The Future of Electric Vehicles Comparing Predictions from Industry Experts

The future of electric vehicles: expert predictions

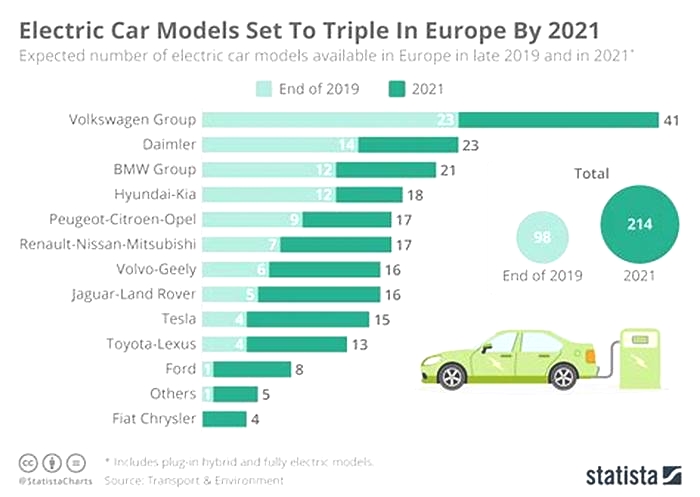

By 2025, 20% of all new cars sold globally will be electric, which will increase to 40% by 2030, according to investment bank UBS. Jaguar is planning to sell only electric vehicles (EVs) from 2025, Volvo is planning the same from 2030, and VW says 70% of its sales will soon be electric.

As a result, the number of EVs on UK roads is likely to increase, but what else does the future look like for EVs? Two experts share their thoughts and predictions.

Taking over the roads

By 2030, the sale of new petrol or diesel vehicles in the UK will be banned, which could result in 14 million EVs on British roads.

Niall Riddell, co-founder of Paua, says the ban of petrol and diesel vehicles are a clear agenda setting item which will help set the thinking process for businesses.

As more EVs are produced and recharging challenges are overcome, these vehicles will become more affordable, accessible, and desirable.

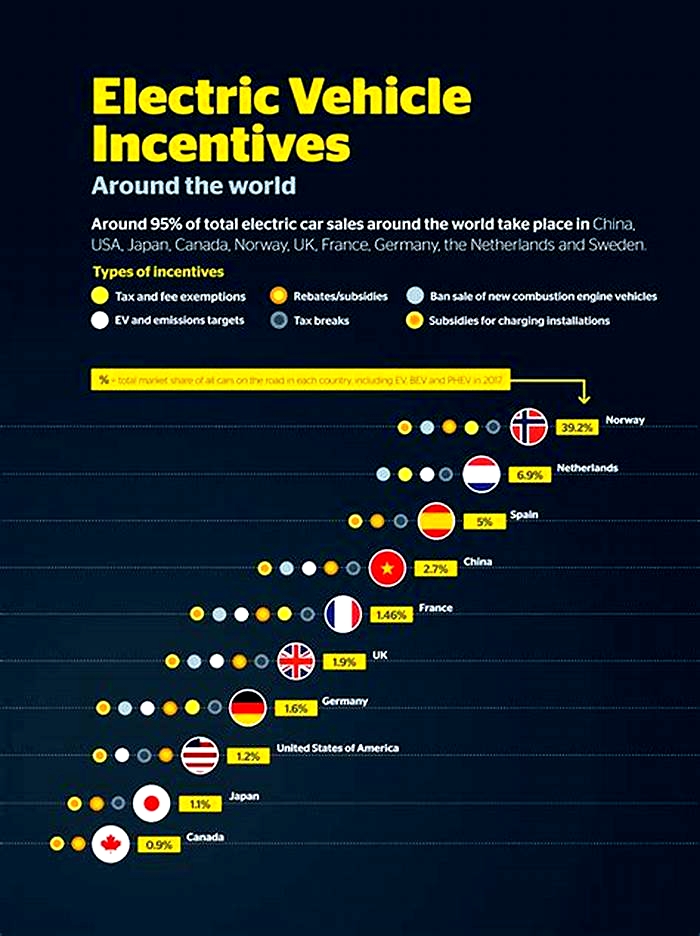

Similarly, Paul Hanwell, Head of Complex Underwriting at NIG, says financial rewards offered by the government will continue to motivate businesses to shift to EVs.

The likes of the salary sacrifice scheme and National Insurance savings are sizeable financial rewards for shifting to an EV. There are government schemes and grants in place to encourage the uptake of charging points for businesses, such as the Workplace Charging Scheme.

He adds that these financial incentives have single-handedly turbocharged the take up of EVs and will continue to do so.

