Top Electric Vehicles with Advanced Driver Assistance Systems ADAS

Top Electric Cars Revolutionizing Mobility with Advanced Driver Assistance Systems (ADAS)

Mercedes-Benzs Drive Pilot system, capable of handling dynamic driving up to 40 mph on freeways, ensures speed, distance, and lane guidance. Safety features, including lidar, a rear camera, and emergency vehicle detection, prioritize security. Redundant actuators and onboard systems enhance flexibility in case of failure, while high-precision positioning, more accurate than GPS, ensures accuracy within inches. Anonymized sensor data and a digital HD map provide a 3D view of the road, encompassing road geometry, route details, traffic signs, and events. Each vehicle maintains an updated onboard map, constantly comparing it with a central data center. Mercedes-Benz aims to launch a production-ready Drive Pilot in the USA by the end of 2023, starting with a limited fleet of SAE Level 3-equipped Mercedes EQS electric sedans named Drive Pilot: First Class.

2] BMW

MODELS- BMW i7, 2024 BMW i5 [planned]

BMW is bringing a new level of convenience and safety to electric cars with the introduction of its ADAS technology, called Personal Pilot, featured in the BMW i7 and the upcoming 2024 BMW i5. This system operates at SAE Level L2+ and is expected to reach Level L3 capabilities in 2023, allowing for hands-free driving on selected highways. Innoviz Lidar enhances perception, and the computing power comes from Mobileye, with plans to switch to Qualcomm soon. BMW is pushing the boundaries of electric vehicle technology, making driving safer and more enjoyable with these advanced features. The upcoming BMW i5 will include a hands-free driver assistance system for added convenience and safety.

3] XPENG

MODELS P5, P7, G9, G6

Last year, Xpeng became the first Chinese auto company to introduce advanced driver assistance system (ADAS) functions for complex urban driving with its City Navigation Guided Pilot (City NGP) program. City NGP empowers the vehicle to autonomously handle a range of driving tasks, including changing lanes, reacting to traffic lights, and navigating complex road conditions. The ADAS platform features a 360-degree sensor fusion framework and an innovative Surrounding Reality (SR) display. Initially available on the XPeng P5 as part of XPILOT 3.5, City NGP requires a seven-day familiarization period and 100 km of driving before full functionality on all roads. Looking forward, Xpeng plans to extend the ADAS system to its new flagship G9 SUV, launching on September 21 in China. The vehicle is said to have an SAE level of L2+, Lidar of Livox and Robosense, and a computing system by Nvidia.

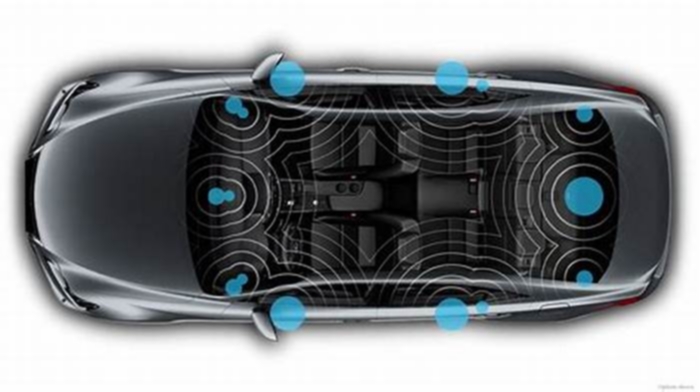

The XPeng P7s XPILOT 3.0, an autonomous driving assistance system, includes the XPeng Navigation Guided Pilot (XNGP). With a total of 31 sensors, including 12 ultrasonic sensors, 10 high-sensitivity cameras, 5 millimeter-wave radars, and 4 surround-view cameras, the XPeng P7 gains omnidirectional perception for a detailed awareness of its surroundings. The XPeng P7 features numerous sensors, radars, and cameras for 360-degree environment detection. The central high-performance computer, Nvidia Drive AGX Xavier, processes the collected data to enable Xmart OS functions such as automated driving and valet parking.

