Why aren t Chinese cars sold in usa

Say goodbye to the U.S. car market as we know it: Cheap Chinese EVs are coming

- Chinese brands have mastered quality and affordability on EVs.

- After years of eyeing the American market, Chinese brands are poised to arrive.

- Competition from Chinese brands is "very, very real."

After years of preparation, Chinese car companies are poised to upend the U.S. electric-vehicle market.

Industry watchers say it's only a matter of time before Chinese automakers bring their impressive and importantly, inexpensive electric cars to the U.S. After years of threatening to set up shop on American shores, the companies are closer than ever to making the move to the U.S.

On their home turf, Chinese companies have already vanquished their American competitors, eating up market share from the likes of Ford and General Motors by offering better quality and less expensive electric cars for shoppers. They've started exporting a slew of brands to Europe too.

As Chinese car industry leaders like Nio and Geely eye a move to the States, the big question is can they overcome political frictions and will American buyers go along for the ride?

"It's going to be an interesting couple of years ahead to see whether Ford and GM and the like can stave off that Chinese competition coming in," said Martin French, a managing director at the consultancy Berylls. "From what we saw at the Shanghai auto show this year, that competition is very, very real."

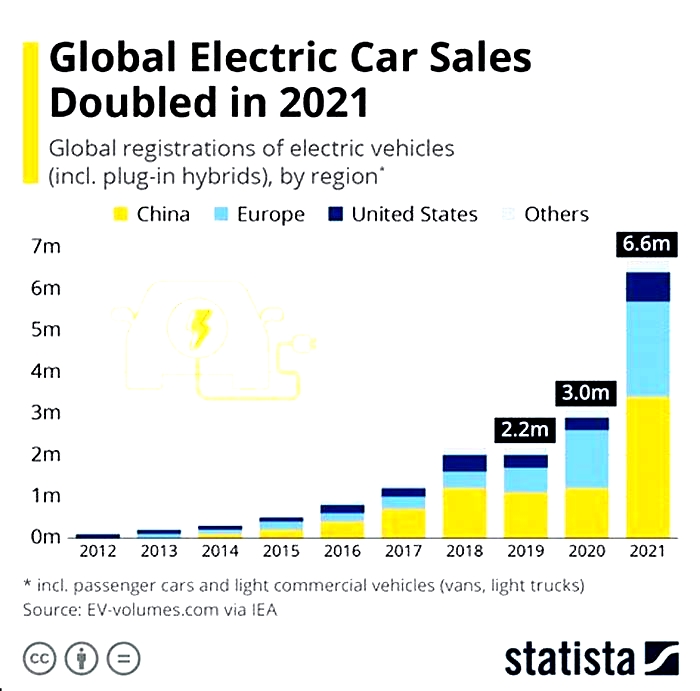

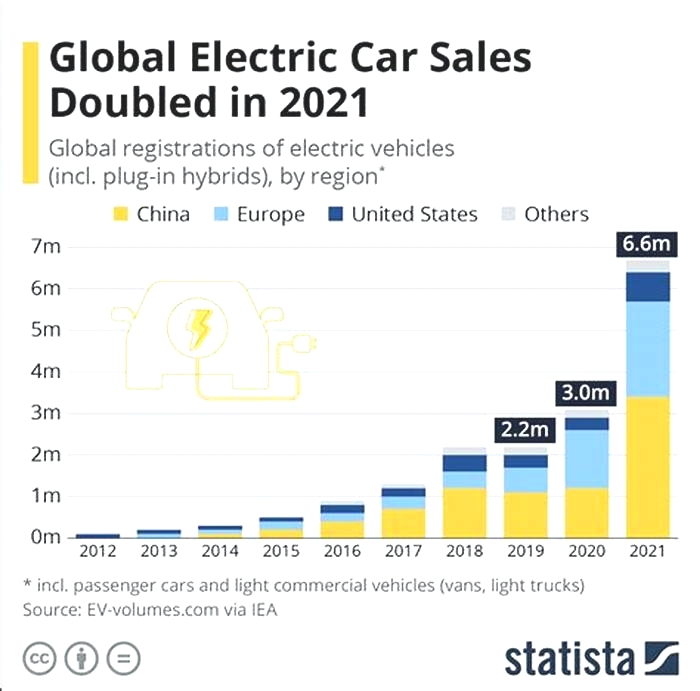

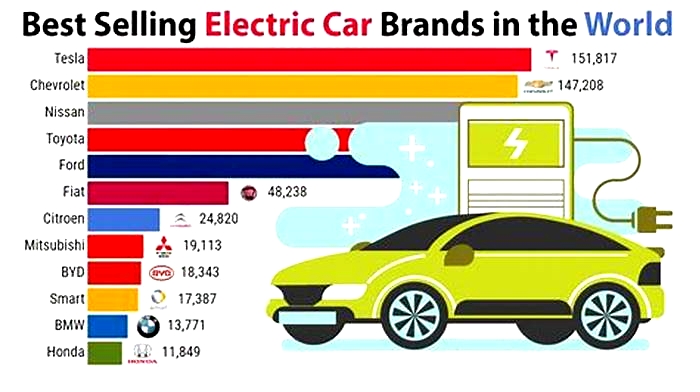

China's EV industry has exploded in recent years. In 2022, U.S. EV sales hit a new high of 800,000, while Chinese buyers snapped up some 5 million all-electric passenger vehicles. After years unchallenged, Tesla is about to lose its crown as the world's largest EV maker to a Chinese company, BYD.

Toyota, Hyundai, now BYD

In the 1970s, Japanese car companies like Toyota and Honda swooped in with affordable and fuel-efficient vehicles that knocked U.S. carmakers on their heels. More recently, Korean brands like Hyundai and Kia have been eating Ford and GM's lunch on SUVs.

History may repeat itself. Chinese EV manufacturers can gain a foothold in the U.S. by coming in at a budget price point, analysts said.

"Is it possible for Chinese companies to do what others have done before, only now with electric vehicles? The answer is absolutely," Bill Russo, a former Chrysler executive and CEO of Automobility, a Shanghai-based advisory firm, told Insider. "Who doesn't want affordable vehicles?"

