The Road Ahead Trends and Predictions in Electric Vehicle Development

The Road Ahead: Trends and Predictions for the Future of EVs

The electric vehicle (EV) industry is on the fast track to success, and it's showing no signs of slowing down. In fact, the coming years are shaping up to be the most exciting yet, with current trends and predictions pointing toward continued growth and development in the industry.

Advancements in battery technology

One of the most exciting trends in the electric vehicle industry is the continued advancement of battery technology. Gone are the days of limited range and slow charging times. Improvements in battery chemistry and design have led to longer ranges and faster charging times, making EVs more practical and convenient for everyday use.

I know, battery replacement is still a taboo concept among EV owners. Yes, theres an 8-year warranty on EV batteries, but once this lifeline is out the window, your only option is to pay for its replacement. And at present, it doesnt come cheap.

Depending on the cars make and model, type of battery, and battery capacity, youre looking at anywhere between $4,000 and $20,000. The main reason for this hefty price tag is the usage of raw materials (lithium, nickel, cobalt, copper, and graphite) for making EV batteries (lithium-ion batteries).

In the coming years, we expect to see even more exciting developments in battery technology, leading to more affordable and accessible electric vehicles.

Increased range

Driving range has been the only upper hand internal combustion engine (ICE) cars have over EVs. Since ICE vehicles burn fossil fuels to create mechanical energy, they can travel farther in one full tank than a fully-charged EV can.

Decades after the launch of the first electric vehicle, modern EVs still lag behind their gas-powered counterparts when it comes to the distance they can travel on one full charge.

As battery technology continues to improve, we can expect to see EVs with longer ranges. This will make them more practical for longer trips and reduce range anxiety.

In fact, just last year, Mercedes-Benz launched the Vision EQXX concept, which promises 620 miles of range and 201 horsepower. While it remains a one-off model, some of its features and powertrain will be the base of future Mercedes-Benz EVs starting with the electrified version of its popular C-Class series.

A few years from now, we can expect EVs to rival or even surpass the driving range of ICE vehicles, allowing longer drives and shorter charging breaks.

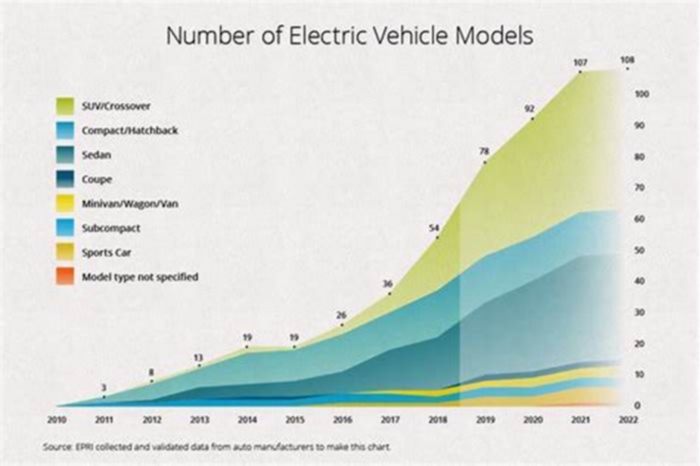

Greater variety of models

As car manufacturers develop EVs more powerful than the next, consumers are the ones reaping the benefits of this healthy competition.

This will make it easier for consumers to find an EV that meets their needs, from SUVs suited for small families to trucks for thrillseekers.

