Why is China leading in the EV market

China's demand for electric vehicles doubles, making it the biggest and fastest growing EV market

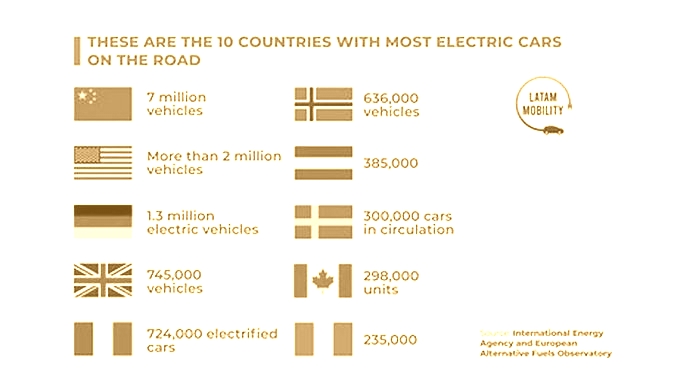

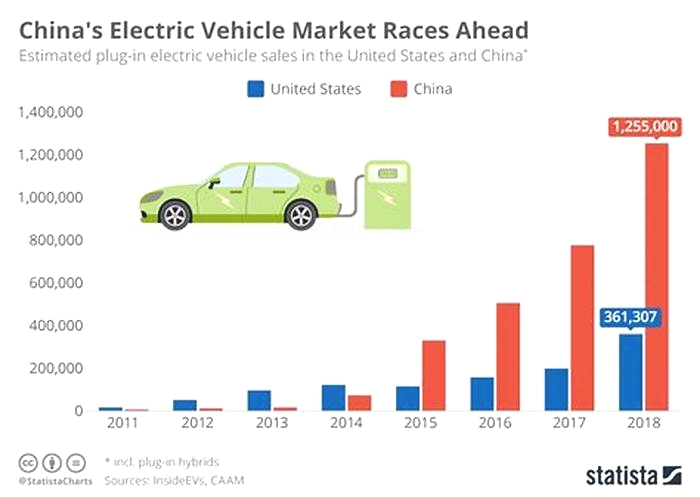

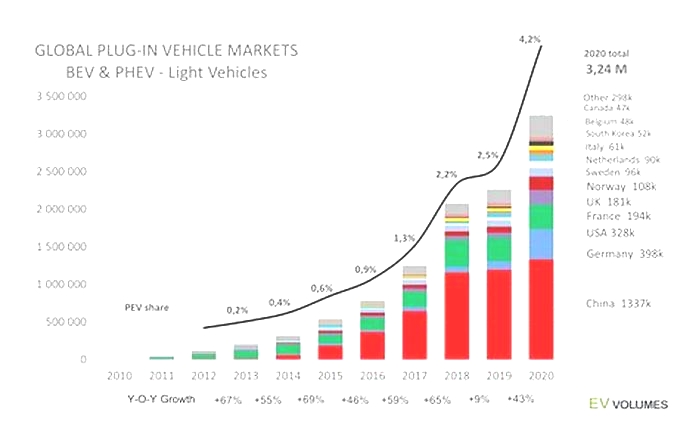

Rising fuel prices have made electric vehicles a more attractive option than ever. A Canalys study shows that electric vehicles (EVs) have continued to grow in demand, with 4.2 million vehicles sold worldwide in the first half of 2022, 63% growth from the first half of 2021. The majority of electric vehicles were sold in mainland China with the US only constituting a tiny sliver of the market.

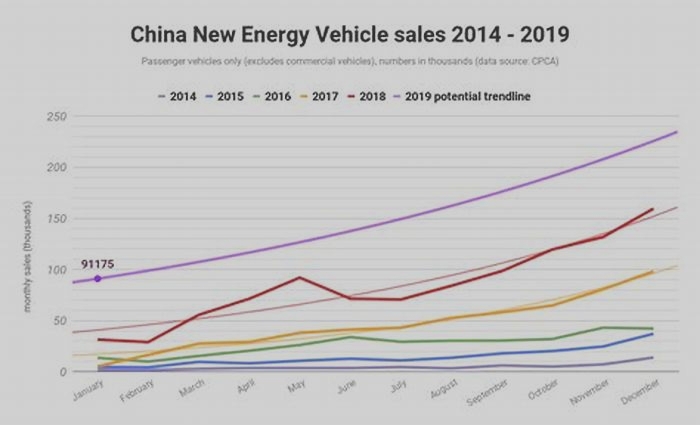

China has the largest and fastest-growing EV market in the world: 2.4 million EVs were delivered to customers in mainland China in H1 2022, equating to 26% of all car sales in China. In the first half of 2021, electric cars only made up 10% of China's car sales, meaning the demand doubled in one year.

