The Power of Electric Mobility How EVs Are Changing Transportation

How electric vehicles and other transportation innovations could slow global warming, according to IPCC

Around the world, revolutionary changes are under way in transportation. More electric vehicles are on the road, people are taking advantage of sharing mobility services such as Uber and Lyft, and the rise in telework during the COVID-19 pandemic has shifted the way people think about commuting.

Transportation is a growing source of the global greenhouse gas emissions that are driving climate change, accounting for 23% of energy-related carbon dioxide emissions worldwide in 2019 and 29% of all greenhouse gas emissions in the U.S.

READ MORE: We have the tools to save the planet from climate change. Politics is getting in the way, new IPCC report says

The systemic changes under way in the transportation sector could begin lowering that emissions footprint. But will they reduce emissions enough?

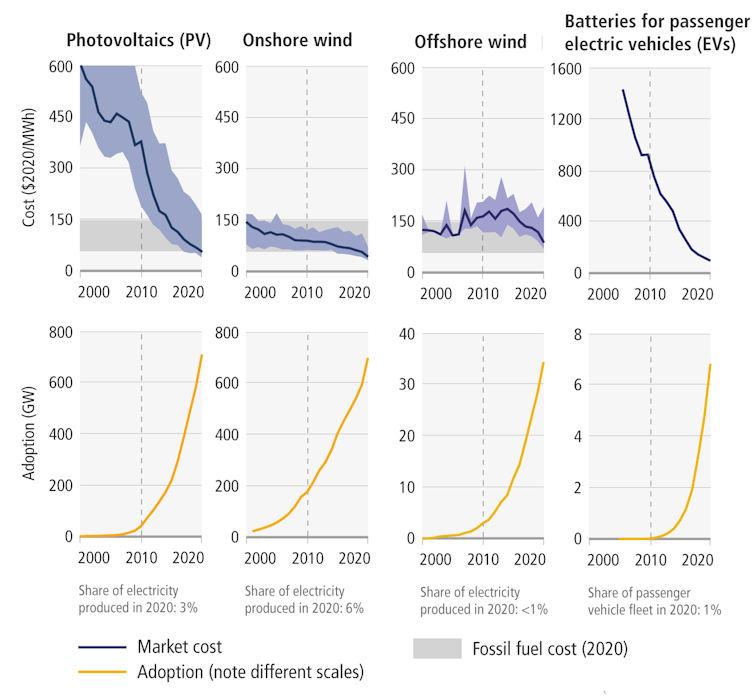

In a new report from the Intergovernmental Panel on Climate Change released April 4, 2022, scientists from around the world examined the latest research on efforts to mitigate climate change. The report concludes that falling costs for renewable energy and for electric vehicle batteries, in addition to policy changes, have slowed the growth of climate change in the past decade, but that deep, immediate cuts are necessary to stop emissions growth entirely and keep global warming in check.

Costs are falling for key forms of renewable energy and EV batteries, and adoption of these technologies is rising. IPCC Sixth Assessment Report

The transportation chapter, which I contributed to, homed in on transportation transformations some just starting and others expanding that in the most aggressive scenarios could reduce global greenhouse gas emissions from transportation by 80% to 90% of current levels by 2050. That sort of drastic reduction would require a major, rapid rethinking of how people get around globally.

The future of EVs

All-electric vehicles have grown dramatically since the Tesla Roadster and Nissan Leaf arrived on the market a little over a decade ago, following the popularity of hybrids.

In 2021 alone, the sales of electric passenger vehicles, including plug-in hybrids, doubled worldwide to 6.6 million, about 9% of all car sales that year.

Strong regulatory policies have encouraged the production of electric vehicles, including Californias Zero Emission Vehicle regulation, which requires automakers to produce a certain number of zero-emission vehicles based on their total vehicles sold in California; the European Unions CO2 emissions standards for new vehicles; and Chinas New Energy Vehicle policy, all of which have helped push EV adoption to where we are today.

Beyond passenger vehicles, many micro-mobility options such as autorickshaws, scooters and bikes as well as buses, have been electrified. As the cost of lithium-ion batteries decreases, these transportation options will become increasingly affordable and further boost sales of battery-powered vehicles that traditionally have run on fossil fuels.

