The EV Roadmap Planning Your Journey to Electric Vehicle Ownership

Advancing transportation electrification

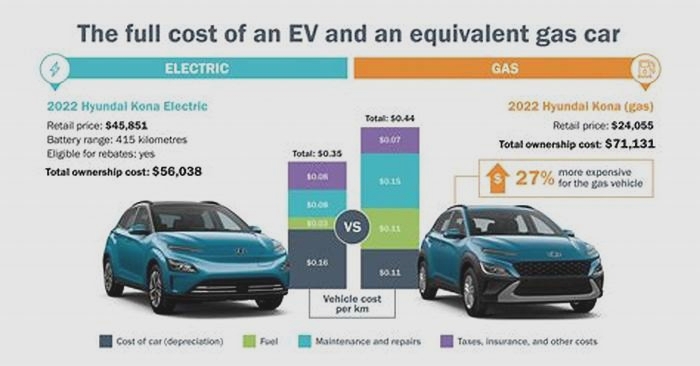

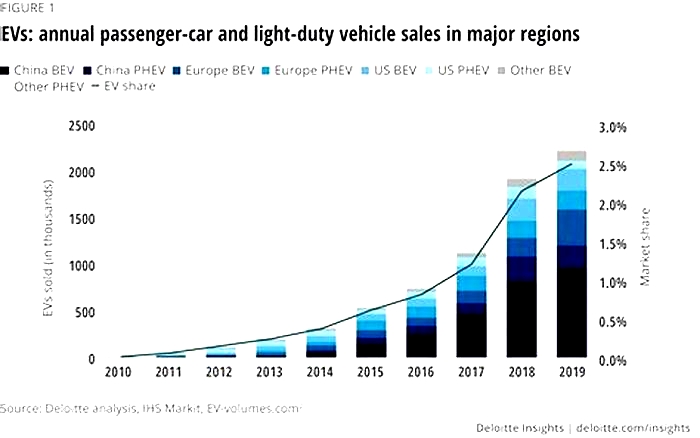

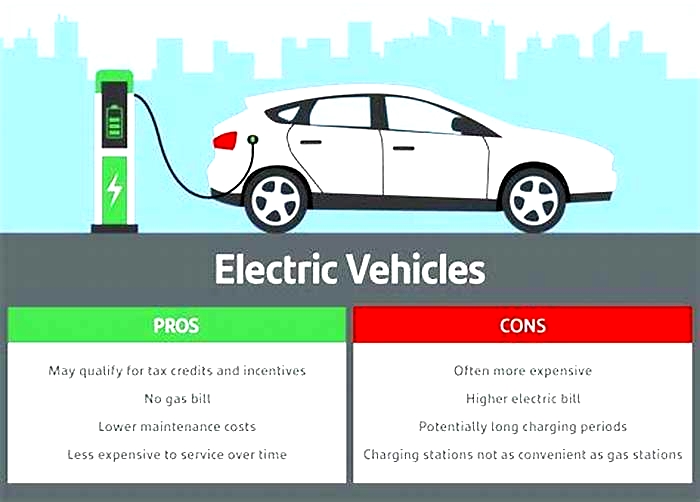

Electric vehicles (EVs) are an important component for the future of clean mobility. They lower greenhouse gas (GHG) emissions, improve air quality, and offer a cost competitive option to gasoline-powered vehicles due to lower fuel and maintenance costs. EV market growth has been expanding, spurred by State of California and local policies focused on reducing GHG emissions through electrification of the transportation network and through vehicle incentives.

The County of San Diego is committed to doing its part to increase the number of zero-emission vehicles on the road and improve access to charging infrastructure to provide clean mobility options for all residents. Learn more about the Countys efforts to increase clean mobilityoptions in the region.

Electric Vehicle Roadmap

The County of San Diegos commitment to sustainability is highlighted n the Board of Supervisors Strategic Initiatives, which identify that actively combating climate change through innovative or proven policies, green jobs, and sustainable facility construction or maintenance is a County priority. To further that commitment and improve air quality and health, and provide long-term economic benefits, on October 16, 2019, the Board of Supervisors adopted the Electric Vehicle Roadmap (EV Roadmap) to identify actions the County will take over the next decade to facilitate the adoption of clean mobility in the region.

The EV Roadmap contains six goals and 11 recommendations that leverage the Countys land use authority, permitting processes, and outreach platforms in order to increase EV ownership and charging installations in the unincorporated area and at County facilities.