"EV sales in mainland China more than doubled in H1 2022, and it is now by far the biggest EV market. 57% of global EV sales were in Mainland China. With 118% year-on-year growth, it is the fastest-growing market as well," said Jason Low, Principal Analyst at Canalys.

Europe doesn't trail too far behind, with 1.1 million EVs delivered in H1 2022, making up 20% of their car sales. Europe holds 27% of the global market sales for H1 2022. Despite making up a large share of the market, the EV sales in Europe have lost momentum, with a 4% growth in electric cars delivered to Europe since the first half of 2021.

Also: EV ownership is neither fairytale nor nightmare

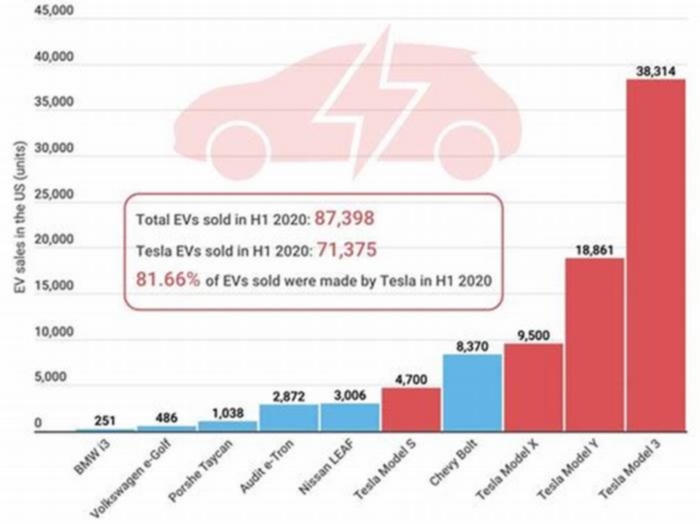

The US only made up 10% of the global electric vehicle market, with 413,000 vehicles sold in H1 2022. Despite making up such a small part of the market share, the US saw a 62% year-on-year growth, with electric vehicles representing 6% of all passenger vehicles delivered. In order for the US to see an expansion in the electric vehicle demand, more car manufacturers need to enter the electric vehicle market.

Also: Sony and Honda plan to form a new electric car company

"Despite the improved range of vehicle types and EVs from more brands, Tesla still accounted for almost 60% of sales in the US in H1 2022. Popular car brands in the US, such as Chevrolet, Ford, Honda, Jeep, Nissan and Toyota, currently sell very few EV models between them. The sooner this changes, the better, and the US EV share will grow," said Chris Jones, VP and Chief Analyst at Canalys.

The EV manufacturing leaders were BYD, Tesla, SAIC Motor, Volkswagen and Geely. It is worth noting that Chinese OEMs dominated electric vehicle manufacturing, with BYD, SAIC Motor and Geely being in the top five EV manufacturers.

Electric vehicle market in China - statistics & facts

Widely promoting battery electric vehicles (BEVs)

In China, sometimes the word "electric vehicles" is used interchangeably with "new energy vehicles" or "alternative energy vehicles", with the only exception being the exclusion of fuel cell electric vehicles (FCEVs). Battery electric vehicles (BEVs) have been more popular than plug-in hybrid electric vehicles (PHEVs), with their respective

sales volumesof 2.9 million and 600,000 units in the year 2021. During the year,

BEVs market sharein China soared to 10.9 percent, and such a figure is expected to further increase in the coming years. The reason for the widespread promotion of BEVs in China is that driving BEVs allows independence from oil consumption, emits zero CO

2, and produces very little noise. In addition, China's expanding EV charging infrastructure adds to the allure of BEVs. By 2021, the number of

publicand

private EV charging pilesin China reached nearly 1.2 million and 1.5 million, respectively.

