Who is China s biggest EV producer

Tesla overtaken by Chinas BYD as worlds biggest EV maker

Unlock the Editors Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Elon Musks Tesla has been knocked off the top spot as the worlds best-selling electric-vehicle maker for the first time by BYD after recording fewer deliveries than its Chinese rival in the past quarter.

The US group handed over 484,000 cars in the fourth quarter, more than the 473,000 anticipated by analysts but not enough to hold on to its title after BYD reported record sales of battery-only vehicles of 526,000 for the same period.

Teslas dethroning by BYD reflects the rise of what was a little-known Chinese group only a decade ago, which Musk himself has publicly dismissed. While growth at the Warren Buffett-backed Chinese company has been mostly achieved on its home turf, BYD is sharpening its focus on finding new foreign markets including in Europe.

Danni Hewson, head of financial analysis at AJ Bell, said BYDs electric cars were becoming increasingly visible on European roads thanks to keen pricing.

BYDs success in chasing down Tesla also underlines the struggle of legacy automakers from the US, Europe, Japan and Korea to adapt to fast-changing consumer preferences for cheaper, smarter electric vehicles.

In a statement published in China, the Shenzhen-based group called itself the world champion for new energy vehicles after notching total annual sales of more than 3mn for 2023 across its vehicles which also include plug-in hybrid cars.

Teslas annual sales were 1.81mn vehicles in 2023, while BYD delivered 1.58mn fully electric cars.

Through much of the past 12 months, BYD benefited from price cuts sparked by Teslas attempt to chase market share, pushing consumers to consider Chinas lower-cost models, according to analysts.

For any doubters left in the west, I hope this is the final data point that points to BYDs strength and, as importantly, how China EV Inc has bullied its way on to the global stage, said Tu Le, founder of Beijing-based advisory company Sino Auto Insights.

He added that while both companies cut prices on some cars over the past year, Tesla did so much more dramatically, signalling that BYD could distance itself further from the US group over the coming year.

Still, WedbushSecurities analyst Dan Ives said it was an important quarter for Tesla to show strong deliveries and momentum heading into 2024.

Teslas annual sales of 1.8mn last year was a major achievement in a choppy macro [economic environment] for the electric vehicles sector, he added.

BYD was founded by Wang Chuanfu, a former university professor, in the mid-1990s. After focusing on manufacturing rechargeable batteries, including for mobile phones, the company expanded into the car industry in the early 2000s.

The Chinese groups early success prompted Buffetts Berkshire Hathaway to invest in the company in 2008. Despite relying on existing industry technology for many years, BYD has focused on stripping out costs from the production process.

Following years of state support and careful industrial planning by Beijing, Chinas automakers now leverage their countrys control over the production of almost every resource, material and component used to make electric vehicles.

BYDs vertically integrated structure it controls mines and produces batteries and chips has made it the envy of foreign rivals as the global car industry transitions away from the combustion engine.

At the end of last year six out of the top-selling EV models in China, the worlds largest car market, were BYD cars, according to Automobility, a Shanghai-based consultancy. While BYDs share of sales has expanded to more than 35 per cent, Tesla has struggled to keep up with the cadence of product launches by Chinese rivals, the consultancy added.

Distilled

Most people have never heard of one of the most important clean energy companies: CATL.

Located in a small Chinese city, Ningde, the companys headquarters are 90 minutes away from the nearest major airport. For a short period in the 1980s, when Ningde was still a small fishing village, Chinas current president Xi Jinping worked there as a Communist Party chief. It was a punishment, a relegation after his father refused to support a crackdown against a liberal reformer. Before CATL, Ningde was best known for its tea plantations and carp farms.

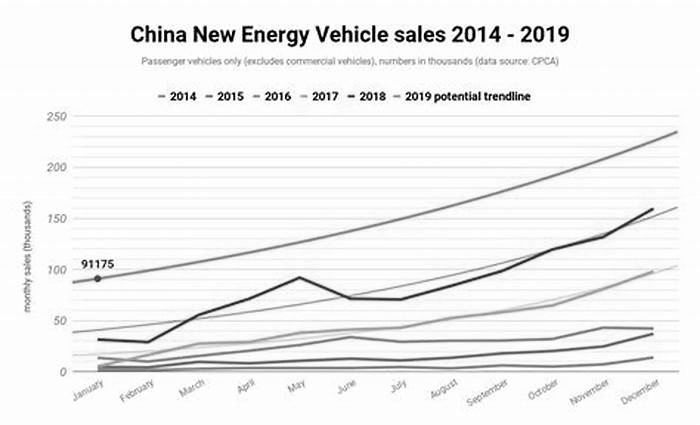

Today, Ningde is home to a company poised to play a central role in the energy transition. In the first half of 2023, CATL made 37% of all EV batteries globally. According to most forecasts, this number will only grow between now and 2030.