An important aspect to remember about electrifying the transportation system is that its ability to cut greenhouse gas emissions ultimately depends on how clean the electricity grid is. China, for example, is aiming for 20% of its vehicles to be electric by 2025, but its electric grid is still heavily reliant on coal.

With the global trends toward more renewable generation, these vehicles will be connected with fewer carbon emissions over time. There are also many developing and potentially promising co-benefits of electromobility when coupled with the power system. The batteries within electric vehicles have the potential to act as storage devices for the grid, which can assist in stabilizing the intermittency of renewable resources in the power sector, among many other benefits.

Other areas of transportation are more challenging to electrify. Larger and heavier vehicles generally arent as conducive to electrification because the size and weight of the batteries needed rapidly becomes untenable.

Ships that can connect to electric power in port can avoid burning fuel that produces greenhouse gases and pollution. Ernesto Velzquez/Unsplash, CC BY

For some heavy-duty trucks, ships and airplanes, alternative fuels such as hydrogen, advanced biofuels and synthetic fuels are being explored as replacements for fossil fuels. Most arent economically feasible yet, and substantial advances in the technology are still needed to ensure they are either low- or zero-carbon.

Other ways to cut emissions from transportation

While new fuel and vehicle technologies are often highlighted as decarbonization solutions, behavioral and other systemic changes will also be needed to meet to cut greenhouse gas emissions dramatically from this sector. We are already in the midst of these changes.

Telecommuting: During the COVID-19 pandemic, the explosion of teleworking and video conferencing reduced travel, and, with it, emissions associated with commuting. While some of that will rebound, telework is likely to continue for many sectors of the economy.

Shared mobility: Some shared mobility options, like bike and scooter sharing programs, can get more people out of vehicles entirely.

Car-sharing and on-demand services such as Uber and Lyft also have the potential to reduce emissions if they use high-efficiency or zero-emission vehicles, or if their services lean more toward car pooling, with each driver picking up multiple passengers. Unfortunately, there is substantial uncertainty about the impact of these services. They might also increase vehicle use and, with it, greenhouse gas emissions.

New policies such as the California Clean Miles Standard are helping to push companies like Uber and Lyft to use cleaner vehicles and increase their passenger loads, though it remains to be seen whether other regions will adopt similar policies.

Public transit-friendly cities: Another systemic change involves urban planning and design. Transportation in urban areas is responsible for approximately 8% of global carbon dioxide emissions.

Efficient city planning and land use can reduce travel demand and shift transportation modes, from cars to public transit, through strategies that avoid urban sprawl and disincentivize personal cars. These improvements not only decrease greenhouse gas emissions, but can decrease congestion, air pollution and noise, while improving the safety of transportation systems.

How do these advances translate to lower emissions?

Much of the uncertainty in how much technological change and other systemic shifts in transportation affects global warming is related to the speed of transition.

The new IPCC report includes several potential scenarios for how much improvements in transportation will be able to cut emissions. On average, the scenarios indicate that the carbon intensity of the transportation sector would need to decrease by about 50% by 2050 and as much as 91% by 2100 when combined with a cleaner electricity grid to stay within the 1.5-degree Celsius (2.7 Fahrenheit) target for global warming.

These decreases would require a complete reversal of current trends of increasing emissions in the transportation sector, but the recent advances in transportation provide many opportunities to meet this challenge.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Spotlight on mobility trends

In a decade that has witnessed remarkable mobility developments, 2023 still manages to stand out. The long list of accomplishments includes some familiar topics, such as the continued growth of micromobility, steady progress with vehicle electrification, and continued investment in autonomous vehicles (AVs). Mobility stakeholders also ventured deeper into relatively new technologies and began seriously exploring the potential of generative AI to transform everything from automotive marketing and sales to R&D.

Despite mobilitys steady progress in 2023, the challenges facing the industry tended to overshadow the good news. Electric-vehicle (EV) sales slowed in some regions, technological issues and lack of public acceptance derailed some AV pilots, and concerns about battery range persisted. Whats more, 2023 provided more evidence that the global automotive market is in the midst of major disruptions. The industrys future is clearly becoming more electric despite some regional sales dips, and Chinese EV OEMs, which hold a strong position in their home market, are now preparing to pursue global opportunities. Meanwhile, OEMs in China, Europe, and the United States continue to roll out increasingly innovative AVs, including some with advanced L3 driving technology.

