What is the most popular EV company in China

Top 10 China EV Brands + 5 Promising Ones (Updated 2023)

Electric cars battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV) are rising rapidly to rival and replace their purely-gasoline counterparts, led by Chinese EV brands and traditional automobile companies.

These China-based auto brands are established EV manufacturers domestically and globally, while some are exciting up-and-coming players.

The 10 Best Chinese Electric Car Brands

This top ten EV manufacturers list isnt in any particular as sales performances change month-to-month and year-to-year, depending on the popularity of their latest releases.

#1 BYD

Founder: Wang Chuanfu

Founded: 2003

Headquarters: Shenzen, China.

2023 Market Cap: USD 94.9 billion

BYD, short for Build Your Dreams, is a long-established electric vehicle brand based in Shenzen, China, with additional manufacturing plants in Xian and Changsha.

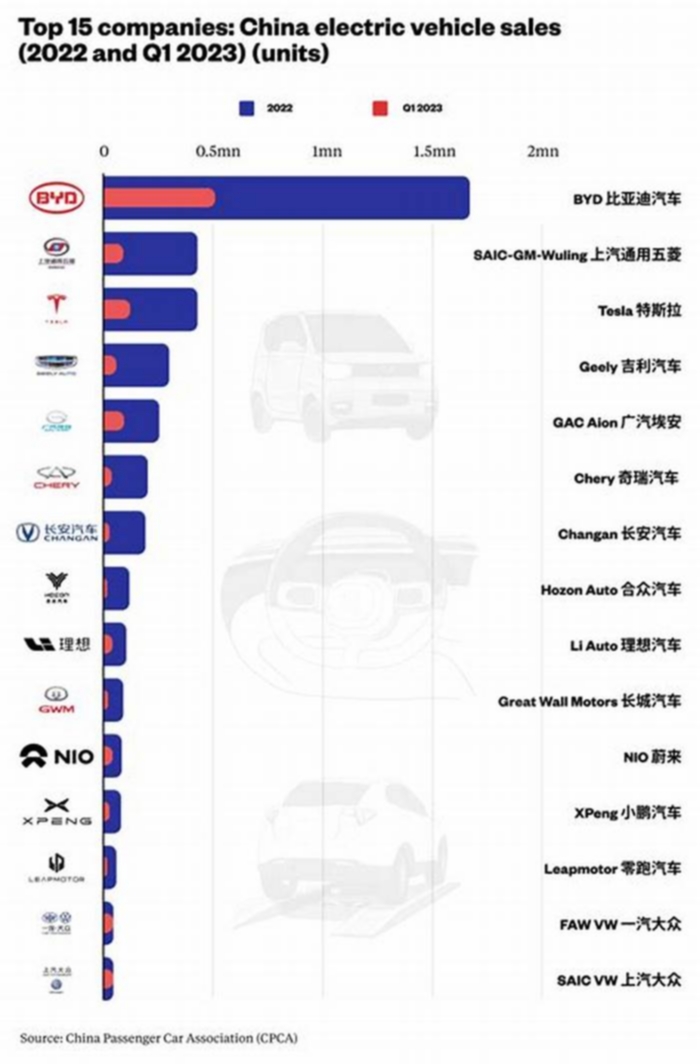

BYD is the largest EV maker locally and globally.

The automakers parent company, BYD Co. Ltd., began life in 1995 as a battery manufacturer before expanding its production to include electric vehicles at the turn of the century.

Although China is its primary market, the broad-ranging auto company designs and sells EVs, plug-in hybrids, and commercial electric vehicles in over 70 countries and regions.

BYDs notable passenger vehicle models are:

- BYD Atto 3 midsize SUV.

- BYD Atto 4 compact sedan.

- BYD e1 city car.

- BYD e2 compact hatchback.

- BYD e3 compact sedan.

- BYD e6 MPV (multi-purpose vehicle).

- BYD e9 midsize sedan.

- BYD Qin compact sedan.

- BYD Tang midsize SUV.

- BYD Song compact SUV.

- BYD Han midsize luxury sedan.

- BYD Yuan subcompact SUV.

- BYD M3e MPV (multi-purpose vehicle).

- BYD Dolphin compact hatchback.

- BYD Seagull city car.

