Which Chinese EV sells more than Tesla

Chinas BYD is selling more electric cars than Tesla

Editors Note: Sign up for CNNs Meanwhile in China newsletter, which explores what you need to know about the countrys rise and how it impacts the world.

Hong Kong/New YorkCNN

BYD overtook Tesla to become the worlds biggest electric car company in the final quarter of 2023.

The Chinese company sold a record number of cars last year, including 525,409 battery electric vehicles (BEVs) in the three-month period to December 31, according to a stock exchange filing. Tesla said Tuesday it delivered 484,507 also a record during the quarter.

Over the year as a whole Elon Musks Tesla (TSLA) still outpaced BYD, selling 1.8 million electric cars. BYD sold 1.57 million electric vehicles, up 73% on 2022, as well as 1.44 million hybrids.

But that means Teslas gap over its Chinese rival, at about 230,000 units in 2023, was significantly narrower than the 400,000 units posted in 2022.

The rapid growth of BYD, which is backed by Warren Buffett, is a symbol of Chinas rising EV industry.

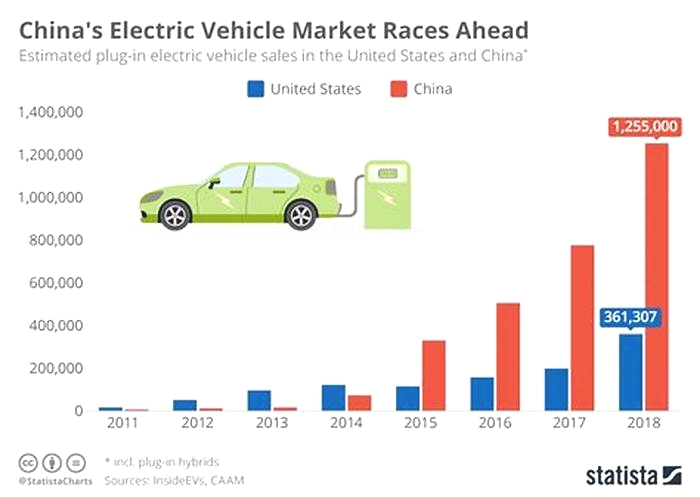

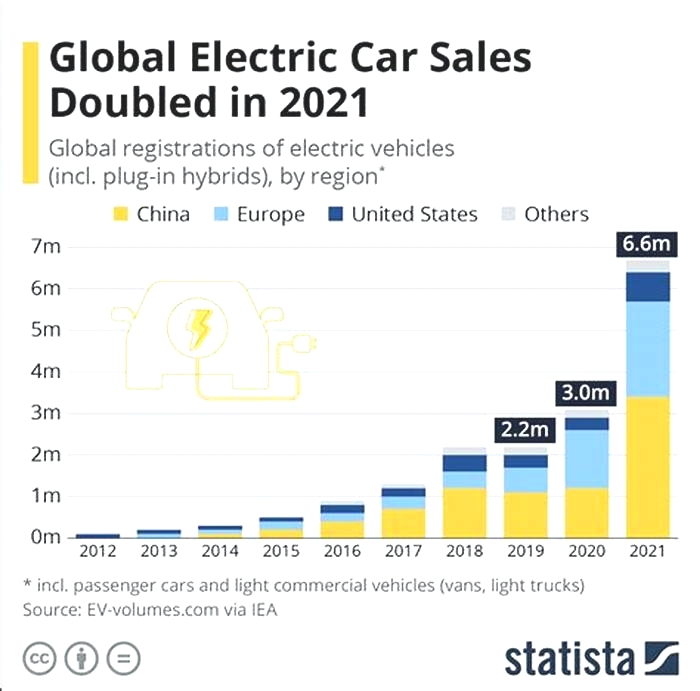

China is progressing quickly inits transition to electric vehicles, thanks to strong government support for the industry. And its carmakers have been pushing into Europe to the alarm of traditional rivals such as Volkswagen and Renault. EU policymakers have launched an investigation into Chinese state subsidies.

Beijing has set a target thatat least 20% of new cars sold annually in China by 2025 should be new energy vehicles (NEVs), which include BEVs, plug-in hybrids and hydrogen fuel cell vehicles.By 2035, the government says, NEVs should become the mainstream of new car sales.

The first goal was achieved in 2022, about three years early.The second may also be reached earlier than expected.

In the first 11 months of 2023, 8.3 million units of new energy vehicles were sold, accounting for more than 30% of total car sales, according to data released last month by the China Association of Auto Manufacturers.

Miao Wei, former minister of Chinas Ministry of Industry and Information Technology,said at a car forum in November that the governments NEV penetration target of 50% by 2035 is likely to be achieved by 2025 or 2026 at the latest, according to state media.

Chinas leading role in the global industry is also thanks to its market scale, cheap labor and supply chain dominance, according to analysts.

China is now leading in production and increasing its comparative edges, banking on its massive domestic market and the first mover advantage, analysts from Natixis Asia, a French investment bank, wrote in a report in late November.