But as political tensions between China and the U.S. intensify, entry into the American market could be more painful for China than it was for Japan or Korea. In addition to general anxieties from consumers who may be less likely to support a Chinese brand, analysts said, lawmakers are likely to apply more scrutiny to any Chinese company with plans to operate in the U.S.

A Trump-era import tariff of 27.5% remains in effect on Chinese cars, while the Biden administration's new tax credits for EV purchases favor vehicles built in North America with battery components that don't come from China.

China is winning on prices

American brands, including EV leader Tesla, have long been promising a long-range EV option priced at or below $30,000. But progress has been slow, and sometimes regressive. GM plans to cancel the Bolt EV, America's cheapest EV, by the end of 2023 and use that factory to build pricey electric pickups instead.

Meanwhile, Chinese brands are unmatched in affordability on their home turf and in Europe.

One of China's most popular EVs is the Wuling Hong Guang Mini, a minuscule city car that costs the equivalent of $5,000. At the Shanghai auto show last month, BYD launched a stylish, pint-sized hatchback called the Seagull with 190 miles of estimated range. Its starting price? Less than $11,000.

Tu Le, managing director of Sino Auto Insights, a consulting firm that specializes in the Chinese auto industry, says Chinese firms aren't skimping on quality for the sake of affordability.

"They have the products to back it up," he said. "I've driven a number of the Chinese EV brands, and boy oh boy, the Europeans are in trouble."

But Chinese domination won't happen overnight

Even when Chinese brands do hit American shores, it won't happen all at once. These companies are likely to test the waters with low-volume launches and study the market before diving in fully. Of the dozens of brands that may want a slice of the pie, only a few will be able to sell in the U.S. at any significant volume, Le said.

The carmakers most likely to break through first will be those that already have a global presence, Russo said: Geely and BYD. (BYD's CEO recently said the company isn't currently eyeing the American passenger-car market, but the company does already have a small commercial vehicle footprint here).

Polestar, a Swedish EV brand owned by Geely and Volvo, already imports from China. Nio, a startup, has announced plans to enter the U.S. by 2025.

The next step: Set up manufacturing in North America, which Le expects Chinese firms to do once they snag a foothold in the market. The sheer size of the U.S. car market means new entrants will need to build locally to compete seriously in the long term, he said.

