Why doesn t Japan make electric cars

TopSpeed

While several regions like California, the EU, and parts of Canada and Australia aim to ban gas-powered cars by 2035 and major automotive players have committed to going fully electric by 2030, Toyota continues to chart a different course. Though facing pressure to join the all-electric bandwagon, the company maintains its focus on a "multi-pronged approach".

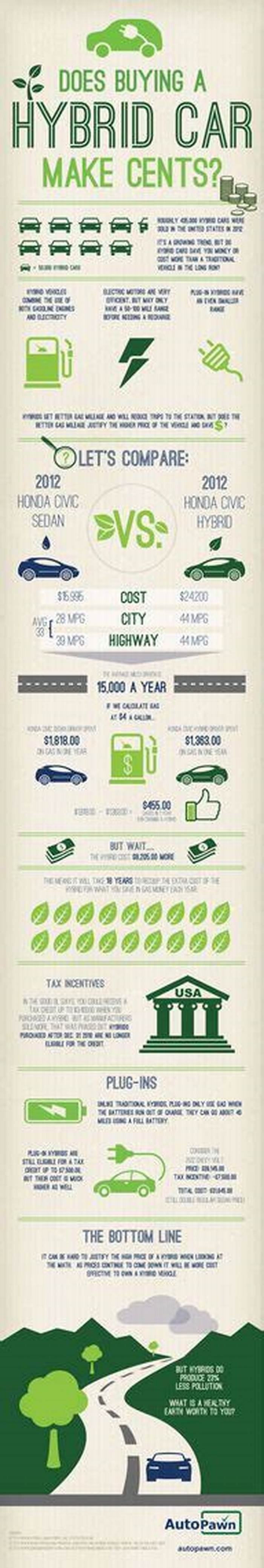

While former CEO Akio Toyoda stepped down in January 2023, his stance on EVs remains. Koji Sato, the new president, inherits a company navigating a complex landscape. The company has invested heavily in hybrid and plug-in hybrid electric vehicles (PHEVs), which remain popular choices for consumers seeking lower emissions and fuel efficiency. The company is also developing solid-state batteries and hydrogen fuel cell vehicles (FCVs), which the Japanese believe hold long-term potential for sustainable transportation.

Toyota's strategy differs from competitors who are focusing mostly on battery electric vehicles (BEVs). Toyota argues that a diverse approach is necessary to cater to different markets, infrastructure limitations, and consumer preferences. Additionally, the firm emphasizes the importance of considering the entire life cycle of a vehicle, including production, usage, and disposal, when evaluating its environmental impact.

However, with growing pressure to accelerate electrification, Toyota faces criticism for its seemingly slower pace compared to some rivals. In 2023, they announced a goal of launching 30 BEV models by 2030, marking a significant shift in their strategy. And in 2024, they are pumping funds into electrification. Already, the Aichi-based firm has invested $1.3 billion in its Kentucky plant to build a brand-new "three-row EV."

UPDATE: 2024/02/29 13:00 EST BY ANIEBIET INYANG NTUI

This article has been revamped with the latest on Toyota's EV strategy and industry trends, plus fresh analysis considering evolving regulations and market dynamics - all to offer a clearer and more current picture.

In order to give you the most up-to-date and accurate information possible, the data used to compile this article was sourced from Toyota and other authoritative sources such as HotCars and CarBuzz.

