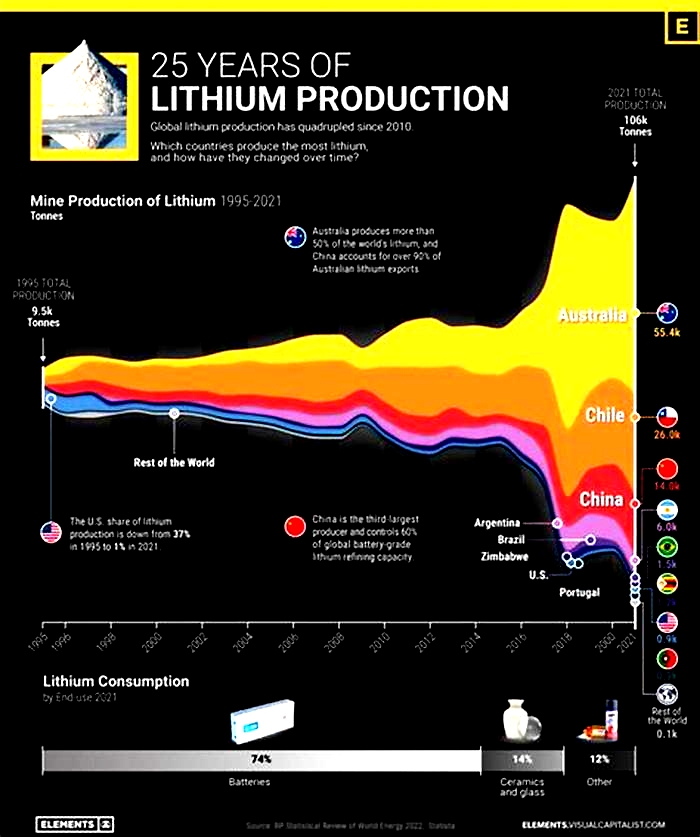

China is also the worlds leading producer of cathodes, battery cells, and battery packs, both for its domestic EV industry and for export. Japan and South Korea, too, are major exporters of battery packs.

In addition to the strategic risks stemming from the concentration in so few places of so much of the supply of critical materials, the logistics of the current global supply chain are very inefficient. Because of their weight, lithium-ion batteries are increasingly manufactured close to EV assembly plants. This means that huge volumes of ore or lithium carbonate are shipped long distances to China for refining and are then shipped back across oceans in the form of lithium hydroxide or cathodes to nations that manufacture battery cells and packs. Diversifying global sources of critical materials would not only make supply chains more resilient, but would also reduce the costs and carbon emissions associated with shipping.

Every major automotive OEM is scrambling to secure future sources of critical lithium materials. Tesla, for example, has signed a three-year agreement with Chinas Ganfeng, one of the worlds largest producers of lithium compounds. Volkswagen is seeking to create what former CEO Herbert Diess has called a full ecosystem of suppliers from lithium extraction to the assembly of batteries in Spain; the company has also entered into an agreement with the German-Australian company Vulcan Energy Resources to obtain lithium from Germanys Upper Rhine Valley region. Vulcan, meanwhile, has made preliminary supply agreements with Renault and Stellantis. Ford has agreed to buy 25,000 metric tons of lithium annually from the Argentina facility of Australia-based Lake Resources.

The Race to Develop Domestic Supply Chains

The recently passedInflation Reduction Act in the US illustrates another global trend reshaping the battery industrya race to create domestic, vertically integrated battery industries with locally produced critical materials. The US legislation provides incentives of up to $7,500 for the purchase of new EVs built in the US, Canada, or Mexico. But the offer comes with stringent local-content requirements. To qualify for half the incentive amount, EVs must eventually contain battery packs assembled in North America. To qualify for the other half, a certain portion of the critical minerals used in the batteries must come from nations with which the US has free-trade agreements. This requirement will be phased in and reach 80% in 2029. In addition, vehicles whose critical-minerals supply chain flows through foreign entities of concern will be disqualified from receiving this half of the incentive amount.