Yet, BEVs have a relatively short driving range compared to PHEVs due to the limited energy storage capacity of the batteries. But this does not largely constrain Chinese consumers from buying them. During an

online customer surveyconducted in October 2021, Chinese consumers considered purchasing a BEV with a driving range of 258 miles, while participants from the United States expected at least 518 miles.

Which one is the best seller?

With the growing global rollout of EVs, Chinese EV manufacturers are becoming well-known. As Chinas top EV producer, BYD realized a

global EV market shareof 8.8 percent in 2021, behind only Tesla and Volkswagen Group. In the ranking of the

worlds best-selling EVsthat year, six Chinese models were among the top 10. For

passenger BEVs, the joint venture SAIC-GM-Wuling is the front-runner in China, with sales of over 424,350 units in 2021, surpassing Tesla and BYD. Its Hongguang Mini EV model was ranked as the second best-selling model in the world, right behind the Tesla Model 3.

This text provides general information. Statista assumes no liability for the information given being complete or correct. Due to varying update cycles, statistics can display more up-to-date data than referenced in the text.

California Management Review

BYD manufactured over 3 million new energy vehicles in 2023, surpassing Teslas production for a 2nd straight year.

Introduction

An EV car is a vehicle powered by an electric motor, using energy stored in rechargeable batteries. It offers a cleaner alternative to gasoline or diesel engines, reducing greenhouse gas emissions and dependency on fossil fuels. EVs are known for their efficiency, low operating costs, and quiet operation. October 2011, in a live interview with Bloomberg, Elon Musk chuckled when questioned about his rival BYD, remarking, Have you seen their car? I dont believe they offer a superior product. Musk expressed his lack of worry regarding BYD posing a significant challenge in the electric vehicle (EV) sector. When January 2023, he was asked to name the toughest competitor, his reply was some company out of China, In a decade of time span, Chinese EV car companies specially BYD have started threatening and dethroning western EV companies. BYD has surpassed Tesla in the last Quarter 2024 as top-selling electric car seller. This article how Chinese companies are dominating electric vehicle market worldwide

Current state of the EV industry

The EV industry is experiencing a period of significant growth and transformation as of 2024. Despite a slowdown in consumer sentiment towards EVs, the push for emissions reductions remains strong, with regulations and milestones for electric vehicles firmly in place. The industry is at a crucial juncture, with many original equipment manufacturers (OEMs) heavily invested in the shift to EVs, focusing on delivering affordable, mass-market EVs with extended real-world range and reliable charging ecosystems.

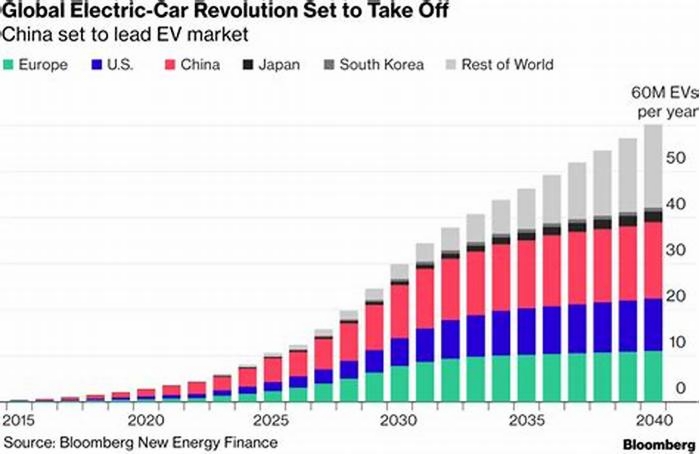

Global sales of battery electric vehicles (BEVs) are projected to reach 13.3 million units in 2024, accounting for an estimated 16.2% of global passenger vehicle sales. This represents a significant increase from 9.6 million BEVs in 2023, marking a 12% market share. Major markets are expected to drive most of this volume, with smaller markets also experiencing growth. The supply chain for EVs is evolving, with OEMs moving towards in-house development of electrified propulsion components and forming partnerships to mitigate the dominance of specific regions, such as mainland China, in the electric motor market. This shift is partly due to efforts to diversify away from permanent magnet usage in electric motors.