- BYD Sea Lion compact SUV.

- BYD Destroyer compact sedan.

- BYD Frigate midsize SUV.

- BYD Landing Ship MPV (multi-purpose vehicle).

#2 Li Auto

Founder: Li Xiang

Founded: 2015

Headquarters: Beijing, China.

2023 Market Cap: USD 23.7 billion

With its Changzhou engineering and manufacturing facility in eastern China, Li Auto is an emerging EV brand, having debuted on the Nasdaq in 2020.

The Chinese car company focuses on plug-in-hybrid technologies of electric vehicles. Besides, it also offers rental services.

Its first release was the Li ONE electric SUV with a 2021 debut, one of the countrys top sellers.

These are Li Autos two primary EV models:

#3 SAIC Motor

Founded: 1955

Headquarters: Shanghai, China.

2023 Market Cap: USD 23.61 billion

SAIC Motor is the largest state-owned car company in China.

It invests heavily in electric vehicles, partnering with General Motors (GM) and Volkswagen to extend its international reach.

Plus, SAIC sells many electric cars locally under its brands, such as MG, Roewe, Maxus, Baojun, Wuling, IM, and Feifan.

Collectively, SAIC and its subsidiary brands and joint ventures sold millions of vehicles annually.

PHEV and all-electric models SAIC produced with Volkswagen include the e-Tharu, ID.4, Passat PHEV, and Tiguan PHEV.

#4 Changan

Founder: China South Industries Group

Founded: 1862

Headquarters: Chongqing, China.

2023 Market Cap: USD 14.21 billion

Established in the nineteenth century as a military equipment factory, the company subsequently began manufacturing commercial vans, trucks, and passenger vehicles.

Oshan and Kaicene are among Changan Automobiles sub-brands, and the company has jointly developed cars with Ford and Mazda.

In collaboration with Huawei, Changan plans to gradually phase out gasoline and diesel vehicles and transition fully into an EV-only manufacturer.

Changan range of EVs:

- Changan Benni

- Changan Benni

- Changan CS15

- Changan CS75

- Changan Eado

- Changan Eulove

- Changan Honor

- Changan Niou

- Changan Oushang

- Changan Star

- Changan Taurustar

- Changan Ford Kuga

- Changan Ford Mondeo Energi

#5 NIO

Founder: William Li

Founded: 2014

Headquarters: Shanghai, China.

2023 Market Cap: USD 13.9 billion

Tencent (producer of the WeChat app), Baidu, and Lenovo are major investors in NIO, a Chinese maker of premium electric vehicles.

Alone or jointly, this EV company sells smart and autonomous-driving luxury electric cars by developing next-generation technologies and artificial intelligence.

Its products include innovative charging solutions and other user-centric services within the NIO OS and NIO Autonomous Driving (NAD) ecosystem.

NIO ET7 was the Chinese brands first autonomous driving model.

NIO electric car lineup consists of:

- NIO EC6 midsize SUV.

- NIO EP9 coupe.

- NIO ES6 midsize SUV.

- NIO ES7 midsize SUV.

- NIO ES8 full-size SUV.

- NIO ET7 full-size sedan.

#6 GEELY

Founder: Li Shufu

Founded: 1986

Headquarters: Hangzhou, China.

2023 market Cap: USD 12.5 billion

Geely Holding Group established Geely Auto in 1997 to enter the automotive industry.

Other car brands the parent company owns, co-owns, or partners with include Geometry, Zeekr, Lynk & Co., Volvo, Polestar, Proton, and Lotus.

With numerous R&D centers, design offices, and production facilities in China, North America, Europe, and South-East Asia, Geely and its affiliated brands are among the top-selling Chinese manufacturers globally.

Some of Geelys recent EV models with its partner or subsidiary brands are:

- Geely Emgrand EC7.

- Geely Emgrand EV300.

- Geely Emgrand GL PHEV.

- Geely Emgrand GS Cross PHEV.

- Geely Emgran GSe Cross EV400.

- Geely Geometry A.

- Geely Geometry C.

- Geely Borui GE.

- Geely Bin Yue Ranger 260T PHEV.

- Geely Xing Yue Star T400.

- Geely JIA-JI PHEV.

- Geely X1 Mini EV.

