Who is Tesla s biggest competitor in USA

From Ford to GM: Who Are Teslas Biggest Competitors & Rivals?

From developing their 4680 battery cells that boasted up to 50% in manufacturing cost reductions to building excitement for their upcoming Cybertruck launch, Tesla has undoubtedly made the most headway in the world of the EV market. As Tesla has established itself as the de facto electric vehicles (EVs) leader, this has spurred competition from both incumbents and newcomers that want a slice of Tesla's massive success. It's come to the point that investors and traders will often hear how a new EV start-up is the next Tesla or a Tesla-killer.

In this article, we will delve into the world of electric vehicle manufacturers and highlight some of Tesla's biggest competitors and rivals, ranging from traditional automotive giants to emerging start-ups. We'll raise what makes each Tesla competitor unique, their year-to-date (YTD) performance and what traders need to be aware of in terms of tailwinds and headwinds.

Why Is Tesla So Popular?

Before we dive into the world of Tesla's competitors and rivals, it's essential to understand why Tesla has become one of the most iconic brands in the world.

At close to a one trillion dollar market capitalisation, Tesla's success combines its innovative technology, strong brand recognition and leadership in autonomous vehicle development. Besides constantly making headlines thanks to the enigmatic antics of CEO Elon Musk, Tesla's growing list of achievements runs the gamut. From becoming the most valuable automaker to launching its charging network that makes it easier for Tesla owners to charge up their vehicles, Tesla continues to make a name for itself in the EV market while establishing a strong moat against rivalling Tesla competitors.

The Rise of Tesla's Rivals

Unfortunately for Tesla, its competitors also benefit from Tesla's success due to the increased awareness of EVs and the growing demand for them. This has allowed these companies to develop their own EV products and in some cases, even build strong competitive advantages. While Tesla's position as a market leader remains strong, the rise of these formidable competitors signifies an exciting era of innovation and healthy competition in the electric vehicle industry. As technology advances and consumer preferences evolve, the market landscape will evolve, offering consumers more choices and driving the electrification revolution forward. From Ford and Lucid to Nio and Rivian, these are Tesla's most significant competitors worth noting if you're remotely interested in investing in the EV space.

Biggest Tesla Competitors & Rivals You Should Know

All YTD performance and market capitalisation numbers are accurate as of 20th June 2023.

1. Ford (NYSE: F)

YTD Performance: +20.30%

Market Cap: 56.891B

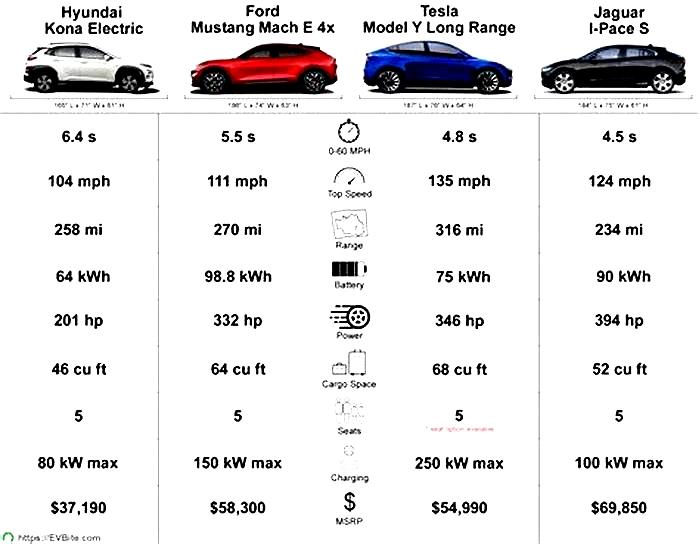

Few would consider Ford one of Tesla's biggest competitors given its history as a legacy automaker if you disregard its recent EV efforts. Ford has made significant strides in the electric vehicle market as an American household name in the automotive industry. For the uninformed, Ford holds the lion's share of the truck market with its F-150. To show that it is serious about penetrating the electric vehicle market, Ford is introducing the F-150 Lightning. The F-150 Lightning is an electric version of Ford's most popular truck model and goes head-to-head with Tesla's crowd-favourite Cybertruck model. The F-150 Lightning combined with the Mustang Mach-E makes Ford a dangerous competitor as the legacy automaker commits to a full-electric line up of vehicles. Tesla certainly has its work cut out for it as it competes on the electric truck and electric SUV fronts, both of which Ford has decades of experience.

