Why did hydrogen cars fail

Hydrogen cars wont overtake electric vehicles because theyre hampered by the laws ofscience

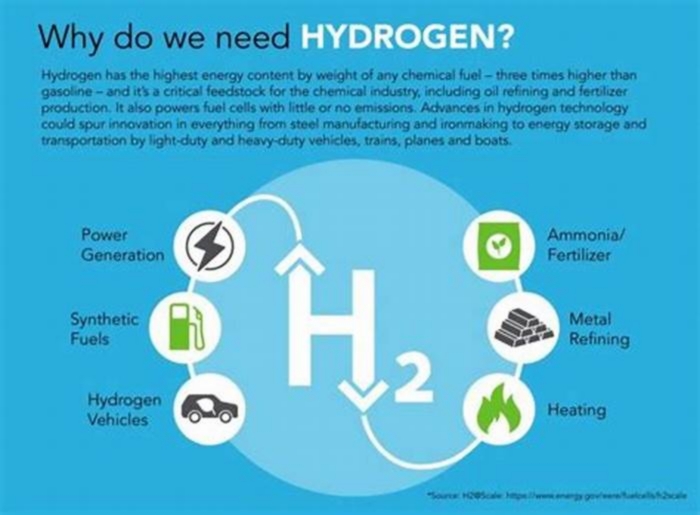

Hydrogen has long been touted as the future for passenger cars. The hydrogen fuel cell electric vehicle (FCEV), which simply runs on pressurised hydrogen from a fuelling station, produces zero carbon emissions from its exhaust. It can be filled as quickly as a fossil-fuel equivalent and offers a similar driving distance to petrol. It has some heavyweight backing, with Toyota for instance launching the second-generation Mirai later in 2020.

The Canadian Hydrogen and Fuel Cell Association recently produced a report extolling hydrogen vehicles. Among other points, it said that the carbon footprint is an order of magnitude better than electric vehicles: 2.7g of carbon dioxide per kilometre compared to 20.9g.

All the same, I think hydrogen fuel cells are a flawed concept. I do think hydrogen will play a significant role in achieving net zero carbon emissions by replacing natural gas in industrial and domestic heating. But I struggle to see how hydrogen can compete with electric vehicles, and this view has been reinforced by two recent pronouncements

A report by BloombergNEF concluded:

The bulk of the car, bus and light-truck market looks set to adopt [battery electric technology], which are a cheaper solution than fuel cells.

Volkswagen, meanwhile, made a statement comparing the energy efficiency of the technologies. The conclusion is clear said the company. In the case of the passenger car, everything speaks in favour of the battery and practically nothing speaks in favour of hydrogen.

Hydrogens efficiency problem

The reason why hydrogen is inefficient is because the energy must move from wire to gas to wire in order to power a car. This is sometimes called the energy vector transition.

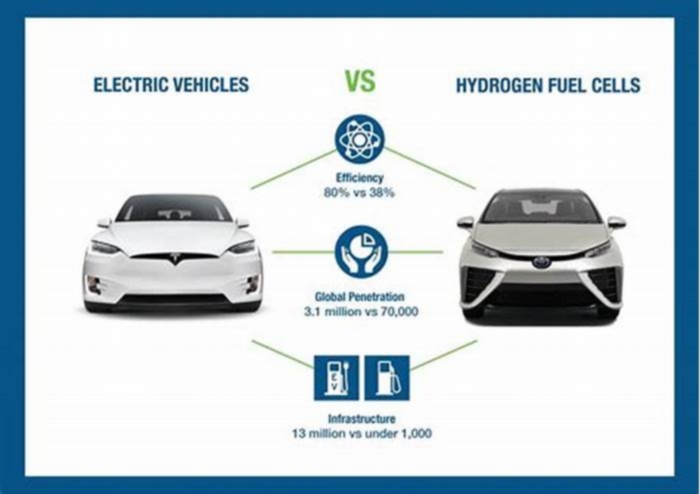

Lets take 100 watts of electricity produced by a renewable source such as a wind turbine. To power an FCEV, that energy has to be converted into hydrogen, possibly by passing it through water (the electrolysis process). This is around 75% energy-efficient, so around one-quarter of the electricity is automatically lost.