Implementation of the EV Roadmap supports the Countys 2018 Climate Action Plan sustainability measures and puts the County on a path to meet state vehicle and charging infrastructure goals in the next decade. EV Roadmap efforts prioritize reaching underserved communities to increase awareness of vehicle incentives and the accessibility of charging infrastructure with priority populations. More information on the Boards approval of the EV Roadmap can be found here.

The plan, which received a 2020 Achievement Award in the category of County Resiliency: Infrastructure, Energy & Sustainability from the National Association of Counties, exemplifies the Countys commitment to sustainability as highlighted in itsStrategic Initiatives.

The purpose of this EV Roadmap website is to highlight the Countys commitment to transportation electrification and track progress on the programs implementation efforts.

Implementation Updates

The County reports annually on implementation efforts of the EV Roadmap since adoption in 2019. You can read implementation progress through the last calendar year in the letters submitted to the Board, below.

Helping Consumers Understand Electric Vehicles

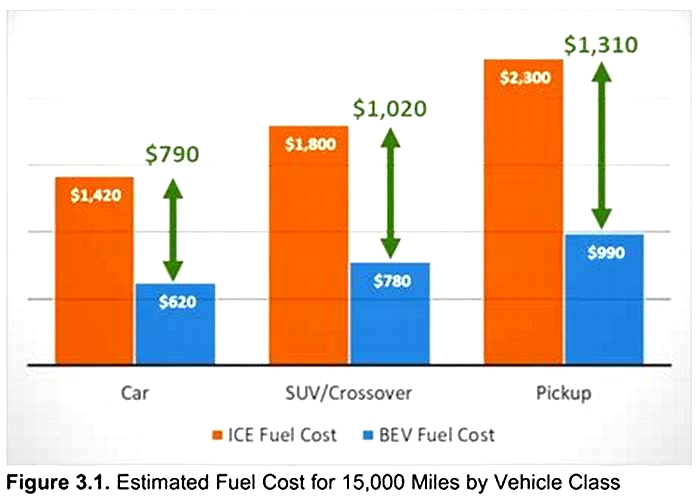

TheEV Consumer Guideprovides technical support, education, and outreach to increase EV use and charging station installations throughout the region. This consolidated source of vehicle electrification information provides information about the benefits of EV ownership, a fuel cost comparison calculator, tools to help search for and compare EV models that fit your lifestyle, charger installation procedures, and available incentives.

Thailands Roadmap to Accelerating Electric Vehicle Industry Growth

In the past years, the electric vehicle (EV) industry in Thailand has undergone accelerated development. Although there is some resistance to fully adopting EVs due to factors like consumer preference, both the public and private sectors are remaining proactive by investing in the holistic development of the industry.

As the market opens to new entrants, it will be important for stakeholders to inform business decisions with accurate information regarding the current landscape of Thailands EV industry. Moreover, potential investors should become familiar with the investment opportunities that are present within the country. For instance, there exists an opportunity for interested parties to explore investments in infrastructure which will help drive EV adoption. Read this excerpt from our latest white paper, Electric Vehicle Development and Deployment in Thailand: Moving Towards an Acceleration of EV Adoption, which you can read in full here.

Current Landscape of Thailands EV IndustryThailand has shown fast-paced growth in Southeast Asia for EV sales, with projections relatively strong for the next five years. As of 2020, there were 1,897 electric vehicles sold in Thailand with a projected growth rate of ~45% to reach ~12,500 units in 2025.The electric vehicle sales value in 2020 was estimated at ~134 million USD, and it is expected that market value will reach ~886 million USD by 2025, driven by strong investments from both the public and private sectors.

There are 22 EV models available in Thailand as of 2022. The car market is dominated by German and Chinese brands such as BMW, Audi, Porsche, BYD, and MG. Chinese brands have a major advantage price-wise due to the Free Trade Agreement (FTA) between Thailand and China, enabling 0% import tax for Chinese vehicles.