#7 Xpeng

Founder: He Xiaopeng, Xia Heng, Lei Jun.

Founded: 2014

Headquarters: Guangzhou, China.

2023 Market Cap: USD 7.9 billion

With offices in America and public trading on the New York Stock Exchange, this China-based EV and technology company has been scaling the domestic sales chart in recent times.

It develops smart electric cars with integrated autonomous-driving features and internet technologies.

XPeng has designed interactive voice systems, similar to Amazons Alexa, and in-car digital assistants, gaining its EVs popularity among young families.

Popular models under the brands stable include:

- XPeng G9 SUV.

- XPeng G3i SUV.

- Xpeng P7 sedan.

- XPeng P5 sedan.

#8 FAW

Founder: FAW Group

Founded: 1997

Headquarters: Changchun, China.

2023 Market Cap: USD 5.55 billion

Its parent company and one of the more prominent state-owned manufacturers, FAW Group (established in 1953), founded FAW Car in 1997.

Besides the FAW brand, the Group also sells vehicles using its other brands, Hongqi and Bestune, and through joint ventures with Toyota and Volkswagen.

The Group does not only make electric passenger cars; commercial buses and trucks form part of its product line.

FAWs own and joint-venture electric cars include:

- FAW Besturn B30

- FAW Besturn B50

- FAW Besturn X40EV

- FAW Besturn X80EV

- FAW Junpai A70E

- FAW Junpai D80E

- FAW Oley

- FAW Senia R7 EV

- FAW Toyota IZOA

- FAW VW e-Bora

- FAW VW e-Golf

- FAW VW ID.4 Crozz

#9 JAC Motors

Founded: 1964

Headquarters: Hefei, China.

2023 Market Cap: USD 3.69 billion

This Chinese car companys products are a balanced mix of commercial and passenger vehicles, with EVs forming a smaller percentage of its total output.

JAC has three sub-brands under its umbrella: Heyue (discontinued 2017), Refine, and Jiayue.

Although they arent the most striking, design-wise, these EV models are affordable and target the broader mainstream market:

- JAC iEV A50

- JAC iEV A60

- JAC iEV J4

- JAC iEV330P

- JAC iEV4

- JAC iEV5

- JAC iEV6

- JAC iEV7

- JAC iEVS4

#10 BAIC Motor

Founder: Xu Heyi

Founded: 1958

Headquarters: Beijing, China.

2023 Market Cap: USD 2.25 billion

BAIC Motor is part of BAIC Group, owned by the Beijing Municipal Government.

What started as a manufacturer of commercial vehicles like buses and trucks, the parent company founded BJEV (Beijing Electric Vehicle Co., Ltd.) in 2009, under which it sells its range of electric cars BAIC eventually spun off BJEV in 2017 with the creation of the ARCFOX brand.

Despite underwhelming sales in recent years, BAIC remains one of the leading EV manufacturers in China.

Among the Chinese brands extensive list of EV cars are:

- BAIC E150

- BAIC EC180

- BAIC EC3

- BAIC EC5

- BAIC EH300

- BAIC EH400

- BAIC ES210

- BAIC EU260

- BAIC EU5

- BAIC EU7

- BAIC EV12

- BAIC EV300

- BAIC EX200

- BAIC EX3

- BAIC EX300L

- BAIC EX360

- BAIC EX450

- BAIC EX5

- BEIJING passenger car series.

- BEIJING BJ series of off-road SUVs.

Promising Chinese EV Manufacturers

While they are purely EV-based brands, their rapid rise with exciting rechargeable all-electric models makes them EV companies to look out for as more startups compete for a share of the new-energy vehicles (NEV) market.

#11 ARCFOX

Founder: BAIC Group

Founded: 2017.

Headquarters: Beijing, China.

Although the BAIC Group has several automotive brands as subsidiaries, Arcfox is an innovative sub-brand dedicated to developing electric cars.

The Chinese EV brand premiered at the 2019 Geneva Motor Show, unveiling its plan for the environmentally-conscious European market.

Its sales performance is rising steadily, and notable EV models include:

- Arcfox Lite

- Arcfox alpha-T

- Arcfox alpha-S

- Arcfox GT

#12 Skyworth Auto

Founder: Skywell

Founded: 2017

Headquarters: Nanjing, China.