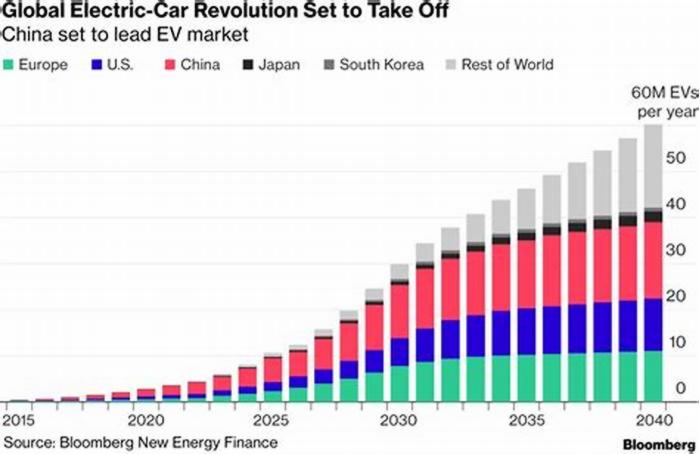

Innovation in thermal efficiency, particularly by Tesla and Chinese OEMs, is leading to more efficient BEVs. Efforts to integrate thermal components and consolidate cooling circuits are becoming a focus for suppliers, potentially leading to shifts in system voltages and the components used. Furthermore, the electric car market is booming, with sales expected to grow by 35% in 2024 after a record-breaking year in 2022. Electric cars share of the overall car market has risen dramatically, from around 4% in 2020 to 14% in 2022, with projections indicating a further increase to 18% in 2024. This growth is concentrated mainly in China, Europe, and the United States, with China leading the way with 60% of global electric car sales. Ambitious policy programs in these regions are expected to further boost the electric vehicle market share in the coming years. The industrys expansion is also having positive effects on battery production and supply chains, with announced battery manufacturing projects expected to meet the demand for electric vehicles up to 2030. However, the manufacturing landscape remains highly concentrated, with China playing a dominant role in the battery and component trade. Other economies are enacting policies to foster domestic industries and improve competitiveness in the EV market.

Competition in EV market

Key players: The electric vehicle (EV) industry features several key players that are shaping its landscape. Tesla, Inc. stands out for its pioneering role and continued leadership in electric car innovation and production. BYD Company, a Chinese firm, has made significant strides in both passenger and commercial electric vehicles, becoming a global leader in EV sales. Volkswagen AG, with its ambitious electrification strategy, aims to become a major player in the electric market through its ID series. General Motors and Ford Motor Company are accelerating their EV production, with notable models like the Chevrolet Bolt and Ford Mustang Mach-E. These companies are complemented by startups like Rivian and Lucid Motors, which are introducing innovative EVs and pushing the boundaries of EV technology. Additionally, NIO and XPeng, other Chinese manufacturers, are rapidly expanding their presence in the electric luxury vehicle market. Each of these companies contributes to the competitive and dynamic nature of the EV industry, driving advancements in technology, infrastructure, and consumer adoption.

Market share: The EV market is diverse and competitive, with several companies vying for leadership. As of recent data, Tesla holds a significant portion of the EV market share in the United States, with approximately 50.9% of the EV market as of the last quarter of 2023. Ford and General Motors (GM) are also key players, with Ford having a market share of around 8.2% and GM around 6.1%. Hyundai-Kia-Genesis, Volkswagen Group, and Nissan-Infiniti are other notable competitors with varying shares. Hyundai-Kia-Genesis, for instance, has seen a substantial increase in their market share, indicating strong performance in the market. Globally, companies like NIO, Hyundai, BMW, and Stellantis are making significant strides. NIO Inc. has a global market share of 1.6%, while Hyundai Motor Company holds 2.54%, BMW has 2.8%, and Stellantis N.V. boasts a 3.76% market share. These figures highlight the competitive and fragmented nature of the global EV market, with Chinese manufacturers like Hozon Auto and Chery Automobile also making notable contributions. The EV market is rapidly evolving, with sales and market shares fluctuating as new models are introduced and consumer preferences shift. Teslas dominance, particularly in the U.S., is challenged by traditional automakers and newcomers alike, all aiming to increase their footprint in the burgeoning EV market. The industrys dynamics are influenced by factors such as technological advancements, government policies, and consumer attitudes toward electric mobility.

