Why is BYD better than Tesla

Chinas BYD overtakes Tesla as top-selling electric car seller

Elon Musks Tesla has been overtaken by its Chinese rival, BYD, as the worlds top selling electric carmaker.

BYD, which has been backed by the US investment billionaire Warren Buffett since 2008, has beaten Teslas production for a second consecutive year.

BYD, which stands for Build Your Dreams, said it produced 3.02m new energy vehicles in 2023. The American multinational Tesla announced on Tuesday that it made 1.84m cars. However, BYDs sales figures include 1.6m battery-only cars, and 1.4m hybrids, which means Tesla is still the leader in the production of electric battery-only cars.

Nevertheless, in the final quarter of last year BYD outsold Tesla in battery-only cars 526,000 to 484,000 for the first time.

Most of BYDs vehicles sell at a lower price point than Tesla, which derives about 20% of its sales from the Chinese market.

Chinese electric carmakers such as BYD and Nio have set their sights on becoming major players in international markets, with a particular focus on Europe. In December, BYD, which sells five models in Europe and has plans to launch three more this year, announced plans to build a new factory in Hungary. Last year, the company said it did not consider building its first European factory in the UK because of the impact of Brexit. BYD said the UK had not even made a top 10 list of possible locations to build its first European car plant.

Chinas top-selling electric carmaker is targeting sales of about 800,000 cars annually in Europe by 2030. However, these goals could be under threat after the European Commission launched an anti-subsidy investigation last September into Chinese electric vehicle imports.

Commenting on the decision at the time, the European Commission president, Ursula von der Leyen, said that Chinese electric vehicles were now flooding global markets and were being kept artificially low by state subsidies.

The investigation, which is expected to last a year, could result in the EU imposing punitive tariffs on Chinese vehicles.

The Hong Kong-listed BYD, which was founded by a former university professor, Wang Chuanfu, and began developing batteries in 1995, intends to become a global powerhouse in the electric vehicle market.

Tesla, which is led by Musk, said last month it was recalling just over 2m vehicles in the US fitted with its Autopilot advanced driver-assistance system to install new safeguards

One of the advantages BYD has over its US and European counterparts is its ability to manufacture electric vehicle batteries in-house.

Susannah Streeter, head of money and markets at the investment platform Hargreaves Lansdown, said: While its the worlds leading supplier of rechargeable batteries, Tesla relies on several suppliers and has flagged shortages of lithium as demand ratchets up as a supply chain obstacle in the years to come.

BYD is already making moves to secure the precious metal by buying a stake in a Chinese lithium producer. Its had its eye on purchasing mines in Africa and is scouting assets in South America, where the metal is mined.

The emergence of China as the top-selling electric vehicle producer comes at a significant time: the start of a presidential election year in the US.

China-US relations, particularly around trade, are likely to be a key part of the campaign for the presidency, which looks likely to be fought between Joe Biden and Donald Trump.

Last month, the Biden administration brought in new protectionist measures for its EV market by blocking full subsidies through his Inflation Reduction Act to EV companies with significant Chinese links. US-manufactured electric vehicles that include Chinese-made battery components would also be blocked from accessing full subsidies.

The Wall Street Journal also reported just before Christmas that the US government was looking at raising tariffs on some Chinese goods, including electric vehicles, to bolster the US clean energy sector. This would be on top of the 25% tariffs on vehicles imported from China, which were brought in under Trumps presidency, and extended under the Biden administration.

The US is looking to take action in other areas where it has security concerns about Chinas manufacturing capabilities.

On Monday it was reported that the Biden administration had put pressure on the Dutch government to block the shipments of hi-tech chip-making machinery to China by one of its key technology companies.

ASML, a leading supplier to the semiconductor industry, confirmed that the government had partially revoked its licence to export three chip-making lithography machines to China.

Bloomberg reported that the decision came after US officials had requested the move in an attempt to restrict the growth in Chinas semiconductor manufacturing capabilities.

Heres what you need to know about BYD, the Chinese EV giant that just overtook Tesla

Editors Note: Sign up for CNNs Meanwhile in China newsletter, which explores what you need to know about the countrys rise and how it impacts the world.

Hong KongCNN

BYD overtook Tesla as the worlds top seller of electric vehicles (EV) at the end of last year, crowning an extraordinary rise for the Chinese carmaker.

It delivered more fully electric cars than Tesla for the first time in the three-month period to December 31, and slashed the sales lead held by Elon Musks company over the year as a whole.

So how did a little-known Chinese battery maker grow so quickly to become Teslas biggest rival?

