Which EV company will survive

Source: T. Schneider / Shutterstock

Fisker (OTCMKTS:FSRN) stock is perhaps one of the saddest stories weve seen from the multi-year bull run in EV stocks. Today, Fisker stock is plunging another 16% to a little more than 1 cent per share. It could be one of the most well-known penny stocks in the market.

Despite an intriguing brand and a well-priced electric SUV, Fiskers recent troubles have compounded. Various macro and sector-specific concerns have hit most EV makers in recent months. But for Fisker, a lack of funding and a delisting from the New York Stock Exchange have put the company in dire straights, with bankruptcy the only likely way out of this mess.

Todays decline is yet another gut punch for Fisker stock investors, tied to news that the company has announced it will withdraw its financial forecasts and pursue options for the continuation of its business. In plain speak, that means bankruptcy is indeed on the table and equity investors (being in second position to debt holders) may ultimately be left with nothing at the end of the day.

Lets dive into what the company announced and why Fisker stock investors are taking it on the chin again today.

Fisker Stock Plunges to New Record Low

Whenever a given company chooses to withdraw financial forecasts, it generally means the outlook is so bleak that its not worth sharing. Sometimes bad news can be good news in the markets, so long as a company can show a smaller-than-expected loss, or beat some very bearish metrics put forward by analysts.

The fact that Fisker isnt even trying says a lot. The company is now more focused on saving itself and being able to weather this storm than it is on providing outlooks or backward-looking data for investors. Without funding from a major automaker, Fiskers outlook certainly is grim, so todays move makes sense in this regard.

One of Fiskers last-ditch efforts to save its brand appears to be cutting prices across its models to create demand for its Ocean SUVs. Well have to see if there are any announcements that come from this move. But its hard to anticipate EV buyers considering the brand, knowing that it will likely go defunct and make everything from servicing to ordering parts next to impossible.

The writing unfortunately appears to be on the wall for Fisker stock.

On Penny Stocks and Low-Volume Stocks:With only the rarest exceptions,InvestorPlacedoes not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day. Thats because these penny stocks are frequently the playground for scam artists and market manipulators. If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand thatInvestorPlace.comswriters disclose this fact and warn readers of the risks.

Read More:Penny Stocks How to Profit Without Getting Scammed

On the date of publication, Chris MacDonald did not hold (either directly or indirectly) any positions in the securities mentioned in this article.The opinions expressed in this article are those of the writer, subject to the InvestorPlace.comPublishing Guidelines.

Chris MacDonalds love for investing led him to pursue an MBA in Finance and take on a number of management roles in corporate finance and venture capital over the past 15 years. His experience as a financial analyst in the past, coupled with his fervor for finding undervalued growth opportunities, contribute to his conservative, long-term investing perspective.

Fisker shares halted as EV company navigates uncertain future

CNN

Shares of Fisker, a California-based electric vehicle startup, were halted Monday. This comes after the company warned, in an earnings report in March, that it might not have enough cash to survive the year.

Later in the day, the New York Stock Exchange announced it planned to delist Fiskers stock due to abnormally low price levels. That delisting will mean the company must offer to buy back bonds that are currently due in 2026 and to immediately pay off other debts due in 2025, according to a filing the company made with the Securities and Exchange Commission.

We do not currently have sufficient cash reserves or financing sources sufficient to satisfy all amounts due under the 2026 Notes or the 2025 Notes, and as a result, such events could have a material adverse effect on our business, results of operations and financial condition, Fisker said in its filing.

Fiskers shares traded for as much as $28 in February of 2021, valuing the company at just under $8 billion, but its shares now currently trade for less than 10 cents per share, reducing the EV car makers total market capitalization to less than $50 million

Fisker had also previously said it was in talks with a major, established automaker but, those talks have fallen apart without a deal, according to a regulatory filing Fisker made Monday. The companys troubles are another sign of the headwinds and speed bumps for the burgeoning EV industry.

Reuters had reported it was in talks with Nissan, citing unnamed sources familiar with the discussions. Those talks centered on Fiskers planned electric pickup, the Alaska, according to the report.

Fisker was founded by its chief executive officer, auto designer Henrik Fisker, in 2016. Its sole product, the Fisker Ocean electric SUV, was produced in Austria under contract by third-party manufacturer Magna Steyr. Last year, 10,000 SUVs were produced but, in its earnings report, the company said only about half had been delivered to customers.

