Who is the largest EV seller in China

Tesla overtaken by Chinas BYD as worlds biggest EV maker

Unlock the Editors Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Elon Musks Tesla has been knocked off the top spot as the worlds best-selling electric-vehicle maker for the first time by BYD after recording fewer deliveries than its Chinese rival in the past quarter.

The US group handed over 484,000 cars in the fourth quarter, more than the 473,000 anticipated by analysts but not enough to hold on to its title after BYD reported record sales of battery-only vehicles of 526,000 for the same period.

Teslas dethroning by BYD reflects the rise of what was a little-known Chinese group only a decade ago, which Musk himself has publicly dismissed. While growth at the Warren Buffett-backed Chinese company has been mostly achieved on its home turf, BYD is sharpening its focus on finding new foreign markets including in Europe.

Danni Hewson, head of financial analysis at AJ Bell, said BYDs electric cars were becoming increasingly visible on European roads thanks to keen pricing.

BYDs success in chasing down Tesla also underlines the struggle of legacy automakers from the US, Europe, Japan and Korea to adapt to fast-changing consumer preferences for cheaper, smarter electric vehicles.

In a statement published in China, the Shenzhen-based group called itself the world champion for new energy vehicles after notching total annual sales of more than 3mn for 2023 across its vehicles which also include plug-in hybrid cars.

Teslas annual sales were 1.81mn vehicles in 2023, while BYD delivered 1.58mn fully electric cars.

Through much of the past 12 months, BYD benefited from price cuts sparked by Teslas attempt to chase market share, pushing consumers to consider Chinas lower-cost models, according to analysts.

For any doubters left in the west, I hope this is the final data point that points to BYDs strength and, as importantly, how China EV Inc has bullied its way on to the global stage, said Tu Le, founder of Beijing-based advisory company Sino Auto Insights.

He added that while both companies cut prices on some cars over the past year, Tesla did so much more dramatically, signalling that BYD could distance itself further from the US group over the coming year.

Still, WedbushSecurities analyst Dan Ives said it was an important quarter for Tesla to show strong deliveries and momentum heading into 2024.

Teslas annual sales of 1.8mn last year was a major achievement in a choppy macro [economic environment] for the electric vehicles sector, he added.

BYD was founded by Wang Chuanfu, a former university professor, in the mid-1990s. After focusing on manufacturing rechargeable batteries, including for mobile phones, the company expanded into the car industry in the early 2000s.

The Chinese groups early success prompted Buffetts Berkshire Hathaway to invest in the company in 2008. Despite relying on existing industry technology for many years, BYD has focused on stripping out costs from the production process.

Following years of state support and careful industrial planning by Beijing, Chinas automakers now leverage their countrys control over the production of almost every resource, material and component used to make electric vehicles.

BYDs vertically integrated structure it controls mines and produces batteries and chips has made it the envy of foreign rivals as the global car industry transitions away from the combustion engine.

At the end of last year six out of the top-selling EV models in China, the worlds largest car market, were BYD cars, according to Automobility, a Shanghai-based consultancy. While BYDs share of sales has expanded to more than 35 per cent, Tesla has struggled to keep up with the cadence of product launches by Chinese rivals, the consultancy added.

Chinas BYD overtakes Tesla as top-selling electric car seller

Elon Musks Tesla has been overtaken by its Chinese rival, BYD, as the worlds top selling electric carmaker.

BYD, which has been backed by the US investment billionaire Warren Buffett since 2008, has beaten Teslas production for a second consecutive year.

BYD, which stands for Build Your Dreams, said it produced 3.02m new energy vehicles in 2023. The American multinational Tesla announced on Tuesday that it made 1.84m cars. However, BYDs sales figures include 1.6m battery-only cars, and 1.4m hybrids, which means Tesla is still the leader in the production of electric battery-only cars.

Nevertheless, in the final quarter of last year BYD outsold Tesla in battery-only cars 526,000 to 484,000 for the first time.

Most of BYDs vehicles sell at a lower price point than Tesla, which derives about 20% of its sales from the Chinese market.

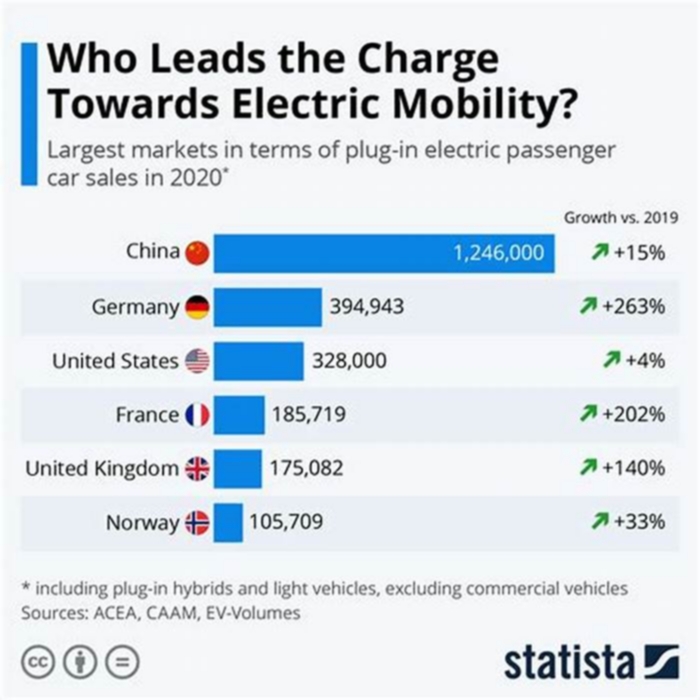

Chinese electric carmakers such as BYD and Nio have set their sights on becoming major players in international markets, with a particular focus on Europe. In December, BYD, which sells five models in Europe and has plans to launch three more this year, announced plans to build a new factory in Hungary. Last year, the company said it did not consider building its first European factory in the UK because of the impact of Brexit. BYD said the UK had not even made a top 10 list of possible locations to build its first European car plant.

Chinas top-selling electric carmaker is targeting sales of about 800,000 cars annually in Europe by 2030. However, these goals could be under threat after the European Commission launched an anti-subsidy investigation last September into Chinese electric vehicle imports.

Commenting on the decision at the time, the European Commission president, Ursula von der Leyen, said that Chinese electric vehicles were now flooding global markets and were being kept artificially low by state subsidies.

The investigation, which is expected to last a year, could result in the EU imposing punitive tariffs on Chinese vehicles.

The Hong Kong-listed BYD, which was founded by a former university professor, Wang Chuanfu, and began developing batteries in 1995, intends to become a global powerhouse in the electric vehicle market.

Tesla, which is led by Musk, said last month it was recalling just over 2m vehicles in the US fitted with its Autopilot advanced driver-assistance system to install new safeguards

One of the advantages BYD has over its US and European counterparts is its ability to manufacture electric vehicle batteries in-house.

Susannah Streeter, head of money and markets at the investment platform Hargreaves Lansdown, said: While its the worlds leading supplier of rechargeable batteries, Tesla relies on several suppliers and has flagged shortages of lithium as demand ratchets up as a supply chain obstacle in the years to come.

BYD is already making moves to secure the precious metal by buying a stake in a Chinese lithium producer. Its had its eye on purchasing mines in Africa and is scouting assets in South America, where the metal is mined.

The emergence of China as the top-selling electric vehicle producer comes at a significant time: the start of a presidential election year in the US.

China-US relations, particularly around trade, are likely to be a key part of the campaign for the presidency, which looks likely to be fought between Joe Biden and Donald Trump.

Last month, the Biden administration brought in new protectionist measures for its EV market by blocking full subsidies through his Inflation Reduction Act to EV companies with significant Chinese links. US-manufactured electric vehicles that include Chinese-made battery components would also be blocked from accessing full subsidies.

The Wall Street Journal also reported just before Christmas that the US government was looking at raising tariffs on some Chinese goods, including electric vehicles, to bolster the US clean energy sector. This would be on top of the 25% tariffs on vehicles imported from China, which were brought in under Trumps presidency, and extended under the Biden administration.

The US is looking to take action in other areas where it has security concerns about Chinas manufacturing capabilities.

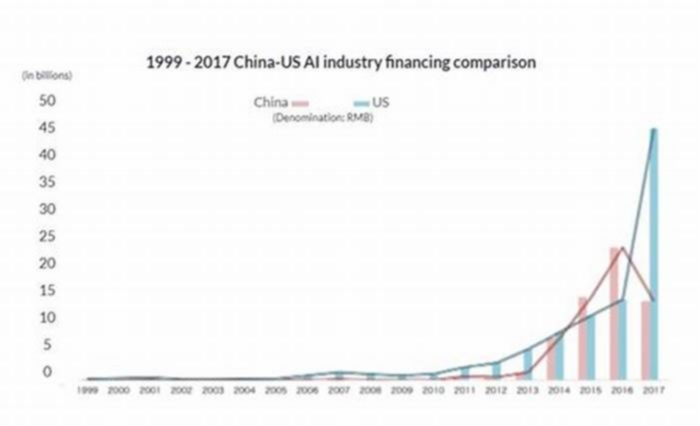

On Monday it was reported that the Biden administration had put pressure on the Dutch government to block the shipments of hi-tech chip-making machinery to China by one of its key technology companies.

ASML, a leading supplier to the semiconductor industry, confirmed that the government had partially revoked its licence to export three chip-making lithography machines to China.

Bloomberg reported that the decision came after US officials had requested the move in an attempt to restrict the growth in Chinas semiconductor manufacturing capabilities.

Chinas top 15 electric vehicle companies

The 15 Chinese companies listed in this guide were all among the top 25 global highest-selling EV brands in 2022. It was a breakout year for BYD, which was the top global company by sales. BYD sold 1.85 million EVs and hybrids in 2022, an increase of 211% year-on-year, which put it far ahead of Tesla with 1.31 million units.

But BYD and Geely are the only purely Chinese companies in the top 10 of global sales for 2022. And BYD still sells as much as 97% of its vehicles in China. Although Chinese companies dominate the domestic industry, their next crucial step is to go global. BYD and other Chinese brands are now aggressively expanding abroad.

China news, weekly.

Sign up for The China Projects weekly newsletter, our free roundup of the most important China stories.