The hydrogen produced has to be compressed, chilled and transported to the hydrogen station, a process that is around 90% efficient. Once inside the vehicle, the hydrogen needs to be converted into electricity, which is 60% efficient. Finally the electricity used in the motor to move the vehicle is is around 95% efficient. Put together, only 38% of the original electricity 38 watts out of 100 are used.

With electric vehicles, the energy runs on wires all the way from the source to the car. The same 100 watts of power from the same turbine loses about 5% of efficiency in this journey through the grid (in the case of hydrogen, Im assuming the conversion takes place onsite at the wind farm).

You lose a further 10% of energy from charging and discharging the lithium-ion battery, plus another 5% from using the electricity to make the vehicle move. So you are down to 80 watts as shown in the figure opposite.

In other words, the hydrogen fuel cell requires double the amount of energy. To quote BMW: The overall efficiency in the power-to-vehicle-drive energy chain is therefore only half the level of [an electric vehicle].

Swap shops

There are around 5 million electric vehicles on the roads, and sales have been rising strongly. This is at best only around 0.5% of the global total, though still in a different league to hydrogen, which had achieved around 7,500 car sales worldwide by the end of 2019.

Hydrogen still has very few refuelling stations and building them is hardly going to be a priority during the coronavirus pandemic, yet enthusiasts for the longer term point to several benefits over electric vehicles: drivers can refuel much more quickly and drive much further per tank. Like me, many people remain reluctant to buy an electric car for these reasons.

China, with electric vehicle sales of more than one million a year, is demonstrating how these issues can be addressed. The infrastructure is being built for owners to be able to drive into forecourts and swap batteries quickly. NIO, the Shanghai-based car manufacturer, claims a three-minute swap time at these stations.

China is planning to build a large number of them. BJEV, the electric-car subsidiary of motor manufacturer BAIC, is investing 1.3 billion (1.2 billion) to build 3,000 battery charging stations across the country in the next couple of years.

Not only is this an answer to the range anxiety of prospective electric car owners, it also addresses their high cost. Batteries make up about 25% of the average sale price of electric vehicles, which is still some way higher than petrol or diesel equivalents.

By using the swap concept, the battery could be rented, with part of the swap cost being a fee for rental. That would reduce the purchase cost and incentivise public uptake. The swap batteries could also be charged using surplus renewable electricity a huge environmental positive.

Admittedly, this concept would require a degree of standardisation in battery technology that may not be to the liking of European car manufacturers. The fact that battery technology could soon make it possible to power cars for a million miles might make the business model more attractive.

It may not be workable with heavier vehicles such as vans or trucks, since they need very big batteries. Here, hydrogen may indeed come out on top as BloombergNEF predicted in its recent report.

Finally a word on the claims on carbon emissions from that Canadian Hydrogen and Fuel Cell Association report I mentioned earlier. I checked the source of the statistics, which revealed they were comparing hydrogen made from purely renwewable electricity with electric vehicles powered by electricity from fossil fuels.

If both were charged using renewable electricity, the carbon footprint would be similar. The original report was funded by industry consortium H2 Mobility, so its a good example of the need to be careful with information in this area.

Why hydrogen cars are not the answer

Imagine an electric car which has a range of 400 miles, can be refuelled almost as fast as a petrol or diesel car yet emits only water. Those are the upsides of a hydrogen fuel cell car (known as a fuel cell electric vehicle, or FCEV). So why arent they everywhere?

There is a dedicated core of FCEV supporters who insist that hydrogen-powered EVs are better than battery-powered EVs, and that the world is crazy for ignoring them. Unfortunately, a hydrogen fuel cell offers few advantages over a battery, with several deal-breaking disadvantages.

The problems that show no sign of really being overcome include cost, lack of infrastructure and relative inefficiencies in delivering hydrogen to customers.

But lets start with a bit of background into FCEVs.