2. General Motors (NYSE: GM)

YTD Performance: +9.72%

Market Cap: 51.879B

General Motors is another significant player aiming to challenge Tesla's dominance in the electric vehicle market. GM's flagship electric vehicle, the Chevrolet Bolt EV, offers a powerful combination of impressive range and an affordable price tag. Notably, GM has announced ambitious plans to introduce multiple electric models under its Chevrolet brand and GMC and Cadillac. By using its manufacturing capabilities and established network of dealerships, General Motors seeks to capture a significant market share in the EV space while competing against Tesla's varied offerings. Aside from competing on the vehicle front, GM has invested heavily in autonomous driving technology through its subsidiary, Cruise Automation. Cruise's Super Cruise software directly rivals Tesla's Full-Self Driving (FSD) software, as both utilise different technologies to enable hands-free driving. While Tesla relies on cameras and sensors to guide its cars, Super Cruise uses a combination of short and long-range radars, making it fundamentally different from FSD.

3. Rivian (NASDAQ: RIVN)

YTD Performance: -16.93%

Market Cap: 14.75B

Rivian electric vehicles have indeed turned some heads in the electric vehicle market. The American EV start-up combines durability and power to create off-roading vehicles that have secured partnerships with some of today's biggest companies. Amazon, for example, has inked a deal with Rivian to produce electric vans in the future, further bolstering Rivian's already impressive reputation. Of course, it's not just businesses that are taking note. Many investors and traders see Rivian as a new competitor for Tesla, especially for unique and capable vehicles like the R1T electric pickup trucks and R1S electric SUVs. Some have gone so far as to anticipate that Rivian's focus on overheads could give it the edge in this race for electric vehicle supremacy. Regardless of the outcome, everyone can agree that Rivian is one EV start-up that deserves attention and admiration, for its innovative designs that are upending the traditional car market.

4. NIO Inc. (NYSE: NIO)

YTD Performance: -8.42%

Market Cap: 13.747B

NIO is one of China's hottest EV brands, given its tremendous growth throughout 2020. Among Chinese EV enthusiasts, NIO is often called the "Tesla of China" and has made significant strides in the electric vehicle market. The company's success is attributed mainly to its focus on developing high-end cars packed with features such as advanced driver assistance systems, hybrid powertrains and artificial intelligence. NIO's most exciting feature is its battery swapping services which allow customers to swap out batteries in just three minutes, significantly reducing charging times. On top of this, NIO also emphasises user experience and customer service - something Tesla has been criticised for lacking. The Chinese start-up is known for offering generous warranties and free repairs for customers within eight years of purchase. NIO even offers a subscription service which provides customers access to car rental services, maintenance, insurance and more; all included in a single fee.The company's flagship models (ES8, ES6 and EC6) cater to different market segments and showcase NIO's commitment to meeting customer preferences. NIO's success in China and its plans for international expansion position the company as a strong competitor to Tesla.

5. Lucid Group (NASDAQ: LCID)

YTD Performance: -9.33%

Market Cap: 11.592B

Lucid Motors is making waves in the electric vehicle (EV) market with its upcoming Lucid Air model. After sufficient backing from the Saudi Public Investment Fund, the company promises to deliver a luxurious "Tesla killer" with superior performance and range compared to its competitors. Although both Tesla and Lucid offer innovative EV designs, the two companies have some apparent differences. Lucid Motors has announced that the new Air model will have up to 517 miles of range off a single charge, beating out the Tesla Model S's current maximum range of 402 miles. In addition, the Lucid Air will feature an advanced Luxury Interior package with luxurious materials, such as dynamic leather seating and white glass trim accents.While Tesla has managed to stay ahead of competitors in terms of production volume, Lucid Motors may be able to capture market share through superior design features and luxury options. In short, it appears that Lucid Motors is setting out to become a serious competitor for Tesla in the luxury EV market.

