Why don t EVs hold their value

HotCars

Its no surprise that the vast majority of electric vehicles sold in the United States bear the Tesla logo. In fact, the Model 3, Model Y, Model S, and Model X are so popular that they are becoming household names like the Ford F-150 and Toyota Corolla.

We know how inflation is eating into our savings and how the pandemic affected businesses in general. On top of facing low volumes and poor sales, manufacturers had to put up with semiconductor shortages and supply chain issues.

How did that affect everyday people, you ask? Well, folks looking to buy new cars have seen prices soar greatly. Dealerships are marking up to a point where people are even paying 40-50% premiums on new cars.

Its not just new cars that are getting expensive, though. Have a look at used car listings, and youll see how theyre priced. Teslas, in particular, have been a hot commodity, both new and used.

However, things are finally looking good for buyers, as outrageous markups have come down and used Teslas are becoming cheaper. But before we discuss why, heres a closer look at how used Teslas skyrocketed in value.

RELATED: 10 Reasons Why You Should Buy A Used Tesla Model Y

What Gave Rise To Tesla Flipping?

The advent of COVIDand all that ensued afterled to a series of events that caused a spike in inflation, supply and demand disruptions, and a global semiconductor shortage. The latter had a significant impact on new car production. Some people, however, saw this as a window of opportunity.

When supply doesnt meet demand, prices tend to rise. So naturally, since there isnt enough supply of new cars, dealerships started marking up the existing inventory, which led to consumers paying more. The market was so hot that Tesla owners started flipping cars for profits.

Its not just supply and demand that led to a spike in used car prices. Financing options became expensive since the Federal Reserve increased interest rates to combat inflation. This has also led to people withdrawing their interest in buying new cars. Ergo, more demand in the used car lot.

However, at some point, the greed frenzy has to stop, which is exactly what happened now. Will this last forever? Probably not, but its the way things are at the time of this writing.

RELATED: Heres Why The Tesla Model Y Is The Fastest-Selling Used Car In The US

Why Are Used Teslas Becoming Cheaper?

Markets are usually cyclical and more often than not, follow a pattern. A combination of factors are typically responsible for a market correction. Depending on the severity, though, corrections can end up becoming reversals. Technically, the used market is entering a cold-down phase, as sellers have realized that its no longer euphoria out there and that demand has dropped.

The average price of a used Tesla in November, according to Reuters, was $55,754, which is a 17 percent decrease from the peak price of $67,297 in July 2022. Additionally, with the passing of the Inflation Reduction Act, the EV tax credit has been officially amended. This will apply to all EVs sold from January 1, 2023. So that means buyers are now willing to wait for new cars, as opposed to settling with used Teslas.

Another reason is that the market is flooded with certain models. Remember, Tesla doesnt offer an extended warranty for the 3 and Y, so older models (circa 2018) are getting dumped. This leads to a saturation in the used Tesla space.

On top of that, dealers who are unaware of the EV trends jumped on the bandwagon, hoping for a quick buck or two. However, the markets have turned, and these dealerships are now selling their inventory just to recoup their capital. This is usually done in auctions. According to Find My Electric, auction EVs are extremely cheap at the moment, which impacts pricing on the private market.

The Real Reason Why Used Teslas Are Becoming Cheaper In The U.S.

Another factor that contributed to the drop in used Teslas is that the company cut prices by $7,500 on Model 3s and Ys sold in December 2022. This practice is not uncommon, as OEMs often drop prices to boost their year-end sales numbers. But for the used market, this became yet another reason for a price correction.

Next, its the overall economic instability. Remember the Feds raising interest rates? Well, thats to curb market spending. In other words, everything is getting expensive. Not to mention the fear of a recession looming around. As discussed, the Feds anti-inflationary policies have shot up borrowing rates, which not only affected new car sales but also used car purchases as well. People are hanging onto money and are postponing expenses that arent justifiable. If anything, people are only willing to spend if the prices are extremely attractive.

