Why aren t electric cars popular in Japan

Why electric cars aren't big in Japan

EV growth in Japan is minuscule

Close

7 mins read15 November 2023

Japans car makers have always seemingly been at the cutting edge of automotive design and technology.

Except, that is, with electric cars. Stand at the side of the streets of Tokyo, the worlds largest city, and you would do well to spot an electric car. I didnt knowingly see one in the best part of a week there, for the recent Japan Mobility Show.

But that shouldnt have come as much of a surprise: from 2016 to 2021, EV sales accounted for between 0.4%

To access this content please subscribe

Already registered?

Login 20% annual savingRegular membership

Automatic renewal

Team membership

799

Price includes a 20% discount for a team of 5

Electric vehicles in Japan - statistics & facts

In 2022, HEV was the most-purchased vehicle type overall in Japan, surpassing vehicles that solely used gasoline. Hybrid electric vehicles were by far the

most popular electrified vehicle type sold in Japan. The country has a comparatively long history of producing modern hybrid vehicles. Toyota Prius was the first widely available hybrid vehicle on the car market, launched in 1997.

Carbon neutrality in the transportation sector

The

transportation sector in Japan emits significant amounts of CO, most of which are caused by private and commercial road vehicles. In 2020, about 15 percent of Japans CO emissions came from automobiles. Since Japan aims to become carbon neutral by 2050, the transportation sector has to undergo drastic changes to achieve this goal. One of the stated targets of the automobile industry is for all sales on the domestic market to be electrified vehicles by 2035.

The road to carbon neutrality in Japans transportation sector is still long and winding. While

hybrid electric vehicles (HEV) have become mainstream, this vehicle type is not emission-free as it also has a conventional combustion engine. Other electric vehicle types have zero tailpipe emissions but currently comprise a negligible portion of the vehicle market in Japan. Moreover, even vehicle types that have zero tailpipe emissions, such as BEVs and FCEVs, are often not entirely green. For instance, hydrogen refueling stations used by FCEVs often provide blue or grey hydrogen created in industrial processes that emit CO. Similarly, recharging stations for BEVs use energy from Japans energy supply grid which still largely relies on fossil fuel resources.

The way forward

The Japanese automotive industry is pursuing a multi-directional approach to reach its emission reduction targets by further developing and deploying

"next-generation vehicles". This includes the entire range of electrified vehicles, as well as gasoline and diesel vehicles that employ technologies to mitigate emissions. As of yet, Japanese consumers seem reluctant to choose fossil-fuel-free propulsion vehicle options. The high price of cars, apprehensions regarding vehicle performance, and the perceived lack of infrastructure are leading concerns of consumers. Further governmentinvestment in infrastructure and creating incentives for the private sector might be required to break new ground, particularly with the hitherto less successful electric vehicle types.

This text provides general information. Statista assumes no liability for the information given being complete or correct. Due to varying update cycles, statistics can display more up-to-date data than referenced in the text.

The Rise of Electric Vehicles in Japan: An Exploration of Market Trends

The automotive sector accounts for over 89% of Japans GDP. In fact, Japan is the worlds third-largest automotive manufacturer! Nevertheless, unlike several other Asian countries, Japan has been slow to adopt zero-emission vehicles (ZEVs).

As the global shift to ZEVs accelerates, the success or downfall of Japans automotive sector will impact the countrys economic stability. As a result, Japans still-emerging role in the evolving global EV landscape will take on significant implications.

This article delves into Japan's ZEV landscape from multiple angles, offering a comprehensive exploration.

- What is the current state of Japans EV market, and how have governmental policies and national EV targets shaped it?

- How is the market share distributed among different vehicle types and commercial EV OEMs?

- What potential challenges does the Japanese EV market face, and how do these challenges impact EV adoption in Japan?

Japans Current EV Market

In Japan, the term Clean Energy Vehicles encompasses a variety of eco-friendly technologies, including battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), hydrogen fuel cell electric vehicles (FCEVs), natural gas vehicles (NGVs), biofuel vehicles (BVs), and solar-powered vehicles (SVs).

This article will use xEV to refer to these vehicles collectively, and ZEV to specifically denote emission-free options like BEVs, PHEVs, and FCEVs.

Japans vehicle market has long been wary of zero-emission vehicles. It has instead favored hybrid vehicles, which controlled 70% 90% of the market throughout the 2010s. Additionally, the government, led by Prime Minister Abe Shinzo, initially focused on hydrogen fuel-cells for car electrification.