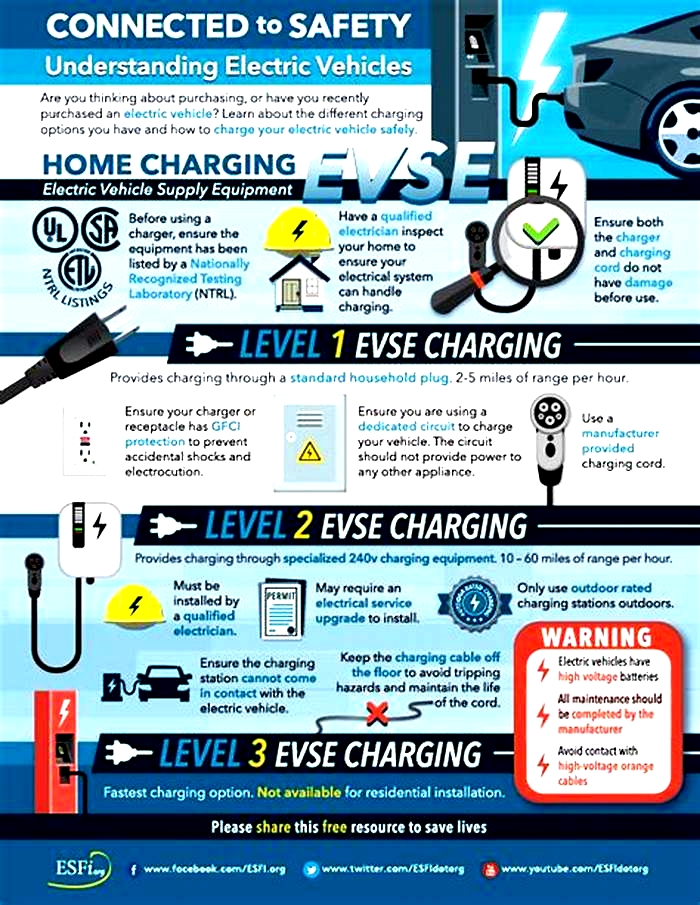

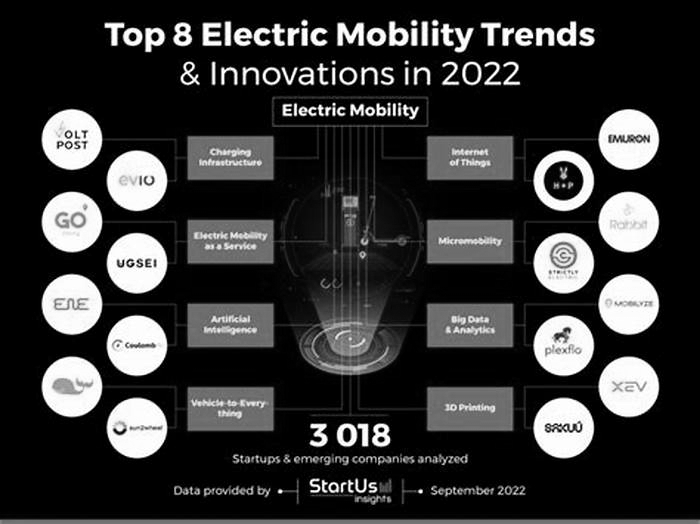

Charging infrastructure

Another key trend in the electric vehicle industry is the expansion of charging infrastructure. As more EVs hit the road, the need for reliable and accessible charging options becomes increasingly important. Fortunately, governments and private companies alike are investing in the development of charging infrastructure, with plans to install thousands of charging stations across the country in the coming years.

Currently, EV owners and businesses are entitled to a tax credit of up to 30% of the total cost of hardware and installation under the Inflation Reduction Act.

On the commercial side of things, EV charging stations could become commercially successful given the right business model, such as a tie-up with convenience store chains to increase foot traffic.

When it comes to residential use, having an EV charger installed in your property is an added value that future renters would likely look for.

A recent welcome development is the planned opening of the Tesla Supercharger network to non-Tesla EVs in the US. This move to break the long-existing Tesla barrier is not only a win for other EVs but also for a community thats still struggling to convince skeptics about its relatability.

While the Tesla wall is still up, you can use Tesla adapters to access 15,000 more charging stations for your J1772 vehicle.

In addition to traditional charging stations, there have been developments in wireless charging technology, allowing for even more convenient and efficient charging options for EV owners.

More charging options

With third-party manufacturers like Lectron providing more affordable charging solutions like the V- BOX, portable dual charger for Tesla, and 48A Adapters, EV drivers will be able to choose which one is right for their needs.

Charging is one of the top concerns among potential customers, and the continuous growth of charging infrastructure will make it easier for consumers to own and operate EVs.

Government policies

Government policies and regulations are also playing a significant role in shaping the future of electric vehicles. Many countries around the world have set ambitious targets for reducing greenhouse gas emissions, and electric vehicles are seen as a key component in achieving these goals.

The US is looking to completely ban sales of ICE vehicles by 2040. But states like California and New York have a more aggressive 2030 deadline.

As a result, we expect continued government support for the electric vehicle industry, with policies such as tax incentives, subsidies, and infrastructure investments aimed at promoting the adoption of EVs.

With the updated Inflation Reduction Act, buyers of qualified clean vehicles (both all-electric and plug-in hybrid) can get a $2,500 to $7,500 federal tax credit, not including the 30 percent or up to $1,000 rebate of the total cost of EV chargers.

We can expect even more incentives as the country braces for the mass purging of gas-powered cars.

Additionally, we may see more stringent emissions standards and regulations for traditional gas-powered vehicles, further incentivizing consumers and businesses to switch to electric.

Decreased costs

EVs are still considered a luxury buy in most parts of the world because of the high price tag and the rarity of related infrastructure.

As the technology involved in electric vehicles become more advanced, we can expect lower overall costs in the coming years.

From the wide availability of charging stations to the advancements in battery technology, coupled with more government incentives, EVs will become more attractive and attainable to drivers in the next few years.

Autonomous driving

Automakers like Tesla have long developed the technology for autonomous driving, albeit not perfectly.