The XPeng G9 is equipped with SAE Level L2+ autonomy, designed for selected cities and highways. Powered by dual Nvidia Drive Orin chips, it controls everything from the G9s digital instrument cluster to the entire ADAS system, utilizing 31 strategically placed sensors around the vehicle. The XPeng G9s in-house R&D team develops both hardware and software to enhance and optimize its sensing capabilities. This design ensures a hassle-free user experience from start to finish. The Xpeng G6 features a bit of similar ADAS features as of Xpeng G9.

4] LI AUTO

MODEL- L9

Each Li L9 vehicle comes equipped with the companys flagship self-developed ADAS, Li AD Max, operating at SAE Level L2+. Enhanced functionality is supported by upgraded perception hardware, featuring one forward 128-line LiDAR, six 8-megapixel cameras, five 2-megapixel cameras, one forward millimeter wave radar, and twelve ultrasonic sensors for 360-degree detection. The sentry mode monitors both interior and exterior using 3D ToF transmitters and external cameras. Li AD Max is powered by dual Orin-X chips by NVIDIA, delivering 508 TOPS of computing power for efficient processing of fusion signals. The dual processors provide redundancy for stable autonomous driving system operation. Additionally, the system is optimized to recognize and proactively react to common accident scenarios, contributing to risk identification and accident prevention.

5] ARCFOX

MODEL- ALPHA S HI

The ALPHA S HI ADAS system, known as City NCA, operates at SAE Level L2+. Its operational design domain (ODD) includes selected cities and highways. Huawei handles both the lidar and computing components of this advanced driver assistance system. The new HI version of ARCFOX Alpha S has 34 high-sensing hardware, forming a 360-degree full-coverage ultra-high fusion sensing system, truly restoring the 3D physical world and accurately identifying obstacles. Its MDC810 intelligent driving computing platform supports 400 TOPS supercomputing power to cope with the test of complex road conditions.

6] FORD

MODELS- MACH- E, F- 150 LIGHTNING

The ADAS system in the MACH-E, named Blue Cruiser, offers hands-free highway driving at SAE Level L2, specifically designed for selected highways. Powered by Mobileye computing, BlueCruise is geared towards reducing stress, enhancing the driving experience, and fostering driver connectivity with nature. The system includes a driver-facing camera that issues alerts if attention to the road wavers momentarily. BlueCruise features adaptive cruise control, maintaining a comfortable distance from the vehicle ahead for added safety. Versions 1.2 and 1.3 include lane-changing assistance, in-lane repositioning, and hands-free enhanced performance, further enhancing the driving capabilities of the Ford MACH-E. Ford F-150 also boasts similar features to ADAS, with secure and safe systems from Blue cruiser.

7] GENERAL MOTORS

MODELS- MOST CADILLAC OR CHEVROLET MODELS

8] TESLA

MODELS- S, X, 3, Y

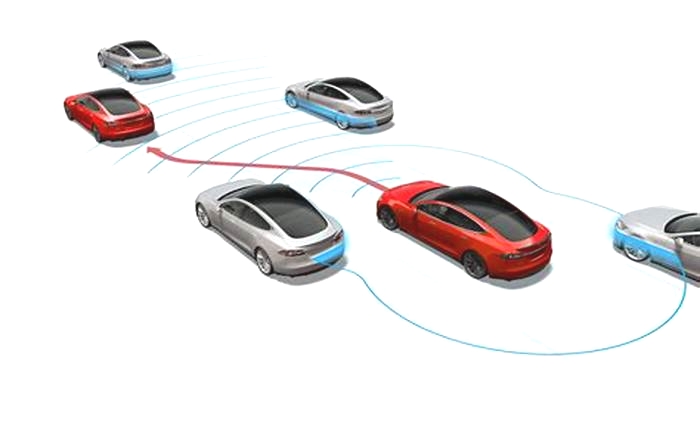

All Tesla models, including Model S, X, 3, and Y, feature the Autopilot/FSD (Full Self-Driving Beta) ADAS system. It features an SAE level of L2+. Operating within selected cities or highways, Tesla handles the computing in-house. Autopilot allows users to navigate from on-ramp to off-ramp, automatically change lanes on highways, summon and retrieve the car, and execute parallel and perpendicular parking with a single touch. This comprehensive ADAS system showcases Teslas commitment to enhancing the driving experience through advanced automation features.

