What happens to EV batteries at end of life

Millions of electric car batteries will retire in the next decade. What happens to them?

A tsunami of electric vehicles is expected in rich countries, as car companies and governments pledge to ramp up their numbers there are predicted be 145m on the roads by 2030. But while electric vehicles can play an important role in reducing emissions, they also contain a potential environmental timebomb: their batteries.

By one estimate, more than 12m tons of lithium-ion batteries are expected to retire between now and 2030.

Not only do these batteries require large amounts of raw materials, including lithium, nickel and cobalt mining for which has climate, environmental and human rights impacts they also threaten to leave a mountain of electronic waste as they reach the end of their lives.

As the automotive industry starts to transform, experts say now is the time to plan for what happens to batteries at the end of their lives, to reduce reliance on mining and keep materials in circulation.

A second life

Hundreds of millions of dollars are flowing into recycling startups and research centers to figure out how to disassemble dead batteries and extract valuable metals at scale.

But if we want to do more with the materials that we have, recycling shouldnt be the first solution, said James Pennington, who leads the World Economic Forums circular economy program. The best thing to do at first is to keep things in use for longer, he said.

There is a lot of [battery] capacity left at the end of first use in electric vehicles, said Jessika Richter, who researches environmental policy at Lund University. These batteries may no longer be able run vehicles but they could have second lives storing excess power generated by solar or windfarms.

Several companies are running trials. The energy company Enel Group is using 90 batteries retired from Nissan Leaf cars in an energy storage facility in Melilla, Spain, which is isolated from the Spanish national grid. In the UK, the energy company Powervault partnered with Renault to outfit home energy storage systems with retired batteries.

Establishing the flow of lithium-ion batteries from a first life in electric vehicles to a second life in stationary energy storage would have another bonus: displacing toxic lead-acid batteries.

Only about 60% of lead-acid batteries are used in cars, said Richard Fuller, who leads the non-profit Pure Earth, another 20% are used for storing excess solar power, particularly in African countries.

Lead-acid batteries typically last only about two years in warmer climates, said Fuller, as heat causes them to degrade more quickly, meaning they need to be recycled frequently. However, there are few facilities that can safely do this in Africa.

Instead, these batteries are often cracked open and melted down in back yards. The process exposes the recyclers and their surroundings to lead, a potent neurotoxin that has no known safe level and can damage brain development in children.

Lithium-ion batteries could offer a less toxic and longer-lasting alternative for energy storage, Fuller said.

The race to recycle

When a battery really is at the end of its use, then its time to recycle it, Pennington said.

There is big momentum behind lithium-ion battery recycling. In its impact report, published in August, Tesla announced that it had started building recycling capabilities at its Gigafactory in Nevada to process waste batteries.

Nearby Redwood Materials, founded by the former Tesla chief technology officer JB Straubel, which operates out of Carson City, Nevada, raised more than $700m in July and plans to expand operations. The factory takes in dead batteries, extracts valuable materials such as copper and cobalt, then sends the refined metals back into the battery supply chain.

Yet, as recycling becomes more mainstream, big technical challenges remain.

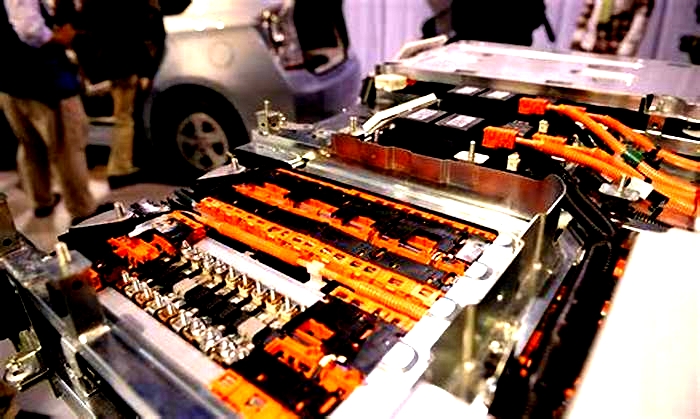

One of which is the complex designs that recyclers must navigate to get to the valuable components. Lithium-ion batteries are rarely designed with recyclability in mind, said Carlton Cummins, co-founder of Aceleron, a UK battery manufacturing startup. This is why the recycler struggles. They want to do the job, but they only get introduced to the product when it reaches their door.

Cummins and co-founder Amrit Chandan have targeted one design flaw: the way components are connected. Most components are welded together, which is good for electrical connection, but bad for recycling, Cummins said.