In the past few years, concerns about its safety have been raised and there have been reported cases of system malfunctions that lead to crashes.

In the next decade or so, we can expect a more advanced and accurate autonomous driving system that not only can prevent fatal crashes but can also help physically-challenged drivers to operate an EV.

Integration with renewable energy

As more renewable energy sources, such as wind and solar, are added to the grid, we can expect to see greater integration between EVs and renewable energy. This may include bidirectional charging, where EVs can store and feed energy back into the grid.

Increased adoption in developing countries

With the cost of EVs predicted to decrease with advancements in technology, we can expect greater adoption in developing countries. This could have a significant impact on global emissions and air pollution.

Looking ahead

Overall, the future of electric vehicles looks promising. With advancements in technology and policies, all roads point towards continued growth and development in the EV industry.

As EVs become more affordable, practical, and accessible, we expect to see a shift towards cleaner and more sustainable transportation options and, eventually, a brighter and more sustainable future.

Electric vehicleswhats ahead

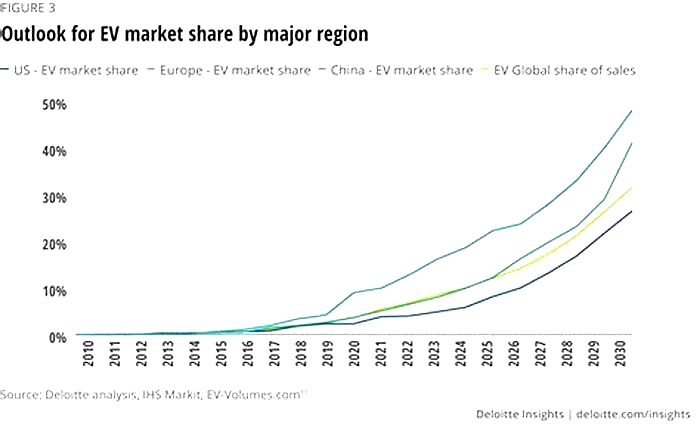

Electric vehicles (EVs) are transforming the mobility sector to an extent not seen since the introduction of the Model T Ford. Public acceptance of EVsonce uncertainhas reached a tipping point and will continue to grow as consumers seek more economical, environmentally-friendly transport options. McKinsey projects that worldwide demand for EVs will grow sixfold from 2021 through 2030, with annual unit sales going from 6.5 million to roughly 40 million over that period.

Our experience with EVs spans all major markets around the world and touches every segment of the value chain.

Topics

Operations and manufacturing | EV batteries | EV infrastructureConsumer EVs | EV trucks, buses, and off-highway vehicles | Strategy

In the regions where electric trucks are becoming commercially available, battery electric trucks can compete on a TCO basis with conventional diesel trucks for a growing range of operations, not only urban and regional, but also in the heavy-duty tractor-trailer regional and long-haul segments. Three parameters that determine the time at which TCO parity is reached are tolls; fuel and operations costs (e.g. the difference between diesel and electricity prices faced by truck operators, and reduced maintenance costs); and CAPEX subsidies to reduce the gap in the upfront vehicle purchase price. Since electric trucks can provide the same operations with lower lifetime costs (including if a discounted rate is applied), the time horizon in which vehicle owners expect to recuperate upfront costs is a key factor in determining whether to purchase an electric or conventional truck.

The economics for electric trucks in long-distance applications can be substantially improved if charging costs can be reduced by maximising off-shift (e.g. night-time or other longer periods of downtime) slow charging, securing bulk purchase contracts with grid operators for mid-shift (e.g.during breaks), fast (up to 350kW), or ultra-fast (>350kW) charging, and exploring smart charging and vehicle-to-grid opportunities for extra income.

Electric trucks and buses will rely on off-shift charging for the majority of their energy. This will be largely achieved at private or semi-private charging depots or at public stations on highways, and often overnight. Depots to service growing demand for heavy-duty electrification will need to be developed, and in many cases may require distribution and transmission grid upgrades. Depending on vehicle range requirements, depot charging will be sufficient to cover most operations in urban bus as well as urban and regional truck operations.

The major constraint to rapid commercial adoption of electric trucks in regional and long-haul operations is the availability of mid-shift fast charging. Although the majority of energy requirements for these operations could come from off-shift charging, fast and ultra-fast charging will be needed to extend range such that operations currently covered by diesel can be performed by battery electric trucks with little to no additional dwell time (i.e. waiting). Regulations that mandate rest periods can also provide a time window for mid-shift charging if fast or ultra-fast charging options are available en route: the EuropeanUnion requires 45minutes of break after every 4.5hours of driving; the UnitedStates mandates 30minutes after 8hours.