Whats a hydrogen car?

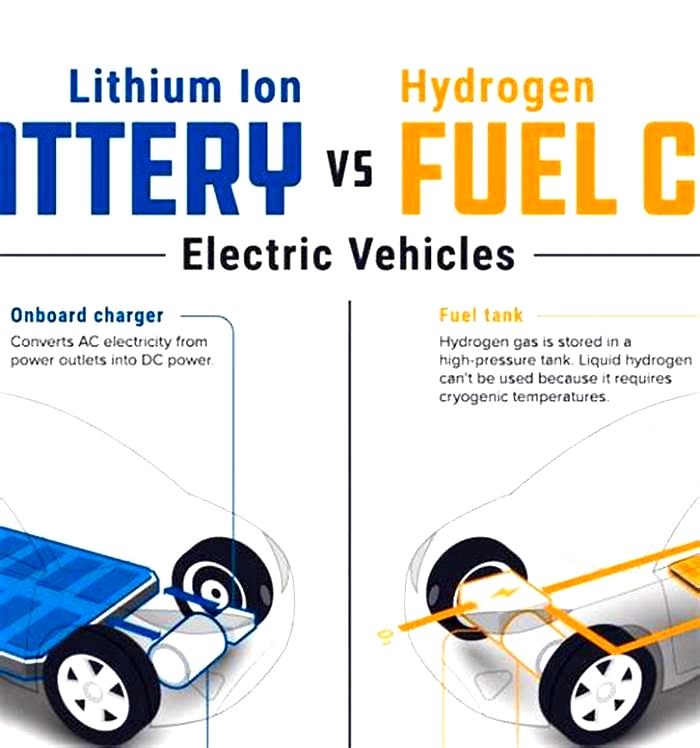

A hydrogen fuel cell car is a type of electric vehicle, using a similar electric motor system to drive the car as used by a battery electric vehicle. The key difference is how the electricity is generated and stored.

In a battery electric vehicle which is any EV you can currently buy on the market the electricity to power the car comes from an external source (usually the national electricity grid) and is stored in a large battery, most often placed along the floor of the car underneath your feet.

In comparison, a hydrogen fuel cell car is fuelled with hydrogen from a fuelling station, in a similar way to filling a petrol car. The hydrogen is then used to create electricity on the go to power the electric motor.

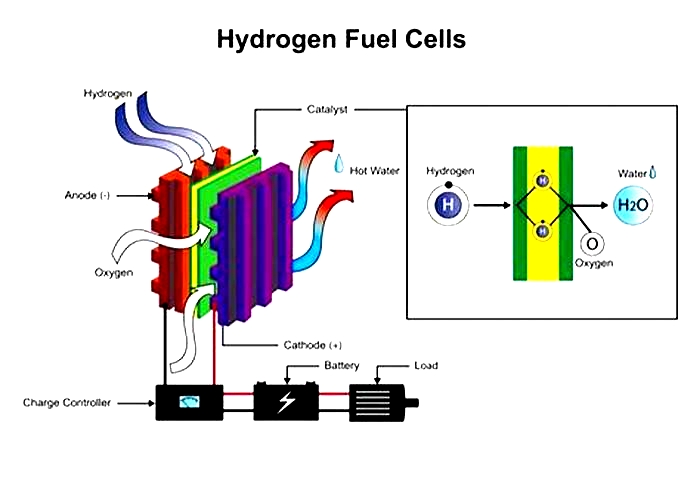

How a hydrogen fuel cell car works

In simple terms, a fuel cell car consists of several pressurised fuel tanks which supply what is known as a fuel cell stack. The stack is made up of individual cells which each produce less than one volt of electricity, so hundreds of them are connected together to produce the necessary voltage to power the electric motor.

The fuel cell generates electricity by forcing hydrogen to react with oxygen. The only output is water.

Hydrogen is used because its a great energy carrier, meaning a small amount can release a lot of energy to drive the vehicle. That also means hydrogen is highly explosive if it leaks, which is why you inevitably read and see references to the 1937 Hindenberg airship explosion anytime anyone mentions hydrogen-powered cars.