Development of EV Infrastructure in Thailand

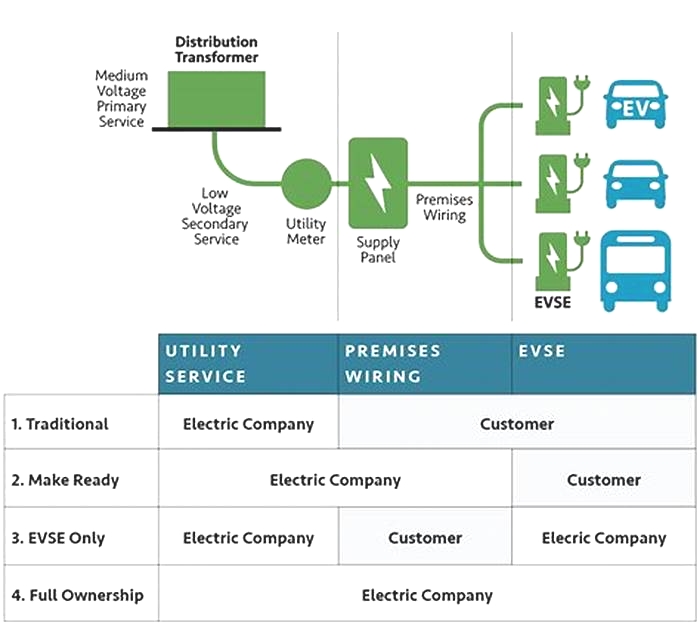

To further drive the adoption of electric vehicles in Thailand, the government and associations such as the Electric Vehicle Association of Thailand (EVAT) are promoting the development of EV charging infrastructure.

The National Energy Policy Commission has encouraged the Time of Use (TOU) charging scheme for EVs being charged at home or in charging stations to minimize electricity usage during the on-peak period of 9:00 a.m. to 10:00 p.m. During the on-peak period, the electricity price is 4.10 THB (0.12 USD) per unit, compared to the off-peak periods which are cheaper at 2.6 THB (0.08 USD) per unit. However, new charging rates were announced in June 2021 with a standardized rate of 2.6 THB per unit (0.08 USD), disregarding on-peak and off-peak periods.

In addition, the BOI is also promoting investments in the EV charging station business with a five-year corporate tax exemption for charging station investors.

Thailands Current EV Infrastructure

As of September 2021, there were 693 EV charging stations in Thailand, with normal chargers (AC outlets) dominating the market at 1,511 units (66%), compared to fast chargers (DC outlets) at 774 units (44%). The AC charging standard is adopted from IEC 62196-2, with AC Type 2 as the standardized AC charger, while DC chargers have complied with the CCS configuration (Combined Charging System).

The major EV charging operators are Oil & Gas companies, electricity state enterprises, and green energy companies. Energy Absolute (EA), a Thai-listed conglomerate, is one of the most active players in the market with over 417 charging locations across Thailand. Charging Station and Evolt are the second and third most active players in the market with 68 and 49 locations, respectively. PTT, the largest Oil & Gas company in the country, also operates its own PTT EV charging stations with 30 locations across Thailand as part of its non-oil business growth plans. PTT aims to construct 300 EV charging stations in the Greater Bangkok areas within 2023, in addition to their network of ~2,000 traditional gas stations across the country.

According to the EVAT, the distribution of EV charging stations is concentrated in central provinces such as Bangkok, Nonthaburi, and Samutprakarn, which make up around 70% of the total locations across Thailand. The number of charging stations in other regions, such as North, East, and South Thailand, remains low.

In addition, EV charger manufacturers can also take the chance to enter the Thai market and produce locally. Currently, the main pain point for stakeholders is that EVC equipment is mostly imported with high taxation, as the development of regulations and incentives for EVCs is still nascent compared to the EV market itself. Local products are also not at a comparable quality level with their imported counterparts, translating into a possible advantage for local players who could raise the quality level while offering more competitive prices leveraging on lower cost of local production.

To get further insight into business trends related to the automotive industry across economies in Asia, subscribe to our newsletter here and check out these reports:Our EV Vision