Toyota Cautions Against Rushing To Electric Vehicles

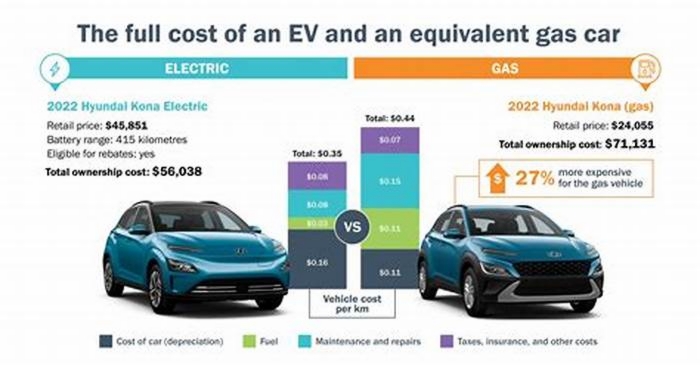

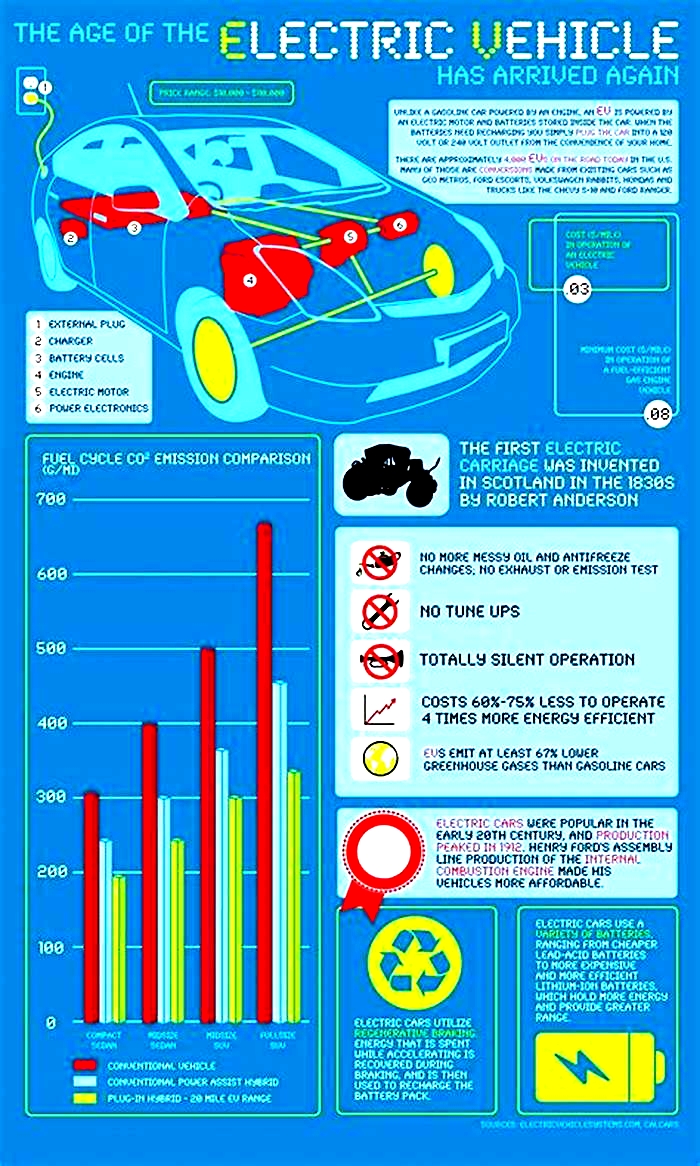

Toyota has expressed concerns about the practicality of a rapid shift to EVs. Akio Toyoda, claimed that EVs are "overhyped" and that the lack of supporting infrastructure and high cost could hinder their mass adoption. EVs currently make up only 0.86% of registered vehicles in the U.S., and as their numbers increase, issues such as electricity demand and grid capacity will become more apparent.

- Charging Stations: The availability of charging stations varies greatly across the globe. Developed nations boast a more developed network due to higher EV adoption rates. However, in developing countries, charging stations remain scarce, creating a significant barrier for potential EV owners. Even developed countries still need to invest in their charging networks. For example, even in the most conservative scenario, the EU will need at least 3.4 million operational public charging stations by 2030.

- Soaring Electricity Demand: The mass adoption of EVs will undoubtedly strain existing power grids. Studies estimate that the U.S. power capacity will need to double by 2050 to meet EV charging demands. This means that the U.S. will need to produce an additional 525 to 860 terawatt-hours of electricity by 2030. This translates to a significant increase in electricity production, requiring substantial investments in generation, transmission, and distribution infrastructure.

- Grid Resilience Concerns: Integrating a large number of EVs into the grid introduces new challenges. Fluctuations in charging patterns can strain the grid, potentially leading to blackouts. Upgrading grid resilience to accommodate these fluctuations will necessitate significant investments. For instance, while some parts of Europe and Asia have more advanced grids due to higher EV consumer demand, it is still not sufficient to support a widespread transition to electric vehicles and the growing demand is already putting their "advanced grids" under pressure.

The Issue Is Carbon Not The Combustion Engine

While the shift towards electric vehicles (EVs) presents a compelling solution to tailpipe emissions, Toyota maintains a nuanced perspective, arguing that solely focusing on electric power doesn't paint the entire picture. Their stance centers on the fundamental principle that carbon, not the combustion engine itself, is the true enemy. This perspective highlights the complex reality that the electricity powering those EVs often originates from fossil fuels, particularly in regions with less developed renewable energy infrastructure.