9] VOLKSWAGEN

MODELS- ID. 4, ID. 5, ID. BUZZ

Volkswagens ID.4, ID.5, and ID.BUZZ features the Travel Assist ADAS system with swarm data. Operating at SAE Level L2, the system is designed for use on highways and country roads. Mobileye handles the computing for this system. Travel Assist with swarm data actively maintains the vehicle in its lane, managing the distance to the vehicle in front, and adhering to the driver-set maximum speed. The Adaptive Lane Guidance function ensures the vehicle stays centered in the lane, and the system can optionally provide active support for lane changes at speeds of 90 km/h and faster. This comprehensive ADAS system demonstrates Volkswagens commitment to enhancing driving safety and convenience.

Activated by tapping the indicator stalk, Travel Assist initiates a lane change when sensors detect no nearby vehicles, and the capacitive steering wheel recognizes the drivers hands. The vehicle autonomously executes the overtaking maneuver, and the driver can intervene and take control at any time.

10] KIA

MODELS KIA EV9

Kia is introducing an advanced driver assistance system, the highway driving pilot (HDP), in the Kia EV9 GT-line. This system aims to enable unsupervised hands-free driving on highways in select markets, achieving Level 3 automated driving. The Kia EV9 GT-line will incorporate 15 sensors, including two lidar, radar, and cameras, providing a 360-degree field of view to detect and react to road conditions and other users, preventing potential collisions. While the HDP system will be available only in specific markets, the vehicle will also feature additional safety measures such as rear cross-traffic collision-avoidance assist, lane-keeping, speed and distance maintenance, and a driver engagement detection system. The Kia EV9 GT-line is set to redefine the driving experience with the introduction of the highway driving pilot (HDP) system. Here you can find more about what is Adas

CONCLUSION

ADAS: Top 40 advanced driver assistance systems companies

The term advanced driver assistance systems, or ADAS, refers to a collection of automotive electronics technologies which are designed to enable vehicles to operate autonomously in certain situations.

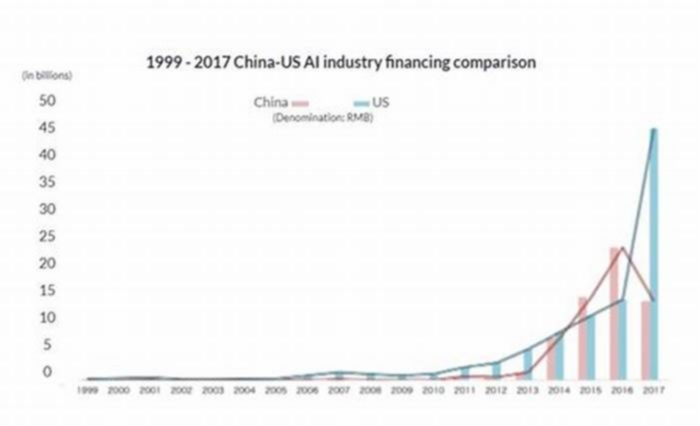

The market for ADAS is forecast to be worth around $70 billion by 2025, according to Grand View Research. And although its already a huge market, a lot of the activity now is with the future in mind, a future in which many believe autonomous and electric cars will dominate.

A longer list of ADAS functions can be found elsewhere on this website, but examples include cruise control, lane-keeping, self-parking, and collision avoidance.

Industry jargon can sometimes confuse and over-complicate the explanation of technologies, but in this instance, the terminology is far simpler than the increasingly sophisticated and bewildering array of complex systems already on the market and in development.