In the European Union, meanwhile, the European Battery Alliance, funded by the EU Commission, has taken several steps to secure lithium and other minerals critical to the energy transition. And in India, before approving and awarding incentives to proposed battery projects, the federal government requires assurances that they will meet certain thresholds for local content.

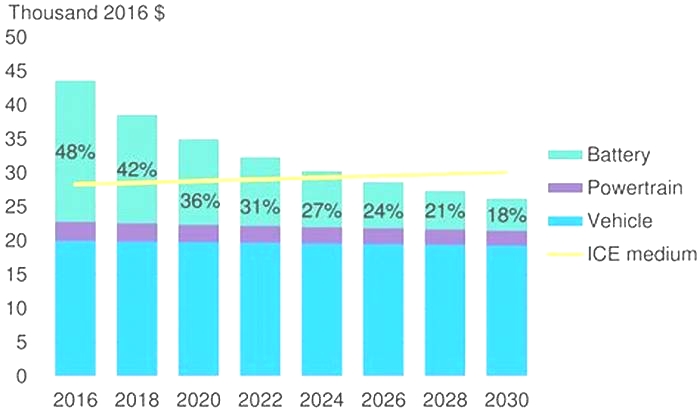

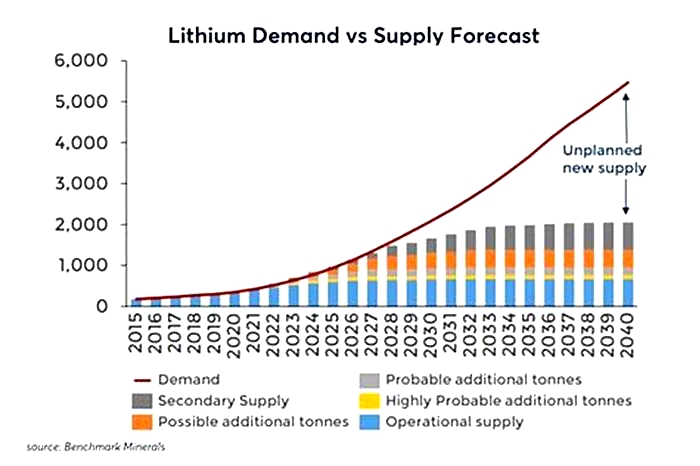

By 2035, the lithium supply gap is projected to be acuteat least 1.1 million metric tons, or 24% less than demand.

At the same time, nations with critical raw materials are seeking to leverage their reserves to build domestic battery industries. Indonesia, for example, supplies one-third of the worlds refined nickel. It wants to deploy new processes, such as high-pressure acid leaching, to refine more nickel into battery-grade metal. Indonesia also wants to develop downstream manufacturing. A consortium of state enterprises, including a mining company that owns a significant share of the nation's nickel reserves, has signed a memorandum of understanding with LG Energy Solution to invest in a $9 billion consortium to process the metal and manufacture cathode materials, cells, and finished batteries. It has also signed an MOU with Chinas Contemporary Amperex Technology (CATL), which has announced plans to invest in a $6 billion initiative with Indonesian partners to develop battery manufacturing, recycling facilities, and mining projects.

Its natural that nations with large lithium reserves will want a greater share of the economic wealth generated by the rechargeable-battery boom. The mining, initial processing, and refining of lithium account for 25% to 30% of the available profit pool for lithium-ion batteries. The manufacture of anodes, cathodes, and electrolytes accounts for a 20% to 25% share. Production of cells and assembled batteries represents 45% to 50% of the batteries' profit pool.

Addressing Environmental Risks

Before new lithium-mining operations can be brought online, the environmental hazards of mining must be addressed. Governments and stakeholders need to weigh the tradeoffs between minings impact on local environments and the benefits of a net reduction in CO2 emissions from vehicles.

New mining projects must be environmentally sustainable in order to compete in the face of stiffening regulations in global markets. Starting in 2024, for example, the EU will require importers to declare the CO2 footprints of batteries sold in the region. The EU will also set emission limits and require that a certain amount of lithium be recycled. In addition, the European Commission is considering establishing a battery passport, a technology platform that will enable everyone in the supply chain to share information on the manufacturing history of every battery sold in the EU.