Relatively new in the EV market, Skywell began developing its first electric car in 2017 and started selling the Skywell ET5 in 2020.

The parent company renamed its EV manufacturing division in 2021 as Skyworth Auto for a clearer distinction, and the ET5 similarly and subsequently adopted a name change to Skyworth EV6.

#13 NETA (Hozon Auto)

Founder: Fang Yunzhou

Founded: 2018

Headquarters: Shanghai, China.

Hozon Auto is a relatively new but promising Chinese EV manufacturer.

It established the NETA marque in 2018. The N01 compact SUV launched the same year was the automakers first production EV model.

NETA sold over 60,000 electric cars in 2021, aiming to double the number the following year.

Some of NETAs exciting EV models are:

- NETA N01

- NETA N03

- NETA U

- NETA V

- NETA 05

- NETA Eureka

- NETA S

#14 Aiways

Founder: Fu Qiang, Gu Feng.

Founded: 2017

Headquarters: Shanghai, China.

Established in 2017, Aiways is a Chinese company that manufactures electric cars and offers mobility services.

The company has an EV production facility in Shangrao (Jiangxi province) and a battery manufacturing base in Changshu (Jiangsu province), and its core technologies cover electric drive and artificial intelligence.

New to the EV scene, the startup Chinese electric vehicle brand has two compact electric crossovers in production:

#15 Leapmotor

Founder: Fu Liquan, Zhu Jiangming.

Founded: 2015

Headquarters: Hangzhou, China.

Leapmotor co-developed the artificial intelligence chip with Zhejiang Dahua Technology (a security camera tech company) as part of its autonomous vehicles smart electric car technologies.

Leapmotor also partnered with state-owned automaker FAW to develop key intelligent EV technologies and innovative production measures, plus manufacture core EV parts.

With its increasing sales performance and state-of-the-art in-house technologies, expect Leapmotor to leapfrog many of its competitors in the coming years.

Among Leapmotors current production EV models:

- Leapmotor C01 midsize sedan.

- Leapmotor C11 midsize SUV.

- Leapmotor S01 compact sports car.

- Leapmotor T03 hatchback.

Other China EV Makes

The electric car industry is a flourishing market with many players.

Although the fifteen EV companies listed above are carving out a significant share of the market, these Chinese electric vehicle makers deserve mention:

- Chery

- GAC Aion

- Great Wall Motors

- DFM (Dongfeng Motor Corporation)

- Weltmeister

- Hongqi

- Lynk & Co.

- WEY (owned by Great Wall Motors)

- Baojun

- Bestune

References:

https://www.byd.com/

https://www.nio.com/

http://global.geely.com/

https://heyxpeng.com/

https://jacen.jac.com.cn/

China's Most Popular EV is No Longer a Tesla

Tesla sales in China more than doubled in 2020, to nearly $6.6 billion, accounting for 21 percent of the companys booming worldwide total. But Tesla no longer makes Chinas most popular electric car: Meet the tiny Wuling Hong Guang Mini EV, whose equally microscopic price helped it find 36,700 buyers in January. That easily kneecapped the 21,500 sales of the Model 3 sedan, even as Tesla ramps up production at a new plant in Shanghai.

The four-passenger Wuling Mini went on sale last July, a joint project between Wuling, General Motors and Chinese state-owned automaker SAIC. The doorstop-shaped city car is just 2.9 meters long, about 0.7 meters shorter than the Chevrolet Spark subcompact thats the smallest car sold in America.

With a modest 20 kilowatts (27 horsepower), 85 Nm of peak torque, a 100-kph (62 mph) top speed and 170 km (106 miles) of driving range, the Wuling is no match for a Model 3 in space, tech, range or performance. But the Tesla, which starts for around $36,000 in China, cant touch the Wulings price: Just $4,500 (RMB 28,800), or $6,000 (RMB 38,800) with a larger, 13.9-kWh battery.

A price more in line with motorcycles has made the Mini a best-seller in whats already the worlds biggest market (in total sales) for both cars and electrified vehicles. Among 25.1 million cars sold in China in 2020, 5.4 percent were so-called New Electric Vehicles, a category that includes EVs, hybrids and plug-in hybrids. Since its introduction in late July 2020, the Mini found 200,000 buyers in its first 200 days, according to Irene Shen, head of communications for GM China.

