Which company can beat Tesla

HotCars

The American electric car company Tesla Motor Inc. is a company that is headed by Elon Musk. Elon has spearheaded this company and increased its sales to reach top heights. Tesla was founded in 2003 and has its headquarters in Palo Alto, California. The company is also into development apart from its automotive segment. This is a new-age and brilliant sector of Tesla that is into very innovative manufacturing. However, there are some companies that are nearing Tesla in terms of revenue and can beat it, probably in the near future.

RELATED: 10 Ways To Save Money Buying A Tesla

Here we show you five of them and also give you five reasons why Tesla will stay number one.

10 Company That Can Beat It: Volkswagen

One of the top competitors of Tesla would be Volkswagen. This company has its headquarters in Wolfsburg, Germany, and is a really old company, having been founded in 1937. It is now headed by Herbert Diess who is the chairman and CEO. With more than 650,000 employees Volkswagen has revenue of over $270 billion.

RELATED: 10 Reasons Volkswagen Drivers Are Obsessed With Their Cars

It has operations in the manufacturing field as well. With great automobiles under various categories, Volkswagen has upgraded and revamped itself to be one of the best in the world. It has diversified its operations to various countries and the name is synonymous with quality and style.

9 Reason It Will Stay Number One: Elon Musk

Though Tesla was founded by Martin Eberhard and Marc Tarpenning, it is Elon Musk who has made all the difference to the company. Elon has been able to take the company and two others to over $1 billion valuations. He is one of the shareholders in Tesla and now owns about 23% of Tesla stock. He invested 54.5 million in Tesla and this has helped him steer Tesla to what it is today. With his space missions and transportation advancements, like the Hyperloop, Elon is able to bring all the latest technology together to create a simplified tomorrow. Elon Musk is the reason why Tesla will stay number one for a longer time.

8 Company That Can Beat It: BMW

Another of Teslas competitors is BMW which is a great automobile company thats been there for ages. The company was founded in 1969 in Munich. The chairman and CEO of BMW (Bayerische Motoren Werke AG) is Oliver Zipse who has managed to get the BMW brand to every corner of the world. The brand name is something that is associated with luxury and power. It has its operations in the manufacturing section and produces cars that are top quality. It has above 134,000 employees and revenue of over $100 billion. BMW is a group that Tesla needs to keep a lookout for indeed.

7 Reason It Will Stay Number One: Superb Cars

Tesla will stay number one for the simple reason that they produce fantastic cars that are electric. With the Model S, they hit the jackpot. It received Motortrends Car of the Year award as well. With a 5-star safety rating, the Model S is a powerful yet safe car to drive. Another great car that has come from the Tesla factory is the Model X. This is a sport utility vehicle with a speed of 3.2 seconds from 0 to 60 mph. Tesla has been manufacturing quality cars for 11 years and the sales have been so good that they were able to repay loans nine years early.

6 Company That Can Beat It: AES

AES is a great competitor to Tesla. It was founded in Arlington, Virginia in 1981 and is now a Fortune 500 company. It generates electric power and is the worlds leading company that distributes electric power. It actually generates about 42% of the revenue that Tesla does. It has also now announced a 10-year alliance with Google in order to see the future of energy. It is no wonder that AES is now considered the number three competitor to Tesla. With president and CEO Andres Gluski, AES has reached revenue of $10 billion. It currently has about 10,500 employees.

5 Reason It Will Stay Number One: Elons Future Plans

As we mentioned, Elon Musk is the reason why Tesla is so popular today. His plans for the future are genuinely fantastic and it can be seen in the cars he is building and his almost child-like enthusiasm about the future. Model 3 is a car that will be an electric four-door sedan and will have autopilot technology. He also wants to increase the car range to 1000 miles for every charge. This will surely boost car sales dramatically. Elon and his ideas are always something to look forward to. Tesla benefits from the innovative mind of the company employees and their drive and passion to build.

4 Company That Can Beat It: Siemens

Siemens is another German multinational company that can give Tesla a run for its money. It stands at number four in the list of competitors. It has its headquarters in Munich, Germany, and offices all over the world. It is the largest manufacturing company in all of Europe and has branched out into various domains like manufacturing, automation, and energy. President and CEO Joe Kaeser has helped to build the image of the company and bring it up to $100 billion in revenue. Siemens has a total of at least 379,000 employees all over the world. With their diversified portfolio, they may easily overtake Tesla.

