The Future of Electric Vehicle Charging Infrastructure What to Expect

In the regions where electric trucks are becoming commercially available, battery electric trucks can compete on a TCO basis with conventional diesel trucks for a growing range of operations, not only urban and regional, but also in the heavy-duty tractor-trailer regional and long-haul segments. Three parameters that determine the time at which TCO parity is reached are tolls; fuel and operations costs (e.g. the difference between diesel and electricity prices faced by truck operators, and reduced maintenance costs); and CAPEX subsidies to reduce the gap in the upfront vehicle purchase price. Since electric trucks can provide the same operations with lower lifetime costs (including if a discounted rate is applied), the time horizon in which vehicle owners expect to recuperate upfront costs is a key factor in determining whether to purchase an electric or conventional truck.

The economics for electric trucks in long-distance applications can be substantially improved if charging costs can be reduced by maximising off-shift (e.g. night-time or other longer periods of downtime) slow charging, securing bulk purchase contracts with grid operators for mid-shift (e.g.during breaks), fast (up to 350kW), or ultra-fast (>350kW) charging, and exploring smart charging and vehicle-to-grid opportunities for extra income.

Electric trucks and buses will rely on off-shift charging for the majority of their energy. This will be largely achieved at private or semi-private charging depots or at public stations on highways, and often overnight. Depots to service growing demand for heavy-duty electrification will need to be developed, and in many cases may require distribution and transmission grid upgrades. Depending on vehicle range requirements, depot charging will be sufficient to cover most operations in urban bus as well as urban and regional truck operations.

The major constraint to rapid commercial adoption of electric trucks in regional and long-haul operations is the availability of mid-shift fast charging. Although the majority of energy requirements for these operations could come from off-shift charging, fast and ultra-fast charging will be needed to extend range such that operations currently covered by diesel can be performed by battery electric trucks with little to no additional dwell time (i.e. waiting). Regulations that mandate rest periods can also provide a time window for mid-shift charging if fast or ultra-fast charging options are available en route: the EuropeanUnion requires 45minutes of break after every 4.5hours of driving; the UnitedStates mandates 30minutes after 8hours.

Most commercially available direct current (DC) fast charging stations currently enable power levels ranging from 250-350kW. The European Unions Alternative Fuels Infrastructure Regulation (AFIR) aims to enable mid-shift charging across the EUs core TEN-T network, which covers 88% of total long-haul freight activity, and along other key freight corridors. The provisional agreement reached by the European Council and Parliament includes a gradual process of infrastructure deployment for electric heavy-duty vehicles starting in 2025. Recent studies of power requirements for regional and long-haul truck operations in the UnitedStates and Europe find that charging power higher than 350kW, and as high as 1MW, may be required to fully recharge electric trucks during a 30- to 45-minute break.

Recognising the need to scale up fast or ultra-fast charging as a prerequisite for making both regional and, in particular, long-haul operations technically and economically viable, in 2022 Traton, Volvo, and Daimler established an independent joint venture, Milence. With EUR500million in collective investments from the three heavy-duty manufacturing groups, the initiative aims to deploy more than 1700 fast (300 to 350kW) and ultra-fast (1MW) charging points across Europe.

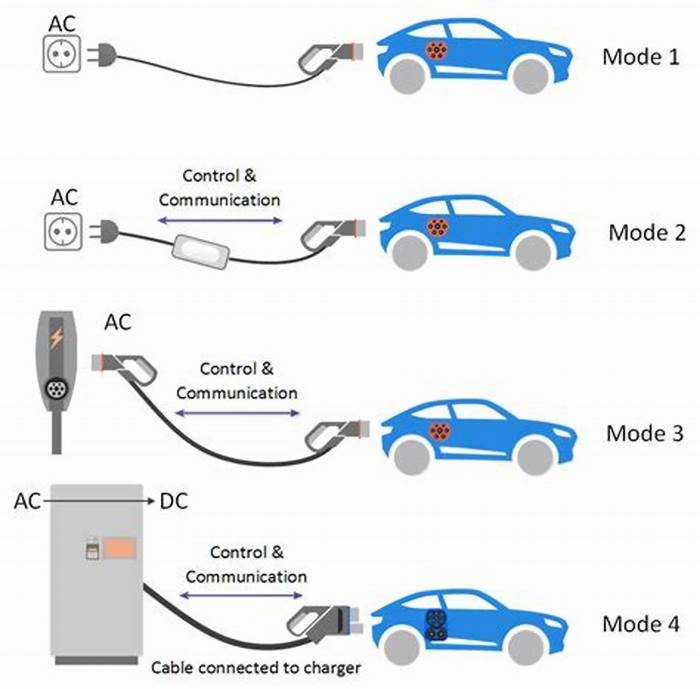

Multiple charging standards are currently in use, and technical specifications for ultra-fast charging are under development. Ensuring maximum possible convergence of charging standards and interoperability for heavy-duty EVs will be needed to avoid the cost, inefficiency, and challenges for vehicle importers and international operators that would be created by manufacturers following divergent paths.