6. Xpeng Motors (NYSE: XPEV)

YTD Performance: +2.35%

Market Cap: 9.32B

Xpeng is one of the fastest-growing electric vehicle manufacturers that has captured significant market share in China. In recent years, Xpeng has launched multiple models, including its much-awaited G3 SUV. With fully electric powertrains, these vehicles offer top-notch features and a luxurious riding experience.What sets Xpeng apart is its cutting-edge technology. For example, their AI-powered driving system, XPILOT 3.0, has features like automatic parking assistance, adaptive cruise control, and other active safety features. Another of their innovations is the Autopilot 2.5, which offers smooth driving, automatic lane switching, and auto-braking to ensure passenger safety.Furthermore, Xpeng's advanced infotainment system, which includes a smart touchscreen with My Voice AI and entertainment facilities, holds a leading position in the market.Xpeng's focus on customer experience has led to rave reviews and high ratings.Additionally, considering the G3 SUV's impressive range of 500km and a top speed of 170 km/hour, it is unsurprising that Xpeng's recent preorders were quickly sold out. With its outstanding technology and innovative products, Xpeng has established itself as a major rival and competitor to Tesla.

7. Li Auto Inc (NASDAQ: LI)

YTD Performance: +55.06%

Market Cap: 33.18B

To challenge Tesla's position as the dominant electric vehicle producer in China, Li Auto has released several models with impressive specs, including their flagship model, the Pro 5 SUV. This model boasts an impressive 600km range on a single charge and can reach 160km/h. Li Auto offers more affordable prices than Tesla, making them attractive to budget-conscious buyers looking for an electric vehicle alternative.In addition to providing competitively priced vehicles, Li Auto is also taking advantage of technological improvements by producing cars with a suite of featurescomparable or even superior to those found on Tesla models. Through its use of Lidar technology, high-quality cameras, and advanced software algorithms, Li Auto vehicles can offer automated parking and lane-keeping assistance and improved safety features like automatic emergency braking and blind spot detection systems.With these innovations, Li Auto is poised to become a severe competitor to Tesla. Their quality products and competitive pricing make them attractive to consumers looking for an electric car alternative. They could potentially take away substantial market share from Tesla soon.

Conclusion

While Tesla has made significant strides in the electric vehicle market, it faces tough competition from various players. Legacy automakers like Ford andGeneral Motors are actively investing in electric vehicles to challenge Tesla's dominance. Electric vehicle start-ups likeRivianand Lucid Motors bring innovation and new ideas to the market. Chinese competitors like NIO, Xpeng Motorsand Li Auto are rapidly growing and targeting domestic and international markets. As the electric vehicle market continues to evolve, Tesla's biggest competitors and rivals will play a crucial role in shaping the industry's future. Can Musk's Tesla maintain this lead as the competition ramps up? Only time will tell as the world embraces the electric vehicle transition.

Keen to read up more about Tesla? Our analysis covers the current sentiment of Tesla shares and their possible overbought status. Also, don't miss out on our concise summary of Tesla's Master Plan 3 event earlier this year.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Meet Teslas Biggest Competitor: The Future of Electric Vehicles

Disclaimer: We sometimes use affiliate links in our content. For more information, visit our Disclaimer Page.