Lastly, supply chain issues are getting sorted one by one. Chip shortages are being addressed by the respective manufacturers, increasing their output, thereby meeting demands. Delays for most new cars have dropped significantly. For instance, the wait for a Model 3 Standard Range used to be a year, but now its only a month or two.

Sources: Reuters, Find My Electric

HotCars

Without a question of a doubt, the future of the automobile is electric. Whether we like it or not, it is the way to the future. Electric cars are great machines, silent, smooth, quick, but still expensive. However, the other benefit is zero tail-pipe emission, because there isn't a tailpipe on an EV for obvious reasons.

But when you factor in the entire manufacturing journey of electric cars, it raises quite a few questions about its actual impact on our planet. There are still quite a lot of carbon emissions during the manufacturing process of an EV. But many automakers are working towards streamlining their businesses, with goals to be entirely carbon-neutral in the next few decades. It is still early days for the electric vehicle, but the path continues to get clearer by the day with innovations.

Tesla proved that an EV is a viable alternative to the traditional ICE motorcar. The legacy automakers, Mercedes-Benz, BMW, Jaguar, Volvo, VW, and more followed suit. All of them make some great electric vehicles and the demand for them is consistently growing around the world.

Why then, do electric cars depreciate far more than their gasoline or diesel-powered counterparts? The answer is not as simple as you think and yet, yet not very complicated either.

We highlight why electric cars depreciate faster than ICE-powered cars, but not Tesla.

Update April 2022: This article was updated with new information about electric cars.

Common Beliefs And Myths About EVs

Many traditionalists are not convinced that the ICE is on its way out. Most shrug it off as just a fad. Some raise the question about the longevity of the Lithium-ion batteries that power them, and recycling them.

However, this notion is both correct and incorrect. The fact is that the electric vehicle is a new technology. The infrastructure and ecosystem to support it are still being developed around the world. It was the same with combustion-powered vehicles. When they were introduced in the late 1890s, people did not accept the technology at the time favoring their coaches or horsedrawn carriages. For them, machines could not replace the trusted 'horse'-power. Look at us now... It takes time for new technologies to be accepted by the market.

For some, maintaining an electric car is also a cause for concern. People are wary of the costs of maintenance after the warranty runs out. With only one moving part in the electric motor and a few other components, EVs are easier to maintain than traditional ICE-powered models. They are more prone to software glitches, than mechanical wear and tear.

The current crop of EVs is like the early laptops or mobile phones. Innovative, but they were obsolete very quickly after a breakthrough that made them more accessible. EVs are currently in the infancy stage, thus expensive. However, a breakthrough in battery technology could help provide comfort against the currently existing woes of the electric vehicle lifestyle.

The lack of awareness, demand for used EVs for the most part, and the battery deterioration are one of the major factors at play. These are the key reasons why electric vehicles depreciate more than ICE-powered cars.

RELATED: Here's Why Hydrogen Is Better Than Battery-Powered Electric Vehicles

Why Teslas Hold Their Value

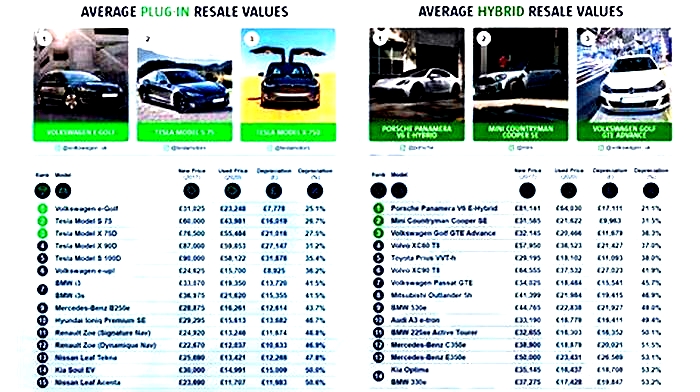

A new sedan depreciates 39% after three years while trucks do a little better at 34%. Electric vehicles drop an astonishing 52%. While EVs like the Nissan Leaf and Chevy Volt EV depreciate heavily, Tesla models tend to hold their value better and are comparable to their traditional counterparts.