Process innovations could make lithium extraction much more eco-friendly. Some new technologies and mining best practices hold promise for reducing the environmental impact to a level consistent with the highest environmental standards, such as those of the EU. For example, direct lithium extraction (DLE), in which most brine water is recycled, could greatly reduce the amount of water required.

Several pilot projects are underway to use DLE to recover lithium from naturally occurring geothermal brine deposits. Geothermal energy is used to extract the lithium, and the brine is then recycled back into the geothermal source. Vulcan Energy Resources and Cornish Lithium of the UK are among the companies investing in geothermal brine projects.

A Framework for Sustainable Lithium Development

Companies across the battery value chain must mobilize now to boost supplies and diversify their supply chains. Economic development and geopolitical pressures are creating the need for integrated, regional battery industries. In many cases, mining companies, refiners, battery manufacturers, and automotive OEMs will need to revamp their global manufacturing and sourcing footprints in order to bring more output closer to markets where EVs are sold. The US Inflation Reduction Act is set to kick off the next wave of capacity investments, supply chain reshuffling, and product portfolio adjustments. Other governments are likely to make moves in response.

To accomplish this mobilization and protect supplies, coalitions are needed. Miners, battery manufacturers, automakers, governments, and financiers must work together to ensure that desperately needed lithium extraction projects migrate from the possible to the probable category in terms of their likelihood of coming online. To be successful, extraction projects should apply a framework for success that includes the following actions:

- Bring best practices in environmental sustainability. International mining and manufacturing partners should bring state-of-the-art technologies and processes such as DLE to minimize water and soil contamination and reliance on fossil fuels. Global partners can help domestic companies implement systems for documenting and reporting their carbon footprints to comply with increasingly stringent regulations in key global markets.

- Create opportunities to develop downstream industries. International partners should work with governments to bring downstream industries closer to lithium reserves and make them part of regional supply chains. Mining companies, processors, and manufacturers of batteries and key components can provide advanced production processes, operating expertise, and access to international markets. Automotive OEMs can support local battery industries by committing to purchase large volumes of output on long-term contracts. Investors, such as financial institutions, sovereign funds, and private equity firms, can provide stable financing to build industrial capacity.

- Guarantee fair value for domestic stakeholders. To ensure that host governments and local communities benefit adequately from their natural resources, royalties, shares of profits, and other benefits should be substantial enough to secure popular support for the long term. International investors in battery projects can also contribute to broader economic development and industrial capabilities by investing in infrastructure, skills-training programs, and partnerships with education systems. National and municipal governments can provide financial support and other incentives and work with international consortia to ensure that projects help advance economic and social goals.

Meeting the explosive growth in demand for lithium products in the coming years poses a host of daunting challenges. But these challenges must be met if the transition to renewable energy and the global fight against climate change are to stay on course. We believe that public-private coalitions across the rechargeable-battery value chain can not only meet industrys needs for critical materials. They can also develop these resources in ways that are environmentally sustainable, advance the economic development agendas of governments, meet key localization requirements, and deliver a fair share of benefits for local communities.

Electric vehicle targets impossible without changes to lithium pipeline

Unlock the Editors Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Battery manufacturers are confronting a severe lithium shortage, highlighting the need to challenge Chinas dominance of raw material supply chains, an Australian lithium producer has warned.

Stuart Crow, chair of Lake Resources, said western companies and governments had failed to build adequate supply chains for lithium, making the sudden boom in electric vehicle manufacturing unsustainable.

There simply isnt going to be enough lithium on the face of the planet, regardless of who expands and who delivers, it just wont be there, he said. The carmakers are starting to sense that maybe the battery makers arent going to be able to deliver.

Lithium-ion batteries play a critical role for governments hoping to decarbonise their economies, and the west is working to loosen Chinas grip on the lithium supply chain and processing capacity in particular. Disruption from the war in Ukraine and subsequent sanctions imposed on Russia have also underlined the importance of supply security.

