What will replace electric cars

Cost to Replace an EV Battery

EV Battery Replacement Cost

Battery technology is changing at an astounding rate. The cost of batteries is going down and expected to continue to drop. Plus, EV battery packs have a warranty from the automaker of eight years or 100,000 miles. Add to that the fact that todays batteries are built to last longer than the cars they serve. Chances are that you will sell your EV for another zero-emission vehicle long before you need to replace the battery.

But thats not the question, is it? The question on the table today is, what would it cost to replace the battery pack in your EV? Lets find out.

The Cost to Replace an EVBattery

Depending on the EV you drive, replacing the battery pack could be free if your car is still under warranty, or it could cost up to $20,000 depending on the make and model of car. It could also cost as little as $2,500 to replace the battery.

The batteries used in hybrid cars such as the Toyota Prius are smaller and less expensive to replace than the big heavy battery packs found in vehicles such as the Ford F-150 Lightning pickup truck or Tesla Model S. For instance, replacing the battery in a Prius might only cost you $2,700 while replacing the battery pack in that Tesla could set you back up to $20,000.

As of this writing, battery replacements are fairly rare and there isnt much information out there on costs to replace EV batteries. So, consider that the cost of batteries will continue to drop as more people purchase EVs. The price you would pay today will be more than it would be if you replaced the battery ten years from now when it is showing signs of age through battery degradation.