Upcoming challenges

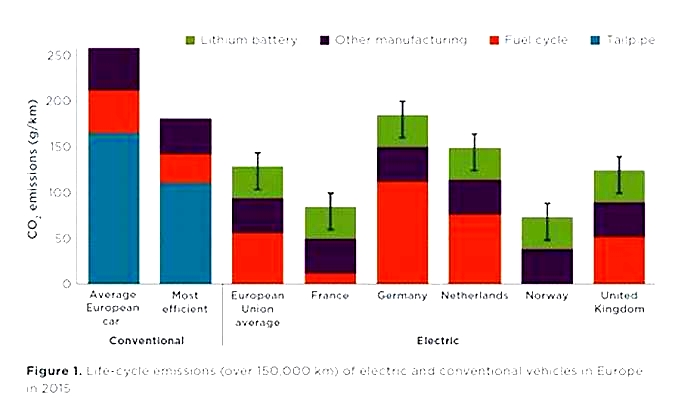

Riddell says the EV market could face challenges with its supply chain of minerals, in particular lithium and cobalt.

Most EV batteries are lithium-ion batteries, and the minerals needed for these include lithium, cobalt, and graphite.

At the moment, however, countries with the biggest EV sales are also the countries with some of the biggest supply chain vulnerabilities. Germany and the US have the second and third-largest EV sales, but they also have some of the most vulnerable supply chains and are heavily reliant on imports of raw materials. the industry will need to address and resolve issues with the supply chain yo keep up with the rise of EVs.

For Hanwell, this is also a key issue adding it is good to see the plans to make batteries recyclable is finally moving up the agenda.

He says upcoming challenges for the EV market lie with the charging infrastructure. While huge investment has been made to the UKs charging infrastructure, its not yet fit for purpose for the desired increase in EVs. Similarly, fast charging needs to become more prevalent.

Hanwell also says the insurance industry is a vital enabler of the continued uptake of EVs and, whilst these vehicles pose new risk considerations, availability of insurance solutions remains scarcer than with internal combustion engine vehicles.

Future of EV fleets

Hanwell points out that the EV industry should expect to see a greater presence in companies.

Whether its businesses offering EVs to staff under the salary sacrifice scheme or companies adding EVs to their fleets, were seeing a rise in EVs being used by businesses, which will increase.

Although the EV market share is 16.7%, Riddell says there is still a huge amount for the EV industry to learn if more electric vehicles are to be put on the roads.

NIGs response to the future of EVs

To reflect the growth in the EV space, we have extended some of our product wordings, like Fleet and Mini Fleet, to include cables and batteries for EVs.

We can also provide cover for EV charge points, and we now include subscription-based EVs on demand for businesses and EV salary sacrifice business.

Contact your local NIG underwriter to learn more about our EV insurance capabilities.

8 Predictions About the Future of the Auto Industry

In his new book A Brief History of Motion, author Tom Standage writes an engaging and informative overview of how we got from the invention of the wheel to modern cars.

Standage, who is also a deputy editor at The Economist, draws parallels between the past and the present. In doing so, he's able to paint a picture of what's in store for the automotive industry in the next 50 years.

As the saying goes, history repeats itself. He saw that numerous times over the course of writing the book.

"It's uncovering the things that people in the past have done or felt or said that shows how similar they are to us today," Standage told Newsweek in an interview.

Even something that seems as modern as car culture has origins in the first instances of private coach ownership in the 17th century, where wealthy European aristocrats would parade their custom-built horse-driven coaches for each other in parks.

"Some of these have surprisingly deep roots," he explained. "That's what I really enjoy discovering. These sorts of sociological underpinnings of what we think are contemporary."

Making those connections, Standage is able to present a collection of arguments about where the industry will go in the next 50 years when it comes to car ownership, autonomous vehicles, traffic and more.

Here are his eight predictions for the future of the automotive industry.

Prediction 1: We've reached peak car

Evidence has been piling up over the last few decades supporting the theory that society is reaching "peak car."

While people have been predicting the death of the car for almost as long as cars have been on the road, Standage points to global, long-term trends.

For one, the book cites a 2016 McKinsey survey of 4,500 people that found that 60 percent of Chinese consumers no longer thought that car ownership was a status symbol. Forty percent of respondents said that the rise of alternative transport methods makes car ownership seem less important.

A 2019 Accenture report, which surveyed 7,000 people in China, Europe and the U.S. found that if given the option of autonomous mobility solutions, 78 percent of Chinese respondents would be willing to give up car ownership. In Europe and the U.S, that number was 55 and 39 percent, respectively.

In the U.S., less 16-year olds are getting drivers licenses. The proportion has fallen from 46 percent to 25 percent since the 1980s.

A 2019 working paper from the National Bureau of Economic Research found that U.S. millennials are owning cars at the same rate as previous generations.

Despite the elevated demand that has driven car prices up over the last year, Standage doesn't think that such demand is a sustainable trend. While the total number of passenger miles is rising, the total number of vehicles isn't catching up.

"The pandemic has pushed some people off transit and into cars, but my view is that this is a short-term blip," he argued. "This is not going to lead to a permanent move away from public transport and a permanent increase in the desire to drive around in cars."