Henrik Fisker had expected that outsourcing manufacturing to Magna, a company that also builds cars for Mercedes, BMW, Jaguar and others, would reduce the companies risks because it wouldnt have to invest in its own manufacturing facilities.

Fisker had also announced plans to produce a small, affordable EV called the Pear. Foxconn, the Taiwanese electronics company best known for manufacturing Apples iPhones, had been in discussions to produce the Pear at a Foxconn-owned factory in Ohio. Those talks never came to fruition.

And more bad news has been mounting for the company recently. The Ocean was the subject of a scathing review by American YouTube tech personality Marques Brownlee. The video wastitled, This is the Worst Car Ive Ever Reviewed.

Do not buy this version of the Fisker Ocean, reads the videos description. Brownlees video has racked up more than 4.5 million views so far, and it sent Fiskers stock price plunging after its release.

Consumer Reports also recently published its own review of the Ocean panning its ride quality and software although the reviewers did like its cargo space, rear seat legroom and large glass moonroof.

Henrik Fisker admitted, in an interview with the industry newspaper Automotive News, that the Ocean had quality problems. He blamed the issues on software from various suppliers that worked poorly together. He said the problems were being addressed through software updates.

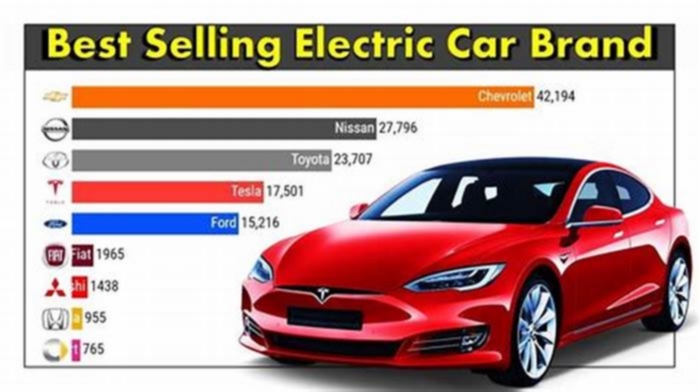

But, besides its own quality issues, Fisker had to deal with much greater competition from established automakers than had existed when the company was established. Now, besides Tesla, companies like Hyundai, Kia, Ford and General Motors offer electric SUVs that are substantially similar to the Ocean and without the risks of dealing with an unknown startup.

Only 10 carmakers will survive global EV battle, says Tesla rival Xpeng

Stay informed with free updates

Simply sign up to the Electric vehicles myFT Digest -- delivered directly to your inbox.