Toyota argues that a comprehensive approach considering the entire lifecycle of a vehicle and its fuel source is necessary. This includes factors like battery production and disposal, energy grid efficiency, and the availability of renewable energy sources in different regions. They contend that hybrid and hydrogen fuel cell technologies, alongside strategic investments in renewable energy infrastructure, offers a more holistic and adaptable solution in the race towards carbon neutrality.

RelatedToyota's hybrids surge while Teslas stumble, but both face complex futures beyond their core technologies.Toyota Is Navigating The Global Divide In EV Adoption

The global march towards electric vehicles (EVs) is undeniable, but the journey is paved with uneven terrain. While some regions sprint ahead, others stumble over hurdles, creating a landscape of disparate progress. In Europe and China, supportive policies, robust charging infrastructure, and a blossoming variety of affordable EV models fuel rapid adoption. Stringent regulations in Europe incentivize EV purchases, while China's massive market and government backing propel its EV industry forward.

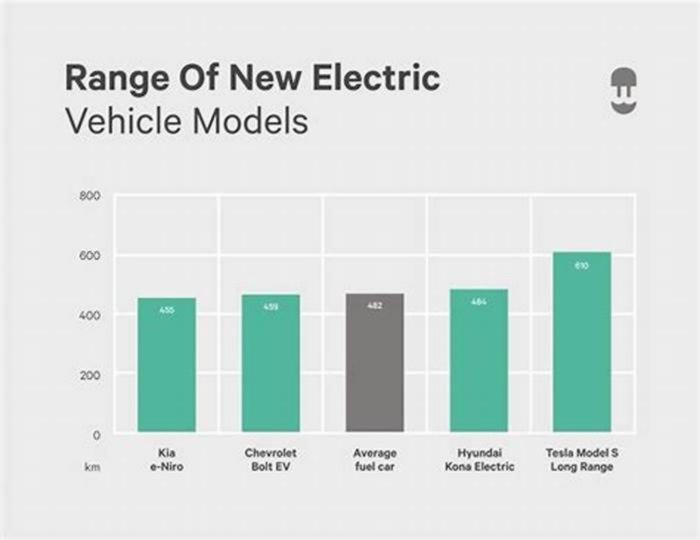

The United States, despite its automotive might, lags behind. Tamer regulations, a fragmented charging network, and a preference for larger, less fuel-efficient vehicles create roadblocks. This leaves American consumers with fewer compelling EV options and limited infrastructure support. Developing countries, particularly in Africa, face an even steeper ascent. The lack of charging infrastructure, limited access to electricity, and high vehicle costs create formidable barriers to entry. Affording and utilizing EVs seems like a distant dream for many in these regions.

Toyota's Balancing Act

Toyota, with its global reach and significant presence in emerging markets, embodies the complexities of this transition. While recognizing the imperative of sustainability, the company expresses concern that a full-blown, rapid shift to EVs could leave a significant portion of its customers, particularly those in developing countries, without access to affordable and reliable transportation. This creates a delicate balancing act for Toyota: navigating the demands of sustainability while ensuring inclusivity and affordability for its diverse customer base.

RelatedIn eight years, the Mirai only sold 14,000 examples. However, Toyota is keeping it alive, and pushing for more hydrogen vehicles, here's why.Toyota's Stance Is Also Fueled By Geopolitics

A deeper look reveals a strategic chessboard, where resource independence and geopolitical considerations hold critical pawns. Unlike China and South Korea, Japan lacks the natural resources needed for mass battery production, creating a reliance on foreign suppliers. In a culture deeply ingrained in self-sufficiency, this dependence is a bitter pill to swallow. Hydrogen, on the other hand, offers a tantalizing alternative. Japan boasts a strong foothold in hydrogen technology, special thanks to Toyota, with decades of research and development under its belt.

Japan's Strategic Chessboard

The vision: a future fueled by domestically produced hydrogen, unshackling the nation from the clutches of foreign resource dependence. This resonates deeply with a national psyche that values control and security. However, the world has not marched in lockstep with Japan's hydrogen ambitions. The infrastructure, cost, and efficiency concerns surrounding hydrogen fuel cell vehicles (FCVs) have hampered their widespread adoption compared to EVs. The market has spoken, and currently, it favors the readily available and rapidly evolving electric option.

Toyota and the entire Japanese auto industry banked hard on hydrogen, for several reasons, one of which maintaining independence from a resource standpoint. Japan doesn't have the resources required for mass battery production, so it needs to rely on China or South Korea. From a geopolitical standpoint, that's a no-no in Japanese culture. The Japanese master hydrogen, and still believe in it, but the world is not on its side with the technology. History has shown us that it's not always the "best" technology that wins, it's the one that has an easier market adoption. EVs have won because the market has adapted to them better.