CATLs rise, like the growth of Chinas entire EV supply chain, was far from preordained. When the company launched in 2011, Chinas auto industry lagged far behind those in Germany and the United States. Companies in China like CATL were manufacturing products en-masse, but rarely did they make the most advanced products. Most advanced battery research was happening in national labs in the United States.But today, many of the worlds most advanced batteries are being built by Chinese companies like CATL.

So how did a small battery company headquartered in a carp fishing village become the biggest battery producer in the world? Thats the question, I want to explore in todays story. Ill cover:

How CATL used their experience making lithium-ion batteries for iPods to create the worlds cheapest EV batteries

Why Chinas leadership decided to invest aggressively in EVs around 2008

The various policies that China used to support its EV industry (and hurt those in other countries)

What flying pigs have to do with all of this

Why international automakers and policymakers are so worried about Chinas EV dominance

Chinas biggest nickel producer to list battery unit in Hong Kong

Unlock the Editors Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Chinas Tsingshan Holding Group, the worlds biggest nickel producer, is set to raise up to HK$2.39bn ($306mn) in an initial public offering of a battery-making subsidiary on Monday, testing investor appetite at the end of another lacklustre year for listings in Hong Kong.

The IPO of Chinese lithium-ion battery manufacturer REPT Battero Energy is set to be the fourth largest in Hong Kong this year but comes after tepid market sentiment for new share listings. Its stock exchange has become only the seventh-largest destination for IPOs in 2023, after topping the global rankings as recently as 2019.

The listing gives rare public exposure to Tsingshan and its low-key founder Xiang Guangda, who was unexpectedly thrust into the global spotlight when his huge bet on falling nickel prices backfired in March last year. Tsingshan suffered a trading loss of about $1bn and the London Metal Exchange suspended nickel trading for eight days.

REPT is the latest Chinese battery maker to tap global investors in offshore markets, as the countrys electric vehicle industry gears up for global expansion.The listing exposes Xiangs strategy of extending his raw materials business into the manufacturing of EV batteries.

Tsingshan was a long-term, predictable supplier of raw materials that could support future global expansion, said REPT director Wang Haijun at an online briefing last week.

REPTs goal is to become a highly international enterprise, and it is currently deploying overseas infrastructure in countries like Indonesia, Europe, Chile and elsewhere, he added.

The company is debuting in a market in which no listing has surpassed $1bn this year, according to Dealogic, with investor enthusiasm damped by Chinas sluggish economy, capital outflow pressures due to high US interest rates and rising geopolitical risk.

The largest IPO has been that of ZJLD, a Chinese distiller of the popular baijiu spirit, which raised $677mn in April. Only 58 companies have listed up to December 12, down 18 per cent from the same period in 2022.

Its fair to say that this year the sentiment [for Hong Kong share sales] remains pretty weak, and investors remain very selective of the deals that they would like to participate in, said Pruksa Iamthongthong, senior investment director of Asia Dragon Trust at Abrdn.

The EV sector still offers structural growth given its importance in the energy transition, Iamthongthong said.

It comes down to how much do you want to pay in the current transition, she said. The valuation is looking relatively more attractive when theres low investor appetite, but you may needto stomach thevolatilityin the short term.

REPT has been pushing forward with its share sale due to internal pressure for cashing out and the challenge of fierce domestic competition, a person close to management said.

As the 10th-largest Chinese EV battery maker, REPT has had its market share decline from 1.7 per cent in 2022 to 1.2 per cent in the first six months of this year, as bigger rivals such as CATL and BYD grow production capacity.

REPT said in its prospectus that sales had gradually shown signs of recovery, but we still face an increasingly intensified competitive landscape in the lithium-ion battery industry.

