Why are hybrids not popular

Are Hybrid Cars Worth It?

"

"Most new hybrid owners justify the higher initial purchase cost of their vehicle by saying that they'll make up the difference in fuel savings. Well, that plan may take a little (or a lot) longer than most new car owners think.

Oftentimes, it can take several years to make up that cost of a hybrid car in gas savings. When gas was setting new record-high prices in the summer of 2008, people penciled out the time it would take to recoup in fuel savings the extra dollars they had paid for a hybrid car.

At the time, a hybrid car may have sounded like a great idea. In fact, when gas prices are high, hybrid cars can make up the price difference in as little as two years like in the case of the Toyota Camry Hybrid. At that time there were also tax credits and incentives available from the federal government, and some state governments, for purchasing new hybrids. Those credits have all dried up, though. There are still tax incentives available for plug-in hybrids and purely electric vehicles, but even those will likely end in a few years as more of these vehicles become available on the marketplace.

But when you're talking about an extreme case, like the Lexus LC hybrid sports car (which happens to have an almost six-figure price tag), even when gas prices are relatively low, it would take decades to make up the difference in price.

OK, gasoline is great, but you can do better. You can plug your car in.

PHEVs are no longer a no-brainer vs. hybrids

Plug-in hybrids are a great way to adapt to the electric-car future without having to rely on it, cold turkey. Those considering plug-in hybrid models this year have a number of better product choices than in previous yearswith longer electric range, better drivability and additional off-road capability.

Yet suddenly, far fewer of them are making as much financial sense versus hybrids, due to the abrupt loss of the federal EV tax credit for many of the markets PHEVs after President Biden signed the Inflation Reduction Act (IRA).

2021 Jeep Wrangler 4xe

The revamped credit under IRA, called the Clean Vehicle Credit, only applies to plug-in hybrids and EVs that are American-made. And with the exception of a handful of PHEVs from Chrysler, Ford, Jeep, and Lincoln, plus a few more select models from Audi, BMW, and Volvo, EV tax credit eligibility has been drastically cut.

Do your calculations on cost, fuel, electricity

Until recently, plug-in hybrids have been a smart choice if you value low operating costs and the best overall valuewhile maximizing battery resources and making, in most cases, a greener choice versus hybrids.

Loren McDonald, founder and chief analyst of the consultancy EVAdoption, cites the Kia Niro Plug-In Hybrid as an example. It previously qualified for a $4,585 tax credit, nearly negating the $4,900 price difference with the Niro Hybrid. But now? Well, it depends on whether or not you still might be eligible for state or even local incentives applying to plug-in hybrids.

Opting for the PHEV version may have been a no-brainer for many buyers, McDonald notes, when adding in state and utility incentives, plus lower fuel costs, but now it will require more consideration.

While its certainly too early to tell based on market data, there may be cases where prospective buyers turn around and get a hybrid instead.

U.S. EV and PHEV sales share - EVAdoption

PHEVs have seen steady growth along with EVs over the past few years. And while EVs appear to be locked onto a rapid-rise trendline, theres not as strong a long-term prognosis for PHEVs. As of Julybefore the passage of the IRAS&P expected that in 2030 just 5% of U.S. new vehicle sales would be plug-in hybrids, versus 47% fully electric vehicles. Thats up from the 1.5% PHEVs and 5.5% EVs anticipated by EV Adoption for the second quarter of 2022.

No tax credit, yet PHEV sticker prices rising?

There have been a few plug-in hybrid market introductions in recent weeks, and the pricing decisions have been a bit surprising. Despite the loss of the tax credit, these prices on newly ineligible PHEVs have gone up versus eligible predecessors.

Mitsubishi confirmed one such example this past week. Its 2023 Outlander Plug-In Hybrid will start at $41,190, including the mandatory $1,345 destination fee. Thats up nearly $3,000 in sticker price, from $38,240 for 2022.

In bottom-line money for most purchasing households, the Outlander PHEV is up more than $9,500 versus last year. The Outlander PHEV used to be eligible for the federal EV tax creditan amount of $6,587 based on its battery capacity. The 2023 version, with its larger 20-kwh battery pack, would have been eligible for the full $7,500 amount had it reached the market before the August 16 signing.

2023 Mitsubishi Outlander Plug-In Hybrid

As we reported in a first drive of the Outlander PHEV, this models bigger battery, stronger electric motors and expanded electric-only operation provide an excellent 38 all-electric miles of operation plus a seamless transition between power sources in hybrid mode. It represents the best technology from the Japanese brand and is a strong alternative to the Toyota RAV4 Prime, best that vehicle with an additional row of seats.