3 Reason It Will Stay Number One: Gigafactory

The Gigafactory is a new venture from Tesla and is a huge building that will create lithium-ion batteries. These are the batteries that will be used in the Tesla cars. The 3000-acre area has space to employ 850 employees, as well as 1,700 construction workers. The Gigafactory can also continue even during earthquakes. The factory plans to produce a capacity of 35 gigawatt-hours of battery. Tesla is surely looking into the future and this is what makes it one of the best in the world. This is the reason why Tesla seems to be number one for some time now.

2 Company That Can Beat It: LG Chem

LG Chem or LG Chemical is headquartered in Seoul, South Korea. It is the largest chemical company in Korea and the 10th largest chemical company in the world. With CEO Hak Cheol Shin, LG has drastically upgraded itself and stayed on top of the latest technological advancements.

RELATED: 10 Sports Cars That Are A Headache To Drive In The City

LG is now a name known all over the world with quality appliances and other products. The 24,900+ employees working for LG strive to bring quality products to every doorstep. Revenue of $25 billion is what LG has managed to achieve with its hard work. Tesla needs to check the success of LG over the years.

1 Reason It Will Stay Number One: Helpful to Competitors

Tesla has a market capitalization of about $620,000 per car and has sold about 125,000 cars of the different models since 2008. With its sales model being legal in 48 states in the US, Tesla has really reached out to everyone. Tesla stays in the number one spot because it helps competition by giving away patents for free. This is great as others can create more developed products and increase the target points in technology. Tesla creates such a wonderful atmosphere for innovators that it is special to work for the company. This is another great reason why Tesla will stay at the number one spot for a long time to come.

NEXT:10 NASCAR Drivers With The Most Wins (& How Much They Won)

ScienceWhat is BYD? How a battery maker beat Tesla to become the world's largest EV company

This is the story of a young company that took a risky bet on electric vehicles (EVs) and grew into a giant.

No, it's not Tesla.

It's a brand you may not have heard of, because they sell so few cars in Australia.

But analysts say it may one day dominate the global auto industry.

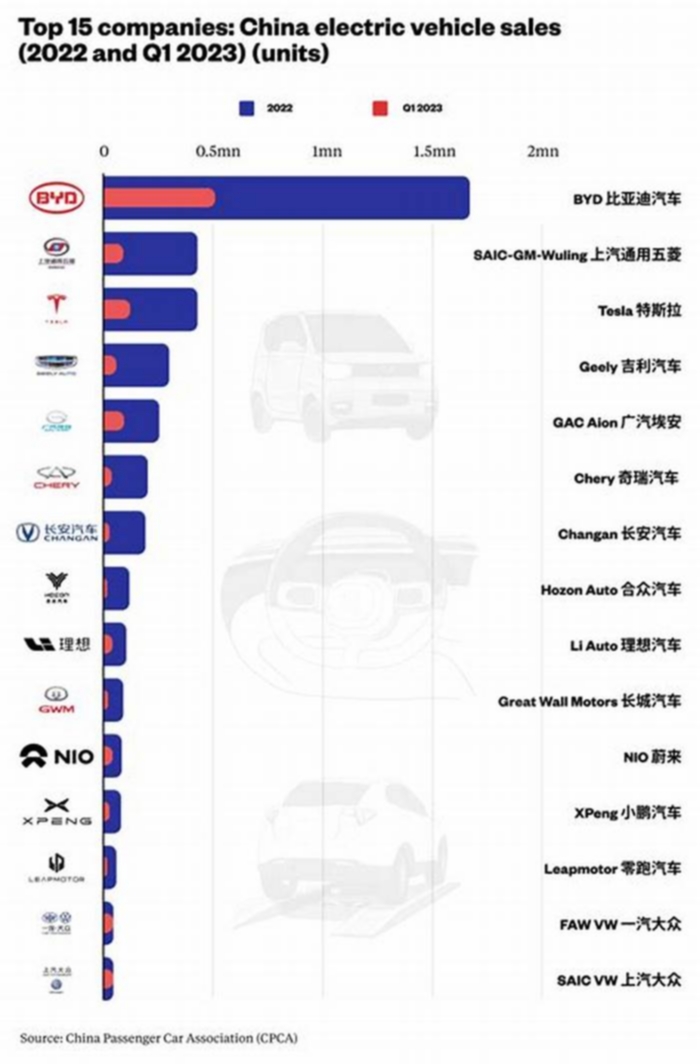

The company is the Chinese car maker BYD, which recently overtook Tesla as the world's largest EV company.