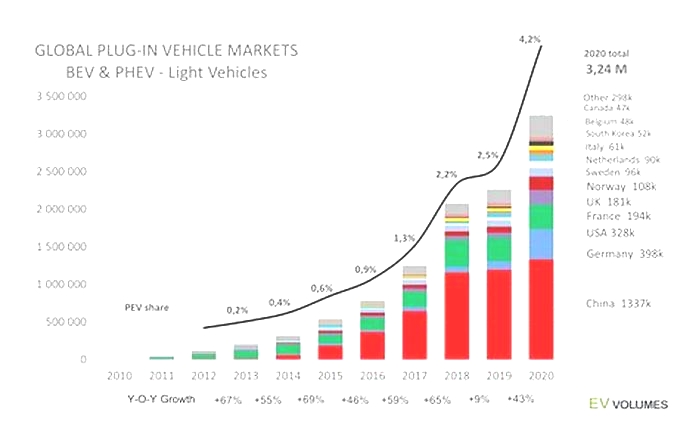

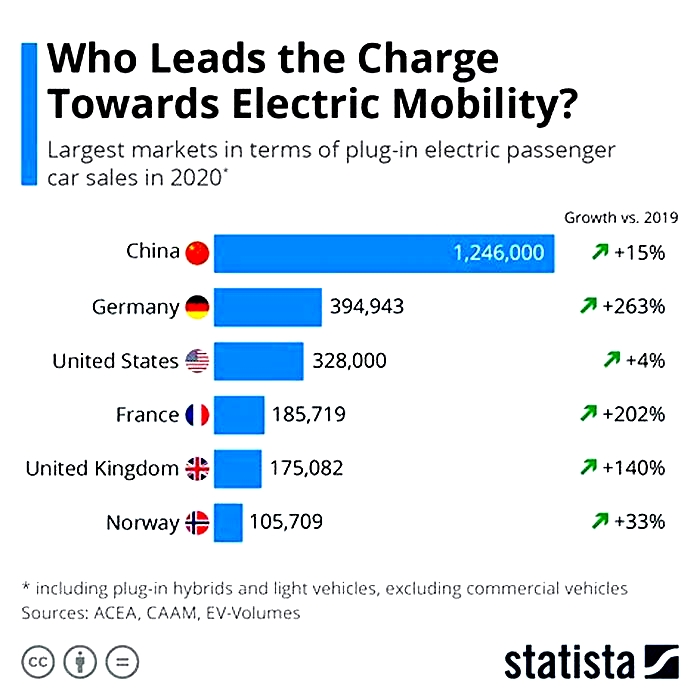

Are you wondering who could possibly rival Tesla in the rapidly expanding electric vehicle (EV) market? Well, its no secret that globally,EV salesare projected to make up half of allnew car purchasesby2035.

This blog post will guide you through an intriguing journey into the world of EVs, unveiling Teslas formidable competitors and what makes themstand tall. Read on for a riveting ride into the electrifyingfuture of automobiles!

Key Takeaways

- Tesla currently holds a dominant position in the electric vehicle (EV) market, with aglobal EV market share of around 21%and aU.S. EV market share of around 54%.

- New competitors are emerging that challenge Teslas dominance, including Nio Inc., Li Auto Inc., Rivian Automotive Inc., General Motors Co., Toyota Motor Corp., Ford Motor Co., and Ferrari NV.

- These competitors are gaining ground through their innovative approaches, impressive sales figures, and aggressive investments in EV technology and production.

- The future of the EV market is shaping up to be an exciting and competitive landscape, with multiple players vying for dominance as the demand for electric vehicles continues to grow.

Teslas Dominance in the EV Market

Tesla has established a dominant position in the electric vehicle (EV) market, with its success attributed to its innovative approach and strong consumer demand for their high-performance luxury EV models.

Overview of Teslas success

Backed byinnovative technologyand atrailblazing vision, Tesla Inc. has been a game-changer in the electric vehicle (EV) market. As of now, it holds an impressive U.S. EV market share of around 54% and a global EV share of around 21%, solidifying its dominance as theleading player in the field.

The brainchild of Elon Musk, this California-based company catapulted into prominence with its commitment to creatinghigh-performance luxury vehiclesthat were not justenvironmentally friendlybut also packed with cutting-edge features likeautonomous driving capabilities.

Through iconic models such as Model S, Model X, and Model 3, Tesla revolutionized consumer perception towards electric cars while recordingstaggering growth numbersyear after year.

Teslas market value

Teslas market value has seensignificant fluctuationsover recent years. The electric carmaker, led by industry disrupter Elon Musk, once held an unassailable position with astaggering 72% sharein the U.S. EV market.

However, this dominance didnt last ascompetition grew fiercerand new players entered the field. Teslasslice of the market pie shrankconsiderably to 54%, indicatingincreasing pressure from competitorsincluding Ford Motor Co., Rivian Automotive Inc., and Nio Inc.

In terms of global presence, Teslas influence is less pronounced withjust around 21% market share. This figure sheds light on Teslas international performance which pales compared to its domestic success in America a fact largely attributed to aggressive expansion strategies pursued by other manufacturers such as China-based Li Auto Inc., BMW from Germany, and Toyota Motor Corp from Japan.

Despite these headwinds, Wall Street continues to hold confidence in Teslas potential for growth and innovation within the electrified vehicle space.

The Rise of Teslas biggest competitors

New competitors in the EV market are emerging, challenging Teslas dominance and sparking increased competition. Lets take a closer look at some of Teslas biggest competitors:

Nio Inc.