"Americans think the tidal wave is coming from Silicon Valley. It's not," Le said. "It's coming from both directions."

Technology | Why cant Americans buy cheap Chinese electric cars?

By Kyle Stock | Bloomberg

EV variety is easy to find outside the US. Where American drivers now have about 50 electric cars to choose from, Europes array is almost double that, and Chinas nearly triple. With that variety come more small and midsize options, and more cars with price tags that wont break the bank.

Ask any US automaker and theyll say this is mainly a profitability problem. To pay for investments in electrification, carmakers are first focusing on trucks, SUVs and other premium models. That same tension is at the center of the United Auto Workers strike, which is pitting factory workers looking to preserve pay and benefits in an EV world against carmakers who say they cant go electric, meet union demands and stay in the black.

China, meanwhile, has become a global powerhouse in electric cars: Itsexpected to account for about 60% of the worlds 14.1 million new passenger EV sales this year, according to BloombergNEF. Many of those options are small and affordable; some are downright cheap. Take BYDsAtto 3, a small, front-wheel-drive crossover with one of the most advanced batteries in the game. The Atto 3 costs just $20,000 in China and starts at $38,000 in the UK and Europe. But not a single Atto 3 is headed for the US market.

Why not? The answer is part logistics and part politics.

Although the US has a strong track record of mainstreaming foreign cars Toyota is one of the countrys most popular brands the challenges of entering such a competitive market are hard to overstate. All foreign automakers do so at a disadvantage, starting with a 2.5% tariff on most imports. But intwo categoriesthat disadvantage is substantial enough to almost entirely stamp out foreign competition: pickup trucks and cars made in China.

Since a 1964 spat over European tariffs on poultry, the US has levied a 25% tax on imported trucks, now known as the chicken tax. That surcharge largely cleared the road for Detroits truck titans at least until Japanese brands established US factories to get around it and today means tricky economics for any foreign automaker looking to crack the lucrative American truck market.

The China dynamic is more recent. In 2018, just as China was starting to crank out a wave of compact EVs, US president Donald Trump implemented tariffs on about $370 billion of imports from the country each year, including a 27.5% tariff on cars made in China. That policy persists under the Biden administration. In Europe, by contrast, the tariff on Chinese cars is 9% low enough for those machines to at least trickle into the market.

If you have a 20% to 25% cost advantage, it makes sense to go to countries where even after the tariff you are price-competitive, Aakash Arora, a managing director in Boston Consulting Groups auto practice, told Bloomberg News.

But tariffs are just the first hurdle for a global car company looking to crack the US market. Most Chinese cars havent been engineered with US safety regulations in mind;just going through those protocols is an expensive and elaborate process. Then theres the cost of building a retail network and some sort of safety net for servicing cars and backstopping warranties.

Dave Andrea, a principal at Michigan-based consultancy Plante Moran, compares the US auto market to a siren song: compelling until you get close enough to see the risks. Its a big market, but not a growing market per se, he says. And you have to displace existing manufacturers, existing brand loyalty.

Newcomersmust pour enough money into marketing to get some semblance of name recognition a tall order for foreign companies and EV upstarts alike. California-based Lucid Group, a startup that makes the longest-range electric car in the US, saw brand awareness as important enough to spring for a commercial during this years Oscars (at an estimated cost of $2 million).

Even established foreign brands struggle for relevance with American buyers. You could argue Fiat has been a bust in America, says Kevin Tynan, an analyst at Bloomberg Intelligence. Mitsubishis done nothing, Isuzus gone and Mazdas probably hanging on by its fingernails.

If Chinese carmakers were somehow able to overcome tariff economics, dealer-network logistics and marketing hurdles, they would still face another challenge in the US. There may bea decent chance of American consumers going for a Chinese EV, but theres almost no chance of US politicians supporting an auto-market evolution that benefits Chinese companies over American ones.

Trump put [the China tariff] on there honestly in a fit of pique, but its going to stay, says economist Mary Lovely, a senior fellow at the Peterson Institute. In Washington right now, theyll go after anything that looks like its got a Chinese component.