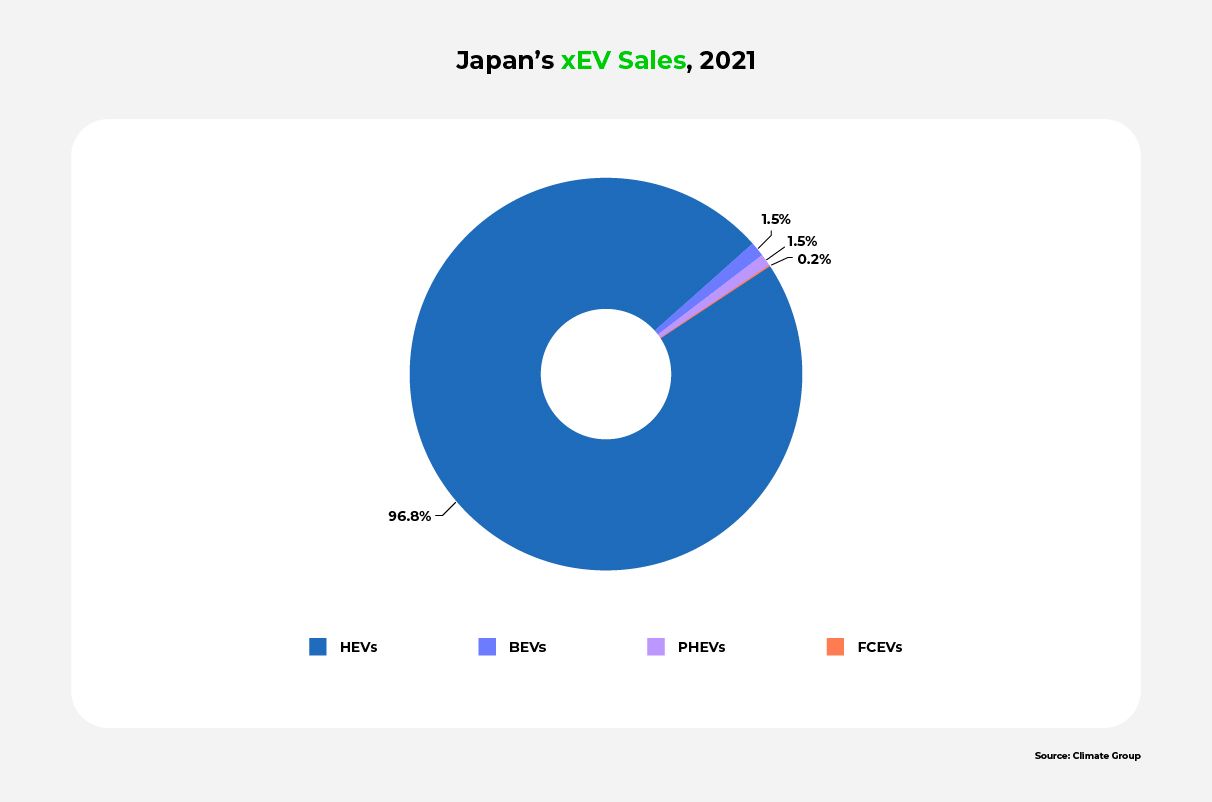

Due to this focus on hybrid and hydrogen technologies, Japan has been slow to respond to the global EV trend. In 2021, although xEVs constituted about 33.5% of total car sales in Japan, BEVs accounted for just 1.5% of these.

More recently, however, Japan's commitment to net-zero emissions by 2050 and 46% emission reduction by 2030 has begun to popularize EVs. In 2022, Japan hit an all-time high in ZEV sales: 92,000, representing a 109% YoY increase. Studies predict that, between 2023 and 2032, BEV sales will increase, ultimately achieving a 37.8% revenue share.

The driving force behind this trend is twofold: OEMs intensifying efforts to enhance and reintroduce electrified versions of existing conventional cars, on the one hand, and governmental policies to encourage xEV adoption, on the other.

Japans domestic 2-wheeler market has declined by over 50% over the past 30 years; Japanese motorcycle manufacturers now generate most of their profits from overseas markets. Although interest in electric scooters is growing, consumer demand is not strong enough for domestic 2-wheeler EV sales to constitute a significant component of the market.

Government Incentives & National EV Targets

Japan has been struggling to keep up with global EV trends. Clean energy vehicle policies face challenges including limited lithium resources, unstable energy sources, industry growth, and CO2 reduction.

The over-prioritization of HEVs has further slowed down progress, as has Japans shifting stance on ZEVs due to global trends and local demand. As the situation intensifies, Japans government is gradually recognizing the need for action, and is adopting tax redemptions, incentives, and mileage tax discussions. At this point, Japan must choose between proactive hydrogen plan suspension or market-driven action.