In China, co-developers China Electricity Council and CHAdeMOs ultra ChaoJi are developing a charging standard for heavy-duty electric vehicles for up to several megawatts. In Europe and the UnitedStates, specifications for the CharIN Megawatt Charging System (MCS), with a potential maximum power of 4.5MW, are under development by the International Organization for Standardization (ISO) and other organisations. The final MCS specifications, which will be needed for commercial roll-out, are expected for 2024. After the first megawatt charging site offered by Daimler Trucks and Portland General Electric (PGE) in 2021, at least twelve high-power charging projects are planned or underway in the United States and Europe, including charging of an electric Scania truck in Oslo, Norway, at a speed of over 1MW, Germanys HoLa project, and the Netherlands Living Lab Heavy-Duty and Green Transport Delta Charging Stations, as well as investments and projects in Austria, Sweden, Spain and the United Kingdom.

Commercialisation of chargers with rated power of 1MW will require significant investment, as stations with such high-power needs will incur significant costs in both installation and grid upgrades. Revising public electric utility business models and power sector regulations, co-ordinating planning across stakeholders and smart charging can all help to manage grid impacts. Direct support through pilot projects and financial incentives can also accelerate demonstration and adoption in the early stages. A recent study outlines some key design considerations for developing MCS rated charging stations:

- Planning charging stations at highway depot locations near transmission lines and substations can be an optimal solution for minimising costs and increasing charger utilisation.

- Right-sizing connections with direct connections to transmission lines at an early stage, thereby anticipating the energy needs of a system in which high shares of freight activity have been electrified, rather than upgrading distribution grids on an ad-hoc and short-term basis, will be critical to reduce costs. This will require structured and co-ordinated planning between grid operators and charging infrastructure developers across sectors.

- Since transmission system interconnections and grid upgrades can take 4-8 years, siting and construction of high-priority charging stations will need to begin as soon as possible.

Alternative solutions include installing stationary storage and integrating local renewable capacity, combined with smart charging, which can help reduce both infrastructure costs related to grid connection and electricity procurement costs (e.g.by enabling truck operators to minimise cost by arbitraging price variability throughout the day, taking advantage of vehicle-to-grid opportunities, etc.).

Other options to provide power to electric heavy-duty vehicles (HDVs) are battery swapping and electric road systems. Electric road systems can transfer power to a truck either via inductive coils3 in a road, or through conductive connections between the vehicle and road, or via catenary (overhead) lines. Catenary and other dynamic charging options may hold promise for reducing the uncertainty of system-level costs in the transition to zero-emission regional and long-haul trucks, competing favourably in terms of total capital and operating costs. They can also help to reduce battery capacity needs. Battery demand can be further reduced, and utilisation further improved, if electric road systems are designed to be compatible not only with trucks but also electric cars. However, such approaches would require inductive or in-road designs that come with greater hurdles in terms of technology development and design, and are more capital intensive. At the same time, electric road systems pose significant challenges resembling those of the rail sector, including a greater need for standardisation of paths and vehicles (as illustrated with trams and trolley buses), compatibility across borders for long-haul trips, and appropriate infrastructure ownership models. They provide less flexibility for truck owners in terms of routes and vehicle types, and have high development costs overall, all affecting their competitiveness relative to regular charging stations. Given these challenges, such systems would most effectively be deployed first on heavily used freight corridors, which would entail close co-ordination across various public and private stakeholders. Demonstrations on public roads to date in Germany and Sweden have relied on champions from both private and public entities. Calls for electric road system pilots are also being considered in the China, India, the United Kingdom and the United States.

The future of electric vehicle charging infrastructure

International Energy Outlook 2021: Data Tables (20202050)Transportation Sector Tables (US Energy Information Administration, 2021); https://go.nature.com/3s7EkFp

Ritchie, H. Cars, planes, trains: where do CO2 emissions from transport come from? Our World in Data https://go.nature.com/3uinFSi (2020).