A flavor of this tension is already playing out in the European Union, where Chinese brands accounted for an estimated 8% share of EVs last year, according to an EU official. In a bid to ward off a flood of cheap imports, the European Commission on Sept. 13 launched an investigation into Chinas EV subsidies. President Ursula von der Leyen said prices for Chinese electric cars are kept artificially low by huge state subsidies, which is distorting our market.

For the US EV market, what comes next hinges in part on the UAW negotiations. This year through August, US factories made about 7 million cars and trucks, according to Bloomberg Intelligence data, almost two thirds of which came from union plants.

If the carmakers concede to the union on higher pay, Tynan expects they will in turn negotiate for a smaller, more flexible workforce, which would lock in fewer car models, fewer cars and higher prices. If I can sell less and make more, thats the whole point, he says.

In short, Detroit is drifting further and further from the starter car, while factories in China are specializing in it. Just dont expect the latter to solve for the former anytime soon.

More stories like this are available on bloomberg.com

2023 Bloomberg L.P.

China isn't buying American cars anymore and it's bad news for everyone except Tesla

- American car companies' sales in China have been on a steady decline.

- "The market has totally changed," Jim Farley, the CEO of Ford, said about China

- Without China, American car companies will likely lean into US electric-vehicle sales.

Thanks for signing up!

Access your favorite topics in a personalized feed while you're on the go.

This story was originally published in April 2023.

Chinese automakers are giving US car companies a run for their money, especially as the momentum behind electric vehicles accelerates and that could force Ford and GM to make some hard decisions.

Other than Tesla, popular US auto brands lost major ground in China last year, the world's largest car market that's critically important to manufacturers. GM's car sales there fell by 20% from 2021, while Ford's declined by 33.5%, according to advisory firm Automobility Ltd.

"The market has totally changed," Jim Farley, the CEO of Ford, told reporters at an April charity event in Detroit. "We're going to have to rethink what the Ford brand means in a place like China."

That's especially true as EVs take center stage, Farley said, noting that he has learned the luxury brands that sell only electric vehicles do best in Chinese markets.

Chinese EV-maker market share in China rose by 17% in 2022, while that of foreign automakers dropped by 11%. Some of this can be attributed to Chinese car companies' ability to build better and cheaper cars, especially EVs, that consumers are keen to buy.

"It's pretty much the consensus belief that the US automakers are increasingly irrelevant" in China, Edison Yu, an analyst at Deutsche Bank, told Insider.

"As we make this transition to EV, the GMs, the Fords in China will really have to be very bold and aggressive to find success," Yu said.

"At some point, there needs to be either a decision to continue or to pull out," Yu said. "We're at a point where one does need to make a decision on their future."

Car companies will double down on US buyers and EVs

As the industry bounced back from the Great Recession, and China became the fastest-growing and most EV-friendly car market in the world, American car companies rushed to enter the market.

But as political tensions intensify between China and the US, operating in China is starting to become more of a risk for US companies.

Add in the fact that Chinese brands spent the last several years sapping up industry know-how from joint ventures with US brands, and the Chinese market suddenly becomes a much more hostile place for American companies.

That means that US companies will redouble their EV efforts at home, where they can count on a more reliable and loyal customer base. The one kink in that plan is Elon Musk and his ongoing price war.

"Price wars are breaking out everywhere. Who's going to blink for growth?" Farley said at the event.

The China versus America face-off is at a stalemate for now

While American companies lose ground in China, there is a bright spot. The pandemic forced automakers to make more with less, by shifting their supply chains and focusing on the markets where they make the biggest profit margins.

GM largely led the charge to exit money-losing markets, pulling out of Europe in 2017 and later leaving Russia, India, and Australia. The company still operates in China but is struggling to defend its market share. GM's China sales fell 25% in the first quarter of 2023 after retreating 20% last year.

The retreat from China and a hyper-focus on the US could be risky.

Making up the difference in Europe isn't likely to be an option for US car companies Europe's a market that Chinese car makers are already aggressively chasing after, and the competition is increasingly fierce.

While there aren't currently any Chinese car brands for sale in the US, the concern is that eventually, Chinese automakers could eventually make a play to upend the US market.

"What happens in China will not stay in China," Bill Russo, the CEO of Automobility, told Insider in January.