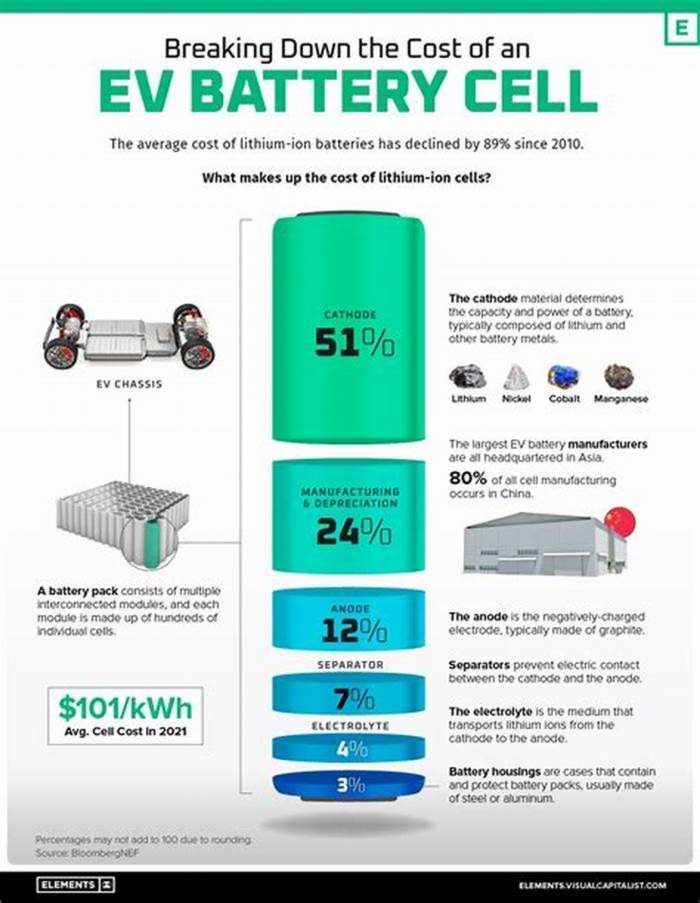

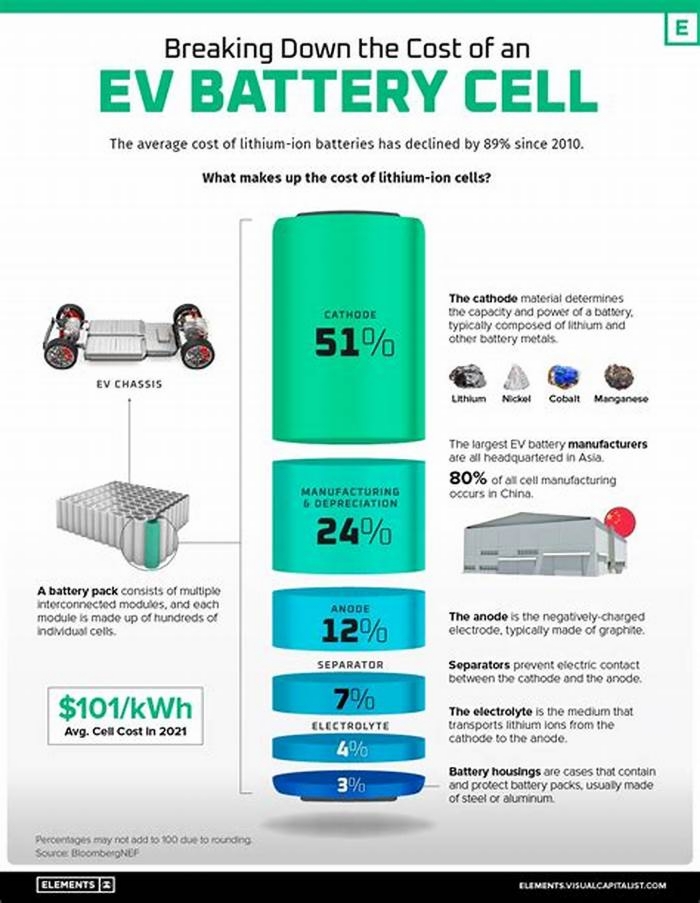

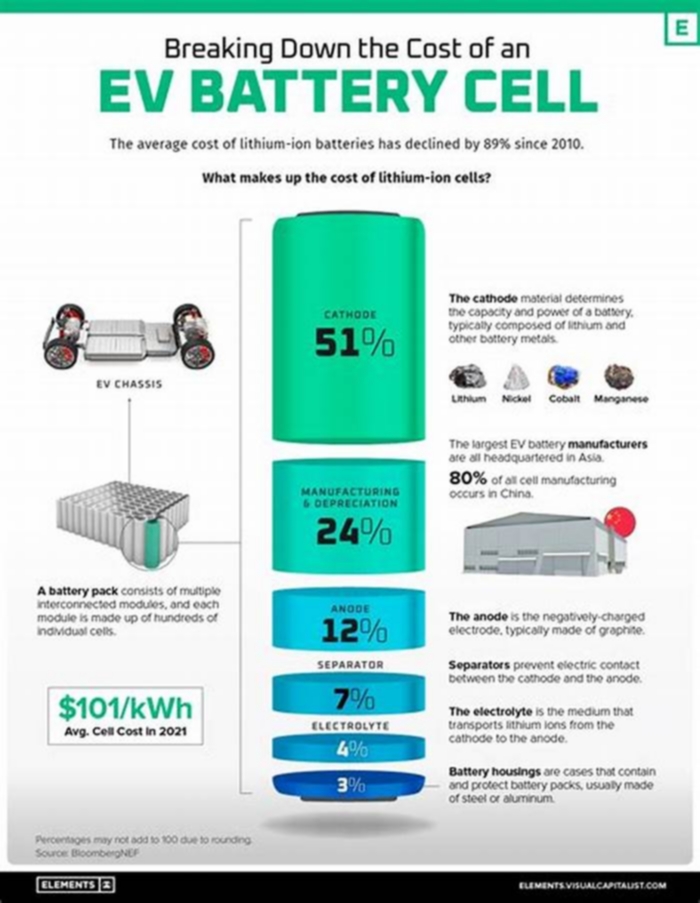

The Department of Energys Vehicle Technologies Office estimates the cost of electric vehicle lithium-ion battery packs have declined 89 percent between 2008 and 2022, using 2022 constant dollars. A recent report by McKinsey & Company suggests that EV batteries could drop a further 70 percent in price by 2025. According to this study, the price of lithium-ion EV battery packs could fall from $500-$600 per kilowatt hour today to around $160 by 2025 due to a rise in EV sales and a drop in component prices.