National EV Vision

Electrified Vehicle Strategy 2050

Japan aims to transition all vehicles produced by Japanese automakers in global markets to xEVs by 2050. This ambitious long-term goal is intended to achieve world-leading environmental performance and support a Well-to-Wheel Zero Emission approach, effectively eliminating emissions throughout a vehicle's lifecycle, from fuel production to operation.

Green Growth Strategy Through Achieving Carbon Neutrality in 2050

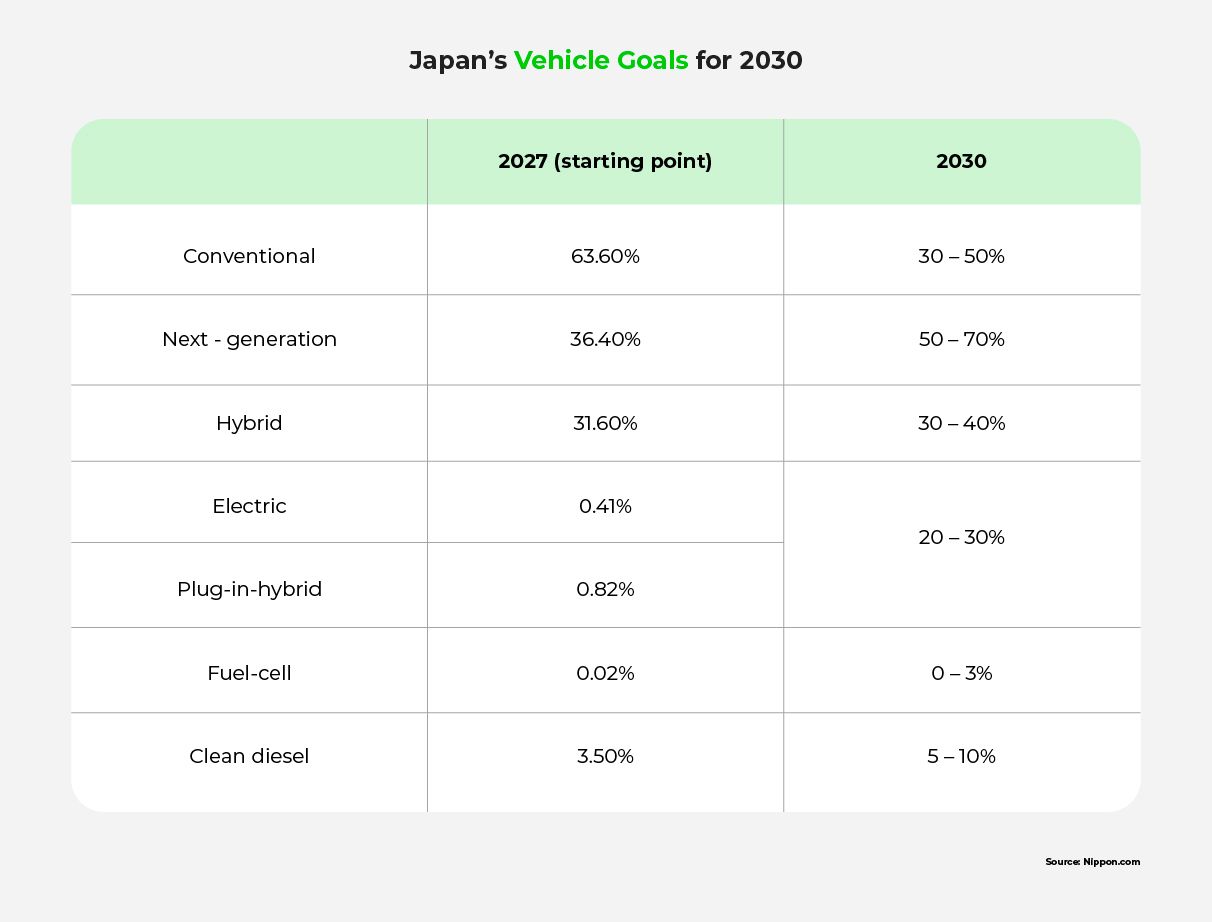

The Ministry of Economy, Trade, and Industry (METI) set out a new policy goal in 2021, as part of the Green Growth Strategy: to achieve 100% xEV vehicles sales by 2035. This includes HEVs, where sales already comprise almost 30% of the total in Japan.

Japans 2030 Fuel Efficiency Targets

Japans national government has announced plans to increase the percentage of EVs and PHEVs in passenger car sales to 20-30%, and the percentage of FCVs up to 3%, by 2030.