Acelerons batteries join components with fasteners that compress the metal contacts together. These connections can be decompressed and the fasteners removed, allowing for complete disassembly or for the removal and replacement of individual faulty components.

Easier disassembly could also help mitigate safety hazards. Lithium-ion batteries that are not properly handled could pose fire and explosion risks. If we pick it down to bits, I guarantee you, its not going to hurt anyone, Cummins said.

Changing the system

Success isnt guaranteed even if the technical challenges are cracked. History shows how hard it can be to create well-functioning recycling industries.

Lead-acid batteries, for example, enjoy high rates of recycling in part due to legal requirements as much as 99% of lead in automobile batteries is recycled. But they have a toxic cost when they end up at improper recycling facilities. Spent batteries often end up with backyard recyclersbecause they can pay more for them than formal recyclers, who have to cover higher operating costs.

Lithium-ion batteries may be less toxic but they will still need to end up at operations that can safely recycle them. Products tend to flow through the path of least resistance, so you want to make the path which goes through formal channels less resistant, Pennington said.

Legislation could help. While the US has yet to implement federal policies mandating lithium-ion battery recycling, the EU and China already require battery manufacturers to pay for setting up collection and recycling systems. These funds could help subsidize formal recyclers to make them more competitive, Pennington said.

Last December, the EU also proposed sweeping changes to its battery regulations, most of which target lithium-ion batteries. These include target rates of 70% for battery collection, recovery rates of 95% for cobalt, copper, lead and nickel and 70% for lithium, and mandatory minimum levels of recycled content in new batteries by 2030 to ensure there are markets for recyclers and buffer them from volatile commodity prices or changing battery chemistries.

They arent in final form yet, but the proposals that are out there are ambitious, Richter said.

Data could also help. The EU and the Global Battery Alliance (GBA), a public-private collaboration, are both working on versions of a digital passport an electronic record for a battery that would contain information about its whole life cycle.

We are thinking about a QR code or a [radio frequency identification] detection device, says Torsten Freund, who leads the GBAs battery passport initiative. It could report a batterys health and remaining capacity, helping vehicle manufacturers direct it for reuse or to recycling facilities. Data about materials could help recyclers navigate the myriad chemistries of lithium-ion batteries. And once recycling becomes more widespread, the passport could also indicate the amount of recycled content in new batteries.

As the automobile industry starts to transform, now is the time to tackle these problems, said Maya Ben Dror, urban mobility lead at the World Economic Forum. The money pouring into the sector offers an opportunity to ensure that these investments are going to be in sustainable new ecosystems and not just in a new type of car, she said.

Its also worth noting that sustainable transport goes beyond electric cars, said Richter. Walking, biking or taking public transportation should not be overlooked, she said. Its important to remember that we can have a sustainable product situated within an unsustainable system.

What will happen when all those EV batteries reach their end of life?

The federal government and the provincial governments of Ontario and Quebec have committed tens of billions of dollars to the development of electric vehicle (EV) battery-manufacturing facilities and supply chains over the past two years.

Substantial support is also being provided by the federal government and some provinces to subsidize EV purchases for Canadians and for the development of EV charging infrastructure. Regulatory proposals are also under consideration to mandate 100%-zero-emission vehicle sales for light-duty vehicles by 2035.

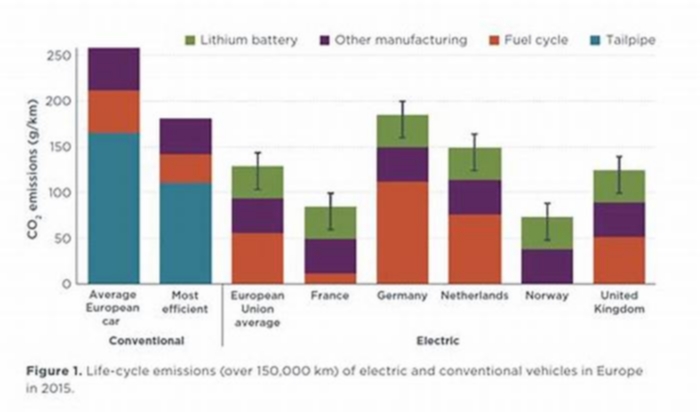

EVs outperform conventional internal combustion engine vehicles by wide margins in terms of reducing direct emissions of greenhouse gases and other pollutants, as well as in energy efficiency.

Road transportation produces 14% of global GHG emissions. The widespread adoption of EVs is therefore widely accepted as an essential component of effective decarbonization plans.