Global EV Outlook 2021 (International Energy Agency, 2021); https://go.nature.com/3ggU5Es

DeSilver, D. Todays electric vehicle market: slow growth in U.S., faster in China, Europe. Pew Research Center https://go.nature.com/34kDJI5 (2021).

Fact sheet: President Biden announces steps to drive American Leadership forward on clean cars and trucks. The White House https://go.nature.com/3AO9MMJ (2021).

Ewing, J. What if highways were electric? Germany is testing the idea. New York Times https://go.nature.com/3s1B8e8 (August 2021).

The rails. Elonroad https://go.nature.com/3oHcLBL (2021).

Morris, C. South Korean electric buses use dynamic wireless charging. Charged https://go.nature.com/3rgsN7s (August 2013).

Hampel, C. ElectReon Wireless progresses dynamic charging in Israel. Electrive https://go.nature.com/32P9vwx (2019).

Slovick, M. Dubai tests electric buses that can pick up charge while on the move. Electronic Design https://go.nature.com/3IUqPPV (2020).

Worlds first wireless charging road for trucks begins operations in Sweden. Automotive EV https://go.nature.com/3Jhcqh0 (2020).

Hubbard, B. EVs charged wirelessly as they drive at Arena del Futuro circuit in Italy. WhichEV https://go.nature.com/3AT4DDg (2021).

Schmidt, B. Volkswagen leads consortium to develop wireless road charging for electric cars. The Driven https://go.nature.com/3sczN4B (2021).

Eisenstein, P. A. Michigan pilot program to let EVs charge while driving. The Detroit Bureau https://go.nature.com/35Iko4n (2021).

INCIT-EV Project: innovative electric charging solutions to be tested in Europe. INCIT EV https://go.nature.com/3JmvP0e (2020).

Jensen, M. USU launches NSF-funded engineering research center for electrified transportation. Utah State University https://go.nature.com/3rgf6Fy (2020).

Sims, A. $13.5M boost for leading EV charging research. University of Auckland https://go.nature.com/3Gjy8ir (2021).

Tesla, N. In Trans. American Institute of Electrical Engineers Vol. VIII, 266319 (IEEE, 1891).

Tesla, N. Electric railway system. US patent 514972 (1894).

Hutin, M. & Leblanc, M. Transformer system for electric railways. US patent 527857 (1894).

Bolger, J. G. Supplying power to vehicles. US patent 3914562 (1975).

Shladover, S. E. IEEE Trans. Intell. Transp. Syst. 8, 584592 (2007).

Article Google Scholar

Green, A. W. & Boys, J. T. In Proc. IEEE International Conference on Power Electronics and Variable-Speed Drives 694699 (IEEE, 1994).

Huh, J., Lee, S., Park, C., Cho, G. H. & Rim, C. T. In Proc. IEEE Energy Conversion Congress and Exposition (ECCE) 647651 (IEEE, 2010).

Kissin, M. L. G., Hao, H. & Covic, G. A. In Proc. IEEE Energy Conversion Congress and Exposition (ECCE) 18441850 (IEEE, 2010).

Onar, O. C. et al. In Proc. IEEE Applied Power Electronics Conference (APEC) 30733080 (IEEE, 2013).

Choi, S. Y., Gu, B. W., Jeong, S. Y. & Rim, C. T. IEEE J. Emerg. Sel. Top. Power Electron. 3, 1836 (2015).

Article Google Scholar

Cirimele, V. et al. IEEE Trans. Veh. Technol. 69, 25012512 (2020).

Article Google Scholar

Hannon, K. Could roads recharge electric cars? The technology may be close. New York Times (November 2021).

Laporte, S., Coquery, G., Deniau, V., Bernardinis, A. D. & Hautire, N. World Electr. Veh. J. 10, 84 (2019).

Article Google Scholar

Kumar, A. et al. In Proc. IEEE Wireless Power Transfer Conference (WPTC) 14 (IEEE, 2015).

Lu, F., Zhang, H., Hofmann, H. & Mi, C. IEEE Trans. Power Electron. 30, 60116014 (2015).

Article Google Scholar

Sinha, S., Regensburger, B., Kumar, A. & Afridi, K. K. IEEE Trans. Transp. Electrification 5, 10401059 (2019).

Article Google Scholar

Sinha, S., Kumar, A., Regensburger, B. & Afridi, K. K. IEEE J. Emerg. Sel. Top. Power Electron. 8, 20222040 (2020).

Article Google Scholar

Limb, B. J. et al. IEEE Trans. Transp. Electrification 5, 135146 (2019).

