Where does China rank in EV market

Global EV market forecasted to reach 17.5 million units with solid growth of 27% in 2024

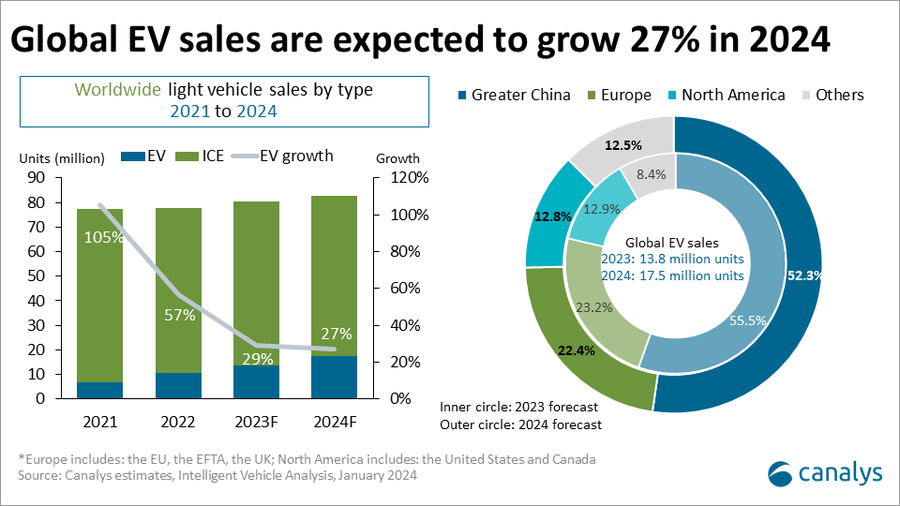

The latest Canalys research predicts sales of global electric vehicles (EVs) to grow 29% and reach 13.7 million units, equating to a penetration rate of 17.1% in 2023. Greater China remains the largest EV market, shipping 7.6 million units with 55.5% market share. Europe, with a shipment of 3.2 million units and North America with a shipment of 1.8 million units will round up the top three markets in 2023. Canalys forecasts the global EV market will grow by 27.1% in 2024, hitting 17.5 million units.

Carmakers are accelerating localization efforts to drive consumer demand by launching region- and market-fit EV models and enhancing the overall EV user experience by developing charging infrastructure and intelligent services ecosystem to support smarter mobility. The general weak cost-effectiveness and subsidy reductions are two significant challenges that carmakers must address to gain stronger growth momentum.

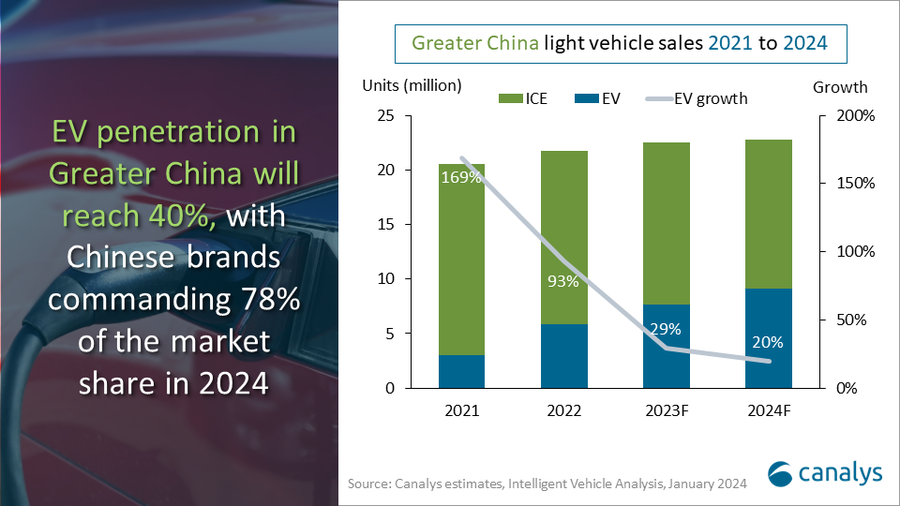

With the government prioritizing sustainable economic development and expanding vehicle consumption, Canalys forecasts light vehicle sales in Greater China to grow 1% to 22.7 million units in 2024. EVs are projected to reach 9.1 million units, taking up 40% of total sales. Drops in battery cost will further drive BEV sales in the compact and subcompact vehicle market. PHEVs will continue gaining market share in the next two to three years due to their cost-effectiveness and stronger adaptability.