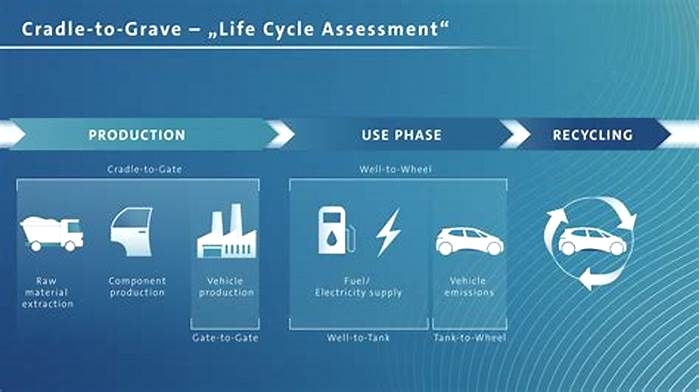

However, when viewed on a life-cycle basis, the electrification of transportation raises wider sustainability issues, such as:

- The need for increased electricity supply to meet the additional demand flowing from the widespread adoption of EVs;

- The impact and risks associated with the materials and supply chains needed for EV manufacturing, particularly the mining of critical minerals for battery production;

- The management and disposal of end-of-life EV batteries, which are complex manufactured products that may contain materials classified as toxic under the Canadian Environmental Protection Act and other legislation.

The first issue is complex and important. It is being examined through studies by governments, utilities, non-governmental organizations and the academic community. The second and third issues have received much less attention.

The federal government and many provincial governments, including Ontario, are aggressively supporting development of critical mineral resources for EV battery manufacturing. But there has been little action or discussion about what will happen when EV batteries reach their end of life.

That needs to change. Areas of risk and opportunity need to be identified early and frameworks established to address these issues before they become serious problems. The approach taken in Europe could be a model for this.

The significance of end-of-life EV batteries will grow as EV sales are expected to accelerate dramatically to the tens of millions per year over the next decade. Each new EV sale will eventually result in an end-of-life battery that will need to be managed.

In addition to the need to prevent harm to the environment or human health from their disposal, there are also positive outcomes. Materials recovered from end-of-life batteries could substantially reduce the need to mine new critical materials. They could also reduce the negative environmental, health and social impacts associated with these extractive activities.

There is also growing interest in the potential for EV batteries to have "second lives" in electricity grids, supporting the integration of renewable energy sources and providing emergency backup.

In the context of these questions, a study released in October by York University's sustainable energy initiative examined the development of policy and regulatory regimes for the post-consumer management of end-of-life EV batteries in Canada, the United States and the European Union.

Its key finding is that regulatory frameworks for end-of-life EV battery management are essentially non-existent in North America.

B.C. and California were found to be potentially moving in the direction of establishing preliminary regulatory structures. Quebec did launch a voluntary recovery system in June 2023. Other North American jurisdictions, including Ontario, indicated they had no intention to establish any form of post-consumer management framework.

Publicly available information on the actual fate of end-of-life EV batteries in North America is extremely limited.

It has been argued that the value of end-of-life EV batteries to recyclers and manufacturers is high enough to prevent the batteries from ending up in landfills or long-term storage. However, in the absence of any transparency requirements around recovery rates and tracking the fate of end-of-life batteries, it is impossible to substantiate this claim.

In contrast to the situation in North America, end-of-life EV batteries have been managed under a European Union (EU) battery directive since 2006. The EU also adopted an updated regulatory framework in June 2023 that will be binding on all member states.

While weaker than its original proposals, the EU regulation is based on the principle of extended producer responsibility. Manufacturers are required to establish plans for recovery and recycling of end-of-life batteries they make or introduce into the market.

The regulation also establishes systems for tracking the fate of end-of-life EV batteries, including "battery passports" and moves in the direction of requiring a minimum level of recycled materials for new batteries.

Canada needs to develop a national regime for end-of-life EV battery management of its own. It should follow the model of key elements in the new EU regulation. These should include the responsibility of manufacturers and importers to establish recovery and recycling systems, reporting requirements and the use of battery passports to help in tracking, reuse and recycling.

The lack of attention to these questions in Canada while governments invest billions in the development of battery supply chains and manufacturing facilities highlights the need to pay attention to the life-cycle implications of energy transitions.

Citation: What will happen when all those EV batteries reach their end of life? (2023, November 20) retrieved 19 April 2024 from https://techxplore.com/news/2023-11-ev-batteries-life.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no part may be reproduced without the written permission. The content is provided for information purposes only.