Article Google Scholar

EV Infrastructure in India: What to Expect By 2030

The Indian government aims to have EVs comprise 30% of new private vehicle registrations, amounting to 8 crore EVs, by 2030. To support this dramatic rise in EV adoption, India will need a total of 39 lakh public and semi-public charging stations, for a ratio of 1 station per 20 vehicles.

The current ratio approximately 1 charging station per 135 EVs is significantly lower than the global ratio of 1 charging station per 6 to 20 EVs; this shortage in charging stations could push India to be 40% behind its EV 30@30 vision.

To remedy this, the government has implemented a series of policies and incentives related to EV charging infrastructure, which affects all stakeholders in the EV ecosystem.

To promote a better understanding of how EV charging infrastructure can shape India's electric mobility by 2030, this article addresses the following questions:

- Why does India need to prioritize the development of its EV charging infrastructure?

- What is the current state of EV charging infrastructure in India, and what challenges does the country face in implementing widespread EV charging infrastructure?

- How does the government plan to improve EV charging infrastructure by 2030?

Electrifying India's Mobility: Preparing for 2030

Indias charging infrastructure requires urgent attention. A robust nationwide charging network is crucial to promoting ongoing electric vehicle adoption in India, both because it can help EV owners charge their vehicles quickly and conveniently, and, even more critically, because it will eliminate drivers concerns about running out of charge. This is key because range anxiety is still a primary deterrent against EV adoption.

The Indian government has launched many EV charging infrastructure initiatives. Most notably, the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme provides incentives for EV adoption and charging infrastructure growth. The government has further accelerated EV adoption by setting up the National Electric Mobility Mission Plan (NEMMP), which incentivizes EV purchases.

However, the success of these government initiatives for charging infrastructure depends on private sector investment. The government alone cannot create a robust and extensive charging network on its own. Private sector players, including charging infrastructure providers and resident welfare associations (RWAs), should contribute to charging infrastructure development as well.

Private sector investment may have the additional benefit of fostering innovative business models such as battery swapping and smart charging, which can make charging more affordable and convenient for EV owners. This, however, may be easier said than done.