All EV chains lead to China

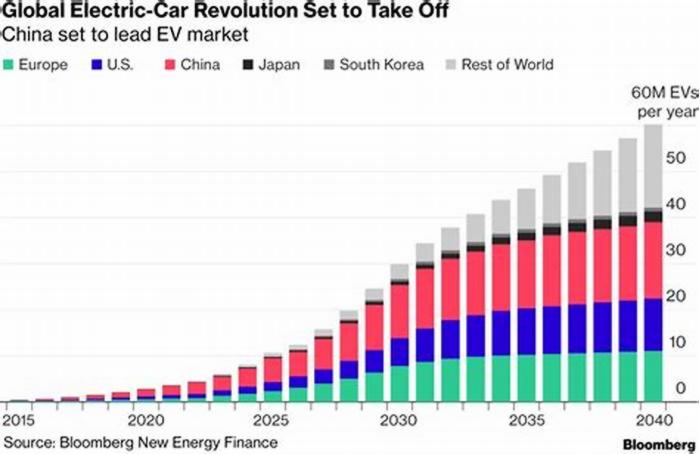

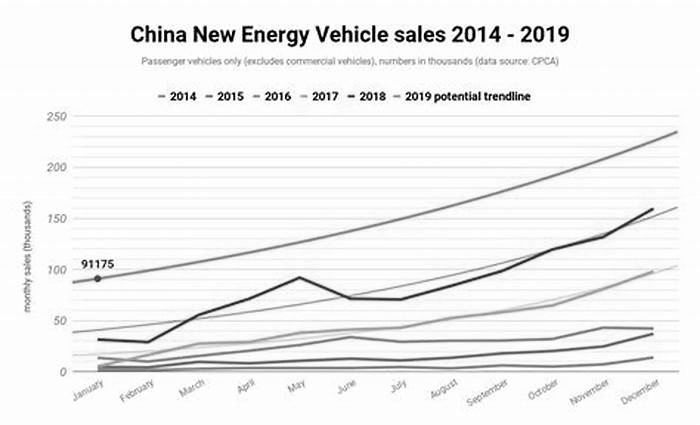

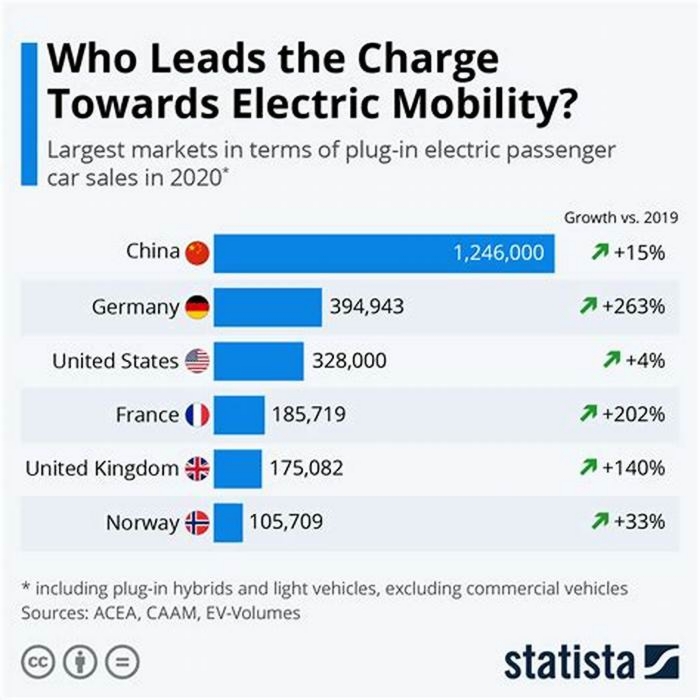

In the global race to build EVs and the batteries that power them, China is winning hands-down. This includes the mining and processing of the raw materials and precious metals that go into batteries.

Although sodium-ion batteries are now increasingly entering the market, up to 99% of all batteries installed in NEVs are still made from lithium, and also contain base metals such as aluminum, copper, and iron, as well as more expensive metals like cobalt, nickel, and manganese.

China controls crucial links in the supply chains of all these metals. In addition to ramping up domestic lithium production, Chinese companies have undertaken a range of direct investments, equity deals, and supply or sales agreements with mining companies in Africa, South America, Indonesia, Australia, and Canada. In May 2022, for example, BYD reportedly identified six lithium mines for acquisition in Africa that would yield 1 million tonnes of lithium carbonate enough to guarantee the companys production for a full decade.

Downstream of mining, China dominates production at every stage of the battery supply chain, from the fabrication of the positive and negative electrodes to the manufacturing of the cells and their assembly into modules and then battery packs. About 75% of the global production of battery cells, 70% of specialized cathodes, and 85% of anode materials occur in China. China also produces 66% of separators and 62% of electrolytes.

Companies lost along the way

Our previous China EV guide was published in April 2021, and it includes several companies that have become notable casualties of Chinas cutthroat EV industry. Most of the dropouts, like Enovate , Byton , and WM Motor, have subsided under the relentless cost pressures of the industry. For the same reason, Evergrande New Energy Auto, an EV company that was launched in 2019 by the heavily indebted property developer China Evergrande Group, was reportedly sold off for 360 million yuan ($51.73 million) in December 2022.

In 2023 and the coming few years, we will likely see various other brands fall by the wayside, but the 15 mentioned here will probably stick around. There will also be new ones: Smartphone and consumer electronics giant Xiaomi announced in March 2021 that it would start making EVs, but it has not yet joined the market.

The 15 leading EV companies in China

These are the 15 Chinese companies (including Tesla, which is not a Chinese company but manufactures most of its EVs in China) and joint ventures (JVs) with the highest EV sales in China in 2022 and the first quarter of 2023, based on data collected by the China Passenger Car Association (CPCA).

In addition to CPCA data, the Ministry of Public Security compiles numbers of insured vehicles, which shows how many EVs are sold to individual customers (as opposed to car and rental companies). The insurance numbers broadly track CPCA sales data but are somewhat lower.

- BYD

- SAIC-GM-Wuling (joint venture)

- Tesla

- Geely

- GAC Aion

- Chery

- Changan

- Hozon Auto

- Li Auto

- Great Wall Motors

- NIO

- XPeng

- Leapmotor

- FAW VW (joint venture)

- SAIC VW (joint venture)

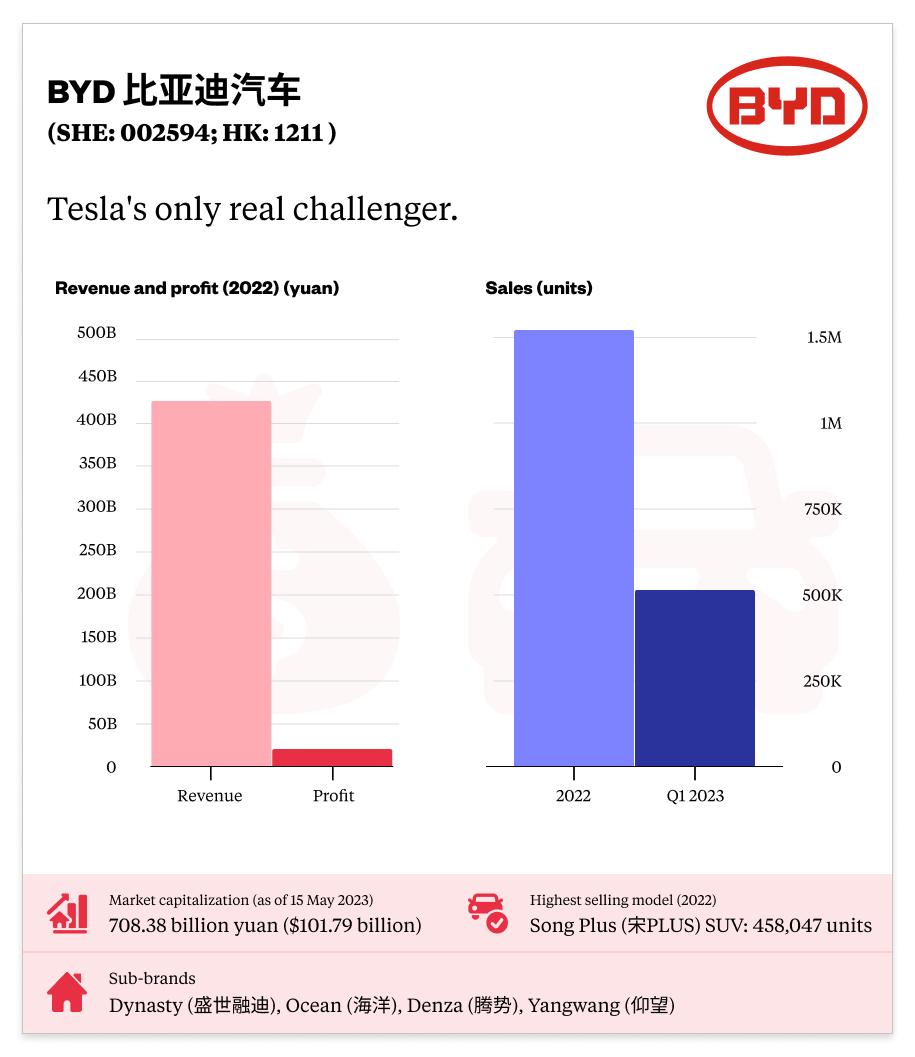

1. BYD

The ChinaEdge database profile

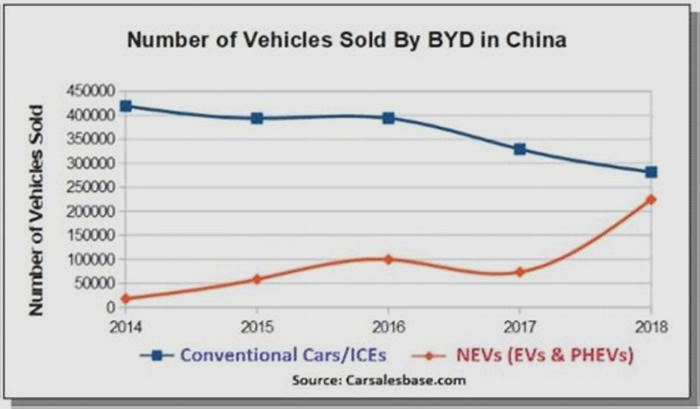

Founded in 1995 with headquarters in Shenzhen and downtown Los Angeles, BYD began as a rechargeable battery business in the IT sector before branching out into handset electronics and then automobiles, including EVs. BYD took the money raised from a 2002 Hong Kong IPO to acquire an automotive unit from Tsinchuan Automobile , then the sixth-largest car manufacturer in China by sales volume.

At first, BYD focused on gas-powered cars, as it developed its battery technology. Then in 2008, the company introduced the F3DM, its first mass-produced plug-in hybrid, which allowed for 60 miles of electric driving on a full charge before switching to a conventional combustion engine. Also in 2008, Warren Buffett acquired a 10% stake in BYD for $230 million. Government subsidies and incentives to boost the NEV industry began kicking in soon after; BYD has been bolstered by billions of yuan in government subsidies and grants for research and development.

In a 2011 interview, Tesla CEO Elon Musk mocked BYD for its unattractive designs and weak technology, but hes not laughing anymore: BYD is now the worlds leading seller of NEVs and Teslas only real global rival. Tesla was the worlds leading EV company by sales from 2019 to 2021, but in 2022, BYD sold over 1.8 million EVs worldwide for a global market share of 18.3%, beating Teslas 1.3 million units sold and 13% market share. (The closest global competitors behind the two frontrunners were way behind: SAIC-GM-Wuling and VW with below 500,000 units.)

In China, BYD has a market share of about 30%, with at least 25 different models on sale, including hybrids and full EVs, ranging in price from 100,000 yuan ($13,841) to 1 million yuan ($138,417). In November 2022, BYD launched a new high-end EV brand called Yngwng , which means look up, and presales of the first model, the U8 SUV, commenced at the 2023 Shanghai auto show. The company will be launching another new luxury brand, code-named Brand F, in 2023.

BYD has three major production bases in Shenzhen, Xian, and Changsha and is currently constructing several more. The company expects to make 4.7 million vehicles in 2023, and 6.2 million in 2024. Crucially, BYD has a vertically integrated production chain and produces its own batteries, and it is the only Chinese company with a complete insulated-gate bipolar transistor (IGBT) industry chain, which is essential for EV production.