Appealing new EVs were launched at the end of 2023, setting the stage for 2024, noted Alvin Liu, Analyst at Canalys. EVs are the core growth driver for the vehicle market in Greater China. EVs from Chinese carmakers, which are expected to take up 78% of the market in 2024, are pulling ahead, widening the user experience gap compared to internal combustion engine (ICE) vehicles. The latest battery technologies and improving infrastructure address charging anxiety. The formation of charging ecosystems, such as NIOs Battery Swap Alliance, Mercedes-Benz and BMWs Super Charging Network and Lotuss Flash Charging Alliance, will further grow BEVs market share. However, maintaining a growth rate of over 50% this year is impossible as EVs have reached a critical mass and convincing the remaining EV skeptics will be a growing challenge.

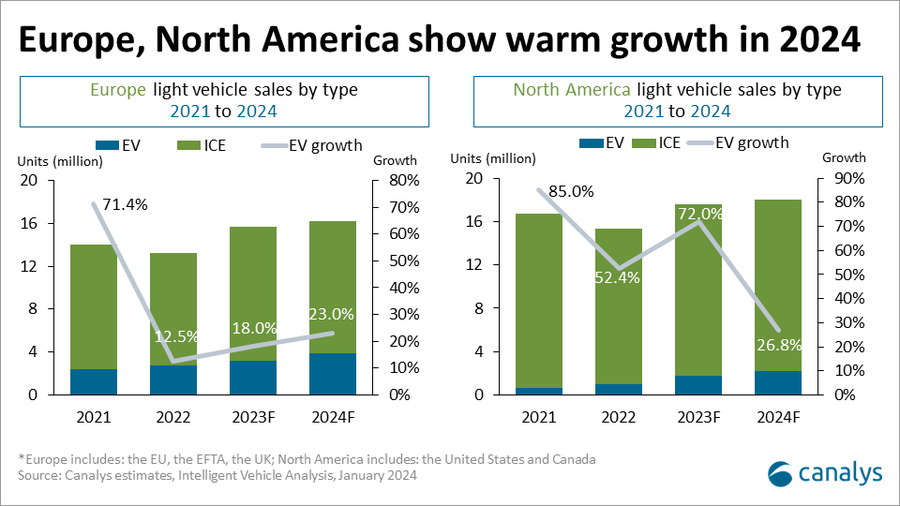

Despite inflation and interest rate hikes, the European light vehicle market is expected to grow 18.6% with a shipment of 15.7 million in 2023, demonstrating Europes market resilience post-COVID-related supply issues. The sale of EVs is expected to grow 18%, slightly below the overall light vehicle market, to maintain a market share similar to 2022 at 20.3%, suggesting that Europe is still in the early stage of electrification transformation.

Canalys predicts that the 2024 European light vehicle market will sustain a growth of 2% to 3%, with EVs taking up 24.2% of the market share, shipping 3.9 million units. Amid slowing BEVs demand, a shift to PHEVs can ease market pressures despite the EUs push for an aggressive combustion engine phase-out. Europes EV market has started transitioning from policy-driven to product-driven in 2024, a necessary phase in the industrys transformation, stated Jason Low, Principal Analyst at Canalys. The subsidy restriction will slow down EV demand and the looming price war will threaten not just EV goals but carmakers electric transition confidence. To counter such challenges, carmakers in Europe are set to make the EV market more affordable by releasing new models such as the KIA Niro EV, BMW IX2, Renault 5, Citroen e-C3 and others. European carmakers should be aware of Chinese carmakers eyeing Europe, as they are expected to deploy similar product and pricing strategies while continuing their efforts to establish local production in the region, like that of BYD, SAIC and other positive OEMs.