Kia also, since the tax credit demise, hiked the base price of its Sorento Plug-In Hybrid by more than $5,000 for 2023, versus 2022. That roomy, three-row model was also eligible for $6,587 under the outgoing EV tax credit, meaning that the 2023 Sorento PHEV, at $51,185, now costs about $11,600 more than last years model. Thats for a streamlined lineup putting all the focus on the top-of-the-line SX-P trim, including all-wheel drive, a suite of driver-assistance features, and an AC inverter good for powering a laptop.

Will more PHEVs be made in America?

While Stellantis' Jeep Wrangler 4xe and Chrysler Pacifica Hybrid are two of the top-selling American-built plug-in hybrids for which the EV tax credit still apply, the buyers of the popular Toyota RAV4 Prime and Prius Prime can no longer claim it due to their Japanese assembly.

The loss of the EV tax credit for imported models also includes some of the PHEVs with the longest electric range, such as all but one of Volvos Recharge PHEVs recently given larger battery packs. While the XC60 Recharge PHEV we drove last year is among those counted out for their European assembly, Volvos South Carolinabuilt S60 T8 Recharge sedan, at 41 EPA-rated electric miles, is its sole PHEV that currently qualifies.

2022 Volvo XC60 Recharge

McDonald doesnt see that the IRA will necessarily cause a shift of more plug-in hybrids from foreign-made to American-made. Thats because one of the key issues isnt just the potential sales volume that might make U.S. assembly worthwhile, but whether or not they can meet future battery cell and mineral requirements as laid out for the Clean Vehicle Credit.

Since they are both selling at a significant volume (from an EV perspective) and assembled overseas, they may not believe it is worth the investment to shift manufacturing to North American factories, he says about the Toyotas.

Californias 50-mile requirement

Furthermore, the tighter regulations from Californiaadopted by at least nine other statesare another factor. They require that PHEVs deliver 50 miles of electric range, starting with the 2026 model year, to earn the full ZEV credit amounts from the states Air Resources Board.

2023 Hyundai Tucson Plug-In Hybrid

That requirement could be a last straw for automakers, in terms of the number of PHEVs they can produce with bigger batteries and added complexity while also adding more fully electric models, and it might potentially swing automakers that are currently very bullish on PHEVs, like Hyundai and Kia, away from them. They might instead focus on a few U.S.-sourced, U.S.-assembled EVs that would qualify and be more cost-effective.

Some automakers may simply use this requirement as a catalyst to exit the PHEV business and focus on regular hybrids and full BEVs, said McDonald.

Market forces could fix this

Michael Fiske, associate director for powertrain forecasting at S&P Global Mobility, suggested that the market forces around simple supply and demand might be limiting the growth of PHEVs as a greener possibility for some shoppers.

Demand far outpaces supply, and it will for the next year or so, said Fiske, inflating sticker prices and transaction prices. These vehicles are positioned to be competitive in the current environment, and the current environment is anything but normal, he said.

The manufacturers, they have shareholders, and need to maximize their profits, and thats an easy way to do it, Fiske added. Theres no need to try to discount it to try to attract more buyers because youre going to be selling out no matter what.

Fiske said theres a sense within the industry that the market will normalize and prices may need to come back down, but as some manufacturers will qualify for the new credit and others wont, pricing will be readjusted differently. As such, some automakers will decide that plug-in hybrid is a good transition technology and others wont.

Model lineups will change

How the combination of the IRA and the California requirements will affect plans for PHEVs vs. EVs remains to be seen, and its going to be a new and different calculation for each company.

Manufacturers trying to figure out how to qualify or if it's worth it anymorethats definitely going on, Fiske said. But as well, we still have a continuing semiconductor shortage, and that is playing a significant role, along with this overall inflation.

Another articles related to Why are hybrids not popular

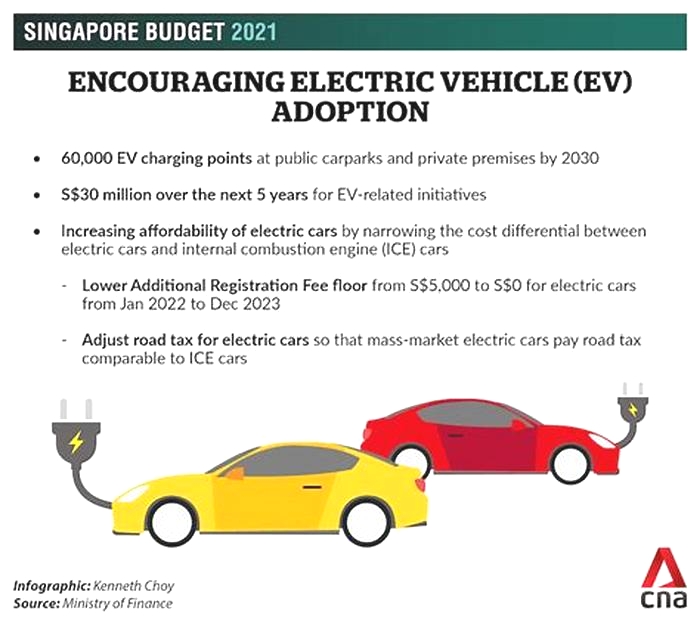

Why electric car is not popular in Singapore?