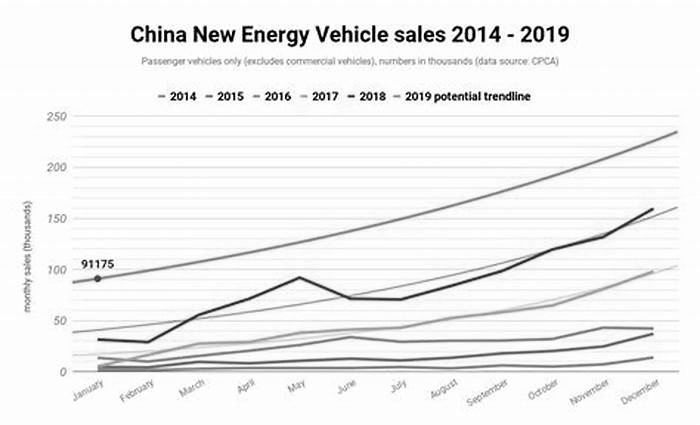

As a key player in the escalating race of electric vehicles, Nio Inc. is gaining ground fast on Teslas turf. Known as Chinas Tesla, this Shanghai-based automotive startup has surged to prominence with its high-quality cars and impressive sales figures.

A staggering31% increase in vehicle deliverieswas reported by Nio in April 2023 compared to the previous year, showcasing an undeniable growth pattern that cant be overlooked. Despite facingregulatory hurdles and potential delisting threatsfrom U.S. regulators, Nio continues to thrive, fueled by Bank of Americas endorsement through a buy rating along with a $12 price target for its stock.

As one of seven EV stocks recommended as viable alternatives to Tesla, Nio remains an unpredictable yet potentially game-changing factor within the EV market.

Li Auto Inc.

Li Auto Inc. is making waves in the electric vehicle (EV) market with its impressive performance and innovative approach. As the first company to sell anextended-range EV, Li Auto has set itself apart from the competition.

In April 2023 alone, Li Auto reported a remarkable516% increase in vehicle deliveriescompared to the previous year, highlighting its ability to meet the growing demand for EVs. This Chinese EV maker has caught the attention of Bank of America, receiving a buy rating and a price target indicatingpositive growth potential.

With strong delivery numbers and recognition from industry experts, Li Auto is proving to be aformidable contenderin the future of electric vehicles,challenging Teslas dominancein this evolving market.

BYDAuto Co., Ltd.

BYD (Build Your Dreams) is another major competitor in the electric vehicle market, especially in China. Established in 1995, BYD has quickly risen to prominence and has become a significant player in the EV industry.

Backed by Warren Buffetts Berkshire Hathaway, BYD has a strong financial position, allowing it to compete on a global scale. In 2022, BYD surpassed Tesla in sales, selling 1.86 million electric vehicles compared to Teslas figures.

BYD offers a wide range of options to consumers, including all-electric and plug-in hybrid models, giving customers more choices in the type of electric vehicle they prefer. This variety has contributed to BYDs success, as it caters to different market segments.

One advantage BYD has over Tesla is its vertical integration. BYD produces its own batteries, ensuring stability in the supply chain and reducing reliance on external suppliers. On the other hand, Tesla sources the majority of its batteries from third-party suppliers, which may pose challenges in terms of supply chain management and cost control.

While Tesla focuses on producing premium electric vehicles, BYD offers more affordable options, appealing to the broader consumer base. This different positioning allows BYD to compete with Tesla in terms of sales volume.

Rivian Automotive Inc.

Rivian Automotive Inc. is making waves in the electric vehicle (EV) market as one of the most promisingautomaker startups. The company, which recently went public, has caught investor attention with itsdirect-to-consumer sales model, similar to that of Teslas.

Bank of America has given Rivian a positive rating and sees great potential for its stock price. With their2023 production guidanceaffirming their commitment to delivering 50,000 vehicles, Rivian aims to establish itself as a formidable competitor in the EV industry.

Known for its off-road capabilities and luxurious features, Rivian offers two models: the R1T electric pickup truck and the R1S electric SUV. As EV technology continues to evolve, Rivian stands out as an exciting player ready to compete against Tesla and other major automakers in this rapidly expanding market.

General Motors Co.

General Motors Co. is amajor player in the electric vehicle marketand aims to overtake Tesla as the top U.S. EV seller by the mid-2020s. With $35 billion in planned EV investments through 2025, General Motors is serious about its commitment to electric vehicles.

They have announced plans to launch 30 new electric vehicles globally by 2025 and aim to have anentirely zero-emissions lineup by 2035. Associated with Chevrolet, which is a direct competitor to Tesla, General Motors ambitious goals and significant investments make them a formidable threat in the EV market.