According to a survey by iseecars, a Tesla Model S depreciates by 36.3 percent while a Model X holds its value a bit better at 33.9 percent. However, because of the demand for the Model 3, and Tesla's unable to keep up, the compact electric car holds its value the best at a staggering 10.2 percent after three years. That is outright astonishing, but unsurprising.

While this does indicate that Tesla is at the forefront of the game, it doesnt mean that the other EVs in the market like the Nissan Leaf or the Chevy Volt are bad. So whats the actual reason behind these numbers?

RELATED: This Is The True Cost Of Owning A Tesla Model 3

Why Do Other EVs Lose Value?

A base Nissan Leaf, in 2017, cost about $31,000. With federal tax rebates, the Leaf's price would drop to about $22,000. Five years down the line, the same car is currently worth between $8,000 to $14,000. If you take the tax benefit as a discount, that is not a bad deal,

On the flip side, due to the derireability for Tesla's electric models, they are in high demand and people are willing to pay more for them. The automaker doesn't offer any tax rebate incentives and charges a premium due to the high demand for the Model 3. This allows for the Model 3 to retain its value more than others. But Teslas and the Model 3 in particular is an exception to the rest of the market that does lose value.

In general, electric cars will continue to depreciate at a higher rate for now. But as time progresses and more EVs are on the road, prices will begin to stabilize. People around the world are beginning to clean up after themselves and their emissions for the sake of the planet. We may witness a time when ICE-powered cars become relics in the future. Electric vehicles, or some other form of propulsion, could one day become the norm.

Top 25 Cars That Hold Their Value the Best and the 25 Worst

Summary:

- Electric vehicles are the worst segment at holding their value, losing 49.1 percent in five years

- Trucks and hybrids retain the most value, losing only 35 and 37 percent, respectively

- Several sports cars, small SUVs and economy cars also hold their value extremely well, with the Porsche 911, Jeep Wrangler and Honda Civic among the best models

- Luxury SUVs and sedans, including the Maserati Quattroporte, BMW 7 series and Maserati Ghibli, are some of the worst vehicles at holding their value

All cars are holding their value better in 2023 compared to 2019 as a result of reduced new car production during the pandemic and constrained used car supply today. Prior to the pandemic, the average car would lose about 50 percent of its value in five years. Today the average 5-year depreciation is 38.8 percent, with electric vehicles the worst group losing approximately half their value.

iSeeCars analyzed over 1.1 million vehicles sold from November 2022 to October 2023 to determine 5-year depreciation rates. In comparing this data historically, it found that depreciation was lower across major segments than in 2019.

The good news for car owners is that all used cars hold their value better than they did five years ago, said Karl Brauer, iSeeCars executive analyst. But not all used cars retain value equally, with trucks and hybrids among the best segments and electric vehicles the worst. Hybrids have a nearly 12 percentage point advantage over EVs in value retention, which translates to thousands of dollars in higher market value after five years.

EVs have the worst depreciation across major vehicle types

While the average 5-year depreciation for all vehicles is 38.8 percent, electric vehicles are more than 10 percentage points worse at 49.1 percent. SUVs also lose more value than the average vehicle at 41.2 percent.The disparity between electric vehicles and hybrids is worth noting, with EVs the worst group at holding their value and hybrids among the best, said Brauer. Some manufacturers have reduced or even abandoned the hybrid market in favor of EVs, but these figures suggest consumers still appreciate a hybrids combination of higher fuel efficiency and zero range anxiety.Vehicles that depreciated the least over five years

These 25 cars hold their value far better than average. The top-ranked Porsche 911 coupe only loses 9.3 percent of its value after five years, indicating incredibly strong demand for this sports car in the used market. Three other Porsches, along with six Toyotas, four Subarus, and three Chervolets, reflect ongoing consumer demand for sports cars, small SUVs, and fuel-efficient economy cars. The rise in used car pricing over the past few years drove many buyers toward these smaller, lower-priced models.Several sports cars are among the top vehicles at holding their value, including four of the top 10 models, said Brauer. We saw a spike in demand for fun cars during the pandemic lockdowns, and demand for them remains strong in the post-pandemic world.Vehicles that depreciated the most over five years