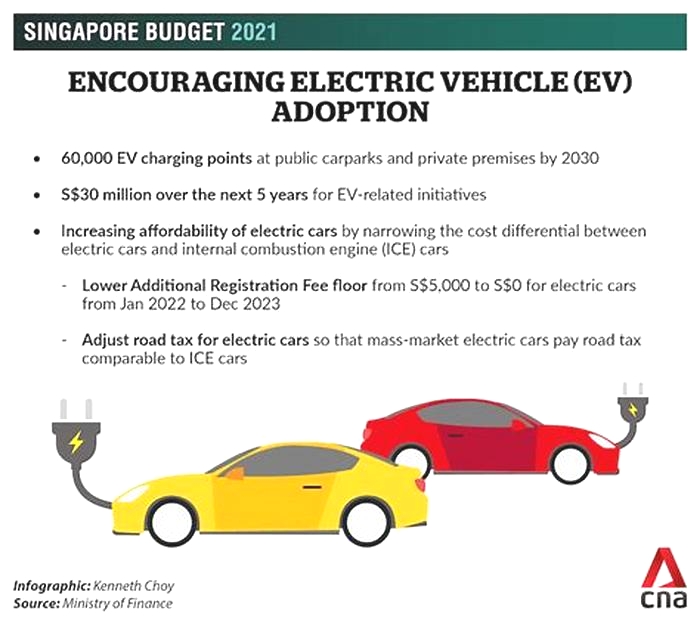

Japans EV Charging Infrastructure Landscape

Tokyo Electric Power Company Holdings (TEPCO) is planning to boost the number of rapid chargers on highways to 1,000 units by 2025. Meanwhile, the government in Tokyo is working to expand the network of public charging points from the current 30,000 to 150,000 by 2030.

EV Supply-Side Incentives

Research and Development Grants

Japan currently invests in EV R&D, focusing on batteries and charging tech for improved capabilities. Government support includes $2.2 billion for battery production and $1bn subsidies for manufacturers like Toyota, aiming to bolster supply chain security.

Tax Reductions

To encourage the transition from gas to electric/hybrid cars, reducing lithium-ion battery costs is key. Accordingly, Japan is considering implementing tax incentives for firms investing in emission-cutting battery production facilities.

Financial Assistance for Charging Infrastructure

The Japanese government is providing a total of 12.5bn (USD 85mn) for e-mobility in a supplementary budget for 2021. They have designated a budget of 6.5B (USD 59.5mn) to establish new charging stations, and 6bn (USD 54.9mn) to develop new hydrogen filling stations.

Government Procurement Incentives

Japan's Act on Promoting Green Purchasing sets a strong green procurement framework. Government agencies are mandated to practice it across product categories. xEVs, including passenger cars, buses, and trucks, are part of the procurement database.

EV Demand-Side Incentives

Subsidies for EV Purchases

In 2021, Nikkei reported 25 bn (USD 193mn) subsidies for electric and fuel cell vehicles. BEV incentives reached 800,000 (USD 5,460) per vehicle, but eligibility requires access to renewable charging sources, which is challenging for urban residents.

Reduced Acquisition Tax

The Eco-Car Tax Break offers deductions or exemptions on motor vehicle tonnage tax, automobile acquisition tax, and motor vehicle tax for xEVs. Eligible types of vehicle also include efficient internal combustion engine vehicles.

Exemption from Automobile Weight Tax

The Japanese government aims to boost EV and hybrid adoption through revised vehicle weight tax (VWT) rules. Starting January 2024, vehicles hitting 80% of Japans fuel-economy target will receive 50% tax cuts; vehicles hitting 70% will receive 25% tax cuts. These rules will change by May 2025, requiring vehicles to meet 80% and 90% of the fuel-economy target to receive 25% and 50% breaks, respectively.

Lowered Road Tax

In Japan, combustion-powered vehicles can be taxed up to 110,000 (USD 789) annually, based on engine size. However, all EVs and fuel cell vehicles are taxed at a flat rate of only 25,000 (USD 178) per year.