Prediction 2: There will be a shift toward the best tech

According to Standage, the most relevant historical parallel is not with the car industry 100 years ago. Rather, it's what took place during the advent of the smartphone.

In 2007, Nokia had about 50 percent of the cell phone market share. But the way they thought about the future of the phone, he explained, was all wrong.

"They thought that making a smartphone is just going to be adding a bit more software to a phone," he said.

After the iPhone was announced, the market shifted away from companies with hardware expertise to firms that had compelling software.

That's where we are now in the automotive industry, he said. The near future is going to be dominated by those that have the best tech, rather than those who can build the best car overall.

Prediction 3: Software will move the needle

Consequently, Standage says that that shift is already underway. The most influential carmakers of the future are the ones that are the best at software, he argued. The shrinking number of components needed for an electric car point to this.

"All of the complexity of an electric car goes into the software," Standage said. "So suddenly, being good at software is the only thing that matters. And it's obvious that the established carmakers are not good at software."

He points to his own car, a Mercedes-Benz A250e plug-in hybrid, saying that it feels like its tech is tacked onto the car rather than well-integrated, pointing out that Tesla's electric vehicle market dominance is propelled by its software edge.

Based on historical examples, Standage thinks that carmakers who suddenly need to pivot to software won't take away that edge.

"If anyone is going to challenge Tesla it's going to be a startup that's good at software rather than an existing carmaker that suddenly gets religion, so to speak."

Prediction 4: Street space will be rethought

Standage argues that there's no way to solve growing traffic problems in the traditional sense.

"As soon as you solve traffic - as soon as you have no traffic on the road - people look at an empty road and go 'I could drive on that,'" he said. "It's inherently insoluble and I think we just need to accept that"

More roads will always lead to more cars, he posits, so the focus should turn to where it shifted last year under lockdowns: giving more street space to alternatives like bike lanes or pedestrian walkways.

"There's this worldwide trend to start giving street space back to things other than cars," he said. "We took street space away from other users and gave it to cars for a century and it turned out that no amount of street space is ever enough."

A 2021 note from the UCLA Institute of Transportation Studies argues that one way to solve traffic congestion is to introduce congestion charges.

Prediction 5: Road funding will come from new sources

As electric vehicles gain in popularity and with autonomous driving on the horizon, Standage thinks that there will have to be a shift in how federal, state and local governments fund their roads.

He argues that a scheme based on per mile usage is the best way to fund road maintenance as gas cars are phased out.

"At the moment you can sort of do per mile road charging through gas taxes because the more you drive the more you pay in gas tax," he said. "But once people are using electric cars that's not going to work anymore."

On a more local level, he argues in the book that municipalities will have to develop their own tolls to acclimate to the rise of autonomous vehicles (AVs).

"AVs would allow for more subtle forms of per mile road tolling and congestion charging - adjusting prices depending on time, place, vehicle type, number of riders, traffic levels...to improve transport equity," he wrote.

Prediction 6: Subscription Models

Standage writes that in the future, the most popular form of transportation will be a combination of services offered through what he calls "the internet of motion",

What most people will likely use for transportation is a combination of services wrapped up into one service and most likely for a monthly subscription fee. Otherwise known as "mobility as a service", this model is already gaining traction in cities around the world.

In Helsinki, a single app lets you access trains, taxis, car rentals and other modes of transport for a monthly fee, with an additional fee to have free rein of a car on the weekend.

"I think that sort of approach is just much less hassle," he said. "Once it becomes more convenient and cheaper not to own a car, then fewer people are going to want to own cars."

Some carmakers are embracing the subscription model. Volvo, Porsche and Audi have monthly subscription plans.

Prediction 7: Road trips may require rentals

When asked about the fate of small communities and roadside businesses if autonomous vehicles go mainstream, and drivers can sleep in their cars on the way to their destination, Standage says that the question shows the outdated thinking about cars in modern life.

"When you're buying a car, you're thinking about that because the most difficult thing you're ever going to ask a car to do is the long journey where the car is full of people and luggage," he said. "The amount of time you spend driving a car under those circumstances is extremely small."

He added that while it would be easier to replace the car for short distance trips, the majority of car trips, future drivers may have to rely on car rentals or carpooling services for longer road trips.

Prediction 8: High-income individuals become car owners

Twenty or so years down the line, Standage predicts that overall car ownership will return to its roots: wealthy people will be the ones that will want to bear the costs of car ownership.

The rest of the public will engage in some kind of subscription model.

"I think the mega-rich will want to own cars, but I think a lot more people will say that the expense of car ownership is just not worth it," he posited.

Standage argued that current trends point to increasing expenses for owning cars in an urban environment.

"There's more traffic," he said. "You have to pay things like congestion charges. It's essentially becoming more of a hassle to own a car than it used to be. So as these alternatives become cheaper and easier to access through smartphones, more people at the margins will be doing that."

Car ownership isn't going away all together, he added.

"We're still going to have cars. We're still going to have people owning cars. But I think the number of people for whom private car ownership makes sense will start to go down."

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.