Based in the Chinese megacity of Shenzhen, BYD was founded in 1995 by Wang Chuanfu, a low-key former academic who still runs the company. Wang says the letters BYD dont stand for anything in particular. He said he chose a rather strange name to set it apart from other startups.

It is Chinas top EV producer and exports electric taxis, buses and other vehicles to the rest of the world, including Europe, South America, Southeast Asia and the Middle East. Unlike Tesla (TSLA), it also makes plug-in hybrids.

Israel and Thailand currently countas BYDs major overseas markets, where the Chinese company ranks number one in EV sales.

Its best-selling passenger cars are the Qin and Song models. The Qin is a compact sedan available as a plug-in hybrid or an all-electric car. The BYD Song is a series of compact crossover SUVs.

Compared to Tesla, BYD is known for offering more affordable cars, which helped it attract a wider group of consumers. Its entry-level model sells in China for just over $10,000; the cheapest Tesla Model 3 costs more than $32,000.

BYDs passenger cars are not yet available in the United States. But its electric buses made in Lancaster, California are soldin the country.

Wang, an engineer, first moved to Shenzhen in the early 1990s to run a battery making business for a Beijing-based government research institute, according to his official resume in the companys filings.

Government posts in China at that time were considered iron rice bowls, a popular term for a job for life.But Wang soon quit and founded BYD.

The start of his entrepreneurial journey coincided with the opening of the Chinese economy to the world. Chinas former leader Deng Xiaoping had set up the countrys first special economic zone in Shenzhen, which encouraged hundreds of manufacturing businesses to flock to the city, lured by its liberal economic policies and cheaper labor and land costs.

By 1997, Wang had grown his small workshop to a medium-sized cellphone battery maker with more than 100 million yuan ($14 million) in annual sales.

That year, the Asian financial crisis provided a growth opportunity as plunging battery prices pushed many competitorsout of business. Wangs company was ableto survive due to its cost advantage, according to the Southern Weekly newspaper.

By 2003, BYD had become the worlds largest producer of nickel-cadmium batteries, which were widely used in mobile phones.

But Wang wanted more. Eyeing the future growth of EVs, Wang ventured into the car industry in 2003, acquiring a state-owned automaker in the city of Xian for269 million yuan ($38 million).

While that surprise decision angered the companys strategic investors and triggered a 21% plunge in the companys Hong Kong-listed shares, as Wang later described, he remained steadfast.

I build cars because I am optimistic about the future development of electric vehicles, he said defiantly after the share price plunge, according to state-owned Beijing Business Today.

Just five years later, in 2008, Wang was vindicated when he received a $230 million investment from his most famous backer, Warren Buffett, who paid about $1 per share for a stake of around 10%. That vote of confidence helped boost the companys stock by as much as 1,370% over the next year.

BYD launched its first plug-in hybrid model at the end of 2008. Since then, BYD has taken off as an EV manufacturer, partly thanks to the Chinese governments support for the industry.

Buffett has been gradually trimming his stake in BYD since 2022, taking some of the enormous profits he has made. According to the most recent filing by Buffetts Berkshire Hathaway, the firm held nearly 8% of BYD as oflate October. Those shares are now worth 18.28 billion Hong Kong dollars ($2.3 billion).

BYD has dominated the Chinese EVindustry since 2015, when it surpassed its domestic and overseas rivals in the worlds biggest car market. One of its key advantages against Tesla, the number two player in China, is price.

Teslas four models the Model 3, Model Y, Model S and Model X have price tags ranging from $40,000 to $120,000 in the United States.In China, the cheapest Tesla model, the base Model 3,has a starting price of 229,900 yuan ($32,375). It has a range of 272 miles on a full charge and a top speed of 140 miles per hour.

By contrast, the BYD Seagull has a starting price of 73,800 yuan ($10,392) in China. It has a top speed of 81 miles per hour.The Seagull is available with two battery packs.The smaller battery has a range of 190 miles, while the larger battery has a range of 251 miles.

Both Tesla and BYD vehicles have received safety ratings from international organizations. In 2022, Teslas Model Y and BYDs Atto 3 received a five-star Australasian New Car Assessment Program (ANCAP) rating respectively.