- William Clavey, TopSpeed Journalist and EV Expert

Leaked Document Reveals Toyota's Strategy

A recent leak of an internal Toyota document also sheds light on their electric vehicle (EV) production and sales strategy, revealing a focus on hybrids over pure EVs. This decision stems from three key barriers Toyota sees as hindering widespread EV adoption.

Toyota's "1:6:90 Rule"

Facing these challenges, Toyota proposes the "1:6:90 rule" as an alternative approach. This rule suggests that:

- For the same amount of critical minerals used in one EV, Toyota could produce six plug-in hybrids or 90 non-plug-in hybrids.

- In their view, the overall lifetime carbon reduction of 90 hybrids is 37 times greater than a single EV.

From the leaked docs, Toyota argues that widespread adoption of hybrids, even with smaller emissions reductions per vehicle, would lead to a faster and more significant overall impact on carbon emissions.

RelatedToyota's water-cooled hydrogen engine tackles heat challenges, aiming for cleaner, high-performance vehicles, and here's what you need to know.Toyota's Multi-Pronged Strategy For A Diverse Electric Future

Toyota's position is akin to a seasoned gambler placing bets across multiple tables, each with its own unique advantages and risks. Their diversified portfolio, encompassing highly successful hybrids, hydrogen fuel cell vehicles (FCVs), and even exploring other options such as solid-state batteries, reflects a strategic approach that goes beyond simply chasing the latest fad.

- Catering To Diverse Needs: Unlike some competitors who have narrowed their focus to solely battery-electric vehicles (BEVs), Toyota recognizes that consumer needs and preferences vary greatly. Their diverse offerings cater to a wider spectrum, from eco-conscious urban dwellers who value the efficiency and practicality of hybrids to long-distance travelers seeking the rapid refueling and extended range of FCVs. This flexibility allows them to adapt to evolving market trends and customer demands, avoiding being locked into a single technology.

- Hedging Against Uncertainty: The future of automotive propulsion remains an open book. While BEVs are currently gaining momentum, their widespread adoption faces hurdles such as charging infrastructure limitations, range anxiety, and battery costs. Toyota's diversified approach acts as a hedge against these uncertainties. If BEVs encounter unforeseen challenges, their strong hybrid presence can provide a safety net. Similarly, if FCVs overcome technical and cost barriers, they could become a game-changer, and Toyota is already well-positioned to capitalize.

- Beyond Just Replacing Gasoline: Toyota's vision for carbon neutrality extends beyond a simple "swap and replace" strategy. They recognize that a holistic approach is necessary, considering factors beyond just tailpipe emissions. Battery production and disposal carry their own environmental burdens. FCVs, with their zero emissions at the point of use and potential for green hydrogen production, offer a cleaner alternative lifecycle. This broader perspective sets Toyota apart from companies solely focused on BEV dominance.

- A Puzzle With Many Pieces: While hybrids and FCVs are currently Toyota's key players, the firm remains open to exploring other promising technologies. Potential future contenders such as biofuels and even solid-state batteries find a place in its portfolio.

Beyond Hybrids And Into The Future

While Toyota has long championed hybrid technology, recent developments suggest a significant shift as they accelerate their entry into the pure electric vehicle (EV) market.

- Kentucky Plant Expansion: A hefty $1.3 billion investment is dedicated to building a dedicated production line for an all-new, three-row electric SUV at their Kentucky plant. This move signifies a clear focus on electrifying the U.S. market, a key region for Toyota's global success.

- Building Where They Sell: This Kentucky investment exemplifies Toyota's commitment to the "build where they sell" philosophy. By producing EVs in the U.S., they aim to reduce costs, shorten delivery times, and cater directly to the specific needs of American consumers.

- Solid-State Battery Development: Toyota is actively researching and investing in solid-state batteries, a game-changing technology promising faster charging times and significantly longer ranges. Their goal is to commercialize this technology by 2027-2028, potentially putting them at the forefront of battery innovation. This focus on solid-state batteries highlights Toyota's commitment to exploring alternative battery technologies beyond traditional lithium-ion. This diversification has the potential to mitigate potential supply chain constraints and offer more sustainable solutions in the future.

- Expanding EV Offerings: The ambitious plan to launch 10 new battery-electric vehicles globally and sell 1.5 million EVs per year by 2026 demonstrates a significant shift in strategy. This move expands their portfolio beyond hybrids, offering a wider range of choices to cater to diverse customer preferences and market segments.