Essentially, ADAS can be thought of as automated or even autonomous driving functions, and developers of these technologies are seeing growing demand for their systems.

In this article, we list approximately 40 of the leading companies, in alphabetical order, in the ADAS market.

A large number of automotive technology experts and observers say that cars and other vehicles are becoming increasingly autonomous, they have greater levels of internet connectivity, and theyre going electric.

In short: autonomous, connected, and electric. Or ACE for short. Which can perhaps be our small and totally unnecessary contribution to automotive industry jargon.

AImotive

It used to be called AdasWorks, which probably shows how the technology has gravitated towards AI in recent years. Or at least how AI has become an important part of ADAS.

AImotive was established just four years ago, and appears to concentrate totally on bringing fully driverless cars to the market.

The company offers a range of software plus hardware solutions, including chips specifically designed to process AI tasks in a power-efficient way.

Aisin Seiki

With a market capitalization approaching $15 billion, Aisin Seiki is one of the largest companies in the automotive technology market. Established 70 years ago, its 30 percent owned by Toyota, and mainly supplies engines, drivetrains and chassis.

Aisin considers itself a pioneer in ADAS, especially in automated parking, which it is says is making even more advanced by making it remote-controlled using a smartphone.

Ambarella

Although Ambrella has been enjoying a lot of success in the smart home market, the camera systems the company has developed for the automotive sector are also generating interest because it uses deep neural network processing and environmental perception to assist the driver or the car.

Ambrellas cameras have been used in the Darpa Grand Challenge, a trip from China to Italy in full autonomous mode, which included driverless navigation at highway speeds.

Ambrella is another company which specializes in a limited number of technologies, in this instance, based on cameras.

ARM

Better known as a chip designer, ARM is a hugely influential company in the semiconductor world. Although its share of the automotive and other markets may not be dominant under its own name, its chip designs probably feature in the significant proportion of systems in most sectors.

Automotive companies have been turning to ARM to help design autonomous and ADAS systems. The company has been basing its solutions on its Cortex processors and building what it describes as complex autonomous compute systems, sensor fusion being one its main preoccupations.

ARM was acquired by the SoftBank Group in 2016. ARM employs more than 6,000 people and currently has annual turnovers in the region of $1.4 billion.

Autoliv

Autoliv is a relatively new company, having been founded in 1997, but in todays startup culture that makes it quite old. It has a market capitalization of approximately 7.5 billion, and employs a sizeable 66,000 people worldwide.

Its early work was in seat belt technology, which gradually expanded to include steering wheels, airbags and a range of safety functions. In terms of ADAS, Autolivs main product is its electronic control unit, or ECU.

ECUs look like chips, are function as the brains of the car, enabling it to respond to data from sensors all over the vehicle. It is estimated that new cars have approximately 100 embedded ECUs.

Bosch

Bosch is a giant of a company in any market, a household name, and, correspondingly, its also a giant in the ADAS sector.

Such is the breadth of its range of technologies its 400,000 employees produce that it could probably be described as a one-stop shop for automotive electronics and technology in general.

The company has strengthened its partnerships with German automakers such as Mercedes, and is developing comprehensive solutions for vehicles of tomorrow autonomous, connected and electric.

Continental

Most people probably know Continental as a tyre supplier, but the company is much more than that, and its interest in the ADAS segment has been underlined by a number of technologies it has been showcasing.

The company has developed technologies such as assisted and automated driving control units, which is a fancy name for ECUs, as well as radars and lidars light detection and ranging systems for automotive applications.

It also has a V2X unit for vehicle-to-infrastructure communication, an area which is seeing fast growth along with the rest of the market.

Delphi Automotive

Delphi recently renamed itself Aptiv, and employs almost 150,000 people. Its still a auto parts supplier, and its main innovation is something it calls a predictive powertrain.