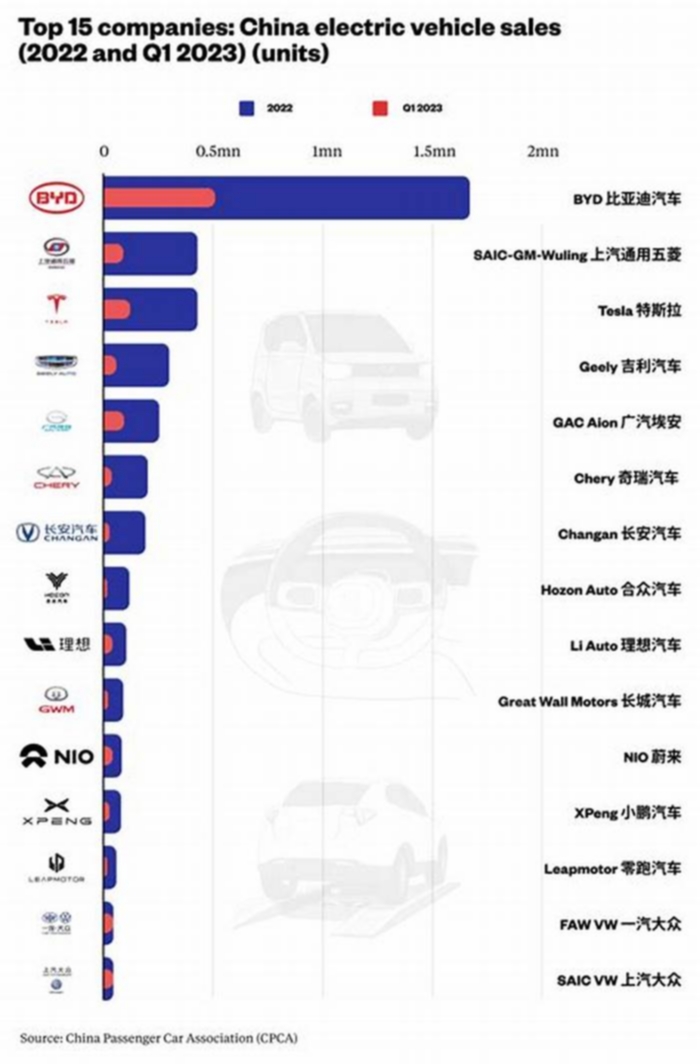

The worlds car industry will shrink to only 10 companies over the coming decade, a Chinese rival to Elon Musks Tesla has said, as intense competition in Chinas electric vehicle market spills on to the global stage.

Brian Gu, vice-chair of Guangzhou-headquartered Xpeng, said for Chinese companies to be among the last carmakers standing, they would need to have annual sales of at least 3mn vehicles, underpinned by global exports. The worlds largest carmaker Toyota sold 10.5mn cars in 2022, while Tesla sold 1.3mn.

The warning comes at a historic juncture for the global car industry. China is on the cusp of overtaking Japan as the worlds biggest exporter of cars by volume after passing Germany last year. At the same time, slowing growth and an intense price war is pushing low-cost carmakers to the brink of collapse in China, the worlds biggest car market.

To be in that 3mn club you cannot be a China-only player, you have to be a global player. We think in that scenario, maybe close to half your volume is coming from outside of China, Gu said in an interview with the Financial Times.

In five to 10 years, its going to be a much more concentrated market. I think the [number] of players will probably be reduced to less than 10 at the global stage.

Xpeng, which was founded in 2014 and raised $1.5bn in a 2020 initial public offering in New York, has been hit by intense competition in China.

It ranked 12th by sales among electric-vehicle makers in China during the first three months of the year. The company, which sold more than 120,000 vehicles in 2022, has been hit by an almost 50 per cent decline in first-quarter sales this year after Tesla cut prices. In January, Xpeng was forced to follow suit, slashing the prices of three of its four models by as much as 13 per cent.

Gu, formerly JPMorgans managing director and chair in Asia, struck a defensive tone over the sales slump, blaming the timing of the companys new model launches. But he forecast that the market would stabilise in the second half of this year.

This year, I think were faced with a very competitive landscape, he said. Theres obviously [price-cutting] pressure...which not only causes competition but also creates hesitancy among consumers.

Gu acknowledged that deteriorating US-China relations complicated the companys overseas expansion plans.

Xpeng, which is backed by Alibaba and has invested heavily in autonomous driving, is targeting growth in Europe this year but does not have immediate plans to sell cars in the US.

Entering the US for Chinese brands may be difficult today, Gu said. We need to take time to study it and find a way to access that market.

Despite the challenges, Gu said the company saw plenty of growth opportunities outside of China.

Xpeng, as with all Chinese electric-car producers, depends on US chip designers including Nvidia and Qualcomm for advanced semiconductors. This has fuelled concerns that Chinese carmakers could be exposed as the US government expands restrictions on Chinas access to cutting-edge US chip technology.

So far, none of our partnerships has been impacted by any of the political noise, he said, adding that, if the restrictions did start to have an impact on the company, the whole China industry will find a solution.

Domestically, Xpeng has also hit speed bumps. Last September, customers complained about the carmakers confusing models. The company was forced to rename its luxury sport utility vehicle less than 48 hours after its launch.

Shortly after the naming controversy, Xpeng began restructuring. The company recruited as co-president Wang Fengying, a former chief executive at Great Wall Motor who helped that company become the first Chinese group to export locally made cars.

3 Top-Rated EV Charging Stocks Wall Street Analysts Are Loving Now: January 2024

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Starting in 2024, the Internal Revenue Service (IRS) extended an improved version of a tax credit system for electric vehicle (EV) buyers to 2032. Individuals purchasing used or new domestically manufactured EVs can instantly claim tax credits of up to $7,500, regardless of their tax liability. This move is a game-changer, as it expands the accessibility of the tax credit and aims to incentivize the adoption of EV cars. Also, the EV charging equipment tax credit of up to $1,000 remained in place, further bolstering prospects for some top-rated EV charging stocks.

