Why Chinese electric cars are cheap

Here's why Chinese brands like BYD and MG can price their electric cars so cheap

Ever wondered how Chinese brands like BYD and MG are able to price their electric cars so much more affordably than any other brand? We did and so we decided to investigate.

See until now we have been told by car companies that the real reason why electric vehicles are so expensive is because the lithium-ion batteries cost so much to make.

Hyundai's senior manager of Future Mobility Scott Nargar told CarsGuide earlier this year that the sudden surge in demand is making it hard for current lithium mines to keep up.

Everybody is after the same very limited supply of raw materials for batteries, he said.

There are already very established mining industries for cobalt and copper, but its the lithium which goes into lithium-ion batteries which adds that big cost to them.

Theres about six different battery manufacturers and huge demand for a limited amount of batteries.

At the time Kia Australias product manager Roland Rivero also said that the higher price of electric vehicles compared to petrol and diesel ones was due to the cost of making the batteries.

Battery costs (raw materials which make up the battery) arent coming down and supply in general has been tight relative to demand, he said.

The higher price of electric vehicles compared to petrol and diesel ones is due to the cost of making the batteries.

That would explain why a little electric Kia Niro starts at $66,590 before on-road costs. Thats the price of a big petrol SUV, but also the cost of an electric small SUV.

Weve been told that until Australia starts opening and operating large lithium mines, and until theyre operating at full-scale capacity, then the prices of EVs will stay high. That could be a decade away.

We sort of came to terms with that and the idea that until batteries can be made cheaper, then prices of cars that had them would stay high.

Then Chinese brands came in offering electric cars which undercut their rivals ruthlessly.

The MG4 is the same size as a Kia Niro and has the same sized 64kWh battery. But while Kia asksmore than $66 grand, MG is charging just $44,990.

BYDs Seal has an 82.56kWh battery in the Premium grade which lists for ,798.

How is this possible? Is Kia overcharging? Does MG have better access to battery raw materials?

Well Kia isnt overcharging. Tesla cant match the prices of Chinese brands either. The Model 3 with the 82kWh Long Range battery lists for $71,900. BYDs rival sedan the Seal also has an 82.56kWh battery in the Premium grade which lists for $58,798.

Hyundai offers the Ioniq 6 with a 77.4kWh, and the most affordable version is $71,500.

So, whats going on?

Hyundais Chief Operating Officer John Kett shared his insight into how the Chinese brands are able to price their EVs so competitively with CarsGuide.

Hyundai offers the Ioniq 6 with a 77.4kWh, and the most affordable version is ,500.

I dont think well ever be able to [have] price points like them, he said.

BYD has their own battery supply chain. And if you dont have a supply chain, then youre leaning on a government body or CATL, and so theyve got scale and theyve definitely got a price advantage over us.

BYD is now the worlds largest electric vehicle maker, but long before it made cars it was a rechargeable battery producer. Now BYD is second only to China-based CATL as the worlds largest lithium-ion battery maker as well.

As much as we talk about their EV credentials, and it's very strong, I think up until September this year theyve exported out of China more than two million cars and 75 per cent of those cars are ICE (internal combustion engine) cars, Kett said.

So all this excess capacity and amortised transmission and engine facilities, thats why they can price so aggressively in their ICE cars and then complementing them with their EVs.

The MG4 is the same size as a Kia Niro and has the same sized 64kWh battery but is nearly ,000 cheaper.

I think the whole world is going to confront the same reality that were seeing - the Chinese where theres ICE opportunity will maximise if by virtue of the fact that theyve got scale, and well see that impact here. And their EVs will take their place.

So it appears then that not only are Chinese brands in a more advantageous position in sourcing the most expensive part of an EV - the battery - thanks to either producing them themselves or through government assistance, but the sheer scale of their operations means theyre willing to undercharge and absorb the loss of earnings.