EV sales in North America are expected to reach 1.8 million units in 2023, driven by government subsidies and EV charging infrastructure. Despite a 20% drop in the ASP of EVs in 2023, insufficient product choices and inconvenient charging experience hampered demand, impacting the market growth of EVs, noted Low.

Canalys predicts that in 2024 the North American EV market will grow 26.8% to 2.2 million units but with the lowest EV penetration at 12.5%, compared to Greater China and Europe. In 2024, EV product range will expand, covering mini vehicles, full-size SUVs and pickups, effectively broadening EVs target user range, supported by a unified charging standard as more OEMs join Tesla's North American Charging Standard (NACS), addressing some of the EV sales obstacles, commented Low.

Despite challenges to stimulate EV demand in 2024, carmakers will continue to make bets and invest in multiple areas to gain the upper hand in EV technology. Unique factors remain essential in markets such as Greater China. Globally, carmakers need to quickly deploy new EV technologies focusing on cost control and boosting EV user experiences, especially surrounding charging. A solid fundamental will ensure a better position for carmakers to attain more growth in 2025 when EV growth is expected to accelerate. Chinese carmakers will be a force to be reckoned with as they will soon reap the fruits of their global investment in regional manufacturing.

*EVs include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

Senior Canalys analysts will be attending CES in Las Vegas from 9-12 January 2024 and look forward to meeting press, clients and new contacts in person.Book a meeting with our analysts.

For more information, please contact:

Jason Low: [email protected]

Alvin Liu: [email protected]

About Intelligent Vehicle Analysis service

Gain detailed insights into the transformation of the global automotive market with Canalys' industry-leadingIntelligent Vehicle Analysis service. We focus on critical aspects, from brand analysis to model evaluation. With our specialized research on electric vehicles (EVs), new energy vehicles, and intelligent vehicles, Canalys provides insightful data about car connectivity, convenience, driver assistance, and safety features. The Canalys Intelligent Vehicle Analysis Service goes beyond the typical market research product. It is a tailored solution designed to empower businesses with the tools they need to make informed decisions and stay competitive in the rapidly changing automotive landscape.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email [email protected].

Please click here to unsubscribe

Copyright Canalys. All rights reserved.

The increase in demand for electric vehicles is driving demand for batteries and related critical minerals. Automotive lithium-ion (Li-ion) battery demand increased by about 65% to 550GWh in 2022, from about 330GWh in 2021, primarily as a result of growth in electric passenger car sales. In 2022, about 60% of lithium, 30% of cobalt and 10% of nickel demand was for EV batteries. Only five years prior, these shares were around 15%, 10% and 2%, respectively. Reducing the need for critical materials will be important for supply chain sustainability, resilience and security, especially given recent price developments for battery material.

New alternatives to conventional lithium-ion are on the rise. The share of lithium-iron-phosphate (LFP) chemistries reached its highest point ever, driven primarily by China: around 95% of the LFP batteries for electric LDVs went into vehicles produced in China. Supply chains for (lithium-free) sodium-ion batteries are also being established, with over 100GWh of manufacturing capacity either currently operating or announced, almost all in China.

The EV supply chain is expanding, but manufacturing remains highly concentrated in certain regions, with China being the main player in battery and EV component trade. In 2022, 35% of exported electric cars came from China, compared with 25% in 2021. Europe is Chinas largest trade partner for both electric cars and their batteries. In 2022, the share of electric cars manufactured in China and sold in the European market increased to 16%, up from about 11% in 2021.