BYD models, however, are not renowned for their smart functionality, and in terms of assisted or autonomous driving, its cars are inferior to Teslas. But BYD has achieved enormous success in China by offering customers a value-for-money proposition, and the company has other crucial advantages in its quest to become a truly global brand: It is profitable, it has an integrated supply and production chain and produces its own batteries, and it is fast becoming a global brand as it enters ever more foreign markets.

Back to top.

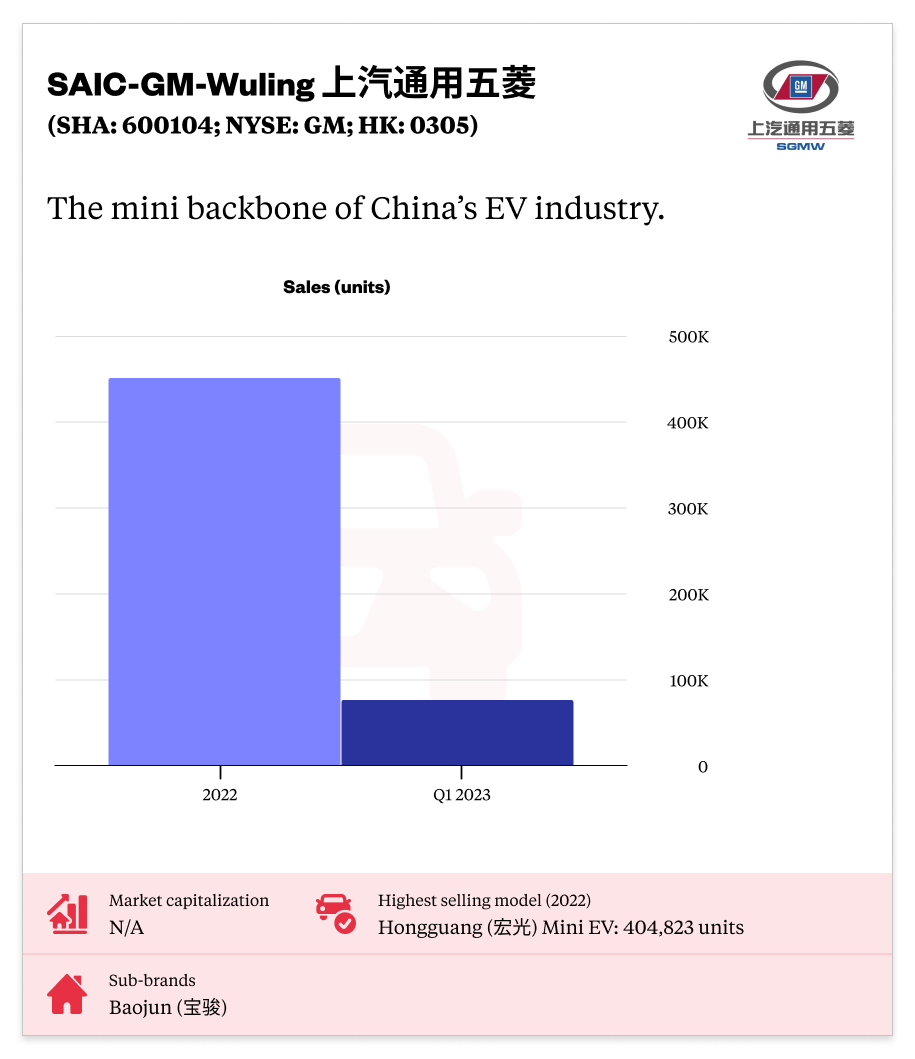

2. SAIC-GM-Wuling (joint venture)

The ChinaEdge database profile

Mini EVs have practical advantages over full-size EVs, and this has made them very popular (as well as cheap) and fundamental to Chinas shift to electric mobility. The highest-selling electric sedan in China in both 2021 and 2022 was the Hongguang () mini EV manufactured by Wuling , part of the joint venture that was formed in 2002 with SAIC (one of Chinas Big Four auto manufacturers) and General Motors (GM).

The joint venture was initially a successful manufacturer of minivans, but launched the Hongguang in July 2020, which was an immediate market hit, and now accounts for around 90% of SAIC-GM-Wulings total sales. The Hongguang starts at 44,800 yuan ($6,563), with three other models ranging up to 99,900 yuan ($14,635). For comparison, as of January 2023, the Nissan Leaf was the cheapest EV in the U.S., with an entry-level model price tag of $20,875 (after the $7,500 federal tax credit).

The Hongguang does not have all the safety features of a conventional size EV, however, and lacks airbags, which is one reason it is more affordable.

The proportion of mini EV sales of total EV sales in China increased from 17.7% in 2019 to 29.8% in 2021. But this proportion fell back to 19.3% in 2022, and the era of the mini EV may be gradually drawing to a close as larger models become more popular and affordable. Sales of the Hongguang increased by only 13% year-on-year in 2022, and in the first quarter of 2023, sales actually dropped by a full 26.2% year-on-year from 105,227 to 77,701 units.

There may be more promising markets for Chinese mini EVs in Europe, Asia, and the developing world, however, and SAIC-GM-Wuling is gearing up to increase its EV exports. The company already exports tens of thousands of conventional vehicles a year, and in August 2022 started selling the Hongguang Air EV in Indonesia. SAIC-GM-Wuling plans to make Indonesia a hub from which it can explore other markets in the region. The Hongguang is currently on sale in Europe under the brand FreZe Nikrob for 13,000 to 15,000 ($13,800 to $16,000).

In September 2023, SAIC-GM-Wuling plans to launch three new premium mini EVs under its Baojun () brand.

Back to top.

3. Tesla

In 2018, Tesla became the first foreign automaker permitted to produce cars in China without a Chinese partner, and today, it remains the sole foreign company to own 100% of an EV factory or any kind of car factory in China. Chinas government has also given Tesla preferential corporate income tax treatment, partly enabling Tesla to become one of the most successful EV companies in China.

While BYD and Tesla are rivals for Chinas auto market, in many ways, they are more complementary than competitive. Tesla focuses on premium EVs with high profit margins. While BYD also sells some luxury vehicles and is launching higher-end EV brands, its more focused on affordable cars.

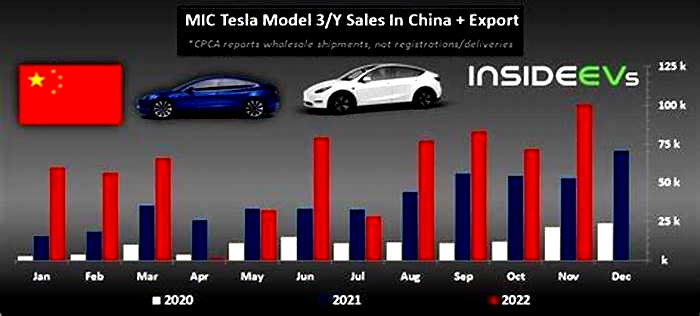

Teslas factory on the outskirts of Shanghai began production in January 2020 for the Chinese as well as the global market. In 2022, it produced around 711,000 cars, accounting for 52% of Teslas global output.

In January 2023, Tesla delayed plans to expand its Shanghai factory, which would have increased production to 2 million units annually (although it may yet expand production at the plant this year). But in April 2023, Tesla announced that it is building a new battery plant in Shanghai, with construction scheduled to commence in the third quarter of 2023 and production in the second quarter of 2024. The plant will produce 10,000 of Teslas Megapack large energy storage units annually.

In 2022, Teslas China sales increased by 37.1% year-on-year to 439,770 units, and in the first quarter of 2023, sales increased by a further 26.9% year-on-year. In the first quarter, Tesla also exported almost 92,000 vehicles from China, a year-on-year increase of 24%. The Tesla Model Y was the second-highest-selling EV in China in 2022, shipping a total of 315,607 units (behind the Hongguang mini EV with 404,823 units).

In October 2022, Tesla started reducing the prices of its EVs in China, and in January 2023, it again reduced the prices of the Model 3 and Model Y by between 6% and 13.5%. The company has implemented similar price cuts in Europe, Mexico, and the U.S. The price cuts seem to be working well for Tesla in China: In March 2023, China sales and exports amounted to 88,869 units, an increase of 35% year-on-year and the second-highest monthly tally ever. In the first quarter of 2023, Teslas total volume of made-in-China cars amounted to 229,322 units, an increase of almost 26% year-on-year and a new quarterly record.

Back to top.

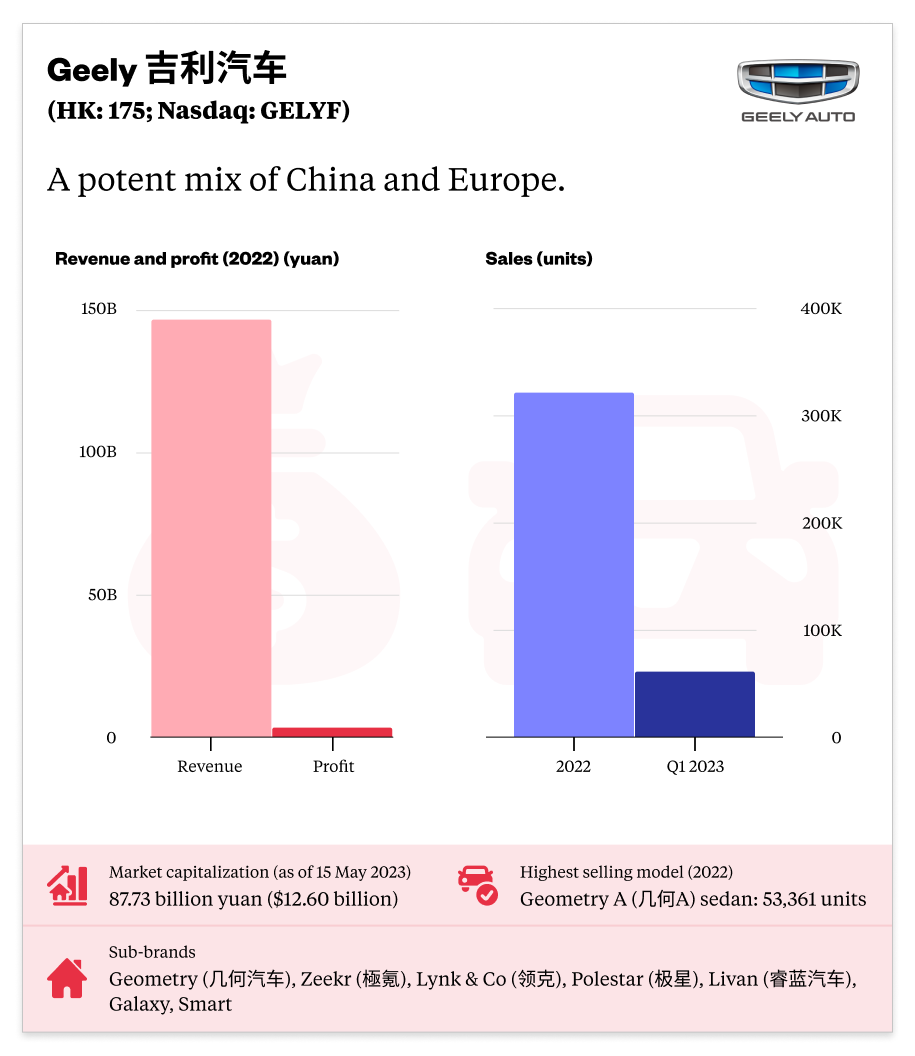

4. Geely

The ChinaEdge database profile

Hard-charging entrepreneur L Shf founded Geely with money borrowed from family as a fridge manufacturer in Hangzhou, Zhejiang Province, in 1986. In the 1990s, the company rebranded as Geely Auto and began producing minivans and cars. By 2010, Geely had acquired Volvo, and its sprawling empire now includes a stake in Daimler AG, owner of Mercedes-Benz, and significant investments in two flying car companies.