The term powertrain, simply put, refers to the system which transfers or converts the power generated by the vehicle engine into the the movement of the wheels on the road surface.

The term predictive, as Delphi uses it, appears to refer to the integration of computing technology which would enable the car to plan autonomous journeys and monitor the condition of the car, alerting of maintenance requirements, as well as operate in a more fuel-efficient way.

Denso

It might not be a household name like one or two others on this list, but Denso is a giant in the automotive sector, mainly because it is the main supplier for Toyota.

With annual revenues typically in the region of $45 billion, Denso has enormous resources and has been using them to acquire startups and other companies to position itself appropriately for the future.

Denso supplies a huge range of products and services, from powertrains to ECU and semiconductor design. In ADAS, it concentrates on radar, lidar, and V2x systems, but its also keen on showcasing its automatic lane-change offering.

Elektrobit

A supplier of embedded and connected software products, Elektrobit specializes in automotive technologies. Its main offering for autonomous cars is the EB Robinos software.

Faar

This company offers what it describes as a full autonomous driving kit, which includes software and hardware. It also offers more niche solutions for things like actuator bypassing and data collection.

Gentex

A well-established company with a market cap of almost $6 billion, Gentex supplies camera-based features for vehicles, but its specialism is in the mirror.

The mirror is central to Gentex products and it the company says it is enhancing its capability to apply additional features to the mirror, including lane departure warning, forward collision warning, and traffic sign recognition, among others.

Gentex also supplies custom sensor clusters which may include multi-purpose cameras, velocity sensors, rain sensors and humidity sensors.

Green Hills Software

With a concentration on safety and security, which all of the companies are, Green Hills Software offers its own platform for ADAS, complete with an integrated development environment.

The platform includes numerous frameworks, software applications, and support for a. variety of automotive processors.

Harman International

Samsung acquired Harman a couple of years ago, which gave the smartphone giant instant access to the automotive sector because Harman is a Tier 1 supplier, basically meaning preferred.

Originally specializing in audio, the company expanded into in-car entertainment in general, and has recently been developing connected car technology.

Now, with access to Samsungs vast experience in sensors and cameras, Harman says it it offers a truly holistic ADAS experience. Specifically, however, its strengths are in augmented reality systems to assist driving, and data analysis powered by artificial intelligence.

Hella

Unusually, Hella is a family-owned company. It supplies a range of automotive products and services, including technologies for autonomous driving.

The company says autonomous driving is made possible by more sophisticated technologies, more powerful control units and new software architectures within and beyond the vehicle.

In terms of specifics, it supplies radar sensors, camera software, shake sensors, and adaptive front lighting systems, among other ADAS-type products.

Hitachi Automotive Systems

Part of the giant conglomerate which recently took over ABB Switzerland, Hitachi Automotive Systems says ADAS will be a key part of the growth of the market for autonomous driving systems.

The company has developed what it calls an ADAS Controller, which it says enables easier modification and addition of applications.

So, if you want to add a new sensor to the car, or new software, the ADAS controller is designed to be flexible in that way.

Hyundai Mobis

The parts and services arm of Hyundai Motor, Mobis has annual revenues above $32 billion. So its one of the biggest automotive parts and services companies on this list.

Hyundai Mobis has been supplying ADAS functionalities such as electronic stability control for quite some time, but last year, it started aggressively investing in autonomous driving technologies.

These will include radar and sensor technologies. Its particularly interested in developing sensors that can convert external driving circumstances into digital signals and read them accurately, saying this is an important challenge for an autonomous industry that is now readying itself for the era of autonomous driving.

Imagination Technologies

A tech company in the more modern sense, Imagination does not specialise in ADAS, but it has launched a product for the automotive sector.

PowerVR Automotive is a hard plus software solution which is designed to accelerate the development of autonomous vehicles.

Infineon

Another company which, while not a top 10 chipmaker overall, is huge in the automotive market. Infineon is one of the better-known names in ADAS.