EV supply chains are increasingly at the forefront of EV-related policy-making to build resilience through diversification. The Net Zero Industry Act, proposed by the European Union in March 2023, aims for nearly 90% of the European Unions annual battery demand to be met by EU battery manufacturers, with a manufacturing capacity of at least 550GWh in 2030. Similarly, India aims to boost domestic manufacturing of electric vehicles and batteries through Production Linked Incentive (PLI) schemes. In the UnitedStates, the Inflation Reduction Act emphasises the strengthening of domestic supply chains for EVs, EV batteries and battery minerals, laid out in the criteria to qualify for clean vehicle tax credits. As a result, between August 2022 and March 2023, major EV and battery makers announced cumulative post-IRA investments of at least USD52billion in North American EV supply chains of which 50% is for battery manufacturing, and about 20% each for battery components and EV manufacturing.

McKinsey Electric Vehicle Index: Europe cushions a global plunge in EV sales

McKinseys proprietary Electric Vehicle Index (EVI) assesses the dynamics of the e-mobility market in 15 key countries worldwide (for more information on the metrics evaluated, see sidebar What is the Electric Vehicle Index?). EVI results for 2019 and the first quarter of 2020 provide important insights about market growth, regional demand patterns, market share for major electric-vehicle (EV) manufacturers, and supply-chain trends.