In 2020, Geely announced its Blue Geely Initiative, which included a plan that 90% of its sales would be EVs by 2020. This overambitious goal proved impossible, however, and in 2022, the company attained only 30%, and this may increase to 50% in 2023. Nevertheless, like for BYD, 2022 was something of a breakout year for Geely, with its EV sales increasing by a whopping 277.8% year-on-year, which is even larger than the increase for BYD (208.2%).

Geely has launched various joint ventures and marque EV brands, including:

- Polestar , a brand originally established in 1996 and acquired by Volvo in 2015 and then established as a dedicated EV brand by Volvo and Geely in 2017. At the 2023 Shanghai auto show, Polestar launched the Polestar 4, its fourth model, a compact SUV with a starting price of 349,800 yuan ($50,870).

- Lynk & Co , launched in 2016, another joint venture with the companys subsidiary Volvo, but targeted at the mid- to high-end hybrid and internal combustion engine vehicle market. Lynk & Co is based on the China Europe Vehicle Technology (CEVT) tech center in Gothenburg where 1,700 Chinese and European engineers work shoulder-to-shoulder. As of May 2023, Lynk & Co has launched six models, including six SUVs, an electric scooter, and one sedan.

- Geometry , launched in 2019 and targeting the low- to mid-range EV market. As of May 2023, Geometry has launched six models, mostly sedans, the last of which were the G6 sedan and the M6 SUV in November 2022, both of which featured Huaweis Harmony operating system.

- Zeekr , launched in 2021, a premium brand targeting targeting the high-end EV market. In October 2021, Zeekr started deliveries of its first model, the 001 sedan. In January 2023, deliveries commenced for Zeekrs second model, the 009 multi-purpose vehicle (MPV), and in April 2023, sales commenced of a third model, the X compact SUV. The 001 and 009 both feature CATLs Qilin battery.

In January 2020, Geely launched a 5.4 billion yuan ($783 million) joint venture (JV) with Mercedes-Benz called Smart Automobile. As per the agreement, Mercedes-Benz will design the cars produced by the joint venture and Geely will engineer them. In September 2022, Smart started selling its first model, the compact SUV Smart 1, but as of April 2023, monthly deliveries have exceeded 5,000 units only once. In April 2023, Smart unveiled a second model, another compact SUV called the Smart 3. In January 2022, Geely launched a joint venture with Lifan Group called Livan focusing on developing battery swap EV models, and in February 2023, Geely launched yet another EV sub-brand called Galaxy aimed at the hybrid and EV markets, with plans to launch seven new models by 2025.

Some of Geely sub-brands sold really well in 2022. As per Ministry of Public Security insurance registry sales numbers, Geometry sold 116,182 units, a year-on-year increase of 252.99%; Zeekr sold 71,441 units, a year-on-year increase of 1,182%; and Lynk & and Co. was further back with 24,557 units, a year-on-year increase of 165.94%.

Geelys EV ambitions were bolstered in 2013 when it acquired the iconic London Taxi Company. In 2017, Geely changed the taxi makers name to the London Electric Vehicle Company, and opened an EV plant in Antsy, Coventry, to manufacture extended-range EV taxis. Geelys main EV assembly plant is in Hangzhou, Zhejiang Province. Including its facilities in Gothenburg and Coventry, Geely operates plants in Hangzhou, Ningbo, and Frankfurt, and research and development centers in Shanghai, Barcelona, and California.

Geelys EV transformation started relatively late, and it may be spreading itself too thin: The company has more than 30 brands and joint ventures and a huge variety of product types, from fossil fuel vehicles to hybrids, full EVs, and cars running on hydrogen and ethanol. If EV sales are any guide, however, Geely is doing something right.

Back to top.

5. GAC Aion

The ChinaEdge database profile

GAC Aion is the EV unit of Guangzhou Automobile (GAC) Group, which is majority-owned by the Guangzhou municipal government. GAC Aion has had a meteoric rise over the last few years. In the first quarter of 2023, with sales of over 80,000 units (a year-on-year increase of 79%), it is now third on the sales table behind BYD and Tesla.

GAC Group first started working on NEVs in 2011. In July 2017, GAC New Energy was officially launched. The brands first model appeared in November 2018, the Aion S compact electric sedan, with a battery capacity of 58.8 kWh and an admirable maximum range of 316 miles on one battery charge. The Aion S sold well from the outset, shipping 30,000 units in 2019, 45,000 units in 2020, and almost 75,000 units in 2021.

In November 2020, GAC New Energy changed its name to GAC Aion when the latter became a marque brand under GAC Group. The Aion Y, a compact hatchback launched in April 2021, also sold well, shipping 34,108 units in 2021. Of GAC Aions total 2022 sales of 273,757 units, the Y hatchback accounted for 119,687 units and the S sedan for 115,655 units, and the two models collectively accounted for 85.9% of total sales.

In October 2022, GAC Aion completed Series A financing of a whopping 18.29 billion yuan ($2.62 billion), setting a new record for the largest single private equity financing in Chinas EV industry.

In September 2022, GAC Aion launched a new high-end sports car brand called Hyper , the first model of which is the Hyper SSR pure electric supercar, which will be mass produced from October 2023 and carry a price tag of 1.28 million yuan ($186,920). At the Guangzhou Auto Show in January 2023, GAC Aion officially launched the second Hyper model, the pure electric coupe Hyper GT.

GAC Aion executives habitually claim to have world-leading tech, including its Magazine Battery 2.0 (so called because it has the appearance of an ammunition storage magazine), the Quark Drive palm-sized electric motor that it claims is able to generate more horsepower than a V8 engine, and advanced software and electronics.

While GAC Aions sales numbers are impressive, they are somewhat artificially inflated: A large proportion of the sales were not to individual customers but to car businesses like rental and car-hailing companies, especially Ontime , GAC Aions own car-hailing business. In 2021, for example, as much as 43% of GAC Aions total sales came from these businesses.

Back to top.

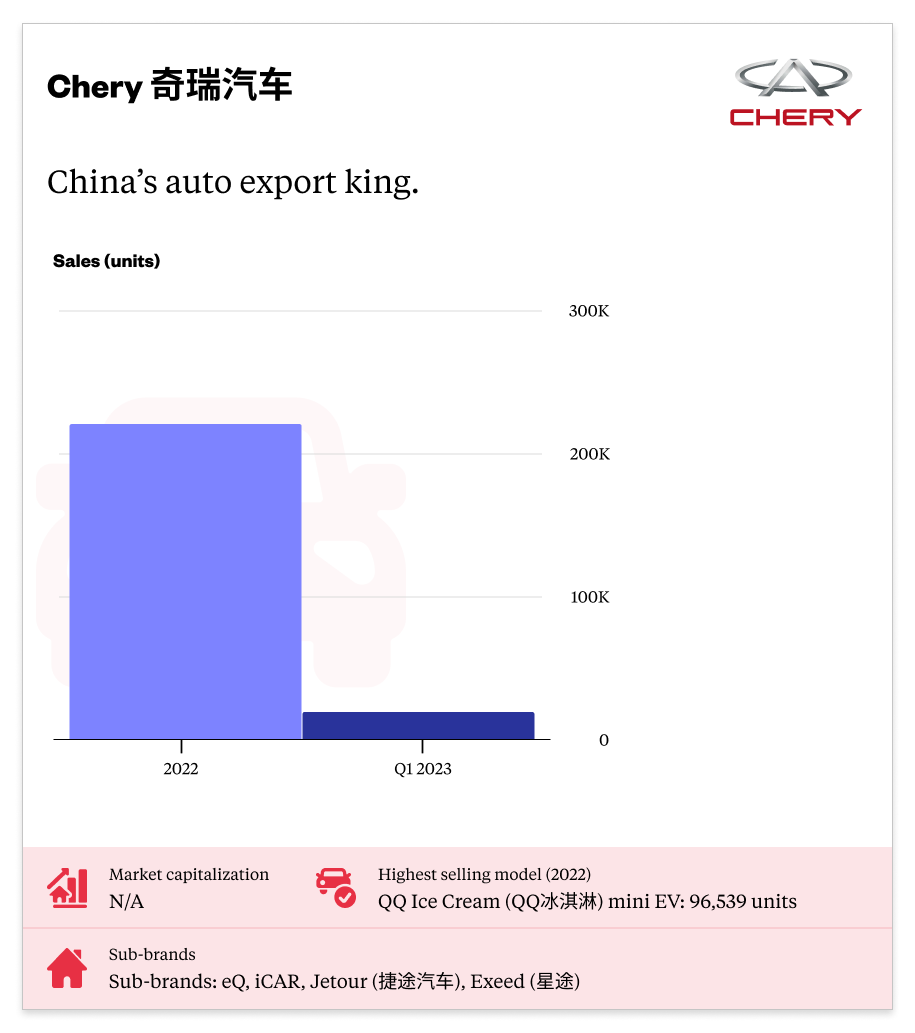

6. Chery

The ChinaEdge database profile

A state-owned automaker headquartered in the city of Wuhu in Anhui Province, Chery was founded in 1997 and began producing vehicles in 1999, focusing mostly on cars, vans, and SUVs. In 2007, the Wall Street Journal considered Chery to be Chinas largest independent vehicle maker, describing its corporate culture as an odd hybrid of Communist state enterprise and entrepreneurial start-up. Geely never formed joint ventures with any established Western automakers.

In 2001, Chery started exporting vehicles. By the end of 2022, the company had exported a cumulative total of more than 2.4 million vehicles, accounting for 20% of all Chinese auto exports over the last two decades, making it Chinas largest auto exporter over this period.

In 2022, of Chinas total vehicle exports of 3.11 million units, Chery contributed 452,000, or 14.5%, an increase of 68% year-on-year. Thus, in 2022, one out of every seven cars exported from China were made by Chery, and at least one of every three cars Chery sells is for the export market. As of 2022, Chery has exported to over 80 countries and has more than 1,500 dealers and service outlets overseas. In 2022, Cherys cumulative sales reached a historic high of 1.23 million vehicles (according to the company), which included 221,157 new energy vehicles.

Cherys transition to EVs started relatively early with its first EV, the Ruq M1, launched in 2010. Cherys presence in the EV market so far, however, is overwhelmingly constituted by mini EVs. Although Chery has several sedan and SUV electric models under the names Tiggo, Arrizo, and Omoda, of the companys 221,157 EV sales in 2022, the Chery Ant eQ and the QQ Ice Cream, both mini EVs, jointly contributed more than 180,000 units, or 82% of the total.

Chery is now in the middle of an ambitious new program to radically enhance its EV offering. In September 2022, Chery unveiled a new plan, called Yogung () 2025, to increase its competitiveness in electrification and smart driving. The plan will include spending of 100 billion yuan ($14.25 billion) over five years, the development of a network of six research facilities in China and around the world, and 13 core technologies, including vehicle platforms, smart driving, and electrification. Over the same period, Chery plans to launch 18 new pure electric models.