Also keep in mind that EV manufacturers are turning to solid-state battery packs which are less expensive, last longer, and are capable of taking consumers over 500 miles on a charge.

EVBattery Replacement Costs: Third-Party Batteries

So far, we have only talked about the replacement battery cost through the manufacturer. But third-party batteries could cost less. Companies such as hybrid2go and evsenhanced.com offer full-service battery replacement with lifetime warranties.

What would it cost to replace the battery in a few of Americas favorite all-electric cars, the Nissan Leaf and Chevy Bolt? As of this writing, the battery would cost approximately $6,200 for the Leaf and $16,000 for the Bolt. The popular BMW i3s replacement battery runs around $13,500. However, you can find replacement batteries for both the Bolt and the i3 on eBay for as little as $2,500.

The vehicles that offer the most range, and therefore have the largest battery packs, obviously cost more to replace. The Tesla Model 3 will take you over 300 miles on a charge and the replacement battery costs around $16,000. Labor costs to replace that Tesla battery will run you an additional $2,300. Thats because swapping out the battery pack on most electric cars is a complicated task, similar to replacing the engine in a gasoline-powered car.

While the physical labor only takes a day or so, getting the replacement battery can take weeks. Also keep in mind that not all battery replacements mean that you need to replace the entire battery pack, Sometimes the mechanic can just replace the defective cells to save you time and money.

Will Hydrogen Cars Replace Electric Cars?

The demand for clean power sources in vehicle-related technology is increasing daily due to harmful effects caused by toxic emissions from internal combustion engines. Technologies used in existing eco-friendly vehicles are evolving with time. This article will discuss electric and hydrogen vehicles, their types, comparison between hydrogen and electric vehicles, recent studies, prospects, and whether hydrogen vehicles will replace electric cars.

Image Credit: petrmalinak/Shutterstock.com

Image Credit: petrmalinak/Shutterstock.com

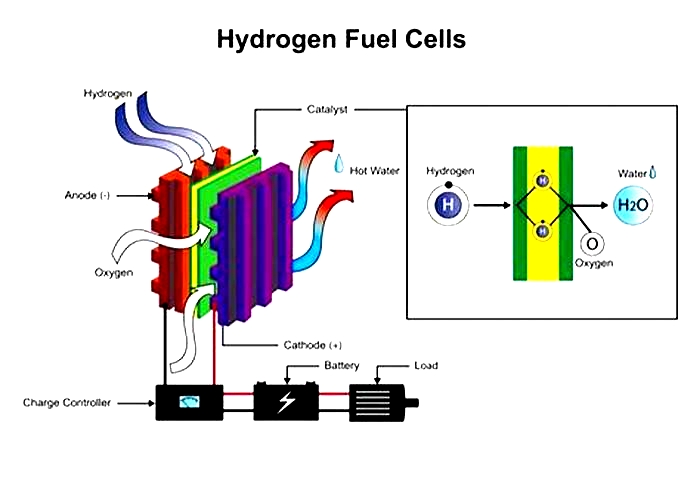

What are Hydrogen Vehicles?Vehicles of different kinds that run on hydrogen fuel are collectively referred to as hydrogen vehicles. These automobiles could use internal combustion engines, gas turbine engines, or hydrogen fuel cells as propulsion systems.

Two types of hydrogen-powered engines are generally used: a conventional internal combustion engine, where hydrogen gas is used instead of gasoline or natural gas, and another using hydrogen fuel cells.

Similar to gasoline stations, hydrogen vehicles have hydrogen fueling stations. Steam-methane reforming is a process for producing hydrogen gas that is then stored in hydrogen fueling stations.

What are Electric Cars?An electric vehicle is powered by an electric motor using electrical energy instead of an internal combustion engine and does not have a fuel tank.