Having conquered China, it's now racing to expand worldwide.

Experts say BYD and other Chinese EV-makers mark a new era in transportation, as significant as the Ford Model T in the 1900s, or the emergence of Japanese manufacturing in the 1970s.

The rise has been meteoric. Two decades ago, BYD had not built a single car.

And 10 years before that, it was a start-up with anondescript factory in Shenzhen making batteries for mobile phones.

"The BYD story is a 20-year-old story," says Bill Russo, CEO of Automobility, a China-based investment advisory firm.

"And no-one took it seriously until the last 12 to 24 months when they started to outsell Tesla."

We're gonna need a bigger battery

Back in 2003, Mr Russo was working for DaimlerChrysler (now Mercedes-Benz)in the US when colleagues returned from a scouting trip to China.

They told an outlandish story about a little-known companycalledBYD.

Its founder, Wang Chuanfu, saw a future in EVs.

"He had this notion of 'We're going to be a car company, we're going to be an EV company,'" Mr Russo, who now lives in Shanghai, says.

"A lot of people at our company thought that was overly ambitious, to put it mildly."

Eight years earlier, in 1995, Mr Wang had resigned from a government research job and borrowed 2.5 million yuan (equivalent to around $960,000 in today's money) from a relative to build a factory to make mobile phone batteries.

The company he founded, BYD, stood for "Build Your Dreams".

By the early noughties, it was the world's second-largest producer of rechargeable batteries, supplying Motorola, Ericsson and Nokia.

But BYD saw a greater opportunity, Mr Russo says.

"The original intent was, 'Hey, you know, I make batteries for small things. If I make batteries for bigger things, I could sell more batteries.'"

BYD saw what traditional car companies hadn't, or were choosing to ignore.

Improvements in the cost and energy density of lithium-ion batteries opened the door to affordable EVs.

Or at least that was the idea.

The obstacles to building affordable EVs were daunting.

First, BYD had to learn how to make petrol-powered cars in order to develop a brand and test manufacturing techniques.

Then it had to solve the engineering challenges associated with running a car on battery power instead of internal combustion.

It also had to bring down thethen-sky-high cost of lithium-ion batteries.

And it had to do this before its larger and more experienced rivals.

Despite everything, Mr Wang was confident. The CEO told reporters in 2008 that BYD would bethe world's largest car company by 2025.

EVs, he said, were a blank canvas for the car industry. The future was up for grabs.

"We're talking new cars and everyone is starting from the same point."

The uphill struggle to make an EV for the masses

Tu Le, founder of the consulting firm Sino Auto Insights, recalls seeing a BYD car for the first time in 2009.

"The vehicles in the early days were complete trash," he says.

"The doors were paper thin and it would disintegrate if hit by any large vehicle."

He didn't think the company would thrive.

But others disagreed, and one in particular had deep pockets.

In 2008, at the height of the global financial crisis, Warren Buffet's investment subsidiary bought a 10 per cent stake in BYD.

Western media described Mr Wang,with a ballpoint pen tucked in his short-sleeved shirt pocket, as a "Chinese Bill Gates".

"Mr Buffett is clearly betting that he will be the geek who launches the next revolution in automotive technology," one reporter wrote.

A few years later, Tesla CEO Elon Musk was asked if BYD was a potential rival in the EV space.

His reply was incredulous.

"Have you seen their car?" he replied with a smirk.

But over the next 13 years, Mr Buffet's $US230 million investment swelled to $US6 billion, a return of about 3,000 per cent.

Helped by generous government subsidies for battery manufacturing, BYD set out to make EVs as affordable as pure combustion cars.