Chery previously launched several EVs under its eQ brand, but the companys first independent new energy brand, iCAR, was only established in 2023. In April 2023, CATL, Chinas battery king, announced that its new-generation sodium batteries will be installed in Cherys new iCAR, which was officially unveiled ahead of the Shanghai auto show. The iCAR will come in three models priced in the range of 150,000300,000 yuan ($21,69743,395), and will specifically be targeted at young people. In the same month, Chery launched a new EV series of premium models (a sedan and an SUV) called Sterra under its Exeed EV brand, as well as a compact SUV hybrid called TJ-1.

In 2018, Chery launched a subsidiary called Jetour that mainly manufacturers electric SUVs. Jetour claims to have delivered more than 180,000 units in 2022, an increase of 17% year-on-year, a significant proportion of which was sold in export markets.

Back to top.

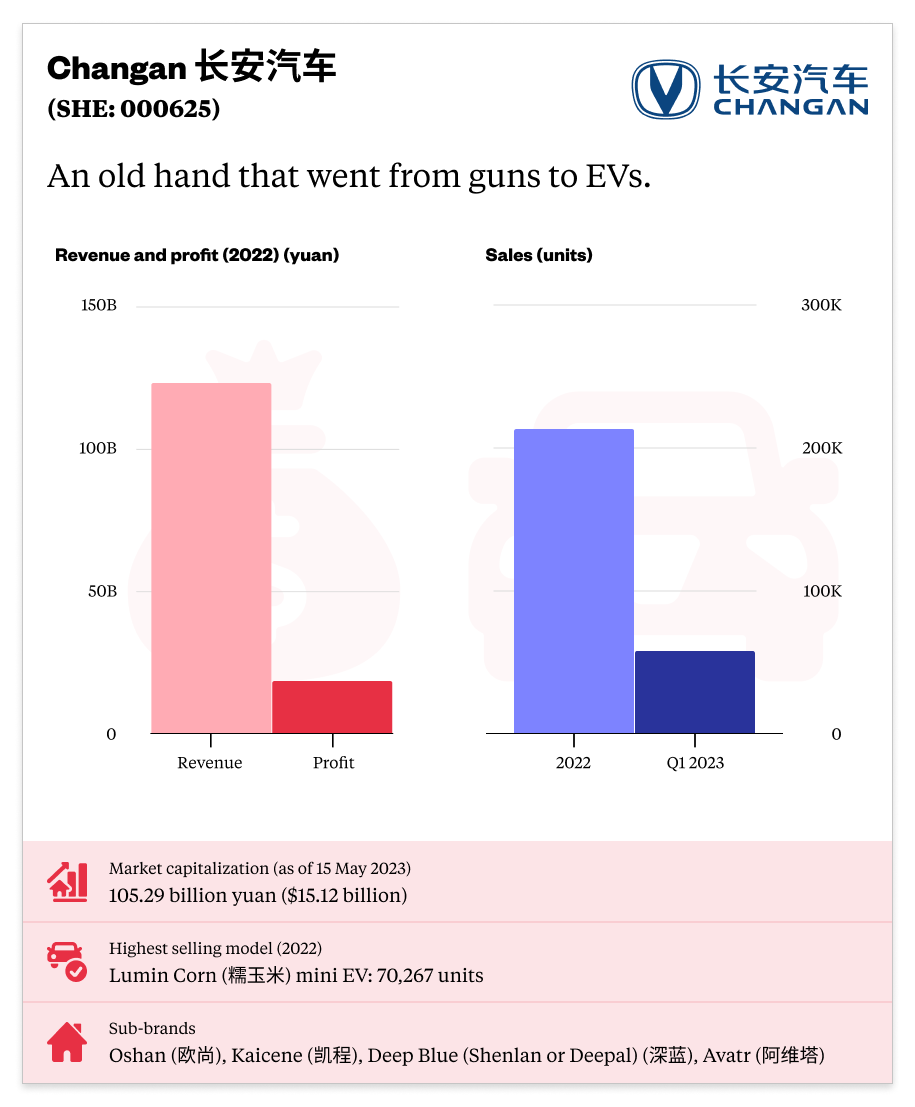

7. Changan

The ChinaEdge database profile

Changan is headquartered in Chongqing and is one of Chinas Big Four state-owned auto automakers (along with SAIC, FAW, and Dongfeng). The company traces its roots all the way back to 1862 as a military supply factory and then a gun factory, so it is Chinas oldest auto manufacturer (although the modern company was established in December 2005). Changan mainly manufactures passenger cars, minivans, and light trucks under three brands: Changan for premium SUVs and passenger cars, Oshan for mid-level SUVs and multi-purpose vehicles (MPVs), and Kaicene for commercial vehicles, trucks, and MPVs.

In 1957, the company produced its first vehicle (and Chinas first jeep), the Changjiang Type 46 46, which was based on the U.S.-made CJ-5 Jeep. The company produced well over 10,000 Type 46s until 1963, and from the 1980s transitioned to civilian vehicles. In 1981, Changan produced its first passenger cars and minivans, originally by means of a partnership with Suzuki. In 2001, Changan established a joint venture with Ford in Chongqing for producing Mondeo, Fiesta, Focus, and other models. In 2006, Mazda acquired a stake in the Changan-Ford joint venture, and Changan started producing Mazda sedans. In 2012, the Changan Ford joint venture was split into two separate joint ventures, Changan Ford and Changan Mazda. Changan was also authorized to produce Volvo models in 2006.

Changan unveiled its first EV in 2015, the Benben mini EV. In April 2020, this model was upgraded with the release of the Benben E-Star hatchback. As of the end of the first quarter of 2023, Changans EV sales have been dominated by such small EVs: In 2022, the companys top-selling EVs were the Lumin Corn mini EV (which was launched in April 2022) with 70,267 units, and the Benben E-Star with 41,351 units. In August 2020, Changan released its first electric SUV, the X7, under its Oshan brand.

Changans EV business only really took off in 2022, however, with the launch of two joint ventures. Back in 2016, Changan announced a partnership with Baidu for smart driving technology, navigation, and services. Changan has now launched two new EV brands, both joint ventures with CATL and Huawei:

- Deep Blue, also known as Shenlan or Deepal, a mainstream EV brand, launched in April 2022. So far, only one model has been released, the SL03 sedan; an SUV, the S7, is scheduled to be released in June 2023.

- Avatr, a premium EV brand, launched in August 2022. The first model was the SUV Avatr 11, which was the first vehicle to be fully equipped with Huawei technology, including its DriveONE dual-motor four-wheel drive system, the AVATRANS intelligent piloting system, and the ADS automatic parking system. The Avatr 11 has a price tag of between 349,900 yuan ($51,892) and 409,900 yuan ($60,790). In March 2023, the next Avatr model, the E12 sedan, was revealed to be undergoing road tests.

Despite being a premium brand, some users have complained about the Avatr 11, which has been plagued by a long delivery cycle, a short warranty, and grumbles about unsatisfactory performance. Users of this SUV have described the user interface as not high-end enough, providing insufficient scope for Huaweis smart technology.

With its two new joint ventures, Changan has now set itself very ambitious goals. In early 2023, the company announced that it plans to attain group sales of 4 million vehicles in 2025, of which 60% will be EVs. From January to April 2023, however, the only one of the new models that has made any impact in the market is the Avatr 11, which shipped 7,264 units, placing it 43d overall on the list of all EV models in this period.

Back to top.

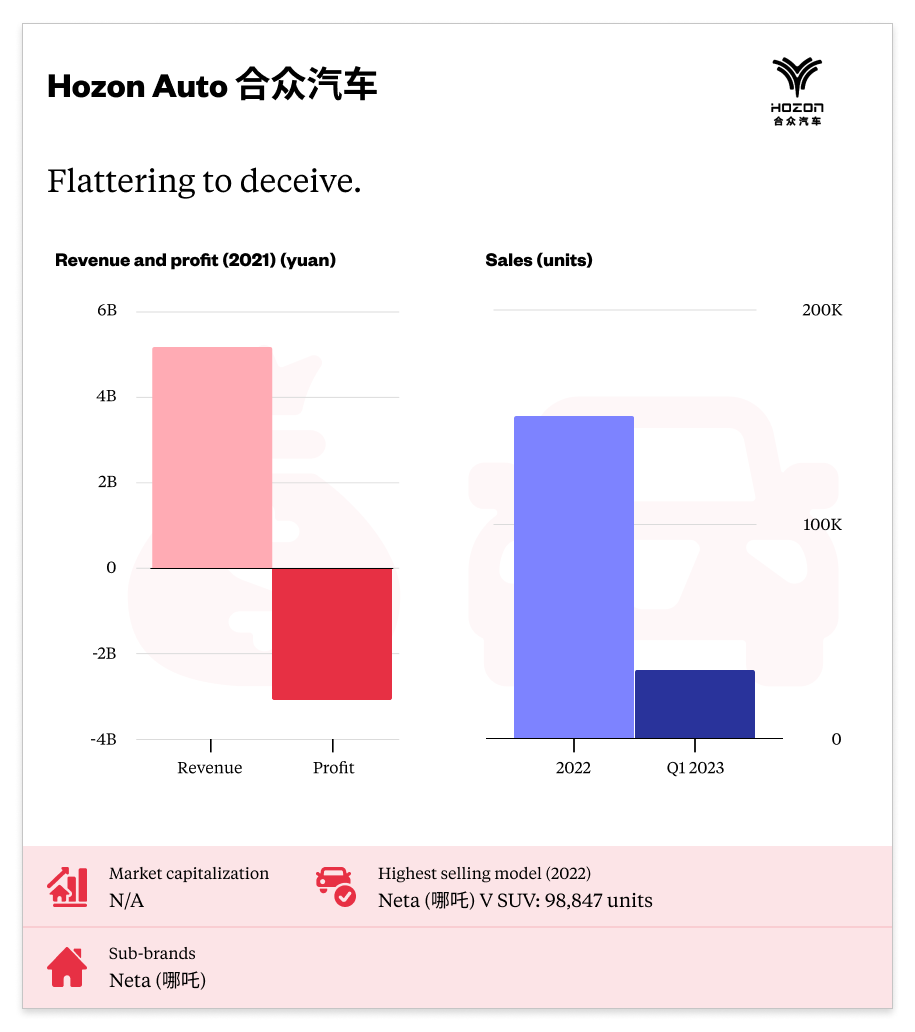

8. Hozon Auto

Hozon Auto has achieved remarkably high EV sales over the last few years, but like GAC Aion, its numbers are inflated by sales to car businesses like rental and car-hailing companies as well as local governments, not to individual customers.

Hezhong New Energy , the parent company of Hozon Auto, was established in 2014. Hozon Auto was officially launched in 2018 when the company launched its Neta brand, and Daniel Zhang ( Zhng Yng) joined as CEO. The companys initial strategy was to produce low-end models and focus first on corporate customers, notably local governments. In 2018, Hozon Auto launched its first model, the SUV Neta N01, at the Guangzhou Auto Show, with a price tag of less than 80,000 yuan ($11,145). The N01 received 50,000 orders before it shipped, but almost all of these were from corporate customers, mostly travel agencies. In fact, in 2019, corporate and government sales accounted for 50% of all Hozon Autos sales.