However, that was 86 years ago and a lot has changed about how hydrogen is used and stored. Modern hydrogen fuel tanks are just as safe, if not safer, than petrol tanks (petrol being another highly explosive product we are quite happy living with on a daily basis). They typically have a carbon fibre shell surrounded by a glass fibre layer. They can withstand double their normal operating pressures and are surrounded by sensors.

Tiny choice, high price

Car makers who have already built production hydrogen fuel cell cars have tended to be those who want to showcase their technical expertise rather than make a profit from them.

In 2008, the Honda FCX Clarity was the first full production fuel cell-powered car in the world. However, it was made in tiny numbers and only available to lease in Japan and California. A second generation appeared in 2016, but that was never available in the UK either and ended production in 2021.

The government claims there are over 300 hydrogen vehicles on UK roads, mostly passenger cars and buses, but the buses far outnumber the cars. There are currently only two hydrogen fuel cell cars in the UK: the Toyota Mirai saloon and the Hyundai Nexo SUV.

Toyota introduced its first Mirai (Japanese for future) in 2015, which was replaced by a second generation from 2020. The current Mirai has three tanks and a claimed real-world driving range of 400 miles. Two versions can currently be ordered at 54K and 65K respectively, and two leasing deals are on offer.

Since 2020, Toyota has sold 60 in the UK and global cumulative sales since launch stand at about 20,000 (to the end of October 2022). A total of about 160 Mirais have been registered in the UK across both generations, although 45 of those have already been declared SORN (in other words, they are currently not registered and cannot be used on public roads).

Toyota is also leading a consortium to develop a prototype hydrogen fuel cell-powered version of its Hilux pick-up at the companys UK vehicle plant in Burnaston, Derbyshire.

Hyundai launched its second-generation fuel cell car, the Nexo, in the UK in 2019. In 2021 it was 65K including the now-discontinued Plug-In Car Grant. Hyundai claimed that after attaching the hydrogen 700 bar nozzle to the car and locking it shut refuelling would be completed in approximately five minutes when the hydrogen tanks were full for up to 413 miles of driving range.

The Nexo is still listed on the UK website, but with no price and has been reported as being only available for business customers. We werent able to establish how many have been sold, although How Many Left, a UK registration database estimates that a grand total of 29 cars have been registered. Take out the cars that Hyundai UK would keep for its own needs and not that many have actually gone to customers.

Other car makers are dabbling with fuel cells or have given up. BMW has just started small scale manufacture of iX5 Hydrogen SUVs in Germany but only for a worldwide test fleet, with no talk of UK sales. Mercedes gave up on its entire hydrogen car programme in 2020 but went into partnership with Volvo to developed fuel cell heavy goods vehicles.

Globally, hydrogen cars arent really happening. Data collected by JATO Dynamics in 2021 stated that global sales of hydrogen fuel-cell cars totalled 15,500 units around the world.

Falling down on refuelling

The battery electric cars supreme advantage is being able to refuel at every place there is an electricity supply, even if a charge at home is still measured in hours. As for public chargers, according to Zap Map, at the end of December 2022, there were more than 37,000 electric vehicle charging points across the UK, across 22,000 charging locations.

More electric charging points are being added each day (though many say not enough for the 2030 deadline) but should you have a fuel cell car the amount of hydrogen refuelling stops is woeful.

Hydrogen storage demands purpose-built facilities, which cant simply be pluged into the national grid like a battery charging point and the current cost to build one hydrogen station is estimated to be 2 million.

To have a viable national network of hydrogen that would cover all the UKs major roads, the government suggests we would need at least 1,000 filling stations (at a cost of around 2 billion). So how close are we to hitting this? Well, not very close at all.

As of January 2023, there are just 11 places in the UK to fill up your fuel cell car. To make matters worse, the number is going in the wrong direction and is actually a decrease of three stations over the last 12 months, as Shell closed its three sites last year.