Growth in the electric-vehicle market has slowed

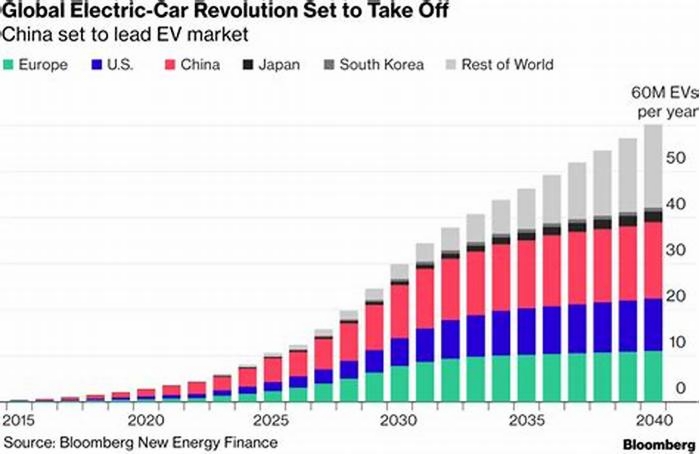

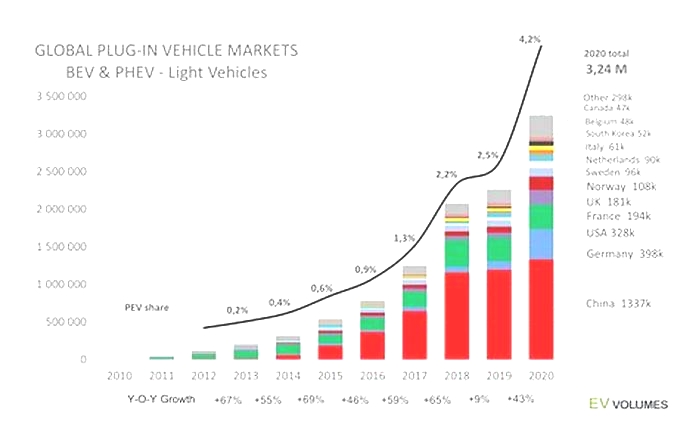

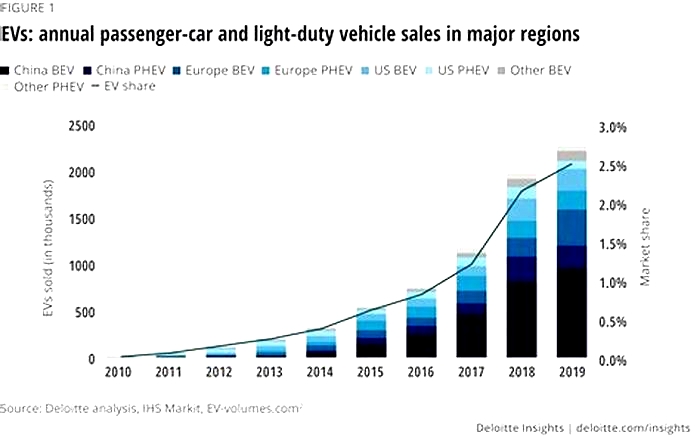

EV sales rose 65 percent from 2017 to 2018 (Exhibit 1). But in 2019, the number of units sold increased only to 2.3 million, from 2.1 million, for year-on-year growth of just 9 percent. Equally sobering, EV sales declined by 25 percent during the first quarter of 2020. The days of rapid expansion have ceasedor at least paused temporarily. Overall, Europe has seen the strongest growth in EVs.

Although these developments are disappointing, they largely reflect the decline of the overall light-vehicle market, which fell by 5 percent in 2019 and by an additional 29 percent in first-quarter 2020. Despite the overall drop in sales, global EV market penetration increased by 0.3 percentage points from 2018 to 2019, for a total share of 2.5 percent. With additional growth in the first quarter of 2020, EV penetration is now at 2.8 percent.

To gain different perspectives on the EV industrys growth and other topics, we interviewed various McKinsey experts (see sidebar, Expert views on the electric-vehicle sectors future development). The remainder of this section explores regional market variations.

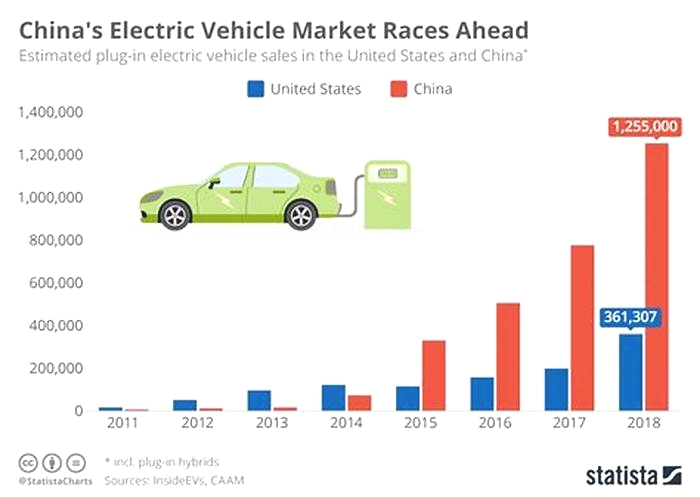

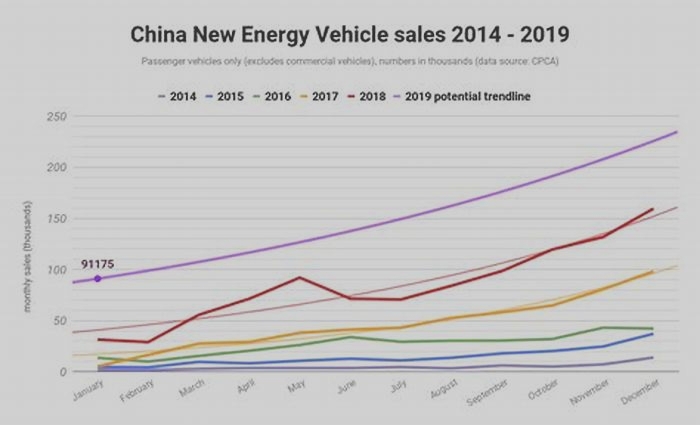

EV market trends vary by region

Key EV markets suggest shifting regional dynamics, with China and the United States losing ground to Europe. EV sales remained constant in China in 2019, at around 1.2 million units sold (a 3 percent increase from the previous year). In the United States, EV sales dropped by 12 percent in 2019, with only 320,000 units sold. Meanwhile, sales in Europe rose by 44 percent, to reach 590,000 units. These trends continued in first-quarter 2020 as EV sales decreased from the previous quarter by 57 percent in China and by 33 percent in the United States. In contrast, Europes EV market increased by 25 percent.