In 2021, Hozon Auto completed a D round of financing of around 10 billion yuan ($1.39 billion), which was led by Qihoo 360, an internet security company, and its CEO, Zhu Hngy , who injected capital into Hozon Auto and eased some of the companys financial distress. With Qihoo 360 on board, Hozon Auto began the process of producing higher-end models, with the Neta V Pro SUV released in 2021, and the Neta S sedan in July 2022, both of which are equipped with Qihoo 360 software. The Neta S also features Huaweis intelligent driving platform and light detection and ranging (lidar) technology. The Neta V was the companys highest-selling EV in 2022 with just under 100,000 units.

Hozon Auto has claimed that its Neta S sedan runs on self-developed technology, but the car in fact contains a patchwork of software and technology from other companies. In November 2022, Hozon Auto launched a new EV technology brand called Haozhi along with three new products: a supercomputing platform, an electric drive system, and a range extender. Yet this is an initial tentative step at developing the brands own technology and will not be used in any of Hozon Autos cars until at least 2025.

Furthermore, Hozon Auto has been unable to enter the capital markets: In 2020, the company tried to list on the Shanghai Stock Exchange, and from early 2022, it shifted its focus to the Hong Kong Stock Exchange but these attempts have failed. And like most of Chinas other EV brands, Hozon Auto is not at all profitable: In 2021, its total revenue was 5.73 billion yuan ($798.98 million) and it suffered a net loss of 2.90 billion yuan ($405.13 billion). In 2020 and 2021, Hozon Auto had a cumulative loss of 4.20 billion yuan ($585.13 million).

In April 2023, Hozon Auto launched the Neta GT, a flashy electric sports car that will retail for 178,800 yuan ($25,934). The GT marks the start of Hozon Autos attempts to produce higher-class EVs and to move away from its low-budget status. The company is now also attempting to venture into foreign markets, and started construction of its first production facility outside China in Bangkok, Thailand. The plant is scheduled to enter production in January 2024, and will supply vehicles for ASEAN countries.

Back to top.

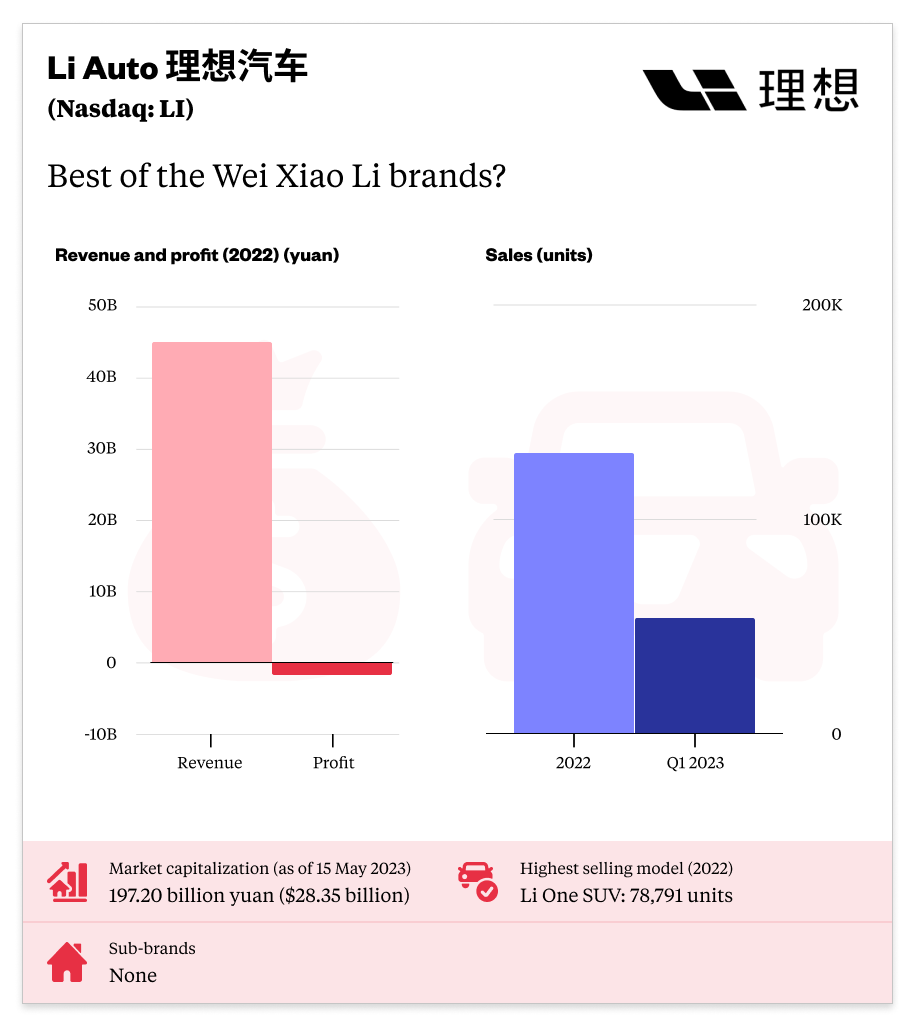

9. Li Auto

The ChinaEdge database profile

Li Auto is the first on the list of Chinas three best-known (aside from BYD) publicly listed EV startups, collectively known as Wei Xiao Li after the first characters of their Chinese names: NIO ( wili), XPeng ( xiopng qch), and Li Auto ( lxing qch).

Li Auto was founded in 2015 and is headquartered in Beijing. In June 2019, the company received a personal contribution of up to 1.96 billion yuan ($285 million) from Meituan CEO Wng Xng and around 207 million yuan ($30 million) from ByteDance. On July 30, 2020, Li Auto raised 7.77 billion yuan ($1.1 billion) in an IPO on Nasdaq, valuing it at 70.70 billion yuan ($10 billion).

The company produces electric SUVs, and its first model, the Li One, was presented in April 2019 at the Shanghai auto show and officially launched on the market in March 2020. In May 2021, Li Auto launched an upgraded version of the Li One with optimized self-driving capabilities and hardware (along with premium features like heated seats and quiet tyres). The Li One retailed for 338,000 yuan (about $48,900). Despite being discontinued in October 2022, the Li One was the companys best-selling model in 2022 with almost 79,000 units, which placed it 15th overall in terms of electric vehicle sales in China.

In 2022, Li Auto launched two new models, the L9 in June and the L8 in September, both six-seat family SUVs. The L9 retails for about 400,000 yuan ($55,200) and the L8, which was intended to replace the Li One, for about 340,000 yuan ($49,000). There are few differences between the two models: The L8 has almost all the functionality of the Li 9, but lacks one light detection and ranging (lidar) sensor and one rear screen, and has a slightly smaller battery.

The company botched the launch of the L8, however. On September 1, Li Auto made a surprise announcement that infuriated some of its customers: The price of the Li One would be cut by 20,000 yuan ($2,869) and production of the model would be discontinued. Customers who had recently purchased the Li One were up in arms as their vehicles had suddenly greatly depreciated in value. Some complained that they had been swindled so the company could clear stock of its older model before launching the L8. On the morning of September 4, more than 60 Li One customers congregated at a Li Auto dealership in Hangzhou, Zhejiang Province, holding banners proclaiming that the company had deceived its customers.

Like the other two Wei Xiao Li brands, Li Auto has had a rather big profitability problem. The companys large annual net loss of 2.03 billion yuan ($291.02 million) in 2022 was nearly six times larger than the 320 million yuan ($45.99 million) net loss of 2021. The company attributed the large net loss mainly to the controversy surrounding the replacement of the Li One, as well as a 106.3% increase in research and development expenditure to 6.78 billion yuan ($974.52 million).

So far in 2023, however, things have been looking up for Li Auto. The companys latest model, the L7, was launched in February 2023 and retails for about 320,000 yuan ($46,000). This vehicle is a five-seat SUV with light-sensitive paint that transitions from black to red to orange through the day, a queen seat, and the ability to be transformed into a camping experience with sleeping space for a family of three.

In March and April 2023, Li Auto sold more than 20,000 units per month (compared with NIO that sold a mere 6,658 units in April and XPeng only 7,079), and the companys sales outlook for the year is looking bright. In the first quarter of the year, the L9 and the L8 both sold more than 20,000 units, placing them 14th and 15th overall on the list of EV sales in China. In May 2023, the company announced further good news with a profit of 933.8 million yuan ($134.6 million) for the first quarter of the year, meaning that Li Auto is the first of the Wei Xiao Li brands to finally break through the profitability barrier.

Back to top.

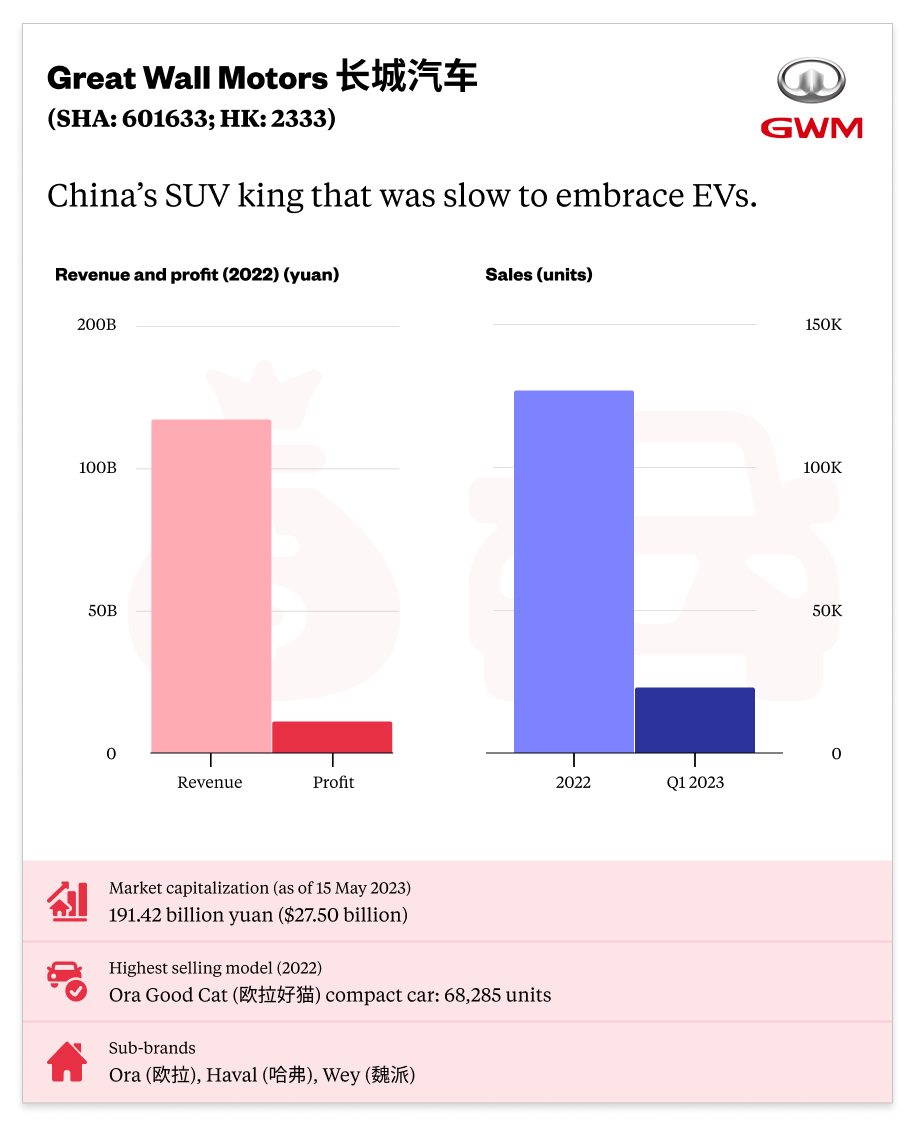

10. Great Wall Motors

The ChinaEdge database profile

Great Wall Motors (GWM) is a privately owned manufacturer that was founded in 1984 and is headquartered in the city of Baoding, Hebei Province. Baoding, in addition to having a reputation as one of Chinas most polluted cities, is also the location of the Xiongan New Area development hub, which one urban planning Ph.D. candidate described as a fusion of nature, high technology, and culture and a tangible, living representation of Xis new era.