Of the remaining sites, most are on industrial estates, at council premises or next to research institutes not particularly convenient to general use by the public. And it appears that there are currently no new sites in the pipeline. Even if a massive new investment was to be announced tomorrow, it would take many years to build a sufficient number of sites to make hydrogen power viable.

Although many people bemoan the lack of electric charging points currently available for battery electric cars, the reality is that is much easier to ramp up in a short timeframe than rolling out more than a thousand dedicated hydrogen fuelling stations all over the country.

Its a similar situation for every other country in Europe, which effectively rules out hydrogen as a viable option for consumers any time in the near future.

Not so green

Current UK hydrogen production and use is heavily concentrated in chemicals and refineries This hydrogen, largely produced from natural gas, is used to make other chemicals and plays a variety of roles in refineries to convert crude oil into different end products. In these two sectors, production and use of hydrogen usually happen on the same site, often integrated into a single industrial facility.

In August 2021, the UK government launched its plan for a world-leading hydrogen economy. Its own analysis suggests that 20-35% of the UKs energy consumption by 2050 could be hydrogen-based. One target is to replace natural gas in powering around three million homes by 2030.

The aim is to replace up to one fifth of natural gas with green hydrogen, powered by renewable energy to split water into hydrogen and oxygen. The strategy also depends on blue hydrogen, produced from natural gas and steam. Blue hydrogen is not emissions-free, but the carbon emissions can be captured, stored and used in other applications.

A truckload of tankers

On top of generating the hydrogen, theres also the matter of delivering it to service stations all over the country unless you can produce hydrogen on-site. That requires a multitude of tanker trucks running up and down motorways all day, every day, which means youre using a lot of fuel just to deliver fuel.

It might be a familiar method of delivery since thats how we have delivered petrol and diesel for the last hundred years, but if youre going to start from scratch with a new energy source, its not exactly the best way to go about it. In comparison, delivering electricity via the national grid is far more efficient and eco-friendly.

Battery electric cars are already extensively fuelled by green electricity. Renewable energy sources made up 43% of the UKs total electricity generation between October and December 2021, and that percentage is growing.

A more viable option for heavy vehicles

Large commercial vehicles are a different story, however. Hydrogen already powers buses in many countries, including the UK. This is seen as a more viable future path as the refuelling/charging equation is far more favourable for these sort of vehicles.

In the future, this could include trucks, trains and other highly energy-consuming vehicles even aircraft which need to cover long distances without stopping and can be refuelled where they are based. That means a relatively small number of private filling stations without relying heavily on public refuelling infrastructure, which is far more achievable.

Thats where all the UK research effort is going. The transport part of the UK governments hydrogen strategy is geared towards trains, commercial vehicles and planes, rather than cars. The strategy aims for 4,000 new zero emission buses, either hydrogen or battery electric, and the infrastructure needed to support them.

Hydrogen is seen as a viable alternative to battery electric trucks, but both HGV charging points and hydrogen refuelling stations are still very sparse. Expected to be fully operational by 2025, the Tees Valley Hydrogen Transport Hub will be a large facility for the production, storage and distribution of green hydrogen and seen as a testbed.

The battery has won out for passenger cars

While the push to increase the use of hydrogen for homes and heavy transport is welcome, the prospect of roads brimming with hydrogen cars still looks like a fairytale pretty much as it has been for the last 50 years.

Even before you allow for the very high list price and choice of only two models, the lack of refuelling stations makes them a non-starter for private users.

Theres a way to go before a battery electric car is viable for everyone but, given the pace of development forced by the end of combustion engine sales, batteries will give longer ranges and charging times will continue to speed up. The amount of progress that has been made over the last decade is significant, and will continue to evolve at rapid rate in years to come.

Thats not to say that there wont be hydrogen fuel cell vehicles available in the future for some customers, a fuel cell EV would be a better choice than a battery EV if the infrastructure was available. But even if it becomes an alternative, its only ever likely to be a niche choice. For everyone else, battery EVs are the obvious answer.

More EV news and analysis at The Car Expert

Additional reporting by Stuart Masson.