The company has developed a number of chips for specialized tasks, such as the Rasic range for radar, and the Real 3 Time-of-Flight image sensor, which provides 3D depth for driver monitoring applications.

Infineon recently decided to invest $2 billion a new semiconductor factory in Austria, and has formed partnerships with companies including Baidu, which should ensure its position in the market.

Magna

One of the better-known companies in the automotive components market, partly because it isnt linked by history to any of the big automakers, although it works with all of them since its one of the largest suppliers.

Magnas background is in electronics, which is essentially what ADAS is mostly about, and in that area, the company says it is actively developing new products for a fully autonomous future.

Magna offers its Max4 ADAS platform for fully autonomous driving, but the functions integrated into it such as emergency braking are also used in the semi-autonomous vehicles of today.

Maxim Integrated

Interestingly, Maxim Integrated is known as a designer and supplier of analog and mixed-signal integrated circuits which sounds like an anachronism in todays world where everything is digital.

Maxim offers systems which support the standard array of ADAS functions, including parking assistance, lane positioning, and collision avoidance, to name a few.

The company employs more than 7,000 people and generates revenues of approximately $2.5 billion a year.

Mitsubishi Electric

Its easy to forget the structure of Mitsubishi. It used to be one single company at some time in the past, but Mitsubishi Electric is apparently separate from Mitsubishi Group, which is the unit that makes cars.

Mitsubishi Electric concentrates on the industrial sector, and offers a massive range of products and services. It has 140,000 employees and annual revenues of almost $40 billion.

For the ADAS market, Mitsubishi Electric is currently developing cameras as well as ECUs, among a variety of sensing and data processing technologies.

Mobileye

Mobileye says it supports a comprehensive suite of ADAS functions, but there are so many of them and its likely that new ones are being developed all the time.

Mobileyes success in the past year or two have been mostly its partnerships with leading automakers, such as BMW, which, while it develops ADAS of its own, is probably interested in working with the Intel-backed company for a variety of reasons.

Among the technologies Mobileye highlights is lane departure warning and forward collision warning.

Nvidia

Although Nvidia not even among the top 10 largest semiconductor companies overall, it has virtually cemented its position as the leading company in the automotive market for ADAS systems.

All large automotive companies the brands as well as their suppliers have signed up to some aspect of Nvidias autonomous driving developer program, and its carputer is likely to feature in many tens of millions of vehicles in the future.

The Nvidia Drive computing system or platform is, as its name suggests, specially tailored for automotive applications, and features deep learning AI and a variety of software libraries, frameworks and source packages for developers.

NXP Semiconductor

Since buying Freescale, another chipmaker which had a large share of the automotive electronics market, NXP has become the de facto leader in the sector.

Overall, NXP is one of the top 10 semiconductor manufacturers in the world, but only just. Its strong position in the auto market is a factor in this.

The company has developed sensor fusion systems and radar and vision systems for an extensive range of scenarios, but its position in the may be challenged by other companies looking for inroads into the automotive market.

OmniVision

As its name suggests, OmniVision specializes in camera-based technologies, offering a range of products for automotive applications.

They include high high dynamic range plus advanced image signal processing, which provide detailed scenes, regardless of light conditions, says the company.

The company employs more than 2,000 people and its revenue is approximately $1.4 billion.

Panasonic

It used to be a household name and still is to a certain extent because of its consumer electronics products. But these days, Panasonic is just as well known for its industrial technologies.

In the ADAS segment, Panasonic offers a range of technologies such as camera-based eye-tracking which can detect drowsiness in a driver, and intelligent rear-view mirrors which adjust to the light and have cameras integrated into them.

Perhaps the cleverest thing about the intelligent mirror is that it requires no external ECU.

QNX

Blackberry is a name that will probably be forever associated with smartphones, but the company has been branching out of late in unexpected ways.

One of the directions it has taken has brought it to the ADAS market, where it is offering software solutions for vision processing and deep neural-net based machine learning algorithms.