Identifying EV Infrastructure Roadblocks in India

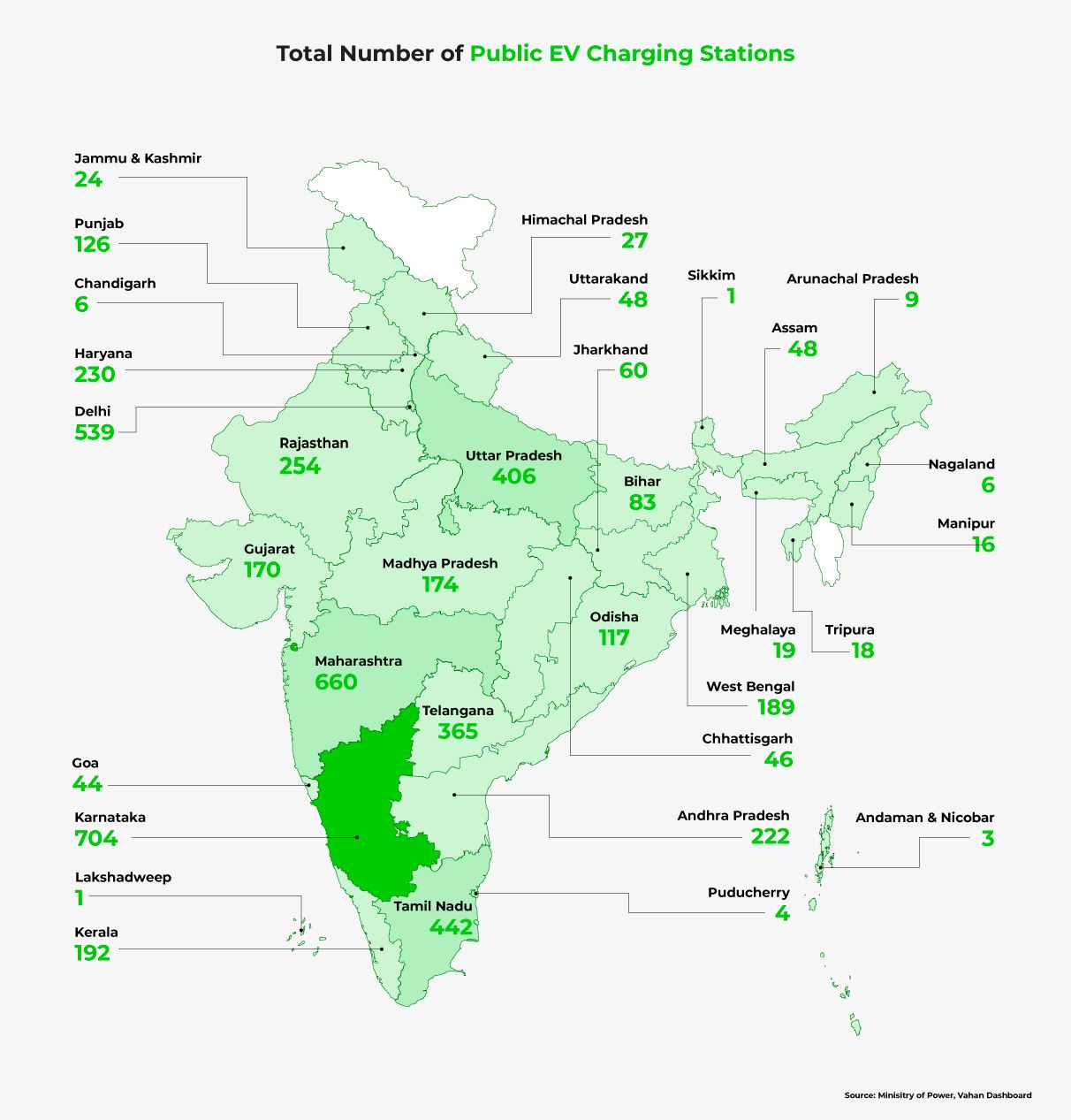

India has set an ambitious goal: electrifying the transportation sector by 2030. To meet this target, India will need a total of 46,000 charging stations across the country. The current state of EV infrastructure in India is depicted below:

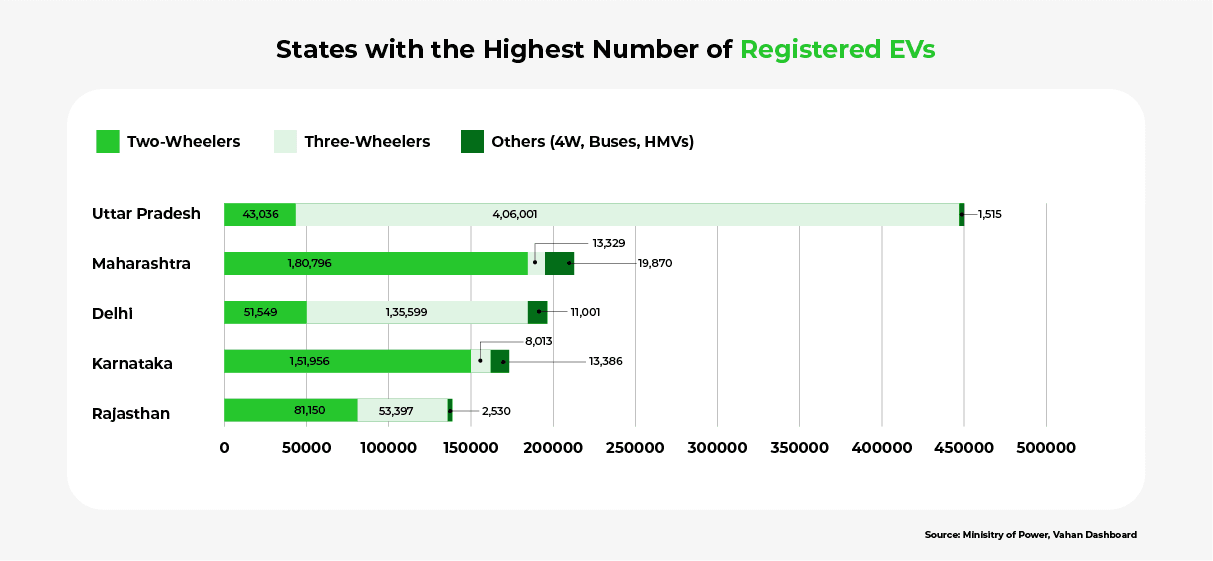

As the above image shows, Indias EV charging infrastructure is unevenly distributed. Furthermore, there is a significant discrepancy between the current number of EVs and the existing charging stations. For example, the state of Uttar Pradesh has 4.5 lakh EVs, but 406 charging stations only one station for every 1,103 EVs!

Unfortunately, the solution to this problem is not as easy as building more charging stations. For example, private sector players like SMB owners and RWAs complain about the high costs of charging stations, which discourages them from participating in charging infrastructure opportunities.

Below we analyze three reasons why Indias EV infrastructure is currently unable to flourish.