Access to raw materials: The access to raw materials is a critical factor in the EV industry, as these materials are essential for the production of batteries and other components. The main raw materials include lithium, cobalt, nickel, manganese, and graphite, which are used in lithium-ion batteries, the most common type of battery used in EVs. Many of these raw materials are concentrated in specific parts of the world. For example, the Democratic Republic of the Congo (DRC) is the largest producer of cobalt, a key component for battery energy density and longevity. Lithium reserves are mainly found in Australia, Chile, Argentina, and China. This geographical concentration can lead to supply chain vulnerabilities and political risks. The rapid growth of the EV market has led to increased demand for these critical raw materials, potentially leading to supply shortages and price volatility. As EV adoption accelerates, ensuring a stable supply of these materials is a significant concern for manufacturers. To mitigate supply risks and reduce environmental impact, the EV industry is investing in recycling technologies to recover materials from used batteries. Additionally, research is ongoing to find alternative materials that could reduce or eliminate the need for scarce resources. For example, efforts are underway to develop batteries with higher nickel content to decrease cobalt reliance or to use sodium-ion batteries as a more abundant alternative to lithium-ion. Automakers and battery manufacturers are forming strategic partnerships with mining companies and investing in mining projects to secure their supply chains. Some are also exploring direct investment in mining operations or long-term supply agreements to ensure access to critical materials.

Regulatory issues

Regulatory issues related to EVs vary across the world, reflecting differences in environmental policies, market readiness, infrastructure development, and technological advancement. These regulations are crucial for shaping the adoption rate and development trajectory of EVs globally. Heres an overview of some key regulatory issues and considerations:

Emissions Standards and Targets: Many countries have set stringent emissions standards and targets to reduce greenhouse gas emissions, which directly impact the automotive industry. The European Union, for example, has implemented strict CO2 emissions targets for new vehicles, pushing automakers to increase their EV offerings. Similarly, China has introduced New Energy Vehicle (NEV) mandates, requiring manufacturers to produce a certain percentage of low-emission vehicles.

Incentives and Subsidies: To encourage the adoption of EVs, governments worldwide have introduced various incentives, including tax rebates, grants, and subsidies for EV purchases, reduced registration fees, and exemptions from congestion charges. However, the availability and scale of these incentives can vary significantly, influencing market dynamics. For instance, the U.S. offers federal tax credits for EV buyers, while Norway exempts electric cars from most taxes, leading to one of the highest EV adoption rates in the world.

Charging Infrastructure Regulations: Adequate charging infrastructure is essential for EV adoption. Regulations concerning the deployment, standardization, and interoperability of charging stations are critical. The European Union has directives in place to ensure the build-out of a comprehensive charging network, while countries like China have invested heavily in charging infrastructure to support their rapidly growing EV market.

Battery Recycling and Disposal: With the increase in EVs, battery waste management becomes a significant concern. Regulations regarding the recycling and disposal of EV batteries are still developing. The European Union, for example, is working on regulations to improve the sustainability of batteries, including measures for recycling and the use of recycled materials.

Safety Standards: EVs must meet specific safety standards, which can vary by region. These standards cover aspects such as crashworthiness, battery safety (including thermal runaway prevention), and electrical safety. As EV technology evolves, regulatory bodies continue to update safety standards to address new challenges.

Vehicle-to-Grid (V2G) Integration: V2G technology allows EVs to return electricity to the grid, offering potential benefits for grid stability and renewable energy integration. However, regulatory frameworks for V2G are in the early stages, with issues around grid connectivity, electricity pricing, and consumer participation yet to be fully addressed.