Key EV markets suggest shifting regional dynamics, with China and the United States losing ground to Europe.

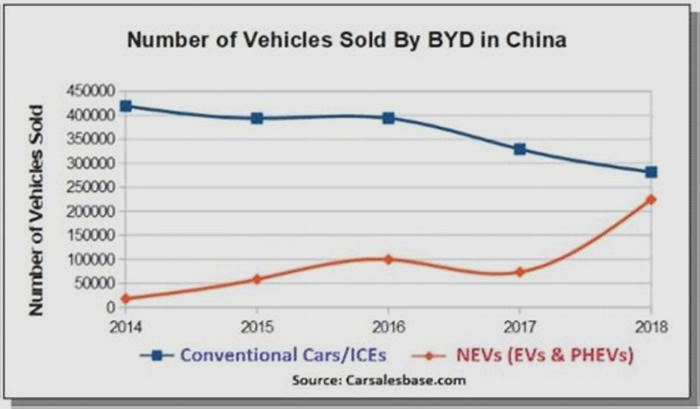

China

The relatively slow 2019 growth of Chinas EV market reflects both an overall decline in the light-vehicle market and significant cuts in EV subsidies. The central government, for example, eliminated purchase subsidies for vehicles that achieve electric ranges (e-ranges) of less than 200 kilometers and reduced subsidies by 67 percent for battery electric vehicles (BEVs) with e-ranges above 400 kilometers. These cutbacks reflect the governments strategy of scaling back monetary incentives for new-energy vehicles (NEVs) and transitioning to nonmonetary forms of support. Since 2019, OEMs have received credits for each NEV produced. The credits take into consideration factors such as the type of vehicle, as well as its maximum speed, energy consumption, weight, and range. Regulators base credit targets for each OEM on its total production of passenger cars. If a manufacturer does not reach the target, it must purchase credits from competitors that have a surplus or pay financial penalties.

In first-quarter 2020, China was heavily affected by the COVID-19 pandemic. EV sales dropped by 57 percent from the fourth quarter of 2019 as consumer demand declined sharply. Several EV manufacturers were also forced to halt production. In response, the central government extended through 2022 (though at reduced rates) monetary incentives that were about to expire. The government also prolonged the purchase-tax exemptions of NEVs through 2022. These measures, together with the governments recent decision to invest billions of renminbi in the charging infrastructureas part of an economic-stimulus program, could help EV sales rebound in 2020.

The United States

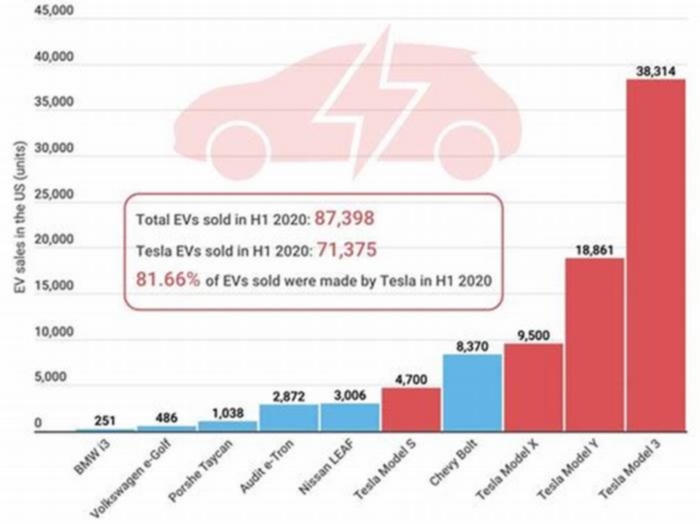

EV sales rose by 80 percent in the United States in 2018, driven by the market launch of the standard version of the Tesla Model 3. The increase slowed in 2019 because of several developments. With Teslas overseas deliveries increasing and the gradual phaseout of the federal tax credit in January and July 2019, the brands US sales for that year declined 7 percent, or 12,400 units. Meanwhile, the Chevrolet Volt was phased out, and its sales fell by 14,000 units. Sales of the Honda Clarity also decreased by 8,000 units.