Heres a closer look at the trends that defined 2023 and will continue to shape mobility in 2024.

A consumer shift from private vehicles to more sustainable options

Mobility is first and foremost about consumer choices, and the McKinsey Mobility Consumer Pulse Survey shows that preferences are indeed shifting. While private cars still dominate the road, 40 percent of survey respondents now use multiple mobility modes, including eco-friendly options such as e-bikes, and 62 percent are beginning to change their transportation habits because of sustainability concerns (Exhibit 1). In a development that could affect vehicle sales, 20 percent of respondents say they would consider replacing their private vehicles with other mobility options over the next ten years, and many are open to using autonomous shuttles if they become available.

New vehicle preferences for everything from electrification to connectivity

EVs have been soaring in popularity for years and remain in high demand, despite some recent sales declines in certain regions. The McKinsey Consumer Pulse Mobility Survey provides more evidence for this trend, with 42 percent of respondents stating that they want their next car to be an EV (Exhibit 2). To be willing to switch from an internal combustion engine (ICE) vehicle to an EV, respondents say their vehicles should be able to travel an average of 437 kilometers on a full charge. In another shift, 47 percent of prospective EV buyers surveyed say they are willing to purchase their vehicles online, showing that the sales process is also evolving.

Both digital connectivity and assistance features, such as automatic braking, are increasingly important purchase considerations. For their next vehicle purchase, 69 percent of survey respondents want more car connectivity services and 34 percent want L4 automation features.

Growing EV demandwith China as the hot spot

McKinsey projects that worldwide demand for passenger cars in the battery electric vehicle (BEV) segment will grow sixfold from 2021 through 2030, with annual unit sales increasing to roughly 40.0 million, from 6.5 million, over that period. China retained its position as the worlds e-mobility hot spot in 2023, with the highest penetration rates (Exhibit 3): one out of every four cars in China in 2023 was a BEV.

BEV growth remained positive across major regions, but it was slower than in past years for several reasons, including lower consumer demand stemming from a more pessimistic macroeconomic outlook and a lack of new attractive BEV model launches globally. In Europe, BEV cash subsidies declined or ended, which further dampened demand. Plug-in hybrid electric vehicle (PHEV) sales grew in all regions except Europe.

China also hosts many local EV companies that are seeing strong domestic sales and have ambitious plans to export their vehicles. One essential factor to the countrys success: an integrated value chain that provides local companies with easy access to everything from raw materials to batteries to digital services.

Chinese EV OEMshigh market share, lower prices

Beyond the quality of their EVs, Chinese OEMs may have an advantage in the global market for one simple reason: their vehicles are less expensive than those from European OEMs across all vehicle segments (Exhibit 4). In fact, one leading Chinese OEM now offers its vehicles at prices that are lower than or on par with those for comparable ICE vehicles.

Chinas integrated value chain contributes to the low prices for domestic OEMs. Other countries may want to consider developing similar value chains as the transition to EVs continues, since lower prices may accelerate the shift.

A growing need for batteries

The McKinsey Battery Insights team projects that the entire lithium-ion (Li-ion) battery chain, from mining through recycling, could grow by 27 percent annually from 2022 to 2030, when it would reach a value of more than $400 billion and a market size of about 4,700 gigawatt-hours (GWh) (Exhibit 5). Batteries for mobility applications, such as EVs, will account for the vast bulk of demand in 2030about 4,300 GWh, McKinsey estimates. The next two sources of demandstationary storage and consumer electronicswill account for a much lower percentage of required GWh.

A new go-to-market model for the EV age

EV buyers value innovation, and that preference extends beyond the car to the buying process itself. McKinseys latest Future of Auto Retail Consumer Survey reveals that respondents who are inclined to purchase an EV are more likely to say that they want more personalization than traditional car buyers (Exhibit 6). They want a smaller set of preconfigured options, for instance, and the opportunity to change configuration after purchase and before delivery. Potential EV buyers also want more simplicity, convenience, and price transparency, including the ability to prebook test drives and secure financing online. OEMs that want to create an innovative and desirable brand impression could consider heeding these preferences as electrification accelerates.