Luxury cars always depreciate faster than mainstream models, with the latest data confirming luxury cars lose an average of 48.1 percent in value after five years. This compares to the industry average of 38.8 percent and 36.8 percent for non-luxury cars. The worst offenders are luxury sedans and luxury SUVs.Buyers looking to keep their vehicles for a long time shouldnt be too worried about these depreciation rates, said Brauer. But if youre rotating into a new vehicle every few years and those vehicles are luxury sedans or luxury SUVs, youre losing a lot of money.Electric vehicle depreciation among the worst

Electric vehicles are still relatively new to the market, which limits the ability to track their 5-year depreciation. But all of the EVs below have been in production for at least five years and have lost more value than the 38.8 percent average across all used cars.Between incentives that effectively lower an EVs price before its even purchased and concerns about battery replacement costs, used electric vehicles have always suffered higher depreciation than equivalent gasoline cars, said Brauer. This pattern will continue until electric vehicles dont require heavy incentives to sell and consumers gain confidence in their long-term ownership costs.Hybrid vehicle depreciation among the best

Hybrid residual values have improved by nearly 20 percentage points in the past 4 years, moving down from 56.7 percent in 2019 to 37.4 percent today. A combination of higher fuel prices and increased familiarity with the technology has expanded the market and raised demand for hybrid vehicles.Toyotas extensive history with hybrid models has established a strong customer base, though Honda and Hyundai are also building a hybrid following, said Brauer.Truck depreciation Americans still love trucks

As a group, trucks hold their value better than any other vehicle type. The average truck loses just 34.8 percent of its value after five years, reflecting both long-term durability and consistent market demand for these models.Midsize trucks hold their value better than full-size models, said Brauer. Trucks like the Colorado, Frontier, and Tacoma have become so capable in recent years that they can replace a full-size truck for many buyers while remaining far easier and cheaper to drive, park, and operate.The best and worst SUVs for depreciation

SUVs remain the most dominant vehicle type in todays car market. Their combination of an elevated ride height, comfortable passenger space, and practical cargo capacity make them popular choices, but not all SUVs depreciate equally. Smaller models have the advantage, with an average 5-year depreciation of 38 percent, while midsize models lose 42.9 percent and large SUVs lose 51.9 percent of their value.As SUVs get larger they get more expensive to buy and fuel, said Brauer. Large SUVs may be necessary for buyers requiring additional passenger and cargo capacity, but when SUVs pass from new to used status the market clearly favors smaller, more fuel efficient models.

These are the best and worst SUVs for residual value in each size category below. As with nearly every vehicle segment, luxury SUVs consistently lose more value than mainstream models.

Small SUVs that hold their value the best

Small SUVs that lost the most valueMidsize SUVs that hold their value the bestMidsize SUVs that lost the most valueFull-size SUVs that hold their value the bestFull-Size SUVs that lost the most valueThe pandemics effect lingers on

Higher new and used car prices are here to stay, said Brauer. Until the restricted new car production of model years 2020 through 2022 moves completely through the used car market there will be a lack of vehicles to meet demand. That means better residual value for car owners, but also higher prices for buyers for the foreseeable future.Methodology

iSeeCars analyzed over 1.1 million used cars from model year 2018 sold from November 2022 to October 2023. Heavy-duty trucks and vans, models no longer in production as of the 2022 model year, and low-volume models were removed from further analysis. MSRPs from 2018 were inflation-adjusted to 2023 dollars based on data from the US Bureau of Labor Statistics. The difference in average asking price for each vehicle between its MSRP and its used car pricing was mathematically modeled to obtain the vehicles depreciation.

About iSeeCars.com

iSeeCars.com is a data-driven car search and research company that helps shoppers find the best car deals by providing key insights and valuable resources, including the iSeeCars VIN Check report and Best Cars Rankings. iSeeCars has saved users over $414 million so far by applying big data analytics powered by over 25 billion (and growing) data points and using proprietary algorithms to objectively analyze, score and rank millions of new cars and used cars.