International Harmonization: The lack of harmonization in EV regulations across different markets can pose challenges for global automakers. Efforts by international bodies like the United Nations Economic Commission for Europe (UNECE) aim to standardize regulations, facilitating vehicle design and compliance for multiple markets

Key Competitive edge for the Chinese EV company BYD

The competitive edge of Chinese EV companies is the result of a multifaceted strategy that combines governmental support, market scale, rapid innovation, and strategic global positioning. As the global EV market continues to evolve, these strengths position Chinese companies well for continued growth and international competition. Chinese EV companies have been making significant strides in the global automotive market, carving out a competitive edge through a combination of strategic initiatives, government support, and innovation. BYD is at forefront as Chinese EV company. Here are several key factors contributing to their competitive advantage:

Government Support and Policies: The Chinese government has implemented a comprehensive range of supportive policies and subsidies to promote the development and adoption of EVs. These include financial incentives for both manufacturers and consumers, stringent emissions regulations that favor electric over internal combustion engine vehicles, and ambitious targets for EV production and sales. Such strong government backing has created a favorable environment for the growth of EV companies.

Large Domestic Market: China is the worlds largest automotive market, providing a vast consumer base for EV companies. The high demand for vehicles, combined with growing environmental awareness and the governments push for greener transportation, has offered Chinese EV manufacturers a significant initial market to scale up their operations and reduce costs through economies of scale.

Rapid Innovation and Product Development: Chinese EV companies are known for their agility and speed in product development and innovation. They have been quick to adopt new technologies, such as advanced battery technologies, autonomous driving features, and connected car services, often bringing new models and features to market faster than their international competitors.

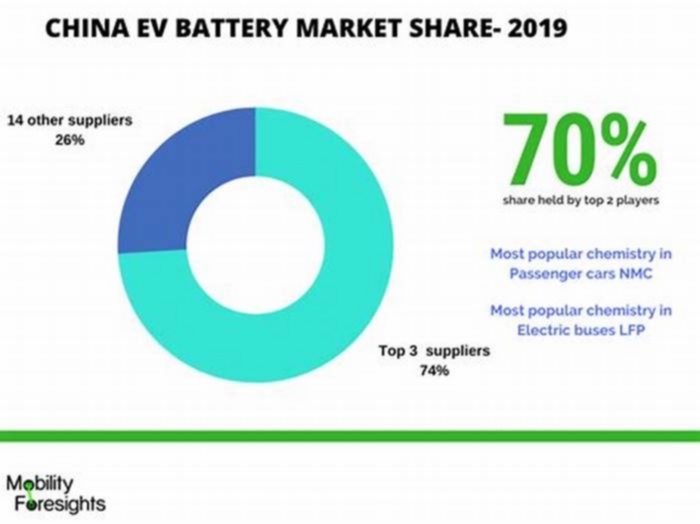

Vertical Integration and Supply Chain Control: Many Chinese EV manufacturers have pursued a strategy of vertical integration, controlling key components of the supply chain, such as battery production and supply. Companies like BYD not only manufacture EVs but also produce their batteries, which helps in reducing costs and ensuring supply chain security. This control over the supply chain gives them a competitive edge in terms of cost, quality, and supply reliability.

Advanced Battery Technology: China is a global leader in battery technology and production, home to some of the worlds largest battery manufacturers like CATL and BYD. BYD is the only companies with in house batteries. The focus on advancing battery technology has led to improvements in energy density, charging speed, and battery life, enhancing the performance and appeal of Chinese-made EVs.

Strategic Global Partnerships and Expansions: Chinese EV companies are actively seeking to expand their global footprint through strategic partnerships, mergers, acquisitions, and the establishment of overseas production facilities. These efforts are aimed at accessing new markets, acquiring advanced technologies, and building global brands.

Cost Competitiveness: Leveraging large-scale production, domestic supply chains, and governmental support, Chinese EV manufacturers can often offer competitive pricing without significantly compromising on quality or features. This cost advantage makes Chinese EVs attractive in both domestic and international markets.

Focused on Innovation in EV-specific Technologies: Unlike traditional automakers transitioning from internal combustion engines, many Chinese companies have been EV-focused from the start, allowing them to innovate and optimize their vehicles specifically for electric propulsion without legacy constraints.