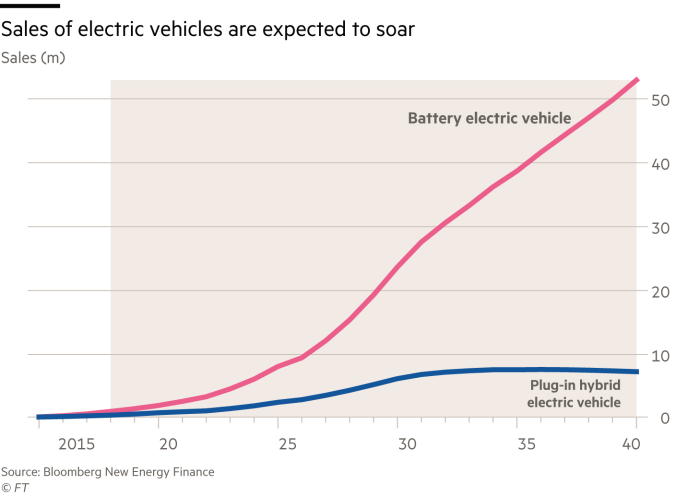

Electric cars dependent on batteries for power are categorized as battery-electric vehicles (BEVs). There are other similar technologies, such as plug-in hybrid electric vehicles (PHEVs).

Types of Hydrogen VehiclesUsing conventional IC engine

Engineering solutions aim to optimize the combustion of a hydrogen-air mixture, develop a power supply system, and reduce explosion hazards.

This concept has not been widely adopted. In addition, the operation of such vehicles is unsafe and requires significantly high costs.

Using fuel cells

The fuel cell hydrogen vehicle is fundamentally similar to an electric vehicle. The difference is that in traditional electric vehicles, the battery is charged from external sources, while in a hydrogen car, electricity is continuously drawn from fuel cells.

Hydrogen engines have two chambers (for anode and cathode) separated by a membrane coated with rare earth metals acting as a catalyst.

As a result of the hydrolysis reaction, the hydrogen in the anode chamber, combined with oxygen from the atmospheric air in the cathode, turns into water vapor.

The process is accompanied by the release of free electrons, which enter the car's electrical network, providing power.

Most hydrogen cars use fuel cell technology called fuel cell electric vehicles (FCEVs).

How Hydrogen Cars Compare with Battery-Electric Vehicles (BEVs)Battery-electric vehicles have the significant advantage of building on an already extensive electric grid infrastructure, which means that virtually every electric outlet in the world can function as a charging station.

On the other hand, fuel cell electric vehicles face the challenge of developing an entirely new infrastructure from the ground up.

For battery-electric vehicles, developing more traditional fast-charging stations is the sole barrier. Although this is not a trivial problem, it is considerably simpler than building a new industry for hydrogen manufacturing, transportation, storage, and distribution.

Moreover, the power is stored in the batteries in hydrogen fuel cell electric vehicles. Therefore, there are many similarities between the two. If battery-electric vehicles are criticized for the limitations and drawbacks of battery-powered systems, the same criticism is also applied to hydrogen fuel cell electric vehicles.

The Technology Preferred by Automobile ManufacturersThe automotive sector has not reached a consensus on how to eliminate vehicle emissions. Most manufacturers prefer battery-electric vehicles, but a select minority have persisted in attempting to make fuel cell hydrogen powertrains function successfully.

Toyota, Hyundai, and General Motors have shown the most reluctance to abandon hydrogen technology, which can achieve zero-emission travel but is far less efficient than BEVs.

Fuel cell electric vehicles have been relatively unsuccessful in prompting a public response. The infrastructure seems to be the primary obstacle; despite fuel cells, electric vehicles have a substantially lower overall efficiency over their whole energy cycle.

Most overnight charging for electric cars occurs in the driver's house, although this is not the case with hydrogen fuel cell vehicles. Even if fuel cell electric vehicles still had a shot at the commercial truck market, recent research has cast doubt on their viability.