1. Inadequate Power Grid

Indias growing power demand, which is expected to increase by 9-12% in the first half of 2023 alone, has already put the power grid under significant strain. Adding EVs to the grid can exacerbate this, which will result in frequent power cuts. This is especially true for rural areas.

This power shortage can, in turn, discourage EV adoption by reducing prospective EV owners confidence about being able to reliably charge their vehicles. Reduced consumer confidence also discourages private sector investment in EV infrastructure.

2. Lack of Public Charging Infrastructure

The Bureau of Energy Efficiency (BEE) expects 46,397 public charging stations to be built across 9 cities by 2030. Currently, however, India only has 5, 234 stations scattered across the land.

Despite the push from the government, retail stores, small business owners, and RWAs, may still be hesitant to provide public charging stations at their premises. They are concerned about the significant capital these stations require. They may also lack awareness about the potential benefits these stations could yield for their businesses.

In the meantime, however, prospective EV owners are still anxious about their vehicles range.

3. Geographical Diversity

India is a vast and geographically diverse country. Its various terrains, from mountains to rain-fed plains, require different charging-related considerations. For example, some of the EV charging infrastructure should be resistant to waterlogging, which is common in certain areas during four months of the year.

Furthermore, due to differing population density and travel patterns, rural areas may require entirely different charging infrastructure from urban areas. This massive rural-urban divide can make it more challenging to install and maintain charging stations in remote areas. To compound the issue, these rural areas may not have sufficient EVs to justify the investment.

These challenges require innovative solutions, which could include everything from using renewable energy sources to developing fast charging technology.

Subscribe to our Newsletter

4 Solutions to Revolutionize EV Charging in India

India is taking several steps to address the challenges of creating a sustainable and efficient EV charging network. The government is increasing public charging infrastructure, incentivizing private sector investment, actively promoting the use of renewable energy to meet the growing power demands, and developing fast charging and smart software solutions.

Below, we analyze the four most prominent initiatives for revolutionizing EV charging in India.

1. Increase Public Charging Infrastructure

The Ministry of Power is collaborating with agencies like the BEE to build EV charging stations in India, along highways, in cities, and in public areas.

Under the FAME India scheme, the Ministry of Heavy Industries has sanctioned the construction of 2,877 EV charging stations across multiple states, as well as 1,576 stations across 16 highways and 9 expressways. These major roads cover 10,275 kilometers across India, so providing sufficient charging stations along them will significantly reduce range anxiety.

Furthermore, the Ministry of Powers Energy Efficiency Services Limited (EESL) initiative has encouraged private players to build 810 EV charging stations.The government is also incentivizing businesses, shopping malls, parking lot owners, and RWAs to set up EV charging stations on their premises.

The government is providing more education on the benefits of charging stations for businesses, and simplifying the installation processes. These incentives must continue in order for India to reach its EV charging infrastructure goals.

2. Integrate Renewable Energy

Integrating renewable energy sources into the EV charging infrastructure can make EV charging cheaper and more sustainable. It can reduce dependence on fossil fuels and the resulting pollution and global warming effects, as well as rendering power cuts less likely and making EV charging more affordable for EV owners.

Indias ample sunshine, flowing rivers, and favorable wind patterns hold vast potential for renewable energy. The government is leveraging these renewable energy sources effectively. In 2022-23, for example, various renewable sources made up 40% of total energy generation, as demonstrated in this table below.

By 2030, the government plans to increase renewable energy generation capacity to 500 GW, which represents 50% of total energy requirements. If realized, this increase would reduce pollution and provide uninterrupted electricity for charging EVs.

3. Develop Fast-Charging Technology

Developing fast-charging technology and its associated software can reduce EV charging times. Slow chargers take anywhere from 1 to 5 hours, but fast chargers take less than an hour. This can alleviate range anxiety, especially for long-distance travel.

Fast-charging technology can also cut down the total required number of charging stations. Since fast-charging stations can charge an EV in a matter of minutes, a small number of fast-charging stations can provide the same level of service as a large number of conventional charging stations.

The Indian government is subsidizing the installation of fast-charging infrastructure across the country. Private companies are also investing in the development of fast-charging technology, with many companies introducing fast-charging stations across the country.

4. Incentivize Private Sector Investment

The Indian government recognizes the private sectors critical role in developing EV charging infrastructure. To incentivize private sector investment, the government has introduced several initiatives and policies.

One of these initiatives is the FAME scheme, under which the Indian government has given oil companies Rs 800 crore to set up EV charging stations. The government has also allowed 100% Foreign Direct Investment (FDI) in the EV charging infrastructure sector, thereby further encouraging private investment.