For now that is, because you can bet that once MG and BYD become established in Australia the prices wont remain the cheapest.

So what will happen when lithium prices become cheaper? Well, they already are. The price of Lithium Carbonate has more than halved since January this year and its forecast that as demand for EVs slows down in the US and Europe, there will actually be an oversupply in 2024 and 2025.

Will that mean cheaper EVs for Australians? Well, we have seen prices reduced by many brands recently, but not halved and the Chinese brands have reduced prices too often in competition witheach other in order to stay the most affordable.

China Makes Cheap Electric Cars; Why Cant Americans Buy Them?

When Americans shop for an electric vehicle, theyre lucky if they find one under $30,000. The cheapest EV in the U.S., the Chevy Bolt, has an effective price (base sticker price minus the $7,500 tax credit) of about $20,000, including freight charges but not state tax. Thats the price GM advertises, which might be different from what you find at a dealership.

Meanwhile, across the Pacific, car shoppers in China have a much easier time finding EVs within that price range and thousands of dollars below it. Any Chinese EV brand could serve this point, but for the sake of comparison, consider the near Bolt equivalent, the new BYD Seagull. The electric hatchback gets about 251 miles of range and can charge between 30% and 80% in a half-hour.

The starting price? 73,800 yuan, or roughly $10,183. That's about $10,000 cheaper than Americas cheapest EV (after the tax credit), and its more than $5,000 cheaper than Americas cheapest car, the Nissan Versa, which lists for about $15,830.