Its first mover advantage and government support through infrastructure investment and subsidies have made it easy for Chinese EV makers to expand domestically and internationally, they said.

However, intensifying competition and a brutal price war last year have impacted the profit margins of many car makers.

As Chinas economy lost momentum, automakers were concerned about a demand slowdown. In January, Tesla cut prices in China to attract customers and stem slowing growth, triggering a price war. Dozens of auto makers followed suit to stay competitive.

The price war has driven up sales, but threatened industry-wide profitability. For the first 11 months of last year, Chinas car industry recorded a profit margin of just 5%,lower than 2022s 5.7% and 2021s 6.1%, according to figures published by the Chinese Passenger Car Association, a government-backed industry group.

To offset the slowing domestic market, Chinese car makers have been seeking growth outside the mainland by expanding in Europe, Australia and Southeast Asia.

BYD sent a big delegation to a car show in Germany last September. A spokesman said then that the company was aiming to double the number of dealer partners in Europe in 2023 and was targeting overseas sales of 250,000, up from about 56,000 in 2022.

Last month, it announced it would build an EV factory in Hungary, which would be its first passenger car plant in Europe. Italready has a bus factory in Komrom, Hungary.

China's BYD is selling more EVs than Tesla

Hong Kong/New York (CNN) BYD overtook Tesla to become the world's biggest electric car company in the final quarter of 2023.

The Chinese companysold a record number of cars last year, including 525,409 battery electric vehicles (BEVs) in the three-month period to December 31, according to a stock exchange filing. Tesla said Tuesday it delivered 484,507 also a record during the quarter.

Over the year as a whole Elon Musk's Tesla (TSLA) still outpaced BYD, selling 1.8 million electric cars. BYD sold 1.57 million electric vehicles, up 73% on 2022, as well as 1.44 million hybrids.

But that means Tesla's gap over its Chinese rival, at about 230,000 units in 2023, was significantly narrower than the 400,000 units posted in 2022.

The rapid growth of BYD, whichis backedby Warren Buffett, is a symbol ofChina's rising EV industry.

China is progressing quickly inits transition to electric vehicles, thanks to strong government support for the industry. And its carmakers have been pushing into Europe to the alarm of traditional rivals such asVolkswagen and Renault. EU policymakers have launched aninvestigation into Chinese state subsidies.

Beijing has set a target that at least 20% of new cars sold annually in China by 2025 should be new energy vehicles (NEVs), which include BEVs, plug-in hybrids and hydrogen fuel cell vehicles. By 2035,the government says, NEVs should become the "mainstream" of new car sales.

The first goal was achieved in 2022, about three years early.The second may also be reached earlier than expected.

In the first 11 months of 2023, 8.3 million units of new energy vehicles were sold, accounting for more than 30% of total car sales, according to data released last month by the China Association of Auto Manufacturers.

Miao Wei, former minister of China's Ministry of Industry and Information Technology,said at a car forum in Novemberthat the government's NEV penetration target of 50% by 2035 is likely to be achieved by 2025 or 2026 at the latest, according to state media.

China's leading role in the global industry is also thanks to its market scale, cheap labor and supply chain dominance, according to analysts.

"China is now leading in production and increasing its comparative edges, banking on its massive domestic market and the first mover advantage," analysts from Natixis Asia, a French investment bank, wrote in a report in late November.

Its first mover advantage and government support through infrastructure investment and subsidies have made it easy for Chinese EV makers to expand domestically and internationally, they said.

However, intensifying competition and a brutal price war last year have impacted the profit margins of many car makers.

As China's economy lost momentum, automakers were concerned about a demand slowdown. In January, Tesla cut prices in China to attract customers and stem slowing growth, triggering a price war. Dozens of auto makers followed suit to stay competitive.

The price war has driven up sales, but threatened industry-wide profitability. For the first 11 months of last year, China's car industry recorded a profit margin of just 5%, lower than 2022's 5.7% and 2021's 6.1%, according to figures published by the Chinese Passenger Car Association, a government-backed industry group.

To offset the slowing domestic market, Chinese car makers have beenseeking growth outside the mainlandby expanding in Europe, Australia and Southeast Asia.

BYD sent a big delegation to a car show in Germany last September. A spokesman said then that the company was aiming to double the number of dealer partners in Europe in 2023 and was targeting overseas sales of 250,000, up from about 56,000 in 2022.

Last month, it announced it would build an EV factory in Hungary, which would be its first passenger car plant in Europe. Italready has a bus factory in Komrom, Hungary.

Heres what you need to know about BYD, the Chinese EV giant that just overtook Tesla

Editors Note: Sign up for CNNs Meanwhile in China newsletter, which explores what you need to know about the countrys rise and how it impacts the world.

Hong KongCNN

BYD overtook Tesla as the worlds top seller of electric vehicles (EV) at the end of last year, crowning an extraordinary rise for the Chinese carmaker.