Subscribe to our Newsletter

Major Players in Japans EV Market

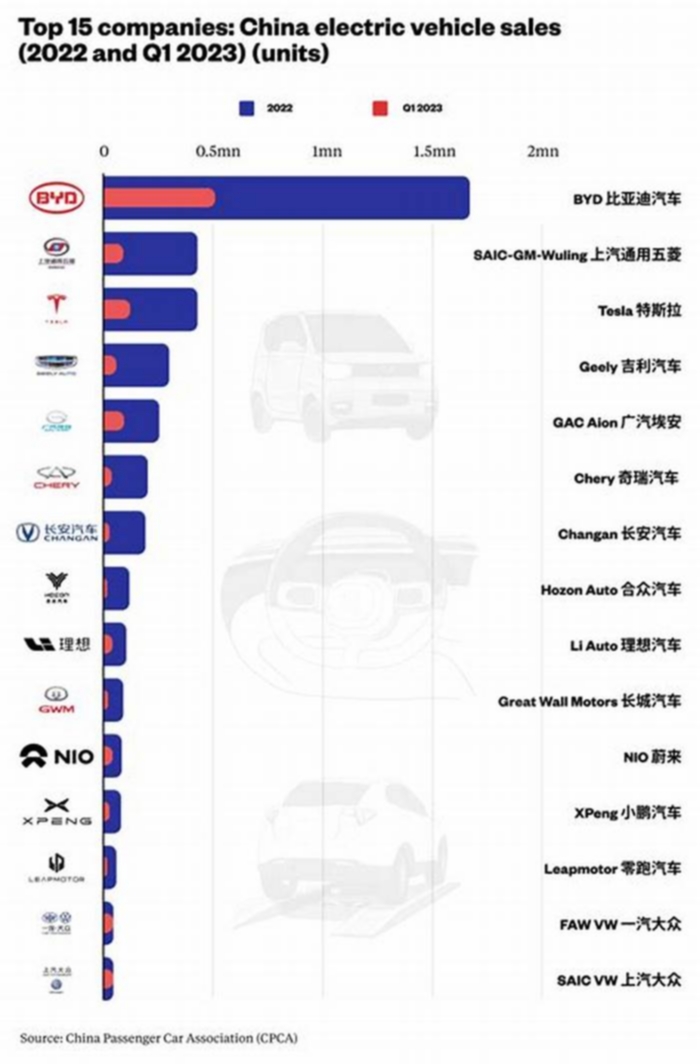

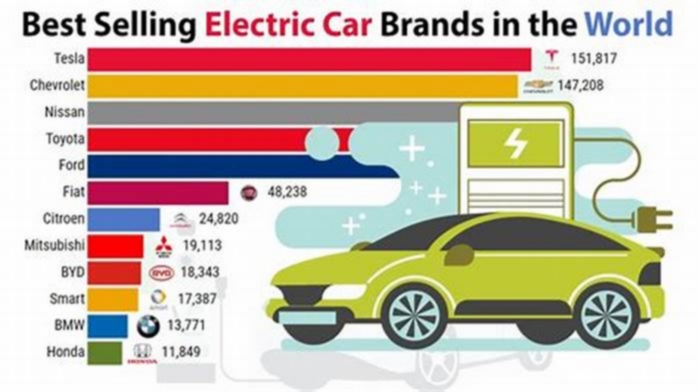

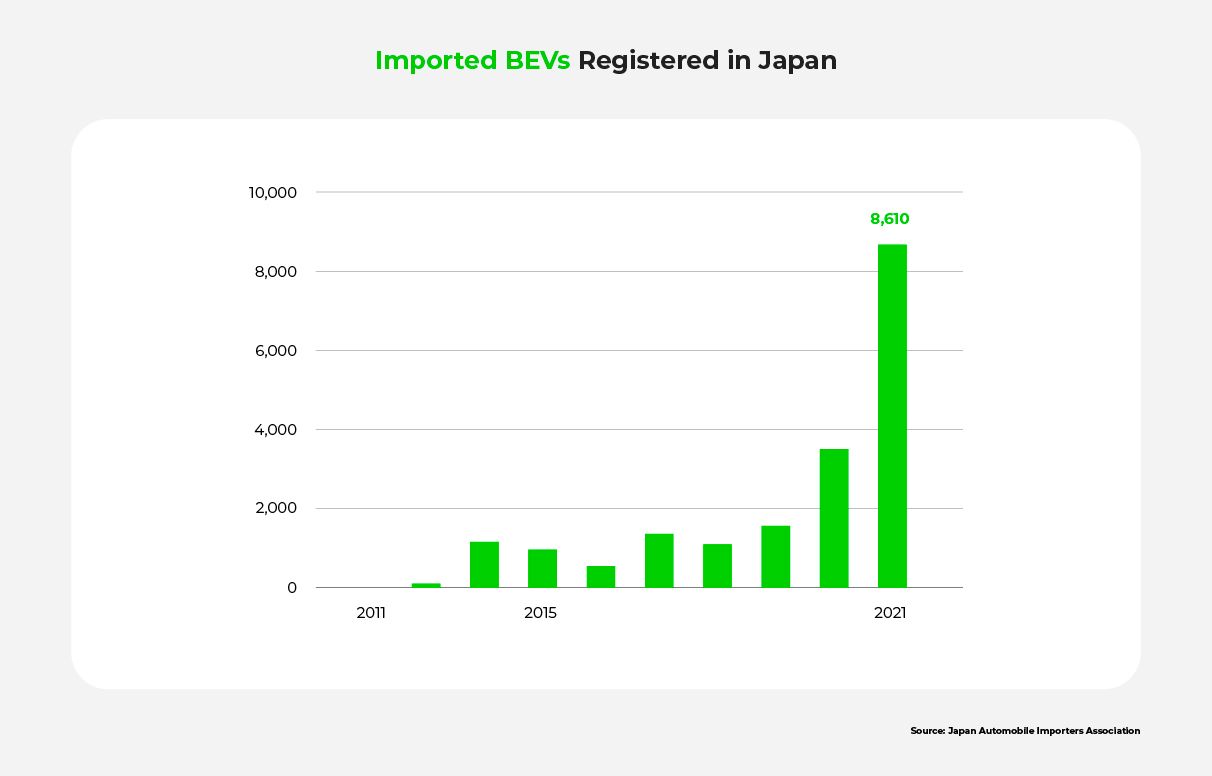

In the realm of imported cars, electric vehicles (EVs) are making significant headway. Sales of foreign electric passenger cars soared by 64% to 16,430 in FY2022, securing a 6% share in the imports market. While Japanese brands predominantly focus on electric minicars, foreign players like Tesla, BYD Auto, and Audi offer luxury EV options.

Domestic OEMs

In 2020, Japanese-made xEVs tallied around 120,000 units, shared between Nissan and Toyota. Since then, however, due to the governments net-zero emission commitments, domestic OEMs have announced plans to launch their own EVs.

Toyota plans to expand its EV range, focusing on technological development in China. Nissan is investing in Renault's Ampere for European EV ventures and hastening New Energy Vehicle (NEV) launches due to sales declines in China. Other Japanese OEMs like Suzuki, Mazda, Mitsubishi, and Subaru are introducing multiple EV models and aiming for substantial EV ratios in their respective markets by 2030.

Currently, minicars, defined as cars with sub-660cc engines, significantly contribute to Japan's EV growth, comprising 54% of the market in FY2021. The top-selling Japanese EV in FY2022 was the Nissan Sakura; thanks to its smaller lithium-ion battery, its relatively affordable price 2.54 million (USD 19,300) has boosted its popularity.

Overseas OEMs

In 2021, out of the 8,610 foreign EVs sold in Japan, more than half were Teslas. Volkswagen EVs were also popular. Hyundai gained traction in 2022, and 2023 marked BYDs entrance into the passenger EV market.

Tesla

Tesla's EV lineup (Models S, 3, X, and Y) bolstered brand visibility in Japan, especially in urban areas with accessible chargers. The Model Y price dropped 24% in 2021, aided by local delivery centers. Meanwhile, urban-focused charging infrastructure expanded via Teslas Supercharger network growth.

Volkswagen