Most commercially available direct current (DC) fast charging stations currently enable power levels ranging from 250-350kW. The European Unions Alternative Fuels Infrastructure Regulation (AFIR) aims to enable mid-shift charging across the EUs core TEN-T network, which covers 88% of total long-haul freight activity, and along other key freight corridors. The provisional agreement reached by the European Council and Parliament includes a gradual process of infrastructure deployment for electric heavy-duty vehicles starting in 2025. Recent studies of power requirements for regional and long-haul truck operations in the UnitedStates and Europe find that charging power higher than 350kW, and as high as 1MW, may be required to fully recharge electric trucks during a 30- to 45-minute break.

Recognising the need to scale up fast or ultra-fast charging as a prerequisite for making both regional and, in particular, long-haul operations technically and economically viable, in 2022 Traton, Volvo, and Daimler established an independent joint venture, Milence. With EUR500million in collective investments from the three heavy-duty manufacturing groups, the initiative aims to deploy more than 1700 fast (300 to 350kW) and ultra-fast (1MW) charging points across Europe.

Multiple charging standards are currently in use, and technical specifications for ultra-fast charging are under development. Ensuring maximum possible convergence of charging standards and interoperability for heavy-duty EVs will be needed to avoid the cost, inefficiency, and challenges for vehicle importers and international operators that would be created by manufacturers following divergent paths.

In China, co-developers China Electricity Council and CHAdeMOs ultra ChaoJi are developing a charging standard for heavy-duty electric vehicles for up to several megawatts. In Europe and the UnitedStates, specifications for the CharIN Megawatt Charging System (MCS), with a potential maximum power of 4.5MW, are under development by the International Organization for Standardization (ISO) and other organisations. The final MCS specifications, which will be needed for commercial roll-out, are expected for 2024. After the first megawatt charging site offered by Daimler Trucks and Portland General Electric (PGE) in 2021, at least twelve high-power charging projects are planned or underway in the United States and Europe, including charging of an electric Scania truck in Oslo, Norway, at a speed of over 1MW, Germanys HoLa project, and the Netherlands Living Lab Heavy-Duty and Green Transport Delta Charging Stations, as well as investments and projects in Austria, Sweden, Spain and the United Kingdom.

Commercialisation of chargers with rated power of 1MW will require significant investment, as stations with such high-power needs will incur significant costs in both installation and grid upgrades. Revising public electric utility business models and power sector regulations, co-ordinating planning across stakeholders and smart charging can all help to manage grid impacts. Direct support through pilot projects and financial incentives can also accelerate demonstration and adoption in the early stages. A recent study outlines some key design considerations for developing MCS rated charging stations:

- Planning charging stations at highway depot locations near transmission lines and substations can be an optimal solution for minimising costs and increasing charger utilisation.

- Right-sizing connections with direct connections to transmission lines at an early stage, thereby anticipating the energy needs of a system in which high shares of freight activity have been electrified, rather than upgrading distribution grids on an ad-hoc and short-term basis, will be critical to reduce costs. This will require structured and co-ordinated planning between grid operators and charging infrastructure developers across sectors.

- Since transmission system interconnections and grid upgrades can take 4-8 years, siting and construction of high-priority charging stations will need to begin as soon as possible.

Alternative solutions include installing stationary storage and integrating local renewable capacity, combined with smart charging, which can help reduce both infrastructure costs related to grid connection and electricity procurement costs (e.g.by enabling truck operators to minimise cost by arbitraging price variability throughout the day, taking advantage of vehicle-to-grid opportunities, etc.).

Other options to provide power to electric heavy-duty vehicles (HDVs) are battery swapping and electric road systems. Electric road systems can transfer power to a truck either via inductive coils3 in a road, or through conductive connections between the vehicle and road, or via catenary (overhead) lines. Catenary and other dynamic charging options may hold promise for reducing the uncertainty of system-level costs in the transition to zero-emission regional and long-haul trucks, competing favourably in terms of total capital and operating costs. They can also help to reduce battery capacity needs. Battery demand can be further reduced, and utilisation further improved, if electric road systems are designed to be compatible not only with trucks but also electric cars. However, such approaches would require inductive or in-road designs that come with greater hurdles in terms of technology development and design, and are more capital intensive. At the same time, electric road systems pose significant challenges resembling those of the rail sector, including a greater need for standardisation of paths and vehicles (as illustrated with trams and trolley buses), compatibility across borders for long-haul trips, and appropriate infrastructure ownership models. They provide less flexibility for truck owners in terms of routes and vehicle types, and have high development costs overall, all affecting their competitiveness relative to regular charging stations. Given these challenges, such systems would most effectively be deployed first on heavily used freight corridors, which would entail close co-ordination across various public and private stakeholders. Demonstrations on public roads to date in Germany and Sweden have relied on champions from both private and public entities. Calls for electric road system pilots are also being considered in the China, India, the United Kingdom and the United States.