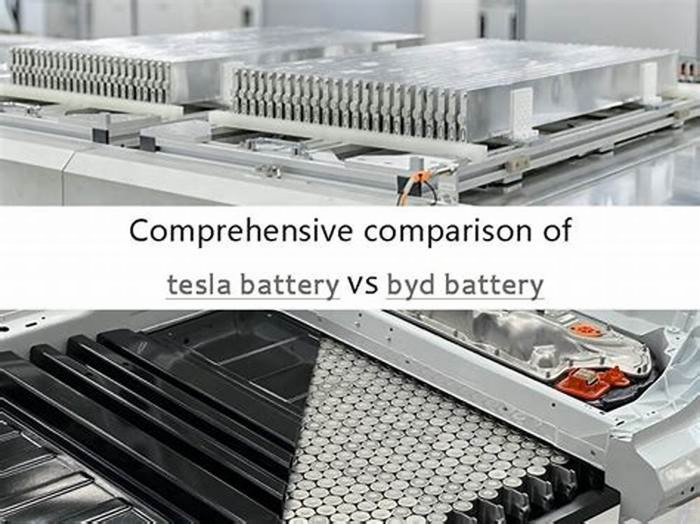

Since 2020, BYD has been making its lithium iron phosphate battery (LFP) Blade Batteries for usein its own cars and for sale to other auto makers, such as Toyota.

The companysaysthe blade-shaped battery is thinner and longer than conventional lithium iron cells, and thus can maximize the use of available space within the battery pack. Its also less likely to catch fire even when its severely damaged, according to BYD.

Tesla also reportedly uses BYD Blade Batteries for its Y cars produced in the Berlin Gigafactory, according to German media.

In March 2023, Elon Musk denied a media report saying Tesla was ending cooperation with BYD on battery supply.

BYD vs Tesla: A Detailed Comparison 2024

Electric vehicles (EVs) are growing in popularity as more consumers seek out sustainable transportation options. Two of the biggest players in the EV market are BYD and Tesla. But how exactly do these two manufacturers and their offerings compare? This article will provide a detailed overview of BYD and Teslas histories, manufacturing, technologies, offerings, and more to help you understand the key similarities and differences.

A Brief History

First, lets look at the backgrounds of these two influential companies.

BYD

BYD (short for Build Your Dreams) was founded in 1995 in Shenzhen, China. It began as a manufacturer of rechargeable batteries for mobile phones and laptops. Over the past two decades, it has grown into an automaker and expanded globally. Today, BYD is focused on three main industries automobiles, batteries and energy storage, and electronics. It aims to create sustainable technologies like electric transportation and renewable energy solutions. The company employs over 200,000 people across six continents.

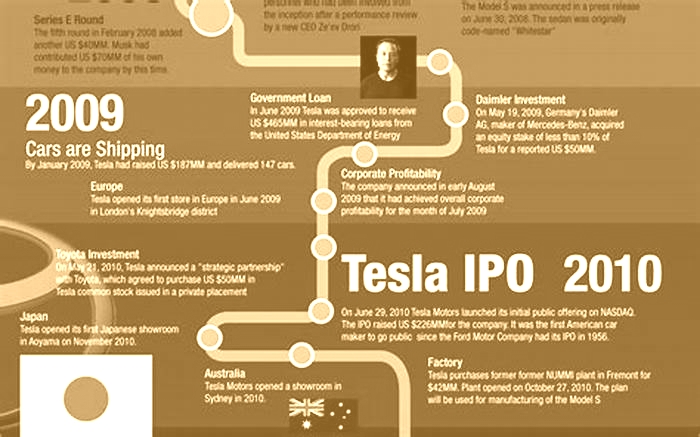

Tesla

Tesla was founded much more recently in 2003 in San Carlos, California by current CEO Elon Musk and other co-founders. Teslas mission is to accelerate the worlds transition to sustainable energy and transportation through increasingly affordable EVs and energy products. Over the past 15 years, Tesla has become the worlds most valuable automaker. It helped catalyze the shift towards EVs with its luxury models and emphasis on technology and performance. The company now produces EVs, related technologies, and solar energy products around the world.

Manufacturing and Sales

When it comes to manufacturing capacity, BYD far surpasses Tesla given its longer history and larger employee base.

BYD operates several vehicle production facilities with tens of gigawatt hours of battery production capacity. This allows BYD to manufacture and sell hundreds of thousands of EVs each year. In fact, BYD is the current top selling EV brand globally thanks to strong domestic sales in China.

Conversely, Teslas vehicle production has struggled with well publicized manufacturing challenges over the years. However, Tesla expects to produce over 1.5 million EVs in 2023 thanks to new factories in Austin, Berlin, and Shanghai.

Both automakers prioritize vertical integration in their operations from batteries to solar panels and semiconductors. But BYD notably carries out almost all manufacturing itself, while Tesla relies more on external suppliers and partners. In terms of sales, Tesla leads in many Western countries like the United States and Western Europe. However, BYD dominates the Chinese EV market and is looking to expand globally in coming years.