Volkswagen entered Japan's EV market in 2017 with ID.3 and ID.4 models tailored to Japanese preferences. Volkswagens EV manufacturing innovations, such as metal binder jet 3D printing, are expected to further accelerate sales.

BYD

BYD's global 7+4 Full Market Strategy has expanded to Japans EV market. Unlike Tesla, which has a proprietary charging network and focuses primarily on EVs, BYD complements country-specific charging strategies and boasts a diversified portfolio spanning various aspects of clean energy and transportation.

Hyundai

After 12 years away from the Japanese market, Hyundai has returned with its Nexo hydrogen fuel cell EV and Ioniq 5 battery EV. Partnerships with DeNA's car sharing and Sompo Holdings for vehicle rentals strengthen Hyundais prospects.

Major EV Fleets

Japans fleets primarily consist of light commercial vehicles used for employee pool cars. Brands like Honda, Toyota, Nissan, Mitsubishi, Mazda, Suzuki, Mitsubishi, and Daihatsu offer electric vehicles for this sector. Car sharing companies like Times Car and taxi and car rental fleets also play a significant role.

Although fleet business is a small part of Japans automotive market, growing interest in electric fleets is evident. DHL Express is deploying 19 electric trucks in Japan in 2023 to cut carbon emissions. Initially, four Hino Dutro Z EVs will serve pickup and delivery operations in Tokyo's Chiyoda, Shibuya, and Taito wards.

Potential Challenges in Japans EV Market

Although Japan is actively moving towards an electric future, effectively addressing its challenges will require a gradual shift. These challenges involve limited resources, supply chain disruptions, environmentally damaging resource extraction, and inadequate charging infrastructure in terms of both quantity and quality. As a result, domestic OEMs are approaching BEVs with caution.

Insufficient Stakeholder Participation

Ironically, Japans delayed entry into the EV market is largely attributable to its past successes: its mastery of internal combustion engine manufacturing, and its robust hybrid vehicles.