Toyota Motor Corp.

Toyota Motor Corp., one of the worldsleading automotive manufacturers, is set to make a significant impact in the electric vehicle (EV) market. With plans to introduce10 new EV modelsand sell1.5 million EVs per year by 2026, Toyota is demonstrating its commitment to embracing the future of electric vehicles.

Seen as apotential rival to Teslaby Bank of America, Toyotasstrong reputation for reliability and qualitycould give them an advantage over other competitors. Theirinvestment in EV modelsand projected sales figures reflect their confidence in the shifting landscape toward sustainable transportation.

By offering both hybrid and fully electric vehicles like their recently announcedbZ4X SUV, Toyota aims to cater to different consumer preferences while reducing emissions and contributing to a more eco-friendly future.

Ford Motor Co.

Ford Motor Co. is a major competitor to Tesla in the electric vehicle industry. With plans to invest $50 billion in EV models by 2026, Ford has shown its commitment to the future of electric vehicles.

In 2022 alone, Ford sold 61,575 EVs in the US, second only to Tesla. Their Mustang Mach-E model ranked third in sales among electric SUVs last year and their F-150 Lightning has already generated an impressive 200,000 reservations.

What sets Ford apart is that three-quarters of its buyers for the F-150 Lightning are new to the brand, indicating broad appeal beyond traditional Ford enthusiasts. With a growing EV portfolio and ambitious plans for expansion, its clear that Ford is positioning itself as a key player in the evolving world of electric vehicles.

Ferrari NV

Ferrari NV (RACE) is making waves in the electric vehicle (EV) market and positioning itself as astrong competitor to Tesla. Recognized as one of the seven recommended EV stocks by Bank of America, Ferrari is committed to embracing the future of electric vehicles.

The luxury carmaker plans to invest $4.6 billion in developing fully electric models, with the goal of achieving5% EV sales by 2026and having80% EV or hybrid models by 2030. This ambitious plan has garnered confidence from Bank of America, which has given Ferraris stock a buy rating and set a price target of $300.

With upcoming models like the Daytona SP3 and Purosangue SUV generating optimism among investors, Ferrari is poised to challenge Teslas dominance in the EV market.

The Biggest Threat to Tesla

The biggest threat to Tesla comes from Nio, General Motors, Toyota, Ford, and other major automakers who are aggressively investing in EV technology and ramping up production.

A detailed comparison between Tesla and its fiercest competitor

The fierce competition in the electric vehicle (EV) market is most notably characterized by the rivalry between Tesla, the current leader in the industry, and Nio, often referred to as Chinas Tesla. The following table provides a detailed comparison of these two dominating EV manufacturers.

Market Share

Teslas global EV market share is approximately 21%, with a U.S. market share of around 54%.

Year-over-Year Growth

Tesla continues to maintain steady growth within the EV market.

Consumer Response

Teslas consumer response is largely positive due to brand recognition, word-of-mouth advertising, and an extensive charging network.

Market Share

Nio, although a Chinese company, is steadily gaining on Teslas market share with continual year-over-year growth.

Year-over-Year Growth

Nio saw a significant 31% year-over-year increase in vehicle deliveries in April.

Consumer Response

Nios consumer response is increasing with the brand earning a reputation as Chinas Tesla.

Both companies have unique strengths and continue to innovate within the industry. As the EV market continues to evolve, the competition between Tesla and Nio will likely escalate, shaping the future of electric vehicles.

Key Factors Contributing to the Competitors Success

The competitors success can be attributed to their relentless innovation and cutting-edge technology, effective market strategy, and positive consumer response.

Innovation and technology

Innovation and technology are driving forces behind the success of Teslas biggest competitors in the electric vehicle industry. NIO, for example, has gained recognition for itscutting-edge battery-swapping technologythat allows users to replace their batteries quickly instead of waiting for them to charge.

This innovative approach has helped NIOimprove charging speed and conveniencefor its customers.

Ford has also made significant strides in innovation with its electric vehicles. The Mustang Mach-E, Fords all-electric SUV, featuresadvanced connectivity optionslikeover-the-air updatesthat continuously enhance the vehicles performance and capabilities.

Additionally, Ford isinvesting heavily in autonomous driving technologyto stay competitive in this rapidly evolving market.