These solutions can have a profound impact on future electric mobility in India.

EV Infrastructure's Impact on India's Future

A robust EV charging infrastructure in India can positively impact the growth of the EV market by reducing range anxiety and enhancing EV adoption.

The shift towards electric mobility can benefit the environment by improving air quality and reducing Greenhouse Gas (GHG) emissions. It can also have a positive impact on the countrys economy.

Reduction in Greenhouse Gas Emissions

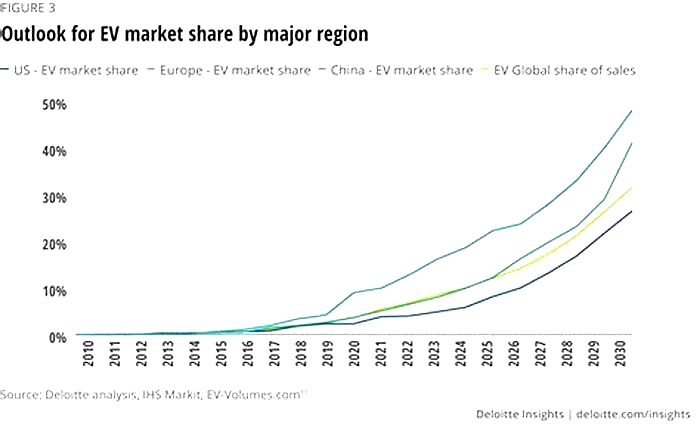

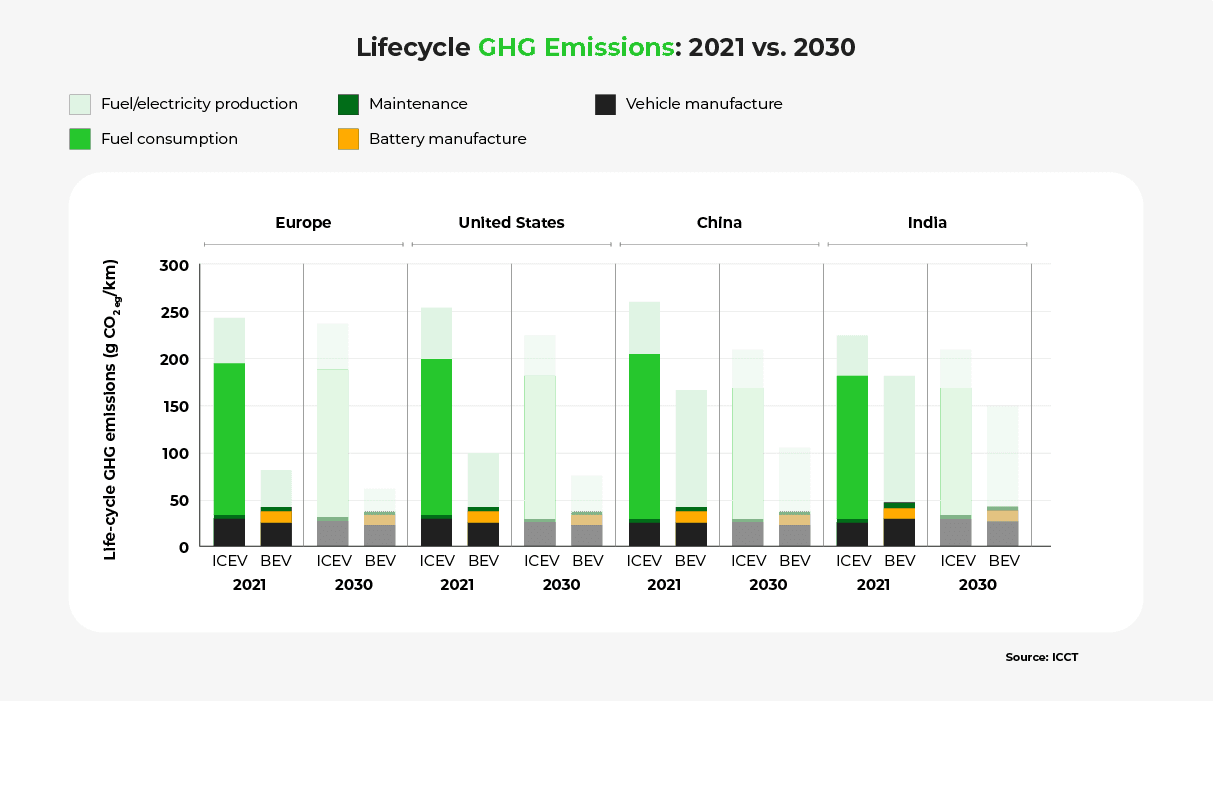

The majority of GHG emissions in India are from the energy and transportation sectors, and can therefore be reduced by the shift towards electric mobility. The chart below provides a glimpse into how different countries are progressing towards meeting EV adoption goals by 2030.