It delivered more fully electric cars than Tesla for the first time in the three-month period to December 31, and slashed the sales lead held by Elon Musks company over the year as a whole.

So how did a little-known Chinese battery maker grow so quickly to become Teslas biggest rival?

Based in the Chinese megacity of Shenzhen, BYD was founded in 1995 by Wang Chuanfu, a low-key former academic who still runs the company. Wang says the letters BYD dont stand for anything in particular. He said he chose a rather strange name to set it apart from other startups.

It is Chinas top EV producer and exports electric taxis, buses and other vehicles to the rest of the world, including Europe, South America, Southeast Asia and the Middle East. Unlike Tesla (TSLA), it also makes plug-in hybrids.

Israel and Thailand currently countas BYDs major overseas markets, where the Chinese company ranks number one in EV sales.

Its best-selling passenger cars are the Qin and Song models. The Qin is a compact sedan available as a plug-in hybrid or an all-electric car. The BYD Song is a series of compact crossover SUVs.

Compared to Tesla, BYD is known for offering more affordable cars, which helped it attract a wider group of consumers. Its entry-level model sells in China for just over $10,000; the cheapest Tesla Model 3 costs more than $32,000.

BYDs passenger cars are not yet available in the United States. But its electric buses made in Lancaster, California are soldin the country.

Wang, an engineer, first moved to Shenzhen in the early 1990s to run a battery making business for a Beijing-based government research institute, according to his official resume in the companys filings.

Government posts in China at that time were considered iron rice bowls, a popular term for a job for life.But Wang soon quit and founded BYD.

The start of his entrepreneurial journey coincided with the opening of the Chinese economy to the world. Chinas former leader Deng Xiaoping had set up the countrys first special economic zone in Shenzhen, which encouraged hundreds of manufacturing businesses to flock to the city, lured by its liberal economic policies and cheaper labor and land costs.

By 1997, Wang had grown his small workshop to a medium-sized cellphone battery maker with more than 100 million yuan ($14 million) in annual sales.

That year, the Asian financial crisis provided a growth opportunity as plunging battery prices pushed many competitorsout of business. Wangs company was ableto survive due to its cost advantage, according to the Southern Weekly newspaper.

By 2003, BYD had become the worlds largest producer of nickel-cadmium batteries, which were widely used in mobile phones.

But Wang wanted more. Eyeing the future growth of EVs, Wang ventured into the car industry in 2003, acquiring a state-owned automaker in the city of Xian for269 million yuan ($38 million).

While that surprise decision angered the companys strategic investors and triggered a 21% plunge in the companys Hong Kong-listed shares, as Wang later described, he remained steadfast.

I build cars because I am optimistic about the future development of electric vehicles, he said defiantly after the share price plunge, according to state-owned Beijing Business Today.

Just five years later, in 2008, Wang was vindicated when he received a $230 million investment from his most famous backer, Warren Buffett, who paid about $1 per share for a stake of around 10%. That vote of confidence helped boost the companys stock by as much as 1,370% over the next year.

BYD launched its first plug-in hybrid model at the end of 2008. Since then, BYD has taken off as an EV manufacturer, partly thanks to the Chinese governments support for the industry.

Buffett has been gradually trimming his stake in BYD since 2022, taking some of the enormous profits he has made. According to the most recent filing by Buffetts Berkshire Hathaway, the firm held nearly 8% of BYD as oflate October. Those shares are now worth 18.28 billion Hong Kong dollars ($2.3 billion).

BYD has dominated the Chinese EVindustry since 2015, when it surpassed its domestic and overseas rivals in the worlds biggest car market. One of its key advantages against Tesla, the number two player in China, is price.

Teslas four models the Model 3, Model Y, Model S and Model X have price tags ranging from $40,000 to $120,000 in the United States.In China, the cheapest Tesla model, the base Model 3,has a starting price of 229,900 yuan ($32,375). It has a range of 272 miles on a full charge and a top speed of 140 miles per hour.

By contrast, the BYD Seagull has a starting price of 73,800 yuan ($10,392) in China. It has a top speed of 81 miles per hour.The Seagull is available with two battery packs.The smaller battery has a range of 190 miles, while the larger battery has a range of 251 miles.

Both Tesla and BYD vehicles have received safety ratings from international organizations. In 2022, Teslas Model Y and BYDs Atto 3 received a five-star Australasian New Car Assessment Program (ANCAP) rating respectively.

Since 2020, BYD has been making its lithium iron phosphate battery (LFP) Blade Batteries for usein its own cars and for sale to other auto makers, such as Toyota.

The companysaysthe blade-shaped battery is thinner and longer than conventional lithium iron cells, and thus can maximize the use of available space within the battery pack. Its also less likely to catch fire even when its severely damaged, according to BYD.

Tesla also reportedly uses BYD Blade Batteries for its Y cars produced in the Berlin Gigafactory, according to German media.

In March 2023, Elon Musk denied a media report saying Tesla was ending cooperation with BYD on battery supply.