Hybrid production is a revenue cornerstone for Japanese automakers, dissuading them from investing in new areas. Industry leaders are wary of undermining existing strengths, while engineers who specialize in complex hybrids find simpler EVs less engaging. Meanwhile, executives fear that switching to ZEVs, which have fewer parts, will negatively impact supplier networks. These factors collectively contribute to Japan's hesitation to commit to EVs.

Inadequate Charging Infrastructure

Japan's electric vehicle charging infrastructure lags behind many other countries. As of 2021, there were only around 29,000 public charging stations nationwide, many of which were dilapidated. In rural regions, stations are disproportionately absent. Furthermore, Japan has only 160 hydrogen refueling stations for fuel cell vehicles. Although there are 7,600 quick chargers available, over 40% are situated in car dealerships, and are therefore challenging to access. Notably, 18 geographical areas lack charging facilities within a 44-mile highway radius, and 60 areas along major roads lack charging facilities within 25 miles. This scarcity discourages EV adoption.

Furthermore, the number of charging stations is going down instead of up. Currently, high output chargers above 200 kilowatts face stringent safety regulations, resulting in elevated costs. Installing 200 kW charging equipment costs tens of millions of yen, plus ongoing operational expenses. The Japanese government subsidized 67% of charging piles constructed between 2013 and 2016, but private sector interest has remained limited since then. Consequently, as of February 2023, there were 800 fewer charging stations than in March 2020.

Since Japan's charging infrastructure is so limited, it has not yet overburdened the national grid. However, global experience indicates that, as EV demand surges, Japan will need to upgrade its grid to keep up.

Battery Technology and Range Issues

As other countries have discovered, lithium ion batteries face challenges in grid-scale energy storage due to degradation, cost, and safety issues. Despite their relatively high energy density compared to other batteries, they remain far less energy-dense than gasoline.

Cost Concerns

The battery industrys heavy reliance on materials like lithium, nickel, and cobalt presents cost concerns. Along with rising demand and disruptions like the Chilean mine disaster in 2010, lithium prices soared and projected a 40-fold demand increase by 2040. Global trade barriers challenge Japan's export-oriented model, necessitating domestic technology retention and supply chain improvement.

Energy Density Limitations

Energy density of mainstream lithium iron phosphate and ternary lithium batteries falls short of development needs, limiting their applications.

Safety Risks

Safety concerns include thermal runaway from overcharging, lithium precipitation, and electrolyte overheating during rapid charging, risking combustion.

Temperature Fluctuations

Temperature fluctuations impact battery performance, with low temperatures increasing viscosity and reducing energy, and high temperatures destabilizing battery interfaces. For instance, batteries rated for 100% capacity at 27C (80F) may deliver only 50% at -18C (0F), impacting performance in Japans particularly cold regions, such as Hokkaido.

Opportunities for Future Growth

As demand increases, Japan is determined to reclaim its place on the world stage of zero-emission vehicles. Despite external competition, there are plenty of opportunities for Japan's traditional automotive giants to excel and succeed in this new era of sustainable mobility.

Digital Transformation and IoT Connectivity

Embracing the CASE concept (connected cars, autonomous driving, sharing, electrification), the global automotive industry is shifting towards a technology-driven landscape. Connected vehicles will create a booming mobility services market, propelled by semiconductors, sensors, autonomous algorithms, and cybersecurity.

Japans smart city strategy, which involves using digital technology to enhance urban life, aligns with this trend, providing a perfect context for EV adoption. Practices such as smart charging, smart parking, and integrated eco-friendly transportation options will fit seamlessly into Japans existing urban frameworks.

Japan's progress is evident, with initiatives like Nissans Choimobi Yokohama car-sharing service promoting low-emission transport and sustainable urban mobility. The service targets ultra-compact EVs, and aims for public-private collaboration to expand its reach.

Electric Mobility and Infrastructure Development

Challenges in charging infrastructure and battery production hinder EV adoption in Japan, but also offer growth prospects. Addressing these hurdles involves exploring charging station development and battery advancements.

Charging Infrastructure

Japan's stringent safety regulations inflate costs, particularly for high-output chargers; Japan could consider deregulating standards for >20 kW chargers to foster innovation. In addition, Japan could proactively mitigate any future space constraints by exploring innovative mobile chargers, equipped with AI for locating EVs and wireless stations.

Battery Production

Japan's battery resource scarcity could be countered via deep-sea mineral extraction. Alternatively, focusing on next-gen batteries is promising; solid-state batteries with non-flammable electrolytes would ensure safety, while lithium-air batteries would offer high energy density for extended ranges. Toyota, Honda, and Nissan are optimistic about producing these advanced batteries by the mid to late 2020s, potentially offering a competitive edge.