Some international OEMs did successfully launch new models in the United States in 2019, including Audi (the e-tron) and Hyundai (the Kona). Sales of VWs e-Golf also increased. These three brands accounted for more than 24,500 units of EV sales, but their strong performance could not offset the decline of other models. US sales of EVs decreased further in first-quarter 2020, by 33 percent from the previous quarter.

The federal governments recent moves to loosen regulations could further decelerate the EV market in the United States. In March 2020, for instance, the government revised fuel-economy standards, to a 2026 target of 40 miles per gallon (mpg), from 54 mpg. Todays low oil prices are also contributing to the EV slowdown, since they significantly lower the total cost of ownership for vehicles powered by internal-combustion engines (as compared with EVs). These changes are creating great uncertainty, and the US EV markets development could depend largely on the number of states adopting Californias Zero-Emission Vehicle Program and on the vicissitudes of oil prices.

Europe

Unlike other key EV markets, Europe has seen significant EV growth. In 2019, sales increased by 44 percent, the highest rate since 2016. The European Unions new emissions standard95 grams of carbon dioxide per kilometer for passenger carscould also boost EV sales because it stipulates that 95 percent of the fleet must meet this standard in 2020 and 100 percent in 2021. BEV sales picked up speed substantially, with a 70 percent growth rate propelled by three models: the Tesla Model 3, Hyundai Kona, and Audi e-tron.

EV sales increased by double-digit percentages in 2019 in almost every European country. Sales in some smaller markets, such as Estonia, Iceland, and Slovakia, declined in absolute terms. EV sales in Germanyand the Netherlands contributed nearly half44 percentof overall EV-market growth in Europe; in both countries, units sold increased by about 40,000 units. Those numbers translate into a 2018 growth rate of 55 percent for Germany and 144 percent for the Netherlands. In both countries, these strong EV sales resulted from increased demandfor new models, the availability of existing models with larger battery sizes, and changed government incentives (for more information on the power of incentives, see sidebar Purchase subsidies juice EV sales.)

In the first quarter of 2020, European EV sales rose as the overall EV penetration rate increased to 7.5 percent. With the exception of Hong Kong, all of the top ten markets for EV penetration were in Europe (Exhibit 2). The strong regulatory tailwinds and high purchase incentives in several European countries could dampen the impact of the COVID-19 pandemic and further boost the EV market. That said, EV sales will probably face tougher impediments in second-quarter 2020, when the pandemics impact on Europes countries and economies should peak. So far, no European OEM has changed its plans to roll out EV models, and several countries are discussing additional purchase incentives as part of their economic-stimulus programs.

Electric-vehicle makers are debuting new models and boosting sales of existing ones

Automakers launched 143 new electric vehicles105 BEVs and 38 plug-in hybrid electric vehicles (PHEVs)in 2019. They plan to introduce around 450 additional models by 2022 (Exhibit 3). Most are midsize or large vehicles. Given the estimated production levels, German manufacturers, with an expected volume of 856,000 EVs, could overtake Chinese players in 2020. That would boost Germanys global production share from 18 percent in 2019 to 27 percent in 2020.

New emissions regulations in Europe and China, which will come into force between 2020 and 2021, partly explain why EV-model launches have increased significantly. These regulations pose major challenges for automakers, since they will face potential penalties of up to several billion euros unless they increase their EV penetration rates significantly.