Public Carparks

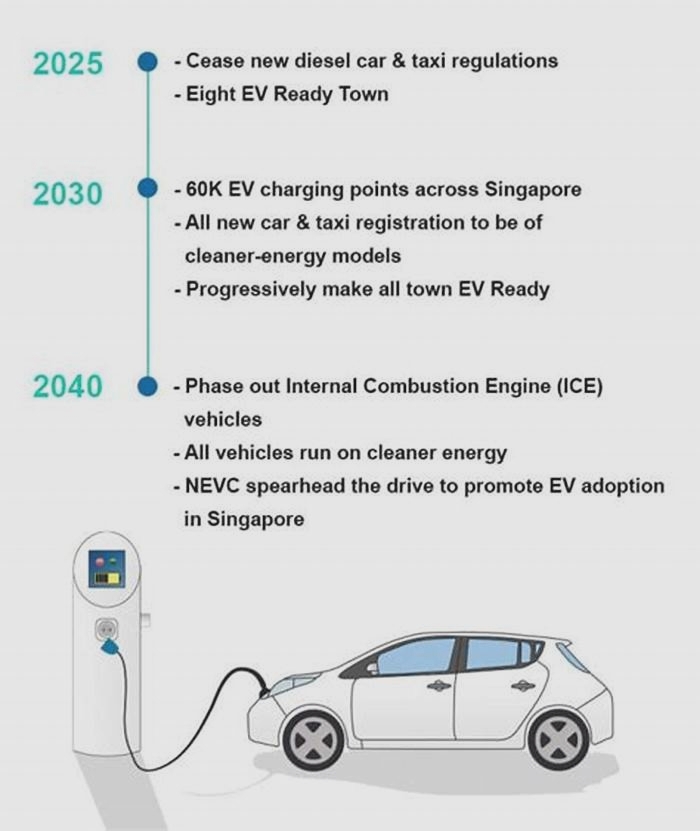

Every HDB town will be EV-Ready by 2025 with close to 2,000 HDB carparks to be fitted with charging points. Over one in three HDB carparks are now equipped with EV chargers.

While overnight slow charging will continue to be the predominant charging strategy for most vehicles, high-powered fast chargers will be needed to meet the needs of certain segments of high mileage EVs such as taxis or commercial vehicle fleets. The Government will kickstart the deployment of fast chargers at HDB carparks in commercial complexes, Town Centres / Neighbourhood Centre and JTCs premises, which are frequented by fleet drivers during their breaks, and are close to amenities such as hawker centres and coffeeshops.

Private Premises

For non-landed private residences such as condominiums and private apartments, installing chargers can be a challenge as the number of residents who ownEVs are likely to be small. To incentivise charger installation in these carparks, anEV Common Charger Granthas been introduced to kickstart the installation of shared charging infrastructure.

Motorists living in private residences can work with the property owner or Management Committee to get the necessary approvals to install EV chargers in the premise. Motorists living in landed properties who wish to procure an EV charger should engage Licensed Electrical Workers (LEW) and equipment specialists to install the EV charger at their property or approach EV Charging Operators for their services.

Currently, EV Charging Operators such as Shell, Strides, ComfortDelgro Engineering, Charge+ and SP Mobility are already providing charging services islandwide, in places such as petrol stations, shopping malls, office buildings and industrial estates.

Carparks in New Developments

We are continuously monitoring EV adoption and studying measures to ensure that new developments can provide sufficient electrical capacity for EV charging in their carparks. These new developments include upcoming HDB towns, commercial buildings and private residences such as condominiums.

Future scenarios of Chinas electric vehicle ownership: A modeling study based on system dynamic approach

Azadeh, A., Neshat, N., Rafiee, K., & Zohrevand, A. M. (2011). An adaptive neural network-fuzzy linear regression approach for improved car ownership estimation and forecasting in complex and uncertain environments: The case of Iran. Transportation Planning and Technology, 35(2), 221240.

Article Google Scholar

Bao, H., Guo, X., Liang, J., Lan, F., Li, J., Chen, G., & Mo, J. (2022). Relevance vector machine with optimal hybrid kernel function for electric vehicles ownership forecasting: The case of China. Energy Reports, 8, 988997.

Article Google Scholar

CATARC. (2021). China automotive industry yearbook 2021. China Automotive Technology & Research Center (CATARC).

Chen, X. (2020). Purchase tax exemption extending 2 years. Automotive Observer, 5, 78.

Google Scholar

CNBS. (2021). China statistical yearbook 20172021. National Bureau of Statistics of China (CNBS).

Dong, F., & Liu, Y. (2020). Policy evolution and effect evaluation of new-energy vehicle industry in China. Resources Policy, 67, 101655.

Article Google Scholar

Gan, Y., Lu, Z., Cai, H., Wang, M., He, X., & Przesmitzki, S. (2020). Future private car stock in China: Current growth pattern and effects of car sales restriction. Mitigation and Adaptation Strategies for Global Change, 25(3), 289306.

Article Google Scholar

Guan, Y., Shan, Y., Huang, Q., Chen, H., Wang, D., & Hubacek, K. (2021). Assessment to Chinas recent emission pattern shifts. Earths Future, 9(11), e2021EF002241.

Article CAS Google Scholar

Guo, J. (2020). Research on the actual operation of electric vehicles in China: The average daily travel of private passenger vehicles is about 65 kilometers. Accessed from 6 Jan 2022 https://zhuanlan.zhihu.com/p/150357157.

Hao, X., Lin, Z., Wang, H., Ou, S., & Ouyang, M. (2020). Range cost-effectiveness of plug-in electric vehicle for heterogeneous consumers: An expanded total ownership cost approach. Applied Energy, 275, 115394.

Article Google Scholar

Hu, B., Na, L. I., Liu, Y., & Zheng, L. (2014). Prediction on private cars in Wuhan city based on system dynamics model. Journal of Wuhan University Technology, 36(1), 6568.