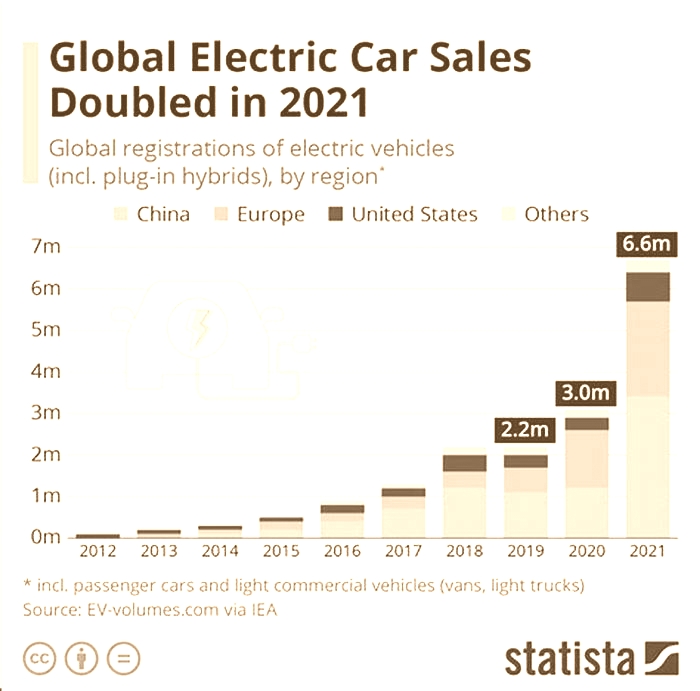

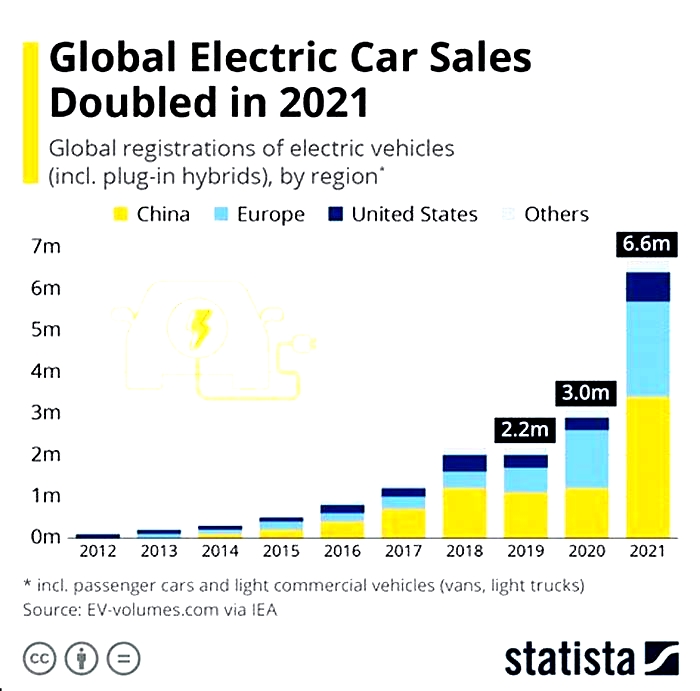

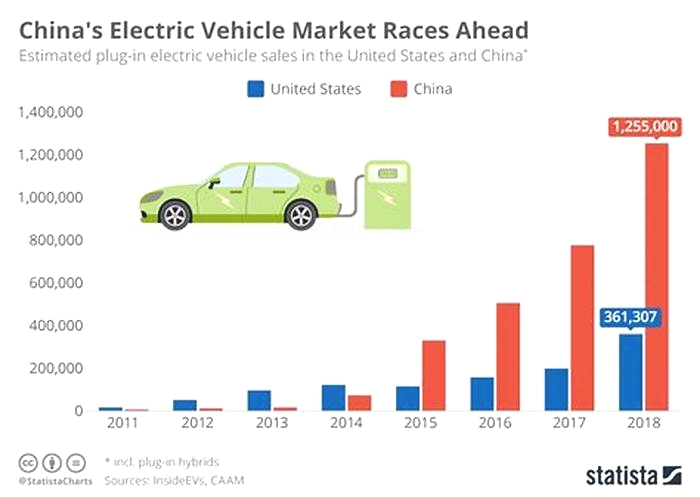

A vehicle like the Seagull on American soil might attract more EV buyers, decreasing dependence on cheaper gasoline cars and pushing the U.S. closer to achieving a net-zero emission economy by 2050. In China, an estimated one-third of new car sales are electric, compared with 5.8% in the U.S. in 2022.

At the same time, opening the U.S. market to Chinese EVs would increase dependence on China at a politically sensitive time, which is why Americans likely wont see a BYD Seagull in their neighborhoods anytime soon, or any other Chinese EV.

Why Americans cant buy cheap Chinese EVs

Despite some speculation over Chinese companies swooping in and introducing a slew of cheap EVs to American drivers, no Chinese EV-maker is yet manufacturing cars in the U.S., nor do any have firm plans to do so in 2023.

In fact, diplomatic tensions between Beijing and Washington help make it unlikely Chinese EVs could be to our era what Japanese and South Korean cars were to the 1970s and '80s: affordable, fuel-efficient alternatives to American brands. Even after U.S. Secretary of State Antony Blinken and Chinese President Xi Jinping agreed in June to improve relations, the superpowers differ on so much global policy from the sovereignty of Taiwan and Ukraine to territorial disputes in the South China Sea its hard to imagine the U.S. opening itself to a flood of cheap Chinese EVs.

Attendees look at a BYD electric vehicle during the 2023 Central China International Auto Show on May 25 in Wuhan, China. (Getty Images AsiaPac via Getty Images News)

The only way to procure one now is to buy it from a third-party site like Alibaba and import it from China. But dont get your hopes up: A Trump administration-era 27.5% tariff still applies to Chinese EV imports. Taking into account the tariff, freight charges and registration fees, youre likely not going to pay much less than you would for a Chevy Bolt, especially because the latter qualifies for the $7,500 EV tax credit but Chinese EVs dont. In addition, cars made for the Chinese market arent subject to U.S. safety standards.