In 2021, a fleet of 100 hydrogen trucks produced by GWM subsidiary FTXT Energy Technology were used for a construction project in Xiongan New Area. This illustrates two salient aspects of GWM: its focus on building trucks (it started out building trucks, and built only trucks between 1996 and 2010), and its recent foray into Fuel Cell Electric Vehicles (FCEVs) powered by hydrogen.

The roots of GWM go back to 1976, when Wi Dling , the uncle of GWMs current chairman, Wi Jinjn , founded a vehicle repair shop. In those early years, the company produced passenger cars and mini trucks in small quantities, mostly based on Nissan and Toyota models, eventually transitioning to focus on SUVs.

In 2003, the company listed on the Hong Kong Stock Exchange, the first private Chinese auto manufacturer to go public (in 2011, it listed on the A-share market in Shanghai). In 2011, the companys reputation as Chinas SUV leader was established with the release of the H series SUVs under the Haval sub-brand. Described as a high-imitation version of the Honda CR-V, the H series was the highest-selling SUV in China for eight years, and by 2016 had propelled GWMs annual sales volume to over a million units.

Yet the predilection for SUVs meant that GWM was slow in embracing electrification. It launched the high-end brand Wey in 2016 and invested in producing a series of hybrid models under this brand. GWMs dedicated EV brand Ora was only launched in 2018, but just one model, the Good Cat compact car, has made any significant impression on the market. In 2022, the total sales volume of GWMs hybrid models was only 28,000 units, including those of the Haval and Wey brands. In 2022, the Ora brands annual sales volume was only 104,000 units, a year-on-year decrease of 23%. GWMs total sales volume in 2022 was 1.06 million units, a year-on-year decrease of 17%.

Belatedly, GWM is now going all in on EVs: As per its Strategy 2025 announced in 2021, the company is targeting global sales of 4 million units in 2025, 80% of which will be new energy vehicles. GWM has also explored hydrogen energy from 2015, and established a hydrogen energy technology center in 2018, and a new company, FTXT Energy Technology, in 2019.

Overall, however, GWM has struggled to transition from traditional auto manufacturing to EVs, and the companys outlook in this regard still appears dubious: In the first quarter of 2023, Ora sold 17,766 units (accounting for the vast majority of GWMs new energy sales), a year-on-year decrease of 47%.

Back to top.

11. NIO

The ChinaEdge database profile

Founded in November 2014 and headquartered in Shanghai, NIO is the second on the list of Chinas three best-known (aside from BYD) publicly listed EV startups, collectively known as Wei Xiao Li after the first characters of their Chinese names: NIO ( wili), XPeng ( xiopng qch), and Li Auto ( lxing qch).

The company was launched by CEO William Li ( L Bn) with backing from several other tech executives, most notably the CEO of JD.com, and with investments from Tencent, Baidu, Sequoia, and Warburg Pincus, among others. In 2018, NIO had an IPO on the New York Stock Exchange, raising 12.52 billion yuan ($1.8 billion), and conducted further listings on the Hong Kong Stock Exchange in March 2022, and on Singapore Exchange Limited in May 2022.

In November 2016, NIO held its first foreign press conference in London, during which the company announced its English brand name NIO, a new logo (with two elements depicting sky and earth representing vision and action), and launched its first electric supercar, the EP9. Aside from the EP9, NIO has launched two full electric sedans, the ET5 and ET7, and five SUVs, the coupe SUVs EC6 and EC7 and the mid- to large SUVs ES6, ES7, and ES8. In addition, in 2017, NIO showcased a prototype of a concept car, the Eve, which has been described as part space shuttle, part living room, that will have fully autonomous driving capabilities. The company originally planned to launch the Eve on the market in 2020, but this has not yet occurred.

In December 2022, NIO launched the coupe SUV EC7 and the full-size SUV ES8, which are available for purchase in China from May and June 2023, respectively. The ES7, launched in 2022, was intended to take advantage of the camping craze that was sweeping China, and was the first passenger car in China that could legally tow recreational vehicles (RVs) and trailers.

In August 2022, the ES8 was put through the 1,000-kilometer (621-mile) test in Norway, in which an EV is driven this distance and its performance is closely monitored. The ES8 completed the required distance in just nine hours, which was the best EV time ever registered and considerably shorter than the top Tesla models and other electric SUVs. In addition, the ES8 required just three battery swaps along the way.

The latter concept of battery swapping is key to NIOs strategy. NIO is the Chinese EV brand that has ventured furthest down the path of battery swapping EVs, and has invested considerable funds to construct its own network of swapping stations. As of September 2022, the company had over 1,100 swapping stations across China that have swapped a cumulative 12 million batteries. By 2025, NIO plans to have a total of 3,000 battery swap stations in China.

In 2021, NIO began entering global markets starting with Norway in May of that year, including two battery swap stations and a 2,150-square-meter (23,142-square-foot) showroom, meeting space, and caf (known as a NIO House) in Oslo. According to CEO William Li, the company chose Norway because this country and NIO have a shared vision when it comes to energy conservation and innovation. In September 2022, NIO started operations at a 10,000-square-meter (107,639-square-foot) plant in Biatorbagy, 20 kilometers (12.4 miles) west of Budapest, Hungary, from where the company will supply battery swap stations to Europe. NIO plans to operate a total of 1,000 such facilities outside China, mostly in Europe, by 2025.

In October 2022, NIO announced its entry into Germany, Holland, Denmark, and Sweden with the ET5 and ET7 sedans, and the ES7 SUV. This included the establishment of more NIO Houses in several European cities, including Hamburg, Frankfurt, Dsseldorf, Amsterdam, Rotterdam, and Copenhagen, in addition to the 83 of these venues that the company already had. NIOs sales record in Norway has not been encouraging, however, and in 2022, none of NIOs models was on the list of the top 20 EV brands in this country.

With expensive battery swap stations and an asset heavy European market entry strategy, NIOs bottom line has suffered for years and the company seems further away than ever from being profitable. In 2022, NIO reported a net loss of 2.09 billion yuan ($299.74 million), which was almost 260% more than in 2021.

Back to top.

12. XPeng

The ChinaEdge database profile

XPeng was founded in August 2014 by former Guangzhou Automobile (GAC) Group executives Xi Hng and H To , along with angel investor and quasi-eponymous later CEO H Xiopng , founder of Chinese mobile browser company UCWeb UC (which was acquired by Alibaba in June 2014 in what was at the time the largest deal ever in Chinas internet industry).

XPeng is headquartered in Guangzhou with main offices in Beijing, Shanghai, Silicon Valley, San Diego, and Amsterdam, and manufacturing plants in Zhaoqing and Guangzhou, Guangdong Province. In November 2019, XPeng completed a 2.81 billion yuan ($400 million) Series C financing round with investors including Xiaomi. In August 2020, XPeng was listed on the New York Stock Exchange with an IPO that raised 10.46 billion yuan ($1.5 billion). In July 2021, the company made a dual listing on the Hong Kong Stock Exchange, raising 11.62 billion yuan ($1.8 billion).

The company manufactures SUVs with models starting with the initial G, and sedans with models starting with the initial P. The companys first model, the G3 SUV, was launched in November 2018, followed by the P7 sedan in April 2019, with deliveries commencing in June 2020. In 2022, the P7 sedan, with its XSmart software (which the company claims is on a par with that of Tesla) and the XPilot autonomous driving assistance system (which some have considered to be more advanced than the driving systems of foreign models like the Audi e-tron), was still the companys top-selling model, shipping almost 60,000 units.

In March 2023, the company launched a new version of the P7 under a new name, P7i, with significant upgrades in terms of interior design and connectivity, driver assistance, performance, range, and charging speed. The P7 has consistently accounted for the major share of XPengs overall sales: From January 2021 to April 2023, this model was the companys top monthly seller every month with the exception of only three months.

At the Shanghai auto show in April 2023, XPeng launched its G6 coupe SUV, which is the first model to be manufactured by means of the companys Smart Electric Platform Architecture (SEPA) 2.0, which reportedly essentially has the same foundation as that used by Tesla for the Model Y, i.e., large single-piece front and rear underbody castings joined in the center by a massive battery pack. The G6 will have a price tag of just under 210,000 yuan ($30,000), nearly $10,000 less than the cheapest Shanghai-built Model Y. In other words, the G6 is essentially a copy of the Model Y, as some industry experts have pointed out. The company will be hoping the G6 achieves better results than its previous SUV, the G9, which was launched in September 2022 and has never entered the monthly list of 150 best-selling EVs in China. Overall, XPengs monthly sales have been below 12,000 units since June 2022, and monthly sales from January to April 2023 have been below 8,000 units.

In October 2022, XPeng launched a new semi-autonomous driving system called XNGP, which enables the car to carry out some driving functions automatically but still requires a driver behind the wheel. XNGP replaced the XPilot system, and is XPengs answer to Teslas Autopilot. By 2024, the company plans to have semi-autonomous driving features available in all major cities in China.

XPeng has also invested in flying cars. In 2013, the company established XPeng AeroHT , which describes itself as the largest flying car company in Asia. In October 2022, the AeroHT X2, a two-seat electric vertical takeoff and landing (eVTOL) aircraft with eight propellers, completed its first test flight in Dubai. At the end of October, the AeroHT X3, a two-ton aircraft that has the appearance of a car with four double rotors attached, made its first test flight. In July 2022, AeroHT announced that trial production lines have been completed for the X2 and X3, and the company plans to start mass production in 2024. The X2 will be priced at around 881,760-1.65 million yuan ($126,000236,000), while the X3 will have a price tag of around 979,734 yuan ($140,000).

All these activities have cost XPeng a lot of money, and it is further away than most from any sign of profitability. From 2018 to 2022, XPeng reported a cumulative net loss of 21.82 billion yuan ($3.16 billion), which was an average annual net loss of 4.36 billion yuan ($633.69 million).

Back to top.

13. Leapmotor

The two men from Zhejiang Province behind Leapmotor, Zh Jingmng and F Lqun , were the founders in 2001 of Dahua Technology, a company that sells video surveillance products and services, and which is today one of the worlds leading surveillance equipment companies. Dahua listed on the Shenzhen Stock Exchange in 2008, and currently has a market capitalization of around 70 billion yuan ($10 billion). In 2021, the surveillance industry news website IPVM reported that Dahua was using surveillance cameras and software to provide real-time Uyghur Warnings to the Chinese police, as explained in Dahuas own technical documents.

At Dahua, Zhu and Fu noticed the clear trend of the automotive industry toward electrification and computing power, and also of vehicle-mounted cameras for autonomous driving. So in 2015, they had a factory constructed for Leapmotor in Jinhua, Zhejiang Province, and the company was initially funded by Dahua. From 2016 to 2019, Leapmotor had five rounds of financing that raised about 3 billion yuan ($418.35 million), and in 2021, Leapmotor raised a further 8.8 billion yuan ($1.22 billion).