Google Scholar

iResearch. (2021). White book of China's new energy vehicle industry 2020. Accessed from 6 Jan 2022 https://report.iresearch.cn/report_pdf.aspx?id=3713.

Jiang, S., Zhang, L., Hua, H., Liu, X., Wu, H., & Yuan, Z. (2021). Assessment of end-of-life electric vehicle batteries in China: Future scenarios and economic benefits. Waste Management, 135, 7078.

Article Google Scholar

Kester, J., Noel, L., Zarazua de Rubens, G., & Sovacool, B. K. (2018). Policy mechanisms to accelerate electric vehicle adoption: A qualitative review from the Nordic region. Renewable Sustainable Energy Reviews, 94, 719731.

Article Google Scholar

Koot, M., & Wijnhoven, F. (2021). Usage impact on data center electricity needs: A system dynamic forecasting model. Applied Energy, 291, 116798.

Article Google Scholar

Li, K., Ma, T., Wei, G., Zhang, Y., & Feng, X. (2019). Urban Industrial water supply and demand: System dynamic model and simulation based on cobb-douglas function. Sustainability, 11(21), 5893.

Article Google Scholar

Liu, X., Sun, X., Zheng, H., & Huang, D. (2021). Do policy incentives drive electric vehicle adoption? Evidence from China. Transportation Research Part A: Policy and Practice, 150, 4962.

Google Scholar

Ma, L., Wu, M., Tian, X., Zheng, G., Du, Q., & Wu, T. (2019). Chinas provincial vehicle ownership forecast and analysis of the causes influencing the trend. Sustainability, 11(14), 3928.

Article Google Scholar

OECD. (2022). Real GDP long-term forecast. Organisation for Economic Co-operation and Development (OECD). Accessed from 6 Jan 2022 https://data.oecd.org/gdp/real-gdp-long-term-forecast.htm

Rietmann, N., Hgler, B., & Lieven, T. (2020). Forecasting the trajectory of electric vehicle sales and the consequences for worldwide CO2 emissions. Journal of Cleaner Production, 261, 121038.

Article CAS Google Scholar

SCPRC. (2020). New energy vehicle industry development plan 20212035. State council of the People's Republic of China (SCPRC). Accessed from 6 Jan 2022 http://www.gov.cn/zhengce/content/2020-11/02/content_5556716.htm.

SCPRC. (2021). Notice on subsidy policies for the promotionnew energy vehicles in 2022 State Council of the People's Republic of China (SCPRC). Accessed from 6 Jan 2022 http://www.gov.cn/zhengce/zhengceku/2021-12/31/content_5665857.htm.

UNDESA. (2019). World population prospects. United Nations Department of Economic and Social Affairs (UNDESA). Accessed from 6 Jan 2022 https://population.un.org/wpp2019/Download/Standard/Population/.

Wang, N., Tang, L., Zhang, W., & Guo, J. (2019). How to face the challenges caused by the abolishment of subsidies for electric vehicles in China? Energy, 166, 359372.

Article Google Scholar

Whelan, G. (2007). Modeling car ownership in Great Britain. Transportation Research Part A: Policy and Practice, 41(3), 205219.

Google Scholar

Xiong, Y., & Wang, L. (2020). Policy cognition of potential consumers of new energy vehicles and its sensitivity to purchase willingness. Journal of Cleaner Production, 261, 121032.

Article Google Scholar

Yuan, R., Guo, F., Qian, Y., Cheng, B., Li, J., Tang, X., & Peng, X. (2022). A system dynamic model for simulating the potential of prefabrication on construction waste reduction. Environmental Science and Pollution Research, 29(9), 1258912600.

Article Google Scholar

Yuan, X., & Cai, Y. (2021). Forecasting the development trend of low emission vehicle technologies: Based on patent data. Technological Forecasting Social Change, 166, 120651.

Article Google Scholar

Zeng, Y., & Hesketh, T. (2016). The effects of Chinas universal two-child policy. The Lancet, 388(10054), 19301938.

Article Google Scholar

Zhang, X. W., & Chang, J. Y. (2012). Research on urban car ownership prediction based on PCA-BP neural network. Computer Simulation, 29(12), 376379.

Google Scholar

Zhiyan Consulting. (2021). Analysis on the current situation and investment scale of China's new energy vehicle charging (changing) facilities in 2020. Accessed from 6 Jan 2022 https://www.chyxx.com/industry/202108/966512.html.

Zhu, Z., & Du, H. (2018). Forecasting the number of electric vehicles: A case of Beijing. IOP Conference Series Earth Environmental Science, 170, 042037.

Article Google Scholar