For Americans to really enjoy the low prices available in China, they would need Chinese EV companies to move their operations to North America, thus sidestepping the tariff. That would involve building factories and manufacturing cars in the U.S. (or in a place where the tariff doesnt apply, like Mexico). And while such a notion isnt impossible, so far only one Chinese EV company, Nio, has made strides to open on American soil, and even it has only leased space in San Jose, California, but hasnt built assembly plants or announced plans to do so.

Aside from political headwinds and tariffs, Chinese companies would also have to deal with the American publics perception of China. While certainly many Americans would buy a cheaper EV, regardless of where it came from, others might resist Chinese brands on the grounds that they dont want to support an economic rival. Mistrust and suspicion not helped by a spy balloon incident and the governments ban of TikTok from federal devices could sway public opinion away from Chinese cars, even if they are safe and reliable.

Will the U.S. ever make cheap EVs like China?

Looking to the near future, American automakers will have a tough time selling EVs at prices as low as those in China. Even with support from the Inflation Reduction Act, American EV-makers havent figured out how to secure battery-grade materials efficiently, leaving them at the mercy of the worlds largest producer of them China.

According to research from The New York Times, China controls about 41% of the worlds cobalt mining and 28% of lithium, two key ingredients in many long-range EVs. Even if Chinese mining companies don't extract the metals themselves, chances are the materials will still pass through China the country refines about 73% of the worlds cobalt and 67% of its lithium. It also produces about 77% of cathodes and 92% of anodes, two essential components in batteries, which is perhaps why more than 6 in 10 battery cells are made in China.

[The Chinese have] reached a point where they can manufacture cars efficiently like smartphones, whereas North America is still stuck trying to overhaul an outdated manufacturing supply chain.Zayn Kalyan, CEO of Infinity Stone Ventures

Control over the battery supply line has made China home to the world's largest electric vehicle market. Even American EV-maker Tesla has set up a Shanghai factory and sold 94,469 of its Model Ys in China in the first quarter of this year. For comparison, it sold about 83,664 Model Ys in the U.S. during the same period and 71,114 in Europe.

The U.S., for its part, produces less than 2% of the worlds lithium from a single mine in Nevada. American cobalt production is even more dismal: less than 0.40%, according to data insights from Mining Technology, an online publication covering the mining industry. The fact that the U.S. doesnt have viable supplies of metal is one major reason its EVs are so expensive (although greater recycling capacity could help ease the demand for mined lithium).

China has dominance over critical minerals and a robust manufacturing industry, says Zayn Kalyan, CEO of Infinity Stone Ventures, a Vancouver, British Columbia-based supplier of critical metals for clean energy. Theyve reached a point where they can manufacture cars efficiently like smartphones, whereas North America is still stuck trying to overhaul an outdated manufacturing supply chain.

To be sure, the U.S. does have critical metals on its home turf. Ample lithium reserves are in several states, including Nevada, California and North Carolina, while cobalt has been discovered in Idaho and Minnesota. But unless the permitting process for mines, which can take seven to 10 years, is shortened, its hard to imagine these states supplying American EV-makers anytime soon.

At this point, for the U.S. to sell cheap EVs like China, it would need to do something radical, like invent new battery technology that requires fewer or different chemistries of metals. But even that would require a long-term perspective. The issue, Kalyan says, isnt finding a different composition of metals. Its finding a different composition that you can scale. There are lots of new chemistries to compete with lithium-ion batteries, but scaling it upward to meet demands for EVs is the challenge.

In the meantime, you can still order a new Chevy Bolt for about $20,000 after the $7,500 tax credit. But even that option will soon be unavailable GM said it will discontinue the Bolt after 2023. CEO Mary Barra has hinted at plans for replacing it with another affordable option, but there has been no official announcement. As of now, GM plans to convert the Orion Assembly plant, which makes Bolts, to build more expensive EV Silverados and Sierras, continuing an American trend of building bigger cars at slightly higher production costs for wider profit margins.

(Top photo by Getty Images AsiaPac via Getty Images News)