Circular Economy Models and Sustainable Practices

The drive towards EV growth is intrinsically linked to curbing CO2 emissions. However, for this effort to be meaningful, the electricity used to power and manufacture EVs must come from low-emission sources. Other countries have been exploring solutions involving repurposing EVs as stationary storage batteries during downtime, fostering a cycle where increased EV usage promotes renewable energy adoption and vice versa.

In Japan, Nippon Car Solutions and Nippon Rent-A-Car Service, Inc. have initiated an EV rental program in collaboration with Kyushu Electric Power Company. This innovative project aims to harness renewable energy through a solar power plant coupled with EV rental storage batteries.

Resource scarcity poses another hurdle for Japan's ZEV development. Recycled materials offer a solution, by reducing reliance on imports. Japan acknowledges this, and is exploring circular economy practices within the EV sector, focusing on strategies such as reuse, repair, refurbishment, remanufacturing, and recycling. Additionally, Japan could capitalize on its existing vehicle stock by transforming existing internal combustion engine and hybrid vehicles into EVs.

Investment in Research and Development

Japans strong foothold in ZEV and battery technology presents significant opportunities for the country to thrive in the global xEV trend. The government recognizes these advantages and is actively backing the research and development of ZEV-related technologies.

In 2022, Japan allocated substantial funds around 331.6bn (USD 2.5bn) to enhance materials for magnets and batteries. This investment aims to reduce reliance on rare earth elements and lithium. The private sector is also increasing R&D investments, with companies like Honda committing $64bn for research over the next decade.

Japan's history of successful collaboration between the government and private sector has been pivotal in driving innovation, industry growth, and economic prosperity. As the nation invests in EV research and development, it is poised to become a technological leader, fostering job creation and economic expansion.

The Future Of Japans EV Market

Japan stands at the crossroads of its automotive legacy and the rapid global shift towards ZEVs. Despite already being a major player in the automotive industry, Japan grapples with substantial challenges, such as limited resources, charging infrastructure, and battery technology issues.

However, Japan is expressing its determination to evolve. The governments ambitious targets for ZEV adoption and investments in research and development underscore the countrys commitment to leading the charge in sustainable mobility. Collaborations between public and private sectors, innovative initiatives such as repurposing EV batteries for renewable energy storage, and the exploration of circular economy models demonstrate Japan's multifaceted, strategic approach.

By embracing opportunities in digital transformation, advanced battery technologies, and international collaboration, Japan is positioning itself to not only catch up but also excel in the global ZEV trend.

The road ahead may be challenging, but Japan's automotive prowess and adaptive spirit pave the way for a promising electric vehicle revolution.

Want to know more about Japans EV landscape? Please visit the FAQ and Resources sections below!

FAQ

What key factors are driving EV adoption in Japan?

Key factors driving EV adoption in Japan include government targets for emissions reduction, increased emphasis on clean energy, and growing public awareness of environmental concerns.

How is the Japanese government supporting the growth of the EV industry?

The Japanese government supports the EV industry through R&D grants, tax reductions, financial assistance for charging infrastructure, and subsidies for EV purchases.

Which companies are major players in the Japanese EV market?

Major players in Japan's EV market include Toyota, Nissan, Honda, Suzuki, and Mitsubishi. Foreign companies like Tesla and Volkswagen also have a presence.

What incentives are available for Japanese consumers to purchase electric vehicles?

Incentives for consumers include subsidies for battery-electric, plug-in hybrid, and fuel cell vehicles, reduced acquisition tax, and exemption from automobile weight tax.

What are the projected trends for EV growth in Japan?

Projections indicate that BEVs will dominate with a 37.8% revenue share by 2032. Passenger cars are expected to lead EV sales, driven by OEM efforts and government incentives.

How does the Japanese EV market compare to other global markets?

While Japan's EV market is growing, it initially lagged behind due to a focus on hybrid and hydrogen technologies. However, recent advancements and policy shifts are positioning Japan to catch up with and excel in the global EV trend.

Resources

Spherical Insights: Japan Electric Vehicle Market Insights Forecasts to 2032

Discover market insights regarding Japan's EV landscape here.

Mordor Intelligence: Japan Electric Car Market Size & Share Analysis Growth Trends & Forecasts up to 2028

Learn about trends in the Japanese electric car market here.

Climate Group: Japan and the Global Transition to Zero Emission Vehicles

Explore Japans role in global ZEV trends here.

LUT University / Agora / Renewable Energy Institute: Renewable Pathways to Climate-Neutral Japan

Read about Japans determination to harness renewable energy here.

NIMS: The Challenge of the Rechargeable Battery Revolution

Learn about Japans advanced battery technology research projects here.