The company initially made cars in cooperation with Changjiang Auto , but in early 2021, Leapmotor took over Changjiangs full production and assembly line. The company has released four all-electric models so far, the S01 coupe, the T03 hatchback, the C11 SUV, and the C01 sedan, which was officially released on September 28, 2022, the day before the company went public in Hong Kong.

The IPO did not go well, however, because although it raised 5.77 billion yuan ($800 million), the company had originally targeted 10.82 billion yuan ($1.5 billion). After the first day of trading, the Leapmotor stock ended at HK$31.90 ($4.06), a drop of 33.5% from the opening price, which was the worst first-day performance for a Hong Kong IPO above 3.60 billion yuan ($500 million) on record. By the end of March 2023, however, Leapmotors stock had recovered almost all of its losses since going public, with a cumulative gain of about 27% in that month alone.

Leapmotors revenue has steadily increased over the years, from 117 million yuan ($16.31 million) in 2019 to 3.13 billion yuan ($436.76 million) in 2021, and then a big jump in 2022 to 12.40 billion yuan ($1.80 billion). But so has the companys net losses, from 901 million yuan ($125.64 million) in 2019 to 2.84 billion yuan ($396.88 million) in 2021, and then a further doubling to 5.10 billion yuan ($740.80 million) in 2022.

Although Leapmotor claims to target the mid- to high-end market, in reality, its cars are at the low end of the market. The company plans to launch seven new electric models up to the end of 2025 in the mid- to high-end segments of the market, by which time it wants to attain annual sales of 800,000 units a very ambitious target considering that 2022 sales were slightly over 100,000 units. Most of these sales were accounted for by the companys small EV, the T03 hatchback in the 69,00085,000 yuan ($9,60011,900) price range.

From January to April 2023, Leapmotors sales have been slow, with April being by far the best month with 8,726 units. In January 2023, CEO Zhu Jiangming stated that the company would have to sell 400,000 to 500,000 units per year to reach the break-even point.

Even though the company claims to have fully independent research capabilities in all parts of the EV manufacturing process, Leapmotors cumulative investment in research and development of less than 1.4 billion yuan ($195.23 million) from 2019 to 2021 is far inferior to the 3 billion to 4 billion yuan that the three Wei Xiao Li brands spend on research and development each year. Leapmotors relative lack of investment in research and development is a particular concern for an EV company because, as one analyst put it, for makers of traditional fuel vehicles, its easy to build a sofa on four wheels, but for EV companies, its much harder to build a computer on four wheels.

As of the end of July 2022, Leapmotor had 443 stores in 151 cities in China, and the company plans to open its first flagship store in Europe in 2023. Leapmotor is now aiming to shift its focus to the mid- to high-end segments of Chinas EV market, e.g., 150,000 yuan (around $20,000) to 300,000 yuan (just over $40,000). Much of the companys hopes now rest on the C11 SUV (priced at up to 200,000 yuan or $27,900) and the brand-new C01 sedan (priced at up to 270,000 yuan or $37,700). From February to April 2023, the C11 was Leapmotors top-selling model, shipping 6,146 units in April (70% of the companys total sales that month), but the C01 has so far barely made an impact on the market, shipping a mere 1,126 units in April.

Back to top.

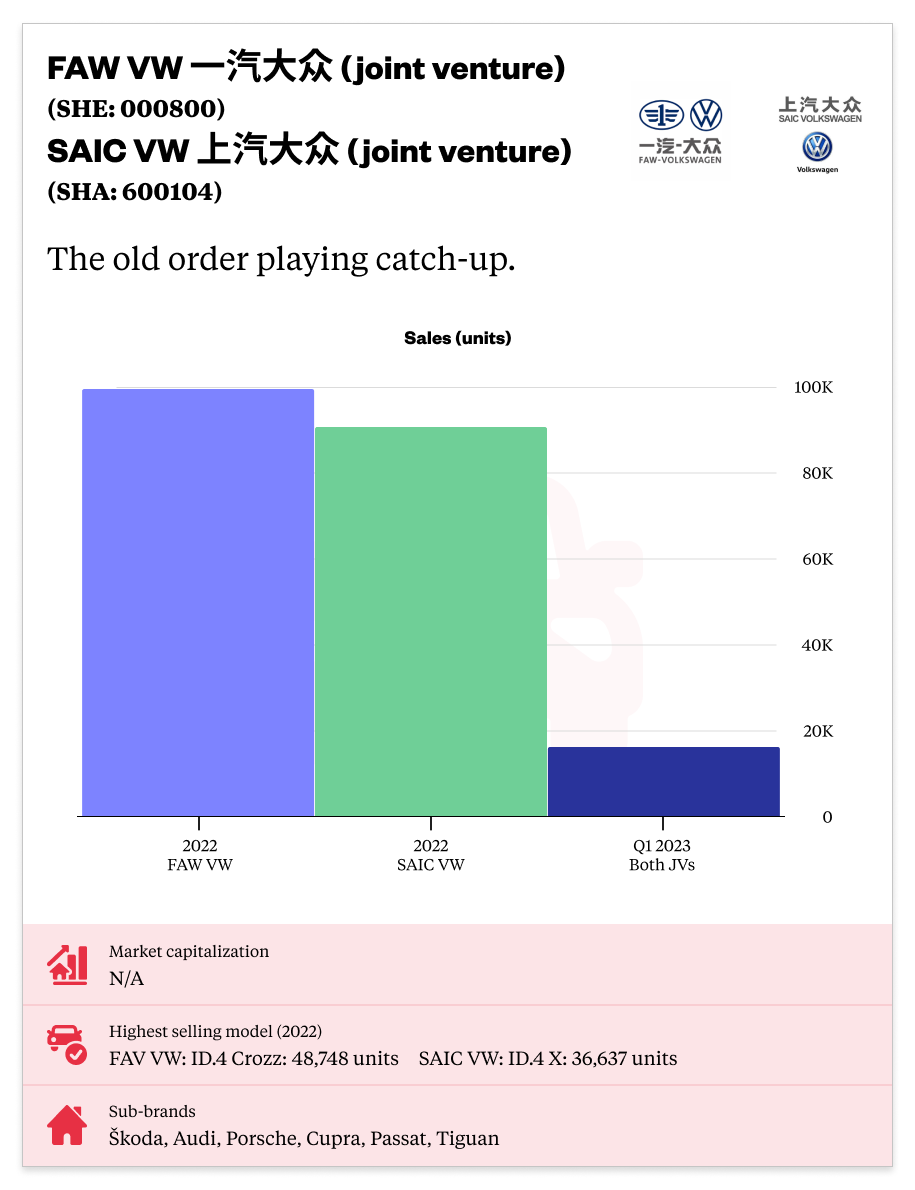

14. FAW VW (joint venture)

15. SAIC VW (joint venture)

The ChinaEdge database profiles: FAW Group; SAIC

Founded in October 1984 with SAIC, one of Chinas Big Four auto manufacturers, SAIC VW is the first joint venture established by the German auto group Volkswagen (VW) in China. The second, FAW VW, was established in 1991 with FAW Group, another of Chinas Big Four, and a third, VW Anhui with Jianghuai Automobile Group (JAC) , was established in 2017. VW Anhui, in which VW increased its stake to 75% in 2020, is a dedicated EV manufacturer, although all three joint ventures produce EVs. In April 2023, VW announced a new investment of 7.69 billion yuan ($1.1 billion) to establish a new company with the project name 100%TechCo in Hefei, Anhui Province, to develop EVs and to integrate the work of VWs three China joint ventures in research and development.

SAIC VW is the second-oldest auto industry foreign joint venture in China, preceded only by Jeep (Jeep has since closed its last factory in China, citing government meddling). From the time VW entered China in the 1980s, its vehicles topped the sales charts year after year. Forgotten in Europe, the Santana (the sedan version of the Passat), for example, became a legendary vehicle in China.

From 2019, however, when VW sold 4.23 million cars in China, the companys sales in the country have been steadily decreasing, dropping by 9.1% in 2020 and a further 14.1% in 2021. As Chinas EV market became the worlds largest in 2015, VW was slow to transition to electrification, and found itself flatfooted in China. VW only started selling its first EV in China in 2020, the ID.4 SUV, and from 2021, the ID.3 compact hatchback and ID.6 SUV. Of the companys total planned EV sales of 1.5 million EVs by 2025, 500,000 are planned to be ID.4 models.

In July 2021, VW Group announced its NEW AUTO strategy with a plan to have EVs account for 50% of total output by 2030 and almost 100% by 2040. In March 2023, VW Group announced plans to invest 180 billion euros ($192.6 billion) between 2023 and 2027, two-thirds of which would go toward electrification and digitalization. Under this new plan, VW aims to have 70% of all sales be for EVs in Europe by 2030 and 50% in the U.S. and China.

VW and its subsidiary Audi have made substantial investments in China and FAW for EV manufacturing. In 2020, Audi and FAW signed an agreement to establish production in China of Audis Premium Platform Electric (PPE) that will manufacture several Audi EV models for the Chinese market from 2024 onward. In February 2022, Audi and FAW received approval from Chinese authorities to start construction on a 21 billion yuan ($3.3 billion) EV plant in Jilin Province, set to enter production in December 2024 with an annual capacity of 150,000 cars.

In 2022, VW reported an overall decrease in sales in China of 3.6% to 3.18 million units, but an 68% increase in full EV sales to 155,700 units, which was its second-largest EV market, compared with EV sales of 352,000 units in Europe, which increased by 13.4% year-on-year. In the first quarter of 2023, however, VWs EV sales in China (as reported by the company) fell drastically, decreasing by 25.4% year-on-year to 21,500 units, compared with an increase of 68.1% year-on-year to 98,300 in Europe. From January to April 2023, no single VW EV sold more than 10,000 units in China. The ID.3 was the highest seller overall, placing 35th of all EVs in China with 9,290 units.

One of the reasons for the ID models poor recent sales record in China is software, which is indicative of VWs struggle to transition to electrification. Starting in June 2021, ID customers in China started uploading videos on social media showing highly stressful experiences while driving, including the vehicles control screens and instrument panels blacking out, and the gear knobs and accelerator pedals becoming unresponsive. Then, on December 1, 2022, an open letter entitled simply Letter to SAIC-VW appeared online in China. The letter complained about control and navigation screens that go crazy in ID vehicles, and excoriated VW for dishonoring the faith placed in it by Chinese customers as a trustworthy brand with a history of a century.

In fact, VW has long struggled with software. The companys Modularer Infotainment Baukasten software system is very buggy: In July 2022, VW had to postpone the launch of several new models due to problems with the software. Indeed, the persistence of software problems was a decisive factor in the firing of Herbert Diess as CEO in July. Diess had reportedly upset the Porsche and Piech families by blaming Porsche and Audi for jeopardizing the Cariad project.

On September 1, 2022, Oliver Blume took over as the new CEO, and pointedly remarked on his first day that VW will escalate the development of EVs. Blume immediately made the crucial decision to terminate Diesss policy of using only self-developed software. In October, Cariad announced an investment of 19.36 billion yuan ($2.47 billion) in a new joint venture with Horizon Robotics (with VW holding 60%), a Chinese software developer focusing on advanced driver assistance systems (ADAS) and autonomous driving.

Back to top.