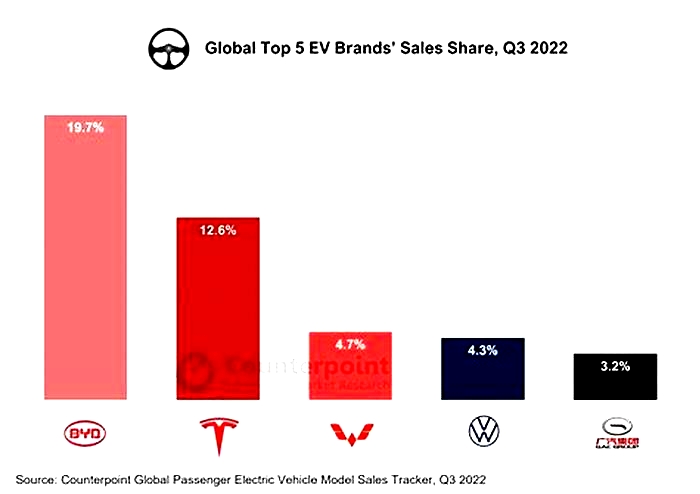

Among EV manufacturers, Tesla continued as market leader in 2019, with 370,000 units sold globally, for a market share of about 16 percent, up from 12 percent in 2018 (Exhibit 4). The launch of the Model 3 outside of the United States was the main reason for this surge. With 300,000 units sold worldwide, the Model 3 outpaced sales of the BJEV EU-series threefold and sales of Nissan Leaf fourfold.

At the brand level, most Chinese EV manufacturers faced declining sales, while demand was high for the EV offerings of some international OEMs.

The supply chain is localizing

With announced launches of new EV models spiking, both automakers and suppliers are increasing their global footprints in target markets by localizing the production of vehicles and components. For example, Tesla began construction of its Shanghai plant in January 2019 and delivered the first locally produced EV that December. The company plans to build its next production plant in Germany by 2021. Similarly, Volkswagen and Toyota have announced plans to set up EV plants in China.

In a similar development, battery-cell manufacturers are increasing their production capacities in target markets. The total lithium-ionbattery market for EV passenger cars grew by 17 percent, to 117 gigawatt-hours in 2019, enough to power 2.4 million standard BEVs. Most of the new capacity will be established in Central Europe, with companies preparing to meet demand throughout the region. Company announcements suggest that the global market should expand to about 1,000 gigawatt-hours by 2025. The Chinese battery maker CATL had the largest market share in 2019, at 28 percent, while its absolute capacity grew by 39 percent. CATL has recently continued its global expansion, signing new contracts with several international OEMs and setting up a factory in Germany.

South Korean manufacturers are trying to catch up with large-scale investments in new overseas production plants. SK Innovation, for example, announced it would invest an additional 5 billion in its planned US factory, while LG Chem is investing $2.3 billion in a joint venture (JV) with General Motors in the United States.

Overall, JVs are becoming a popular collaboration model in the battery industry, with an increasing number of partnerships announced in 2019. This trend mainly reflects the fact that JVs enable automakers to lock in enough capacity to reach their ambitious sales and production targets. Automakers also prefer multisourcing strategies involving a number of cell makers. Even Tesla, which used to rely solely on cells from Panasonic, signed new contracts with CATL and LG Chem for the Chinese market in 2019.

The EV market has grown quickly, but the dynamics vary by region. In key markets, the transition from ICEs to electric powertrains reached a tipping point in 2019, fueled by more stringent emissions regulations, access restrictions in cities, advancing EV technologies that lengthen driving ranges and cut prices, and the expansion of the charging network. The same forces will further expand uptake over the coming years, but their evolution will vary by market.

To win, automakers and suppliers must develop a detailed view of whats happening in each market by monitoring the regulatory environment, customer preferences, infrastructure development, and the moves of competitorsespecially new entrants, including start-ups from outside the industry. Companies that match customer demand with suitable EV models and catch regulatory tailwinds may secure the most promising pockets of growth going forward.