Lake Resources share price more than doubled in March, giving it a market capitalisation of A$2.5bn (US$1.9bn), after it signed a memorandum of understanding with the Japanese import-export group Hanwa to deliver 25,000 tonnes of lithium carbonate a year. On Monday, the company announced it had signed another non-binding offtake deal with US carmaker Ford.

Right now China owns basically 70-80 per cent of the entire supply chain for electric vehicles and lithium-ion batteries, and therefore energy storage, Crow said. The west has been remarkably slow to adopt a strategy to try and assist and secure a supply chain.

Daniel Morgan, a mining analyst at investment bank Barrenjoey, said it was impossible for the [EV production] targets being made by either carmakers or governments to be met. He added: Theres a great love of throwing out lofty targets, but where the rubber hits the road its not going to happen.

Lake Resources, which is listed on the Australian Securities Exchange, is developing a lithium production plant in Argentina. There it will use technology developed by US company Lilac Solutions, backed by Bill Gates, to extract lithium directly from brine, rather than via the more common evaporation method.

Climate Capital

Where climate change meets business, markets and politics.Explore the FTs coverage here.

Are you curious about the FTs environmental sustainability commitments?Find out more about our science-based targets here

It plans to produce 50,000 tonnes of lithium carbonate a year by 2025 and is focused on building supply chains that bypass China.

Lake Resources plant in Argentina has by itself yet to produce any lithium carbonate, despite having been set up in 2015. Crow said that was a result of the time it takes to develop lithium projects, which carmakers had not adequately factored in when setting their EV production targets.

The forecasts for the [lithium] deficit this year vary from 50,000 tonnes per annum out to 400,000 tonnes, on a market that looks potentially to produce 450,000 tonnes a year, he said. Anecdotally, were hearing stories of two very large battery makers in the market trying to source 150,000 tonnes [each] of lithium hydroxide this year. And with 450,000 tonnes of supply, its not going to happen.

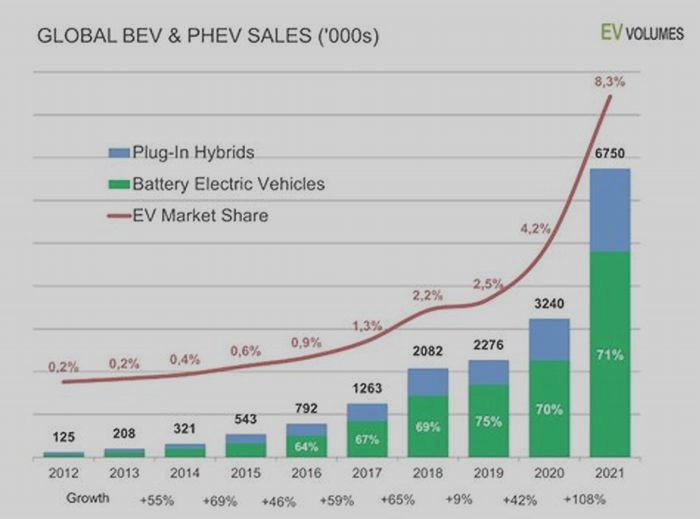

While the US wants half of all car sales to be EVs by 2030, the EU has proposed banning internal combustion engine car sales altogether by 2035. Major marques including Volkswagen, Ford, Stellantis, General Motors and Toyota have all announced ambitious targets to ramp up EV production and phase out petrol cars.

The International Energy Agency estimates global EV sales must reach 47mn a year by 2030 to ensure transport emissions are consistent with its sustainable development scenario, which would keep global warming well below 2C in line with the Paris climate accord.

Mining group Rio Tinto predicts demand for lithium will rise by 25-35 per cent a year over the next decade.

Barrenjoeys Morgan said 28mn EV sales by 2030 was a more realistic projection, but even that would not be possible with current announced lithium projects. Indeed, it would require lithium production to increase six-fold between now and 2030.

Theres eight years until 2030. We need to start hearing about new projects now, he said, adding that it was a great time to be a miner.