Cost Of Owning An Electric Car In Singapore 2024 Here comes the real thing calculating the total cost of owning an electric car. However it differs from EV to EV, depending on the model of the car, the age of the car, and many other factors like NCD and so on.Lets just say you decide to purchase a more affordable model by Honda and itll already cost you about $185,000 (including COE) at the beginning. Besides the cost of the vehicle, youll have to factor in the following costs:Car insurance ... read more

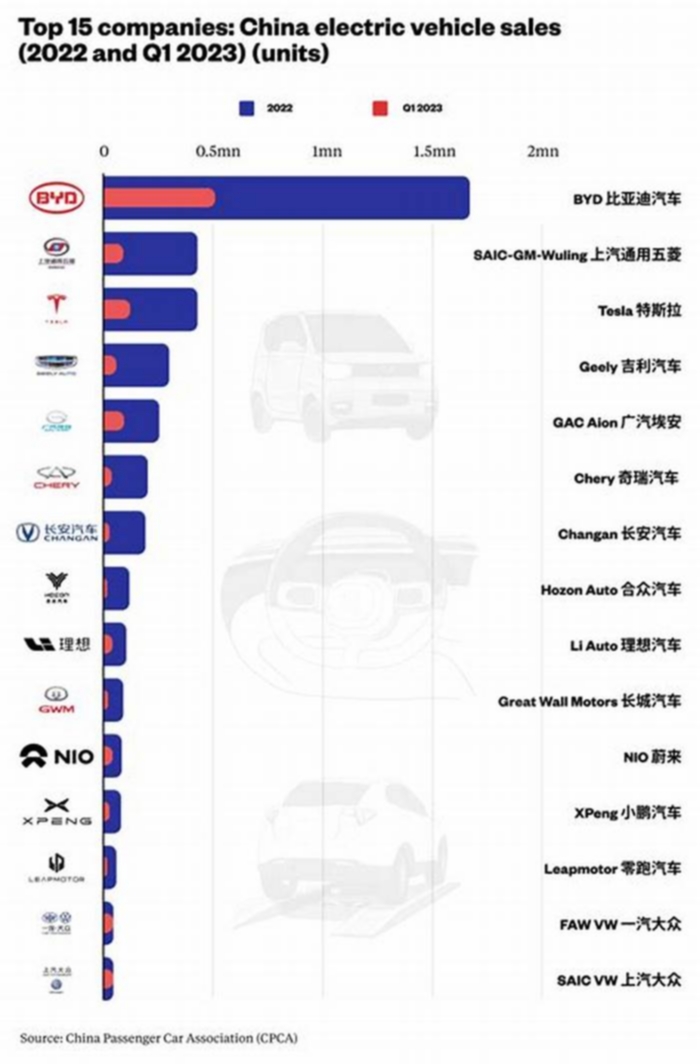

What is the most popular EV company in China?

Top 10 China EV Brands + 5 Promising Ones (Updated 2023)Electric cars battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV) are rising rapidly to rival and replace their purely-gasoline counterparts, led by Chinese EV brands and traditional automobile companies.These China-based auto brands are established EV manufacturers domestically and globally, while some are exciting up-and-coming players.The 10 Best Chinese Electric Car BrandsThis top ten EV manufacturers list ... read more

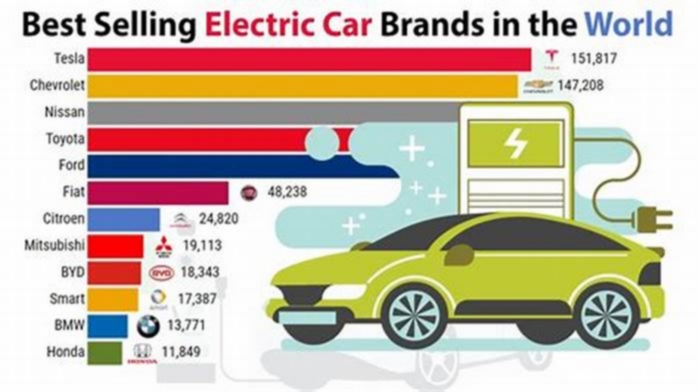

What is the most popular electric car brand in the world?