Its one of the few companies to use the open-source Robot OS, which may help to tap into a larger ecosystem of developers going forward.

Renesas Electronics

Another semiconductor manufacturing company, Renesas specializes in the automotive sector. In fact, by some calculations, it is the largest automotive semiconductor maker, and the worlds largest maker of microcontrollers.

Renesas has 20,000 employees and is part of the larger NEC Corporation.

Its main ADAS offerings are based on camera technologies. So, among other technologies, it has something called surround view, which is self-explanatory to an extent, but uses Renesas automotive computing platform, R-Car, which runs something the company calls cognitive computing, another term to mean artificial intelligence.

Sick

While public roads may have to wait many years before fully autonomous vehicles drive themselves along them, in the logistics and supply chain industry, there are many tens of thousands of driverless vehicles operating in warehouses all over the world.

A huge proportion of them were built using Sick technology, such as its collision avoidance system, which is a large part of the reason why the companys turnover is increasing beyond $2 billion a year.

One thing to consider is that autonomous vehicle technology is likely to affect both these sectors simultaneously in the future.

Takata

The recent troubles at Takata appear to be related to its airbags, because of which BMW recalled 360,000 cars in China in the past few days.

The company filed for bankruptcy a couple of years ago. However, it was previously regarded highly in the sector and may make a comeback.

Texas Instruments

One of the leading suppliers of chips to the automotive industry, Texas Instruments produces processors specifically for ADAS.

These processors support functions such as parking assistance, surround view, and driver monitoring. Modules are available for cameras, radar, lidar, sensor fusion, and even ultrasound.

The companys annual revenues are in the region of $15 billion and it employs 30,000 people.

TRW Automotive

Mainly a car parts supplier, TRW was acquired by automotive technology manufacturer ZF Friedrichshafen in 2015. As a result, it will likely become a supplier and possibly a developer in the ADAS sector.

Valeo

Probably best known for manufacturing powertrain systems, Valeo is a huge business, with around $4 billion in annual sales and 25,000 employees.

Like all others in the sector, the company is investing heavily in developing technologies for autonomous and connected cars.

Specifically, it offers products including weather sensors, lane change systems, and automated parking, among others.

Vector

Employing 2,500 people at 26 locations makes it a big company, but such is the size of this market that there is plenty of room to grow manifold.

Vector is a specialist automotive electronics company of 30 years standing. Its offerings tend to be a combination of hardware and software solutions.

They include measuring instruments to acquire sensor data, checking and optimizing ECU functions, software components, and algorithm design.

Velodyne

By some calculations, Velodyne is one of the leading suppliers of lidar technology, in which it specializes.

Lidar has become such an important component in self-driving vehicles that it is seeing numerous innovations within itself, meaning there are different types of lidar now.

And while we are talking about autonomous vehicles and ADAS in this article, these kinds of components can be used in a variety of scenarios beyond automotive.

Visteon

Visteon is an automotive component supplier with annual revenues of more than $3 billion, and it employs 10,000 people.

Wabco

The potential size of the market for ADAS in commercial vehicles such as trucks is huge, and this is where Wabco operates. The company has developed a wide range of ADAS technologies for large vehicles.

These include ADAS functions in braking, stability control, suspension, transmission automation and aerodynamics.

Wabco employs 12,000 people and has annual revenues of more than $2.6 billion. Last month, the 150-year-old company was acquired by ZF Friedrichshafen.

ZF Friedrichshafen

With annual revenues of almost $42 billion and 140,000 employees, car parts maker ZF Friedrichshafen is one of the largest companies on this list.

With ADAS permeating almost all of its products, ZF is fast becoming one of the leading suppliers of autonomous technology in the automotive market.

Cameras, radar, laser and communication systems are part of the technology mix at ZF, and the company has developed a vehicle computer, called ProAI RoboThink, than it says can process 150 trillion operations a second.

It resembles the Nvidia computer which other ADAS developers are also Bosch are working with.