Future of Hydrogen VehiclesA recent study published in January 2022 by Nature Electronics suggests that fuel cell electric vehicle technology will not play a major role in sustainable road transport in the future.

Although certain manufacturers claim they will have fuel cell electric vehicles available in the next few years, the industry has gradually shifted toward battery-electric vehicles.

According to the research findings, due to recent developments in battery technology and the new megawatt charging standard for battery-electric trucks, the next generation of electric trucks is anticipated to surpass fuel cell hydrogen cars in terms of market share.

Electric cars: the race to replace cobalt

In a laboratory on an industrial park an hours drive outside Boston, Tufts professor Michael Zimmerman is hoping a material he invented in his basement can help solve a crisis facing the electric car industry which has inadvertently tied its fortunes to one of the poorest and least stable countries in the world.

In between his teaching, Mr Zimmerman runs start-up Ionic Materials, whose battery material could mark the future for the car industry as it races to go electric after a century of producing petrol cars. His hope is that his homegrown prototype could pave the way for a new generation of batteries that does not use cobalt, a silver-grey metal, more than 60 per cent of which is mined in the Democratic Republic of Congo.

Backed by highly respected computer scientist and investor Bill Joy, who spent years searching for the perfect battery, Ionic counts the Renault Nissan Mitsubishi carmaker alliance, Hyundai and French oil company Total among its shareholders.

The world wants to electrify vehicles, Mr Zimmerman says in his office across the car park from a shopping mall. Ive never seen such a massive industry say [it wants] to completely switch technologies. Every single company, government and country they all want to do it worldwide.

The list of Ionics backers reflects increasing concerns among carmakers over current battery technology and its reliance on the DRC. Cobalt supply is dominated by a handful of mining companies, including Switzerland-based Glencore, or mined by hand and sold to Chinese traders in the country. Child labour is common, according to human rights groups.

In other words, the product that is the shining hope of the new economy is for the time being highly dependent on some of the most-criticised practices of the old industrial economy.

For many experts, the battery will reign supreme in this century just as oil did in the last. Batteries power our everyday digital lives, from our iPhones to our laptops. But they are also key for electric cars to replace petrol-powered vehicles and for some types of renewable energy. Without them, it will be much harder for the world to end its addiction to fossil fuels and limit the impact of climate change.

But batteries are complicated to produce and contain a delicate mix of chemistries that have to meet a demanding list of performance requirements. Customers expect fast charging, a long battery life and safety and in conditions ranging from the cold winters to the heat of the Arizona desert.

Without a big shift in battery technology, cobalt demand is set to more than double during the next decade with the share from the DRC set to rise to more than 70 per cent. Gleb Yushin, a professor at the School of Materials and Engineering at Georgia Institute of Technology, puts it more bluntly: the potential growth of electric cars will not materialise, he says, unless there is a battery breakthrough.

There will be no EV industry without DRC cobalt, says Caspar Rawles, who tracks the market for London-based consultancy Benchmark Mineral Intelligence. Without the DRC, this ramp-up in EVs wont happen.

Mr Zimmerman began thinking about batteries five or six years ago, just as electric vehicles were starting to gain traction and the first Teslas were becoming popular. Back then, cobalt was a niche metal mainly used in jet engines and smartphones.

Since then sales of battery electric vehicles and plug-in hybrid versions have grown from about 6,000 cars in 2010 to 1m cars sold last year, or about 1 per cent of annual sales. There will be a further 340m electric vehicles (including passenger cars, trucks and buses) produced between now and 2030, according to analysts at McKinsey.

That has led to an increase of battery factories. The number of gigafactories under construction, named for the gigawatt hours of batteries they can produce each year, has increased tenfold over the past eight years to 41, according to Benchmark Mineral Intelligence. Simon Moores, the founder of the company, says the battery is destined to become the oil barrel of the 21st century.