A few bumps in the road but continued progress for autonomous driving

OEMs and tech companies alike made important advances in autonomous driving in 2023, but these were balanced by some setbacks. One tech company, for example, successfully piloted robotaxis in the United States, but another was forced to discontinue its pilot after several accidents. We now estimate that adoption of vehicles with some L4 capabilities will occur at scale around 2026, with the first applications likely involving autonomous parking, followed by highway driving (Exhibit 7). More complex applications, such as driving in an urban environment, will require longer timelines for at-scale deployment. Reflecting the technological complexities of autonomous driving, the anticipated timelines for the emergence of L4 capabilities are now longer than they were in 2021.

A complex investment picturewith some signs for optimism

Innovation does not happen overnight after an inventor has a eureka moment. Within mobility, think of the complications involved in reconfiguring the automotive value chain to support EV production or the intense testing and reworking required to build the software stack for autonomous driving. These efforts require major funding from external investors, and the early part of 2023 showed signs that they were pulling back. Funding was down by 44 percent in the first quarter of 2023, compared with the same period last year, and 13 percent lower in the second quarter (Exhibit 8). In late 2023, mobility investment showed more positive momentum, and we expect this to continue in 2024. Companies that specialize in electrification, especially batteries, are attracting the most investment, followed by those that focus on AVs.

Private-market funding and corporate investment efforts for mobility initiatives continue to be significantly more selective; however, some strongly sought-after technology clusters like EVs still show momentum.

Micromobility options grew, suggesting big changes are ahead for the private-vehicle market

Micromobilitye-scooters, bikes, mopedsis here to stay. In the recent McKinsey ACES Consumer Survey, almost one-third of respondents say they plan to increase their use of micromobility and nearly half are planning to replace their private vehicles with other modes of transport. McKinsey estimates that the global micromobility market will reach about $360 billion by 2030, up from about $175 billion in 2022mainly driven by e-bike sales (Exhibit 9). Europe will represent the highest share of that value.

Future air mobility made progress, but funding slowed

The future air mobility sector had a mixed year in 2023. Disclosed investment totaled $4.5 billion for the year. Although this was lower than the $4.9 billion raised in 2022, the number of deals more than doubled to 151. New aircraft orders totaled $22 billion, and the backlog of open aircraft orders, including options and letters of intent, increased to 21,300 (Exhibit 10).

At the seven leading companies specializing in electric vertical takeoff and landing (eVTOL) vehicles, the number of cumulative disclosed test flight hours now totals over 8,000. The future air mobility sector also saw an increase in the number of deals or relationships along the supply chain in 2023, as well as more commercial-drone flights and new regulatory approvals for drone flights beyond the visual line of sight.

Applied AI still has a lead over generative AI within mobility

Mobility actors are still heavily investing in both new and existing technologies. A McKinsey analysis of 3,500 mobility start-ups that specialize in digitization or the so-called ACES trendsautonomous driving, connectivity, electrification, and shared mobilityshows that they are more likely to invest in applied AI applications compared with other leading-edge solutions (Exhibit 11). Applied AI has a firm lead over generative AI within mobility because it enhances so many processes and addresses long-standing pain points, including those related to engineering, R&D, procurement, manufacturing, marketing and sales, and life cycle services. Companies, for instance, can use AI to identify customers who are at risk of being lost to a competitor and then create incentives to increase their satisfaction, potentially reducing churn and decreasing costs. Since many mobility stakeholders just began seriously exploring generative AI in 2023, it might soon gain more traction.

In retrospect, 2023 was a year of getting things done in mobility. Despite some setbacks, mobility stakeholders kept moving toward some of the industrys most important goals, including increasing battery life, developing more sophisticated EVs, overcoming the hurdles to L3 and L4 automation, and continuing the transformation to a less car-centric world. While external funding was down in the first quarter, it began trending upward later in the year, and select areas still generate high interest from investors. That bodes well for the entire sector, including niche areas such as future air mobility. As we move into 2024, the mobility sector is likely to experience both consolidation and scaling. As always, stakeholders will pursue innovation, but the increased attention to profitability will also persist. The resilience and persistence that they demonstrated in 2023 should also serve them well as the new year opens.