Despite the strong backing of Tsingshan on sourcing raw materials, analysts and investors have questioned REPTs profitability. While sales grew by more than 64 per cent year on year to Rmb6.6bn ($928mn) in the first half of 2023, the company is still lossmaking.

REPT said future sales and its control of costs would be key factors for its profitability, but there was no assurance as to whether and when it will become profitable.

Others have raised concerns about a high number of related-party transactions between REPT and Tsingshan.

The parent company is one of REPTs five largest customers, accounting for 12.7 per cent of total revenues in the first half of this year, up from 5.9 per cent in 2022. The company said Yongqing Technology, another Tsingshan subsidiary, helped sell more batteries to US EV manufacturers this year.

There isnt much visibility in the financial situation of its parent, which leaves doubts about the healthiness of related transactions between them, said a China-focused manager at a UK-based hedge fund who did not wish to be named.

Chinas BYD is now the worlds largest EV producer, dethroning Tesla

Chinas BYD is now the worlds largest EV producer, dethroning Tesla. (Photo by Nicolas ASFOURI / AFP)

- The shutting down of Teslas Gigafactory in Shanghai has dragged down its production and sales, giving way to China-based auto giant BYD to top the charts.

- BYD delivered 641,000 cars in six months, 300% higher than the year before, while Tesla only sold 564,000.

When Shanghai went into an extensive restrictive lockdown earlier this year, it halted the production of many large companies operating in that cityone of which was US-based electric vehicle (EV) giant Tesla Inc. Midway through the lockdown, Tesla were among the only few factories that was able to resume operations and deploy resources to get its staff into a closed-loop system. While Tesla got busy salvaging its output in its gigafactory in China, Chinese auto giant BYD were silently dethroning the American giant in terms of sales.

The Chinese automaker backed by Warren Buffetts Berkshire Hathaway, according to company filings, soared past Tesla as the worlds leading EV seller in the first six months of the year. Precisely, the Shenzhen-headquartered BYD sold 641,350 new energy vehicles (NEV) in the first half of 2022, a 314.9% increase from the same period last year. Of those sales, 323,519 were battery EVs.

By comparison, Tesla delivered only 564,743 vehicles sold in the first two quarters of 2022. To recall, the EV giant had blamed a tough second quarter on supply chain and sales disruptions in China after its operations were hit by lockdowns and travel restrictions. In total, Teslas Shanghai Gigafactory 3, responsible for half of its 2021 global production, was shut for 22 days in May. Even once the factorys production restarted, it fumbled as it attempted to reach pre-pandemic levels due to ongoing parts shortages.

There is however a big catch with BYD sales. Not all of its 641,350 vehicles sold were fully electric. Of the total, 323,519 units or just over 50% were battery EVs while the rest were plug-in hybrids. Under Chinas sales rules, PHEVs and BEVs are counted together as NEVs. In hindsight, all of the 564,743 vehicles sold by Tesla are fully electric.

Nevertheless, BYDs rise is not something that should be taken lightly, especially by Tesla. BYD has mainly based its sales in Mainland China, but is also undertaking rapid expansion in the global market. Despite a series of regional lockdowns across China, BYDs factories have been able to remain open throughout as they are largely based away from Covid hotspots like Shanghai, where Tesla has its largest Chinese presence.

At this point, the company seems to be on its track to achieve its 1.5 to two million sales target with its plug-in EVs this year, approximately three to four times higher than its sales in 2021. To top it off, Beijings push for its citizens to cut down on their personal carbon emissions has definitely helped BYDs rapid ascent as Chinas largest domestic automaker.

Even in 2021, BYD grabbed the top position, shipping a total of 603,783 unitsup 218% from the year before, unseating Tesla in China. The US EV giant on the other hand came in second place in China last year, selling an estimated 240,000 vehicles during 2021, accounting for 26% of the Texas-based companys global sales.

Experts also reckon BYD would soon challenge foreign automakers on their home turf, especially in the US, considering the automakers expansion plans. To recall, last year, BYD started exporting passenger EVs to Europe and earlier this year, a model went on sale in Australia, according to Nikkei Asias report.

There are also plans to increase manufacturing capacity. Assembly plants for passenger vehicles are limited to a few locations, including Shenzhen headquarters, the report said, adding that the company is moving forward with plans to build or expand facilities in about 10 locations.