In addition, the Biden administration just announced $623 million to expand EV charging infrastructure in the U.S. The funding aligns with a target of installing 500,000 EV chargers nationwide by 2030 to facilitate reliable and fast charging stations. The timing makes some EV charging stocks a preferred choice for investors.

With expectations of rate cuts and increased capital investment, EV manufacturers may resume programs postponed during the second half of 2023. Despite a slower growth rate of EV sales, volumes did not decline. 2024 is also expected to surpass 19 million units, making up 13% of new car sales. Combining tax incentives and lower interest rate expectations could boost sales even further and support EV charging stocks.

Given recent policy developments, infrastructure funding and expected consumer demand, now may be an opportune time to research the top-rated EV charging stocks Wall Street analysts are loving in January.

ChargePoint (CHPT)

Source: JL IMAGES / Shutterstock.com

ChargePoint (NYSE:CHPT) operates the largest public EV charging network in the U.S., with over 31,000 locations and 56,000 charging ports. 96% of the companys ports are fast Level 2 chargers, taking 3-8 hours to charge an EV fully. The company is well-positioned to benefit from its existing fast-charging infrastructure compared to 11-20 hours using Level 1 chargers.

CHPT reaffirmed its plan to achieve positive non-GAAP Adjusted EBITDA in Q4 of 2024. The company more than doubled its revenue from last year, totaling $543 million compared to $241 million on January 30, 2022, leaving no questions about why Wall Street analysts love the EV charging stock.

Recently, Citigroup maintained a neutral rating with a $2.40 price target, while DA Davidson reiterated a buy rating and a $4.00 price target. On average, nineteen Wall Street analysts give a price target of $3.79, double the current price of $1.90. Coupled with laying off 12% of its workforce, the EV charging stock may continue to ascend in January.

EVgo (EVGO)

Source: Sundry Photography / Shutterstock.com

EVgo (NASDAQ:EVGO) has over 850 locations and over 3,000 connectors, but most ports are the Level 3 faster-charging ports that operate using direct current (DC). These chargers have an average charging time of 30-60 minutes, providing a more convenient option for drivers focused on port locations and charging costs.

Concerns about a recession have also eased since EVGO was last downgraded in October. With the economy recovering and the U.S. expected to dodge a recession, commercial customers may be more willing to buy.

But Wall Street analysts are loving EVgo because the company reported a revenue increase of 234% YOY in Q3 and expects to have 3,400-3,700 DC stalls in operation or under construction by the end of 2024. Eight analysts forecast an average price target of $6.19, more than double its current level of $2.71, a substantial boost for the EV charging stock.

Aside from partnering with Honda(NYSE:HMC) to provide EVgo network access and charging credits to Honda and Acura EV drivers, EVGO recently extended its partnership with Toyota(NYSE:TM) bZ4X customers. The combination of DC charging infrastructure, improving economic conditions and partnerships all contribute to the positive outlook for the EV charging stock.

Blink (BLNK)

Source: David Tonelson/Shutterstock.com

Blink (NASDAQ:BLNK) has more than 3,500 stations as compared to ChargePoint and EVgo, but almost entirely Level 2. However, according to its Q3 report, the company contracted, deployed or sold nearly 6000 charging stations during that quarter alone. This resulted in record total revenues of $43.4 million in Q3, up 152% YOY.

With an advantage in manufacturing production, Blinks product sales increased 162% to $35.1 million, and service revenues increased 119% to $6.7 million. The company anticipates ongoing growth opportunities as EV adoption increases and charging infrastructure expands. It targets positive EBITDA by the end of the 2024. Notably, the adjusted EBITDA loss improved to $11.7 million compared to a $17.6 million loss in the prior year period.

Most recently, Needham upgraded Blink to a buy rating, providing a $7 price target on January 8. This was the first EV charging stock upgrade among the three top-rated EV stock picks, up from the current price level of $2.54. 11 Wall Street analysts see an even higher price target of $10.55 for the EV charging stock. Coupled with rising short interest of nearly 33%, up from 29% previously, a short squeeze raises the prospect of a January price spike.

On the date of publication, Stavros Tousios did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Stavros Tousios, MBA, is the founder and chief analyst at Markets Untold. With expertise in FX, macros, equity analysis, and investment advisory, Stavros delivers investors strategic guidance and valuable insights.

More From InvestorPlace

The post 3 Top-Rated EV Charging Stocks Wall Street Analysts Are Loving Now: January 2024 appeared first on InvestorPlace.