Not even Tesla, the market pioneer, had been able to do this.

BYD was effectively trying to dethrone theinternal combustion engine.

"The backbone technology of the automotive industry had not been altered since the mid-1880s," Mr Russo says.

"That's a pretty big moat that's kept away any technological disruption."

The Chinese EV market booms

Being the only major car maker to produce battery cells from scratch, BYD enjoyed a major advantage over its rivals.

Batteries can account for up to 40 per cent of an EV's total cost and manufacturing them in-house was much cheaper.

Tesla, on the other hand, bought its battery cells from Panasonic and then assembled them into battery packs. (It's since expanded into cell manufacturing, and also found other suppliers, including BYD.)

In economics terms, BYD pursued a strategy of vertical integration, or owning the different stages of the supply chain.

BYD was so vertically integrated it owned shares in the South American lithium mines that supplied its battery minerals refineries.

BYD had another advantage over its foreign rivals. With the Chinese government heavily subsidising consumers, China overtook the US as the world's largest EV market in 2014.

By 2020, China accounted for about half of global EV sales.

This demand meant BYD could build larger factories, which made its cars cheaper.

Despite all this, petrol cars still outsold electric ones.

"Then COVID happened," Mr Le says.

"And that's when you see that hockey-stick graph."

A combination of factors, from falling EV prices combined with a wider range of models, as well as Chinese buyers opting for personal vehicles over public transport, saw sales boom.

Australia benefited. Battery makers, and even the car companies themselves, rushed to secure limited global supplies of critical minerals.

Much of the lithium for these millions of Chinese EVs was mined in Australia.

By 2023, after years of price wars, some EVs were cheaper to buy than comparable petrol cars in China(when including an EV tax discount).

That year, it overtook Volkswagen as the top-selling car brand in China.

The achievement was seen as emblematic of the rise of the domestic auto industry, and a passing of the baton from foreign car-makers, Mr Russo says.

"Chinese companies, and in particular BYD, have been able to solve the problem of making EVs affordable."

Independent studies found BYD manufactures EVs 25 per cent cheaper than European car makers, and 15 per cent cheaper than Tesla.

Legacy car-makers, caught flat-footed, may not be able to compete with lower-cost Chinese EVs, Mr Le says.

Several have tried and failed to build their own EV battery cells to save on cost.

"But they can't build them, they don't know how," he says.

Last month, Elon Musk brought up BYD in an earnings call with Tesla investors. He'd mocked BYD in 2011, but this time his tone was different.

Chinese automakers will "demolish" global rivals unless governments put up trade barriers, he said.

"The Chinese car companies are the most competitive car companies in the world."

BYD expands overseas, including Australia

In 2022, having established itself in China, BYD expanded overseas.

It sold about 12,000 vehicles in Australia last year, or about 1 per cent of the total figure.Japanese and Korean car-makers, along with Ford, still dominate.

Tesla outsold BYD four to one.

(In January 2024, BYD narrowly outsold Tesla, but that was due to a delayed shipment of Teslasto our shores.)

BYD says it has "lofty goals" to be the best-selling car brand in Australia.

With our roads packed withpetrol-guzzling four-wheel drives and utes, this prediction may seem overly optimistic.

But as governments promote EV purchases, and EVs themselves get cheaper, change is coming.

The five cheapest EVs in Australia are currently all Chinese models.

"In the EV space, the only two players that have any [manufacturing] scale are Tesla and BYD," Mr Le says.

"Fifteen years from now, Tesla and BYD are going to be the major players."

Neither BYD nor Tesla crack the top 10 for world's largest car companies.

But others are making similar claims.

Late last year, the investment bank UBS announced a changing of the guard:

"BYD and other leading Chinese[car manufacturers] are set to dominate the global automotive market with high-tech, low-cost EVs for the masses."

Elon Musk may be an EV pioneer, but "it's not the pioneer who profits all the time", Mr Russo says.

"It's the settler who comes in later with an ever better business model.

"Henry Ford didn't invent the internal combustion engine. He just made it affordable.

"That's what Wang Chuanfu has done for the EV."

Get all the latest science stories from across the ABC.