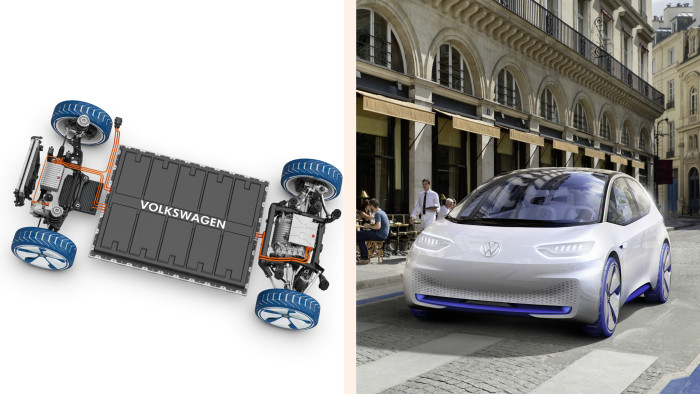

Discovered by 96-year-old American professor John Goodenough while he was at Oxford university in 1980, the lithium-ion battery has proved pivotal for 20th century science and technology, paving the way for portable electronic devices from camcorders to smartphones. It has also become the standard choice for electric cars, which use hundreds of battery cells placed together in packs that resemble metal briefcases, and weigh up to 600kg.

But since Sony commercialised lithium-ion technology in 1991 there have been few substantial improvements in the technology, Mr Zimmerman says. He believes the battery that powers our world may have reached its limit.

Everyone wants their smartphone to last longer and their car battery to not blow up, he says. My belief is that lithium-ion batteries are at a dead-end right now; theres really no further improvement that can be made with the current technology.

Battery cells rely on four main parts: a positive and negative electrode, a separator and a liquid electrolyte. The positive electrode, or cathode, is coated in a carefully processed metal oxide slurry that in most cars includes lithium, cobalt, nickel and manganese. When the battery is discharged, lithium ions flow to the cathode generating a flow of electrons and electricity. When the battery is recharged they flow back to the anode, the negative electrode, which is normally made of graphite.

Cobalt is essential for stopping the battery from overheating and the stability it brings to the battery materials also allows users to charge and discharge their car over many years. But it is also the most expensive of the metals used hindering the ability of carmakers to lower the cost of electric cars to compete against their petrol counterparts.

Analysts at Liberum, the London-based brokerage and investment bank, estimate that the cost of cobalt in a kilogramme of battery cathode material is about $12, compared with $8 for lithium and $5 for nickel. Metals account for about 25 per cent of the battery cost, they estimate. While new sources of cobalt are being developed in Idaho, Alaska and Australia, they are not due to produce metal until after 2020.

Mr Zimmerman, a materials scientist, started to look at a relatively unexplored area of research the electrolyte, which is generally what catches fire in batteries. If a solid material instead of a liquid were used, so the theory goes, the batteries could be safer and lighter. It could also allow carmakers to reduce the amount of cobalt in the cathode or even, he says, eliminate it entirely.

The first electrically conductive solid electrolyte was discovered in the 1830s by British scientist Michael Faraday but it had never worked in a battery at room temperature. Working in his basement Mr Zimmerman created a polymer material that could do just that.

It was a really ugly piece of plastic in a roll with little pinholes in it everywhere, but you had to say wow, recalls Mr Joy, who was searching for a solid state battery technology while at venture capital firm Kleiner Perkins. This is just amazing that it demonstrated feasibility of a property that had been sought for so long.

Carmakers from Toyota to Mercedes-Benz and the British engineering group Dyson are working on so-called solid state batteries like Mr Zimmermans and there were about $400m of investments in the technology in the first half of the year, according to consultancy Wood Mackenzie. They forecast that such batteries will make up the majority of electric car technology by 2030 but will not enter the market until 2025.

There are still a number of challenging problems in order for an all solid state battery to be a commercially viable proposition, says Peter Bruce, a professor in the department of materials at Oxford university. But they are now being addressed.