In addition to having no tailpipe emissions, EVs can convert 60% of the electrical energy from the grid, whereas petrol and diesel vehicles convert only 17 to 21% of fuel. The resulting decrease in GHG emissions will improve air quality, which, in turn, can support public health, increase productivity, and reduce healthcare costs.

Increased Use of Renewable Energy

To reduce dependence on fossil fuels and oil imports, India is steadily adding renewable energy to its overall power consumption. Increased EV adoption will require more power, which could lead to more renewable energy generation.

The Open Access Rules 2022 of the Ministry of Power enable EV owners to purchase green energy directly from producers. This move can also pave the way for charging EVs with renewable energy.

Economic Growth

The shift to EVs and renewable energy sources will reduce India's dependence on oil imports, thereby freeing up money which can be put towards generating more jobs. The resulting increase in demand for EVs and battery manufacturing may also create more job opportunities in this sector.

According to one IVCA-EY-Induslaw report, the expanding EV industry is predicted to create 10 million direct and 50 million indirect jobs by 2030. This rapid growth may help India achieve a stable, sustainable $10 trillion economy by 2035.

Powering Ahead: India's EV Future Beckons

India's successful transition to electric mobility is contingent upon developing a robust charging infrastructure. Although India faces many challenges in creating a reliable and efficient charging network, the government is working to increase the number of public EV charging stations, incentivize private investment, and integrate renewable energy sources.

These measures could make India a leader in sustainable transportation and clean energy. Developing EV charging infrastructure in India can also create new job opportunities, boost economic growth, and enhance public health and overall quality of life.

If India can achieve its goals, it can inspire other countries, thereby ultimately creating a more sustainable and greener future for all.

For more information about EV charging infrastructure in India, please see the FAQ and Resources below.

FAQ

What is the current state of electric vehicle charging infrastructure in India?

The EV-to-public-charging ratio in India is 135:1 the country has 1 charging station for every 135 vehicles. This is very low compared to the global average of 6:20. This gap in India is due to factors like an inadequate power grid, the vastness of the country, the high cost of investment, etc.

How many public charging stations are currently available in India?

5,254 public charging stations are currently operational in India. To meet its 2030 goals, India needs a total of 46,397 stations. Until then, India can complement the existing fast charging infrastructure with slow chargers to meet EV drivers needs.

What charging standards are used in India?

In India, 3 agencies are responsible for creating and implementing charging standards involving EVs and their components: the Bureau of Indian Standards (BIS) creates interoperability standards; the Central Electricity Authority creates power grid safety standards; and the Automotive Research Association of India (ARAI) creates manufacturing and safety standards, known as AIS-XXX standards.

What initiatives are being taken by the Indian government to promote electric vehicle charging infrastructure?

Under the FAME II scheme, the Indian government plans to set up EV charging stations across 9 cities. The government has given oil companies Rs 800 crore for setting up EVs, and is subsidizing EV charging infrastructure installation for small business owners and RWAs.

How many electric vehicles will be on Indian roads by 2030?

A report by KPMG estimates that Indian roads will have 40 to 50 million EVs by 2030. The central and state governments favorable EV policies, in combination with public and private sector investments in EV charging infrastructure, are expected to expand the EV market and drive EV adoption.

How many charging stations will India need by 2030?

India will need an estimated 46,397 charging stations to meet its goal of 30% electrification of automobiles by 2030. JMK Research predicts that, over the next 18 months, the country will see about 7,000 new charging stations from both private and public players. These numbers are expected to continue increasing during the coming years.

Resources

India Times: Charging Infrastructure Needs a Big Push

Get more information about Indias increasing need for EV charging infrastructure.

The Better India: Can India Charge 102 Million Electric Vehicles by 2030?

Gain insight into Indias planned electric vehicle revolution.

Financial Express: How Indian EV Policies Assist the Countrys Mobility Transition

Read about the Indian governments paradigm-shifting EV infrastructure policies.

NITI Aayog: Handbook for EV Charging Infrastructure Implementation

Learn more about implementing EV charging infrastructure in India.

Bolt.Earth: EV Charging in Apartment Complexes and RWAs

Discover how RWAs can boost EV charging infrastructure in India.