Technologies and Innovations

BYD and Tesla take different approaches when it comes to core technologies and innovations.

Batteries

BYD manufactures its own lithium iron phosphate (LFP) blade batteries. It claims these batteries are more chemically stable and support faster charging compared to typical EV batteries.

In contrast, Tesla uses lithium-ion batteries with nickel based cathodes supplied by Panasonic and CATL. These batteries deliver very high energy density for extended range. However, BYD criticizes the safety risks of lithium-ion batteries.

Tesla is also developing next generation 4680 battery cells in house. These tabless batteries promise significant cost reductions and five times more energy capacity. BYD has hinted at its own next gen battery technology on the horizon as well.

Semiconductors

BYD designs and manufactures its own semiconductors for key systems like battery management and autonomous driving. The BYD Han EV for example features BYDs DiPilot driver assistance system and its own vehicle chipset.

Meanwhile, Tesla relies on external suppliers like AMD, Samsung, and Nvidia for the hardware and chips powering its vehicles. It sets itself apart with excellent software, over the air update capabilities, and the Full Self Driving beta system.

EV Platforms

BYD has developed its flexible e-Platform architectures for EVs. These modular platforms can accommodate a wide range of vehicle types and configurations.

On the other hand, Tesla engineered its vehicles inhouse from the ground up specifically for electric propulsion. This purpose built approach allows Tesla to highly optimize performance, safety, and interior space.

As you can see, BYD and Tesla take different technological approaches aligned with their respective strengths and priorities as companies.

Model Lineups and Offerings

BYD and Tesla offer broadly similar all electric lineups ranging from affordable sedans/hatchbacks to luxury SUVs. However, there are some key differences among their models.

BYD

BYDs lineup reflects its Chinese heritage with compact vehicles tailored to local urban transportation needs. BYDs most popular models include the Han luxury sedan, Song and Yuan SUVs, Qin and Dolphin compact sedans, and various Tang plug-in hybrid SUV models.

BYD positions itself as an affordable EV option. Most models fall into the $25,000 to $50,000 price range before incentives. However, the flagship Han EV costs over $70,000.

Tesla

In comparison, Tesla targets higher price points, premium styling, and high performance with its trifecta lineup of luxury sedans and crossovers the Model 3, Model Y, and flagship Model S and Model X. Base prices range from ~$48,000 for the Model 3 to $105,000+ for the Model X Plaid variant.

Tesla plans to eventually launch a smaller, more affordable hatchback priced at around $25,000. This model will bring Tesla closer to BYDs compact vehicle offerings and price points. But for now, Tesla focuses squarely on the luxury EV segment.

Charging Infrastructure

A robust charging infrastructure enhances the convenience and practicality of owning any EV. Here too, BYD and Tesla take slightly different approaches based on their unique ecosystems.

BYD vehicles support both proprietary BYD charging connectors and global standard plug types. BYD is actively building out charging stations, battery swap facilities, and other infrastructure across China to serve its domestic customer base.

Tesla operates its vast proprietary Supercharger fast charging network worldwide with over 40,000 Superchargers worldwide and counting. This exclusive Tesla infrastructure provides incredible convenience for Tesla owners. But it doesnt directly contribute to widespread EV adoption by non Tesla vehicles.

As the EV market grows, shared and standardized charging solutions will likely prevail over proprietary networks. But for now, both BYD and Tesla leverage their own infrastructures to closely match their products and customers.

Autonomous Driving Capabilities

Autonomous driving technology is an important frontier for EV makers. Here, Tesla holds a strong lead over BYD.

Teslas Autopilot advanced driver assistance system comes standard across Teslas lineup. Customers can also add the $15,000 Full Self Driving Capability package for sophisticated autonomous features like automatic lane changes, navigation to chosen destinations, and advanced object recognition powered by Tesla Vision.

BYD offers its comparable DiPilot system on the Han sedan and other select models. DiPilot includes typical ADAS functionality like traffic jam assist, adaptive cruise control and automated emergency braking. However, it does not approach Full Self Drivings capabilitiesyet. BYD hints that fully autonomous driving could arrive soon.

For now though, Tesla clearly sets itself apart on the autonomous driving front thanks to billions of miles of real world testing data accumulated across its global fleet.

Performance and Efficiency

As you might expect, performance and efficiency benchmarks vary across BYD and Teslas model ranges. But some general trends emerge.