Ionic is one of a number of start-ups hoping to commercialise the next battery breakthrough. It is a field that has seen its fair share of failures, such as the bankruptcy of Pittsburgh-based saltwater battery company Aquion Energy, which raised money from Bill Gates and Kleiner Perkins, in March last year.

In the meantime, battery companies are racing to reduce the amount of cobalt they use with conventional technology. Yoshio Ito, the head of Panasonics automotive business, which supplies Tesla, told reporters in Tokyo last month that it aims to decrease the use of cobalt in Teslas EVs in two to three years. Tesla has said the company was aiming to achieve close to zero usage of cobalt in the near future.

Most carmakers are moving towards batteries that use more nickel and as much as 75 per cent less cobalt. These products are expected to pick up market share over the next few years.

Venkat Viswanathan, a professor at Carnegie Mellon University, says cobalt can be reduced using liquid electrolyte chemistries. Ionic Materials is one pathway to making low cobalt cathodes but a liquid electrolyte pathway is also something that many battery makers are working on and have feasible solutions, he says.

Yet, even with a shift to lower cobalt batteries, demand for the metal is still expected to more than double by 2025, according to Wood Mackenzie. Zero cobalt is hard, low is possible, [but] zero is very tricky at this point, Mr Viswanathan says.

For his part, Mr Zimmerman says the low-cobalt batteries still come with a considerable fire risk that will require expensive monitoring technology.

In his small study he plays videos on his laptop of nails going into the latest low-cobalt cathodes with liquid electrolytes, which he calls the nail penetration test. Theres smoke, fire and bad things about to happen, he says, as we watch the cells catch fire in a metal chamber. In such fires toxic gases are produced that require fire crews to wear specialist clothes. Its just fundamentally unsafe, he says.

The cobalt is expensive and it gets mined from unethical sources in the Congo, so people want to put less cobalt in, Mr Zimmerman adds. When you put less cobalt in, the voltage of the cathode goes up and the current liquid electrolytes cant work at that higher voltage. But our polymer can.

Ionic says it has tested its polymer material with cathodes that have either little cobalt or none at all and is working with companies to commercialise the technology. If successful, it says it could find its way into batteries within a few years and into electric cars after that.

Mr Joy, who co-founded Sun Microsystems and wrote some of the founding code of the internet, says such technologies are critical to addressing climate change. The current mix of materials has been stretched to the limit, he says.

What happened with Sony inventing the lithium-ion...well, we ended up with things that get rechargeability, he says. But they gave up...not only safety and cost but also abundance because there isnt physically enough cobalt to electrify the world.

Captive market: Risks rise for mining groups in the DRC

Despite its abundant resources, the DRC remains one of the poorest countries in the world, where more than 80 per cent of the population does not have access to electricity. Its a curse rather than an opportunity, says Jean-Claude Maswana, associate professor of economics at the Graduate School of Business Sciences in Japan of the countrys metal deposits. If history is a guide I dont see any evidence that might point to the rising price of cobalt being a blessing.

Carmakers and battery producers have been caught off guard by the need to source from the DRC, according to one executive. They dont have a strategy, he says. All of the OEMs the whole supply chain is looking at security of supply. With very few exceptions nobody has set a definite strategy, everybody has been looking at the problem but nobody is solving it.

Risks may also be rising in the country. Last month Glencore revealed it faces a wide-ranging US government investigation into bribery and corruption after federal prosecutors demanded details of its business dealings in the DRC, Nigeria and Venezuela. In June, the company said it would continue to pay its former business partner in the DRC, Israeli billionaire Dan Gertler, in euros after he was sanctioned by the US government for his opaque and corrupt mining deals in the DRC.

In addition long-delayed elections are due in the country in December. President Joseph Kabila, a close friend of Mr Gertlers, who came to power in 2001 after his father was assassinated, agreed this month not to stand. But his choice of Emmanuel Ramazani Shadary as his successor has raised concerns about his continuing influence in the country.

I give a 1 per cent chance that the election can be fair or free, its impossible, adds Mr Maswana.