Volkswagen is another key player harnessing innovation and technology to challenge Tesla. With its ID range of electric vehicles, Volkswagen aims to combinestate-of-the-art software and hardware advancementsto deliver a seamless user experience.

By focusing onsmart mobility solutions and advanced driver-assistance systems, Volkswagen is positioning itself as a leader in the transition toward sustainable transportation.

Market strategy

Teslas competitors are employing diverse and innovative market strategies to challenge the electric vehicle giant. General Motors (GM) aims to overtake Tesla as the top U.S. EV seller by the mid-2020s, focusing on an aggressive expansion and a commitment to producing electric models across its brands.

Toyota plans to introduce 10 new EV modelsin the coming years and aims to sell 1.5 million EVs annually by 2026, displaying its determination to compete in the growing market. Ford is investing heavily in EV models, with plans to spend $50 billion through 2026, and has already gained traction with the successful sales of over 61,000 EVs in the U.S. last year.

Ferrari is also entering the race with an investment of $4.6 billion into developing full EV models while aiming for a 5% share of its sales from EVs by 2026, emphasizing their intention to be part of this rapidly evolving market.

Consumer response

Consumers have shown a strong response to the growing competition in the electric vehicle (EV) market, shifting their attention from solely focusing on Tesla. While Tesla has been the dominant player for years, its U.S. EV market share has dropped from 72% in January 2022 to around 54% today, indicatingincreased interest in alternative EV brands.

Chinese companies like NIO and Li Auto have seen significant growth, with NIO reporting a 31% increase in vehicle deliveries in April compared to last year. Similarly, Li Auto reported an impressive 516% year-over-year increase in vehicle deliveries during the same period.

This consumer response highlights awillingness to explore and embrace new players in the evolving EV landscapebeyond just Teslas offerings.

The Future of the EV Market

The future of the EV market is full of exciting possibilities, with new competitors emerging and established players stepping up their game. From innovative technology to shifting consumer preferences, theres a lot to explore.

Read on to discover what lies ahead for electric vehicles.

Predictions and trends

The future of the electric vehicle (EV) market looks promising, with experts predictingsignificant growth and advancements. By 2035, EVs are projected to make up approximately 50% of all new car sales worldwide.

This surge in popularity is driven by factors such asincreasing environmental awareness,government initiatives promoting clean transportation, andadvancements in battery technologythat improve range and charging capabilities.

Additionally, major automakers are jumping on the EV bandwagon, with companies like General Motors, Toyota, and Ford investing billions of dollars into their respective EV lineups.

Related: Rise of Electric Vehicles: Analysis and Key Findings

Conclusion

In conclusion, while Tesla has undoubtedly dominated the electric vehicle market for years, therise of new competitorsposes a significant threat to its reign. Companies like Nio Inc., Li Auto Inc., Rivian Automotive Inc., General Motors Co., Toyota Motor Corp., Ford Motor Co., and even Ferrari NV are making strides ininnovation, technology, and consumer responsethat could potentially challenge Teslas position.

The future of the EV market is shaping up to be an exciting andcompetitive landscape with multiple players vying for dominancein this sustainable transportation revolution.

FAQs

Who are Teslas biggest competitors in the electric vehicle market?

Teslas biggest competitors in the electric vehicle market include multinational automobile manufacturers such as Ford, General Motors, Volkswagen, and Mercedes-Benz, as well as specialized companies like Nio and Rivian.

What factors are shaping the competition in the electric vehicle market?

Key factors shaping the competition in the electric vehicle market include expanding global reach, diverse product offerings, advancements in autonomous driving technology, market capitalization, and financial resources, charging infrastructure, and collaboration and partnerships among companies.

How are Teslas competitors addressing the issue of charging infrastructure?

Teslas competitors are addressing the issue of charging infrastructure by investing in the development of their own charging networks or partnering with existing charging infrastructure providers to ensure their customers have access to charging facilities.

How do Teslas competitors leverage their financial resources in the EV market?

Teslas competitors leverage their financial resources by investing heavily in research and development, production capabilities, marketing efforts, and charging infrastructure, enabling them to challenge Teslas dominance in the electric vehicle market.

Why is autonomous driving technology crucial in the electric vehicle market?

Autonomous driving technology has become a critical aspect of the electric vehicle market because it enhances vehicle safety, efficiency, and convenience, providing a significant competitive advantage for companies that can successfully develop and implement advanced driver-assist systems.