BYD EVs excel at efficiency thanks to the companys battery expertise. For example, the Han EV achieves an exceptional NEDC range of 605 km (376 miles). Other models like the Qin Pro EV sedan likewise deliver excellent energy efficiency and range from BYDs blade batteries.

Conversely, Tesla obsesses over acceleration, power and thrilling performance with track capable trims like the Model S Plaid hitting 60 mph in under two seconds. The downside is efficiency can suffer in pursuit of performance. Most Tesla models achieve EPA ranges around 300 to 400 miles per charge depending on configuration.

So while Tesla clearly dominates on acceleration and fun to drive dynamics, BYD edges ahead on overall driving range and transport efficiency. Ultimately though, both automakers continue pushing EV performance boundaries in different but equally impressive ways.

Safety

Safety is paramount for any vehicle, and electric cars are no exception. Once again, BYD and Tesla take slightly different approaches here.

BYD emphasizes its automotive grade lithium iron phosphate battery chemistry as inherently less prone to thermal runaway and fire issues compared to lithium ion batteries. The company also equips models like the Han EV with extensive safety redundancies across critical vehicle systems.

Tesla does not break down specific safety technologies and features. Rather, it stakes its reputation on real world data. Tesla claims one accident for every 4.31 million miles driven in which drivers were using Autopilot technology. This compares very favorably to the average of one accident for every 0.5 million miles driven globally. So Teslas safety record speaks for itself.

Until BYD vehicles rack up billions more test miles, Tesla likely maintains an overall edge on demonstrated safety. But BYDs fundamental battery chemistry and safety systems do merit consideration by prospective owners as well.

Conclusion

BYD and Tesla take surprisingly different approaches across many facets of EV design, technology, and manufacturing. Key differences include:

- Manufacturing: BYD favors vertical integration while Tesla uses more external suppliers

- Batteries: BYD produces its own LFP blade batteries; Tesla uses Panasonic/CATL lithium-ion cells

- Semiconductors: BYD manufactures its own chips in house; Tesla relies on AMD/Nvidia/Samsung

- Charging Infrastructure: BYD builds proprietary infrastructure focused on China, while Tesla offers its vast global Supercharger network

- Autonomy: Tesla boasts a formidable lead in self driving functions with Full Self Driving Capability

- Performance: Tesla obsesses over acceleration and power; BYD edges out Tesla on overall efficiency

- Safety: Both boast excellent safety based on real world data, battery fundamentals, and overall design

Yet in other areas like model lineups and basic EV powertrain approaches, BYD and Tesla adopt surprisingly similar strategies.

As the global transition towards EVs accelerates, BYD and Tesla will continue competing for dominance across the biggest auto market (China) and highest-margin luxury segment. This competition will ultimately benefit consumers and the environment as both companies push each other to enhance EV technology even further in the coming years.

FAQs

What is BYDs most popular model?

BYDs top selling model is the Han luxury EV sedan thanks to its combination of style, seating for 5, ample range from BYDs blade batteries, and relatively reasonable pricing compared to the imported Tesla Model 3 in China.

How much cheaper is BYD vs Tesla?

On average, BYD vehicles start around $25,000 to $50,000 USD before incentives for sedans and SUVs. Tesla models range from $48,000 on the low end (Model 3) to $105,000+ for the Model X Plaid. So BYD targets more budget conscious mainstream buyers, while Tesla focuses exclusively on the luxury categories for now.

Which company is growing faster?

BYD is currently growing faster in terms of units sold thanks to its dominance of the Chinese EV market. However, Tesla is ramping up production capacity more quickly as new factories come online in Germany, Texas, and elsewhere. Long term, both automakers are poised for tremendous growth this decade.

Is BYD coming to America?

Not yet, but its expected in the next few years. BYD is reportedly looking for a US manufacturing facility location. The company already sells electric buses, trucks, forklifts and other commercial EVs in the US. Entering the consumer passenger EV segment is the likely next step.

Which company leads on self-driving technology?

Tesla holds a commanding lead on autonomous driving over BYD and other rivals. Its billions of test miles accumulated from customer owned vehicles gives Tesla an insurmountable data advantage for the foreseeable future. BYD is actively developing more advanced ADAS and self driving systems but is still playing catch up to Teslas capabilities.

Meet Sawood, the visionary force behind techlasi.com. A seasoned tech expert and prolific blogger, Sawood's passion for technology shines through in every aspect of their work. Specializing in mobile technology, gadgets, and how-to guides, Sawood crafts insightful content that caters to both tech enthusiasts and novices alike. With a knack for decoding complex tech concepts and predicting industry trends, Sawood ensures that techlasi.com remains at the forefront of the dynamic tech landscape.