The top 9 electric vehicle manufacturersDire distress about climate change and CO2 emissions seems to have been in the air for decades, yet the idea of banning the sale of fossil fuel-consuming still sounds radical to the point of being unimaginable.And yet, today, no fewer than 51 countries around the world have announced plans to implement a ban on the sale of new gas guzzlers, with various dates for those rules kicking in (the earliest, just a few years away now, is 2025, which is when ... read more

Why aren t electric cars popular in Japan?

Why electric cars aren't big in Japan EV growth in Japan is minuscule Close7 mins read15 November 2023Japans car makers have always seemingly been at the cutting edge of automotive design and technology.Except, that is, with electric cars. Stand at the side of the streets of Tokyo, the worlds largest city, and you would do well to spot an electric car. I didnt knowingly see one in the best part of a week there, for the recent Japan Mobility Show.But that shouldnt have come as much of a ... read more

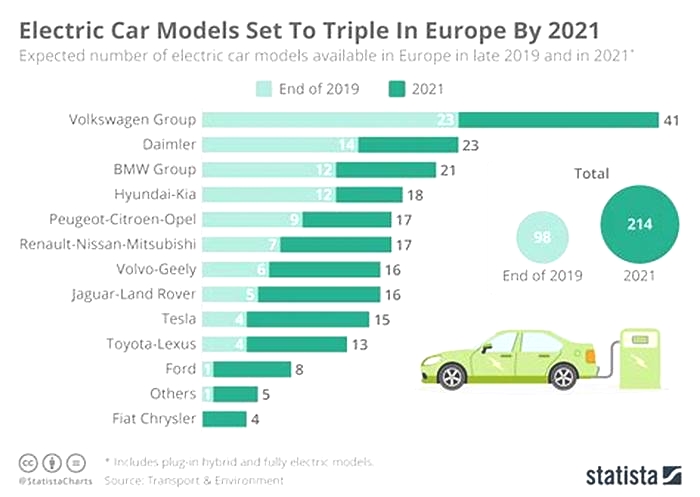

Comparing Popular Electric Vehicles in North America vs. Europe

Some characters could not be decoded, and were replaced with REPLACEMENT CHARACTER.A small but significant share of car owners in the United States have traded filling up for plugging in, and many more are thinking of joining them. In a recent Pew Research Center survey, 7% of U.S. adults said they currently have an electric or hybrid vehicle, and 39% said they were very or somewhat likely to seriously consider buying an electric vehicle the next time theyre in the market for new wheels.Outside ... read more

Electric Vehicles Popular in Southeast Asia with Focus on Affordability

Capturing growth in Asias emerging EV ecosystemThe case for immediate electrification of consumer transport is undeniable. The transport sector accounts for about 17 percent of global greenhouse gas emissions, and stimulating supply and demand for electric-vehicle (EV) adoption in the mass market will be pivotal for Asian countries to meet national emissions goals and a global 1.5-degree climate change target.For industry incumbents and attackers, accelerating EV ecosystem development across ... read more

Chevrolet Malibu EV: Electric Version of Chevrolet's Popular Sedan

General Motors to Axe Chevrolet Malibu in 2024, Replace With EV: ReportGeneral Motors introduced the current generation of Malibu in late 2015 as a 2016 model, and it lived up to its predecessor's legacy by earning its keep in sales and doing little else. But with Chevrolet walking its sedans off the plank and the Malibu's sales plunging for two straight years despite a 2019 refresh, the model's future is looking grim at best. According to a report by Automotive News, the American automaker ... read more

Ford Escape EV: Electric Version of Ford's Popular Compact SUV

Road Test: 2024 Ford Escape PHEV2024 Ford Escape PHEV Curiously, if you look at the electric section of Fords main consumer site, you wont find the 2024 Escape plug-in hybrid only the Mustang Mach-E, F-150 Lightning, and the E-Transit work van. Sure, theres a less prominent electrified section in its vehicles section, where youll find those plus the Escape plug-in hybrid that I drove for a week as well as a regular hybrid version of the Escape (look, ma, no plug).As one of six trims of Fords ... read more

Audi Q5 e-tron: Electric Version of Audi's Popular SUV

Everything we know about the Audi Q5 e-tron [Update]Update: Production section updated.The Audi Q5 e-tron that made its world debut at Auto Guangzhou 2021 in November 2021 entered its first and perhaps only market, China, in mid-2022. Heres everything we know about the regional Audi electric SUV.What is it?The Audi Q5 e-tron is not the successor to the Audi e-tron but a longer, more spacious version of the Q4 e-tron that debuted in April 2021. Like the VW ID.6 that it is based on, this electric ... read more