The Mini is tapping into a large consumer base in China, and makes an EV truly affordable for everyone, Shen said.

Shorter than even Japans famous, penny-pinchingKei cars, the Wuling is designed to negotiate tight city streets and tighter parking. Four passengers fit aboard, with room for two 26-inch suitcases or a stroller when rear seats are folded. The Mini can recharge its larger battery in nine hours on Chinas standard 220-volt, 50-Hertz outlets.

Compared with some bargain-basement cars of the pastmost notoriously,Indias star-crossed Tata Nanothe Wuling seems more engineered to modern standards. GM says 57 percent of the structure is made from high-strength steel. Anti-lock brakes, electronic brake-force distribution, ISOFIX rear child-safety restraints and ultrasonic rear-parking sensors are standard; but not the electronic stability control thats been required on new cars in the U.S. and EU for several years, or an automated emergency braking system. While GM cites 16 rigorous safety tests for the Wuling, it did not confirm whether the car could meet current crash-test standards in Western nations.

Westerners, or Tesla fans, might be tempted to scoff at the Wulings speck-sized body, glacial acceleration or limited range. But while the Wuling is too small to crack the size-obsessed American market, its philosophy may be instructive; especially for cities and nations looking tomicrotransitas a potential solution to traffic-clogged streets, emissions and urban quality-of-life issues.

The Wuling weighs just 665 kilograms (1,466 pounds), which helps it squeeze 170 km of range from just 13.9 kWh of battery.

Image: General Motors

Batteries remain by far the most expensive part of an EV, even as costs for lithium-ion cells have fallen toward $100 per kilowatt hour. Analysts say the battery in a typical electric family sedan can cost between $10,000 and $15,000roughly double the price of the entire Wuling. So the Wuling creates a virtuous cycle: The smaller and lighter the car, the less battery it needs to deliver a given range. And a smaller battery itself weighs less. That keeps a lid on mass and costs, for automakers and consumers.

America, in fact, has an analog for the Wuling: The new electric Mini Cooper SE. In the current EV climate, obsessed with the range race to 300, 400 miles or more, the Minis 110-mile (177 km) driving range can make it seem as quaint as the Wuling. In some quarters, short-hop EVs are seen as a dead-end in design and market viability. But look again.

The U.K.-based, BMW-owned Mini is a relative giant compared with Wulings Mini, including more than twice the curb weight (1,430 kilograms). Accordingly, the Mini Cooper carries more than double the battery to deliver similar official range of 177 kilometers (110 miles), albeit with massively superior power and performance. But in America, the Mini Cooper is the Lilliputian, with attendant advantages: Its 32.6 kWh, 220-kilogram pack is one-third the size of Teslas largest packs, and one-sixth the size of the brawny, 200-kWh packs that GM will begin stuffing into its longest-range GMC Hummer EV later this year. Setting aside any Muskian advantages in Gigafactory battery costs, the Mini battery should cost one-third the price of Teslas.

It all leads to the Mini being among the slimmest and most affordable EVs in America. The Mini starts from just $30,745, versus $37,495 for the larger-batteried Chevy Bolt, and $39,125 for a Nissan Leaf Plus. Subtract a $7,500 federal tax credit, and the luxurious, sharp-handling Cooper SE falls to $23,245, on par with gasoline econoboxes like the Toyota Corolla. Incentives in California and other states can push the price closer to $20,000, making the Mini a potential electric steal.

Light makes right in another way: In my testing in Miami and New York, the Mini proved it can easily top its official EPA ratings, covering closer to 210 kilometers (130 miles) in real-world drives. Again, that doesnt sound like much for interstate trips. But for everyday errands or school drop-offsor in cities that may look to tax or even ban combustion-engine cars130 miles is more than enough for days of local driving. And EV skeptics consistently fail to acknowledge that owners plug in daily or nightly at work or home. They wake up to a car with maximum range fully restored, and never visit a gas station again.

Mini executives underline that, for 78 percent of owners, the Mini is the second, third or even fourth car in the household.

The point? For Americans whose driveways are littered with gasoline-burning cars, an EV like the Mini Cooper SEthe closest we may ever get to a speck-sized Wulingcan still make a whole lot of sense.